Is NEO the Most Undervalued L1 Left? Entries,Targets & FA Inside📌 Coin: NEO (Neo)

💰 Buy Levels:

✅ First Entry: $7.00

✅ Second Entry: $6.00

🛑 Panic / SL Level: $5.00

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: Layer 1 / Smart Contracts / Digital Identity

*️⃣ Use Case: NEO is a smart economy blockchain, designed to combine digital assets, identity, and smart contracts under one unified platform.

*️⃣ Tech: Built with delegated Byzantine Fault Tolerance (dBFT) consensus — fast finality, low energy, and supports multiple coding languages (C#, Java, Python).

*️⃣ Token System: Two-token model — NEO (governance) and GAS (fees). Holding NEO auto-generates GAS passively.

*️⃣ Narrative Fit: One of the OG Ethereum competitors, often called the "Ethereum of China" — positioning it well for East Asia Web3 narratives.

*️⃣ Unique Angle: Strong ties to Chinese developers and regulatory bodies; integrated into some government-facing blockchain pilots.

📊 Tokenomics & Market Data

(As of July 2025)

🪙 Current Price: ~$6.65

🧾 Market Cap: ~$470M

🔢 Rank: ~Top 100

🧮 Circulating Supply: ~70.5M NEO

🔒 Max Supply: 100M NEO

🔁 Token Distribution: Fixed supply, no inflation

🎁 Bonus: Generates GAS rewards passively for holders (staking-lite utility)

🎯 Bull Market Target (Realistic)

Target Range: $15 – $20

*️⃣ Based on prior cycle retrace zones, ecosystem relaunches, and renewed China Web3 engagement.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $35 – $55+ $75

*️⃣ Would require full East Asia Web3 revival, new developer momentum, and speculation on legacy L1s with real governance systems.

✅ Final Take

🧠 NEO blends legacy reputation with clean tokenomics and unique East Asia exposure. While developer activity lags behind

we ask Allah reconcile and repay

Neousd

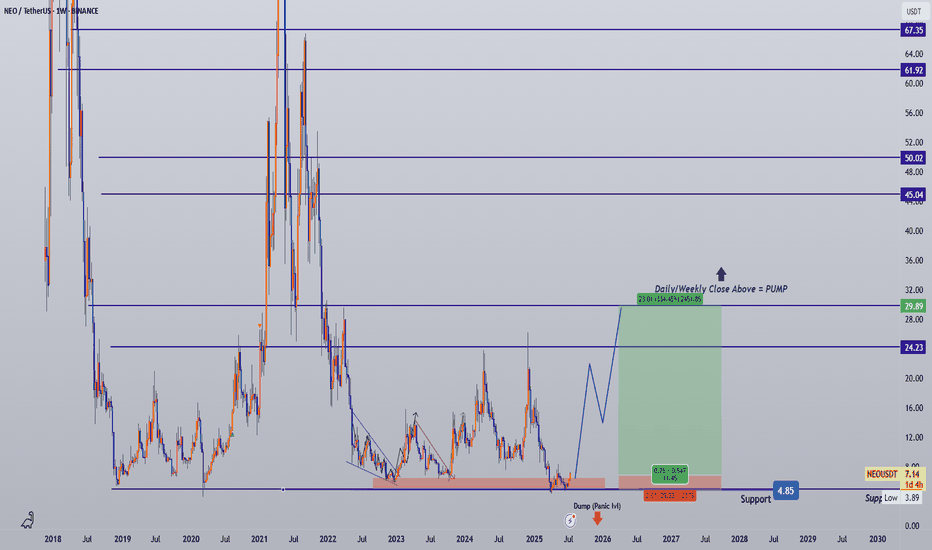

NEO/USDT – Strong Long-Term Accumulation Zone Detected!

🧾 Full Technical Breakdown (1W Timeframe):

NEO is currently revisiting a multi-year demand zone in the range of $3.90 – $4.50, a historically critical level where price has previously bounced before initiating massive rallies.

This zone has acted as a strong accumulation base during:

March 2020 crash

Mid-2019 correction

And now again in 2025 — making this the third test of the zone in a macro cycle.

The recent candlestick behavior shows price compression with long wicks, signaling demand absorption and the potential emergence of buyers.

📐 Key Pattern Formation:

Possible Double Bottom or Adam & Eve Reversal Pattern forming on the weekly chart.

Combined with horizontal support and psychological round number zone ($4–$5), this can be the foundation of a long-term trend reversal.

Price has entered a volatility contraction phase, which often precedes an impulsive breakout.

📈 Bullish Scenario:

If the support holds and we see a breakout with increasing volume:

1. Short-Term Targets:

$6.85 (local resistance)

$9.10 (previous consolidation block)

2. Mid-Term Targets:

$14.31 (last major breakdown level)

$21.54 (multi-month range resistance)

3. Long-Term Targets:

$29.38 – psychological level from previous cycle

$47.88 – historical supply zone

$62.48+ – potentially a multi-year bullish cycle if macro market turns risk-on

Watch for:

Bullish engulfing or hammer candle on the weekly

Breakout from descending structure with strong RSI divergence

Volume expansion above key resistances

📉 Bearish Scenario:

If the yellow support box fails:

Breakdown below $3.90 may signal continuation of macro downtrend.

Immediate bearish targets: $3.30 (2019 low), followed by price discovery below.

Invalidates the bullish reversal structure.

Could coincide with overall crypto market capitulation.

Risk Mitigation:

Use tight stop-loss below $3.90 if entering early

Scale into positions gradually (DCA) instead of full entries

🔥 Strategic Summary:

> “High-conviction zones are not found often — but this looks like one of them.”

With confluence of:

Historical demand zone

Psychological support

Pattern structure

Volume tapering near bottom

…this could be one of the last best accumulation zones for NEO if the market recovers over the next 6–12 months. A macro trend reversal could offer 4x–10x returns if history plays out once again.

📊 Resistance Levels to Watch:

$6.85

$9.10

$14.31

$21.54

$29.38

$47.88

$62.48

$115.28 (macro ATH level)

#NEOUSDT #NEOTechnicalAnalysis #CryptoReversal #BullishCrypto #NEOAccumulation #AltcoinBreakout #NEOPricePrediction #WeeklyCryptoAnalysis #SupportAndResistance #NEOChart #DoubleBottomPattern

#NEO is back at its historical demand zone!#NEO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel, this support at 5.45.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 5.30, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 5.55

First target: 5.63

Second target: 5.73

Third target: 5.86

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

NEOUSD: Minimum target for the end of this Cycle $30.Neo turned marginally bullish on its 1D technical outlook (RSI = 56.743, MACD = 0.356, ADX = 25.407) as it has validated the start of the new bullish wave, rebounding on the same level as it did on March 9th 2020. This is the least aggressive Bull Cycle for new but the presence of a HH trendline implies that a Cycle high can be minimum made on it. With the 1W MACD about to form a Bullish Cross, we expect the HH to get hit by the end of the year (TP = 30.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NEO is bearish (1D)The NEO structure is bearish. We have a support zone on the chart, and with this bearish structure, we expect the price to reach the demand zone.

The target is the same as the green box.

The closure of a daily candle above the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

NEOUSDT Weekly Chart Analysis: A Bullish OutlookOverview:

NEOUSDT appears to be in a sustained uptrend, exhibiting a series of higher highs and higher lows on the weekly chart. This analysis will delve into the technical indicators and key levels that support this bullish outlook.

Trend Analysis:

Uptrend: The price action is clearly defined by an upward-sloping trendline, confirming the bullish trend. This trend has been in place since late 2022, demonstrating consistent buying pressure.

Higher Highs and Higher Lows: The price is consistently making higher highs and higher lows, a classic characteristic of an uptrend.

Support and Resistance:

Support: The 200-week moving average, currently around $16, is acting as a crucial support level. This long-term moving average often signifies a strong base for bullish trends.

