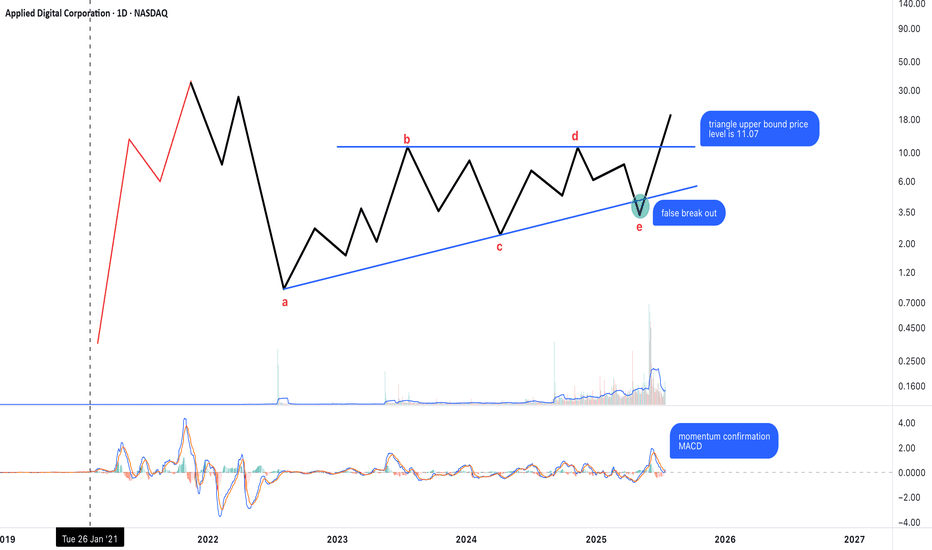

Possible Neutral Triangle Breakout – Key Level at 11.07The chart appears to show a completed neutral triangle (a–b–c–d–e), with a breakout emerging above the upper boundary at 11.07.

Wave a looks like a complex structure (possibly elongated flat or flat + zigzag).

The rest of the legs are mostly zigzag forms, consistent with triangle rules.

False breakdown below wave e followed by a strong reversal.

MACD is confirming momentum during the breakout attempt.

As long as price stays above 11.07, this breakout may be sustained. If confirmed, the next target zone could align with the height of the triangle projected upward.

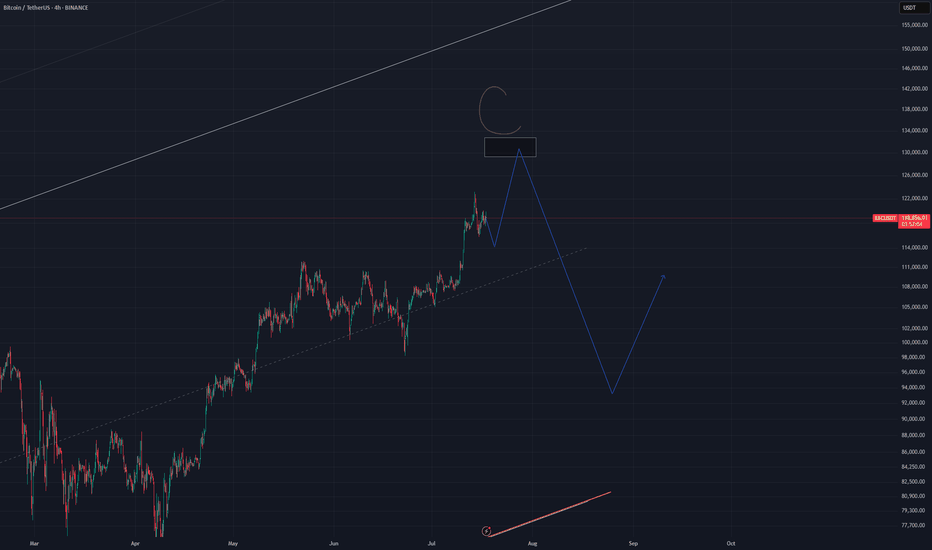

Neo Wave

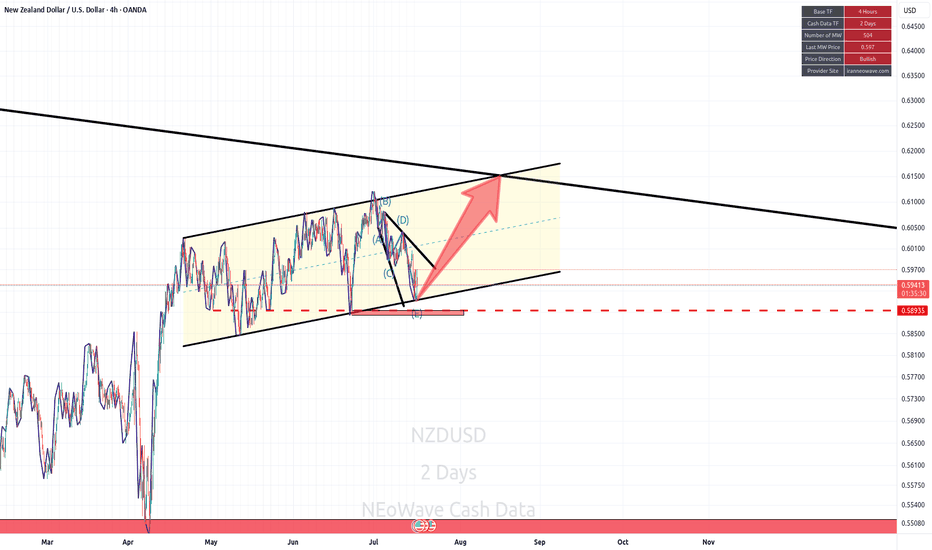

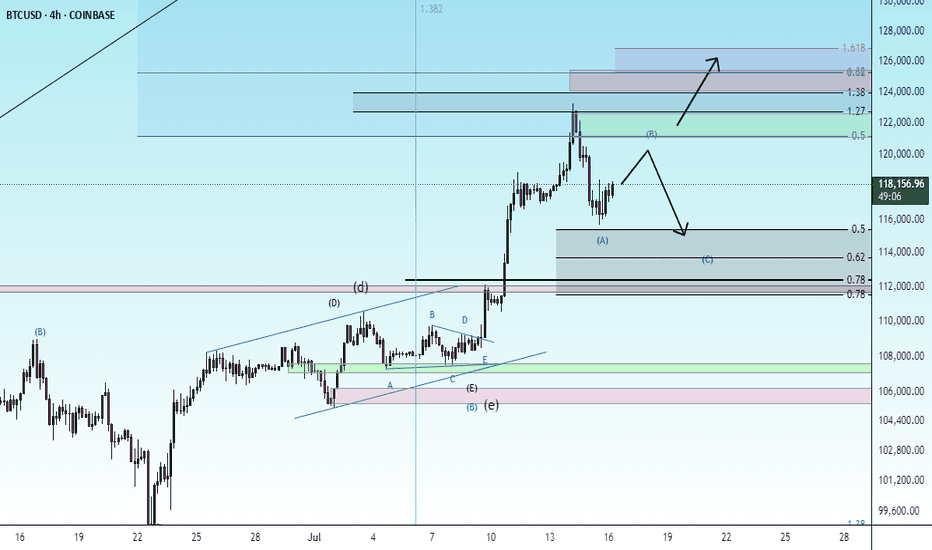

USDT Dominance Looks Really Bearish In Big TimeFrames (3D)Before anything else, pay close attention to the timeframe | it’s a high timeframe and will take time to play out.

From the point where we placed the red arrow on the chart, it seems that the correction of USDT dominance has begun on the higher timeframes.

After wave A completed, the price entered wave B, which formed a symmetrical pattern, followed by an X wave and then a triangle.

Now that the triangle appears to be complete, we seem to be in the bearish wave C of a larger degree.

