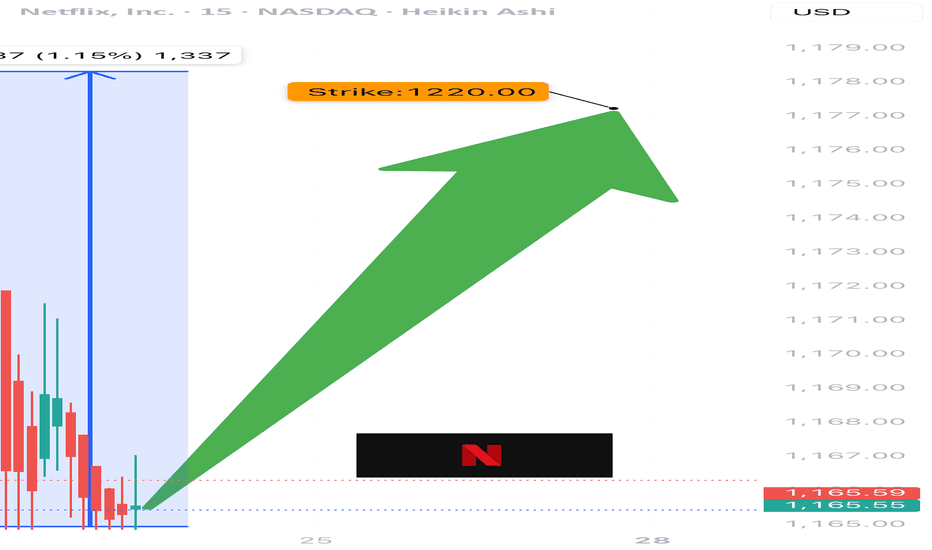

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

🟢 Buy NFLX $1220 Call exp 7/25

💰 Entry: $0.50

🎯 Target: $0.90

🛑 Stop: $0.30

📈 Confidence: 65%

⚠️ Watch volatility closely. Fast exit = smart exit.

#NFLX #OptionsFlow #OptionsAlert #BullishPlay #DayTradeSetup #NetflixStock #TechOptions #UnusualOptionsActivity #TradingView #GammaSqueeze

Nflxbuy

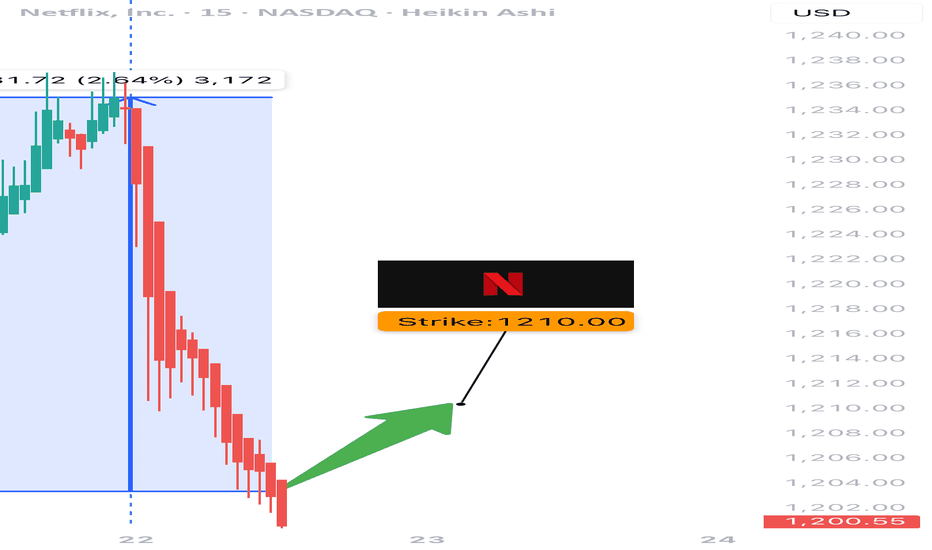

$NFLX Weekly Call Setup – 07/22/25

🚀 NASDAQ:NFLX Weekly Call Setup – 07/22/25

Volume Surge 📈 | RSI Bullish ✅ | Options Flow Mixed 🔁 | 3DTE Lotto Play 🎯

⸻

📊 Market Snapshot

• Price: $1203.16

• Call/Put Ratio: 1.01 → ⚖️ Neutral

• Weekly RSI: ✅ 63.2 (Momentum confirmed)

• Volume Surge: 📈 1.6x previous week

• Gamma Risk: ⚠️ Moderate

• DTE: 3 (Theta decay accelerating)

⸻

🧠 Trade Setup

{

"Instrument": "NFLX",

"Direction": "CALL",

"Strike": 1210.00,

"Entry": 24.10,

"Profit Target": 7.00,

"Stop Loss": 12.00,

"Expiry": "2025-07-25",

"Confidence": 0.65,

"Size": 1,

"Entry Timing": "Open"

}

⸻

🔎 Sentiment Breakdown

Indicator Status

📈 Weekly RSI ✅ Bullish confirmation

📉 Daily RSI ⚠️ Flat – no momentum edge

🔊 Volume ✅ Surge (1.6x baseline)

🔁 Options Flow ⚖️ Neutral (C/P = 1.01)

💨 VIX ✅ Favorable for calls

📰 News Risk ❌ Downgrade noise = volatility

⸻

📍 Chart Zones to Watch

• Support: $1198

• Breakout Trigger: $1210

• Resistance Targets: $1220 → $1250

• ⚠️ Key Watch: Gamma acceleration if $1210 breaks with volume

⸻

🎯 Viral Caption / Hook (for TV/X/Discord):

“ NASDAQ:NFLX 1210C is riding a volume rocket. RSI says go — options flow says maybe. Gamma vs. downgrade risk. 3DTE = Lotto edge or fade?”

💵 Entry: $24.10 | 🎯 Target: +30–50% | 📉 Stop: $12.00 | ⚖️ Confidence: 65%

⸻

⚠️ Best For:

• 📊 Breakout traders riding weekly momentum

• 🚀 Volume chasers following RSI confirmation

• ⏳ Scalpers with a handle on 3DTE gamma dynamics

⸻

💬 Want a debit spread alternative (e.g., 1200/1225)? A theta-scalped condor? Or 0DTE lotto scalp?

Drop a comment!!!

Netflix on the Rise Bullish Breakout in Motion!Trendline Support

The price is respecting an ascending trendline, indicating a strong bullish sentiment.

Recent candles have bounced off this support line, confirming its reliability.

Breakout Confirmation

The price has broken above a key horizontal resistance level around $870.

This breakout suggests bullish continuation, especially with volume support.

Risk-to-Reward Setup

A well-defined risk-to-reward ratio is visible.

Stop-loss appears to be placed below $853, protecting against a false breakout.

Target set around $939 aligns with a significant resistance zone, offering a potential reward.

Indicators

Positive price momentum is evident, with higher highs and higher lows forming.

Likely supported by broader market strength in tech stocks.

Next Steps

Monitor the price action for sustained movement above $870.

A retracement to retest the breakout level could provide a secondary entry.

Key resistance to watch: $900 and $939.

NFLX is poised for a bullish continuation, with the current setup offering a high-probability trade opportunity.

NETFLIX’s Next Big Move: Massive Breakout Imminent?Technical Analysis:

NFLX (Netflix), on the 15-minute time frame, has set up a long trade with a strong entry at $744.60, supported by good volume. The breakout occurred above a consolidation phase, indicating market interest in a bullish move.

The price action is holding above the entry level, and the Risological Dotted Trendline is trending upward, providing a strong support foundation for the trade. This long setup points to a potential bullish continuation as Netflix approaches the following targets.

Key Levels:

Entry: $744.60

Stop Loss (SL): $715.10

Target 1 (TP1): $781.07

Target 2 (TP2): $840.08

Target 3 (TP3): $899.09

Target 4 (TP4): $935.56

Observations:

The breakout was backed by strong volume, reflecting confidence from the bulls.

Price is consolidating near TP1, suggesting momentum is building for further upside.

The Risological Dotted Trendline is trending upwards, giving strong support around $744, ensuring the trend stays intact.

Outlook:

Netflix's long trade setup shows strong potential for upward movement. With the support of the Risological Dotted Trendline and high volume backing, this trade is well-positioned to meet its targets. Watch for any pullback near $740, which could present another opportunity to re-enter or add to positions.

$NFLX last leg higher? $661-680 targets?NASDAQ:NFLX looks like it's setting up for a final move into resistance.

It just broke above resistance and reclaimed it as support. Now the final thing it needs to do is break up above the trendline.

If it can do that, then I think we'll hit one of the final two resistance targets.

Let's see how it plays out.

Netflix Ventures into Video Game Streaming: A Game-Changer in th

Introduction:

We are calling all savvy traders! Brace yourselves for a groundbreaking announcement that has the potential to reshape the entertainment industry as we know it. Netflix, the streaming giant that has revolutionized the way we consume movies and TV shows, is now stepping into the realm of video game streaming. This exciting move will diversify Netflix's offerings and open up a world of opportunities for the company and its loyal subscribers.

The Game-Changing Leap:

Netflix's decision to enter the video game streaming market signifies a strategic shift that promises to captivate gamers and entertainment enthusiasts. With a vast user base of over 200 million subscribers worldwide, the platform's foray into gaming is poised to disrupt the industry and create a new era of immersive entertainment experiences.

Why This Matters:

By expanding its services to include video game streaming, Netflix is tapping into a multi-billion-dollar market, further solidifying its dominant force in the entertainment industry. This move diversifies their revenue streams and enhances their competitive edge, enticing new subscribers and keeping existing ones engaged for extended periods.

The Netflix Advantage:

What sets Netflix apart from traditional gaming platforms is its ability to leverage its vast content library and recommendation algorithms to curate personalized gaming experiences. Imagine a world where Netflix recommends movies and TV shows and suggests video games tailored to your preferences. This integration of gaming into their existing ecosystem creates a seamless and immersive user experience, making Netflix an all-in-one entertainment hub.

The Call-to-Action:

As traders, it's crucial to recognize the immense potential that Netflix's entry into video game streaming brings. This exciting move will drive the company's growth and create new investment opportunities. By diversifying its offerings, Netflix is positioning itself for long-term success and continued innovation.

So, don't miss out on this game-changing opportunity! Keep a close eye on Netflix's journey into video game streaming and consider adding it to your investment portfolio. Stay informed, analyze the market trends, and seize the potential rewards that lie ahead as Netflix continues to redefine the boundaries of entertainment.

Conclusion:

Netflix's decision to venture into video game streaming is a bold and exciting move that has the potential to revolutionize the entertainment landscape. By diversifying their offerings, the streaming giant is primed to captivate a broader audience, enhance user engagement, and create new avenues for growth. As traders, it's essential to recognize the significance of this move and stay ahead of the curve. So, gear up for a thrilling ride as Netflix transforms the way we play and stream, and seize the opportunity to long Netflix as they embark on this exhilarating journey into the world of video game streaming.

Research firm claims Netflix adding new subscribers According to a recent report by a research firm, Netflix has added a significant number of subscribers after their password crackdown.

This is excellent news for investors as it shows that Netflix is taking proactive measures to protect its content and attract new subscribers. As we all know, a growing subscriber base is crucial for the success of any streaming service.

With this in mind, I encourage you to consider investing in Netflix. The company has a proven track record of success and constantly innovates to stay ahead of the competition. By investing in Netflix, you can be a part of their continued growth and success.

I hope you will join me in investing in Netflix and taking advantage of this exciting opportunity. I look forward to your comments.

msn.com/en-us/money/technology/netflix-added-subscribers-after-password-crackdown-research-firm-says/ar-AA1cleMG?li=BB16M4hs

Netflix remains positive.Netflix - 30d expiry - We look to Buy at 332.21 (stop at 312.09)

Daily signals are bullish.

There is no clear indication that the upward move is coming to an end.

Previous resistance at 330 now becomes support.

Previous support located at 330.

329.82 has been pivotal.

We look to buy dips.

Our profit targets will be 382.42 and 388.42

Resistance: 368.90 / 380.00 / 396.50

Support: 348.71 / 332.63 / 313.39

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

NFLX Daily Short Squeeze Setup using Wolfe Waves$NFLX The wolfe wave indicator is increasing in popularity as we continue to see more people using it and enjoying the results. In some of the educational material and streams posted in Tradingview, I go over a short squeeze setup using wolfe waves. You can watch the video here: www.tradingview.com There are a multitude of gaps within gaps and they will all eventually fill some time in the future - only the market makers with designation will determine that. In the meantime, we can use wolfe waves to identify short squeezes or breakout patterns by using the indicator as a contrarian. In the short term, with earnings season starting in January 2023, there is a setup that NFLX may fill the 314 gap. If the gap fills, then it would be a great level to manage risk and hold onto a few runners to see if the 334 level is retested. If NFLX breaks 334, then short will squeeze and the stock price of NFLX will explode higher to fill the next two gaps above 380 and 400 before 2nd week of January. For disclosure, we are long NFLX.

