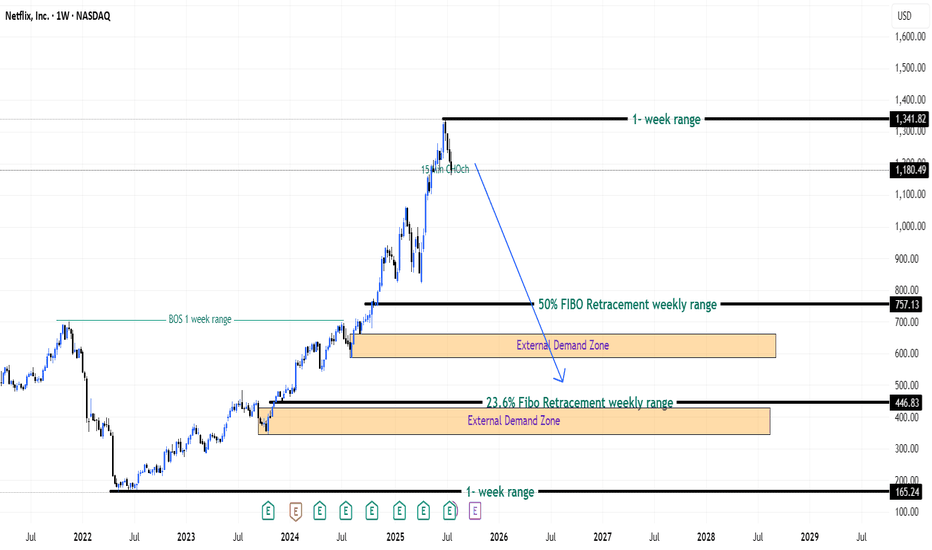

Bulls Quit? Bears Ready! - Netflix Stock (USA) - {27/07/2025}Educational Analysis says that Netflix (USA Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS,

Happy Trading,

Stocks & Commodities TradeAnalysis.

My Analysis is:-

Short term trend may be go to the external demand zone.

Long term trend breaks the new high after going from discount zone.

Netflixshort

Breaking: Netflix ($NFLX) Surges 3% Amidst Topping Q1 Earnings The shares of Netflix (NASDAQ: NASDAQ:NFLX ) is surging 3.5% in Friday's premarket session amidst Q1 earnings beat.

Netflix (NASDAQ: NASDAQ:NFLX ) reported first-quarter earnings that topped analysts’ expectations, sending shares higher in extended trading Thursday, extending the gains to Friday's premarket session.

The streaming giant's revenue grew over 12% YoY to $10.54 billion, above the analyst consensus from Visible Alpha. Net income of $2.89 billion, or $6.61 per share, rose from $2.33 billion, or $5.28 per share, a year earlier, beating Wall Street’s expectations. The period marked the first quarter Netflix did not report subscriber numbers.

Netflix's Gains Come as Subscription Prices Rise

The better-than-expected results came in part due to higher subscription and ad revenues, the company said, along with the timing of expenses.

Netflix had raised prices for its plans in January, hiking its ad-supported plan to $7.99 from $6.99 per month, the standard ad-free plan to $17.99 from $15.49 a month, and its premium plan to $24.99 from $22.99 a month.

Netflix maintained its fiscal 2025 revenue projection of $43.5 billion to $44.5 billion. Analysts on average had expected $44.27 billion. The company's second-quarter revenue forecast of $11.04 billion exceeded Wall Street's estimate of $10.91 billion.

Co-CEO Greg Peters said Netflix expects to double its advertising revenue this year, as the company rolls out its ad tech suite. The suite is live in the U.S. and Canada, with 10 other markets expected in the months to come.

Technical Outlook

As of the time of writing, NASDAQ:NFLX shares are up 3.29% in Friday's premarket session. NASDAQ:NFLX chart pattern has formed a perfect resistant and support point carved out since the 11th of November, 2024. Should NASDAQ:NFLX break the $1064 resistant point, a break out might be imminent for the entertainment giant.

Conversely, failure to break above that point could resort to a cool off to the $800 support point. NASDAQ:NFLX RSI is primed for a breakout as it is not oversold nor overbought but well positioned for a bullish move.

NFLX - NetFlix is overhyped an TA says tooBesides what I think about NFLX (bad for you, poor quality & service, lairs etc.), there is something that can be used to rate and judge a Stocks pricing - The Technical Analysis.

The white Fork projects the most probable path of price. The U-MLH is the upper stretch, the L-MLH the lower and the CL is the Center, where price is in equilibrium.

Where is price now?

It mooned to the upper Warning-Line!

Such moves are insane, crazy, not healthy and produce by manipulation and/or greed that eats Brains.

However - As I follow the rules of the Medianlines (Forks), I know that price is hyper extended up there. So, it can't go further? Of course it could. But Chances are poor that it will.

Instead, Chances are high that price falls down to the U-MLH. At least.

Why?

Besides price is stretched, it failed to move up to the next Warning Line (WL2).

So, there you have it.

I'm shorting NFLX and my target is at least the U-MLH, with further downside potential with PTG2 at the Centerline.

NFLX ( Netflix ) SELL TF M15 TP = 631.71On the M15 chart the trend started on Aug. 20 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 631.71

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

Netflix has recorded a new ATHNetflix has recorded a new ATH.

Netflix (NFLX) has been a powerhouse, reaching new all-time highs. After hitting an ATH of around $700 on November 15, 2021, the stock experienced a significant decline, bottoming out at approximately $162 on May 11, 2022.

However, it has since rallied impressively, culminating in a fresh all-time high of around $710 today.

For those who entered the market during the downturn, this has been a remarkable opportunity. Congratulations are certainly in order.

