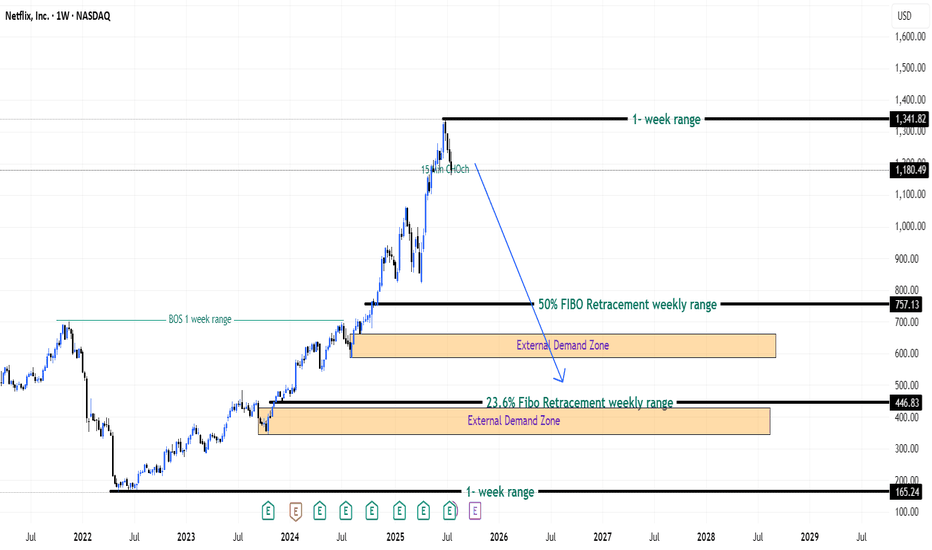

Bulls Quit? Bears Ready! - Netflix Stock (USA) - {27/07/2025}Educational Analysis says that Netflix (USA Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

Stocks & Commodities TradeAnalysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Netflixlong

NFLX Weekly Options Outlook — June 1, 2025🚨 Multi-Model Summary

This week’s analysis from top AI models (Grok, Claude, Llama, Gemini, DeepSeek) shows moderate bullish momentum for NASDAQ:NFLX , with a range of technical insights and trade strategies.

🧠 Model Highlights

Grok (xAI)

🔹 Technicals: Price above 10EMA, nearing overbought.

🔹 Sentiment: Bullish news (BofA), VIX low.

🔹 Trade: Buy $1290C @ $0.94 → PT $1.41 / SL $0.47

🔹 Confidence: 60%

Claude (Anthropic)

🔹 Technicals: Strong EMAs, bullish MACD on 5M.

🔹 Sentiment: BofA upgrade + options flow into $1300.

🔹 Trade: Buy $1220C @ $12.25 → PT $18–20 / SL $8

🔹 Confidence: 72%

Llama (Meta)

🔹 Technicals: Bullish near-term; RSI normalized.

🔹 Sentiment: BofA bullish note, minor CNBC drag.

🔹 Trade: Buy $1290C @ $0.94 → PT $2.50 / SL $0.40

🔹 Confidence: 65%

Gemini (Google)

🔹 Technicals: Uptrend, MACD divergence noted.

🔹 Sentiment: Strong BofA note, watch $1180 max pain.

🔹 Trade: Buy $1250C @ $4.40 → PT $6.60 / SL $2.20

🔹 Confidence: 60%

DeepSeek

🔻 Bearish Divergence

🔹 Technicals: Overextended short-term.

🔹 Sentiment: Max pain + put skew → downside risk.

🔹 Trade: Buy $1100P @ $0.71 → PT $1.77 / SL $0.35

🔹 Confidence: 65%

✅ Consensus Takeaways

🟢 4 out of 5 models lean bullish

📊 Price > EMAs, sentiment tailwind (BofA upgrade)

⚠️ Max pain at $1180 could act as late-week magnet

⚡ Risk-on setup but overbought—watch for short pullbacks

🎯 Chosen Trade Setup

💡 Trade Idea: Buy NFLX $1220C (2025-06-06)

💵 Entry: $12.25

🎯 Target: $18.40 (+50%)

🛑 Stop: $7.96 (−35%)

🔢 Size: 1 contract

🧠 Confidence: 70%

⏰ Entry: At open (Monday)

⚠️ Key Risks to Watch

RSI near overbought → potential pause

Max pain gravity at $1180 into Friday

Late-week gamma decay = faster premium loss

Macro news or earnings surprises may shift bias

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "NFLX",

"direction": "call",

"strike": 1220.0,

"expiry": "2025-06-06",

"confidence": 0.70,

"profit_target": 18.40,

"stop_loss": 7.96,

"size": 1,

"entry_price": 12.25,

"entry_timing": "open",

"signal_publish_time": "2025-06-01 16:24:59 EDT"

}

Breaking: Netflix ($NFLX) Surges 3% Amidst Topping Q1 Earnings The shares of Netflix (NASDAQ: NASDAQ:NFLX ) is surging 3.5% in Friday's premarket session amidst Q1 earnings beat.

Netflix (NASDAQ: NASDAQ:NFLX ) reported first-quarter earnings that topped analysts’ expectations, sending shares higher in extended trading Thursday, extending the gains to Friday's premarket session.

The streaming giant's revenue grew over 12% YoY to $10.54 billion, above the analyst consensus from Visible Alpha. Net income of $2.89 billion, or $6.61 per share, rose from $2.33 billion, or $5.28 per share, a year earlier, beating Wall Street’s expectations. The period marked the first quarter Netflix did not report subscriber numbers.

Netflix's Gains Come as Subscription Prices Rise

The better-than-expected results came in part due to higher subscription and ad revenues, the company said, along with the timing of expenses.

Netflix had raised prices for its plans in January, hiking its ad-supported plan to $7.99 from $6.99 per month, the standard ad-free plan to $17.99 from $15.49 a month, and its premium plan to $24.99 from $22.99 a month.

Netflix maintained its fiscal 2025 revenue projection of $43.5 billion to $44.5 billion. Analysts on average had expected $44.27 billion. The company's second-quarter revenue forecast of $11.04 billion exceeded Wall Street's estimate of $10.91 billion.

Co-CEO Greg Peters said Netflix expects to double its advertising revenue this year, as the company rolls out its ad tech suite. The suite is live in the U.S. and Canada, with 10 other markets expected in the months to come.

Technical Outlook

As of the time of writing, NASDAQ:NFLX shares are up 3.29% in Friday's premarket session. NASDAQ:NFLX chart pattern has formed a perfect resistant and support point carved out since the 11th of November, 2024. Should NASDAQ:NFLX break the $1064 resistant point, a break out might be imminent for the entertainment giant.

Conversely, failure to break above that point could resort to a cool off to the $800 support point. NASDAQ:NFLX RSI is primed for a breakout as it is not oversold nor overbought but well positioned for a bullish move.

Netflix (NFLX) – A Safe Haven Amid Tariff UncertaintyKey Supporting Arguments

Amidst the unpredictability of Donald Trump's tariff policies, Netflix might serve as a defensive play.

Positive consumer sentiment, a surge in subscriber growth, and strategic hikes in subscription prices are poised to power robust results for the first quarter of fiscal year 2025.

Investment Thesis

Netflix (NFLX) is a global leader in video streaming, offering a vast library of original and licensed content to subscribers worldwide. With over 95% of its revenue stream coming from subscriptions, the company secures a solid foundation against the whims of market volatility. NFLX’s nascent foray into advertising contributes a mere 3% to its revenue, ensuring that any tremors in the macroeconomic climate have a minimal ripple effect.

Netflix's business model, anchored in subscription revenue and expansive geographic diversification, shields the company from the whims of unpredictable tariff policies. Amidst the relentless cycle of tariffs being slapped on and lifted from a variety of products and the growing tide of protectionism, streaming platforms such as Netflix, which thrive on subscription-based models, emerge as devensive assets. This is largely because they steer clear of the tumultuous world of physical goods production, importation, and exportation. The sustainability of the company’s streaming empire is anchored in its formidable user engagement—clocking in at around 2 hours per household daily—paired with historically low subscriber churn and entertainment value that punches well above its price tag. These elements collectively mitigate NFLX’s risk profile in the face of a potential recession. While advertising revenue may take a hit if trade tensions intensify and trigger an economic downturn, it is worth noting that ads only contribute to about 3% of Netflix's total revenue. Despite its worldwide footprint, the company still rakes in a hefty slice of its revenue—around 40-45%—from the U.S. market, offering a protective buffer against possible international sanctions or restrictions. Meanwhile, its strategic geographic diversification across Europe, Latin America, Asia, and the Middle East not only mitigates risks but also fortifies the sustainability of its business model.

Netflix is poised to potentially exceed expectations in its Q1 2025 earnings report. In Q4 2024, the company shattered expectations by pulling in a recordbreaking 19 million new users, a surge we anticipate will roll into 2025, powered by its rich and diverse content lineup. By the year's end, Netflix strategically hiked prices in the U.S. and UK, a move poised to bolster its Q1 2025 revenue. With a bold target of 29% growth for 2025, the company is banking on buoyant consumer spending and these subscription price upticks to hit the mark. Netflix projects a free cash flow of no less than $8 billion, creating a strategic opportunity for potential share buybacks.

Our target price for NFLX over the next two months is pegged at $1,080, paired with a "Buy" recommendation. We suggest setting a stop-loss at $880.

Netflix Eyes $1,200: Can It Break Key Levels to Soar Higher?Good morning, trading family!

Netflix (NFLX) is looking exciting right now, and here’s what I’m watching:

-If we drop below $973, we might see $950 support come into play.

-But if we break above $991, there’s potential for a rally to $1,055 and higher—with $1,200 as the ultimate goal.

Big moves could be coming, so keep these levels on your radar!

