TradeCityPro | NEAR: Breaking Boundaries in Layer 1 AI Crypto👋 Welcome to TradeCityPro!

Today's analysis will focus on NEAR, a Layer 1 and AI crypto project with a market cap of $3.17 billion, ranking 31st on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, following an upward leg from $0.993 to $8.298, a range box formed over a year from $3.615 to $8.298. Recently, with the market's downturn, the price finally broke below this box's floor at $3.615.

✅ Currently, the price has pulled back to this area after breaking $3.615 and has dropped to $2.574, where it's currently forming a supportive green candle.

⚡️ The $2.574 area is robust, showing positive price response, and it remains to be seen what happens next. If this support breaks, the price could move towards lower areas like $1.830 and $0.993.

🔑 Conversely, if the price can sustain this support and move above $3.615, a significant upward momentum could enter the market, potentially driving the price at least up to $8.298. A break above $8.298 could see the next target at $16.839.

📊 Market volume has increased following the range break, which is natural as the price has finally moved out of a range, and increased volume has entered. Continuation of this volume increase could heighten the likelihood of breaking $2.574.

📅 Daily Timeframe

In the daily timeframe, we can observe more detailed price movements.

💫 As seen, the main support at $3.615 has broken, and subsequently, a price box formed between $2.804 and $3.615. Coinciding with an RSI divergence, the floor at $2.804 broke, and the price dropped to $2.161.

🎲 Currently, the price is correcting back towards the $2.804 area. Market volume is rising, and the RSI divergence trigger has not yet been activated, indicating ongoing bearish momentum.

💥 If the RSI breaks the 50 area, the divergence could impact the market and eliminate the bearish momentum. This would be the first sign of a trend change, but the main ceiling at $3.615 must be broken to confirm a trend reversal.

📉 For short positions, breaking the $2.161 area is suitable, and if this area breaks, the price could drop to $1.682. For long positions, breaking $2.804 is a risky trigger, with the main trigger at $3.615 for a more solid position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

NEAR

$NEAR - Approaching key liquidity levels. #NEAR has created a BOS, followed by a drop into our POI, which has provided a nice 21% bounce. It’s a level where one can spot-buy NEAR. Personally, I’d only look for longs from the 3M HOB refined into MTF or the demand level just below it.

Other info., such as TPs and entries, is provided in the chart.

I’ve noticed that people usually miss Supply and Demand levels, and if there’s one thing I’ve learned in this recent correction, it’s that these levels, if reached, are highly respected - especially if there’s an OB/HOB at the same level. The best example of this is #ETH, which found support at the 3M Demand level, proving the significance of S&D versus just looking at individual liquidity levels.

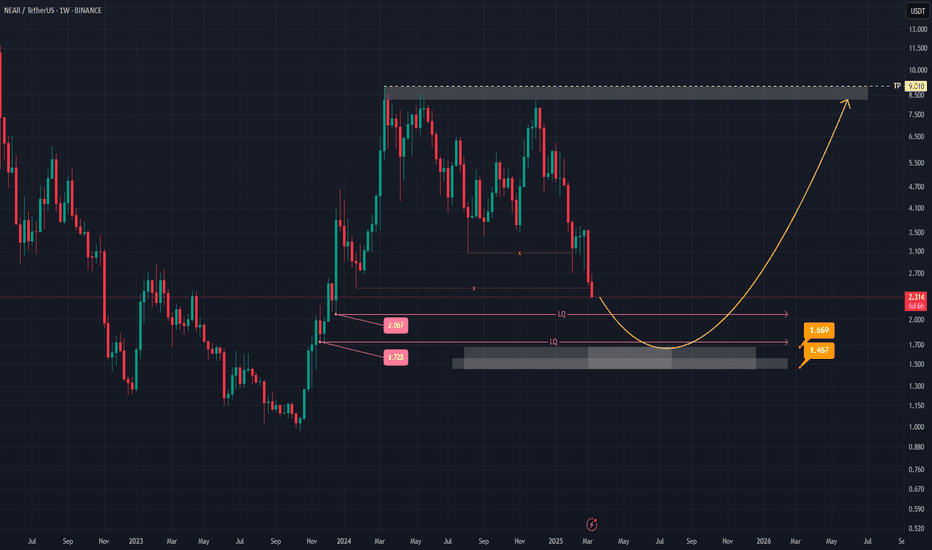

NEAR (NEARUSDT) Weekly Analysis: Potential Reversal in SightHey everyone! Let’s take a look at NEAR (NEARUSDT) on the weekly chart. There’s a chance the price might move into the 1.728–2.067 range, possibly sweeping up some liquidity before heading toward the 1.467–1.669 zone. This area seems like it could act as a launchpad for a potential bounce, aiming for higher targets afterward.

Watch for a spike in trading volume around that zone—if volume picks up, it could indicate stronger buying interest. Another key signal to look out for is a bullish candlestick pattern (like a hammer or a bullish engulfing), which might confirm a reversal if it appears near the 1.467–1.669 level.

Of course, if the price drops below 1.467, it might change this outlook and suggest a different path forward. Since the market can be unpredictable, it’s always important to keep an eye on these levels and stay prepared.

