Near Protocol price analysisFor many deposits, the correction of the #NEAR price was quite painful.

But if you look at the global chart of OKX:NEARUSDT , it's not so critical.

We want to believe that someday #NEAR will cost $20 again, and there are theoretical and technical possibilities for this....

But before that, buyers need to be able to fix the price of #NearUSD above $3.5, and then above $4.5 at the exit from the "bearish flag".

Only there is a safe medium-term purchase point for the #NearProtocol token in the current realities.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

NEARUSDT

NEAR USDTNEAR is trading below a trendline from December, currently holding within the blue support zone at $2.091–$2.350.

A breakout above the trendline and $2.712 resistance could trigger bullish momentum. The key resistance at $3.563, which previously acted as strong support, could pose a challenge. After breaking below, the price consolidated under this level for 28 days before declining further. A breakout with volume could push the price toward higher levels marked on the chart.

METISUSDT UPDATEMETISUSDT is a cryptocurrency trading at $17.57. Its target price is $32.00, indicating a potential 80%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about METISUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. METISUSDT is poised for a potential breakout and substantial gains.

UniversOfSignals | NEAR: Weekly Timeframe 👋 Welcome to UniversOfSignals !

Today's analysis will focus on NEAR, a Layer 1 and AI crypto project with a market cap of $3.17 billion, ranking 31st on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, following an upward leg from $0.993 to $8.298, a range box formed over a year from $3.615 to $8.298. Recently, with the market's downturn, the price finally broke below this box's floor at $3.615.

✅ Currently, the price has pulled back to this area after breaking $3.615 and has dropped to $2.574, where it's currently forming a supportive green candle.

⚡️ The $2.574 area is robust, showing positive price response, and it remains to be seen what happens next. If this support breaks, the price could move towards lower areas like $1.830 and $0.993.

🔑 Conversely, if the price can sustain this support and move above $3.615, a significant upward momentum could enter the market, potentially driving the price at least up to $8.298. A break above $8.298 could see the next target at $16.839.

📊 Market volume has increased following the range break, which is natural as the price has finally moved out of a range, and increased volume has entered. Continuation of this volume increase could heighten the likelihood of breaking $2.574.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

universOfSignals | NEAR: Breaking Boundaries in Layer1 AI Crypto👋 Welcome to universOfSignals !

Today's analysis will focus on NEAR, a Layer 1 and AI crypto project with a market cap of $3.17 billion, ranking 31st on CoinMarketCap.

📅 Daily Timeframe

In the daily timeframe, we can observe more detailed price movements.

💫 As seen, the main support at $3.615 has broken, and subsequently, a price box formed between $2.804 and $3.615. Coinciding with an RSI divergence, the floor at $2.804 broke, and the price dropped to $2.161.

🎲 Currently, the price is correcting back towards the $2.804 area. Market volume is rising, and the RSI divergence trigger has not yet been activated, indicating ongoing bearish momentum.

💥 If the RSI breaks the 50 area, the divergence could impact the market and eliminate the bearish momentum. This would be the first sign of a trend change, but the main ceiling at $3.615 must be broken to confirm a trend reversal.

📉 For short positions, breaking the $2.161 area is suitable, and if this area breaks, the price could drop to $1.682. For long positions, breaking $2.804 is a risky trigger, with the main trigger at $3.615 for a more solid position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

TradeCityPro | NEAR: Breaking Boundaries in Layer 1 AI Crypto👋 Welcome to TradeCityPro!

Today's analysis will focus on NEAR, a Layer 1 and AI crypto project with a market cap of $3.17 billion, ranking 31st on CoinMarketCap.

📅 Weekly Timeframe

In the weekly timeframe, as you can see, following an upward leg from $0.993 to $8.298, a range box formed over a year from $3.615 to $8.298. Recently, with the market's downturn, the price finally broke below this box's floor at $3.615.

✅ Currently, the price has pulled back to this area after breaking $3.615 and has dropped to $2.574, where it's currently forming a supportive green candle.

⚡️ The $2.574 area is robust, showing positive price response, and it remains to be seen what happens next. If this support breaks, the price could move towards lower areas like $1.830 and $0.993.

🔑 Conversely, if the price can sustain this support and move above $3.615, a significant upward momentum could enter the market, potentially driving the price at least up to $8.298. A break above $8.298 could see the next target at $16.839.

📊 Market volume has increased following the range break, which is natural as the price has finally moved out of a range, and increased volume has entered. Continuation of this volume increase could heighten the likelihood of breaking $2.574.