If this analysis helped you, I’d love to hear your thoughts. Drop a comment, give it a like, or share with others. Let’s trade smarter and live better!

Kris/Mindbloome Exchange

Trade What You See

Netflix Stock Up 14% Premarket Following Record-Breaking QuarterNetflix Inc. ( NASDAQ:NFLX ) is making headlines with a significant 14% surge in premarket trading, fueled by the company’s record-breaking fourth-quarter performance. This milestone, driven by live sports programming and the return of its flagship series, *Squid Game*, marks a pivotal moment for the streaming giant. Here’s an in-depth look at the technical and fundamental aspects behind this remarkable rally.

Record Subscriber Growth

Netflix added an unprecedented 18.9 million subscribers in Q4 2024, bringing its global subscriber base to over 300 million. This growth, more than double Wall Street’s expectations, surpasses the company’s previous record of 15 million new subscribers in Q1 2020. Notably, this quarter marked the final time Netflix will report subscriber numbers, signaling a shift toward emphasizing financial metrics such as revenue and profit.

Revenue and Profit Surge

Netflix reported a 16% year-over-year increase in revenue, reaching $10.2 billion for the quarter—its most substantial growth since 2021. For 2025, the company projects revenue of up to $44.5 billion, a 14% increase, with an operating margin of 29%. These robust financials underscore the company’s ability to sustain growth amidst a competitive streaming landscape.

Key Drivers of Growth

1. Live Programming: Netflix’s venture into live sports, including its first major National Football League games and the Jake Paul vs. Mike Tyson boxing match, has proven to be a game-changer. These events attracted record sign-ups, highlighting the potential of live programming to drive subscriber growth.

2. Content Strategy: The return of Squid Game and the success of the hit movie Carry-On further bolstered subscriber numbers. Netflix’s diverse programming mix ensures broad audience appeal, while no single title dominated subscriber additions.

3. Password Sharing Crackdown: The company’s crackdown on password sharing contributed to its best-ever year for subscriber growth, with 41 million new customers added in 2024.

4. Advertising Revenue: While still in its early stages, Netflix’s advertising business is gaining traction. A majority of new subscribers in markets with ad-supported tiers opted for this model, signaling growing acceptance of ad-supported streaming.

Price Increases

Netflix is boosting prices across several markets, including the U.S., Canada, Portugal, and Argentina. The most popular U.S. plan now costs $17.99 per month, a $2.50 increase. These price hikes are expected to contribute significantly to revenue growth in 2025.

Market Reaction

Netflix shares closed at $869.68 in New York on Tuesday and are set to open with a 14% gain in premarket trading. If sustained, this would mark the stock’s most significant gain since October 2023.

Technical Analysis

As of premarket trading, NASDAQ:NFLX is up 14.70%, reflecting bullish sentiment driven by the record-breaking quarterly performance. The Relative Strength Index (RSI) was at 48.99 before this surge, indicating the stock was neither overbought nor oversold.

Bullish Gap-Up Pattern

The premarket rally sets the stage for a potential gap-up pattern at market open. This technical phenomenon occurs when a stock’s opening price is significantly higher than its previous closing price. Historically, gap-ups are strong bullish indicators, often followed by brief pullbacks as traders digest the news.

Resistance and Support Levels

- Resistance: The stock is eyeing its one-month high as the next resistance level. A breakout above this point could trigger further bullish momentum.

- Support: Immediate support lies at the $776 level. A breakdown below this level could lead to a retest of lower support zones, but this scenario appears less likely given the current bullish momentum.

Market Outlook

With the broader stock market expected to rally following Donald Trump’s inauguration earlier this week, NASDAQ:NFLX is poised to capitalize on favorable market conditions. The combination of strong fundamentals and bullish technical indicators suggests a continued upward trajectory in the near term.

Conclusion

Netflix’s record-breaking quarter underscores its resilience and adaptability in an evolving streaming landscape. The company’s strategic focus on live programming, diverse content offerings, and advertising is paying off, driving subscriber growth and revenue to new heights. From a technical perspective, the stock’s premarket surge and bullish patterns point to a strong start for 2025.

As Netflix pivots toward prioritizing financial metrics over subscriber numbers, investors have much to look forward to in terms of sustained growth and profitability. With NASDAQ:NFLX setting the stage for a historic year, the streaming giant remains a compelling investment opportunity for traders and long-term investors alike.

Netflix (NFLX) AnalysisNetflix recently experienced a pullback, dropping to a significant demand zone around $820-$850, which has historically acted as strong support. This drop has attracted traders eager to capitalize on the current discounted price, anticipating a potential bullish rebound.

Looking at the chart:

1️⃣ Previous Earnings Reaction: The last earnings report sparked a 12% spike, showcasing Netflix’s potential for strong momentum following positive results.

2️⃣ Demand Zone Support: The stock is consolidating around this key level, indicating that buyers are stepping in to defend it.

3️⃣ Bullish Expectations: Traders are positioning themselves for the upcoming earnings report, expected on 01/21/2025 after market close, which could act as a major catalyst for upward movement.

If the earnings report meets or exceeds expectations, we could see Netflix rally toward all-time highs, with the first resistance zone around $940 and a longer-term target of $1,020.

NETFLIX’s Next Big Move: Massive Breakout Imminent?Technical Analysis:

NFLX (Netflix), on the 15-minute time frame, has set up a long trade with a strong entry at $744.60, supported by good volume. The breakout occurred above a consolidation phase, indicating market interest in a bullish move.

The price action is holding above the entry level, and the Risological Dotted Trendline is trending upward, providing a strong support foundation for the trade. This long setup points to a potential bullish continuation as Netflix approaches the following targets.

Key Levels:

Entry: $744.60

Stop Loss (SL): $715.10

Target 1 (TP1): $781.07

Target 2 (TP2): $840.08

Target 3 (TP3): $899.09

Target 4 (TP4): $935.56

Observations:

The breakout was backed by strong volume, reflecting confidence from the bulls.

Price is consolidating near TP1, suggesting momentum is building for further upside.

The Risological Dotted Trendline is trending upwards, giving strong support around $744, ensuring the trend stays intact.

Outlook:

Netflix's long trade setup shows strong potential for upward movement. With the support of the Risological Dotted Trendline and high volume backing, this trade is well-positioned to meet its targets. Watch for any pullback near $740, which could present another opportunity to re-enter or add to positions.

Netflix - Bullish Move Of +50% Ahead!Netflix ( NASDAQ:NFLX ) is trading at an important breakout level:

Click chart above to see the detailed analysis👆🏻

Netflix is just another one of these stocks which is perfectly following cycles and market structure. After the recent drop of about -80%, Netflix perfectly tested the bottom of the reverse triangle pattern, created bullish confirmation and took off towards the upside.

Levels to watch: $700, $1.000

Keep your long term vision,

Philip (BasicTrading)

Netflix Shares Hit an All-time High Tuesday On Strong Ad SalesKey Takeaways:

- Netflix shares hit an all-time high on the back of a significant increase in upfront ad sales.

- The company reported a 150% surge in advertising commitments compared to 2023.

- Strategic moves in content, technology, and live events have bolstered investor confidence.

Netflix ( NASDAQ:NFLX ), the streaming giant that once dominated the entertainment landscape through its pioneering subscription model, has now reached a new pinnacle in its market journey. On Tuesday, Netflix's shares soared to a record high, closing at $696.59 after touching an all-time high of $711.33 earlier in the day. This surge follows the company's impressive report of a substantial increase in upfront ad sales commitments, signaling a major shift in its business strategy.

A New Era of Advertising Success

Netflix's success in the advertising arena marks a significant turning point. The company announced that it had secured more than a 150% increase in upfront ad sales commitments over 2023, closing deals with all major holding companies and independent agencies. These partnerships are not just for any content, but for some of Netflix’s most anticipated upcoming releases, including global hits like "Squid Game," fan-favorite series "Outer Banks," and the much-anticipated "Happy Gilmore 2." Moreover, Netflix is tapping into the lucrative live event market, securing deals for high-profile broadcasts such as Christmas Day NFL games and "WWE Raw."

This strong performance in ad sales reflects Netflix's strategic decision to evolve beyond its traditional subscription model. For years, Netflix resisted the idea of incorporating ads into its platform, fearing it might alienate its user base. However, in an increasingly competitive streaming landscape, the company’s pivot to an ad-supported tier has proven to be a game-changer. This move not only attracted a new segment of budget-conscious consumers but also opened a new revenue stream that investors are now enthusiastically embracing.

Strategic Shifts Bolster Investor Confidence

Netflix’s surge in stock price is not solely due to its advertising success. The company has also been making strategic shifts to enhance profitability and sustain growth. These include cracking down on account sharing, which has long been a drain on potential revenue. By introducing stricter controls on password sharing, Netflix has effectively compelled many users to convert to paying subscribers, boosting its subscriber base and revenue.

In addition, Netflix has been judicious in its content spending, focusing on producing hits that resonate with global audiences. The success of series like "Bridgerton," surprise hits like "Baby Reindeer," and the French movie "Under Paris" underscore Netflix’s ability to create content that not only captures viewers’ attention but also drives subscriber growth.

Moreover, Netflix’s expansion into live events and sports broadcasting represents another avenue for growth. Live content is a highly sought-after commodity in the streaming world, and Netflix’s foray into this space with events like NFL games indicates its intent to compete on multiple fronts.

Financial Turnaround and Market Position

The financial landscape for Netflix has dramatically improved over the past few years. Once criticized for its heavy spending and negative free cash flow, Netflix has now become a model of profitability. The company’s disciplined approach to content spending, coupled with its new revenue streams from advertising and live events, has alleviated investor concerns about its financial health.

Netflix’s stock, which at one point had lost more than 75% of its value from its 2021 peak, has since rebounded, quadrupling in value. This remarkable turnaround is a testament to the company’s successful adaptation to market challenges and its ability to innovate within a highly competitive industry.

As of this year, Netflix shares have risen by 44%, far outpacing its competitors. While Disney, Warner Bros Discovery, and Paramount Global have struggled with declining stock prices, Netflix has solidified its position as a leader in the streaming industry. The company’s price-to-earnings ratio, now at 32 times estimated earnings, is significantly lower than its 10-year average, reflecting improved investor sentiment and confidence in its long-term strategy.

Technical Outlook

At the present time, Netflix stock ( NASDAQ:NFLX ) has experienced a 1.33% increase and is trading within the overbought region, displaying a Relative Strength Index (RSI) of 72 subsequent to reaching a historic peak. Despite the exuberance surrounding the all-time high, traders are advised to exercise vigilance. Notably, Netflix stock ( NASDAQ:NFLX ) is overbought, and any potential reversal in trend could precipitate a decline to the 1-month low, which in turn may result in the breach of the structure established in proximity to the 100-day Moving Average.

Conclusion

Netflix’s recent achievements highlight the company’s ability to evolve and adapt in a rapidly changing entertainment landscape. By embracing advertising, cracking down on account sharing, and expanding into live events, Netflix has not only bolstered its financial performance but also reinvigorated investor confidence. As the company continues to refine its strategy, it appears well-positioned to maintain its leadership in the streaming industry and continue delivering value to its shareholders.

NFLX Jan 26th Update, Target got hitWe had a great bull flag setup going into the earnings.

Now the target got hit, will be watching for a retracement into early Feb and another push higher into Feb OPEX

Nothing bearish here to even try taking a short trade. There is still one more gap to close above the price, should be hit first before reversal starts.

Also the price might just consolidate/correct in time and push above to a new high. Any shorting should have solid stops

Netflix's Spectacular Q4 Performance Ignites Investors Spirit Netflix (NASDAQ: NASDAQ:NFLX ) has once again defied expectations with its stellar fourth-quarter performance, surpassing Wall Street estimates and achieving its largest-ever subscriber growth for the final quarter. The streaming giant added a remarkable 13.1 million subscribers, soaring past the projected 8.97 million, and bringing its total subscriber count to a staggering 260 million. As the company's stock experiences an upward surge, it's evident that Netflix ( NASDAQ:NFLX ) is not just riding the wave of its content library but actively reshaping the landscape of streaming services.

Unprecedented Subscriber Growth:

Netflix's robust subscriber growth in Q4 is attributed to strategic content releases, including the much-anticipated final season of "The Crown" and David Fincher's original film, "The Killer." The company's ability to consistently deliver compelling and diverse content has solidified its position as a streaming powerhouse. The 13.1 million new subscribers showcase not only the platform's global appeal but also its adeptness at retaining and attracting viewers.

Financial Triumph:

Netflix's ( NASDAQ:NFLX ) financials also paint a rosy picture, with revenues surging to $8.8 billion, surpassing both forecasts and the company's own guidance of $8.7 billion for the quarter. This represents a remarkable 12.5% year-over-year growth, driven in part by the crackdown on password sharing and the introduction of a subscription plan with advertising. The company's focus on profitability is further emphasized by the increased 2024 full-year operating margin forecast of 24%, up from the previously projected range of 22% to 23%.

Diversification Strategies:

Beyond its core streaming business, Netflix ( NASDAQ:NFLX ) is venturing into new territories, notably advertising and gaming. The streaming giant is keen on making advertising a significant revenue driver, with plans to enhance the attractiveness of its ad-supported tier. Netflix's foray into live entertainment, exemplified by the announcement of streaming WWE Raw starting next year, highlights the company's commitment to diversification and staying ahead of the competition.

Competitive Edge and Future Outlook:

While competitors in the streaming space grapple with profitability concerns and content cutbacks, Netflix ( NASDAQ:NFLX ) remains unwavering in its commitment to investing in a robust content slate. The company's refusal to pursue acquisitions of traditional entertainment companies or linear assets sets it apart in an industry undergoing significant changes. As Netflix ( NASDAQ:NFLX ) anticipates continued competition, its dedication to improving the entertainment offering signals a long-term strategy focused on capturing and retaining subscribers in an evolving market.

Looking Ahead:

Netflix's exceptional performance in Q4 2023 not only cements its status as a leader in the streaming industry but also underscores its resilience in adapting to changing market dynamics. With a record-breaking subscriber base, expanding revenue streams, and a commitment to innovation, Netflix ( NASDAQ:NFLX ) seems poised for continued success in the years to come. As the company navigates the delicate balance between subscriber growth and profitability, its strategic moves in advertising and gaming hint at a future where Netflix ( NASDAQ:NFLX ) goes beyond being a mere streaming service, evolving into a diversified entertainment powerhouse.

Netflix : Elliott Wave Analysis 🌊 In the aftermath of Netflix's Earnings Call, witness a remarkable 7% surge in after-hours trading!

The intricate chart unfolds the completion of the initial cycle in July 2020, marked by an expanded Flat and Wave II concluding around $165. Embarking on a new Wave (1), the chart showcases an engaging 5-wave structure to the upside.

Upon our analysis, the low of Wave 4 hints at an impulsive rise for Wave ((iii)), targeting a range between 227% and 361%. Anticipating stabilization around $575, the narrative continues with the formation of Wave ((iv)), paving the way for the final ascent of Wave 5. This strategic sequence defines the overarching Wave (1), setting the stage for a robust sell-off in Wave (2) before the next surge of streaming momentum. 🚀🎥

NFLX / 1H / TECHNICAL ANALYSIS NASDAQ:NFLX I expect a bullish movement towards the 518 level if the resistance zone at the 503 level is breached and there are candlestick closures. Our support level is at 461.

Like and comment if you find value in our analysis.

Feel free to post your ideas and questions at the comments section.

Good luck

Netflix's Legal Triumph and Ad-Driven Ascension

In a recent legal showdown, streaming giant Netflix emerged victorious in a California federal court, successfully defeating a shareholder lawsuit that accused the company of concealing the impact of account-sharing on its growth trajectory. The lawsuit, filed by a Texas-based investment trust in May 2022, sought damages for investors who purchased Netflix shares between January 2021 and April 2022. Despite the significant blow to the stock value and a subsequent drop in subscribers, U.S. District Judge Jon Tigar ruled that the plaintiffs failed to provide evidence supporting their claims.

Legal Victory and Investor Response:

The judge's decision, delivered on Friday, underscores the importance of substantiated claims in legal battles. While Netflix shares initially faced a downturn, losing a third of their value, the ruling has provided a reprieve for the streaming giant. The door, however, remains open for the investors to refile the lawsuit if they can bolster their claims with additional facts.

Netflix's Stock Rollercoaster:

The legal victory is just one chapter in Netflix's rollercoaster journey in the stock market. Between January and April 2022, the company's shares experienced a drastic decline of around 50%. The drop was triggered by revelations that account-sharing and increased competition had hindered new subscriptions. Former CEO Reed Hastings attributed some of the challenges to the complexities of interpreting subscription trends amid the ongoing COVID-19 pandemic.

Ad-Supported Triumph:

Amidst the stock market turbulence, Netflix is finding success in an unexpected corner—the ad-supported realm. Recent reports indicate that Netflix's ad-based plan has surged, surpassing 23 million global monthly active users. This substantial growth, revealed by President of Advertising Amy Reinhard at the Variety Entertainment Summit at CES 2024, marks a notable increase from the reported 15 million users just over two months ago.

Engaging the Audience:

Reinhard emphasized the robust engagement levels among users on ad-supported plans, with a staggering 85% streaming on the platform for more than two hours daily. This data suggests that the ad-supported model is resonating well with Netflix's audience, providing a fresh perspective on the evolving dynamics of streaming preferences.

Pricing Strategy and Market Penetration:

Netflix's pricing strategy for its ad-supported plan is noteworthy, with the Basic With Ads plan priced at $6.99 per month in the United States—less than half the cost of the Standard plan at $15.49 per month. This strategic pricing could be a key factor in attracting a broader audience to the ad-supported tier, as ad-tier subscriptions reportedly account for approximately 30% of all new signups in the 12 countries where the platform has been launched.

Microsoft Partnership and Technological Advancements:

Netflix's success in the ad-supported arena is further amplified by its ad-tech deal with Microsoft. The partnership designates Microsoft as Netflix's global advertising technology and sales partner, playing a pivotal role in the triumph of Netflix's advertising strategy and technology infrastructure.

Conclusion:

As Netflix navigates legal challenges and charts a new course in the ad-supported landscape, the streaming giant continues to demonstrate resilience and innovation. The legal victory provides a foundation for future endeavors, while the surge in ad-supported subscriptions showcases Netflix's adaptability in meeting evolving consumer demands. The company's strategic pricing, coupled with a robust technological infrastructure, positions it for continued success in an ever-changing streaming landscape.

Is Netflix Stock A Buy After Third-Quarter ReportsInternet television network Netflix (NFLX) has a commanding lead in the streaming video market but its growth has slowed. NFLX stock cratered in 2022 after the company reported two straight quarters of subscriber declines. However, after a corporate course correction, some people might be wondering: Is Netflix stock a buy right now?

Subscriber Growth Drives Netflix Story

Netflix stock has benefited from the cord-cutting trend as people quit traditional pay-TV services.

Over the last several years, Netflix has been laser-focused on growing its global subscriber base. It wants to build a competitive moat with scale. It has been investing heavily in local-language original content production worldwide. Netflix stock performance is linked to its net subscriber additions.

But Netflix stock tumbled 51% in 2022 as subscriber growth stalled. Growth has rebounded in 2023 thanks to the addition of a lower-cost, advertising-supported service as well as a crackdown on unpaid account sharing.

In the third quarter, Netflix added 8.76 million subscribers worldwide, vs. forecasts for 6.06 million. It ended the third quarter with 247.15 million subscribers worldwide.

