Nestleindia

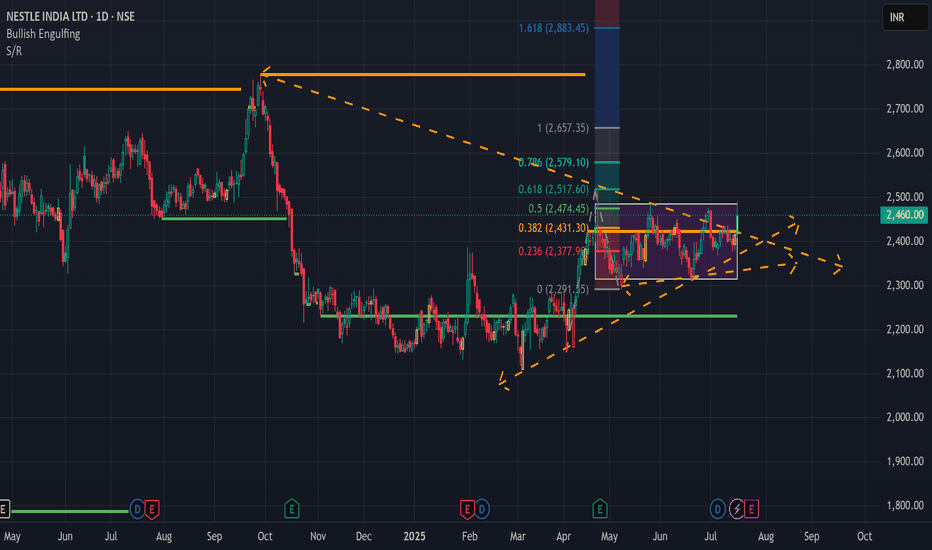

NESTLE INDIA If the price bounces from this support, the next resistance level could be around 2,450–2,500.

If the price breaks this support, it would be a bearish breakdown, and the price could fall to 2,250 or even lower.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

NESTLEIND - Range Bound -Box BreakOut -DailyThis is a technical analysis chart of **Nestle India Ltd. (NSE: NESTLEIND)** on a **daily timeframe**, and here's a breakdown of what it's showing:

---

### 📊 **Price Action and Pattern**

- **Range Bound (Accumulation)**: From around **November 2024 to mid-April 2025**, the price was consolidating between approx **₹2,135 (support)** and **₹2,342 (resistance)** — a classic **rectangle consolidation pattern**.

- **Breakout**: The stock has recently **broken out of this range** and is currently trading around **₹2,416.60**, suggesting a **bullish breakout**.

---

### 🔍 **Measured Move**

- The chart shows a **measured move target**:

- Rectangle height: ~**₹210.85**

- Breakout level: ~**₹2,342**

- **Target price** after breakout: ~**₹2,555.75** (highlighted in green)

This implies a potential **upside of 9%** from the breakout level.

---

### 🔊 **Volume Analysis**

- Noticeable **increase in volume during the breakout**, which confirms the **validity of the breakout**.

- Volume spikes have historically aligned with key price movements in this stock.

---

### 📌 **Key Levels**

- **Support**: ₹2,342 (previous resistance), and below that ₹2,135

- **Resistance**: ₹2,555, and further up at ₹2,765 – ₹2,778 (previous highs)

---

### 🧠 **Conclusion**

- **Bullish bias** post-breakout from the rectangular base.

- Potential for move towards **₹2,555**, with **volume support**.

- Traders might look for:

- Pullback to ₹2,342 for entry

- Tight stop-loss below support

- Target near ₹2,555 or partial booking en route

---

Nestle - Long term Bottom formation and Breakout for investmentSupport b/w 2100-2150 since Dec 24 has been holding

50 month SMA at 2106— very strong & rarely breaks

200 week SMA rarely breached & now at 2132

Moving averages: Crossed 20/50/100 day SMA

MACD: Daily +ve, Weekly +ve, Monthly -ve

Daily CCI > 100 (bullish)

Resistance Levels:

- 2280 (range)

- 2380-2400 : 2380 (100 week SMA), 2387 (parallel), 2394 (50 week SMA)—converging soon.

Break above 2280 likely coming week, but break above 2380-2400 with volume needed for long term breakout.

2100 support intact currently

At 2268-2280: Strong 2100 support. Buy on every dip for long term or on 2280 breakout.

