NZDUSD | Perspective for the new week | Follow-up detailsIt is over 200pips move in our direction since my last publication on this pair (see link below for reference purposes - the positive outcome from this speculation is indeed interesting as one of my client did not believe in our sell position hence he closed the trade😄and lost the opportunity to recover his account ) and it appears that we have milked the Bearish move to its end as the appearance of a reversal set-up at this juncture hints at a possible rally which might be a correction of the impulse leg we took advantage of. The Kiwi hit 10-month lows on Friday as coronavirus lockdowns undermined their economies and pushed out policy tightening hereby sparking a steep drop in bond yields.

After hitting a month low @ $0.68050 early in the week, the Kiwi bounced higher in a rangebound trade to post a slight gain at the end of the week with signs of a reversal in the air should price break and close above key level @ $0.68400.

Tendency: Uptrend (Bullish)

Structure: Supply & Demand | Reversal pattern (Double Bottom)

Observation: i. Since the beginning of the month of August 2021, we witnessed a spiral move downward as the price continued to find lower lows.

ii. After hitting bottom @ $0.68100, we witnessed multiple rejections of this level during the latter part of last week trading session which gave rise to the appearance of a Double Bottom pattern - a very strong reversal setup.

iii. Double Bottom: a charting pattern that describes a change in trend and a momentum reversal from prior leading price action shall be confirmed as soon as the price does a Breakout/Retest of the Neckline which is also my Key level at this juncture.

iv. Considering the Bearish momentum on this pair; it is advisable that we become patient for confirmation which shall be at the completion of reversal pattern to hop in the rally.

v. Please note that this reversal might be a correction of the bearish impulse leg (temporarily bullish) and if the price breaks above a 61.8/78.6% retracement then we can be looking at the possibility of an outright reversal... Trade consciously!😊

Trading plan: BUY confirmation with a minimum potential profit of 100 pips.

Risk/Reward : 1:5

Potential Duration: 3 to 7days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

This is a long-term perspective and you might watch this space for speculation on lower time frames as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

Necklinetrader

AUDJPY Fibonacci ClusterThe price formed 2 harmonic patterns in the support area.

In this complete pattern, there are several Fibonacci levels that coincide with the support area.

So that it is possible to become a cluster as an area reversal.

If the price stays above this level, it will go to 38.2 and 61.8 level as default targets for the harmonic pattern

GBPAUD | Perspective for the new weekA Breakout of channel negated my speculation on this pair as price continued to find new highs (see link below for reference purposes) and the appearance of a Double Top structure at this juncture in the market insinuates a risk of further decline if price successful breakdown Neckline @ AU$1.87800. Positive development unfolding as the Reserve Bank of Australia (RBA) is expecting that once the covid restrictions end, the economy would stage a quick rebound as it revised down its 4Q GDP forecast by 0.75%.

Tendency: Downtrend (Bearish)

Structure: Supply & Demand | Reversal pattern (Double Top)

Observation: i. It is very glaring that the Pound has imposed a show of strength over the Aussie since the beginning of the year 2021 hereby registering an 8.7% gain to culminate at AU$1.89800 at the end of July 2021.

ii. The appearance of Double Top structure at the very peak of the Bullish run inspires an extremely bearish technical reversal pattern after the price touched a peak two consecutive times (AU$1.89800 & AU$1.89230 respectively) with a moderate decline between the two highs.

iii. Even as sellers continue to make attempts to close below Neckline @ AU$1.878000 in the last two weeks, positive developments from the RBA incites a possible strength for the Aussie at least for the meantime as we anticipate a Breakdown of AU$1.87800 in the coming week(s).

iv. In this regard, I have identified a supply niche around AU$1.88500/1.88740 - an area I suspect momentum for selling opportunity as below key level remains a comfortable zone to open a position.

v. A successful Breakdown/retest of Neckline shall be an opportunity to add a position to our existing position.

vi. For the meantime, I am assuming that the Bearish expectation might be a correction of the impulse leg (see weekly chart below) until proven otherwise...Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 200 pips.

Risk/Reward : 1:4

Potential Duration: 3 to 10days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD | Perspective for the new week | Follow-up detailsWith over 60pips move in our direction since my last publication, the character of price action during the course of last week trading session appears to have shed more light on the direction that the majority are heading as price broke and closed below our previous key level @ $1.39850. As multiple rejections of our previous neckline @ $1.39400 (see link below for reference purposes) affirms strength for sellers at this juncture in the market, The Pound continues to drop on the back of a stronger Dollar following a robust NFP release as price breaks down a significant level @ $1.38700 which technically serves as a Neckline of a Triple Top pattern. In this regard, I expect a risk of further decline for the Pound in the coming week(s).

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Reversal pattern (Triple Top)

Observation: i. The following narrative is a follow-up on my previous broadcast since we are yet to see any significant setup that reveals otherwise.

ii. The pattern formation of three peaks moving into the same area ($1.39400) with pullbacks in between shall be considered complete once the price closes below pattern support @ $1.37800 (Neckline).

iii. The appearance of a Triple Top pattern at a critical zone as our previous Neckline @ $1.39400 predict the reversal in the movement of price action thereby indicating a further slide in price.

iv. As the Key level remains our yard sick for bearish continuation, a further breakdown and retest of $1.38600 shall give rise to a new Supplication area for future selling opportunities and options to add to the existing position.

v. Considering the strong Demand zone @ $1.38600, the early hours/days of the new week might see a price climb to test the Bearish trendline to incite further decline...Trade consciously!😊

vi. I am looking forward to the completion of a possible Harmonic pattern (AB = CD) on the weekly chart ( see chart below for reference purposes).

Trading plan: SELL confirmation with a minimum potential profit of 200 pips.

Risk/Reward : 1:5

Potential Duration: 3 to 7days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

CHFJPY | Perspective for the new week | Follow-up detailsWith a break-even position on this pair and considering the appearance of a Double top structure, I suspect that price is going through a correction phase in anticipation of a rally in the coming week hence an opportunity to take a quick trade in the opposite direction of my last speculation arises (see link below for reference purposes).

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Reversal pattern (Double Top) | Trendline

Observation: i. Since the 20th of July 2021, the price has continued to find a higher high and appear to have found a roadblock @ Y121.200 following a double rejection of this level.

ii. Double Top: The appearance of an extremely bearish technical reversal pattern after the price reached a peak two consecutive times (Y121.200 & Y121.130 respectively) with a moderate decline between the two highs and it is confirmed when the price fell below support level equal to the low between the two prior highs (Neckline @ Y120.500).

iii. In view of my last speculation on this pair, I suspect that the double top at this juncture in the market signals a medium-term trend change in price with the anticipation of a rally in the nearest future.

iv. In this regard, the neckline remains a Key level for a short-term bearish continuation.

v. Please note that the early hours/days of the new week might see price climb to test Y120.750/120.900 area to incite bearish continuation...Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 80 pips.

Risk/Reward : 1:3

Potential Duration: 2 to 5days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

NZDUSD | Perspective for the new week | Follow-up detailsSince my last publication on this pair (see link below for reference purposes; the price has moved a little above 50pips in our direction as we witnessed a transition into a consolidation phase which also explains the doubt/indecision in the market in the last 3 weeks. Despite observing multiple rejections from the $0.69200 area in the last week, I suspect that the Greenback is setting up for strong gains in the coming week(s).

