NFLX WEEKLY OPTIONS TRADE (07/28/2025)**🎬 NFLX WEEKLY OPTIONS TRADE (07/28/2025) 🎬**

**Institutions Are Buying Calls – Should You?**

---

📈 **Momentum Breakdown:**

* **Daily RSI:** Mixed ➡️ Possible short-term weakness

* **Weekly RSI:** Bullish bias intact ✅

🔥 Overall = **Moderate Bullish** trend confirmed on the **weekly timeframe**

📊 **Options Flow:**

* **Call/Put Ratio:** **2.23** 🚨

💼 Strong institutional call flow = **bullish bias** from big money

* **Strike Ideas from Models:**

* \$1260 (Grok/xAI)

* \$1230 (Gemini/Google)

* \$1220 (Meta)

* ✅ **\$1200** (Consensus Strike)

🧨 **Volume Warning:**

* 📉 Institutional participation is **lower than average**

* 🚫 Could signal weak follow-through or fading interest

---

🧠 **AI Model Consensus (Grok / Gemini / Claude / Meta / DeepSeek):**

✅ Call buying favored across the board

✅ Weekly bullish momentum confirmed

⚠️ Daily RSI & low volume = headwinds

📌 Play it smart: momentum’s real, but conviction isn’t maxed

---

💥 **RECOMMENDED TRADE (65% Confidence):**

🎯 **Play:** Buy CALL Option

* **Strike:** \$1200

* **Expiry:** 2025-08-01

* **Entry:** \~\$8.50

* **Profit Target:** \$16.00 → \$17.00

* **Stop Loss:** \$5.10

📆 Entry Timing: Monday market open

📏 Position Size: Risk-managed (2-4% portfolio)

---

⚠️ **RISK CHECKLIST:**

* 🟡 **Volume Fragility:** Institutions not fully loading

* 🟥 **Gamma Risk:** Expiry this week = possible sharp swings

* 🔴 **Daily RSI Divergence:** Short-term weakness still possible

---

📌 **TRADE DETAILS (JSON Format for Automation):**

```json

{

"instrument": "NFLX",

"direction": "call",

"strike": 1200.0,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 16.00,

"stop_loss": 5.10,

"size": 1,

"entry_price": 8.50,

"entry_timing": "open",

"signal_publish_time": "2025-08-01 09:30:00 UTC-04:00"

}

```

---

**TL;DR:**

🟢 Weekly bullish setup with strong options flow

🟡 Daily weakness = proceed with discipline

🎯 \ NASDAQ:NFLX \$1200C for short-term momentum upside

💬 Are you following the institutions or fading the low volume?

\#NFLX #OptionsFlow #AITrading #WeeklySetup #InstitutionalMoney #TechStocks #UnusualOptionsActivity #TradingView #MomentumTrading

Nflxtradingsetup

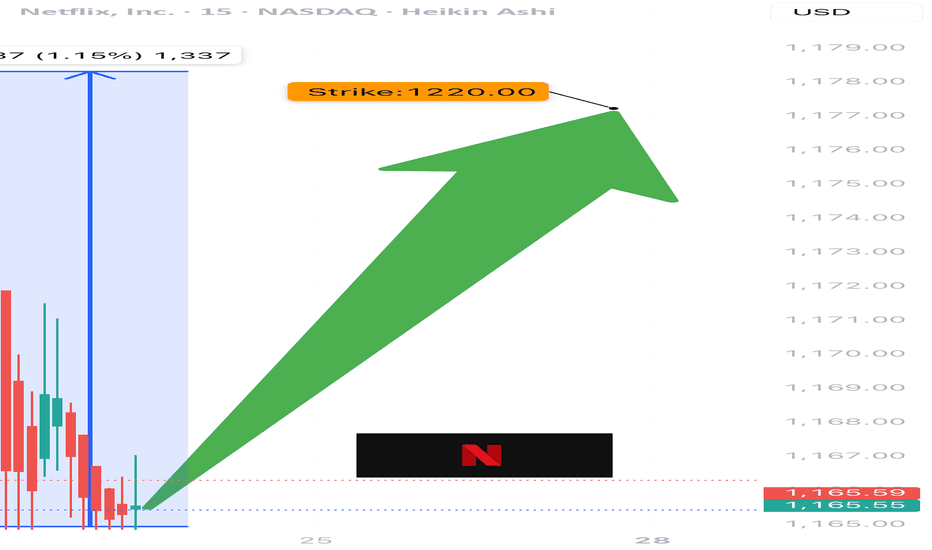

NFLX TRADE IDEA (07/24)

🚨 NFLX TRADE IDEA (07/24) 🚨

⚔️ Bulls vs. Bears… but calls are winning 🐂📈

🧠 Quick Breakdown:

• Call/Put Ratio: 1.27 → bullish edge

• RSI < 45 = 🔻oversold territory

• VIX favorable = room to run

• High gamma = big moves incoming ⚡️

• Expiry: TOMORROW = 🔥 time decay risk

💥 TRADE SETUP

🟢 Buy NFLX $1220 Call exp 7/25

💰 Entry: $0.50

🎯 Target: $0.90

🛑 Stop: $0.30

📈 Confidence: 65%

⚠️ Watch volatility closely. Fast exit = smart exit.

#NFLX #OptionsFlow #OptionsAlert #BullishPlay #DayTradeSetup #NetflixStock #TechOptions #UnusualOptionsActivity #TradingView #GammaSqueeze

How Earnings Reporting Could Impact Netflix (NFLX) Share PriceHow Earnings Reporting Could Impact Netflix (NFLX) Share Price

Earnings season is gaining momentum. Today, after the close of the main trading session, Netflix (NFLX) is set to release its quarterly financial results.

Analysts are optimistic, forecasting earnings per share (EPS) of $7.08, up from $4.88 a year earlier, and revenue growth to $11.1 billion.

The upbeat sentiment is driven by:

→ the fact that Netflix’s business model is relatively resilient to tariff-related pressures;

→ the company’s success in curbing password sharing and promoting a more affordable ad-supported subscription tier.

Netflix has reported revenue growth for six consecutive quarters, outperforming competitors such as Disney, Amazon, and Apple. Its market share has climbed to 8.3%, with YouTube remaining its only serious rival—YouTube's share increased from 9.9% a year ago to 12.8% in June, according to Nielsen. If current trends hold, this reporting quarter could mark another strong performance for Netflix.

However, is the outlook truly that bullish?

Technical analysis of NFLX stock chart

The NFLX stock price is currently moving within an ascending channel (marked in blue), and it is now testing the lower boundary of this formation. Of concern is the recent pronounced bearish movement (B), which has dragged the stock from the channel’s upper boundary to its lower edge—erasing the bullish momentum (A) that followed the breakout above the $1,250 resistance level.

What’s next?

→ On the one hand, bulls may attempt to resume the upward trend within the channel.

→ On the other hand, bears could build on their recent momentum (highlighted in red) and break the ascending trend that has been in place since May.

It appears the fate of the current uptrend hinges on the market’s reaction to today’s earnings release.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