📅 Daily Timeframe

In the daily timeframe, we can observe more detailed price movements.

💫 As seen, the main support at $3.615 has broken, and subsequently, a price box formed between $2.804 and $3.615. Coinciding with an RSI divergence, the floor at $2.804 broke, and the price dropped to $2.161.

🎲 Currently, the price is correcting back towards the $2.804 area. Market volume is rising, and the RSI divergence trigger has not yet been activated, indicating ongoing bearish momentum.

💥 If the RSI breaks the 50 area, the divergence could impact the market and eliminate the bearish momentum. This would be the first sign of a trend change, but the main ceiling at $3.615 must be broken to confirm a trend reversal.

📉 For short positions, breaking the $2.161 area is suitable, and if this area breaks, the price could drop to $1.682. For long positions, breaking $2.804 is a risky trigger, with the main trigger at $3.615 for a more solid position.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

KAVAUSDT UPDATEKAVAUSDT is a cryptocurrency trading at $0.4711. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KAVAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KAVAUSDT is poised for a potential breakout and substantial gains.

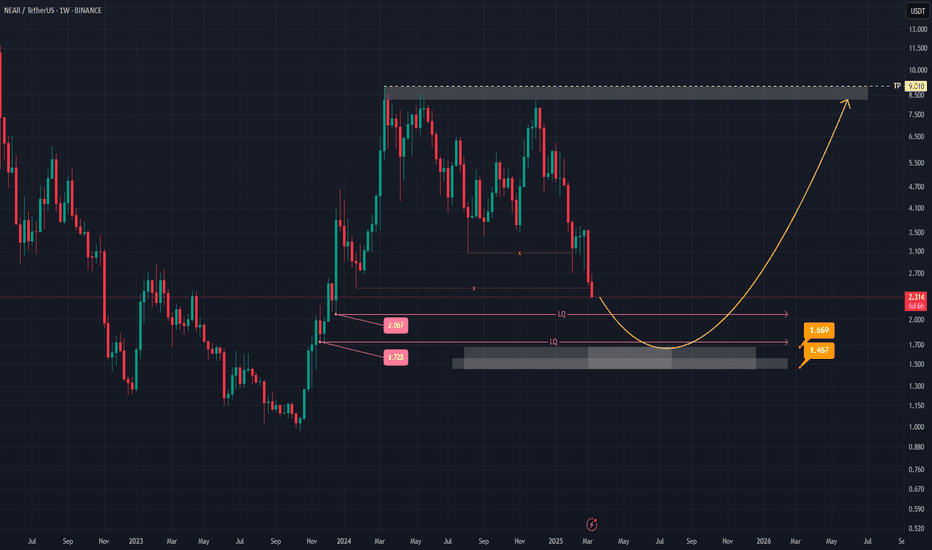

NEAR (NEARUSDT) Weekly Analysis: Potential Reversal in SightHey everyone! Let’s take a look at NEAR (NEARUSDT) on the weekly chart. There’s a chance the price might move into the 1.728–2.067 range, possibly sweeping up some liquidity before heading toward the 1.467–1.669 zone. This area seems like it could act as a launchpad for a potential bounce, aiming for higher targets afterward.

Watch for a spike in trading volume around that zone—if volume picks up, it could indicate stronger buying interest. Another key signal to look out for is a bullish candlestick pattern (like a hammer or a bullish engulfing), which might confirm a reversal if it appears near the 1.467–1.669 level.

Of course, if the price drops below 1.467, it might change this outlook and suggest a different path forward. Since the market can be unpredictable, it’s always important to keep an eye on these levels and stay prepared.

Above all, remember to do your own research and stay informed—this space can move fast, and it’s best to approach it with a curious mind. Keep learning, stay positive, and good luck out there! 📈

NEAR Protocol Prepares For Long-Term Reversal (Bullish Breakout)NEAR Protocol (NEARUSDT) has been in a correction pattern since March 2024. It has been sideways within a wide range for an entire year.

The baseline, or long-term support, matches the 0.786 Fib. retracement level for the bullish wave that developed between late 2023 and early 2024. Current price action is happening above this level. Once resistance turned support.

The lowest price since January 2024 was hit just four days ago, 4-March. While this level was a more than a year long low, trading volume was very low. Even on the 2-Feb. drop bear volume was already dropping. Ever since the peak in March 2024, with each successive drop this pair produces, trading volume continues to drop. Revealing a weakening bearish trend.

A trend weakens when it is reaching its end.