It is expected that in the coming months, the price will reach the green zone.

Note that this is a high timeframe analysis, and the move will take time, with lots of fluctuations along the way.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

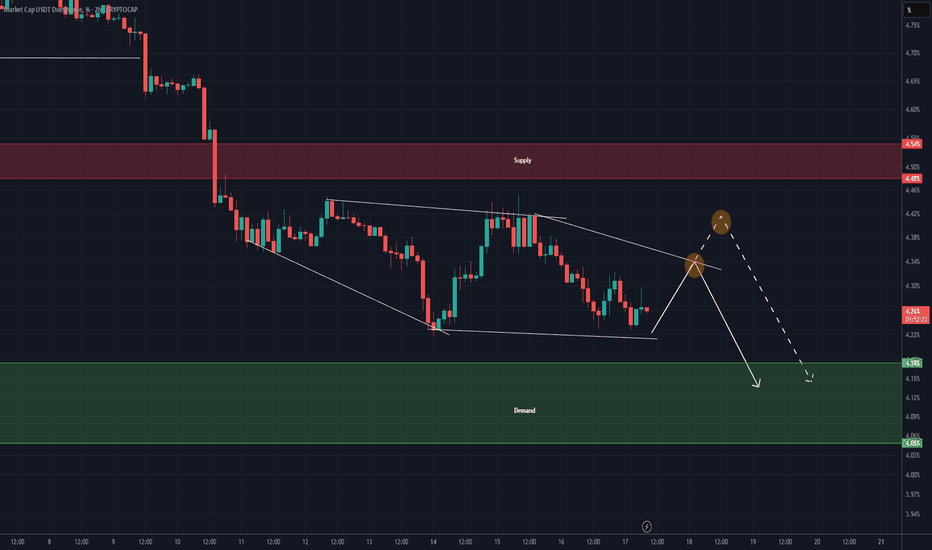

USDT DOMINANCE New Update (2H)This analysis is an update of the analysis you see in the "Related publications" section

According to the previous analysis, the price dropped nicely, which helped turn the market green.

Now the structure appears clearer, and we have a zigzag diamond pattern on the chart.

To complete wave F of this pattern, the price might move slightly higher toward the areas marked with yellow circles.

The price still hasn't reached the strong support zone and remains at a distance from it.

Let’s wait and see what happens.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ETHEREUM Roara Map (1D)The previous phase of Ethereum appears to have been a completed diametric, and now it seems we are in a flat pattern.

It can be said that we are currently in wave B of the flat, which itself appears to be a diametric.

This diametric could even extend to the 4300–4800 range.

The green zone is the rebuy area.

A daily candle close below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Where is the rebuy zone for CKB? (2D)From the point where we placed the red arrow on the chart, the CKB correction has begun.

It seems that CKB is in a bearish wave C.

We have identified two entry points for rebuy, where a position can be taken in the spot market.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ME Analysis (1D)After holding above the support zone, we have a bullish Change of Character (CH) on the chart, which is a bullish sign. Additionally, the trigger line has been broken.

After a slight pullback, the price may move toward the targets.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

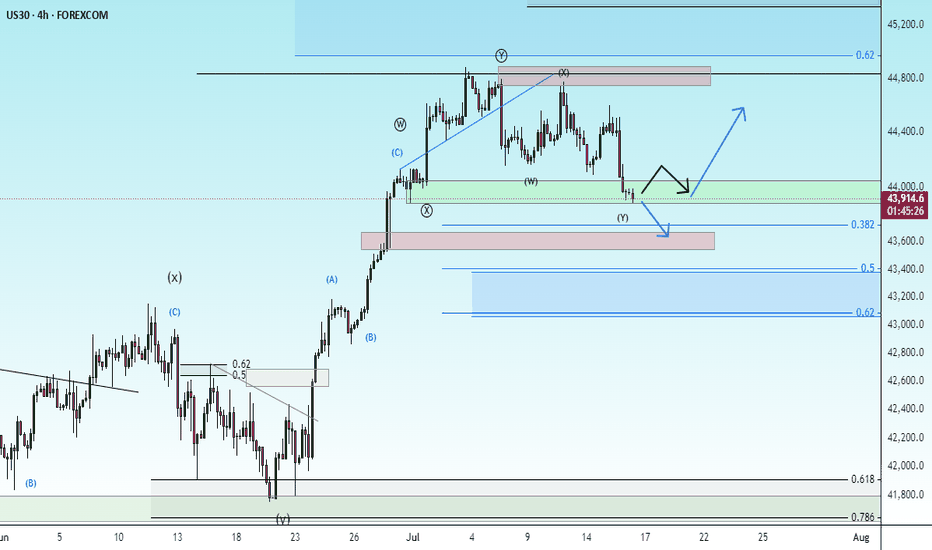

check the trendIt is expected that a trend change will form within the current support area and we will witness the beginning of the upward trend.

If the price breaks through the support zone, the continuation of the correction is likely.

If the price breaks through the support levels, the continuation of the downtrend is likely.

check the trendConsidering the price behavior in the current support area, possible scenarios have been identified. It is expected that a trend change will form in the current support area and we will see the start of an upward trend.

If the price passes the support area, the continuation of the downward trend will be likely.

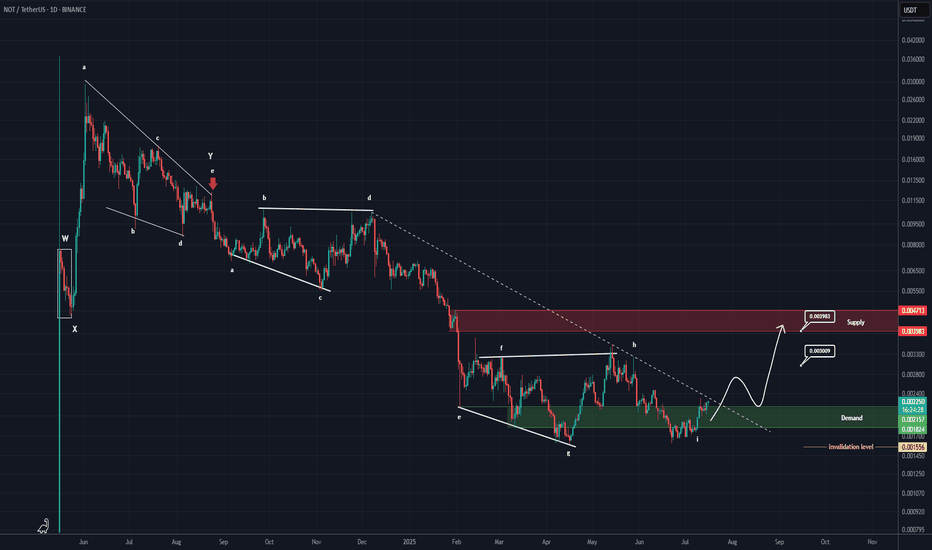

NOTCOIN New Update (1D)From the point where the red arrow is placed on the chart, the correction labeled as NOT has started.

The correction appears to be a symmetrical one, which now seems to be coming to an end. The current upward wave could be the X wave.

In previous analyses, we had also considered the structure to be symmetrical, but on a larger degree. However, based on the data currently available, it seems that the degree of this symmetrical structure is smaller.

If the price holds above the green zone, it may move toward the targets and the red box. The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

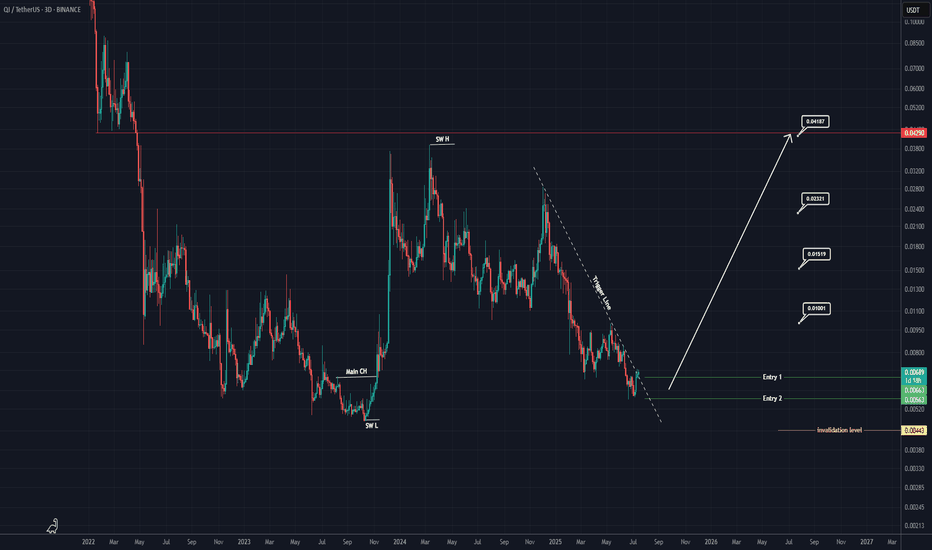

QI Looks Super Bullish (3D)The price has reached a significant zone on the higher timeframes and has failed to create a lower low. Additionally, a major Change of Character (CH) has formed on the chart.

There are signs indicating that the price is attempting to form a double bottom on the higher timeframes.

We have identified two entry points for taking a spot position.

The closure of a daily candle below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

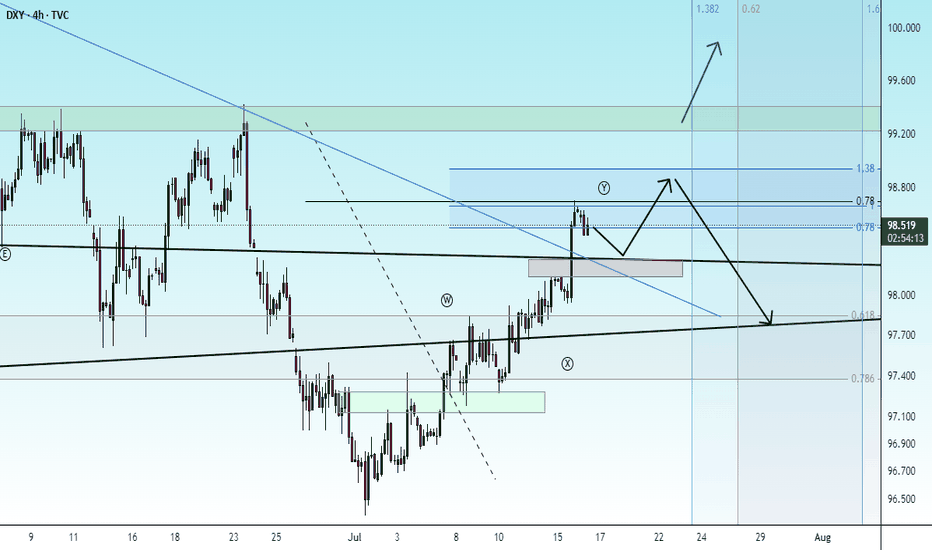

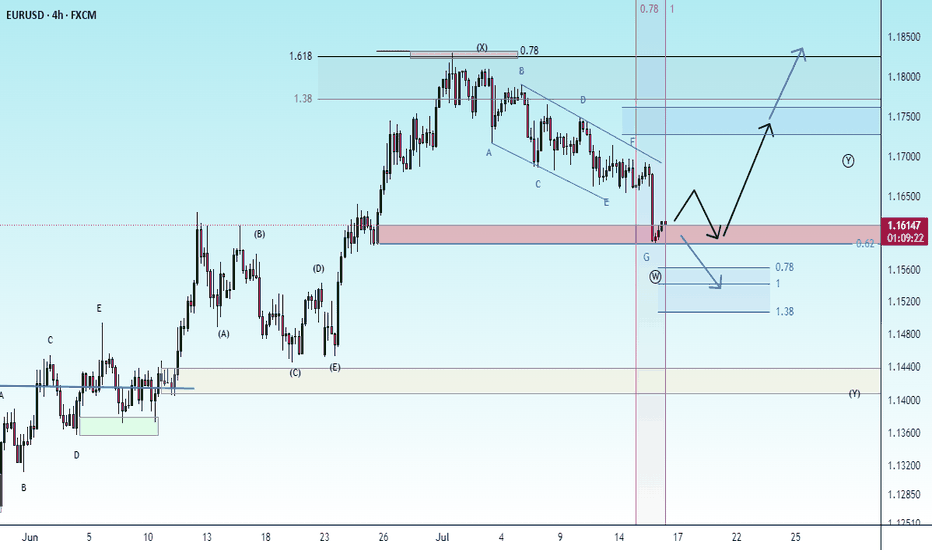

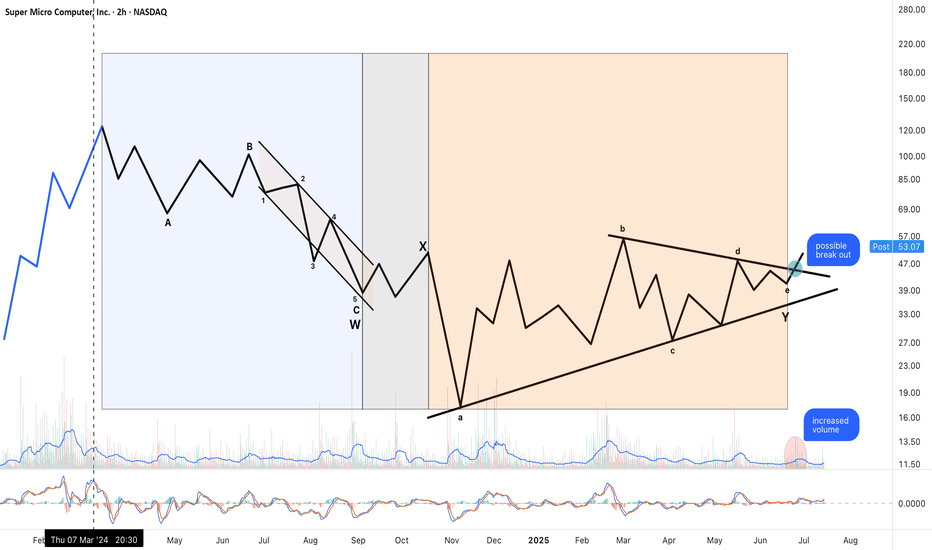

NeoWave Structure: Flat–X–Triangle Combination - break outThis chart illustrates a possible NeoWave-style corrective combination: a Flat–X–Triangle structure, likely completed and followed by a breakout.

W Wave: A well-structured Flat correction (labeled A–B–C) with a clean internal 5-wave impulse in C. Balanced time and volume across subcomponents suggest structural completion.

X Wave: A simple, proportionally shallow X connector, in line with NeoWave time and price minimums.

Y Wave: A textbook contracting triangle (labeled a–b–c–d–e), with near-perfect Fibonacci relationships between legs:

• Wave b retraces approximately 61.8% of wave a

• Wave d retraces approximately 78.6% of wave c

• Time symmetry is preserved

• Volume compresses into the apex, a classic triangle behavior

Breakout Observed:

• Price has moved above triangle resistance

• Volume increased at breakout

• MACD shows positive crossover and rising momentum

Interpretation:

This may mark the end of a prolonged corrective structure and the beginning of a new impulsive sequence. Triangle projection targets suggest the $77–80 area as a minimum, with higher Fibonacci extensions possible (e.g., 1.618 or 2.618 of prior moves) if this evolves into a 3rd wave.

Technical Approach:

This analysis follows NeoWave principles (Glenn Neely), emphasizing structural clarity, wave proportion, time-price balance, and breakout behavior.