Japanese Yield Surged to Record High 3.2% - Nikkei OutlookAre Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major exporters (like Toyota, Sony, and Panasonic), as their overseas earnings convert into higher yen profits.

But what’s the downside? - Inflation

Yes, they wanted inflation, below 2% yoy will be ideal, but not at this rate of growth at 3.5%.

Another key reason for the stock rally starting in 2020 was that, just like the U.S., the Bank of Japan (BOJ) unleashed massive monetary stimulus, flooding markets with liquidity during the pandemic.

Although the yen has fallen sharply, it seems to have stalled since 2024, that was when the BOJ started raising interest rates from –0.1% to the current +0.5%.

With inflation continuing to rise, the BOJ will likely maintain a hawkish stance on interest rates.

This could cause the yen to strengthen or push USD/JPY lower.

I am also observing a potential head and shoulders formation on the USD/JPY. And if the yen strengthens, this may cause the Japanese stocks to meet its road block.

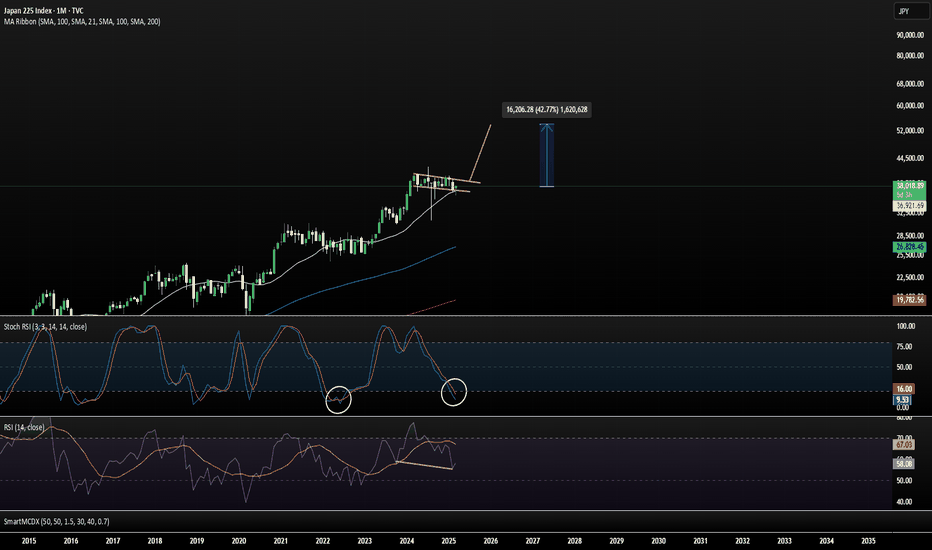

Nikkei 225 performance since the post WWII to its roaring 80s, to its collapsed, and now rebounded.

Even though prices have breached the 80s level in 2023, it could represent a false breakout, as prices continue to fall back below that historic resistance the last 2 years.

My assessment: The Japanese stocks are still testing their 80s high — a major psychological level.

With money printing, the yen weakened; and a weaker currency fueled inflation.

With inflation, yields and interest rates rise, borrowing costs are increasing across the different tenures — and that’s not good news for stocks.

The 30-year yield is now at around 3% — a level surpassing the deflationary years and that’s something most Japanese would not have imagined just a few years ago.

With a raising interest rate and a stronger yen, let’s see how this will impact the Nikkei 225.

Since the BOJ began raising interest rates at the beginning of 2024, the market has literally stalled within a wide 10,000-point range.

And there is a key support level at 30,000, we can see it was a resistance in the past.

Currently, the BOJ is trying their best in managing the yen and inflation very carefully, to maintain financial system stability. Based on this sentiment, I believe the market will likely continue moving within this wide range — though it may gradually narrow over time.

Make sure to keep monitoring the direction of the Japanese yen, yields, and inflation.

If the yen strengthens too quickly, or if yields and inflation rise too sharply, it could push the market to break below this range and start trending downward.

And if it is all well, market will likely to continue its upward momentum.

Another key factor I am watching closely is tariffs.

The direction of the Japanese stock markets will also be influence by the tariff agreements ultimately with US, and as well as how quickly they can forge potential trading partnerships and alliances — just like other nations, they are racing against time.

Micro Nikkei Futures

Ticker: MNI

Minimum fluctuation:

5.00 index points = ¥250

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

Japan 225

NIKKEI 1W forecast until end of July 2025Broadening wedge formation on the table - a lot of sideways movement within the range of 38,758 and 36,607

Upward momentum will last for a couple of weeks more. The most likely top is 38,758

Starting from second half of June 2025 we may see a start of correction strong, but healthy. Correction/rest bottom is expected in mid July at 37,075 and should not fall deeper than 36,607

Second half of July the index would probably try to climb up to 58,758 with doubtful success.

NI225: Local Bullish Bias! Long!

My dear friends,

Today we will analyse NI225 together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 37,966.80 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 38,197.40. Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

Japanese Markets: Still a Buy?Are Japanese markets still a buy after rising 170% since the pandemic, surpassing their roaring 1980s levels?

The reason why Japanese stocks have become some of the best-performing equities in Asia is largely due to the falling yen — a depreciation of around 60%. A weaker yen boosts Japan’s major exporters, as their overseas earnings convert into higher yen profits.

But what’s the downside? Inflation. (expand)

Yes, they wanted inflation, below 2% yoy will be ideal, but not at this rate of growth at 3.5%.

