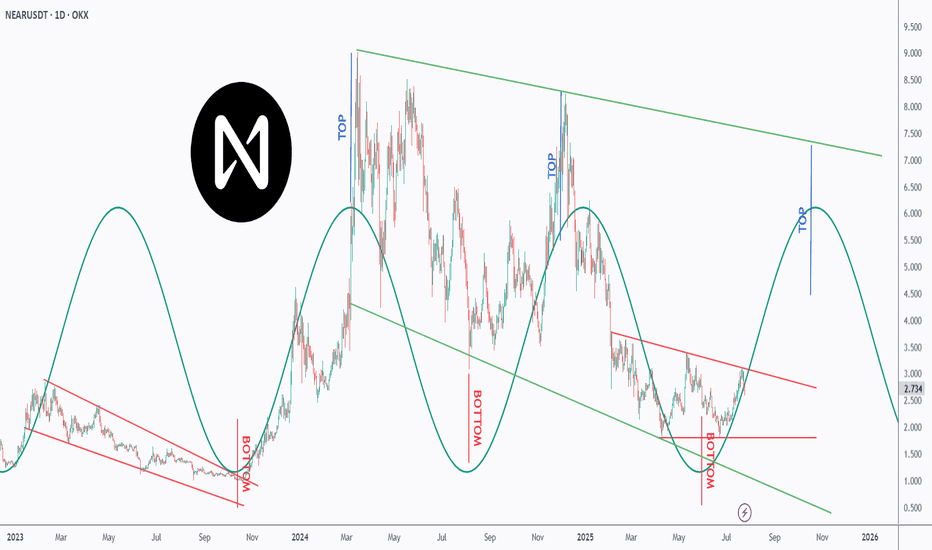

Is NEAR NEARing Its Next Explosion? Watch This Perfect Pattern!NEAR is dancing to a powerful rhythm — and it’s all in the cycles 🔁

This chart uncovers a repeating top-bottom cycle that has held since early 2023, with precise peaks and valleys emerging every few months 📉📈.

After bouncing off a major bottom at ~$2, NEAR is now approaching the mid-line of the descending red channel, suggesting a potential trend reversal is underway 🔄.

Each previous “BOTTOM” aligned with strong recovery waves 🚀, while the projected “TOP” now points toward the $6–7 zone — aligning perfectly with the upper green trendline resistance 🎯.

If the pattern continues, we could be looking at another macro push before year-end 2025 📆.

📊 Will NEAR ride this wave to new local highs — or is it just another lower high in the making? Either way, the rhythm of this chart is too clean to ignore.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

NEAR

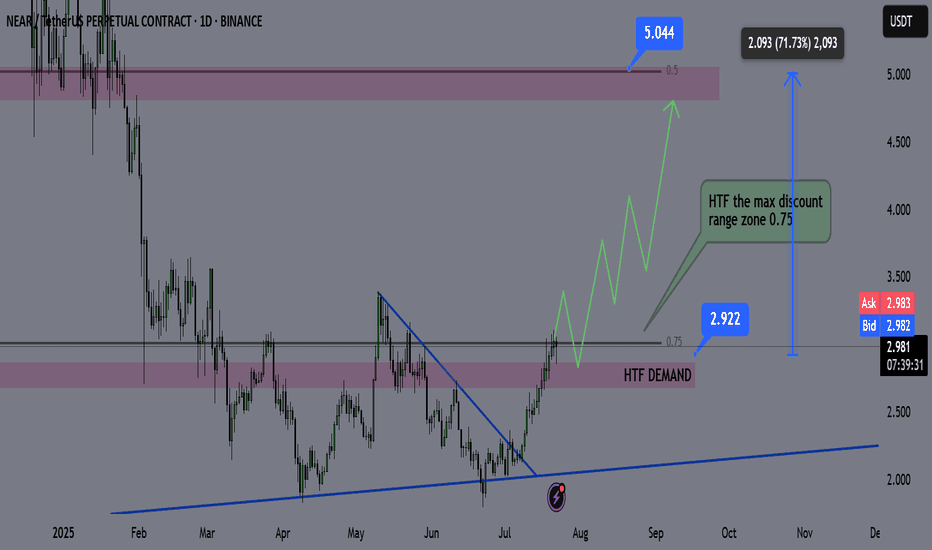

NEAR Swing Long Idea - Altseason 2025📌 Fundamental Sentiment:

The entire crypto market is rallying, alongside other risk assets. This is mainly driven by U.S. policy expectations — Trump is pressuring Powell to resign and aggressively pushing for rate cuts from the Federal Reserve.