Above all, remember to do your own research and stay informed—this space can move fast, and it’s best to approach it with a curious mind. Keep learning, stay positive, and good luck out there! 📈

NEAR Protocol Prepares For Long-Term Reversal (Bullish Breakout)NEAR Protocol (NEARUSDT) has been in a correction pattern since March 2024. It has been sideways within a wide range for an entire year.

The baseline, or long-term support, matches the 0.786 Fib. retracement level for the bullish wave that developed between late 2023 and early 2024. Current price action is happening above this level. Once resistance turned support.

The lowest price since January 2024 was hit just four days ago, 4-March. While this level was a more than a year long low, trading volume was very low. Even on the 2-Feb. drop bear volume was already dropping. Ever since the peak in March 2024, with each successive drop this pair produces, trading volume continues to drop. Revealing a weakening bearish trend.

A trend weakens when it is reaching its end.

But this isn't really a bearish trend but more like a long-term, wide consolidation pattern. It is classic pre bull-market action. There is a long-term lower high but the bottom is flat. When the next bullish wave develops, which is what will happen as the correction ends, the candles that we are seeing now will become almost invisible, same as if you were to look to the deep left side of the chart. Each time bull-market action develops, the preceding candles become really small. This is because bull-markets tend to produce growth that is out of proportion will all previous price action.

NEAR Protocol will hit new All-Time Highs. This is certain. It will be amazing and this amazingness is starting in a matter of days.

It will take months and months and months for the complete bullish cycle to reveal itself, but it will start within days. It tends to start low. Slowly but surely momentum grows, and as if it was never happening, the next moment we are here trading and exchanging, the entire market is experiencing growth.

We will be chatting and exchanging, having fun as our profits grow.

Thank you for reading.

Allow me to be your guide. It will be a tour that will not only change our lives but also the world.

Namaste.

NEAR - Bullish Movement Soon!NEAR has been overall bearish from both long-term and short-term perspectives, trading within the falling channel marked in red.

However, it is currently hovering around a support level, the lower trendline, and the key $3 round number, so we will be looking for longs on lower timeframes.

For the bulls to take over in the short term, a break above the last minor high at $3.025 is needed.

For the bulls to remain in control in the medium term, a break above the $3.65 major resistance is required.

Disclaimer:

This content is for informational purposes only and should not be considered financial or investment advice. Always do your own research and consult with a professional before making any investment decisions.

NEAR Price Outlook: Support, Resistance and Alt Season PotentialHello, Traders!

NEAR Protocol has been underperforming during this cycle, showing notable weakness compared to some other assets in the market.

However, it still holds potential for an upside move, especially if we witness a proper altcoin season.

Currently, NEAR is trading around a strong support area in the $4.50–$5.00 price range.

This area has historically been significant, and it seems unlikely that buyers will allow the price to break below it.

If an uptrend is to occur, it is most likely to begin from this area.

The $4.50–$4.80 zone presents an attractive accumulation range for mid-term investors, especially for those looking to position themselves ahead of any potential recovery.

However, for NEAR to convincingly shift into an uptrend, it must reclaim and sustain a position above the $6.00 resistance level.

If the price manages to break and hold above this threshold, we could see NEAR retesting its recent highs around the $8.00 level, with the possibility of pushing even higher depending on market conditions.

It's essential to note that NEAR overall remains weak.

Any significant upside movement would likely require BTC.D to drop below the 55% threshold, signaling a favorable environment for altcoins to rally.

Until then, NEAR is more likely to remain range-bound or continue its downtrend.

Please don’t forget to boost this idea and leave your comments below.

#NEAR/USDT Ready to go higher#NEAR

The price is moving in a descending channel on the 1-hour timeframe and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 4.70

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.90

First target 5.46

Second target 5.83

Third target 6.32

NEARUSDT Long Spot Position / Follow for the UpdatesBINANCE:NEARUSDT

COINBASE:NEARUSD

📊 Position: LONG

The bullish scenario remains active as long as the price consolidates above the yellow zone (triangle). Any long shadow below this zone is considered an opportunity to buy the dip until the price starts to rise.

🟡 Leverage: 1x

📍 Entry: Near $4.70 - 4.80$

🎯 Targets:

TP1: $5.75

TP2: $7.35

TP3: $9.25

TP3: $11.75

🔴 Stop Loss: $3.342 (-14.89%)

NEARUSDT: Golden Pocket Retest & Rebound SetupNEARUSDT is currently testing the golden pocket zone around $4.34 - $4.48 and forming a Descending Broadening Wedge , a bullish reversal pattern. If the price holds at this support level, there's a strong chance of a rebound, with potential targets around $10.80 to $15.20. However, if the support fails, the price could drop further to the $3.79 area. Keep an eye on price action and wait for a breakout confirmation to find a safer entry point!

Trade Setup: NEAR Long OpportunityMarket Context:

NEAR is retracing alongside the broader market, presenting a favorable opportunity for a long spot trade at a key support level. With AI being a strong narrative, NEAR is positioned for potential growth in this sector.

Trade Details:

Entry Zone: Around $4.2

Take Profit Targets:

$5.00

$5.50

Stop Loss: Below $4.00

This trade takes advantage of NEAR's retracement to enter at a critical support level with favorable upside potential. 📈