NEAR Breakout Confirmed—But Is This Just a Bull Trap?Yello Paradisers! Did you see that breakout on #NEARUSDT? After weeks of consistent lower highs and a clearly defined descending resistance, price action has finally snapped that bearish structure and completed a textbook inverse Head and Shoulders formation on the 12H chart. This kind of pattern doesn’t appear often at key cycle points, and when it does—especially with confirmation—it becomes a high-probability signal of a trend reversal.

💎#NEARUSDT ,The neckline of the inverse H&S, sitting around the $2.17–$2.23 zone, has now been broken and crucially retested as support. This means the former resistance is now acting as a probable base for bulls, and if price remains above this area, the market is likely preparing for a strong probable impulsive move to the upside.

💎The structure shows clear bullish intent, and from a technical perspective, the first resistance comes in at $2.72. A clean break above that could open the door toward the major resistance zone between $2.97 and $3.05, which would complete the projected breakout target of the H&S pattern.

💎If bulls manage to maintain control above the $2.17–$2.23 support zone, we expect price to slowly build momentum toward $2.72, with increased volatility likely once that level is tested. Should that break occur with volume, the next leg may extend rapidly into the major resistance zone. However, if price fails to hold above this flipped support zone, we will be closely watching the $2.02–$1.89 area as the last major support before invalidation.

💎A daily candle closing below $1.798 would invalidate this entire bullish thesis and put the market back into a neutral-to-bearish range.

💎Adding more probability to this setup, NEAR is now trading above multi-timeframe EMA on higher time frame. This multi-timeframe EMA alignment supports bullish continuation, as momentum begins to shift in favor of buyers. However, continuation depends heavily on how price reacts at each resistance level—especially as we enter the mid-$2.70s.

💎The probable move from here is bullish, with the expectation that NEAR pushes toward the $2.72 level in the short term, followed by a potential rally to $2.97–$3.05 if momentum sustains. This scenario remains valid as long as price holds above $2.17, and especially above $2.02. Below that, the structure weakens. Below $1.798, the bullish bias becomes fully invalidated.

This is the only way you will make it far in your crypto trading journey. Stay sharp and patient, Paradisers. It’s not about chasing pumps—it’s about positioning smartly before the crowd.

MyCryptoParadise

iFeel the success🌴

NEARUSDTPERP

NEARUSDT Breakout Watch Descending Triangle Reversal in Progress🧠 Pattern and Structure Analysis

The NEAR/USDT pair is currently displaying a long-term Descending Triangle pattern that has been developing for over 6 months. While descending triangles are typically bearish continuation patterns, a breakout to the upside often signals a strong trend reversal.

Descending resistance trendline: Multiple touchpoints confirming the structure.

Horizontal support zone: Strong base formed between $1.79 – $2.21.

The current price action shows a potential breakout above the descending resistance, indicating a possible shift in trend.

🚀 Bullish Scenario

If the breakout is confirmed (especially with high volume and daily close above the trendline), NEAR could rally toward the following resistance levels:

1. Target 1: $2.693 – minor resistance

2. Target 2: $3.021 – key psychological and technical level

3. Target 3: $3.568 – previous support/resistance flip

4. Target 4: $4.635 – major resistance zone

5. Extended Targets: $6.028 and $8.062 – historical highs

📌 Breakout confirmation requires a daily close above $2.25 with increased volume.

🐻 Bearish Scenario

If the breakout fails and the price gets rejected at the trendline:

Price may revisit the strong support zone around $1.79.

A breakdown below this support would open the door to deeper downside levels, possibly below $1.70 or even toward $1.50.

The bearish outlook would be invalidated if the price sustains above $2.30 and forms a higher-high structure.

🔍 Strategic Summary

Pattern: Descending Triangle (Potential Reversal)

Breakout Level: ~$2.25

Key Support: $1.79 – $2.21

Recommendation: Watch for a confirmed breakout with strong volume. Use a trailing stop strategy to lock in profits as targets are reached.

#NEAR #NEARUSDT #CryptoBreakout #AltcoinSeason #DescendingTriangle #TechnicalAnalysis #CryptoTrading #BullishSetup #ReversalPattern #ChartPattern