But this isn't really a bearish trend but more like a long-term, wide consolidation pattern. It is classic pre bull-market action. There is a long-term lower high but the bottom is flat. When the next bullish wave develops, which is what will happen as the correction ends, the candles that we are seeing now will become almost invisible, same as if you were to look to the deep left side of the chart. Each time bull-market action develops, the preceding candles become really small. This is because bull-markets tend to produce growth that is out of proportion will all previous price action.

NEAR Protocol will hit new All-Time Highs. This is certain. It will be amazing and this amazingness is starting in a matter of days.

It will take months and months and months for the complete bullish cycle to reveal itself, but it will start within days. It tends to start low. Slowly but surely momentum grows, and as if it was never happening, the next moment we are here trading and exchanging, the entire market is experiencing growth.

We will be chatting and exchanging, having fun as our profits grow.

Thank you for reading.

Allow me to be your guide. It will be a tour that will not only change our lives but also the world.

Namaste.

NEARUSDT on a bullish climb!

🚀 The price BINANCE:NEARUSDT.P is moving steadily inside an ascending channel, testing *3.080 USDT* resistance. If the breakout holds, we could see a push toward higher levels!

🔑 *Key Levels:*

**Support:**

*3.051 USDT* – main level keeping the trend intact.

*3.000 USDT* – deeper support if retracement kicks in.

**Resistance:**

*3.094 USDT* – key breakout point.

*3.150 USDT* – potential next stop for bulls.

🚀 *Trading Strategy:*

*Long Entry:* After confirming a breakout above *3.094 USDT*.

*Stop-Loss:* Below *3.051 USDT* – protecting against fakeouts.

*Profit Targets:*

*3.120 USDT* – quick scalp target.

*3.150 USDT* – solid take-profit zone.

*3.200 USDT* – full bullish extension if momentum builds.

📊 *Technical Outlook:*

Price respecting the channel = continuation likely.

Volume picking up – signals increasing bullish interest.

Failure to break resistance could lead to a pullback to support.

💡 *What to Watch?*

Watch for volume confirmation on breakout!

If resistance rejects, look for a retest at lower support before re-entering.

Bulls in control, but risk management is key.

Are we heading for a breakout or a pullback? Drop your thoughts! 🚀🔥

Near Protocol AnalysisNear Protocol Analysis:

Near Protocol is currently trading at 3.565, having recently broken through a critical support level. This breakdown has altered the technical structure of the asset, as the price now appears to be retesting the previously breached support zone, which has since transformed into resistance. In technical analysis, such a retest of a broken support level often serves as a key confirmation point for potential trend continuation. Should the current candle close decisively below this newly established resistance level, it could indicate a resumption of the bearish momentum, potentially paving the way for further downward movement.

It is important to consider that the reliability of this bearish outlook will depend on several factors, including the volume accompanying the price action and the broader market sentiment surrounding Near Protocol. Traders should also remain cautious of any signs of rejection or potential reversal patterns at this critical juncture, as these could invalidate the bearish thesis and suggest a shift in market dynamics.

In conclusion, while the current price action suggests a potential continuation of the downtrend.

We would be interested in hearing your perspective on this analysis and whether you concur with the potential bearish outlook for Near Protocol. As always, trade responsibly and prioritize risk management.

NEAR Price Outlook: Support, Resistance and Alt Season PotentialHello, Traders!

NEAR Protocol has been underperforming during this cycle, showing notable weakness compared to some other assets in the market.

However, it still holds potential for an upside move, especially if we witness a proper altcoin season.

Currently, NEAR is trading around a strong support area in the $4.50–$5.00 price range.

This area has historically been significant, and it seems unlikely that buyers will allow the price to break below it.

If an uptrend is to occur, it is most likely to begin from this area.

The $4.50–$4.80 zone presents an attractive accumulation range for mid-term investors, especially for those looking to position themselves ahead of any potential recovery.

However, for NEAR to convincingly shift into an uptrend, it must reclaim and sustain a position above the $6.00 resistance level.

If the price manages to break and hold above this threshold, we could see NEAR retesting its recent highs around the $8.00 level, with the possibility of pushing even higher depending on market conditions.

It's essential to note that NEAR overall remains weak.

Any significant upside movement would likely require BTC.D to drop below the 55% threshold, signaling a favorable environment for altcoins to rally.

Until then, NEAR is more likely to remain range-bound or continue its downtrend.

Please don’t forget to boost this idea and leave your comments below.

#NEAR/USDT Ready to go higher#NEAR

The price is moving in a descending channel on the 1-hour timeframe and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 4.70

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.90

First target 5.46

Second target 5.83

Third target 6.32