NG

Multi-Timeframe Analysis / Natural Gas Futures by ThinkingAntsOkUse this as a guide to develop your view:

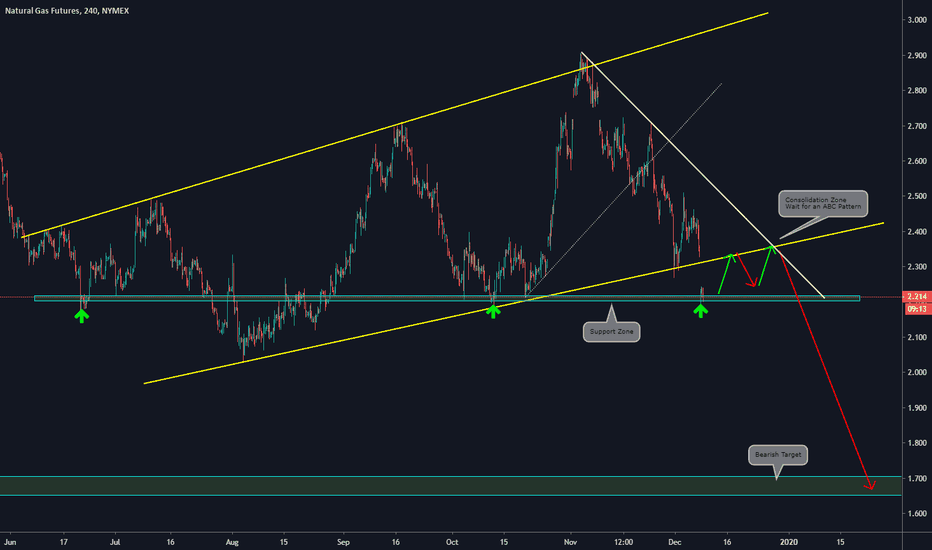

Main items we can observe on the 4HS chart:

a)Price has broken the primary structure (yellow lines) with a bearish movement

b)The price found support on the 2.20 level

c)We Expect an ABC formation with a pullback to the broken structure

d)If the ABC formation happens, we forecast a continuation of the bearish movement towards the next support zone at the 1.7 level

Daily Vision:

Weekly Vision:

Flatulence is naturalColder and more snow than normal in the areas that drive demand, but is that enough to eat the surplus?

Daily

Support is holding @19.21, 9cent's below the daily setup trend @19.30

Weekly

mostly negative to neutral

Monthly

Patterns

Inverted Hammer on an 8 downtrend = Bullish in a downtrend

Star Doji = Bullish in a downtrend

Gravestone Doji = Bullish in a downtrend

Weather Forcast

UNG (natural gas ETF) 16% up 24% down... My intention was to analyze the NG exchange rate. Even so, I still chose his ETF. The fractal motion is much more visible in this. That is why I would like to present this. It is clear from the movement of the exchange rate that Friday's big fall (7%) was an expected process. The figure clearly shows that a fractal sequence has been completed. It is also clear that the original fractal is copied in a 2: 1 ratio. This copy has been slow for a month now. Therefore, I assume that further movement follows similar regularity. This means that NG and its ETF will turn north in the coming days. The ETF may increase by 16%. But from that level, another decline may begin. Nearly 24%. I am expecting the bottom of the ETF to be 15.44 usd. Then the most interesting thing happens. I assume that NG can start an amazing rise after 14 years. I also recommend this for a longer term investment.

NATURAL GAS - Head & Shoulder BREAKOUT!Price just broke out of our inverted head and shoulder neckline. We are expecting price to have a minor retest before rocketing to the upside.

We may find our first level of resistance @ ~2.45. We are targeting the upper 2.60's.

For entries, we will be waiting on lower time frames for a retest of neckline before going long.

Top and Bottom Analysis on Natural Gas by ThinkingAntsOkUse this as a guide to develop your own setup

Main items we can see on the 4hs chart:

a)The price is against a Weekly resistance zone

b)We saw a clear rejection of that level

c)On MACD we can see a bearish Divergence showing the weakness of the current bullish movement

d)The current ascending trendline was broken

e)We will wait for an ABC pattern o something similar, the objective is to have a consolidation on the shown area

f)If that structure is made we will consider it as a clear Zone to short NATGAS towards the Main trendline of the bullish movement

Check the Higher timeframe analysis to make more sense of the 4hs chart

WEEKLY CHART:

DAILY CHART:

Will Natural Gas futures continue to fall? Here is my viewTable of contents:

§ 1 Chart analysis

§ 2 Fundamentals

§ 3 My plan to enter

§ 1 Chart analysis

Looking at the NG!1(LNG futures) price, it's quite easy spotting the giant downward channel that price has been moving within for a while now.

As you likely already know, if you are a conservative trader like I am you would look only to take shorts at this point at the top of the channel, but in this case, things might be a bit different...

§ 2 Fundamentals

Now although looking strictly at the chart you would of course look to take shorts on the top of the channel, however, as I have mentioned in my FLNG analysis, China and India are planning on going from Coal heating to Natural Gas heating .

With that said, as we are currently moving away from summer and I predict colder weather will hit these countries within the next month, we might see a change in direction of price in NG as demand rises. Historically we have seen up to a 100% price increase during the winter, as that is when we have the most demand for heating.

§ 3 My plan to enter

I will be looking to enter short if price rejects upper channel and creates a regular divergence with the RSI, and I will enter if the price closes below the 50 EMA.

I will be looking to enter long if price breaks trough the upper channel, and we are met with a hidden divergence.

Another possibility is price retracing partly downward after rejecting top channel but not reaching the bottom of the channel, in which case if we get a regular divergence close to a previous support I will be looking to go long again, or atleast exit my trade.

Hope you found this helpful and good luck with your trading, although, if you trade based on luck you are already screwed.

Have a good day everyone

Long Trade Idea on Natural Gas + Weekly view by ThinkingAntsOkUse this as a guide to develop your own setup

Main items we see on the 4hs chart:

a)Price is inside a descending channel

b)On MACD we can see a bullish divergence in the inner waves of the descending channel

c)On a closer look, we can see that the price broke out from the descending trendline and now is leaving a Pin bar on the zone

d)We will wait for a retest of the broken descending trendline and an ABC structure (like flag patterns) before taking long setups

e)Currently, this is just a trade idea we need to wait for more confirmations before opening positions.

Weekly vision:

5 reasons to be bullish on Natural Gaz / $UGAZ1. Natural gaz is very weather dependent and seasonal. In the last 20 years, natural gaz went up 14 out of 20 times between Aug and Nov. The exceptions were (2000, 2005,2008, 2010, 2011 and 2015).

2. In the last 20 years, natural gaz was above $2.25 98% (eye ball) of the time. As you can see on the chart, $2.25 is a clear floor.

3. Adjusted for inflation for 20 yrs at 1.5% inflation rate, this floor should be in the $3.00 range in 2019.

4. Average price in the last 20 yrs has been around $4.50 ish. There is lots of room above!

5. With the FED's dovishness, the dollar will start softening soon. It may creep up a few more days but it will come down. Commodity will then have upward price pressure.

The price is falling at the moment. I would like to see it stabilize first but this looks like a pretty good odds trade to execute some time in August, below $2.25. The question is, ...How low can it go? My advice, keep an eye on it...

The above are only my opinions and are not a trading advice. This is just something to get you thinking... an idea, THAT'S ALL! I am not responsible nor liable for any financial losses you may incur following my ideas. Also know that leveraged ETFs such as UGAZ carry additional risks. READ the prospectus! Do your own analysis and due diligence PLEASE!

Good luck to all!

THE WEEK AHEAD: AAPL, GILD, X, BIDU; GDXJ, /NGEARNINGS

On initial screen for high rank/high implied, here are next week's potential winners for earnings-related volatility contraction plays: AAPL (31/27) (Tuesday after market close), X (52/54) (Thursday after market close), GILD (30/27) (Tuesday after market close), and BIDU (50/41) (Tuesday, but unspecified as to before or after market close). Because background implied on both AAPL and GILD are <50% (not what I like to see to play an earnings-related volatility contraction), those are cut from the list, leaving X and BIDU.

Pictured here is a tight short strangle in the September cycle paying 1.11/.56 at 50 max as of Friday close, with break evens at 12.89/18.11, and delta/theta metrics of 2.59/1.74. You can naturally go full on short straddle, but giving the setup some room between the put and call will give you the ability to adjust the strikes intra-trade without going inverted to do so, as you might have to if you went with the September 20th 15 short straddle, which is paying 2.29/.57 at 25 max with break evens at 12.71/17.29, and has delta/theta metrics of -10.62/1.99.

The rather unfortunate thing about BIDU is it's an ADR, so the precise announcement date and time is always up in the air until the last moment. That being said, the Sept 20th 95/100/130/135 iron condor is paying 1.46 at the mid (.73 at 50 max), has break evens at 98.54/131.46, and has -.17/1.82 delta/theta metrics. Naturally, I'd ordinarily like to collect one-third the width of the wings in credit, but it's hard to see what that will actually pay with markets showing wide in off hours.

BROAD MARKET

IWM (11/15)

EEM (7/16)

QQQ (6/15)

SPY (6/12)

EFA 0/11

VIX 12.16

Because of low implied in "local expiries" (<45 days 'til expiry or less), I've been going out a little farther in time than usual, taking advantage of implied volatility term structure,* which currently slopes from longer-dated expiries into this current state of affairs, (See RUT Iron Condor Trade, below), with the small added bonus being that longer-dated expiry implied volatility tends to expand less relative to shorter-dated implied volatility in the event of a "local" volatility pop, which is the usual concern with selling premium in low volatility environments. Naturally, I'm not going all crazy with these longer-dated setups, but staying small and keeping powder dry for more favorable volatility metrics in shorter duration expiries.

SECTOR EXCHANGE-TRADED FUNDS

Top Funds By Rank: GDXJ (78/35), GDX (53/29), SLV (48/20), GLD (39/12), TLT (25/10), SMH (25/24), USO (23/32), XOP (20/30).

GDXJ continues to have ideal exchange-traded fund metrics of >70 rank, greater than 35 implied for premium selling ... .

IRA TRADES

I pulled the trigger on a couple of "not a penny mores" last week in XLP and XLU. Suffice it to say, I did not get stellar credit collection/cost basis reduction for these, since we're far away from the prices at which I want to acquire, but will look to roll out on weakness and/or in increased volatility. It's either stick something out there and get paid to wait or wait for lower and get paid nothing ... .

HONORABLE MENTIONS

/NG, UNG: Natural gas is around 52-week lows here. Generally, I look for a seasonality play where "peak injection" has historically set up, but it's generally a crap shoot as to where that will occur (that pesky Mother Nature), and it's usually later in the year. I'm watching it, but won't get particularly excited to enter something bullish until we break 2.00. Ideally, I'm looking to get in at around that 2016 low ... .

* -- You can see this in RUT, with August implied at 15.3%, September at 16.1%, October at 16.7%, and December at 17.6%.

Natural Gas: Higher sell opportunity on the medium term.NG is trading within a steady Channel Down on 1W since February (RSI = 36.221, MACD = -0.203, Highs/Lows = -0.1685) with the price currently consolidating after making a Lower Low near 2.160. Based on the 1D RSI pattern, Natural Gas should now seek a higher level near 53.00 for rejection which inside the Channel Down will be in the form of a Lower High.

The expected horizon is around 65 days since the last Lower High. If it tests and gets rejected again on the MA50, then we will have an even stronger bearish reversal confirmation. The next Lower Low is projected in roughly 55 days after the last one. Under these circumstances we are going short with TP = 2.000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

"Top and Bottom Analysis" NATGAS by ThinkingAntsOk4H CHART EXPLANATION:

Main Items we Observe on the Chart:

-Price is inside an ascending channel

-Currently, the price is against a Major Support zone

and facing the lower trendline of the ascending channel

-We draw a descending trendline, we expect that to be broken before taking any long setup.

Based on this if price closes above 2.597 we expect a continuation of the bullish movement towards the upper trendline of the ascending channel at 2.723

MULTI TIMEFRAME VISION:

- Weekly:

-Daily: