NEIROUSDT: Critical Support Zone – Rebound or Breakdown Ahead?🔍 Price Structure & Pattern Formation

On the daily chart, NEIROUSDT is currently testing a major demand zone (highlighted in yellow) between 0.0004337 – 0.0003500 USDT. This area previously acted as a strong accumulation zone back in May and is now being retested as key support.

Price has entered a consolidation range after a short-term rally from April to May 2025.

Strong Support: 0.0004337 – 0.0003500

Nearest Resistance Levels: 0.0005109, 0.0006198

---

📈 Bullish Scenario

If the price holds above the demand zone and forms a valid bullish reversal pattern (e.g., bullish engulfing, pin bar), then a bullish move could follow.

Upside Targets (Resistance Levels):

1. 0.0005109

2. 0.0006198

3. 0.0009048

4. 0.0017091 (extended target)

5. 0.0020403

6. 0.0027043 (mid/long-term target)

Bullish Confirmation:

Daily close above 0.0006198

Increasing volume on bounce

Bullish candlestick formation in demand zone

---

📉 Bearish Scenario

If the price breaks below 0.0004337 and closes the day under it, it would indicate further downside potential.

Downside Targets (Support Levels):

1. 0.0003500 (bottom of demand zone)

2. 0.0002700

3. 0.0001600

4. 0.0001390 (previous major low)

Bearish Confirmation:

Strong daily close below 0.0004337

Retest of the zone fails as resistance

Bearish volume spikes

---

📐 Price Patterns

Potential Double Bottom: A bounce from this zone may form a double bottom pattern, with the neckline near 0.0006198.

Sideways Range / Accumulation: Price action since June indicates potential accumulation if the support holds.

---

🔑 Conclusion

NEIROUSDT is at a critical juncture — waiting for confirmation whether it will bounce from this strong demand zone or break down to continue the bearish trend. Key resistance and support levels are well-defined, providing clear strategies for breakout or rebound traders.

---

📌 Trading Suggestions

Aggressive Longs: Look for bullish signals inside the demand zone (0.00043 – 0.00035)

Conservative Longs: Wait for a breakout above 0.0006198 for trend reversal confirmation

Shorts: Enter if there's a confirmed breakdown below 0.0004337

#NEIROUSDT #CryptoAnalysis #TradingView #AltcoinWatch #SupportResistance #TechnicalAnalysis #BullishSetup #BearishScenario #CryptoTA #ChartUpdate #PriceAction

NEIROETHUSDT

NEIROETH Breakout Loading!$NEIROETH is currently consolidating within a symmetrical triangle pattern on the daily chart, suggesting a potential breakout in either direction. The price action has respected this pattern for several weeks, gradually forming higher lows and lower highs. Notably, both the 100 EMA and 200 EMA are acting as dynamic support, reinforcing the bullish structure. A confirmed breakout above the upper trendline could open the door for a strong move toward the $0.21 level, offering significant upside potential.

NEIRO/USDT On the Edge of a Breakout

🔍 Full Technical Analysis (1D Timeframe)

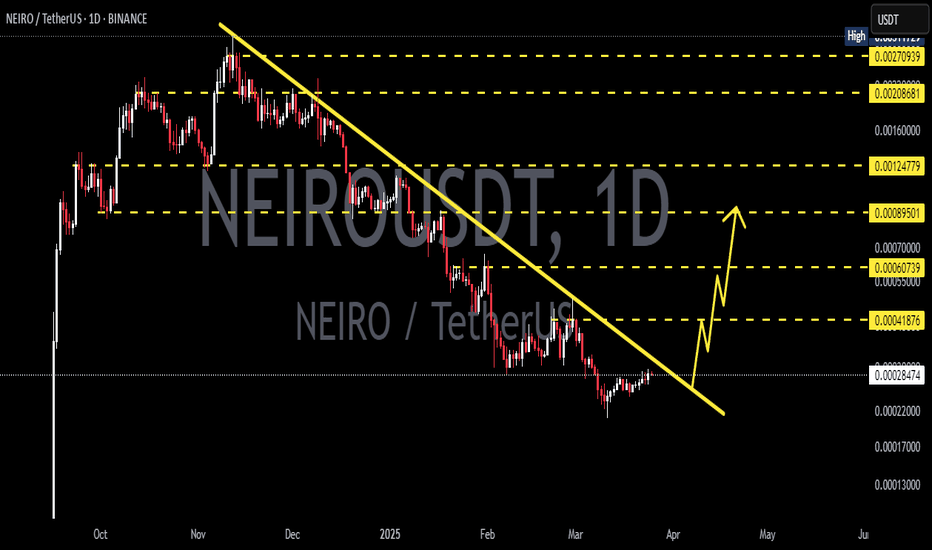

NEIRO/USDT is currently in a highly critical and potentially explosive phase. After a strong downtrend that began in late 2024, the price has entered a structured Falling Channel (Downward Parallel Channel) that has lasted for over 2 months.

This pattern often represents a quiet accumulation phase, where smart money prepares for the next big move — and right now, all eyes are on a potential bullish breakout.

🧩 Market Structure & Chart Pattern

📐 Falling Channel

Parallel support and resistance lines sloping downward.

Price has tested the upper boundary multiple times, building pressure toward a breakout.

🔍 Volume Analysis

Volume is decreasing as price nears the end of the channel — a classic sign of an impending breakout.

⚠️ Breakout Watch

A breakout above the upper channel resistance (~0.00045 USDT) could lead to a multi-phase rally.

📈 Bullish Scenario (Breakout Confirmation)

If the price breaks above the upper boundary and confirms the breakout with strong volume, the following targets come into play:

1. 🔹 First Target:

0.00052438 USDT – The initial horizontal resistance.

2. 🔹 Second Target:

0.00061749 USDT – A previously broken support, likely to be retested.

3. 🔹 Major Target:

0.00090443 USDT – A strong resistance zone from a past distribution range.

4. 🎯 High Target Zone:

0.00273117 – 0.00311729 USDT – A historical supply zone and possible long-term target.

> ✅ Confirmation Needed: Valid breakout must be accompanied by strong volume, a daily candle close above the channel, and preferably a successful retest of the breakout level.

📉 Bearish Scenario (Failed Breakout / Rejection)

If the breakout fails and price gets rejected:

Price may fall back to the lower channel support near 0.00035 – 0.00037 USDT.

A breakdown below this range could push price toward:

0.00027 USDT

0.00013878 USDT (key historical support and cycle low)

This would indicate that accumulation is not yet complete and sellers still control the market.

📊 Strategic Summary

> NEIRO is approaching the end of a well-defined falling channel, setting up for a potential bullish breakout. If successful, the structure of the market provides multiple levels for profit-taking. However, validation through breakout confirmation and risk management is essential.

⏳ Watch daily candle closes and volume closely!

📌 Trading Plan Summary

✅ Buy on breakout and retest of channel resistance

🛑 Stop loss: Below invalidation levels or channel support

🎯 Targets: 0.000524 – 0.000617 – 0.000904 – 0.0027+

#NEIROUSDT #NEIRO #CryptoBreakout #AltcoinSetup #FallingChannel #BullishPattern #CryptoTechnicalAnalysis #BreakoutTrade #Altseason2025

NEIRO on Reversal Watch #NEIRO

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.00033500, acting as a strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.00032700.

Entry price: 0.000352560.

First target: 0.00036600.

Second target: 0.00038073.

Third target: 0.00029830.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

NEIRO on Reversal Watch – Waiting for ConfirmationBought a bit here, but the main trigger is above the Monthly Open and the block it's currently sitting on.

Structure still leans bearish on the daily and higher timeframes, so I'd prefer a strong S/R flip at a key level rather than blindly expecting a market structure shift.

