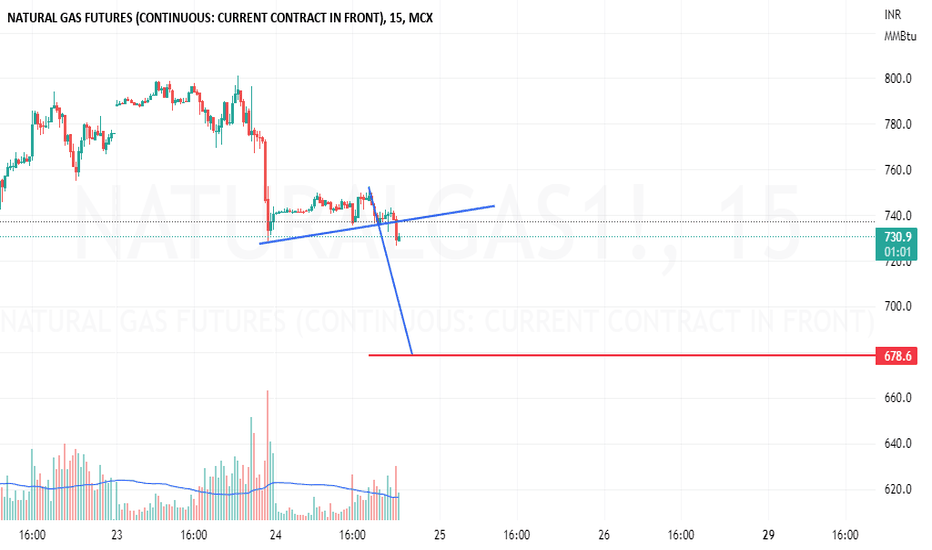

Natural Gas (NATGASUSD): Confirmed Breakout 💨

Last week, I shared with you a head and shoulders pattern formation

that I spotted on Natural Gas on a daily time frame.

The price has successfully closed below its neckline.

The price is currently heading towards 6.175.

Bias remains very bearish.

If you missed the entry, consider an occasional retest of a broken neckline.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Ng1!f

The head and shoulder pattern means only one thingNatural Gas behave erratically and its extremely chaotic. It likes to give you the assurance that you are in control while sneaking and stealing your money away. It shows a head and shoulder patter, an even double top pattern. All the technical markings are showing one thing, NG! is ready to reverse it's price action.

But when it's clear, too clear should you believe NG! I wouldn't. Technical analysis says NG should reach $5 but my gut feeling says it will try to rip you off one last time. I would expect the great crash around next January. Not now.

But if it happens now, make sure to stock up some for really good long positions during the winter.

Natural gas: head and shoulders top pattern; $5 in sight?US natural gas prices have formed a head and shoulders top pattern, which may signal a weakening of the current major bullish trend and a subsequent reversal into a bearish one.

The left shoulder coincided with the relative highs at the end of July at $9.30/MMbtu, a level that was then followed by a pullback to $7.53 (August 8) prior to the beginning of a new rally toward the head at nearly $10.

The right shoulder was formed by the decline from $9.97 to $7.80, followed by a brief rebound at $9.22 and another decline to the current $7.86.

Although a brief breakdown was seen in the September 19 session, natural gas is now testing the neckline of the head and shoulders pattern. If confirmed, we could see a return to the level of $5.30, which were hit in early July 2022.

Additional bearish technical signals for the price of US natural gas include the MACD oscillator dipping below the zero line and the RSI slightly pointing south.

Idea written by Piero Cingari, forex and commodity analyst at Capital.com

Natural Gas (NATGASUSD): Technical Outlook 💨

Natural Gas formed a huge head and shoulders pattern on a daily time frame.

7.33 - 7.88 is its wide horizontal neckline.

If the price breaks and closes below the neckline, it will be a very strong bearish signal.

I believe that then the market can easily drop to 6.17 level.

Remember, that for now, a neckline represents a strong demand area.

Consider shorting only after its breakout.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

Energy Natural gas idea (15/09/2022)Natural gas during the day.

The correction in wave 2 may be over, as the rise in the third wave has already started, and it may target a new level above 10.01, but this rise depends on trading remaining above the bottom of 7.532 as well, if trading remains above the bottom of 7.761, we may see an increase in prices.

💶 EUR; Lowest Rate in 19 Years ( Risk of Energy Crisis )🆖As the risks of an energy crisis increase, the euro is nearing its lowest level in 19 years

Today, the price of natural gas has increased by 9%, and the price of electricity for one year in Germany is 14 times higher than the level of one year ago. The numbers are crippling for heavy industries, with Germany's DAX down 2.3 percent today, the steepest drop in the global index.

The euro has strengthened over the past six weeks as the US dollar weakened against a less accommodative Federal Reserve, but that rally appears to have come to an end. Meanwhile, Europe's economic outlook is rapidly deteriorating. The EUR/USD low was at0.9952 in July and is now about 20 pips away. If this rate breaks, the euro will hit its lowest level since late 2002.What is surprising is that the people of Europe have not yet realized how bad the economic situation will be. There is a lag in energy price increases that has not yet been felt and depends on different countries and contract structures, but there is a lot of difficulty ahead.

✌️ Good luck with your trading and investing and remember: Trade smart…OR JUST DON’T TRADE!

--------------------------------------------------------------------------------------------------------------------

👉This analysis is my personal opinion ,not a financial advice ,so do your own research.

💚 if you're fan of my analyses please follow me , give a big thumbs 👍 OR drop a comment 🗯

EUR/USD analysis: US-EU natural gas gap narrowsRecent moves in the EUR/USD exchange rate have been driven primarily by the price differential between natural gas in the United States and Europe, rather than by the ECB's historic rate hike last week.

Over the last 90 days, the correlation coefficient between EUR/USD and US-EU gas price differentials is 0.88, indicating a very strong relationship between the two variables.

The price of gas in Europe has decreased drastically over the course of the past week, with the Dutch TTF benchmark falling by nearly 40% from its highs of €330/Mwh to its current level of €190/Mwh. This was aided by higher-than-expected EU gas storage levels at this time of year, as well as speculation in Europe about a natural gas price cap.

When measured in dollars per million British thermal units ($/MMbtu), the European Dutch TTF is around $61/MMbtu right now, or about $53 more expensive than the US Henry Hub gas price, but significantly lower than the previous price-gap peak of $92/MMbtu.

The narrowing Henry Hub-TTF price spread from $92/MMbtu to $53/MMbtu has helped the EUR/USD rally from 0.987 to 1.011.

What next can we expect?

This week, European nations are expected to announce long-awaited energy emergency measures aimed at lowering skyrocketing gas prices and alleviating the pressures associated with a complete Russian gas shutdown.

If the market sees the announcements about energy policy as bad news for European gas prices (Dutch TTF), the spread between European and US gas prices may continue to narrow, which would sustain the euro in the short term.

However, despite the fact that the price difference between European Dutch TTF and US Henry Hub gas has narrowed, European gas is still nearly eight times more expensive than US gas. This continues to be a significant drag on the European growth outlook, thus capping the euro's upside potential in the medium term.

Idea written by Piero Cingari, forex and commodity analyst at Capital.com

Natural Gas | European Natural Gas Pipeline Closed IndefinitelyGazprom, the russian state-owned energy giant, cut indefinitely the flow of natural gas through the Nord Stream 1 pipeline into Germany citing an oil spill in a turbine.

This looks like the weaponization of energy flows by the russian authorities.

Russia will not restart gas supplies to Europe until western sanctions are lifted, official said.

My chart scenario is a triple top formation with short term price target for Natural Gas of $9.5.

Looking forward to read your opinion about it.

Jamie Gun2Head Trade - Buying Natural GasTrade Idea: Buying Natural Gas

Reasoning: Buying natural gas at a support level, currently in a strong uptrend

Entry Level: 8.909

Take Profit Level: 9.980

Stop Loss: 8.620

Risk/Reward: 3.71:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

NG1!9. 1. 22 Natural Gas I went through a lot of structural things and reversal patterns, and some less obvious observations. You need to look at Natural Gas trading higher, and this is something you see on the higher time frames. It may go lower. You want to think like a buyer and the seller... and then you're less likely to be blindsided. I discuss some of this strategy as well.

NATURAL GAS - 240 MINS CHARTThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: its my view only and its for educational purpose only. only who has got knowledge in this strategy will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. we anticipate and get into only big bullish or bearish moves (Impulsive moves).

Just ride the bullish or bearish impulsive move. Learn & Know the Complete Market Cycle.

buy low and sell high concept. buy at cheaper price and sell at expensive price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

Natural gas and oil could signal capitulation.I’ve been searching for interesting patterns with critical commodities in bear markets. I noticed something interesting. Oil and gas seem to pump before and during the early stages of bear markets. When the largest and most demoralizing drop happens, Oil and gas seem to lead the way. Their previous pump is erased and the market goes with it. Good luck all!

NG shows weakness and lost momentum !!NG was very bullish at the start of 2022. This massive Uptrend stopped in June and led to a correction at the 0.618 Fib line.

After that, NG returns to the same old high, respecting the trend line and forming a significant Resistance.

the RSI is showing a considerable divergence as the second high lost momentum to continue pushing higher.

A break of the trend line in the next weeks will signal a huge short opportunity as the price may reach the 0.236 Fib line and if it breaks through the 0.382-Fib line as the second potential target.

Natural Gas (NATGASUSD): Waiting For Breakout 💨

A lot of questions about Natural Gas:

The price is currently coiling around 8.8 - 9.65 resistance.

I am patiently waiting for its bullish breakout.

I believe that a weekly candle close above that structure will trigger a strong trend following move.

Only after the confirmed breakout, I will consider buying.

For now, be patient.

The market may be stuck around the underlined levels for a long time.

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️