Netflix to find support at 50 EMA again?Netflix - 30d expiry - We look to Buy at 281.11 (stop at 265.74)

Our short term bias remains positive.

Intraday dips continue to attract buyers and there is no clear indication that this sequence for trading is coming to an end.

50 1day EMA is at 276.80.

The 1 day moving average should provide support at 276.80.

Daily signals are bullish.

Expect trading to remain mixed and volatile.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Our profit targets will be 319.49 and 329.49

Resistance: 322.77 / 350.00 / 395.00

Support: 302.10 / 275.94 / 252.09

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Predicting the future using the wolfe wave in Netflix?$NFLX The wolfe wave indicator is increasing in popularity as we continue to see more people using it and enjoying the results. NFLX has been traded aggressively in long puts and has done extremely well using the wolfe on shorter time frames. Now there is a massive setup for a gap fill down to 249 before filling any of the gaps above. The gaps that are above 300 will likely fill on the next earnings run up mid December or early January 2023. Be cautious of any dump first week of January 2023, which we would consider as a buying opportunity into earnings. Markets will pump and then dump.

Last week, there is a daily wolfe wave setup that triggered on Nov 16. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the red perforated line, as shown in the chart. The projected target is around 252 but keep in mind the gap is at 249. I hope all of you bank on this!

Netflix in an ascending triangle.Netflix - 30D expiry - We look to Buy a break of 252.11 (stop at 234.98)

Daily pivot is at 251.99.

A break of yesterdays high would confirm bullish momentum.

We are trading at oversold extremes.

Although an initial rally was posted, sellers emerged and follow through bearish momentum resulted in all the previous day's gains being overturned.

Daily signals are mildly bullish.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

The trend of higher lows is located at 217.00.

Price action has formed a bullish ascending triangle formation.

Our profit targets will be 297.88 and 307.88

Resistance: 245.00 / 252.00 / 260.00

Support: 230.00 / 220.00 / 215.00

Daily perspective

Disclaimer – Saxo Bank Group. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses

$NFX battle of the ads in streaming..A bounce-back for Netflix (NFLX) shares seems to rest on the coming launch of ad-supported tiers for the two streaming leaders, Jack Hough writes in this week’s edition of Barron’s. For Netflix, the goal is to reverse subscriber losses with cheaper plans. For others like Disney+, it’s to offset a recent acceleration in cable cord-cutting. Much could go wrong in the near term for these companies and their rivals, the author notes. Yet, if the television industry is successful, it could not only rekindle growth, but also pull back power that has been lost to the closed-off advertising economies of Google (GOOGL) and Facebook (META). News source from tipranks.

In my prespective view. i think its a good idea for streaming services to add the advertisement since youtube already doing it. If NFLX will have a similar advertisement like youtube where you can skip the ads i dont think its not a bad idea since customer might use to youtube ads.

But it would come down to how the ads are setup for streamers.

The rectangle box is my support/resistance level

Below is my price level entry and exit for intraday or scalp play.

============================================================

For calls; buy above $245.50 and sell at 249.82 or above

For puts, buy below $236.73 and sell at $234.42 or below

============================================================

Bot generated technical analysis:

1st resistance level: 245.09

2nd resistance level: 249.09

1st support level: 231.57

2nd support level: 222.94

Welcome to this free technical analysis. ( mostly momentum play )

I am going to POST where i look for possibly entry and exit for intraday or scalp for trading.

i try my best to make the idea short and simple as possible.

If you have any questions or suggestions on which stocks I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smashed that LIKE or BOOST button and maybe consider following my channel.

thank you!

NFLX-BUY+++No change in view.

I suspect we will correct back towards 250-275 coming weeks. The market is still very oversold, and further we seem to breakout of the bottom pattern. For now BUY @ 180-190 and take profit 255 for now.

In terms of option strategy still would prefer a two-month call strike $ 200 or 205.

NFLX-STRONG BUYIt may be against opinions as it is clear we got some severe problems with the company.

However, looking at medium-term chart, the current level $ 185-190 is a strong buy and I can see a FIB retracement value of $ 290 using RSI condition as well.

Strategy BUY current $ 185-190 and take profit @ 245-255 for now. For those using options, I suggest two-months calls strike price $ 200.