Neo Wave

BTC DOMINANCE is fading - the altcoin wave is coming (3D)This analysis is an update of the analysis you see in the "Related publications" section

First of all, you should know that the time frame is large. the 3-day chart which means altcoins could remain bullish for 1 to 3 months. We should be looking for buy/long positions on altcoins that have strong setups.

We expect a drop from the red zone or even from the current price to complete wave f of this diametric pattern.

Targets have been marked on the chart.

A daily candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

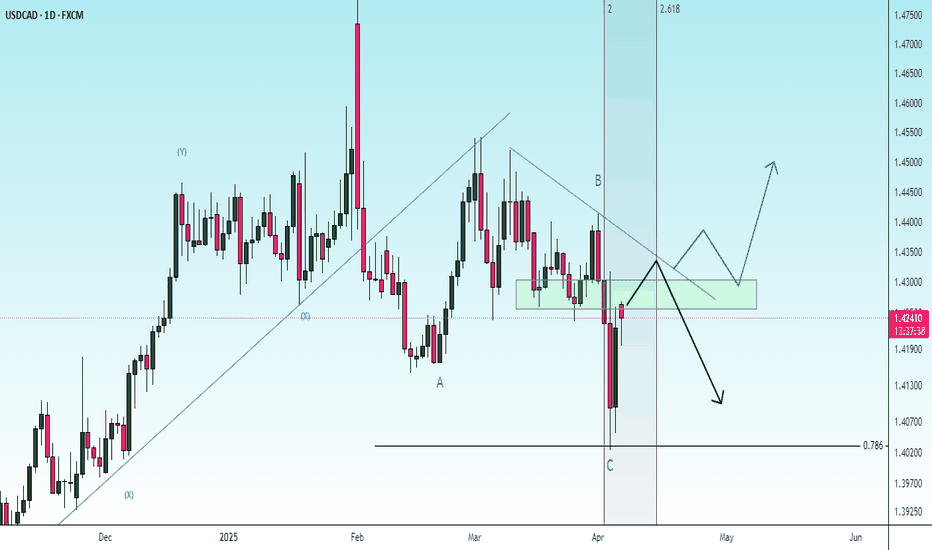

NFP Roadmap (1D)It seems that the NFP has entered a corrective phase from the point where we placed the red arrow on the chart.

Currently, it appears to be in the bearish wave C of this phase, and wave C itself is a symmetrical pattern. At the moment, we are in wave g of this symmetrical pattern.

This symmetrical pattern could complete in the green zone, and the price may enter wave D, which is a bullish wave.

In the green zone, one could look for buy/long positions. it’s best to enter a position with confirmation.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Dogecoin Daily Chart Analysis: A Fresh Start Ahead ?Hello friends, let's analyze Dogecoin, a cryptocurrency, from an Elliott Wave perspective. This study uses Elliott Wave theory and structures, involving multiple possibilities. The analysis focuses on one potential scenario and is for educational purposes only, not trading advice.

We're observing the daily chart, and it appears we're nearing the end of Wave II, a correction. The red cycle degree Wave I ended around 2024 December's peak. Currently, we're nearing the end of red Wave II, which consists of black ((W)), ((X)), and ((Y)) waves. Black ((W)) and ((X)) are complete, and black ((Y)) is nearing its end.

Within black ((Y)), we have Intermediate degree blue (W), (X), and (Y) waves. Blue (W) and (X) are complete, and blue (Y) is nearing its end. Inside blue (Y), red A and B are complete, and red C is nearing its end. Once red C completes, blue (Y) will end, Once blue (Y) completes, means black ((W)) will end that means higher degree cycle wave II in red will end.

If our view remains correct, the invalidation level for this Elliott Wave count is 0.04913. If this level holds and doesn't touch below it, we can expect a significant reversal to unfold wave III towards new highs. This is an educational analysis, and I hope you've learned something by observing the chart and its texture.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Ethereum will be in the bears' control in the mid-term (1D)Based on the recent pivot formations, momentum, and wave degrees, we are observing signs of a deeper correction on the Ethereum chart, which we find necessary to warn about.

As you know, we follow technical evidence and signals to provide analysis—we do not predict the market but rather analyze it step by step.

From the point where we placed the red arrow on the chart, Ethereum's price-time correction has begun.

It appears that an ABC pattern is forming, with wave B now completed or nearing completion after losing the trendline (red dashed line).

Wave C should align with the previous waves in degree and have a longer duration than wave A.

Since wave B retraced close to the top of wave A, wave C’s price correction may not fall too far below the low of wave A.

We have two possible scenarios: either Demand 1 will be the market bottom, or Demand 2.

A daily candle closing above the invalidation level would invalidate this analysis. Let's see how it plays out.

invalidation level : 2941$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ALT looks bearish for mid-term (1D)ALT appears to be in a large-degree bearish wave C. If it reaches the red zone, we can look for a sell/short position targeting lower levels.

The minimum time required for wave C to complete is marked by the vertical line on the chart. Keep in mind that this is the minimum duration—if the wave extends, it may take longer.

A daily candle closing above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

NIL ANALYSIS (4H)The NIL correction started from the point we marked as Start on the chart.

This correction appears to be a Diametric, and it seems we are currently in wave E of this pattern. The price is expected to follow the path indicated by the arrow.

A daily candle close above the invalidation level will invalidate this analysis.

invalidation level: 0.521$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

HIPPO Update (12H)First of all, please note that this is a meme coin, meaning it comes with high volatility and is considered risky.

Pay attention to the timeframe — it’s a large and long-term one.

It appears that a symmetrical pattern is coming to an end, and this token has gone through a decent time and price correction. As long as the green zone holds, it can move toward the targets.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

MORPHO Rebuy Setup (12H)From the point where we placed the red arrow, it appears that the bullish MORPHO wave has ended, and the price has entered a corrective phase. This phase could be a diametric or symmetrical pattern.

Wave G is expected to complete within the green zone.

We anticipate a return of 30% to 50% from the green zone.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You