NEO facing troubles NEO is under threat of falling below $17 in the latest market downturn, which would effectively wipe out all gains since August 2017. The asset peaked at $196.85 on January 10 as the first days of that month coincided with an apex for the entire crypto market. But there are reasons specific to NEO that may be causing the slide.

NEO was meant to resemble Ethereum in that it would be required to make projects run. But the network actually uses the GAS asset to move tokens, so there is no direct demand for NEO. Additionally, ICOs still prefer to collect Ethereum, Bitcoin, and, lately, cash in US dollars or even euros. NEO is simply not as popular for fund-raising.

The additional trouble is that there are not enough airdrops. Barring the high-profile airdrops of Ontology (ONT) and RedPulse (PHX), as well as a handful of other projects, NEO has not enjoyed much popularity on that front. A few airdrops created extreme hype and demand for NEO, but the mood changed later, and a simple airdrop does not inspire more buying.

NEO-BTC

There is a possibility for the beginning of an uptrend in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 45.

. While the RSI downtrend is not broken, bearish wave in price would continue.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.002600 to 0.002000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.002600)

Ending of entry zone (0.002000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00329

TP2= @ 0.00364

TP3= @ 0.00470

TP4= @ 0.00560

TP5= @ 0.00640

TP6= @ 0.00740

TP7= @ 0.00963

TP8= @ 0.01110

TP9= @ 0.01200

TP10= @ 0.01400

TP11= @ 0.01520

TP12= Free

There is a possibility for the beginning of an uptrend in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 45.

. While the RSI downtrend is not broken, bearish wave in price would continue.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.002600 to 0.002000). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.002600)

Ending of entry zone (0.002000)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00329

TP2= @ 0.00364

TP3= @ 0.00470

TP4= @ 0.00560

TP5= @ 0.00640

TP6= @ 0.00740

TP7= @ 0.00963

TP8= @ 0.01110

TP9= @ 0.01200

TP10= @ 0.01400

TP11= @ 0.01520

TP12= Free

NEO / BTC / Deep Gartley Patterns / investment 2018-2019?neo btc -0.23%

because I start investing in these dates every year to have greater return on my investments

NEO (we know that behind this -0.45% project there is a very interesting technology)

my investment portfolio

they are currencies with greater impact of growth-

we all have the opportunity to be free with cryptomonedas ..

What do you think of this perspective?

My $1k to $100k Challenge: Day 54 - Trade #53 NEOHello all and thanks for stopping by and following my personal challenge. I am attempting to turn $1000 into $100,000 by day trading altcoins.

I started my challenge on July 14th with a bankroll of 0.16 Bitcoin that was valued at $1000 at the time. You can follow and see all my trades in my profile.

Current streak of 8 out of 10 profitable trades in a row.

After 52 days and 50 completed trades:

Wins: 24

Loss: 26

Balance: 0.1686 B

USD: $ 1088

*Some trades may be pending and not yet included in my stats

There are too many trades to list. All my trades and stats for this challenge can be found in the link on my profile if you want to follow.

CAUTION: This challenge represents a small portion of my overall portfolio. To maximize the potential of reaching my 100k challenge goal quickly with just 1k, I am using most of my challenge bankroll per trade trying to build up my bankroll for the challenge.

If you are following me, I do not recommend this strategy, but instead you should limit your trades to max 3-5% of your portfolio per trade. Please trade smart.

Alright, here we go with Day 54 trade #53

I invested 0.08 B into NEO . I bought 26.07 @ 306800 satoshi

My Sell targets are:

T1: 322200 5% potential profit

T2: 337500 10% potential profit

T3: 352900 15% potential profit

I will sell 50% at target 1. 25% at target 2 and 3.

If target 1 is hit, I will move my SL up to my buy in price.

If target 2 is hit, I will move my SL up to T1.

SL: 291400

In case you are wondering why my buy price sometimes doesn't match the current price on the chart when I make a new post, this is because I post my coin selection to my Discord group first and then make a new trade idea here which takes about 30 minutes to complete this all.

I am 100% transparent. I show screenshots of my buy price and amount on my Discord group. This has been a fun experiment and I enjoy sharing my journey.

Your comments, agrees and disagrees are always welcome and appreciated.

Thanks for stopping by and have a great day!

NEO - Good Place to BuyNEO is trying to get back into its down trend channel, if you got some NEO around 14 dollars thats very brave and profitable but i believe there is still a lot of profit to be taken from this coin.

Looking very bullish on the hourly, as the MA50 crossed both EMA 144 and MA 200.

On the daily, MA 50 shows around 28-29 dollars so I believe its soon to touch back to that area, or at least get close to it.

Currently the support of the channel is acting like a resistance but it waiting to be broken.

My guess is that we can easily see 21-22 dollars with NEO soon.

Also, there are many Dapps being built on it, which is a good thing because to start a project on NEO platform, the founders of the projects need to purchase NEO coins. I believe its very centralised with limited nodes, but that doesn't change the fact that its one of the most well run projects out there.

DYOR and trade responsibly. =)

There is a possibility for the beginning of an uptrend in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 35.

. While the RSI and the price downtrend in the Daily chart are not broken, bearish wave in price would continue .

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00253 to 0.00183). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00253)

Ending of entry zone (0.00183)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00317

TP2= @ 0.00364

TP3= @ 0.00470

TP4= @ 0.00560

TP5= @ 0.00640

TP6= @ 0.00740

TP7= @ 0.00963

TP8= @ 0.01110

TP9= @ 0.01200

TP10= @ 0.01400

TP11= @ 0.01520

TP12= Free

There is a possibility for the beginning of an uptrend in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 35.

. While the RSI and the price downtrend in the Daily chart are not broken, bearish wave in price would continue .

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.00253 to 0.00183). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.00253)

Ending of entry zone (0.00183)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00317

TP2= @ 0.00364

TP3= @ 0.00470

TP4= @ 0.00560

TP5= @ 0.00640

TP6= @ 0.00740

TP7= @ 0.00963

TP8= @ 0.01110

TP9= @ 0.01200

TP10= @ 0.01400

TP11= @ 0.01520

TP12= Free

NEO with bullish divergence on the dailyNEO has bullish divergence on the daily time frame on multiple indicators. Neo also had a bullish engulfing candle yesterday with a long bottom wick indicating signs of reversal. The outlook for the short term for Neo is bullish. This area also has a rather large high volume node as well as the point of control, so this would be a nice spot for Neo to reverse trend. The wave trend looks to be resetting, lining up for a bullish cross soon, and rsi is back to over-sold levels

NEO BTC TRADE ANALYSIS NEO BTC is still in downtrend but will see some relief rally in coming days due to RSI levels.

You can do some scalp trading during any such rally.'

If you are looking to open a position for long term in NEO then it will be advisable to average out your holdings when NEO test the buy zone identified in blue levels.

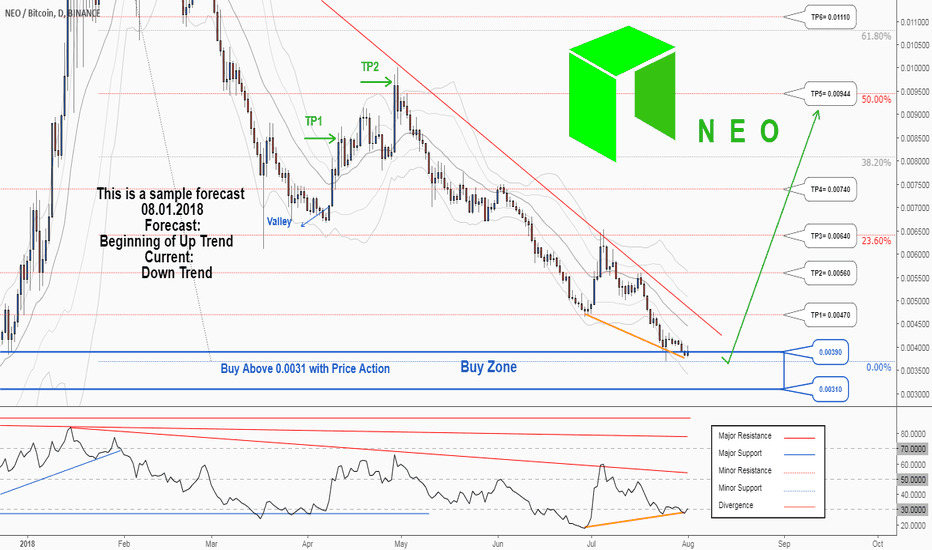

A trading opportunity to buy in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 30.

. There is a valid and clear divergence in the price chart so the probability of the beginning of uptrend is increased.

. While the RSI and the price downtrend in the Daily chart are not broken, bearish wave in price would continue .

Trading suggestion:

. Price is in the support zone (0.00390 to 0.00310), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (0.00390)

Ending of entry zone (0.00310)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00470

TP2= @ 0.00560

TP3= @ 0.00640

TP4= @ 0.00740

TP5= @ 0.00944

TP6= @ 0.01110

TP7= @ 0.01200

TP8= @ 0.01400

TP9= @ 0.01520

TP10= Free

A trading opportunity to buy in NEOBTCTechnical analysis:

. NEO/BITCOIN is in a downtrend and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 30.

. There is a valid and clear divergence in the price chart so the probability of the beginning of uptrend is increased.

. While the RSI and the price downtrend in the Daily chart are not broken, bearish wave in price would continue .

Trading suggestion:

. Price is in the support zone (0.00390 to 0.00310), traders can set orders based on Daily-Trading-Opportunities and expect to reach short-term targets.

Beginning of entry zone (0.00390)

Ending of entry zone (0.00310)

Entry signal:

Signal to enter the market occurs when the price comes to "Buy zone" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about "Entry signal" and the special version of our "Price Action" strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.00470

TP2= @ 0.00560

TP3= @ 0.00640

TP4= @ 0.00740

TP5= @ 0.00944

TP6= @ 0.01110

TP7= @ 0.01200

TP8= @ 0.01400

TP9= @ 0.01520

TP10= Free

Alt currencies / BTC ETF ( how low will they go ?)As you guys have probably noticed by now, Bitcoin is rallying and gathering fomo in anticipation of the ETF's, while alts are losing their value. This is because everyone is selling alts to ride BTC.

Very bad news for alts, but it's a cycle that has been happening over and over in relation to satoshi value.

Bear in mind that its using data from previous Bitcoin Bull run, and it's based on the concept that alt/btc ratio is cyclical. Values can change depending on how strong the holders are. But eventually, everyone cracks.

In this article, we will analyze this cycle, and try to determine how low alts can go. For this I will be posting several charts in the comments below.

ETHEREUM

I will start with ethereum, the king of alt currencies. As you can see, we still have a lot of room to dump, and the coming dump will be very severe and could cause capitulation, as alts have already dropped a lot. We are attempting to break the 0.0058 fibonacci line, and thus indicating a severe drop to 0.03 satoshis.

Since bitcoin is going up, USD value for Ethereum will remain unchanged, however people trading in sats will get hurt.

NEO

Neo has already broken the fibonacci line, and the drop is expected to be around 0.002 which is almost x2 x3 in drops

DASH

Dash is a really interesting case, as we have managed to hold 0.0035, but for the first time in ages, we broke it, so I take into consideration a previous all time lows for fibonacci retracements, and that leaves us with a target of 0.011 ish, which can really hurt holders

OMG

Omise Go, not an exception, is also in between massive fib lines, and a drop could occur to 0.0004 satoshis.

EOS

EOS is breaking the fib line as we speak, which is signalling a drop towards 0.0005 satoshis

LUNYR

Final one is Lunyr. Now why Lunyr? This coin is very old, and has respected the BTC/ALT ratio EVERYTIME. If you look at the previous drop, the chart looks exactly the same. A pump to all time high, then a dump towards 0.0002

Stay strong bros