Tendency: Downtrend (Bearish)

Structure: Supply & Demand | Reversal pattern (Double Top) | Trendline

Observation: i. The Bearish Trendline (see weekly chart) reflects that price has been caught within a Bearish scope since late May 2021 with strong tendencies of a risk of further decline for the Kiwi in the coming week(s).

ii. Conspicuously, multiple rejections of $0.70400 making a confluence with the Bearish Trendline during last week trading session validates my plan to shorting the Kiwi.

iii. Double Top: The appearance of an extremely bearish technical reversal pattern after the price reached a peak two consecutive times ($0.70450 & $0.70390 respectively) with a moderate decline between the two highs further support a Bearish bias as I look forward to a Breakdown/Retest of Bullish Trendline (indicated on shart) in the coming week.

iv. Please note that below the Key level @ $0.70100 remains a yardstick to shorting.

v. A Breakdown/Retest of Neckline @ $0.69750 might welcome addition to the existing position.

vi. And a successful Breakdown/Retest of $0.69200 ( a level that held price "supported" in the last week) might be the straw that will break the camel's back for significant sell continuation.

vii. CAUTION : A breakout and retest of the $0.70400 area shall render the narrative invalid and I shall be switching position for a rally!... Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 120 pips.

Risk/Reward : 1:6

Potential Duration: 2 to 5days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPJPY | Perspective for the new weekIt has been a while since I looked at this pair from a long term perspective but the temptation in the present contraction in the market can not be resisted as I identify a trading opportunity building up for an explosion!

The British pound rallied from the Demand zone during the course of the last two weeks but since the 9th of July 2021, I have noticed that the buyers appear to be struggling to break above Key level @ Y153.200 area to confirm rally continuation. The appearance of a shooting star on the last trading day (Friday, 30th July 2021) expresses another sharp rejection of this level with a potential to transform into a Head and Shoulder pattern thereby signalling a Bearish perspective to this pair for me in the coming week(s).

It is worthy to note that there is a general notion that the Japanese Yen is still considered to be a “safety currency”.

Tendency: Downtrend (Bearish)

Structure: Trendline | Supply & Demand | Reversal pattern (Head & Shoulder)

Observation: i. Since mid-March 2021, we have witnessed a surge in the value of the Pound over the Yen which hit a peak of Y156.200 after which the price continued to find lower lows.

ii. Multiple rejections of Key level @ Y153.200 gives further significance to the strength of sellers at this juncture in the market.

iii. Head and Shoulder: A baseline with three peaks (the outside two is expected to be close in height and the middle is highest). The completion of this pattern will signal with a degree of accuracy that the prevailing uptrend is nearing its end.

iv. Even as we await completion of Head & Shoulder, selling potentials exist below the Key level @ Y153.200 with potential to add position at Breakdown/retest of Y152.000 level.

v. The completion of a bullish-to-bearish trend reversal is confirmed as soon as the price breaks down the Neckline @ Y149.000 (Demand zone) - another window to add a position.

vi. CAUTION: Considering the Bullish perspective from a long term scale, we might see price do a correction into 61.8/78.6% retracement of Impulse Leg (see weekly chart) to incite rally continuation. However, should price breakout/reset Key level @ Y153.200 and Bearish Trendline our perspective shall shift to a rally continuation... Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 500 pips.

Risk/Reward : 1:5

Potential Duration: 10 to 20days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD | Perspective for the new week | Follow-up detailsWe are yet to take a position since price action negates the Bearish expectation projected in my last publication on this pair (see link below for reference purposes) as price broke out of the Bearish trendline to find a new high. The current structure appears to have clues that support selling opportunities as the price is at a zone that has accumulated bearish momentum in the past (since February 2021). The appearance of a technical reversal pattern within a major Supplication area ($1.39500/1.40110) that has had a resistance memory since May 2016 (see weekly chart) calls my attention to Bearish tendencies at this juncture in the market.

Despite slumping earlier this week after Fed Chair Jerome Powell said rate increases were "a ways away" and the job market still had "some ground to cover", the bullish momentum garnered on Friday by the USD could be a platform for better days as anticipation of a positive consensus ahead US Nonfarm payrolls release is in the air!