Netflix also announced price increases for its ad-free service plans in the U.S., U.K. and France.

Netflix stock soared 16.1% on the first trading day after it posted third-quarter results late Oct. 18.

Netflix Stock Fundamental Analysis

In the September quarter, Netflix earned $3.73 a share on sales of $8.54 billion. Analysts had called for earnings of $3.49 a share on sales of $8.54 billion. On a year-over-year basis, Netflix earnings rose 20% while sales climbed 8%.

However, Netflix's financial guidance for the fourth quarter was a tad below Wall Street's targets.

For the current quarter, Netflix predicted earnings of $2.15 a share on sales of $8.69 billion. Analysts had been looking for earnings of $2.17 a share on sales of $8.78 billion in the fourth quarter. In the year-earlier period, Netflix earned 12 cents a share on sales of $7.85 billion.

After a humbling performance in 2022, Netflix says it is focused on profitability. It also is targeting increased revenue with a lower-priced, advertising-supported service tier. Plus, it is looking to monetize rampant account sharing on the service and turn freeloaders into paying customers.

The next major catalyst for Netflix stock could be the company's fourth-quarter earnings report, due in late January.

Netflix Content Draws Subscribers

Since it started its original content push, Netflix has launched quite a few hit shows. They include "Stranger Things," "Squid Game," "Wednesday," "Ozark" and "Bridgerton."

It also has premiered popular original movies such as "Bird Box," "Extraction," "Murder Mystery," "The Old Guard" and "Red Notice."

Recent buzzworthy shows on Netflix include TV series "One Piece," "FUBAR" and "The Fall of the House of Usher." Popular new original movies include action films "The Mother" and "Extraction 2" and comedy "You People."

Meanwhile, Netflix is facing competition from traditional media companies. Max from Warner Bros. Discovery (WBD) launched in May 2023. Paramount Global (PARA) debuted Paramount+ in March 2021. Comcast (CMCSA)-owned NBCUniversal launched Peacock in July 2020.

Other services include Amazon (AMZN) Prime Video, Apple's (AAPL) Apple TV+, Walt Disney's (DIS) Disney+, Hulu and more.

Netflix Enters Video Game Market

To create a stickier service, Netflix added mobile video games as part of its subscription offering in November 2021. Subscribers can play the games on Android and Apple iOS smartphones and tablets.

Since September 2021, Netflix has purchased four game studios. It bought Night School Studio, Next Games, Boss Fight Entertainment and Spry Fox. It also has opened two new game studios.

Netflix currently offers about 80 games to subscribers. They include action, arcade, puzzle, racing, sports and casino games.

Netflix Stock Technical Analysis

On May 18, Netflix stock broke out of a cup-with-handle base at a buy point of 349.80. It climbed as high as 485 on July 19 before pulling back. Netflix hit its record high of 700.99 in November 2021.

Price Momentum

NFLX is trading near the top of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors have been pushing the share price higher, and the stock still appears to have upward momentum. This is a positive sign for the stock's future value.

The Netflix: Streaming The Stock's PotentialKEY POINTS

a. Netflix now has 15 million subscribers in its ad-supported tier.

b. The company is also rolling out new ad products.

c. The success of the new subscription tier is just one of the reasons the stock has surged this year.

The leading streamer just hit a key milestone with its ad business.

Netflix (NFLX 1.80%) was one of the best-performing stocks of the 2010s, but for much of the current decade, the once-meteoric growth stock has struggled to achieve liftoff.

The company got a temporary boost from the pandemic, only to give it all back and then some when the economy reopened in 2022, and it lost subscribers two quarters in a row. Since then, the streaming leader has regrouped, launching initiatives that some investors had long asked for, such as adding an ad-supported tier and cracking down on password sharing.

The results of those moves have been overwhelmingly successful with the stock up 47% year to date, even as many of its streaming peers like Disney and Warner Bros. Discovery are trading near 52-week lows.

With the help of paid sharing, Netflix has added nearly 15 million new subscribers over the last two quarters, beating its total additions from the previous five quarters. The stock jumped following the third-quarter earnings report in October on strong subscriber growth as well.

Building on this recent momentum, Netflix provided an update Wednesday that shows its new ad-based strategy is paying off.

A key milestone

It's been one year since the company launched its ad-supported tier in a handful of its biggest markets, and the company said the new service has now signed up 15 million subscribers, up from just 5 million in May. That news should not only tamp down concerns that growth from this tier has been weaker than expected but also show that the ad-supported option is clearly resonating with subscribers. Additionally, it's impressive to see those gains coming at a time when much of the digital advertising industry is struggling.

That figure represents more than half of net subscriber additions over the last year, though some of the ad-tier subscribers likely traded down from the more expensive ad-free tiers, especially after Netflix just raised prices on some of its plans in the U.S., U.K., and France.

Netflix has also refined its advertising product since launch and now offers five different ad lengths, ranging from 10 seconds to 60 seconds. It also offers targeting to mobile devices as well as options like more genres, time of day, and new audience demographics. Downloads are expected to be available by the end of the week, making Netflix the only ad-supported streamer to offer downloads.

The company has more new features planned for next year, including a binge-watching bonus that gives ad-tier subscribers an ad-free episode after they've watched three episodes in a row. It will also begin offering QR codes in ads and is expanding its partnerships program globally, allowing advertisers to sponsor certain shows.

Netflix's ad-supported tier may cannibalize some ad-free subscribers, but that's part of the company's strategy. Offering ads gives it cover to raise prices on ad-free tiers, as it just did, allowing the company to make more money from the ad-free side of the business (with the idea that the ad-supported tier should be revenue-neutral compared to the ad-free subscription, as it has been for Hulu).

The ad-tier option also capitalizes on massive existing demand from advertisers. As former CEO Reed Hastings noted in an Oct. 2022 earnings call, advertisers have been left behind by the transition to streaming and are anxious to follow the eyeballs that have already gravitated over to streaming services.

With more than 200 million subscribers globally, intimate knowledge of their viewing habits, and the ability to perform precise targeting, Netflix can offer advertisers much more than a traditional linear TV platform.

Why it's a buy

A little more than a year ago, investors seemed to think the growth story at Netflix was over. However, the recent rebound and strength from paid sharing and advertising shows the streamer's second act is well underway.

The company forecast subscriber additions of around 9 million in the current quarter, showing the recent momentum should continue, and its subscription business model means that incremental revenue flows through to the bottom line. Indeed, management sees operating margin improving from 20% this year to 22% to 23% in 2024.

If Netflix can continue to deliver subscriber growth, there's room for profits to go significantly higher. The success of the ad-supported tier will only make that easier.

[EN] Netflix at all-time highs // GaliortiTrading NASDAQ:NFLX in late July attacked the 61.8% Fibonacci of the entire previous decline since November 2021 . It pulled back to its liquidity zone between $370-385 from which it has made a new impulse. Final target: new all-time highs .

1 M

On a long term chart we note that NASDAQ:NFLX in July 2022 rested on its bullish trendline to develop a new bullish leg . Its final target for the next few years would be around $2,000.

1 W

In the shorter term on a weekly chart we observe that NASDAQ:NFLX is developing a symmetrical triangle that is highly likely to break to the upside . The minimum target for such a breakout would take it to around $580 . It should be remembered that the first obstacle after that breakout will be the 61.8% Fibonacci ($492) so it is likely to make a pull-back to the breakout line. In addition, the bearish gap from the end of July will be a resistance to be taken into account.

The 470-495$ is a great liquidity zone that will allow it to perform a new bullish wave with a first target at 580$ (target of the broken triangle) and a second target at new all-time highs.

1 D

The company's third quarter results have led to a large bullish gap with a large volume (the second largest of the year), this translates a great strength as demonstrated by the verticality of the rise. It is logical that in the coming days there could be a correction as prices hit the medium-term downtrend line . It will be a healthy and necessary correction to develop a new momentum that will allow it to definitively leave the 61.8% Fibonacci level .

Pablo G.

Netflix Jumps 14% After Surge In 3rd Quarter SubscribersNetflix (NASDAQ:NFLX) shares jumped more than 13.5% in pre-market Thursday trading after it handily beat profit expectations as subscriber numbers rose.

The streaming giant reported earnings per share of $3.73 on revenue of $8.54 billion. Analysts expected EPS of $3.49 and revenue of $8.54 billion. The third quarter results beat Netflix’s previous guidance.

The company said paid subscribers rose 8.76 million in the third quarter, well above expectations for just over 6 million.

“The last six months have been challenging for our industry given the combined writers and actors strikes in the US,” Netflix said in a shareholder letter, noting that while the writers’ strike has ended, it continues to talk to the actors’ unions. “We’re committed to resolving the remaining issues as quickly as possible so everyone can return to work making movies and TV shows that audiences will love.”

For the fourth quarter, Netflix sees earnings per share of $2.15 and revenue of about $8.69 billion. The revenue growth is expected to be around 10.7%, after growing 7.8% in the third quarter.

The company said operating margin in the third quarter was 22.4%, slightly above its guidance, and it sees 2023 operating margin near the top of its range at 20%.

KeyBanc analysts upgraded shares to Overweight with a $510 per share price target.

"In my my own view, Netflix is entering 2024 a cleaner story as: 1) paid sharing appears to have changed Netflix's ability to reach the next ~250M subs; 2) operating profit and FCF are steadily ramping; and 3) buybacks should support a 25%+ EPS growth profile," they said in an upgrade note.

JPMorgan analysts hiked the price target to $480 per share on the Overweight-rated stock.

"We’re encouraged that NFLX is executing on Paid Sharing by converting borrower households, contributing to revenue acceleration to +12% FXN in 4Q, & we believe the forecast for similar net adds to 3Q +/- a few million should skew to the upside given more favorable seasonality in 4Q & a strong content slate," the analysts wrote.