📌 Technical Analysis:

NEAR has recently broken and closed above a significant HTF support/resistance level.

Additionally, we’re now trading inside the 0.75 Fibonacci retracement level of the HTF bullish trend — which I define as the maximum discounted zone.

For this setup, I’ll apply my Deep Range Theory (DRT):

If price dips below the 0.75 zone and accumulates there,

Then breaks above 0.75 after a period of consolidation,

→ It signals that price aims for the 0.5 level of the range and will likely run HTF liquidity for either reversal or re-accumulation before continuation.

📌 Gameplan:

✅ Break and close above HTF S/R

⏳ Waiting for break and daily close above 0.75

🔄 Retest to LTF demand (4H–1H)

📈 A bounce on LTF demand will trigger the long setup

📌 Trade Management:

This is a mid-term swing trade, as I’m following the HTF bullish trend.

🎯 Target: $5 — which is approximately a +70% move from current price.

❗Risk Management:

If price makes a daily close back below 0.75 after breaking and closing above, I will exit the trade to preserve capital.

I’ll also monitor macro sentiment closely. If there's a sharp bearish shift, I may consider an early exit before reaching the HTF target.

—

🔔 Follow the channel for daily trade ideas & weekly macro recaps.

💬 Drop a comment below if you have any questions or insights!

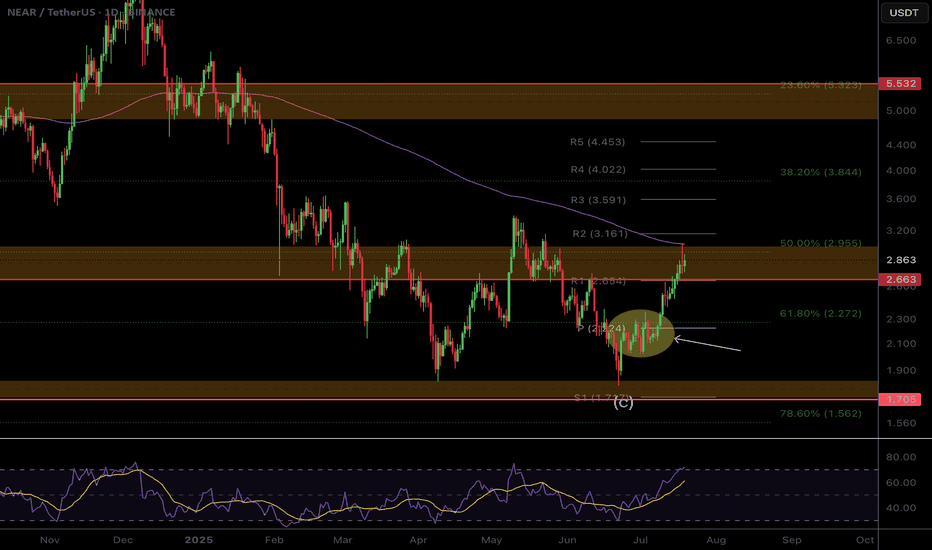

#NEAR Update #2 – July 15, 2025#NEAR Update #2 – July 15, 2025

As seen on the chart, these are the positions I previously opened on NEAR. I didn’t use any stop-loss. Instead, I added to my position when the price dipped slightly, which allowed me to lower my average entry price.

Currently, the targets are clearly defined on the chart. I still do not plan to use any stop-loss, as I have available balance to add further in case of a drop. Those interested in evaluating this setup may consider doing the same.

NEAR has completed the correction phase of both its first and second impulsive moves. Based on this, the current target stands around the $2.78 level.

$NEAR Local Still looks corrective..Though the CBOE:NEAR weekly looks good the same pattern on NEAR that I have highlighted here was also found on NYSE:FET and EURONEXT:RNDR local charts that has held these coins back from moving compared to others and appears corrective in nature and they all end at the daily 200EMA on bearish divergence.

Just something to look out for. A rejection in alts now could see fresh lows

Safe trading

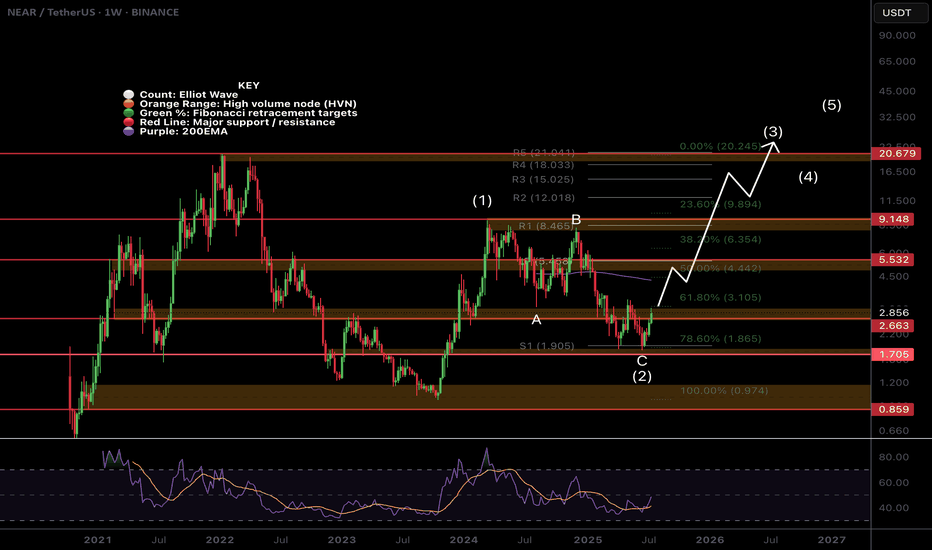

$NEAR Weekly TextBook Elliot Wave!CBOE:NEAR Weekly chart is a great demonstration of the text book motif wave followed by ABC corrective wave.

Bullish divergence has printed on the weekly RSI at the S1 weekly pivot support and the 'alt-coin golden pocket' 0.786 Fibonacci retracement. Price is closing in the major resistance High Volume Node.

The upside target is the newly printed weekly 200EMA followed by the weekly pivot and major resistance HVN just above $5.

A terminal target for this cycle may only see NEAR hitting all time highs around $21, the R5 weekly pivot point.

Safe trading

NEAR - Breakout from falling wedge pattern- Near has successfully broken out from the falling wedge pattern and now heading towards the next minor resistance around 3.6 range

- breakout from the minor resistance should push price towards the 9$ range

Entry Price: 2.57

Stop Loss: 1.66

TP1:2.935

TP2: 3.256

TP3: 3.986

TP4: 5.461

TP5: 7.102

TP6: 8.948

Stay tuned for more updates.

Cheers

GreenCrypto

NEAR Breakout Confirmed—But Is This Just a Bull Trap?Yello Paradisers! Did you see that breakout on #NEARUSDT? After weeks of consistent lower highs and a clearly defined descending resistance, price action has finally snapped that bearish structure and completed a textbook inverse Head and Shoulders formation on the 12H chart. This kind of pattern doesn’t appear often at key cycle points, and when it does—especially with confirmation—it becomes a high-probability signal of a trend reversal.

💎#NEARUSDT ,The neckline of the inverse H&S, sitting around the $2.17–$2.23 zone, has now been broken and crucially retested as support. This means the former resistance is now acting as a probable base for bulls, and if price remains above this area, the market is likely preparing for a strong probable impulsive move to the upside.

💎The structure shows clear bullish intent, and from a technical perspective, the first resistance comes in at $2.72. A clean break above that could open the door toward the major resistance zone between $2.97 and $3.05, which would complete the projected breakout target of the H&S pattern.

💎If bulls manage to maintain control above the $2.17–$2.23 support zone, we expect price to slowly build momentum toward $2.72, with increased volatility likely once that level is tested. Should that break occur with volume, the next leg may extend rapidly into the major resistance zone. However, if price fails to hold above this flipped support zone, we will be closely watching the $2.02–$1.89 area as the last major support before invalidation.

💎A daily candle closing below $1.798 would invalidate this entire bullish thesis and put the market back into a neutral-to-bearish range.

💎Adding more probability to this setup, NEAR is now trading above multi-timeframe EMA on higher time frame. This multi-timeframe EMA alignment supports bullish continuation, as momentum begins to shift in favor of buyers. However, continuation depends heavily on how price reacts at each resistance level—especially as we enter the mid-$2.70s.

💎The probable move from here is bullish, with the expectation that NEAR pushes toward the $2.72 level in the short term, followed by a potential rally to $2.97–$3.05 if momentum sustains. This scenario remains valid as long as price holds above $2.17, and especially above $2.02. Below that, the structure weakens. Below $1.798, the bullish bias becomes fully invalidated.

This is the only way you will make it far in your crypto trading journey. Stay sharp and patient, Paradisers. It’s not about chasing pumps—it’s about positioning smartly before the crowd.

MyCryptoParadise

iFeel the success🌴

NEAR Protocol New All-Time High & Targets (PP: 1,108% Minimum)Here we have the same signal we just looked at in another publication, a break and close daily above EMA55 & EMA89. The bullish bias is confirmed.

The blue dotted line stands for EMA89 while the magenta one is EMA55. Once the action moves above daily, mid- to long-term growth is confirmed. Mid-term bullish above EMA55 and long-term bullish above EMA89. Near Protocol is bullish now.

NEARUSDT Technical analysis

On the main chart above we can see a peak March 2024 and a lower high in December of the same year. This means very strong, prolonged bearish action. After a strong bearish cycle comes a strong bullish cycle, the market tends to fluctuate, always fluctuating between bear and bull.

When the market is down, no need to worry because it will eventually grow.

When the market is up for a long while, watch out because a correction can develop anytime out of nowhere.

The cycles repeat over and over, again and again; forever, just like night and day. Winter, summer, spring and fall, the seasons. Everything in nature is cyclical, the market is no exception. We can use this information to our advantage, we know for certain that we are now entering a major growth phase because of the cyclical nature of the market.

The next high will be a major high compared to March 2024, and possibly a new all-time high compared to April 2022 which is the highest level on this chart. If you want to see bigger projections, go to my profile and search for NEARUSDT. You will find there everything you need.

NEAR Protocol new all-time high & targets

The first target is $12 for 368% profits potential. I don't count $5.77 because that is one of the easy targets. It is a shame to sell too early when prices are going really high-up. The $12 target would be the highest price in more than 3 years, since May 2022. This is the first higher high but not the end, the market is very likely to move higher, much higher.

The next target $18.6 for 615% profits potential. This is a good target to start. We then have $25 and $31 for a maximum of 1,108%. We should hit all of these targets within the next 6 months (6-8 months to be safe).

Patience is key. Buy and hold.

Thanks a lot for your continued support.

Namaste.

#NEAR Update #1 – July 10, 2025🔴 #NEAR Update #1 – July 10, 2025

Near started a new impulsive move after the previous one, but this move isn’t significantly higher. It’s almost at the same level. Therefore, unless this impulsive move reaches the $2.45 zone, we cannot consider it strong.

If NEAR rises to the $2.45 zone, we can call it a strong impulsive move. But if it fails to do so, I expect a pullback of around 5–6%. There is also an imbalance supporting this retracement.

If the price fails to reach the $2.45 zone, there is a likelihood of a pullback towards the $2.22 zone. This is not a long or short recommendation.

TradeCityPro | NEAR Faces Resistance in Lower Range Zone👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review NEAR, one of the AI and Layer1 crypto projects, currently ranked 35 on CoinMarketCap with a market cap of 2.77 billion dollars.

📅 Daily Timeframe

On the daily chart, NEAR has formed a large ranging box between the 1.884 and 3.548 levels and is currently positioned in the lower half of that range.

✔️ After hitting the lower boundary, the price has formed a trigger around the 2.279 level and is now fluctuating below it.

✨ A breakout above this level could give us a long entry. However, the downside is that volume is decreasing and diverging from price. If this volume drop continues, the likelihood of the range breaking to the downside increases.

📊 If volume starts to rise, considering that the RSI is stabilizing above the 50 zone, the probability of a bullish scenario becomes much stronger.

💥 The main resistance above the current price is at 3.548, which I’ve marked as a zone. In my opinion, breaking this level would be the main trigger for a spot buy, and I personally plan to wait for this level to break before buying spot.

🔔 If the price gets rejected from the 2.279 level and bearish momentum enters the market, a break below 1.884 would be a strong short trigger and could signal the start of a new bearish leg and continuation of the previous downtrend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

NEARUSDT Breakout Watch Descending Triangle Reversal in Progress🧠 Pattern and Structure Analysis

The NEAR/USDT pair is currently displaying a long-term Descending Triangle pattern that has been developing for over 6 months. While descending triangles are typically bearish continuation patterns, a breakout to the upside often signals a strong trend reversal.

Descending resistance trendline: Multiple touchpoints confirming the structure.

Horizontal support zone: Strong base formed between $1.79 – $2.21.

The current price action shows a potential breakout above the descending resistance, indicating a possible shift in trend.

🚀 Bullish Scenario

If the breakout is confirmed (especially with high volume and daily close above the trendline), NEAR could rally toward the following resistance levels:

1. Target 1: $2.693 – minor resistance

2. Target 2: $3.021 – key psychological and technical level

3. Target 3: $3.568 – previous support/resistance flip

4. Target 4: $4.635 – major resistance zone

5. Extended Targets: $6.028 and $8.062 – historical highs

📌 Breakout confirmation requires a daily close above $2.25 with increased volume.

🐻 Bearish Scenario

If the breakout fails and the price gets rejected at the trendline:

Price may revisit the strong support zone around $1.79.

A breakdown below this support would open the door to deeper downside levels, possibly below $1.70 or even toward $1.50.

The bearish outlook would be invalidated if the price sustains above $2.30 and forms a higher-high structure.

🔍 Strategic Summary

Pattern: Descending Triangle (Potential Reversal)

Breakout Level: ~$2.25

Key Support: $1.79 – $2.21

Recommendation: Watch for a confirmed breakout with strong volume. Use a trailing stop strategy to lock in profits as targets are reached.

#NEAR #NEARUSDT #CryptoBreakout #AltcoinSeason #DescendingTriangle #TechnicalAnalysis #CryptoTrading #BullishSetup #ReversalPattern #ChartPattern

Breakout Watch: NEAR Approaching Moment of Truth If you want, ICBOE:NEAR is currently testing the breakout zone but is still holding below the key trendline.

It’s a critical spot — if NEAR manages to break and close above this trendline, it could unlock further upside. For now, the trendline remains intact, so patience is needed here.

Watching closely to see if the breakout gets confirmed or if we see another rejection.

DYOR, NFA

TradeCityPro | NEAR: Key Support Battle in Layer 1 AI Protocol👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the NEAR coin for you — one of the prominent AI-focused and Layer 1 protocols that has gained significant attention in recent years.

🔍 This project’s coin, with the ticker NEAR, currently holds a market cap of $2.94 billion, ranking 34th on CoinMarketCap.

📅 Daily Timeframe

As you can see in the daily timeframe, there is a very strong support level at 2.239, which has been tested multiple times. The price has once again reached this zone.

✨ If this level breaks, the price could drop toward lower supports such as 1.694. Therefore, a break below 2.239 would be a valid trigger for a short position.

💫 The trendline drawn on the chart is also a significant level. If 2.239 is broken, price could potentially react to this trendline as well.

💥 If price holds this support and attempts a bullish move, we can open a long position upon breaking 2.653.

📈 The main long triggers, including potential spot buying, are at 3.355 and 3.548. If these levels are broken, NEAR could begin a strong uptrend toward targets at 4.726 and 7.998.

📊 Currently, market volume is ranging — buyers and sellers are evenly matched. We need to wait and see which side gains dominance to follow the momentum.

✔️ On the RSI oscillator, entering the Oversold zone would confirm a short setup, while breaking above the 50 RSI level would confirm a long setup.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

NEAR Protocol Can Hit $35 or $52 in 2025 (PP: 2,000%+)Back to what I was doing... NEAR Protocol (NEARUSDT) closed red three weeks and this week is the fourth week with the action being bearish, why am I bullish?

Four weeks of bearish action and there isn't much, well, bearish action. Total drop is less than 30%. If you look back to January, or say May 2022, four weeks red would be something completely different; market conditions are not the same.

The market now is not bearish nor crashing so we are only seeing a retrace, a retrace is a small correction that ends in a higher low. Wait, let me make a long story short, NEAR Protocol is set to grow.