Micro Nikkei Futures

Ticker: MNI

Minimum fluctuation:

5.00 index points = ¥250

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

www.cmegroup.com

Nikkei H4 | Falling toward a multi-swing-low supportNikkei (JPN225) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 36,688.39 which is a multi-swing-low support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 35,300.00 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 38,831.79 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"JP225 / NIKKEI" Index CFD Market Heist Plan (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "JP225 / NIKKEI" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (37300) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 4H timeframe (35600) Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 39300 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💴💸"JP225 / NIKKEI" Index CFD Market Heist Plan (Day / Swing Trade) is currently experiencing a bullishness🐂.., driven by several key factors.👆👆👆

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis,Positioning and future trend targets with Overall Score...... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

NI225: Target Is Down! Short!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 37,160.17 will confirm the new direction downwards with the target being the next key level of 36,963.23 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NI225: Bulls Are Winning! Long!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break above the current local range around 37,753.72 will confirm the new direction upwards with the target being the next key level of 37,983.91 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

Are you shorting the bounce or waiting for confirmation?Japan’s Q1 GDP came in worse than expected: -0.2% QoQ (-0.7% annualized). Weak consumption, soft exports, and a fading external boost despite a weak yen isn't a great combo for Asia’s largest export economy.

The Nikkei 225 reacted immediately, and the H4 chart is starting to reflect deeper structural pressure.

🔍 Technical Outlook:

- Price reversed from the high of 38,745.

- Price is testing the 50 SMA and could enter the Ichimoku cloud.

- The cloud is signalling a twist, which could be a sign of momentum fading and the trend weakening or reversing.

📊 Projection:

If the price closes below the 50 SMA and breaks through the cloud, further downside could be expected, with the target levels at

- 36,800 (last consolidation zone), and

- 35,570 (38.2% fibonacci retracement level and 200 SMA).

Alternatively, if the bulls defend the cloud, we could see the price climb to the resistance level of 40,500

This is a classic macro meets technicals moment. A weak data print is lining up against the possibility of a technical rollover.

NI225 CORRECTION AHEAD|SHORT|

✅NIKKEI has been growing recently

And the index seems locally overbought

So as the pair is approaching a horizontal resistance of 38,216

Price decline is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NI225: Absolute Price Collapse Ahead! Short!

My dear friends,

Today we will analyse NI225 together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 37,503.33 will confirm the new direction downwards with the target being the next key level of 37,094.95 and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️

NI225: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse NI225 together☺️

The market is at an inflection zone and price has now reached an area around 36,830.69 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 36,249.62..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

Nikkei Futures (NKD/Nikkei 225) Inverse Cup and HandleNikkei futures have setup an inverse cup and handle on the daily. A somewhat rare pattern as most of them turn into double bottoms or sideways consolidation. Maximum downside target for the pattern is 21,000

- Global macro trends continue to worsen

- BOJ stuck between saving the Yen and helping the dollar

- Japan economic fundamentals may allow BOJ to allow inflation to run hot

- Possible US recession could spread around the world

- Yen carry trade still in play although most likely only blows up in catastrophic situation

- Japan has seen the benefit of US monetary and fiscal policy, Trump admin likely to try to pressure Japan into spending money on US goods such as food and weapons

Overall sentiment on NKD is that it has followed US markets especially the Nasdaq for some time. DXY moving up takes pressure off the Yen carry but could be a sign of now US firms taking profit on a very large run up in the past few weeks. Regardless of outcome, volatility is expected.

NI225: Strong Bearish Sentiment! Short!

My dear friends,

Today we will analyse NI225 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 35,720.94 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

NI225: Move Down Expected! Short!

My dear friends,

Today we will analyse NI225together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 34,730.28 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 34,106.69..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

NI225: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse NI225 together☺️

The market is at an inflection zone and price has now reached an area around 33.585.58 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 34.793.45.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

NIKKEI Long From A Massive Support! Buy!

Hello,Traders!

NIKKEI stock index has

Lost almost 27% from the ATH

Which means it is clearly oversold

And the index is about to retest

A massive horizontal support level

Of 30,000 which is a great spot

For going long on the index

And even if the support gets

Broken I would still hold the

Position expecting a rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

"Goooo...!!! Get to the safe-haven choppa!"And there we go... Market participants are in panic mode as tariff show kicks off. Everyone is trying to find a safe-haven like CHF and JPY. However, gold and silver are not the ones, where you need to be now.

Let's dig in!

TVC:GOLD

MARKETSCOM:USDCHF

MARKETSCOM:USDJPY

MARKETSCOM:JAPAN225

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

NIKKEI LONG FROM SUPPORT|

✅NIKKEI went down to retest a horizontal support of 35,250

Which makes me locally bullish biased

And I think that a move up

From the level is to be expected

Towards the target above at 36,093

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

short opportunity This is a very bearish chart. I missed to opened a short position so now I have to wait for the second chance.

I will open a short position if and when:

1. the price comes back up to fill the gap in the daily chart.

2. The price is going to roll back down at major fib level such as 0.618 and 0.5.

3. Momentum indicators in daily chart stay in the bear zone and roll down to the downside.

Japan225 to find buyers at market price?NIK225 - 24h expiry

Price action looks to be forming a bottom.

A Doji style candle has been posted from the base.

Short term bias is mildly bullish. Preferred trade is to buy on dips.

Weekly pivot is at 37485.

We look to Buy at 37485 (stop at 37131)

Our profit targets will be 38496 and 40675

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Nikkei price action forming a top?JP225USD -24h expiry

Price action looks to be forming a top.

The primary trend remains bearish.

Preferred trade is to sell into rallies.

The hourly chart technicals suggests further upside before the downtrend returns.

We therefore, prefer to fade into the rally with a tight stop in anticipation of a move back lower.

We look to Sell at 38270 (stop at 38679)

Our profit targets will be 37247 and 36790

Resistance: 38275 / 40675 / 42155

Support: 36790 / 35590 / 34390

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.