Target - 2700 in 06 months

Long term Stop loss- below 2100

For short swing- Target 2380 if it breaks & closes above 2280, make 2270 as stop loss

NESTLEIND buying opportunityPrice is showing a positive reaction from the institutional buying zone, suggesting a potential buying opportunity at the levels indicated in the chart.

NESTLEIND presents a strong opportunity for both short-term and long-term gains.

Please note: I am NOT a SEBI-registered advisor or financial advisor. The investment or trade ideas I share are solely my personal viewpoint and should not be considered as financial advice.

Nestle-Bullish Swing- Will this be bullish swing? NSE:NESTLEIND

21.08.2024

Buy-2551

Target 01-2643, Target 02-2761

Stop Loss-2447

Risk Reward- 1:2

After the good uptrend from March 2023, price is

under consolidation from Beginning of January

2024. Hopefully it us under the formation of

Bullish Flag and trying to provide the big breakout.

1.Breakout- Inside Bar

2.Trend- Uptrend in higher TF & trying to break the downward range in shorter time frame.

3.KeyLevel- second time rejection from resistance converted to support zone.

4.Volume- Average volumes. Need more & above average volumes in next sessions for more rewards

5. EMA- Perfect rejection from 200 EMA. Price is above 21 EMA & 50 EMA

6. Chart Pattern- bullish flag in the border view

7.RSI- Strong bounce from 30 RSI. Still very good potential for more movement.

Nestle is a strong candidate for Breakout. Nestle India Ltd. engages in the manufacture and sale of food products. The firm offers beverages; breakfast cereals; chocolates and confectionery; dairy; nutrition; foods; vending and food services; imports; exports; and Nestle ad campaigns brands. It operates through the India and Outside India geographical segments.

Nestle India CMP is 2508.50. The positive aspects of the company are Company with Low Debt, Annual Net Profits improving for last 2 years, Dividend yield greater than sector dividend yield, FII / FPI or Institutions increasing their shareholding AND Company with Zero Promoter Pledge. The Negative aspects of the company are High PE (PE=74.5), MFs decreased their shareholding last quarter AND Declining Net Cash Flow : Companies not able to generate net cash.

Entry can be taken after closing above 2529. Targets in the stock will be 2560, 2603, 2626 AND 2649. The long-term target in the stock will be 2692, 2715 and 2760. Stop loss in the stock should be maintained at Closing below 2400. Nestle can be considered as a Portfolio stock due to its strong moat and near monopoly business.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Nestle India shows a Ascending triangle formation.This stock had previously bounced off with good volumes from the constant upward rising demand zone and it has done the same from the same zone on Tuesday's trading session.

24000 is a good support area for the stock and the reversal point of 23883 is an important low to be considered if the current uptrend is to be held.

On the upside the 24500 zone is the resistance level that is keeping the stock from reaching the 25000 mark. If the stock surpasses 24500 then 25000 should be a smooth ride.

CMP 24040

SL 23850

Target 25000

NESTLEINDNSE:NESTLEIND

One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose

NESTLEIND Company website- www.nestle.in

Product Verticals ---> Beverages, cereals, chocolates, dairy, nutrition, foods, vending machines

Famous brands- Nescafe coffee, Maggi noodles, Milkybar chocolate, Milo, Kit Kat chocolate, Bar-One, Milkmaid, Cerelac baby food, Boost health drink ( bet you have heard of them )

4% market share, plenty of upside for such a MNC.

Financials- low debt, ascending PAT (12% yoy ), 0 pledged shares, high dividend yield at 180%

__________________________________________________________________________________________________________________________

PRO TIP : 4 stocks in your portfolio and you own 99% FMCG market in india- ITC, HUL, NESTLE AND BRITANNIA

Buy them all if you can :)

PS: I have the money, vested interest is being invested in all these companies, for the effort of writing this, be a good dude and give it a like a share or buy me a beer :)

STEP UP YOUR GAME! Get Rich!

NESTLE BREAKOUT! POTENTIAL 5% UPSIDEHello guys, So I have found a trade of the FMCG sector-NESTLE, it's consolidating in a symmetrical triangle pattern and looks ready to give the breakout for upside movement.

All the required info is in the chart above, take a look.

BUY ABOVE-19490

Targets mentioned in the chart above (white lines)

RSI has room for BULLS.

MACD turning BULLISH

Please LIKE, COMMENT and SHARE to motivate and support me. I'll keep on posting new ideas on Indices & Stocks. Be sure to follow so that you don't miss any good trades that might have been rewarding.

Any comments and critiques will be appreciated even if it's of opposite view as a trader can also be right so many times.