The market bottom in October 2023 is much, much lower compared to the low hit April 2025, much lower. So we have a very, very strong higher low. This only reveals something we already know, NEAR is bullish and bullish means up. Prepare for growth. The 2025 targets can be seen on the chart.

» How likely is a new all-time high in 2025?

Probabilities are really, really high. NEAR Protocol has a very strong chart that points to a long-term higher high next. The ath being $20, it can easily go higher thanks to the strong higher low mentioned above.

» How long will it take for this new ath to be hit?

Can be anywhere between 4-8 months. I know it is a wide range but with thousands of altcoins, some will move first while others will take longer to reach their bull market top. But late 2025 is the main date and some altcoins will continue bullish through early 2026.

Yes, this pair can be approached with leverage.

Low leverage is better. Low risk is better. Spot is best.

Thanks a lot for your continued support.

Namaste.

NEAR to $45? The Signs Are All There…Just imagine traveling through time.

Many people look back with regret, wishing they had invested in cryptocurrencies before previous bullish cycles. We've all heard phrases like "If only I had bought Bitcoin at $100, I'd be a millionaire by now."

But the real question is: Will you have the courage to make the right decision when the moment comes?

You might think I'm crazy for presenting these targets today — and that's okay. But trust me, in a few months, you'll witness the phenomenal power of our analysis system. The market is fractal by nature; what happens on lower timeframes inevitably plays out on higher ones.

NEAR is one of the most promising blockchains, and all signals are aligning for a move toward $45.

The question is: Do you have the courage to take action now?

NEAR’s Pullback Zone Found — Is $4 Next?NEAR just pulled off a +50% rally from the 0.618 Fibonacci retracement at $2.224 — a strong show of force from the bulls. After that explosive move, price is now cooling off in a consolidation phase, preparing for the next leg higher.

🟢 Long Setup — Dip Before Lift?

The next high-probability long zone lies between:

$3.026 – $2.94

Possible but less likely of a deeper dip to $2.78 (0.5 Fib of the recent move)

Long entries can be laddered between $3.00 and $2.90 (even $2.80 if volatility kicks in).

Stop-Loss: Below the daily 21 EMA ($2.7344) and 21 SMA ($2.6739)

Target: $4.00

R:R: ~4:1 — clean and structured

This setup aligns with standard continuation behaviour after strong impulses — consolidation, retrace, and resume.

🔴 Short Setup (on Rejection at $4.00)

Entry: ~$4.00

Stop-Loss: Above $4.25

Target: Yearly open (~$3.65)

R:R: ~1.5:1 — not ideal, but valid on confirmation

🎯 Summary

NEAR is consolidating after a strong move — either ready to continue higher or retest deeper into Fib support

Long zone: $3.00–$2.90 (poss. $2.80)

Short zone: $4.00 (on rejection only)

Simple structure, clean risk, and nothing forced — exactly how it should be.

Sometimes, less is more. Let price show the next move. Stay ready. 📈

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

NEAR is here to stay!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

After breaking above the falling wedge pattern, CBOE:NEAR has been overall bullish, trading within a rising broadening wedge 🔼 marked in blue and red.

📉 As it approaches the lower bound of the wedge — which perfectly intersects with the green support zone — we’ll be watching for short-term long opportunities 🎯.

From a long-term perspective, for the bulls to fully take control, a break above the $3.6 resistance is needed to confirm the next bullish wave 🚀.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

NEAR Protocol price analysisIt's really hard for CRYPTOCAP:NEAR to grow now....

If we look at the wave analysis, we can assume that the OKX:NEARUSDT price could drop to $2.30-2.50 once again.

And from there, with renewed vigor, it will start upwards to break out of the protracted falling channel above $4.50

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

NEARUSDT Retest in Play After Breakout — Bulls May Take Charge!BINANCE:NEARUSDT has turned the tide after a prolonged downtrend, now forming higher highs and signaling a shift in momentum. Recently, it broke through a key resistance level, flipping it into support, a classic breakout-retest setup. Right now, price action is retesting that breakout zone, and if it holds, we could see a strong bounce and continuation of the bullish structure. This level is crucial, and a successful retest could pave the way for another leg up.

As always, don’t forget to manage your risk. keep a well placed stop loss in case the market flips unexpectedly.

BINANCE:NEARUSDT Currently trading at $2.8

Buy level : Above $2.75

Stop loss : Below $2.2

Target : $5.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts