NATGAS Massive Short! SELL!

My dear subscribers,

My technical analysis for NATGAS is below:

The price is coiling around a solid key level - 4.257

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.892

My Stop Loss -4.468

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

———————————

WISH YOU ALL LUCK

Ng1

NATGAS: Short Trade with Entry/SL/TP

NATGAS

- Classic bearish setup

- Our team expects bearish continuation

SUGGESTED TRADE:

Swing Trade

Short NATGAS

Entry Point - 4.257

Stop Loss - 4.470

Take Profit - 3.881

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

NG1! SELLERS WILL DOMINATE THE MARKET|SHORT

Hello, Friends!

NG1! pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 3.535 area.

✅LIKE AND COMMENT MY IDEAS✅

NATGAS What Next? SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 3.726

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.366

Safe Stop Loss - 3.935

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

NATGAS: Bearish Continuation & Short Signal

NATGAS

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short NATGAS

Entry - 3.726

Sl - 3.886

Tp - 3.421

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

Natural Gas Short: Testing the $4 Barrier – Opportunity Knocks!Natural Gas (XNG/USD) has spiked to revisit the $4 price zone, activating my short trade. This marks the second time in two years that the price has reached this significant resistance area. The $4 level is pivotal, serving as a key psychological barrier and a historic zone of strong price action. With the position now live, I am leveraging the resistance for a retracement opportunity.

Fundamentals:

• Weather and Seasonal Demand: Short-term spikes in demand are driven by cold weather in the U.S., but with futures traders starting to focus on spring, we may see waning bullish momentum in the coming weeks.

• Russian Gas Supply Constraints: Limited Russian gas flows to the EU continue to add uncertainty to the market, but the current rally seems to be pricing in short-term factors rather than long-term structural changes.

• Historical Levels: The $4 spot price has attracted significant attention as a resistance zone, with $3.40 acting as a key support in recent months. The bounce from this level earlier this year highlights its importance.

• Market Behavior: Futures traders’ sentiment and seasonality are critical drivers. As winter progresses, reduced speculative demand may favor a bearish pullback.

Technicals:

• Entry: $4.00 (Resistance Zone)

• Target: $2.60 - 2.70

• Partials: From $3,19

• Stop Loss: $4.40 (Above Recent Highs)

• Timeframe: 12H

This short trade aligns with technical, fundamental, and seasonal narratives. As the price has shown rejection at this zone, I will actively monitor for a breakdown toward the $3.40 level while managing risk prudently. Stay disciplined, follow your trading plan, and remember to pay yourself as the market unfolds.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

NATGAS Massive Long! BUY!

My dear friends,

My technical analysis for NATGAS is below:

The market is trading on 3.072 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.428

Recommended Stop Loss - 2.914

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

———————————

WISH YOU ALL LUCK

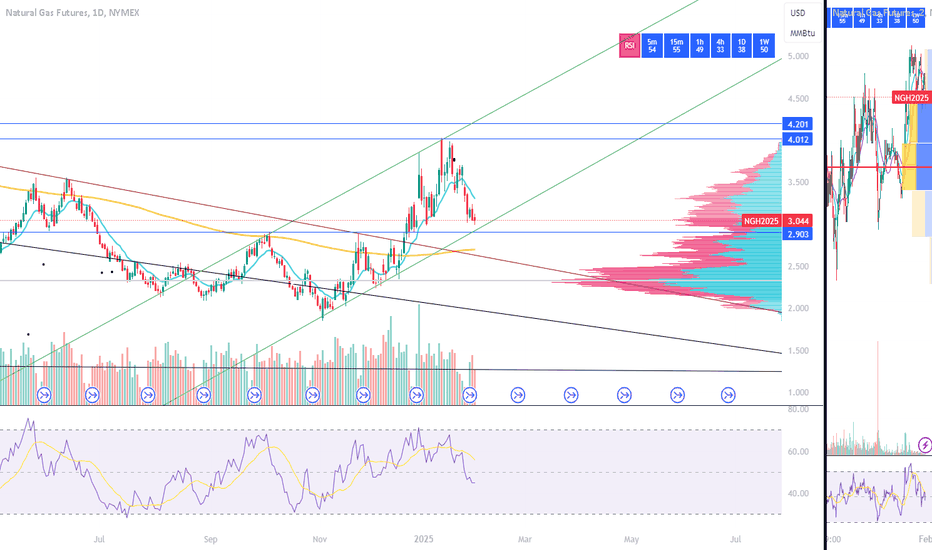

NATURAL GAS: Channel Down bottomed and is rebounding to 4.800Natural Gas is neutral on its 1D technical outlook (RSI = 47.119, MACD = -0.072, ADX = 39.523) as the bearish wave of the long term Channel Up found support on its bottom and the 1D MA100 and is rebounding. It hasn't yet crossed over the 1D MA50 but when it does the bullish signal will be validated. On any occassion, last time the 1D RSI rebounded near this level, it was on the October 18th and August 27th 2024 lows. Both later rebounded by at least +60.48%. We aim for a similar target (TP = 4.800).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

NATGAS: Trading Signal From Our Team

NATGAS

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long NATGAS

Entry Point - 3.072

Stop Loss - 2.846

Take Profit - 3.554

Our Risk - 1%

Start protection of your profits from lower levels

❤️ Please, support our work with like & comment! ❤️

NATGAS Swing Long! Buy!

Hello,Traders!

NATGAS has lost almost

30% from the local highs

In no time so It is oversold

And as the Gas is about to

Retest the horizontal support

Of 2.948$ we will be expecting

A local bullish rebound

And a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

NATGAS Buyers In Panic! SELL!

My dear friends,

Please, find my technical outlook for NATGAS below:

The price is coiling around a solid key level - 4.010

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3.872

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

NATGAS A Fall Expected! SELL!

My dear followers,

I analysed this chart on NATGAS and concluded the following:

The market is trading on 3.981 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 3.750

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

———————————

WISH YOU ALL LUCK

NATGAS Rising Support Ahead! Buy!

Hello,Traders!

NATGAS is trading in a

Rising opening wedge pattern

And the price will soon

Retest the rising support

Below so we are bullish

Biased and we will be

Expecting a move up

From the support line

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

NATGAS Technical Analysis! BUY!

My dear friends,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 3.916 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 4.025

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

NATURAL GAS Long-term buy on the next pull-back.Natural Gas (NG1!) broke this month above its 1W MA200 (orange trend-line) for the first time in two years (last January 2023). Naturally this is a very bullish signal for the long-term and it is more effectively put into context by using our infamous 'Multi-year Cycles', which we introduced on Natural Gas a few years back.

As you can see, every time NG broke above the 1W MA200 after a Support Zone rebound since 1990, it pulled back towards the 1W MA50 (blue trend-line) before resuming the uptrend for a new High.

As a result, we will wait for that right pull-back opportunity to buy and target at least 6.000, which should be achieved by December 2026, which is the Top of the Sine Waves Cycle.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