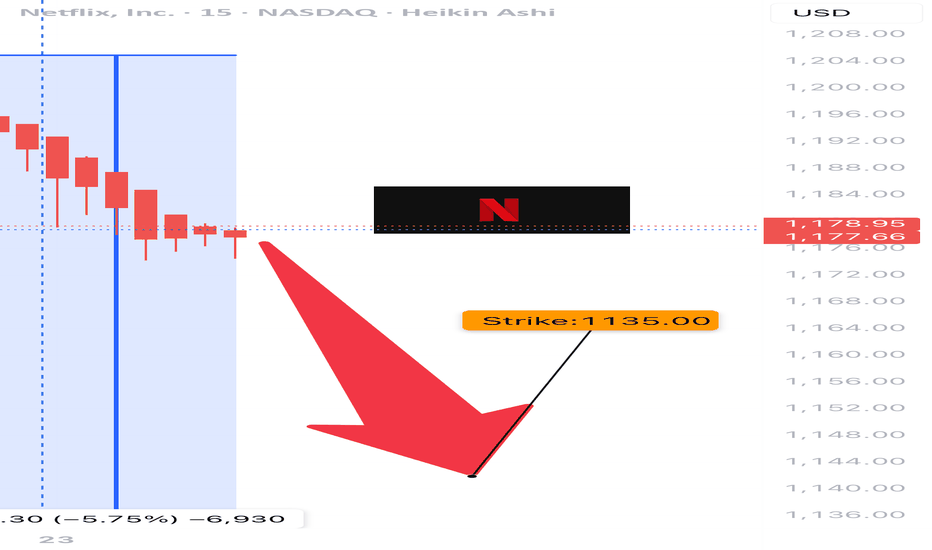

NFLX WEEKLY BEARISH PLAY — 07/23/2025

📉 NFLX WEEKLY BEARISH PLAY — 07/23/2025

🧠 Multi-model AI Consensus Trade Setup

⸻

🔍 QUICK SUMMARY

After reviewing 5 AI model reports (Grok, Gemini, Claude, Meta, DeepSeek), the consensus is moderate bearish for NFLX this week following heavy institutional selling and post-earnings weakness.

💣 Key Reason:

All reports cite declining daily RSI, strong institutional outflows, and mixed-to-bearish volume trends. Despite some caution, the majority lean bearish.

⸻

🎯 TRADE IDEA (WEEKLY PUT PLAY)

{

"instrument": "NFLX",

"direction": "PUT",

"strike": 1135,

"entry_price": 0.77,

"profit_target": 1.50,

"stop_loss": 0.41,

"expiry": "2025-07-25",

"confidence": 70%,

"entry_timing": "Open",

"size": 1 contract

}

⸻

📊 TRADE PLAN

🔹 🔸

🎯 Strike 1135 PUT

💵 Entry Price 0.77

🎯 Target 1.50 (approx. 95% upside)

🛑 Stop Loss 0.41

📅 Expiry July 25, 2025 (2DTE)

📈 Confidence 70%

⏰ Entry Market Open

🧠 Gamma Risk High (be nimble!)

⸻

🧠 Model Summary

• Gemini/Google: 🔻 Strong SELL — Institutional unload, 85% confidence

• Grok/xAI: ⚠️ NO TRADE — mixed signals

• Claude/Anthropic: ⚠️ NO TRADE — high sell volume, but conflicting indicators

• Meta/LLaMA: 🔻 Moderate Bearish — suggests 1175P but supports this setup

• DeepSeek: 🔻 Bearish lean — supports 1135P w/ caution on gamma/time decay

⸻

🚨 NOTES

• 🕒 Only 2DTE — expect volatility + fast decay

• 🔍 Watch price action into open + first 30 mins

• 📉 If NASDAQ:NFLX cracks below $1130 support zone, this setup could fly

⸻

💬 Drop a ⚠️ if you’re watching

💣 Drop a 🔻 if you’re in this PUT

📈 #OptionsTrading #NFLX #WeeklyTrade #AITradeAlert #MemeStocks #PutOptions #ShortSetup

Nflxshort

NFLX chop & dropI had a whole video that I created but couldn't manage to post. Nonetheless... I figured it out and will just share my points in this picture.

*below the 21 ema (1220), I believe we can target 1200 down to 1180. I'll be on the lookout for this trade until it happens.

That's it... that's the post. Enjoy Juneteenth.

Profit taking on Netflix for the summer, only to buy in lowerNASDAQ:NFLX is still in a strong high time frame uptrend, I'm not saying the stock has turned bearish overall, however profits need to be taken when trading and this is one of those times.

I'd prefer to buy back in closer to $1,000 if possible though either way I'll keep 33% of my stack.

NFLX Head Test Cracking!Head test Cracking! Now we get to see what it's made of.

Head tests patterns take out stops before collapsing.

I was forced into "target reached" by TV. Clearly, my target has not been reached since the H&S never broke to trigger a trade to begin with.

This is a much better setup with very low risk, with potentially huge returns for shorts. A lot of meat on that bone!!

Click boost, follow, subscribe! For more tips, tricks, and calls. Let's get to 5,000 followers and help more people navigate these crazy markets.

NFLX - NetFlix is overhyped an TA says tooBesides what I think about NFLX (bad for you, poor quality & service, lairs etc.), there is something that can be used to rate and judge a Stocks pricing - The Technical Analysis.

The white Fork projects the most probable path of price. The U-MLH is the upper stretch, the L-MLH the lower and the CL is the Center, where price is in equilibrium.

Where is price now?

It mooned to the upper Warning-Line!

Such moves are insane, crazy, not healthy and produce by manipulation and/or greed that eats Brains.

However - As I follow the rules of the Medianlines (Forks), I know that price is hyper extended up there. So, it can't go further? Of course it could. But Chances are poor that it will.

Instead, Chances are high that price falls down to the U-MLH. At least.

Why?

Besides price is stretched, it failed to move up to the next Warning Line (WL2).

So, there you have it.

I'm shorting NFLX and my target is at least the U-MLH, with further downside potential with PTG2 at the Centerline.

Netflix on the Rise Bullish Breakout in Motion!Trendline Support

The price is respecting an ascending trendline, indicating a strong bullish sentiment.

Recent candles have bounced off this support line, confirming its reliability.

Breakout Confirmation

The price has broken above a key horizontal resistance level around $870.

This breakout suggests bullish continuation, especially with volume support.

Risk-to-Reward Setup

A well-defined risk-to-reward ratio is visible.

Stop-loss appears to be placed below $853, protecting against a false breakout.

Target set around $939 aligns with a significant resistance zone, offering a potential reward.

Indicators

Positive price momentum is evident, with higher highs and higher lows forming.

Likely supported by broader market strength in tech stocks.

Next Steps

Monitor the price action for sustained movement above $870.

A retracement to retest the breakout level could provide a secondary entry.

Key resistance to watch: $900 and $939.

NFLX is poised for a bullish continuation, with the current setup offering a high-probability trade opportunity.

NFLX ( Netflix ) SELL TF M15 TP = 631.71On the M15 chart the trend started on Aug. 20 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 631.71

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

Netflix Tanks 7.26% on Tepid Forecast, New Support on the WayNetflix Inc. ( NASDAQ:NFLX ) experienced a sharp decline in share value on Friday as a result of its weak revenue forecast and plans to discontinue reporting subscriber numbers by 2025. Despite an otherwise strong start to the year, Netflix's lackluster forecast led to a 7.6% decline in premarket trading in New York, marking the biggest decline since July 2023. While the company surpassed expectations for its first quarter, it indicated that it expects a slower pace of growth moving forward, with subscriber gains anticipated to be lower and revenue expected to increase by 16%.

Netflix's decision to cease reporting quarterly membership and revenue per subscriber metrics from the first quarter of next year has also generated concern among industry analysts. These metrics have long been the primary way in which Wall Street has assessed the company's performance, and as such, the decision may be met with resistance. Netflix has sought to shift the focus to traditional measures of performance, such as sales and profit, but management will continue to report significant subscriber milestones.

Despite a slowdown in 2021 and 2022, Netflix ( NASDAQ:NFLX ) has experienced its fastest growth rate since the early days of the pandemic, largely due to its crackdown on account sharing. The company estimated that over 100 million people were using an account for which they did not pay, and by convincing these individuals to pay for access, Netflix has added 9.33 million customers in the first quarter of 2024, nearly doubling average analyst estimates of 4.84 million.

Netflix's strong slate of original programs has also contributed to its recent growth, with the company delivering a new hit every couple of weeks in 2024. The streaming service accounts for about 8% of TV viewing in the US and is a leading TV network in most of the world's major media markets. The company's recent performance has lifted its shares back toward record highs, giving it a market value of more than $260 billion.

While some analysts have raised concerns that Netflix is trading at a valuation that exceeds the fundamentals of the business, others have been impressed with the company's performance and have raised their price targets for investors. To sustain its growth in the future, Netflix has introduced a cheaper, advertising-supported version of its service targeting cost-conscious customers and has invested in live programming, including stand-up specials, wrestling, and an upcoming boxing match. The company has also reported that approximately 40% of its new customers are selecting the advertising option in markets where it is available, although the advertising tier remains small in comparison to online video giants like YouTube.

Technical Outlook

Netflix ( NASDAQ:NFLX ) stock has broken the ceiling of the rising trend channel on the verge of reaching a new support level at the $504 Pivot point. The stock is trading with a weak Relative Strength Index (RSI) of 25.75 indicating NASDAQ:NFLX stock is in the oversold territory. Traders need to be careful incase of a trend reversal after reaching the new support zone.

NFLX Jan 26th Update, Target got hitWe had a great bull flag setup going into the earnings.

Now the target got hit, will be watching for a retracement into early Feb and another push higher into Feb OPEX

Nothing bearish here to even try taking a short trade. There is still one more gap to close above the price, should be hit first before reversal starts.

Also the price might just consolidate/correct in time and push above to a new high. Any shorting should have solid stops

Netflix - Come in...the water is fineWe dived below the Center-Line.

This is the time for a short, not when it's down at the Lower Medianline Parallel. Because there are lurking Creatures you don't want to meet.

My stop would be above the CL test high.

Keep in mind that earnings are coming out soon. So mybe give yourself time and trade it with an Options Strategy?

Gone for a swim...the water is fine §8-)

Netflix's Bullish Trend Ending: Traders, Prepare for Downtrend!Hi Realistic Traders. Here's my price action analysis on Netflix

In our close examination of NFLX, the streaming titan, a compelling narrative unfolds. Initially, a double-top pattern emerged between July 2020 and January 2022, followed by a significant breakout from the neckline. This breakout confirmed a bearish reversal, resulting in a remarkable 70% decline from its peak.

However, the plot deepens. NFLX recently revisited its double-top pattern's neckline while concurrently crafting a channel chart pattern. Adding to the intrigue, NFLX struggled to regain its former heights and descended below both the lower trendline and the dynamic support line, a classic sign of a sustained bearish trajectory.

Not to be overlooked, the Stochastic indicator chimed in with a bearish divergence, providing further validation for the impending downward movement.

Our target price? Set conservatively at under $300.

Traders, prepare for a captivating journey ahead!

It is essential to note that the analysis will no longer hold validity once the target/resistance area is reached.

Please support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below!

Disclaimer:

"Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on NASDAQ:NFLX ."

NetFlix - Come in, the Water is fine!Below the Lower-Medianline-Parallel, the Water is fine!

,..you think?

Maybe, but there's a Shark waiting for you.

He's Name is "FOMO"!

If you waited for a retest of the L-MLH, then you wasted your time. Here is how you trade a open/close below the L-MLH:

- short immediately with a money Stop/Loss

or

- wait for a re-test of the L-MLH, and short from there on obvious weakness. Put your Stop behind the re-test high.

But don't jump in the mouth of the "FOMO" Shark!

I added the Members material on my website.

Check it out, it's free for all, but you must be a brave Trader §8-)

NFLX - AnalysisNFLX

W1 - After breaking through the trend line, a head and shoulders pattern is formed. If this changes the direction of the trend, we could see moves towards the 285.54 levels in the long term.

If this is a correction, we could see the price move towards the 348.15 level. If the price retests the level of 379.10, then the road is open to a fall to lower targets.

What can you expect?

Movement to the levels 379.10 - 348.15 - after breaking through 379.10, the price may begin a correction to consider buying, awaiting confirmation.

Short

Targets – 379.10 - 362.83 - 348.15

Long-term perspective (retest required) – goals 348.15 - 314.88 - 285.54

Long - will be considered when the situation changes.

Netflix to breakdown?Netflix - 30d expiry - We look to Sell a break of 410.77 (stop at 430.77)

We are trading at overbought extremes.

485 has been pivotal.

Prices have reacted from 485.

Short term bias has turned negative.

Short term momentum is bearish. 411.50 has been pivotal.

A break of the recent low at 411.50 should result in a further move lower.

The bias is to break to the downside.

Our profit targets will be 360.77 and 350.77

Resistance: 430.00 / 445.00 / 455.00

Support: 411.50 / 390.00 / 370.00

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group

NFLX head and shoulders daily?watching netflix over the last few weeks/months, seems to be making a clear head and shoulders move downward, and it would be enhanced by disney/hulu initiating the password sharing and limiting customers that were only paying for one or the other, the user pool was probably diluted from the password sharing as a majority of people dont want ads or pay extra premium....

just my thoughts, short term i am looking down but netflix is well established long term