#PENGUUSDT #2h (ByBit) Broadening wedge breakdownPudgy Penguins printed an evening star then lost 50MA, seems to be heading towards 200MA support next.

⚡️⚡️ #PENGU/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (2.5X)

Amount: 5.0%

Entry Targets:

1) 0.030830

Take-Profit Targets:

1) 0.021034

Stop Targets:

1) 0.035740

Published By: @Zblaba

CSECY:PENGU BYBIT:PENGUUSDT.P #4h #PludgyPenguins #Meme pudgypenguins.com

Risk/Reward= 1:2.0

Expected Profit= +79.4%

Possible Loss= -39.8%

Nft

PENGUUSDT 50%-150% potentialBINANCE:PENGUUSDT is showing a classic cup and handle breakout on the daily chart, supported by a strong upward move and a bullish structure. Price has successfully broken out of key resistance around 0.0173, and volume is picking up. If momentum continues, the projected target points toward the $0.045 level, suggesting a potential upside of 50%-150%. The setup remains valid as long as price stays above the handle low around 0.0141.

Regards

HExa

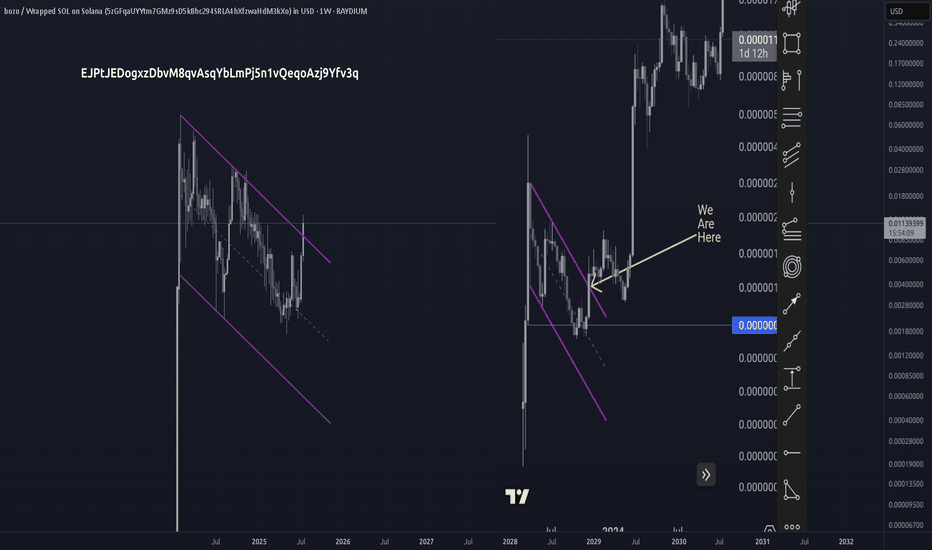

Idea for Sonic bulls - swap Sonic to BRUSH (Paintswap)!I might have unreasonable expectations for Sonic. But I see Sonic as the most underrated L1.

Airdrop and big news coming up for Sonic in the coming week(s).

If you are a mega Sonic bull as I am, you probably just want to accumulate some more Sonic!

This is an idea how you can accumulate more Sonic...

A part Sonics airdrop is traded as an NFT on Paintswap exchange, which is a great NFT platform. If the airdrop "trading" goes smoothly, I think a portion of the airdrop money will go straight into BRUSH (Paintswap exchange token). The airdrop will create momentum and bring more traffic and new users to Paintswap.

My long term goal (as a Sonic bull) is to accumulate more Sonic. One way to do that could be to swap some Sonic -> BRUSH. I think a confirmed "break of trend" will be a good timing to swap a small amount of Sonic to BRUSH.

It looks timing wise that BRUSH breakout will happen at the same time as the airdrop.

If the swap S->BRUSH idea plays out it could give 60% more Sonic.

No financial advice

#AXSUSDT #4h (Bitget Futures) Falling wedge breakout and retestAxie Infinity just pulled back to 50MA support where it's bouncing, looks ready for recovery towards 200MA resistance and more.

⚡️⚡️ #AXS/USDT ⚡️⚡️

Exchanges: Bitget Futures

Signal Type: Regular (Long)

Leverage: Isolated (4.0X)

Amount: 4.7%

Current Price:

2.509

Entry Zone:

2.489 - 2.407

Take-Profit Targets:

1) 2.758

2) 2.991

3) 3.224

Stop Targets:

1) 2.189

Published By: @Zblaba

NYSE:AXS BITGET:AXSUSDT.P #4h #AxieInfinity #P2E axieinfinity.com

Risk/Reward= 1:1.2 | 1:2.1 | 1:3.0

Expected Profit= +50.7% | +88.7% | +126.8%

Possible Loss= -42.3%

Estimated Gaintime= 1-2 weeks

TradeCityPro | TON: Eyeing Breakout in Telegram’s Hottest Token👋 Welcome to TradeCity Pro!

In this analysis, I want to review the TON coin for you. This coin is for the Telegram social network, and in 2024, due to airdrops like Notcoin and Hamster that trended, it became very hyped and widely talked about, and the TON blockchain experienced significant growth.

🔍 Currently, the NFT market has also launched on this network, which has prevented this coin from dropping. This coin, with a market cap of $7.78 billion, is ranked 18th on CoinMarketCap.

⏳ 4-Hour Timeframe

In the 4-hour timeframe, as you can see, after the downtrend that the price had, there was a bullish move following the news of Pavel Durov going to Dubai and leaving France, and now the price is in a correction phase again.

⚡️ Currently, a 4-hour range box has formed, with the bottom of this box at the 2.851 zone and the top at 3.216. There's also a mid-line within this box at 3.044, which the price has broken and is moving toward the 3.216 ceiling.

✔️ If the price movement continues toward the top of the box with this momentum and high buying volume, the likelihood of breaking the 3.216 area will increase significantly. So I suggest that with the breakout of this level, you try to have a long position open.

📉 For a short position, if the price gets rejected from the top of the box, you can enter a trade with a trigger on a lower timeframe. Otherwise, the first trigger is the break of 3.044, and the second trigger is the break of 2.851.

🔼 For a long position, the RSI oscillator is near the Overbought area, and if it enters Overbought, we can expect a sharp bullish move.

📊 Market volume is currently in favor of buyers and is increasing. If volume increases and RSI enters Overbought, you can place a stop buy order above the 3.216 level so that if there is a sharp breakout of this level, your position gets triggered as well.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

One-trick Pony Club pumped and dumped`If you wonder how much all the monkey pictures are REALLY worth, you should check YouTube video:

"Right Clicking All The NFTs"

by Coffeezilla

with 1,399,517 views

uploaded on 21 Dec 2021

The story of sh1tcoins (Bored Ape Yacht Club and all the rest):

Once upon a time, a rich man from the city arrived in a village. He announced to the villagers that he would buy Monkeys for 100 each.

The villagers were very happy, after all there were hundreds of Monkeys in a nearby forest. They caught the Monkeys and got them to the rich man. He bought hundreds of Monkeys and paid 100 for every Monkey the villagers gave him. They began to make a living out of getting Monkeys from the forest and selling it to the rich man.

Soon, the forest began to run out of monkeys that were easy to catch.

Sensing this, the rich man offers 200 for every monkey. The villagers were ecstatic. They went back to the forest, set up traps and caught the monkeys and got them to the rich man.

A few days later, the rich man announced he would pay 300 per monkey. The villagers began climbing trees and risking their lives to catch monkeys and get them to the rich man – who bought them all.

There were no Monkeys left in the forest!

One day, the rich man announced he would like to buy more monkeys – this time for 800 each.

The villagers couldn’t believe this. They were desperately trying to get more monkeys..

Meanwhile, the rich man said he had to go back to the city on some business work and until he returns his manager would deal on his behalf.

Once he left, the villagers were unhappy. They were making quick and easy money from selling monkeys, but the forest no longer had monkeys.

This is when the manager of the rich man stepped in. He made an offer the villagers could not refuse. Pointing out to all the monkeys that the rich man had caged. He told the villagers he would sell the monkeys for 400 each.

“Sell them back to the rich man at 800 each when he comes back” the manager said.

The villagers were over the moon. Buy for 400 and sell for 800 in few days. They had just found the easiest way to double their money. The villagers collected all their savings and even borrowed money. There were long queues and within a few hours, almost all the monkeys were sold out.

Unfortunately, their happiness did not last long, as the manager went missing the next day and the rich man never came back.

Many villagers kept the monkeys with them, hoping the rich man would come back. But soon, they lost hope and had to let the monkeys back into the forest as feeding and taking care of the noisy monkeys became extremely difficult.

Breaking: Apecoin ($APE) Surges 10% Today, Enroute To $1Apecoin's native token ( GETTEX:APE ) which is an ERC-20 governance and utility token used within the APE Ecosystem to empower and incentivize a decentralized community building at the forefront of web3 surge 10% today defying market odds and setting coast for the $1 pivot.

Apecoin has had its own fair share of the market dip lately for an asset with an All -time high of $39.40 during the NFT hype but tanked so hard currently trading at 0.421 per GETTEX:APE coin.

Chart patterns indicate the potential of a breakout in either direction once the asset breaks above the symmetrical triangle pattern formed. Similarly, a break below the symmetrical triangle could resort to a bearish trend for GETTEX:APE coin.

The NFT market is still new albeit further developments is needed to bring the NFT hype back to life, with Apecoin ( GETTEX:APE ) standing at the forefront of NFT's galore.

ApeCoin Price Live Data

The live ApeCoin price today is $0.419761 USD with a 24-hour trading volume of $54,383,857 USD. ApeCoin is up 8.72% in the last 24 hours, with a live market cap of $315,933,934 USD. It has a circulating supply of 752,651,515 APE coins and a max. supply of 1,000,000,000 APE coins.

(ETH) ethereum "nft land"I was recently looking into NFTs on Opensea and while doing so I noticed there are far more NFTs from people based on the Ethereum blockchain compared to the other offerings on Opensea. Even though Solana (SOL) is on the forefront of popularity with Meme projects Opensea does not offer an exclusive Solana chain to provide NFT ideas. Hence, there is not an easy way to compare to amount of Solana projects to Ethereum projects being built, developed and/or offered. It would be interesting to see the comparison of NFTs on Solana versus Ethereum. Ethereum reduced their transactions with a transition to Proof-Of-Stake and since then the number of Ethereum NFTs must be growing. While the news is on a constant watch for new meme projects, tokens, the Opensea network for many other blockchains is not growing as nearly rapidly as Ethereum.

Will this bottoming pattern return you 300%?Dearest reader, superrare has been showing tremendous strength during the recent downtrend by which RARE captured my eye. A whopping 4000% increase in volume in just one day might be a sign for things to come.

Looking at the above chart a couple of things stand out. Looking at the current bars pattern is looks eerily similar to the one from August 2024 (blue arrows).

I expect resistanceline A to be hit in the near future, from current price this would be 100% gain. If broken the sky is the limit but be aware of resistanceline B. If that is broken... expect massive gains!

Target: 0.35$

Stoploss: 0.046$

Rustle

Is There Hope for Sandbox ($SAND) or Is The Gameverse Dead?The Decline of NYSE:SAND : A Look at Its Current State

Once a shining star in the play-to-earn (P2E) gaming and NFT ecosystem, Sandbox ( NYSE:SAND ) has seen a staggering decline from its all-time high of $8.44 to a mere $0.34 at the time of writing. This sharp drop has left investors and gamers questioning the future of metaverse gaming and the sustainability of blockchain-based virtual worlds.

Despite recent hype around Web3 gaming and metaverse adoption, the broader NFT and P2E sectors have remained relatively muted, contributing to NYSE:SAND ’s price drop. However, does this spell the end for The Sandbox, or is a reversal on the horizon?

Technical Analysis

The Relative Strength Index (RSI) currently sits at 23, indicating that NYSE:SAND is in heavily oversold territory. Typically, an RSI below 30 suggests that an asset is due for a rebound, as selling pressure diminishes.

The daily chart is forming a rising wedge pattern, which is a traditionally bearish formation. If the pattern holds, further declines could be expected. However, the $0.39 pivot zone is a critical resistance level. Should NYSE:SAND manage to break above this level, it could spark a campaign towards the $1 mark, a move that would be monumental for the token.

Currently, NYSE:SAND is down 7.27% on the day, with a 14% decline over the last 24 hours. The lack of bullish momentum suggests that investors remain hesitant about a potential comeback. However, if volume spikes and momentum shifts, a short-term recovery could be on the table.

Market Data & Sentiment

- Current Price: $0.3487

- 24-Hour Trading Volume: $113.85 million

- Market Cap: $859.36 million

- Circulating Supply: 2.46 billion NYSE:SAND

Despite the downturn, The Sandbox maintains a top-100 ranking in the crypto market, proving that it still holds relevance. The challenge now is for the platform to reignite user interest and expand beyond its current stagnation.

The Road Ahead: Dead or Dormant?

While the NFT and metaverse hype has faded, it doesn’t necessarily mean the sector is dead. Innovation, adoption, and strategic partnerships could breathe life back into NYSE:SAND and other metaverse tokens.

SOLANA ($SOL) – ROARING REVENUE & FIREDANCER POTENTIALSOLANA ( CRYPTOCAP:SOL ) – ROARING REVENUE & FIREDANCER POTENTIAL

(1/7)

Ecosystem Revenue: Solana’s Q4 2024 app revenue surged +213% to $840M (vs. $268M in Q3), largely driven by meme coin mania. Network revenue reached new highs—$517M in app revenue & $552M in real economic value in January alone! Let’s dig in. 🚀

(2/7) – ONCHAIN ACTIVITY

• DEX Volume in Jan: $339B

• Stablecoin supply: $11.4B

• TVL: $8.6B—all-time highs

• 18 Firedancer validators deployed in Q4, boosting transaction capacity

(3/7) – SECTOR SNAPSHOT

• Market cap: ~$88.6B (late Dec 2024)

• SOL token trades around $200–$300 per recent posts

• Some speculate SOL could hit $500–$1,000—strong fundamentals + revenue growth might point to undervaluation vs. Ethereum ⚖️

(4/7) – COMPETITIVE EDGE

• Outperforms many L1 peers in transaction volume, speed, and revenue

• Handles more transactions than all other chains combined (per X posts)

• DEX volume +150% to $3.3B daily in Q4—low fees & high throughput = user magnet 🕹️

(5/7) – RISK FACTORS

• Market Volatility: Crypto’s rollercoaster can swing SOL prices wildly

• Regulatory: US policy changes, token classification → potential headwinds

• Competition: Ethereum scaling (rollups) & new L1s (Aptos, Sui) loom

• Technical Risks: Firedancer delays or issues = potential network reliability concerns

(6/7) – SWOT HIGHLIGHTS

Strengths:

High TPS + low fees → leading L1 contender

Robust ecosystem growth (TVL, DEX, stablecoins)

Strong revenue: $840M Q4 app rev, $517M in Jan alone

Weaknesses:

Heavy reliance on meme coin activity for recent revenue

Centralization worries due to validator concentration

Opportunities:

Solana ETF approval → institutional inflows 🌐

Firedancer aiming for 1M TPS, tech superiority

Expansion into DePIN, PayFi → new revenue streams

Threats:

US regulatory clampdowns

Ethereum’s scaling solutions & emerging L1 competition

Meme coin hype dying down, revenue from speculation dips

(7/7) – Is Solana undervalued or overhyped?

1️⃣ Bullish—Firedancer + revenue surge = unstoppable 🚀

2️⃣ Neutral—Impressive growth, but watch the meme factor 🤔

3️⃣ Bearish—Competition, centralization concerns… pass 🐻

Vote below! 🗳️👇

ETHEREUM ($ETH) – COULD STAKING ETFs TRANSFORM THE NETWORK?ETHEREUM ( CRYPTOCAP:ETH ) – COULD STAKING ETFs TRANSFORM THE NETWORK?

(1/7)

Ethereum fees (i.e., network revenue) are climbing as DeFi, NFTs, and now potential staking ETFs attract more usage and institutional capital. Let’s see what’s moving the second-largest crypto by market cap! 🚀💎

(2/7) – RECENT “REVENUE” TRENDS

• Network fees jumping with higher on-chain activity (DeFi, NFTs)

• Potential ETF staking could funnel institutional money and supercharge Ethereum’s fees & usage

• ETH price at $2,647—some say undervalued vs. historical highs & future prospects 💸

(3/7) – STAKING NEWS & IMPACT

• CBOE BZX filed to add staking to 21Shares Ether ETF—a first in the U.S. if approved 🏆

• ETH spiked +3% on Feb 13, 2025, after the news broke 📰

• Could pave the way for more institutional ETH adoption & yield opportunities

(4/7) – CRYPTO SECTOR COMPARISON

• NVT ratio (network value to transactions) suggests Ethereum might be undervalued given expected usage hikes

• Competitors (e.g., Solana, Cardano) also have DeFi & smart contracts, but ETH’s brand & developer base remain top-tier 🏅

• If staking ETFs become mainstream, ETH’s yield potential could shine even brighter 🌟

(5/7) – RISK ASSESSMENT

• Regulatory: SEC scrutiny of staking—could they tighten the reins? ⚖️

• Market Volatility: Crypto can pivot from bull to bear in a heartbeat 😱

• Tech Hurdles: Ongoing Ethereum upgrades (sharding) face potential delays ⏳

(6/7) – ETHEREUM SWOT HIGHLIGHTS

Strengths:

Leading smart contract platform, huge dev community

Growing staking potential, possibly extended to ETFs

Weaknesses:

High gas fees + ongoing scalability concerns

Regulatory uncertainties around staking

Opportunities:

If ETF staking passes, institutional inflows could surge 💰

DeFi & NFT expansion continue to drive demand

Threats:

Lower-fee rivals like Solana or Polygon on the rise 🌐

Potential crackdowns on staking by regulators

(7/7) – Is Ethereum undervalued at $2,647 given the ETF staking hype?

1️⃣ Bullish—ETH’s about to skyrocket! 🚀

2️⃣ Neutral—Show me actual adoption first 🤔

3️⃣ Bearish—Competition & regulation overshadow it 🐻

Vote below! 🗳️👇

Breaking: SpaceN ($SN) Surge Over 2000% Amidst Market VolatilityThe cryptocurrency market has witnessed yet another jaw-dropping rally, with SpaceN ( NYSE:SN ), an NFT one-stop investment management tool, surging over 2000% within a single day. This sudden price explosion has raised several questions regarding the sustainability of such gains, given the token’s 1 billion total supply and only 40 million currently circulating in the market.

Market Overview & Trading Activity

SpaceN’s impressive surge has propelled its market capitalization to approximately $44.99 million, ranking it #846 on CoinGecko. However, a major concern among skeptics is the low trading volume relative to its market cap. With a reported $608,223 in 24-hour trading volume, many are questioning the legitimacy of such a steep price increase on a token with a fully diluted valuation (FDV) of over $1.12 billion.

Despite the concerns, the token has shown resilience, outperforming the broader crypto market, which is down -0.80% in the last week. Over the past seven days, NYSE:SN has seen a price increase of 420.40%, making it one of the best-performing assets within the BNB Chain ecosystem.

Technical Analysis

Following its remarkable rally, NYSE:SN experienced a sharp retracement, currently trading down 2.72% at the time of writing. While such a correction is expected after a parabolic move, the price action remains above key moving averages (MA), hinting at a potential second leg up.

Support & Resistance Levels: The recent all-time high (ATH) of $6.15, recorded on January 29, 2025, is a crucial resistance point. If bullish momentum picks up, a move toward this level is possible, with $5 acting as a pivot zone.

Volume Concerns: The lack of significant trading volume and the reliance on Gate.io as its primary exchange raises questions about liquidity. A listing on a top-tier exchange such as Binance or KuCoin could be a major catalyst for further price appreciation.

Trend Outlook: NYSE:SN is trading within a falling trend after the initial spike. However, if the daily candlestick closes in a bullish structure, a potential retest of key resistance zones could lead to renewed momentum.

The Promise of SpaceN

Beyond the price action, the fundamentals of SpaceN provide an interesting case for long-term adoption:

- NFT Management Tool: SpaceN aims to be a one-stop investment management platform for NFTs, allowing users to track investment income, stay updated on NFT projects, and access NFT-focused social circles.

- DAO Functionality: Users can create self-organized DAOs, trade NFTs, and build communities based on shared holdings.

- BNB Chain Ecosystem: Being built on the BNB Chain, SpaceN could benefit from future integrations and potential ecosystem expansions.

Final Thoughts: Is There More Room to Run?

Despite its meteoric rise and subsequent correction, NYSE:SN remains a token to watch. The low trading volume relative to market cap presents some red flags, but the token’s fundamentals and the broader NFT sector’s growth could provide the necessary fuel for another push higher. A key factor will be whether SpaceN secures additional exchange listings and maintains bullish technical indicators.

For traders and investors, keeping an eye on volume trends, resistance levels, and exchange-related news will be crucial. If momentum returns, a push toward $5 and potentially reclaiming its ATH could be on the table. However, caution is advised, given the volatile nature of such explosive moves.

Will NYSE:SN continue its rally, or was this a one-off spike? The next few days will be critical in determining the trajectory of this NFT-focused token.

TOSHI - Base's MEMEDaily Chart:

1H Chart:

Check out:

twitter.com

www.toshithecat.com

It appears that TOSHI is a Base network MEME token surrounding Brian Armstrong's Cat, Toshi.

This MEME coin seems unique in the sense that it functions much like Solana.

It has it's own marketplace for generating unique tokens to list on DEXSCREENER.

I think this token is promising, considering it is fairly "new" to the multiple CEX's now.

Exposure to the token is increasing. I feel like technical indicators can't really come into play until the 2HR, 4HR, 8HR, and 1 day charts can really start drawing.

The Market Cap is under 1B.

PEPE's Market Cap is somewhere around 6.3B right now (1/26/25).

There's significant potential for this coin and I think it could reach .01 with a 2.5B-3.5B market cap.

Lastly, I noticed TOSHI offers NFToshi's and NFToshi 2.0's.

Following this buzz, I think this will draw attention to the their NFT's which will also see a floor increase.

NFToshi's:

rarible.com

NFToshi 2.0's:

magiceden.us

I appreciate any comments.

Thanks.

ARTY - Bullish Phase Confirmed!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📌Fundamental:

Artyfact is redefining the AI gaming industry, introducing cutting-edge technologies that not only elevate gameplay but also transform the way games are developed.

🥇The potential for AMEX:ARTY is immense, with a current market cap of just $17 million and 80% of its tokens already in circulation, signaling a strong foundation for growth.

Additionally, Artyfact is gearing up for several major milestones, poised to capture the attention of millions of users, making it a project to watch closely and consider adding to your portfolio.

Milestones include:

- Artyfact in Epic Games Store

- Artyfact Mini-App in Telegram

- Artyfact Launchpad Launch

- Artyfact on PlayStation

- Artyfact on Xbox

- Artyfact in AppStore

- Artyfact in Google Store

📌Technical:

📈 After breaking above the $0.3 - $0.7 accumulation phase, ARTY started its MarkUp (bullish) phase.

Currently, its short-term correction is almost over as it is retesting a massive demand zone.

🏹As long as the structure holds, I expect a bullish continuation towards the $2.3 major high as a short-term target, and starting with $10 as a first long-term target.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Long now! No doubt that APE will grow and hit 7$ in 2025Hello guys, I am sharing an idea to open long position on current price of APE and hold it to over 7$, which is the last target shown on the chart///

it has done so much consolidation and then it can grow heavily and pump to the moon, I think the price will be over 4$ by next 2 months, I also have an idea for you, for those who doesn't have enough margin or cash to enter, 1$ which is the strong support at the moment, so if you open a long position with a little money like 50$ and use 5x leverage, at current price (1.12$) your liquidation price will be around 0.89$ - 0.90$ which is below the support level of 1$, then hold it to 4$, it will give over 600$ profit... but don't forget to use the liquidation price as stop loss haha! because a small money like 50$ is already to go, but 600$ opportunity isn't to go...

hope you like the idea, happy trading <3

$me magic eden $MEUSDmoving forward i am bullish on magic eden... we are traveling in a nice uptrend in a nice channel.... we currently have a fib resistence at $3.77 which i personally think we will retest before the weekend is over...the channel support line is in the low 3.20's if you are looking to add on a pullback...as we approach the $3.776 range keep an eye on !total to see what the marketcap is doing.... if btc dominence is going down and money is flowing into alts, i expect volume to pick up as we push thru the resistence area. if marketcap starts to drop though i can see the price here coming back down to retest the $3.12 current swing low that was created last week. Price for this token dumped hard after an initail luanch of the token sent out 1,000s to some holders, which where dumped onto the market....a lot of investors into this project tho are staking as many coins as possible to maximize the sites rewards. lockup period is thru mid march to end of march....Stay tuned as i will keep you updated on this chart. Give me a like and follow....Share on X.com also if you like my TA and have found it helpful. Thanks

TradeCityPro | APEUSDT Calm in the NFT Market👋 Welcome to TradeCityPro Channel!

Let’s analyze one of the most well-known coins in the NFT space, which instantly reminds us of the NFT market whenever mentioned.

🌐 Overview Bitcoin

As usual, before starting the analysis, let’s take a look at Bitcoin on the 1-hour timeframe, where it seems the 92722 support has been faked. On the 4-hour timeframe, a good engulfing candle is forming near the year-end, which could be a positive sign.

Today's daily candle is very important. If it closes with good volume, we might consider a risky entry while keeping an eye on the market. If Bitcoin dominance rises, we might see Bitcoin's upward movement toward 115K, and if dominance falls, the altcoin market could offer better opportunities!

📊 Weekly Timeframe

In the weekly timeframe, we can see APE has risen from its last support at 0.557, finally showing signs of life and activity, which is promising for the NFT market, although more active projects like BLUR exist.

After being rejected from 1.883, the resistance level shifts to 2.335, which could mark the breakout point of the weekly box. Breaking this level could act as a trigger for buying, with a stop loss at 0.892.

If 0.892 breaks, it’s logical to set your stop loss below 0.557. Even if you are holding from before, it makes sense to exit your position and cash out below this level.

📈 Daily Timeframe

On the daily timeframe, after the break of 0.894, it was possible to buy with either a Risky stop loss at 0.67 , Secure stop loss at 0.545

If this trade was taken, it would have been reasonable to exit the initial investment at 1.943. If not, it’s better to currently do nothing and let the stop loss hit.

For re-entry, I’d likely wait for 1.943 or 1.269 to break while watching for capital inflow into the NFT market. Personally, I’d focus on other coins in the NFT space with newer features.

During the upward movement, volume increased, and during the correction, volume decreased, which is a positive sign for the bullish trend. Unlike some coins that returned to their daily boxes, APE hasn’t, which makes it slightly more bullish.

⏱ 4-Hour Timeframe

In the 4-hour timeframe, after the drop and rejection from 1.903, sellers are currently active, and the coin is within a box that defines its next move.

📈 Long Position Trigger

The strategy is clear—wait for a break of 1.280 with increased volume to open a long position. Be mindful of market conditions and manage risk with smaller position sizes. The current 4-hour candle looks promising.

📉 Short Position Trigger

After breaking 1.174, a short position can be opened with a target of 1.024, but use a tight stop loss. Once you hit your desired risk-to-reward ratio, manage the position or take profits quickly.

If stopped out, take a temporary break from the market.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

PENGU Token Price Soars 41% Amid Bithumb ListingThe Pudgy Penguins ( CSECY:PENGU ) token has captured the crypto market’s attention, surging 41% in the last 24 hours following its listing on the major South Korean exchange, Bithumb. This strategic development is expected to propel the token's adoption within the Korean market and beyond. But can the rally continue? Let’s dive into the technical and fundamental aspects shaping CSECY:PENGU 's price trajectory.

Bithumb Listing Sparks Market Excitement

On December 24, Bithumb announced the addition of CSECY:PENGU to its KRW market, setting a base price of 43.89 KRW. This announcement caused an immediate 23% spike in the token’s price, highlighting the significance of the listing. With deposits and withdrawals exclusively supported through Solana's blockchain and Bithumb-approved exchanges, the platform ensures secure and seamless trading for users.

The listing aligns with CSECY:PENGU ’s growing popularity, particularly in South Korea, a nation known for its active and influential crypto market. As one of the top exchanges in the region, Bithumb’s support positions CSECY:PENGU for increased visibility and trading activity, contributing to its bullish momentum.

Market Metrics and Community Support

The CSECY:PENGU token has consistently gained traction due to its vibrant community and strategic partnerships. With a market cap of $2.32 billion and a 24-hour trading volume of $1.21 billion, the token demonstrates strong investor confidence. Furthermore, CSECY:PENGU ’s Futures market activity reflects heightened interest, with $687 million in trading volume and $115 million in Open Interest.

Binance’s previous endorsement of CSECY:PENGU further cements its credibility and appeal within the crypto ecosystem. Since its launch, CSECY:PENGU has surged over 700%, fueled by airdrop distributions and strategic exchange listings.

Technical Analysis

As of now, CSECY:PENGU is trading at $0.037, reflecting a 23% daily increase. The token is moving within a bullish flag pattern, a technical setup that typically signals the continuation of an upward trend. However, caution is warranted as the RSI at 80 indicates overbought conditions.

In the event of a price correction, the 38.2% Fibonacci retracement level may act as immediate support. On the flip side, a breakout could push CSECY:PENGU towards its recent all-time high of $0.057, providing an attractive target for bullish traders.

Future Outlook: Will the Rally Sustain?

The Bithumb listing is a significant milestone for CSECY:PENGU , but sustaining the rally depends on broader market conditions and continued adoption. With the crypto community’s support and growing institutional interest, CSECY:PENGU is well-positioned for further growth.

However, traders should monitor key technical indicators and macroeconomic factors, including the overall crypto market sentiment, to navigate potential price fluctuations.

Conclusion

CSECY:PENGU ’s recent price surge reflects the token’s increasing popularity and strategic milestones. While the bullish momentum remains intact, market participants should stay vigilant for potential corrections. With strong fundamentals and promising technical patterns, CSECY:PENGU is a token to watch in the coming weeks.

TradeCityPro | Blur : Dynamic Support Holding👋 Welcome to TradeCityPro!

In this analysis, I will explore Blur, a gaming project, focusing on the daily timeframe to assess its current price action and potential scenarios.

📅 Daily Timeframe: Correction to Dynamic Support

On the daily chart, Blur has been following an ascending trendline that acts as a dynamic support, propelling the price upward after every interaction.

🔍 Recently, the price experienced a fake breakout below this dynamic support, which was quickly followed by increased buying volume and a surge in bullish momentum. As a result, Blur managed to break through the $0.2827 and $0.3314 resistance levels, climbing as high as $0.4438.

🔽 Currently, the price has corrected in two stages and returned to the $0.2827 level, which aligns with the dynamic support. The RSI, after breaking below the 50-level, has supported this deeper correction. If the dynamic support fails to hold and the price trend shifts, the primary support will be at $0.1464.

📈 If the resistance at $0.4438 is breached, the first target is $0.5539, a notable resistance level. The main target is $0.8077, the ATH, which doubles as a critical supply zone due to its significance in price history.

✨ The RSI lacks a clear bullish trigger currently, as no new structure has formed. However, if RSI confirms a bullish momentum resurgence and trading volume increases, the chances of breaking through $0.4438 will significantly improve.

🔑 Market Sentiment and Advice

The market is currently undergoing broad corrections, causing FOMO and uncertainty among traders. However, these pullbacks are natural and essential for sustaining the market’s broader uptrend.

💥 Here’s a reminder for effective trading during volatile times:

Avoid impulsive decisions driven by fear or greed.

Ensure risk and capital management is a priority. Proper management safeguards you from significant losses during corrections, preserving capital for long-term growth.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️ above.

The Road to $66 for STXUSDT (Stacks)$STXUSD has now beautifully broken out of the triangle after an impressive textbook correction at the 0.618 Fibonacci retracement.

This type of correction is a typical feature of wave 2 in an Elliot wave count, which indicates that $STXUSDT is now ready to embark on its third impulsive wave, often referred to as the most explosive one.

Considering the increasing volume, an explosive surge in the number of transactions on the network, and the oscillators, we can expect a swift development in the price towards the following resistance levels:

— 0.57

— 1.06

— 2.85

— 5.96

— 8.16

— 13.17.

#stxusdt #stxusd #BNS #DeFi #BitcoinNFTs #Stacks