Nexo

NEXOBTCNEXO showing continuation expanding wedge, soon it will probably break 1200. fix your profits in 1200-1600

Stop loss on chart red level

NEXO, 10% MIN. Definitivamente este proyecto ha superado por mucho a sus competidores, y ademas pionero en su genero, con excelente atencion al cliente, cambiando totalmente el sistema financiero, Si, aun centralizado, pero aunque la descentralizacion deberia ser la base, siempre como en todo, existira la centralizacion, y si funciona y es justa, todo bien, nexo cumple las expectativas.

El precio en que se esta negociando ahora es el punto clave, por lo pronto creo que es muy posible que al menos nos de un 10 % de ganancias, ya que de seguro llegara a esa resistencia que se ha formado en este canal, sin embargo esto rompera hacia arriba, conservadoramente un 10 %, 30% objetivo, por recomendacion esta moneda es de hold, ademas de que la empresa reparte utilidades cada año a sus token holders.

se parte del nuevo sistema financiero nexo.io

Ahora, en el analisis tecnico, nos muestra las herramientas un movimiento hacia arriba, ya en una semana el adx se ha puesto con pendiente positiva,, acompañada del d1.

Nexo ahora es lider, veremos si se mantiene asi.

NEXO vs BTC - Bears failed to break the trendlineOn heavy selling volume, bears failed to break below the uptrend trendline. This is a bullish sigh, which should result in an upside swing.

NEXO breaking through resistance soon?NEXO is a solid working crypto project with good fundamentals.

At the moment it is printing a HL after a HL and formed a falling wedge in past few months. There is also small cup and handle to be seen in the charts.

It is knocking on resistance and will most likely break through after some volume spike, especially after some strong recent movement from BTC.

Do not forget that NEXO offers yearly dividends as well.

Not on Binance yet, so listing could send this crypto lender to the moon.

Thanks for reading and let see what the future brings.

NEXO Dividend Announcement FOMO

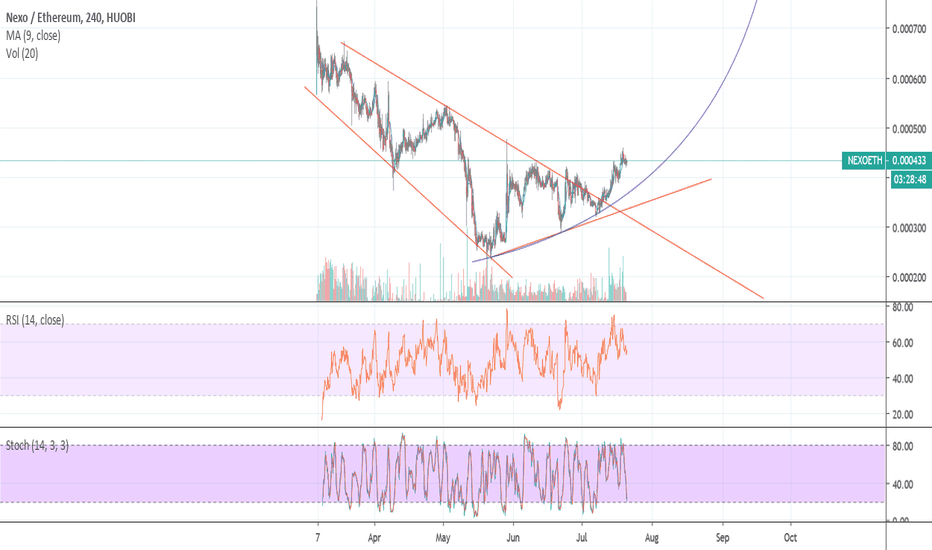

NEXOBTC now is situated into a downtrend channel which probably soon will break because:

-We have a stochastic bullcross

-Rsi is near bottom(30 level) and now is curbating up

-At MACD we can see the first smaller red candle which means the sell pressure is still decreasing=bullish sign

After this channel broke first target is 0.00001507 which is the 0.236 fib resistance and my main and last target is 0.618 fib 0.0000264 sats

EVENTS IN JUNE

- Announce the ex-dividend date for the next Nexo Dividend

- Launch the Nexo mobile app for iOS/Android

- $TRX as a collateral option

-The Nexo Card is launching in Europe first

Fomooo will comee

NEXO - two bullish possibilities!NEXO is an awesome asset. It's very young, but will prove itself soon enough. That being said, looks like either a symmetrical triangle formation or an ascending wedge ... if they keep releasing weekly updates as they've been doing, it may trigger an awesome breakout.

Nexo Support BreakoutUsing trendline analysis from when Nexo first hit Huobi and Ichimoku cloud v5 four hour, it is clear that there will be an imminent breakout around this weekend. Consolidation toward 2150 sats the last couple days with growing buy walls daily further supports my long position on Nexo. No target price since this asset is quite volatile and hard to predict. Stop loss at 2100 sats.

Bitcoin Cash heading south while awaiting the Hard ForkIn less than a month, Bitcoin Cash with go through a hard fork that was scheduled for November 15.The network participants involved are said to have commenced their preparations. Mining Initiative SV-Pool, of which Nchain support, provided an update. In particular, they noted that the public can now access the pool. Bitcoin Cash miners will be able to tweak their hashrate to the SV-Pool, enabling them to be paid by what is known as an initial pay-per-last-n-shares (PPLNS) system. Therefore, over the past seven days, SV-Pool has been obtaining near 2.6% of the global BCH hashrate.

There are some more news for the BCH; Next, which is a crypto loan platform, added Bitcoin Cash on their platform. Nexo facilitates cryptocurrency holders to borrow from $1,000 up to $2 million. Users will need to lock in their digital assets to gain access to required capital. Once the loan has been repaid, users will then be able to retrieve their assets. Furthermore, Nexo’s assets are fully secured with BitGo, as their custodian partner.

After looking at the fundamental part of BCH, lets observe recent price action.

BTC/USD trend remains bearish, as it continues to produce lower lows and lower highs. At the same time RSI oscillator rejecting the trend line, which is another confirmation of the downtrend. On the October 21, BCH rejected the $466 resistance which also increases the downside risk. As long as price remains below this resistance, Bitcoin Cash should be expected to test $426 support. If it will not be able to hold the price, next support is based at 127.2% Fibonacci, that is $355 level, where the bearish trend might end.

But there is also a bullish scenario that definitely should’t be left without the attention. Break and close above the $466 resistance, can be interpreted positively, inviting more BCH buyers to the market. Then, price is likely to increase towards the resistance at $535. This level seems to play a key role, which might reveal intentions of the price in the coming weeks. Break above will send price higher towards either $592, $650 or $ $750 resistance area.

Nexo, a cryptocurrency loan platform, has added support for Bitcoin Cash (BCH). This now makes BCH the 6th token accepted on the platform, as collateral following on from the likes of XRP, LTC, BTC, ETH and BNB. Nexo facilitates cryptocurrency holders to borrow from $1,000 up to $2 million. Users will need to lock in their digital assets to gain access to required capital. Once the loan has been repaid, users will then be able to retrieve their assets. Furthermore, Nexo’s assets are fully secured with BitGo, as their custodian partner.