Looking ahead, the $697 zone appears to be a strong resistance level, while $679 is likely to act as support.

NetFlix - Come in, the Water is fine!Below the Lower-Medianline-Parallel, the Water is fine!

,..you think?

Maybe, but there's a Shark waiting for you.

He's Name is "FOMO"!

If you waited for a retest of the L-MLH, then you wasted your time. Here is how you trade a open/close below the L-MLH:

- short immediately with a money Stop/Loss

or

- wait for a re-test of the L-MLH, and short from there on obvious weakness. Put your Stop behind the re-test high.

But don't jump in the mouth of the "FOMO" Shark!

I added the Members material on my website.

Check it out, it's free for all, but you must be a brave Trader §8-)

Netflix Breaking Major Support Not a Good look Hi guys! This is an Update on Netflix (NFLX) on the 1 day chart.

We are currently at risk of a trend change in the makings due to a breakdown of Major Support.

This is a zoomed in look on the daily timeframe.

But if you look at my previous idea below, notice the Uptrend Channel that Netflix has been following since June 2022.

Todays candle is currently BELOW this Support trendline of the Channel.

Not a good look for Netflix.

But brings in opportunity for take a Short, once confirmation comes in.

Notie also that with the print of the Massive BEARISH Engulfing Candle, we are now below the 21 EMA.

Note the BEARISH Engulfing Candle indicates extreme selling pressure. It shows that the majority of the previous move up to the resistance was sold off by this 1 candle print.

With this daily candle & the engulfing candle it equates to the entirety of that move.

Being BELOW the 21 EMA, tells us declines are likely ahead of us. ALso if we are where we are with the close of our current daily candle, we will confirm BELOW 21 EMA.

Thus supporting probability of further declines.

Look to the Black Horizontal Line below us for our current target for this price decline.

BUT if we can somehow move back ABOVE the channel, by the end of the week before CONFIRMATION. This could support the probability of us resuming our Uptrend.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on NFLX in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

Netflix to breakdown?Netflix - 30d expiry - We look to Sell a break of 410.77 (stop at 430.77)

We are trading at overbought extremes.

485 has been pivotal.

Prices have reacted from 485.

Short term bias has turned negative.

Short term momentum is bearish. 411.50 has been pivotal.

A break of the recent low at 411.50 should result in a further move lower.

The bias is to break to the downside.

Our profit targets will be 360.77 and 350.77

Resistance: 430.00 / 445.00 / 455.00

Support: 411.50 / 390.00 / 370.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

Impact of Netflix Subscription Increase on Stock PriceFirstly, let's acknowledge that as a leading global streaming platform, Netflix has experienced tremendous growth and success over the years. However, the recent announcement of a subscription price increase raises concerns about the company's future profitability and market dynamics.

While the subscription increase may seem logical to counter rising content production costs and maintain profitability, it is essential to consider the potential consequences. Historically, price hikes have been met with mixed reactions from subscribers. In some cases, these increases have resulted in customer churn as consumers seek alternative, more affordable streaming options.

Given the intensely competitive nature of the streaming industry, with established players like Amazon Prime Video, Hulu, and Disney+, it is essential to assess the potential impact on Netflix's subscriber growth. A possible slowdown in subscriber acquisition or an increase in customer churn could negatively impact the company's revenue and, consequently, its stock price.

Therefore, please exercise caution and consider holding off on buying Netflix shares until we have more clarity on the market's response to the subscription increase. Monitoring key metrics such as subscriber growth, churn rate, and competitive positioning will be crucial in making informed investment decisions.

As investors, it is our responsibility to assess risks and opportunities objectively. While Netflix remains a dominant player in the streaming industry, the potential repercussions of its subscription increase must be noticed. By adopting a wait-and-see approach, we can better evaluate the long-term implications on the company's financial performance and stock price.

In conclusion, I encourage you to exercise caution and closely monitor the developments surrounding Netflix's subscription increase. Holding off on buying Netflix shares until we have more visibility on its impact will allow us to make more informed investment decisions.

The stock price of Netflix is experiencing a slight decline.It appears that Netflix shares are attempting to regain their position at 287 dollars, as the current trend seems to be a pullback resulting from the previous breakout of support. It is noteworthy that the price does not seem to be heading any lower, and instead, a strong upward movement is anticipated, which may lead to the price rising to a minimum of 349 dollars.

Netflix - SHORT (54% profit) / where to buy (NEW)In May 2022 Netflix has hit lows seen last time in September 2017.

Since then NFLX has been on a steady rise. It looks like the price is in some kind of a rising channel.

Indicators such as MACD or RSI are implying more upside in the next weeks. It looks good for bulls. Around $380 we may see a rejection as it's a huge resistance now. We expect bears to take over from there and the downtrend to resume. If the price drops 54 % from there we could see a potential higher low /double bottom which would be mega bullish and would help bulls to confirm the long-term uptrend.

-Short at the strong resistance

-exit for shorts / buy area: $177 - $170

Most likely it will take many months for a price to reach a buy area therefore patience is required .

Good luck

Netflix: Continue Watching 🍿Bring on the Popcorn! The Netflix stock continues to rise and should finish the turquoise wave A soon. Once completed, the stock would fall into a correction until the course drops below the support line at $252.06 and wrap up the turquoise wave B. Once the stock hit its corrective low, the course can start an upwards trend to climb further North in the longterm.

$NFLX next target $148$NFLX just rejected resistance in the $300 for the second time and has fallen back below. It looks like price has formed a rising wedge of sorts and upon a breakout fo the structure, would see a breakdown to the $250 range.

However, I don't think that will be the low as price has never tested that $250 support. I think it's likely that we'll break that support area and take out the previous lows ~$170ish before bottoming in the $148 region. Let's see how it plays out.