With ETH holding well and sitting near its previous ATL vs BTC, this could open the door for NEIRO and similar names to perform. Just look at how EURONEXT:AAVE , CRYPTOCAP_OLD:ETHFI , MIL:ENA , and $EIGEN are moving today.

NEIROETH/USDT – Double Bottom Breakout Targeting Higher LevelsHello guys!

Did you buy and hold it?

Let's see if there is another area to buy it or not!

NEIROETH/USDT has formed a double bottom pattern, leading to a sharp 357% rally. The breakout signals a strong bullish reversal, with a target around $0.10232. There’s a possible retest zone at $0.03600–$0.04200 where buyers might step in again. The RSI shows overbought conditions, suggesting a potential short-term pullback, but overall momentum remains bullish.

______________________

Key Points:

Pattern: Double Bottom

Immediate Support: $0.03600–$0.04200 (retest zone)

Pattern Target: $0.10232

Momentum: Strong bullish with overbought RSI warning

Risk: Watch for possible pullbacks but overall trend favors bulls.

NeiroETH — Strong Rebound Zone Hit. Big Move Loading?We just tapped into a major demand zone at 0.01532–0.01607, and the reaction was immediate — strong bounce straight off the level.

From here, I’m looking for at least a recovery into the mid-range of the descending channel, with potential for much more.

Main target — a breakout above the local ATH at 0.01993.

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're curious.

#NEIROETHUSDT maintains bearish momentum❗️Keep an eye on the BYBIT:NEIROETHUSDT.P — the structure suggests a possible local rebound or a breakout of the wedge to the upside. Opening a short here goes against the structure and lacks confirmation

📉 SHORT BYBIT:NEIROETHUSDT.P from $0.01612

🛡 Stop loss $0.01693

🕒 Timeframe: 1H

✅ Overview:

➡️ The chart shows BYBIT:NEIROETHUSDT.P forming a bearish continuation move after breaking out of a consolidation range.

➡️ Entry at $0.01612 corresponds to a retest of former support turned resistance.

➡️ Selling volume is increasing, supporting bearish pressure.

➡️ The POC level at $0.02084 remains far above the current price, highlighting downward imbalance.

🎯 TP Targets:

💎 TP 1: $0.01586

💎 TP 2: $0.01535

💎 TP 3: $0.01500

📢 Additional scenario notes:

📢 A false breakout above the entry zone is possible — wait for confirmation of the $0.01620 break.

📢 Watch for volume spikes near TP1 and TP2 — could signal partial take profits.

📢 If price reclaims $0.01693, the setup becomes invalid.

🚀 BYBIT:NEIROETHUSDT.P maintains bearish momentum — downside move expected!

NEIROETH ANALYSIS (12H)It appears that the NEIROETH diametric pattern started from the point where we placed the green arrow on the chart and completed at the point where we placed the red arrow.

Since the bullish pattern has ended and the price is below the descending trendline, sell/short opportunities can be considered in the supply zones.

The target could be the green zone.

Closing a daily candle above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

NEIROETH Looks Bullish (4H)The correction of NEIROETH started from the point where we placed the red arrow on the chart.

This correction appears to be a diametric pattern, and we are currently in wave f.

Wave g could complete in the green zone, leading to the start of a bullish wave.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#NEIRO/USDT#NEIRO

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.00037460

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.00038150

First target 0.00039430

Second target 0.00040680

Third target 0.0004296

$NEIROETH - Scalp Long SetupOver the past week, NEIROETH has experienced a significant drop of about -83% decrease over the month.

NEIROETH appears to be at a level where we could see a potential bounce.

If we can hold .040 (weekly_rvwap) , there's a chance we retest the nearest swing point at .052 or even tag (m_rvwap) at .060

We can long at current market price and leave something for DCA if we dip around .040 to .038 area

Setting stoploss below the low at .035

Targets:

.052 (swing point)

.060 (m_rvwap)

.72

NEIRO on Fire! All-Time Highs Ahead !!BINANCE:NEIROUSDT has broken a key resistance level with strong volume, signaling a potential big move upward. All-time highs are within reach. Look for pullbacks or confirmation, and always use a stop loss to manage risk. This breakout could lead to major gains!

BINANCE:NEIROUSDT Currently trading at $0.0022

Buy level: Above $0.00215

Stop loss: Below $0.00177

Target : $0.006

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

#NEIRO/USDT Ready to go higher#NEIRO

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.001570

We have a downtrend on the RSI indicator that is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.001582

First target 0.001854

Second target 0.002348

Third target 0.002348

NEIROETH NEW UPDATE (BEARISH)This analysis is an update of the analysis you see in the "Related publications" section

This meme coin is risky and has a lot of volatility

The previous setup is canceled

Based on the timing of the F wave, it appears that the F wave is just ending

Also, the price has hit a supply range and a bearish trend line.

This view is more correct for NEIROETH.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

**NeiroEth Trade Idea**

NeiroEth is currently consolidating and showing signs of preparing for a potential breakout. The chart suggests that a significant move could be on the horizon, and if the breakout is successful, it might lead to a strong bullish rally. This is an important level to watch closely as it could offer a great trading opportunity.

### **Key Points to Consider:**

1. **Breakout Confirmation**: Wait for a clear breakout above the resistance level on higher timeframes (e.g., 4H or daily). Confirm the breakout with increased volume, as it signals strong buying momentum.

2. **Risk Management**: Always trade with proper risk management. Set a stop-loss just below the support zone or recent low to minimize potential losses if the trade goes against you.

3. **Entry Strategy**:

- For **spot traders**, start accumulating gradually and hold for mid-to-long-term targets.

- For **leverage traders**, use moderate leverage and avoid over-leveraging to protect against market volatility.

4. **Targets and Take-Profit Levels**:

- Identify key resistance levels and plan your take-profit zones accordingly. For example:

- First Target: +20-30% (secure initial profits).

- Second Target: +50-80%.

- Final Target: Over 100% if the rally gains momentum.

5. **Market Conditions**: Monitor BTC and the broader market trend, as they can impact the movement of NeiroEth. If the market becomes volatile, adjust your trades accordingly.

6. **Patience is Key**: Remember, breakouts might take time to materialize. Avoid rushing into the trade before proper confirmation. False breakouts can lead to losses, so always confirm the move.

### **Additional Tips**:

- Keep an eye on major support zones in case of retracements, as they can provide better entry points.

- Use a smaller position size for high-risk trades and only invest what you can afford to lose.

- Regularly monitor updates about the project, market sentiment, and overall crypto news.

This is not financial advice. Always conduct your own research (DYOR) before making any investment or trade decisions.

NEIROETH - The Lone Warrior AWAKEN! Or it will AWAKE!NEIROETH is like batman, waiting for the right time to pounce, I would had just doodled and keep it :( but i need to write more to explain so i do ; TLDR people a BIG CHONKY GREEN CANDLE ON THE MOVE

for nerds like me below!!

This is the image below of the TPO VAR and POC

THE TPO VAH and POC suggests

1. Volume Profile Insights:

• POC (Point of Control): Price has been consolidating around key POC levels, indicating areas of heavy trading activity and value. These levels will act as strong support or resistance depending on the direction of the breakout.

• VAH (Value Area High): Multiple rejections around VAH indicate strong resistance above, suggesting that bulls are struggling to push through these levels.

• VAL (Value Area Low): VAL levels have acted as support, with price rebounding several times, indicating accumulation or demand zones.

2. Price Compression:

• The chart shows signs of price compression, as the range between VAH and VAL has tightened in the recent sessions. This suggests a possible breakout is imminent.

3. Volume Behavior:

• Declining volume near current levels indicates indecision in the market. A surge in volume could confirm the breakout direction.

If price remains within the range of VAH ($0.082) and VAL ($0.074), consolidation is likely to continue. This would indicate that the market is still undecided, waiting for a catalyst (news, volume spike, etc.) for a breakout.