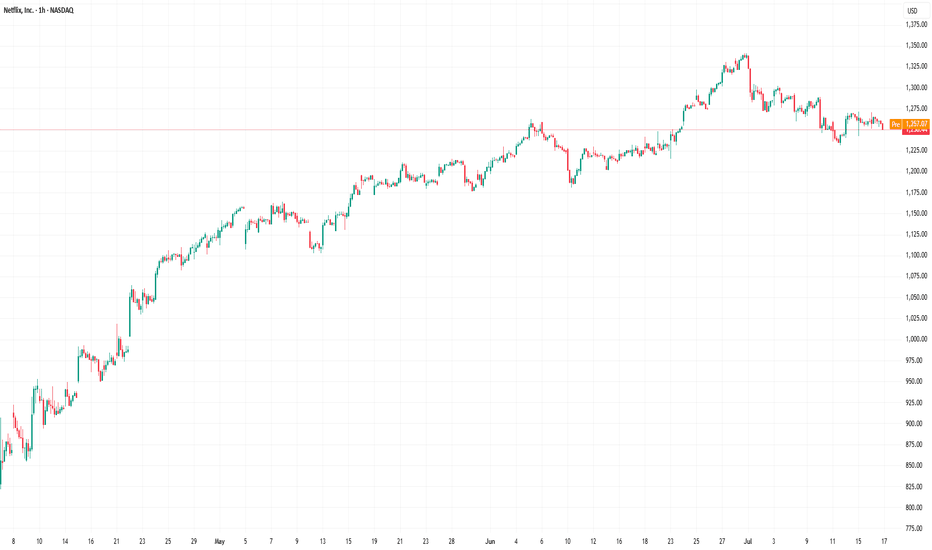

Netflix (NFLX) Share Price Reaches Record HighNetflix (NFLX) Share Price Reaches Record High

According to the charts, Netflix (NFLX) shares have risen above $1,170 – the highest level in the company’s history. Since the start of 2025, the price of NFLX stock has increased by approximately 33%, while the S&P 500 index (US SPX 500 mini on FXOpen) remains close to its opening levels from 2 January.

Why Is Netflix (NFLX) Performing Strongly?

A month ago, we highlighted several factors contributing to NFLX’s outperformance relative to the broader stock market. Among them is the fact that Netflix does not offer tradable goods subject to tariffs in trade wars. As a result, the company could potentially benefit from an economic downturn if consumers spend more time at home.

According to recent reports:

→ Netflix has announced that 94 million subscribers are now using its low-cost ad-supported plan – a figure more than a third higher than the 70 million reported in November.

→ The company also forecasts that advertising revenue will double this year.

Technical Analysis of the NFLX Share Chart

The share price continues to move within the upward channel (shown in blue) we identified previously. At the same time:

→ the price is currently near the upper boundary of this channel, which has repeatedly acted as resistance (as indicated by arrows);

→ the RSI indicator shows a potential bearish divergence.

Under these conditions, a corrective move in Netflix’s stock price cannot be ruled out – for example, towards line Q or the channel median.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Concerns about Netflix's Future Subscription GrowthOver the past few years, Netflix has undoubtedly revolutionized how we consume entertainment. Its vast library of content and the convenience of on-demand streaming have attracted millions of subscribers worldwide. However, recent trends and market indicators raise questions about the sustainability of Netflix's exponential growth.

Firstly, the streaming landscape has become increasingly competitive. With the emergence of new players such as Disney+, Apple TV+, and Amazon Prime Video, the market has become saturated, leading to a fragmented audience. This intense competition poses a significant challenge for Netflix, as it struggles to retain its subscriber base while attracting new ones.

Moreover, the COVID-19 pandemic has temporarily boosted Netflix's subscriber numbers due to lockdown measures and increased demand for home entertainment. However, as the world gradually returns to normalcy, we cannot ignore the possibility of a decline in Netflix's subscriber growth. The return of outdoor activities, cinemas reopening, and live events resumption may divert consumer attention away from streaming platforms, affecting Netflix's long-term growth potential.

Additionally, the rising cost of content production and licensing rights is a significant financial burden for Netflix. While the company has successfully created original content, the competition for exclusive rights to popular shows and movies has become increasingly fierce, leading to soaring expenses. This escalating cost may hinder Netflix's ability to invest in new content and maintain its competitive edge in the long run.

Considering these concerns, I urge you to pause and reevaluate any long-term investment plans for Netflix. It is essential to assess the company's ability to sustain its growth trajectory amidst fierce competition, changing consumer preferences, and mounting financial pressures.

Concerns about Netflix's Future Subscription Growth - A Call to Pause Long-term Investment

As traders, we make informed decisions based on a comprehensive understanding of the market dynamics. I encourage you to explore alternative investment opportunities within the streaming industry or diversify your portfolio to mitigate potential risks associated with Netflix's uncertain future.

In conclusion, the future subscription growth of Netflix remains uncertain, given the intensifying competition, shifting consumer habits, and mounting financial challenges. It is crucial to exercise caution and carefully assess the risks before making any long-term investment commitments.

$NFLX - is it time to buy?$NFLX - is it time to buy?

Could be time to buy - we got triangle pattern, now I look at individual stocks whilst comparing it to the indices of NQ and I am bullish I am buying dips and taking look at FAANGS short term buy looks could be good opportunity.

Q2 2022 earnings on Tuesday. Watch out

Take care

TJ

NETFLIX(NFLX) FUTURE PREDICTIONTechnical Analysis Summary (POLKADOT)

NTFX/USDT

TREND ANALYSIS

We have 3 upwardtrend which is currently active in green.

The wider the trend the longer it is respected.

FUTURE PREDICTIONS

We have to keep respecting and holding new weekly levels and maintaning the trend to keep moving upward.

ALL THE GREEN SUPPORT LEVELS SHOW HOW NETFLEX KEPT LADDERING AND RESPECTING NEW AND HIGHER WEEKLY LEVELS AND CREATING TIGHTER TRENDS.

Good luck everyone, stay safe!

If you need help don't hesitate to send me a message or comment

Trading Involves High Risk

Not Financial Advice

Exercise Proper Risk Management

$NFLXShares of Netflix (NASDAQ:NFLX) were up 4.8% as of 1:14 p.m EDT on Tuesday. The streaming media veteran saw a bullish earnings preview from analyst firm Cowen & Co., which included rosy results from Cowen's proprietary media viewership survey

In a third-quarter survey of 2,500 U.S. consumers, Cowen asked which media platform has the best video content right now.

Netflix led the pack with 28% of the vote, far ahead of YouTube's second-place tally of 15% and basic cable's third-place showing at 10%.

The "other" category, which includes social networks and various smaller video publishing platforms, added up to 13% of the vote.

Netflix was also found to be the leading service that consumers use most often for viewing videos, ahead of "other" platforms and basic cable.

This figure rose to 33% when zooming in on the important age group of 18- to 34-year-olds.

The stock reached another all-time high today, having posted a market-beating gain of 11% in the last three months.

Whether Netflix meets or misses Wall Street's expectations on Oct. 19, the stock is primed to make a big move on the news. Either way, Netflix remains one of my favorite stocks in the digital media space.

On the technical side of things Netflix is looking extremely bullish on the higher frames.

Breaking above previous resistance with a continuation up, I can’t see why this wouldn’t stop here.

It’s a little on the overbought side of things on the daily chart so could see slight pullbacks but overall should continue it’s way up.

MACD bullish.

RSI overbought.

Next point. $700

Watchlist this.

NFLX in a channel; good swing trade setupHello my fellow traders and devoted padawans. One of my followers asked me to analyze NFLX, so here it is. Although NFLX is a great stock it is going to have fierce competition from Disney+ so if you are a long term investor, keep that in sight. But we are here to talk about what's happening right now on the chart. As you can see, NFLX has been rangebound for quite sometime now. This can be seen as a healthy consolidation before a push up but it also means we can take advantage of the swings within the channel to make an extra buck while we wait for a move up (if that happens). I am not in NFLX but after looking at the chart I may jump in for a quick swing trade here and there if the opportunity presents itself.

CHANNEL

So let's talk about how you can take advantage of the channel, which in my opinion is one of the easiest "patterns" (not really a pattern but you get it) to trade because it is in a defined range. Now if you look at the chart you will see that the channel has different levels of support and resistance. That is fine because channels can have sub-channels, which is perfectly normal. The issue with sub-channels is that it may be difficult to know whether the price will move to the support/resistance of the outer channels or if it is going to stay contained within the inner channels. That is why we need other indicators to give us clear signals, a specific one in this case: the Stochastic oscillator.

STOCHASTIC TO THE RESCUE

The Stochastic is a very good oscillator to use in rangebound markets because when combined with other metrics, patterns, and indicators, it can give us clear buy and sell signals. Here I am using it in combination with the channels support and resistance only because that is enough for our scenario.

Sell signal

In this chart I made it very easy for you to see that when the price moves up to the resistance (any of them) and the Stoch is in overbought conditions (above 80 or close to it if we are lenient, which works for our scenario) and crossed bearish (blue line below red) the price fell. That crossover of the Stoch lines would be your sell signal (look at the lines and circles).

Buy signal

Likewise, when the price touches the support (any of the support levels) and Stochastic is in oversold conditions (below 20 or around 20) and the Stochastic lines cross bullish (blue over red) the price moves up. That bullish crossover would be your buy signal.

No trading zone

If there are crossovers of the Stohastic but the price is not reacting to support or resistance, hold off and wait for a better buy/sell signal. Don't overtrade.

MOVING AVERAGES

Finally, you can see that the 14,21, and 50 emas are forming a big ema confluence, which is normal and expected in rangebound markets. You can also see that they become resistance and support to the price, depending on where the price is. If the price is squeezed between support/resistance and the emas, it may be safe to wait for a break above or below the emas even if the Stoch is giving a buy signal and price is on support/resistance. Look at previous price action and use your diligence.

CONCLUSION

This pattern is very easy to trade if you are discipline and don't overtrade but it is not going to last forever so you need to monitor that the price stays within the channel and that other indicators don't start showing bullish or bearish sentiment, which could signal the pattern is about to be broken. In this chart I didn't add other indicators because they are supporting the rangebound move, but on your own chart it is worth adding other indicators to help you identify if/when the pattern is broken and the stock starts trending up or down.

Another long analysis my dear chart warriors but this is a lesson you will like to take with you for other trades. It is easy and simple and carries minimal risks because you can exit as soon as the pattern is broken.

Share the love:

If you get anything out of this TA, please like the chart so it moves up and others can benefit from my work. A simple click on the like button goes a long ways.

Follow for more:

I have an outstanding winning rate (check my other charts). If you want the best entry/exits just follow me, you won't regret. Thanks a lot!

***The ideas shared here are my opinion, not financial advise to place trades. Please do your own research before buying/selling stocks***

NFLX Long/Short?NFLX been having the same pattern for a long while now. But let the market pick the direction before entering a trade.

Bullish over 509, PT 520-525

Bearish under 491, PT 478.43-470

Still stuck in that channel wait for a break of the purple trendline for long, grey trendline for short. Also its tricky with vaccine and stim news. Who cares about NFLX now?!

Netflix Inc. analysis📈NFLX LONG D1

🛒BUY above = 494.30

🎯Target1 = 503.70

🎯Target2 = 509.50

🎯Target2 = 518.95

🛑Trailing Stop loss = 479

❌Cancel trade = 479

🙈Recommended risk = 1-2%

#NFLX #NFLXLONG #BUYNFLX

📉NFLX SHORT D1

🛒SELL BELOW = 479

🎯Target1 = 467.85

🎯Target2 = 460.95

🎯Target3 =

🛑Trailing Stop loss = 494.95

❌Cancel trade = 494.95

🙈Recommended risk = 3-5%

#NFLXSHORT #NFLXSELL

NFLX LONG SET UP (NETFLIX)TITLE/(DATE)- BUY NFLX/USD

ASSET- STOCK

PLATFORM-MT4

ORDER TYPE- BUY Market

Time Frame-4hr

ENTRY PRICE 1- $475.50 ✅ market

ENTRY 2- $468.50

STOP LOSS- $465.50(100 PIPs)

TAKE PROFIT 1-$485.50 (100PIPS)

TAKE PROFIT 2- $495.50(200 PIPS)

TAKE PROFIT 3- $505.50 (300 PIPS)

TAKE PROFIT 4- $525.50 (500 PIPS)

TAKE PROFIT 5- $545.60 (700 PIPS)

STATUS: Active

NFLX:Gap fill up incoming?NFLX looking very very interesting, stochastics looking bullish, bounce off of support and TL, looks pretty good for gap fill to 523 this week with short term pt of 503.Think its safe to say that i'm bull on this one hahah. Any feedback is appeciated,happy trading and stay green!