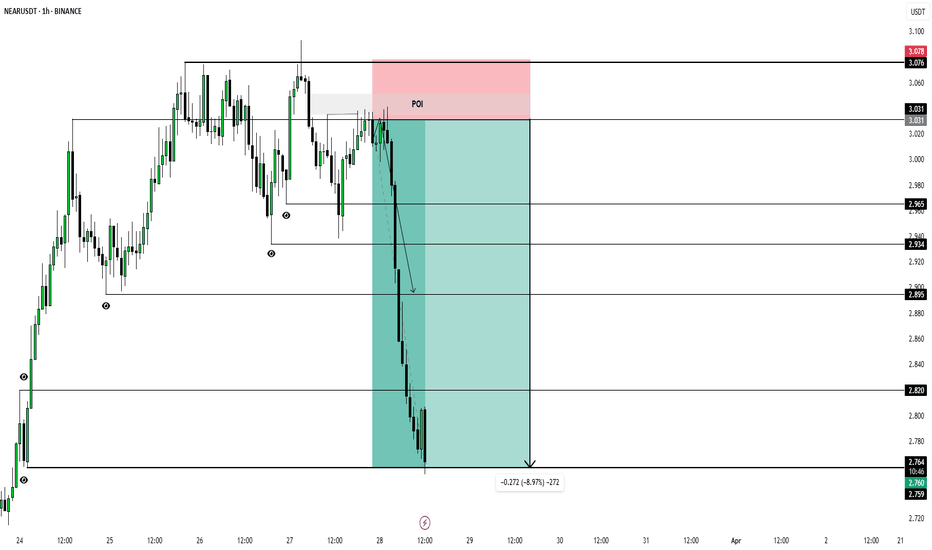

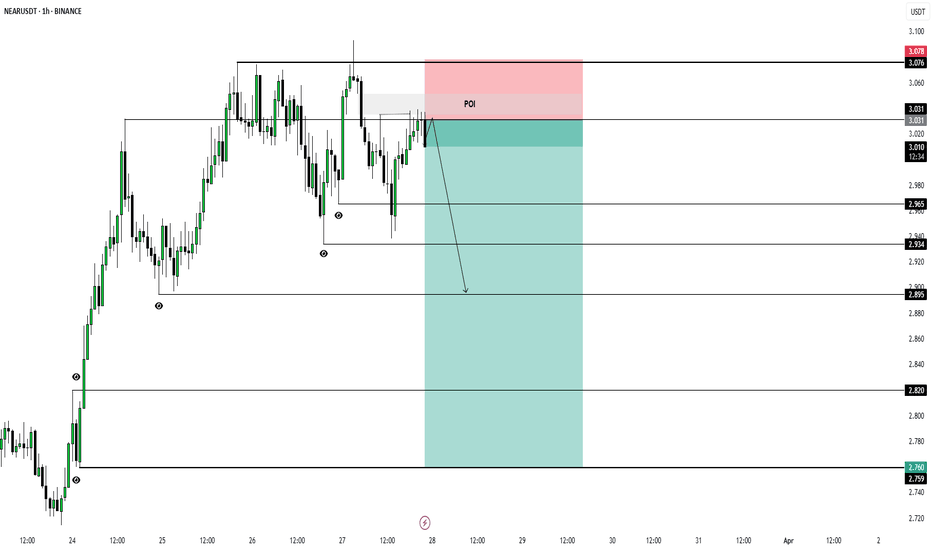

NEARUSDT Retest in Play After Breakout — Bulls May Take Charge!BINANCE:NEARUSDT has turned the tide after a prolonged downtrend, now forming higher highs and signaling a shift in momentum. Recently, it broke through a key resistance level, flipping it into support, a classic breakout-retest setup. Right now, price action is retesting that breakout zone, and if it holds, we could see a strong bounce and continuation of the bullish structure. This level is crucial, and a successful retest could pave the way for another leg up.

As always, don’t forget to manage your risk. keep a well placed stop loss in case the market flips unexpectedly.

BINANCE:NEARUSDT Currently trading at $2.8

Buy level : Above $2.75

Stop loss : Below $2.2

Target : $5.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#NEAR/USDT#NEAR

The price is moving in an ascending channel on the 1-hour frame and is expected to continue higher.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower limit of the channel at 2.65.

Entry price: 2.65

First target: 2.80

Second target: 2.95

Third target: 3.10

Near Protocol price analysisFor many deposits, the correction of the #NEAR price was quite painful.

But if you look at the global chart of OKX:NEARUSDT , it's not so critical.

We want to believe that someday #NEAR will cost $20 again, and there are theoretical and technical possibilities for this....

But before that, buyers need to be able to fix the price of #NearUSD above $3.5, and then above $4.5 at the exit from the "bearish flag".

Only there is a safe medium-term purchase point for the #NearProtocol token in the current realities.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#NEAR/USDT Ready to go higher#NEAR

The price is moving in a descending channel on the 1-hour timeframe and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 4.70

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 4.90

First target 5.46

Second target 5.83

Third target 6.32

NEAR/USDT Trade Setup. NEAR/USDT Trade Setup

Entry Price: CMP and $4.05

Stop Loss (SL): $3.60

Targets:

$8.50

$12.00

$16.00

$20.00

Leverage: 5x to 10x

The chart shows a descending triangle breakout, a bullish reversal pattern, indicating significant upward momentum.

Price is currently above the breakout level, validating potential continuation toward higher targets.

Let me know if you’d like further assistance or adjustments!

DYOR. NFA

NEAR: Technical Analysis | Bullish Momentum BINANCE:NEARUSD | NEAR: After retracing at 78.60% Fib level it has closed above 61.80% Fib level. Pitchfork is also acting really well as a support and resistance levels. If NEAR closes above 50% Fib level and Daily Anchored VWAP ($6.034) it has high probability to reach $9 target.

Near idea!"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Near Protocol NEAR price is lazily creeping upAt the moment, we can see the potential for OKX:NEARUSDT to rise to the range of $6-6.50

Here you will need to decide for yourself whether to hold the position further or get rid of it

Only a confident fix #NEARUSD price above $6.50 can give CRYPTOCAP:NEAR a growth potential up to $10

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more