Resistance: The previous high around $25 represents a significant resistance level. A break above this level could signal further upside potential.

Indicator Analysis:

Moving Averages: The moving averages are generally sloping upwards and are currently below the price, indicating support. This alignment of moving averages reinforces the bullish bias.

MACD: The MACD is above the zero line, suggesting positive momentum. Although it has recently pulled back from overbought levels, it remains supportive of the bullish trend.

Trading Strategy:

Buy and Hold: Given the strong bullish trend, a buy-and-hold strategy could be suitable for investors with a longer-term horizon.

Buy on Dips: Traders can look for opportunities to buy NEOUSDT during pullbacks or consolidations within the uptrend.

Breakout Trading: Consider buying on a breakout above key resistance levels, such as the previous high around $25, with strong volume confirmation.

Risk Management:

Stop-Loss: Place a stop-loss order below the recent swing low or below the 200-week moving average to protect against a potential trend reversal.

Trailing Stop: As the price moves higher, consider using a trailing stop-loss to lock in profits and manage risk.

Conclusion:

The weekly chart of NEOUSDT paints a bullish picture. The uptrend is well-defined, supported by key moving averages and a positive MACD. While short-term pullbacks are possible, the overall outlook remains positive for NEOUSDT.

NEOUSDT Long Setup Setting / Spot TradeBINANCE:NEOUSDT

CRYPTO:NEOUSD

📈Which side you pick?

Bull or Bear

SL1 ---> Low-risk status: 3x-4x Leverage

SL2 ---> Mid-risk status: 5x-8x Leverage

(If there is just one SL on the chart, I suggest, low risk status)

👾Note: The setup is active but expect the uncertain phase as well. also movement lines drawn to predict future price reactions are relative and approximate.

➡️Entry Area:

Yellow zone

⚡️TP:

18

20

23.5

25 (Optimistic)

🔴SL:

12.88

🧐The Alternate scenario:

If the price stabilizes against the direction of the position, below or above the trigger zone, the setup will be canceled.

Neo long setup / Bulls or Bears, Tell me in CommentsBINANCE:NEOUSDT By CrazyS

COINBASE:NEONUSD

Hello Traders

💥Long position on NEO

SL1 ---> Low-risk status: 3x-4x Leverage

SL2 ---> Mid-risk status: 5x-8x Leverage

👾The setup is active but expect the uncertain phase as well.

➡️Entry Area:

Yellow zone

⚡️TP:

9.60

9.72

9.83

9.95

10.10

🔴SL:

9.03 - 8.93

🧐The Alternate scenario:

If the price stabilizes below the trigger zone, the setup will be cancelled.

NEO/USDT: Prime Buying Opportunity Amid Bullish Reversal SignalThe NEO/USDT pair is currently trading at 4.153, showing signs of a potential upward reversal after a recent downward correction. This retracement has brought the price to a critical support level, which is being closely watched by traders. The Relative Strength Index (RSI) has recently dipped into oversold territory, indicating that the selling pressure may be waning and a reversal could be imminent. Additionally, the Moving Average Convergence Divergence (MACD) is beginning to show a bullish crossover, which historically signals a shift in momentum from bearish to bullish.

Moreover, the price action suggests that NEO has formed a bullish divergence, where the price is making lower lows while the RSI is making higher lows. This divergence is often a precursor to a strong upward move. The 50-day moving average is also flattening out, suggesting that the recent downtrend may be losing steam and that a base is being formed.

Considering these technical indicators, the current level offers a strong buying opportunity for investors looking to capitalize on the potential medium-term upside. The combination of oversold conditions, bullish divergence, and a potential MACD crossover suggests that NEO could see significant gains from this point. With the price at 4.153, a well-timed entry could allow for substantial profits as the market reverses and begins to move higher. Therefore, this pullback should be viewed as a prime opportunity to buy, with the expectation of a strong rally in the coming weeks.

NEO (Crypto) BUY TF H4 TP = 11.260 Good luck!On the H4 chart the trend started on Aug. 06 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 11.260

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading