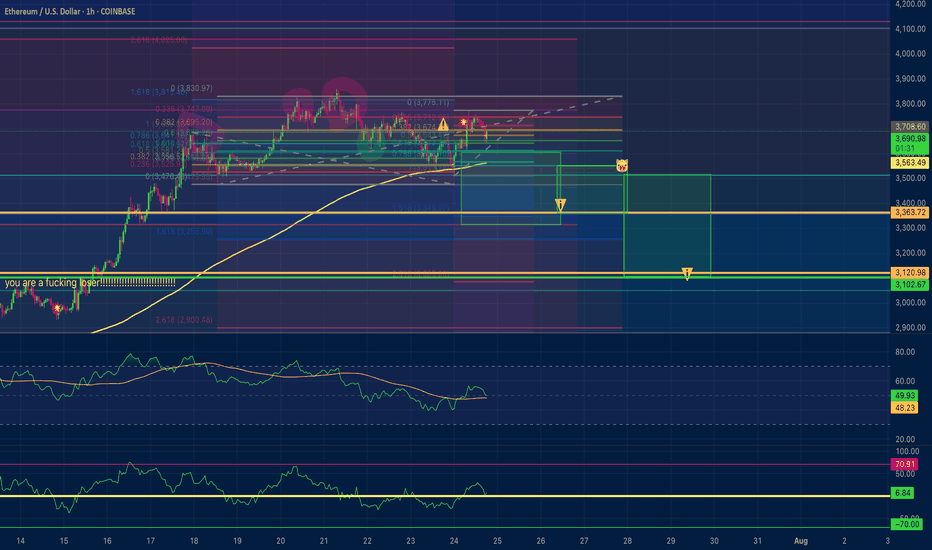

Ethereum Price Target $3,120 by Sunday?Ethereum short position Price Target $3,120 by Sunday ? Negative divergence on the hrly RSI.

Exhausted the 15 minute positive divergence when bouncing off the EMA 200 on the 1 Hour chart. First profit target is $3,350 second is $3,120. I am usually wrong with my estimations... I would recommend the opposite. So go long!

Negativedivergence

Topping Pattern Ahead of Earnings: AAPLNASDAQ:AAPL needs to have a great earnings report on August 1st but it has a topping formation at the moment, after huge speculation from promoting something that is not yet proven to increase sales. You can't take hope to the bank. Speculation occurred as investors assumed that AI would sell more new iPhones in droves. This earnings report will reveal reality one way or another.

There is a negative divergence between the price trend and accumulation/distribution suggesting there may have been quiet rotation against the retail speculation.

RSI Negative Divergence: Possible Market Pullback (SPY, QQQ)UNDERLYING PRINCIPLE:

Divergence between Futures/Stocks/ETFs and their Relative Strength Index (RSI) can be used to predict a bottom or a top. This method is more useful in determining a reversal in overall market than an individual stock. To elaborate the principle let's assume the market is making higher highs but corresponding RSI is making lower highs. Together this uptrend in the market and downtrend in RSI show that the market is losing strength as it is climbing up. Which essentially implies a reversal/pullback in the market.

The same principle can also be applied in determining a possible bottom in the market. Say if the market is making lower lows and corresponding RSI is making higher lows. In that case we can expect an upward reversal of the market.

Current Scenario: Possible Pullback

To inspect the current market I used weekly and daily charts for Nasdaq and S&P 500 ETFs NASDAQ:QQQ and AMEX:SPY .

In NASDAQ:QQQ weekly the negative divergence is eminent as the ETF is making higher high but the RSI is making lower high. If we zoom further into a daily setup then the same negative divergence can be spotted:

For AMEX:SPY on the other hand no divergence can be observed on a weekly setup:

But on a daily setup a Negative Divergence can be detected:

Recent History: Bear Market Bottom

As you can see in both weekly charts, the recent bear market bottom has been identified using the same method: A Positive Divergence.

Thanks for reading.

Negative Correlations in Trading: FULL GUIDEEmbarking on a journey in the world of trading demands a profound understanding of market intricacies. One often-overlooked yet powerful aspect is the domain of negative correlations — the intricate dance where the movement of one asset influences another inversely. This guide aims to be your compass in navigating these complex waters, exploring real-world examples, and providing strategies to harness this knowledge for astute and strategic trading.

Section 1: Unraveling the DXY-BTC Dynamic: Understanding Dollar-Bitcoin Connections

1. The Dance of DXY and BTC:

Delve into the intricate relationship between the U.S. Dollar Index (DXY) and Bitcoin.

Grasp the nuances of how a strengthening DXY tends to exert a weakening influence on Bitcoin and vice versa.

2. Leveraging the DXY-BTC Correlation:

Explore scenarios where the correlations of DXY and Bitcoin align.

Discuss long-term trading strategies that arise from discerning the interconnectedness of these two prominent assets.

Section 2: Discorrelation RSI: Decoding Signals Amidst Market Chaos

1. Understanding Discorrelation RSI:

Introduce the concept of discorrelation RSI, where RSI signals diverge from price action.

Emphasize the significance of recognizing when RSI provides a more accurate reflection of market sentiment.

2. Trading Wisdom with RSI Signals:

Analyze real-world examples where RSI forms a higher low while the price chart indicates a lower low.

Illuminate actionable strategies for entering long positions based on RSI signals during instances of price divergence.

Section 3: Structural Manipulation: Navigating Opportunities Amidst Deceptive Markets

1. OP Case Study: Structural Manipulation vs. RSI Insights:

Explore the dynamics of the OP token, where structural lows are seemingly updated on the price chart.

Unveil instances where RSI provides a more accurate representation of market conditions, presenting buying opportunities during purported oversold conditions.

2. Seizing Opportunities in Manipulation:

Discuss the art of discerning manipulation from genuine market conditions.

Explore how negative correlations can guide traders to capitalize on opportunities created by market manipulation.

Section 4: Crafting Your Strategy: Navigating the Complexities of Negative Correlations

1. Building a Trading Plan:

Outline the essential components of a comprehensive trading plan that incorporates insights from negative correlations.

Emphasize the need for adaptability and ongoing analysis to refine trading strategies.

2. Risk Management in Negative Correlation Trading:

Discuss advanced risk management strategies tailored to the nuances of negative correlations.

Highlight the importance of position sizing and the judicious use of stop-loss orders.

Conclusion: Orchestrating Success in Market Dynamics

As you conclude this profound exploration of negative correlations in trading, envision the market as a symphony of interconnected instruments. The ability to recognize and leverage negative correlations adds a powerful melody to your trading strategy. Regularly revisit and refine your approach, staying attuned to evolving market conditions, and use negative correlations as a guiding force in your trading journey.

💡 Deciphering Negative Correlations | 🔄 DXY-BTC Symphony | 📊 RSI Discorrelation Strategies | 🎭 Unmasking Structural Manipulation

💬 Engage in the discourse: Share your experiences in trading based on negative correlations, pose thoughtful questions, and connect with a community dedicated to mastering the dynamic nuances of the market. 🌐✨

Rotation Patterns in $CVXNYSE:CVX was the Dow 30 component that had the highest loss on Friday.

The chart clearly shows that the earnings report was not going to be good. The pattern is a failed bottom as there has been rotation to lower inventories of the stock for most of this year.

Declining Accum/Distribution indicators at the lows of the range followed by a negative divergence between the price trend and Accum/Dist are indicative of rotation within the sideways trend that never developed into a bottom.

Another Relational Technical Analysis tip to watch out for in other stocks, especially ahead of earnings reports.

USDJPY Strong Negative Divergence Suggests Trend Change SoonPowerful negative divergence on the weekly time frame ( a very reliable time frame in terms of divergences)

suggest that the USDJPY will likely change its multi-week trend and likely turn down or move sideways.

There is other confluence that would support this hypothesis, and a caveat here, though I am not an 'Elliottician'

( Elliott wavers) I use the patterns because they can be reliable if identified as a whole and not "fractalized counting"

with that in mind I see a possible ABCXABC pattern for most assets including the leaders SPX and Nasdaq.

This pattern can not be considered as reliable as weekly negative divergence because there is too much bias

in Elliott wave analysis (the reason why I don't use it) but as I have mentioned above, if we can immediately see the

pattern with out having to overanalyze and add thousands of counts and fractals, then and only then can we

create a hypothesis based upon said pattern. To add to this sell volume on the last drop for the general markets has decreased by comparison

to early spring sell offs. If this is the case and the USDJPY is the leader down (two of the largest economies USA and Japan

would make good leaders in a recovery rally) then we can safely assume that other pairs such as the AUSUSD and the NZDUSD will follow and move up.

The signal is NOT in yet. Therefore we must wait patiently before moving to sell the USD. Keep an eye on the

oscillators on the weekly timeframe and the USDJPY will tell us when to sell it.

This is good news to me because I was getting tired after the last drop the markets have only meandered and have

done nothing except make me lose about .7%. Not a bad loss at all but very annoying.

OIL Negative Divergence Daily SellMy mistake was to omit looking at Oil from the top down. This led me to accurately spot a bullish move with divergence

and as they are reliable it moved in my favour but the longer outlook is now turning bearish. Here the daily suggests

that Oil will not move higher for now. And that a solid short lasting several days, and perhaps even a few weeks

is likely. The idea is simple: Sell oil and set stops above recent higher high.

AUDUSD Negative Divergence Daily Suggests Sell.AUDUSD negative divergence suggests a sell signal in the daily time frame. This implies that the AUDUSD will move downward for the near term future.

We can not be sure what the long term outlook will be for the AUD or the NZD nor the CAD as they tend to all move in tandem. For now we have evidence

that these three currencies will move downward to sideways. The idea to enter such trades is to enter on a sell signal on the hourly which offers better prices and allows us to manage our stops better. If you look at my other charts you will see how I enter into positions in the hourly timeframe.

NASDAQ: Daily trade analysisHere is an idea of what may happen. This is not a prediction but more of a tutorial in what to look for in the daily time frame of negative divergence.

Of course this could be wrong and the bulls buy this to ATHs (all time highs) but I suspect the markets will sell off eventually. And this chart will prepare you

to look for evidence that the markets will turn down on the daily time frame.

Nasdaq: Return to Sell Negative divergence in the 4h time frame indicates a sell in the short term. Though I am not an Elliotician I see an ABC pattern as a correction to the

downtrend I have been charting since December. The ADX you can see did not support the upside by turning upward and cycling over 20. This suggests

the bullish move was weak and is likely over and we will turn back down and return to the main trend.