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Reversal pattern (Double Top) | Trendline

Observation: i. The Greenback resumed recovery with a strong reversal set-up that began on the 21st of July 2021 from the $1.36000 area (see weekly chart).

ii. The line drawn under pivot lows in the last 8 trading days reveals the prevailing direction of participants in the market as price continued to find higher highs.

iii. Double Top: The appearance of an extremely bearish technical reversal pattern within a major Supplication area ($1.39500/1.40110 - see daily chart below) as the price appears to have tested a peak two consecutive times ($1.39830) was later followed by a significant Breakdown of Neckline ($1.39400) on Friday.

iv. I hereby suspect that the early hours/days of the new week might see a price climb to reject neckline to incite a risk of further decline for the Pound in the coming week(s).

v. In this regard, I have identified a niche to go short around $1.39400/1.3900 as a breakdown of Trendline and Key level $1.39850 remains an area to affirm the bearish bias on this pair.

vi. $1.39830 Level - (the peak that formed the Double Top) has a level of significance in my bearish expectations as this level is seen to have a memory of Bearish momentum that garnered over 200pips move in recent times (24th June 2021).

vii. It is worthy to emphasise that the bearish perspective on this speculation could be a correction of the Bullish run that began on the 21st of July 2021 as participants who took advantage of the run take "quick profits" in anticipation of a rally continuation.

viii. This been said, it is appropriate that we put into consideration the possibility of a rally continuation if the price remains above the identified Neckline @ $1.39400... Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 150 pips.

Risk/Reward : 1:6

Potential Duration: 3 to 7days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

USDJPY | Perspective for the new week With over 150pips move in our direction since my last publication (see link below for reference purposes); I have identified a trading opportunity we can take advantage of as the current structure reveals a possible reversal for a rally in the coming week(s). After plummeting earlier in the week against the Japanese yen, the USD turned around to show signs of strength again when the price broke out of Bearish Trendline (21st July 2021) thereby suggesting that the Greenback is on the verge of a potential recovery in the coming week(s).

Tendency: Uptrend (Bullish)

Structure: Breakout | Supply & Demand | Trendline | Reversal pattern

Observation: i. Since the beginning of July 2021; we witness price action spiral downward after hitting a peak @ Y111.700 (the first high this year).

ii. The price found a bottom around Y109.000/109.600 and we can agree that this zone has kept price "supported" between 8th & 19th of July 2021(2 weeks) with clues suggesting buying strength at this zone.

iii. The Breakout of Bearish Trendline that happened on the 21st of July 2021 gives cognisance to my Bullish expectation as I look forward to the completion of the correction phase of Impulse Breakout to incite a rally continuation.

iv. Above the Key level @ Y110.100 and Bullish Trend line (indicated on the chart) shall serve as an area for buying opportunity in the coming week as any move below this level negates my narrative so far.

v. It is important to expect that the early hours/days of the new week "might" see a price drop to test the Neckline, Key level, Bullish Trendline or as far as testing the Bearish Trendline at around Y109.600 to incite a rally continuation.

vi. Breakout/Retest of Y110.400 shall be an opportunity to add to the existing position... Trade consciously!😊

Trading plan: BUY confirmation with a minimum potential profit of 130 pips.

Risk/Reward : 1:5

Potential Duration: 5 to 12days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks, etc.) is high risk and unsuitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation before making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

XAUUSD | Perspective for the new week | Follow-up detailsWe witnessed a 1,500 pips move in our direction since my last publication on this pair (see link below for reference purposes) and it appears we are at another juncture in the market that welcomes another opportunity to hop in the train of a second rally. The beginning of reversal set up at exactly $1,750 Level (Double Bottom) identified on the 29th June 2021 also falls at a 61.8% retracement of a Bullish impulse leg (see weekly chart) insinuates a strong trend continuation in the nearest future.

Tendency: Uptrend (Bullish)

Structure: Breakout | Supply & Demand | Reversal pattern (Double Bottom)

Observation: i. The price has remained "supported" at around $1,750 since it broke above this level on the 15th of April 2021.

ii. A peak at $1,915 was established on the 1st of June 2021 and since then we have witnessed a downward spiral after the completion of Double Top set up that I and my team missed!

iii. The Demand level which had held price "supported" since April 2021 appears to be holding price again as a Double Bottom pattern emerges.

iv. Double Bottom: We do have an extremely bullish technical reversal pattern in play that describes a change in trend and a momentum reversal from prior leading bearish price action as the twice-touched low @ $1,750 area is considered a strong support level.

v. There is an identification of Key level @ exactly $1,800 which serves as a significant level that possesses a strong memory for bullish thrust since July 2020 (see weekly chart).

vi. Breakout and rejection of the Neckline/Key level @ $1,800 during the latter part of last week trading session give some credibility to the Bullish bias hereby revealing participants clamour for Gold over the Greenback.

vii. There is the possibility that the price may plunge to $1,78--- at some point but above Key level @ $1,800 remains our yardstick for buy opportunity in the coming week(s).

viii. A Breakout/Retest of Neckline of the Double Top @ $1,870 might welcome addition to the existing position... Trade consciously!😊

Trading plan: BUY confirmation with a minimum potential profit of 1,500 pips.

Risk/Reward : 1:5

Potential Duration: 15 to 25days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

CHFJPY | Perspective for the new week | Follow-up detailsWe witnessed over 500pips move in our direction since my last publication on this pair (see link below for reference purposes) and it appears we are at another juncture where a possible Trend continuation is looming. The general risk-off tone of the markets is very likely to surge the Swiss franc into a higher high as I anticipate a Breakout/retest of Neckline @ Y120.700 area to clear all doubts off of Bearish tendencies.

Tendency: Uptrend (Bullish)

Structure: Supply & Demand | Reversal pattern (Double Bottom)

Observation: i. In the view of a long term perspective that projects Bullish expectations, it is pertinent that we notice that price has continued to remain above Y119.000 since it broke above this level on the 29th of April 2021.

ii. The Swiss Franc lost all it had gained (over 300pips) between 29th of April and 15th of June 2021 and at the time of writing this report price has come back to settle at the Demand zone where the Bullish run started.

iii. The price consolidating between Y119.000 and Y120.700 confirms the indecision that has gripped the market in the last 3 weeks which also calls for patience if we plan to trade this pair in the coming week(s).

iv. The appearance of a Double Bottom (an extremely bullish technical reversal pattern) inside the Demand zone expresses a build-up that supports a change in trend and a momentum reversal from prior leading bearish price action as the twice-touched low @ Y119.000 area confirms this zone to be a strong support level (as long as it is not broken).

v. Considering the Impulsive Bearish move prior to the consolidation phase; I look forward to a Breakout of Neckline (key level @ Y120.700) for confirmation to hop in a rally.

vi. It is also necessary that I state here that the Demand level is exactly at a 61.8% retracement of a Bullish Impulse leg on a higher time frame (see weekly chart).

vii. Even as I remain unable to rule out a possible breakdown of Demand zone, Break out of key remains our yardstick for Bullish expectation in the coming week (s)... Trade consciously!😊

Trading plan: BUY confirmation with a minimum potential profit of 300 pips.

Risk/Reward : 1:5

Potential Duration: 7 to 15days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

BNB Head and ShoulderBINANCE:BNBUSDT

If you look closely at the pattern on the head and shoulders, you will see that the price is up

It has reached the neckline and even penetrated

But did not complete the price on the pullback neckline

You can consider the neckline as a resistance

Take that the price can go well after that failure

Be

GBPAUD | Perspective for the new week | Follow-up detailsWith over 600pips in our direction since my last publication on this pair (see link below for reference purposes); The price hit a peak around AU$1.85000 in June 2021 and has since then continued to find lower lows. The appearance of a Double Top structure on the chart is a very strong clue that hints at a reversal momentum building as we experience a significant Breakdown of Key level I @ AU$1.84100 during the course of last week trading session.

In the UK, the newly appointed Health Secretary Sajid Javid insisted that the reopening remains intact, showing confidence about returning to normal. However, as cases continue rising – and hospitalizations are inching higher – market participants tend to cast doubt over loosening of restrictions on July 19 which might have a negative impact if not indecision on the Pound in the coming week(s).

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Channel | Reversal pattern (Double Top & Triple Top)

Observation: i. It has been a Bullish run for the Pound since the beginning of the year - 2021 hereby hitting a peak @ AU$1.85000 which is followed by a lower high to transition into a Descending Channel.

ii. The inability of price to touch and surpass the previous high (AU$1.85000) increases doubt on a further rally as a Double Top pattern emerges on the chart.

iii. Double Top: We do have an extremely bearish technical reversal pattern in play after the price reached a peak two consecutive times (AU$1.85000 & AU$1.84800 respectively) with a moderate decline between the two highs.

iv. Even as we await a confirmation which will happen if the price falls below the support level @ AU$1.82700 (Neckline of Double Top) that equals the low between the two prior highs; there is an evident structure that occurred between 30th June & 2nd July 2021 which is characterized by multiple rejections of AU$1.84600 (Triple Top) that signals Bearish tendency in the coming week(s).

v. TRIPLE TOP: formation of three peaks moving into the same zone @ AU$1.84600, with pullbacks in between can be considered complete immediately the price broke down pattern support @ AU$1.84000 on the 2nd of July 2021, indicating a further price slide in the coming week(s).

vi. The early hours/days of the new week might see a price climb to test the Neckline of Triple Top @ AU$1.84000 to incite further decline.

vii. If a climb happens, I have identified a niche around AU$1.83900/1.84400 for selling opportunities.

viii. A plunge below Key level II @ $1.83500 (Breakdown/Retest) might welcome an addition to the existing position and a further plunge below AU$1.82700 welcomes another addition... Trade consciously! :)

Trading plan: SELL confirmation with a minimum potential profit of 150 pips.

Risk/Reward : 1:6

Potential Duration: 3 to 7days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

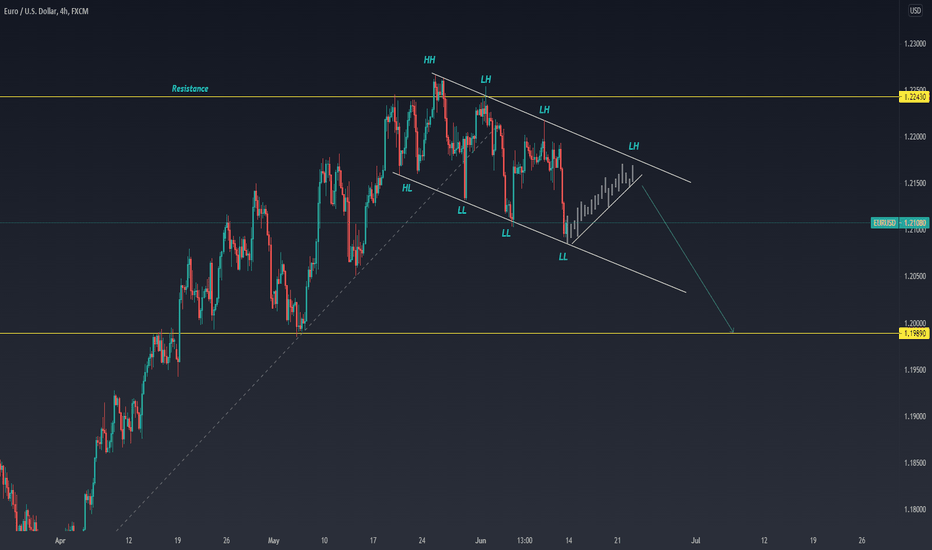

EURUSD False BreakOn the H4 Time frame, the price initially seemed to break support.

However, the price has tried to fight several times.

Currently price make a strong movement and create a large candle.

If the H4 candle closes with a large candle, then we can buy on the next candle.

On H4 and H1 we also have a bullish divergent which is an indication of a strengthening.

NZDUSD | Perspective for the week | Follow upWe experienced over 250pips move in our direction since my last publication on this pair (see link below for reference purposes) and I suspect that price-action is going through a Correction phase that we are yet to decipher when it will stall.

Last week trading session saw the Kiwi close in the positive territory for four straight days and continued to find higher highs that culminated at $0.7070 on Friday. Market participants still remain optimistic for the Greenback ahead of the June Nonfarm Payrolls report. At the time being, market expectations point to a 600,000 increase in the headline number, while the unemployment rate is foreseen contracting from 5.8% to 5.7%.

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Harmonic pattern (AB = CD)

Observation: i. Since hitting a peak at $0.74500 on February 25th 2021, the price continued to find lower lows hereby transposing into what looks like a Descending channel.

ii. DESCENDING CHANNEL: Connecting the lower highs and lower lows of price action with parallel trendlines reveals the prevailing downward trend since February 2021.

iii. A successful Breakdown of $0.71200 on the 16th of June 2021 confirms the Bearish momentum.

iv. With the current structure, Correction phase is happening and I am yet to decipher where and when it will stall in anticipation of a decline continuation.

v. In this regards, I have identified a selling niche around $0.71000/0.78000 area.

vi. I expect a transition into a Harmonic pattern (AB = CD) in the coming week with parameters explained below;

a. Impulse A-to-B is expected to be in harmony with the potential C-to-D leg.

b. The B- to-C leg is expected to fall around 61.8% with the potentials of extending to 78.6% Fibonacci retracement of the A-to-B leg.

c. The C-to-D leg is expected to fall within 127.2 - 1.414% Fib. ext . of the A-to-B @ $0.68000 area.

iv. Should price refuse to climb into the selling niche, anywhere below my Key level remains a yardstick for selling opportunity in the coming week(s).

v. A Further plunge below $0.69400 (breakdown/retest) might welcome addition to the existing position.... Trade consciously! 😊

Trading plan: SELL confirmation with a minimum potential profit of 250 pips.

Risk/Reward : 1:5

Potential Duration: 7 to 15days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

GBPUSD | Perspective for the new week | Follow-UpIt has been over 300pips plunge in our direction since my last publication on this pair (see link below for reference purposes) and it appears we are in the middle of a correction phase that might incite a further risk in decline for the Pound in the coming week!

It is obvious that the British pound rallied a bit during the course of last week trading session but relinquished some of the gains during the latter part of the week and the rapid spread of the Delta plus covid strain in Britain has a high possibility of threatening the already delayed economic reopening, which may further incite fear of buying the Pound.

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Trendline

Observation: i. A significant Breakdown of both the Bullish trendline and Key level @ $1.40000 on the 16th of June 2021 buttress a clamour for Bearish tendencies in the coming week.

ii. I also noticed that the Bullish tendencies that began last week appear not to have the strength to push the price further after citing multiple rejections of Trendline/Key level @ $1.40000 on the 23rd/24th of June 2021.

iii. Should price try to climb early in the new week, I have identified a niche for selling opportunity around $1.39740/1.41000 with confirmation below Key level @ $1.40000.

iv. A Further plunge below $1.38000 (breakdown/retest) might welcome addition to the existing position.

v. CAUTION: Considering the overall Bullish perspective on this pair, it is advisable that we remain extremely patient should the price remain above Key level... Trade consciously! 😊

Trading plan: SELL confirmation with a minimum potential profit of 300 pips.

Risk/Reward : 1:4

Potential Duration: 5 to 10days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

CADCHF Shark 224 CADCHF completed Bearish Shark pattern at level 224

then the price forms a double top as a reversal pattern and breaks the neckline

the price is currently making a correction into neckline.

we can take the sell when the price breaks this correction area with profit targets at the level of 50, 61.8 and 100 percent of CD leg

GBPUSD Sell AreaIn last week's trading, GBPUSD fell quite strong and we need to wait for the price to pullback before another sell.

At the beginning of this week, the price made some upside movement.

The sell area is the S/R area, 50% retracement of the total swing and 61.8% of last week's swing.

This area will hold the price to go up even more.

- For aggressive entry, you can set a sell limit in that area.

- And for conservative entry, you can wait for rejection in that area and wait for correction on a smaller timeframe

GBPCHF | Perspective for the new week | Follow-upA total of 300pips move in our direction since my last publication on this pair (150pips move twice from Supply zone - see link below for reference purposes) and It is interesting how the Key level @ Fr1.27000 transposes into a major determinant of price action since February 2021 (check weekly/daily chart) as a Break above/below of this level incited a trend continuation. Following the latest development in the character of market structure coupled with the strength of the Breakout of Key level (Fr1.27000) that happened during last week trading session, I am about to switch bias from my previous speculation.

Tendency: Uptrend (Bullish)

Structure: Breakout | Supply & Demand | Reversal pattern (Double Bottom)

Observation: i. Double Bottom: Structure reveals a change in trend and a momentum reversal from prior Bearish price action; The twice-touched low is considered a significant support level.

ii. The appearance of a Double Bottom pattern culminated in a successful Breakout of the Neckline (Fr1.27000) during the course of last week trading session to set the pace for a potential Bullish momentum.

iii. The Fr1.71000 area that "resisted" price for 9 days was finally broken on the 16th of June 2021 with an engulfing candle thereby expressing the Buyer's strength at this juncture in the market.

iv. I am of the opinion that the Breakout is currently going through a Correction phase ("quick sells" from participants who took advantage of the Bull run) that will complete and find support at the Neckline area with the anticipation of a rally in the coming week(s).

v. In this regard, I have identified a new demand level for future buying opportunity within the vicinity of the Fr1.27000/1.267000 area (see chart).

vi. Should price continue as predicted, a break above Fr1.27650 might welcome addition to our existing position... Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 150 pips.

Risk/Reward : 1:5

Potential Duration: 1 to 5days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the financial market (including foreign exchange, commodity trading, CFDs, stocks etc.) involve high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

CADCHF | Perspective for the new weekCommodity markets struggle to rebound, but the Canadian dollar remained under strong pressure even at the latter part of last week trading session.

The appearance of a Double Top structure ( a strong reversal pattern) on the chart confirms that the price has found a peak @ Fr0.75000 and has since the beginning of May 2021 continue to find lower lows which culminated in the Breakdown of Key level @ Fr0.74000 - a level that has kept price "supported" for 42days.

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Reversal pattern (Double Top)

Observation: i. i. Double Top: Confirmation of an extremely bearish technical reversal pattern that formed after the price reached a peak two consecutive times with a moderate decline between the two highs insinuates a risk of further decline in the coming week(s).

ii. A successful Breakdown of the Neckline area (Key level) on the 9th of June 2021 was followed by multiple rejections of the same zone.

iii. Multiple rejections of the Fr0.74000 area projects a new supply niche for future selling opportunity @ Fr0.7400/0.74400; this is evident in the activities that occurred in the latter part of last week trading session.

iv. Shooting star: the price tried to rise significantly during the last two days (17th/18th June 2021), but then the sellers took over and pushed the price back down toward the open of the previous day to close below the neckline.

v. In this regard, it appears to be appropriate that we look for a trading opportunity below the neckline in the coming week... Trade consciously! 😊

Trading plan: SELL confirmation with a minimum potential profit of 220 pips.

Risk/Reward : 1:8

Potential Duration: 6 to 12days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

EURUSD AnalysisEURUSD fell quite strongly on Friday' and break its support and form a new low .

In the previous movement the price declined after touching the resistance area.

Then the price broke through its up-trendline and formed a lower low.

We can expect the price to make some correction first before another downside movement.

sell can be done after the price breaks the correction area and targeting the next support/yellow line.