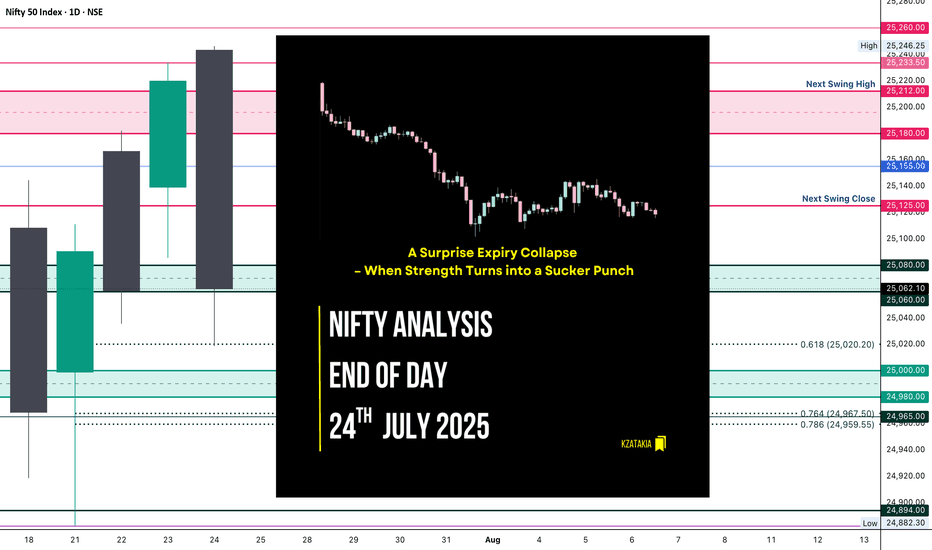

Nifty Analysis EOD – July 24, 2025 – Thursday 🟢 Nifty Analysis EOD – July 24, 2025 – Thursday 🔴

📉 A Surprise Expiry Collapse – When Strength Turns into a Sucker Punch

Today’s session was an unexpected twist.

Nifty opened above the previous day’s high, giving early hope to the bulls—but within the first hour, it slipped to 25,155 and formed its IB. What followed was a sharp 136-point fall, breaking not just yesterday’s low, but also the July 22nd low. This sudden bearish momentum was completely news-driven, and expiry-day long unwinding only added fuel to the fire.

Despite a strong close yesterday, today’s fall erased all of July 23rd’s gains and brought us right back to July 22nd’s close—neutralizing the recent upward effort.

The day closed at 25,062, marginally above key support. Technically, today’s low respected the 0.618 Fib retracement level drawn from July 21st’s low to July 23rd’s high—so a dead cat bounce is possible if no further bad news hits. But if we open below 25,050 tomorrow, expect more downside pressure toward 24,960–24,890 zones.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,243.30

High: 25,246.25

Low: 25,018.70

Close: 25,062.10

Change: −157.80 (−0.63%)

Candle Structure Analysis:

🔴 Body: Large red body (181.2 pts) shows strong intraday selling.

☁️ Upper Wick: Tiny (2.95 pts) → sellers dominated from the start.

🌊 Lower Wick: Moderate (43.4 pts) → small recovery near close.

Candle Type:

Almost a bearish Marubozu — clear domination by sellers with barely any upper shadow, signaling intense sell pressure.

Key Insight:

Bulls lost control after open.

Bears took charge below 25,155.

Close near support, but bias cautious.

Bulls must reclaim 25,150+ for recovery, else 25,000 may give way.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 185.97

IB Range: 83.55 → Medium

Market Structure: Balanced

Trades Triggered:

⏰ 10:05 AM – Short Entry → SL Hit

⏰ 11:10 AM – Short Entry → Target Hit (1:3.6 Risk:Reward)

📊 Support & Resistance Levels

Resistance Zones:

25,125

25,155

25,180 ~ 25,212

25,233

Support Zones:

25,080 ~ 25,060

25,020

25,000 ~ 24,980

24,967 ~ 24,959

24,882

🔮 What’s Next?

A gap-up or stable open may trigger a dead cat bounce toward 25,150–25,180.

A gap-down below 25,050 confirms bearish continuation → next targets: 24,960 / 24,890.

Watch price action around the 25,020–25,060 zone closely.

🧠 Final Thoughts

“Markets are never wrong – opinions often are.”

— Jesse Livermore

Today was a reminder of how expiry day surprises and news flows can flip the narrative. Stay flexible, and keep a bias—but not a blind one.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty50_price_targets

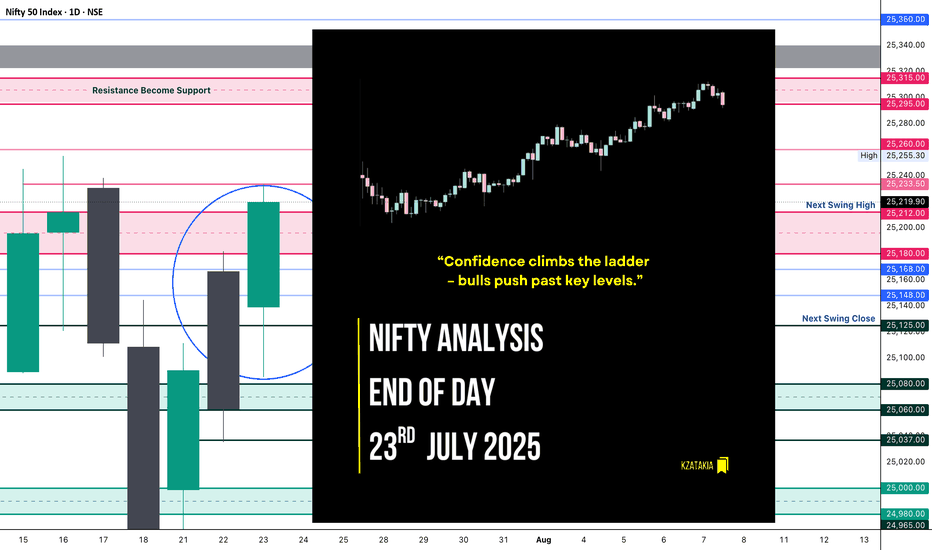

Nifty Analysis EOD – July 23, 2025 – Wednesday 🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

25,180 ~ 25,212

25,233

25,260

25,295 ~ 25,315

25,340 ~ 25,322 (Gap Zone)

Support Zones:

25,168

25,125

25,080 ~ 25,060

25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

RenderWithMe | Nifty 50-Forecast Upcoming Week July 7–11,2025

~~NIFTY 50 Analysis for Next Week (July 7–11, 2025)Current Market ContextRecent ~~

Performance: As of July 4, 2025, the NIFTY 50 closed at 25,461, Up 55 points from the previous session, The index has been trading within an ascending channel, with a weekly decline of -0.45% but a monthly gain of 3.67% and a yearly increase of 4.48%.

# Global Cues: Mixed signals from global markets are influencing sentiment. U.S. markets are hitting record highs, while Asian markets like Japan’s Nikkei 225 (+600 points) and Hong Kong’s Hang Seng (-0.42%) show varied trends. Rising oil prices and geopolitical concerns, along with expectations of new U.S. tariff announcements under the Trump policy roadmap, are creating caution.

# Domestic Factors: Strong institutional buying from Domestic Institutional Investors (DIIs) (net buyers of ₹3,036 crore) contrasts with Foreign Institutional Investors (FIIs) being net sellers (₹1,561 crore). This dynamic suggests domestic support but potential headwinds from foreign outflows.

~~ Technical Analysis ~~

Key Levels:Support: Immediate support lies at 25,000–25,150. A break below 25,000 could signal short-term weakness, with further support at 24,982 and 24,622.

Resistance: Resistance is seen at 25,650–25,750, with a strong barrier at 25,690–25,760. A breakout above 25,750 with volume confirmation could push the index toward 26,000 or higher (potentially 28,435).

Trend: The NIFTY is in a positive trend but showing signs of consolidation. Technical indicators like the Relative Strength Index (RSI) at 67.3 suggest upward momentum but caution as it nears overbought territory.

Chart Patterns: A "Cup and Handle" pattern is forming on the daily timeframe, indicating a bullish continuation if the index breaks above 25,655. However, a failure to sustain above 25,400 could lead to a pullback toward 25,320–25,000.

Moving Averages: The index remains above key moving averages (5 DMA: 24,908.6, 10 DMA: 24,934.2, 20 DMA: 24,862.07), reinforcing a bullish bias as long as it holds above 25,338 (daily closing stop-loss).

Sectoral OutlookPositive Sectors: Nifty Metal (+0.23%) and Nifty Pharma (+0.30%) showed gains, suggesting resilience. Banking remains strong, with Bank Nifty hitting a new high of 57,614.50 despite recent profit booking.

Weak Sectors: Nifty IT (-0.01%) and Nifty Financial Services (-0.47%) faced selling pressure, with key constituents like Kotak Bank (-1.96%) and Bajaj Finance (-1.39%) dragging performance.

Focus Areas: Watch banking and pharma for potential leadership, while IT and financials may remain subdued unless buying interest returns.

Key Factors to WatchGlobal Markets: U.S. and Asian market trends, particularly U.S. tariff policies and Federal Reserve rate cut expectations, will influence sentiment.

Macroeconomic Data: Domestic indicators like inflation, GDP revisions, or RBI policy updates could sway the market.

FII/DII Activity: Continued DII buying could offset FII selling, but a reversal in FII flows will be critical for sustained upside.

Geopolitical Risks: Rising oil prices and U.S.–India trade developments may create volatility.

Technical Breakouts: Monitor for a breakout above 25,750 or a breakdown below 25,000 to confirm the next directional move.

Trading StrategyBullish Case: If NIFTY sustains above 25,650, consider buying call options or index futures targeting 25,760–26,000. Use a stop-loss at 25,000.

Bearish Case: If NIFTY falls below 25,000, short positions or put options could target 24,982–24,622, with a stop-loss at 25,450.

Range-Bound: If the index trades between 25,450–25,750, adopt a neutral strategy like selling iron condors to capitalize on low volatility.

Risk Management: Use strict stop-losses and avoid over-leveraging, as volatility is expected due to global and domestic triggers.

Forecast for the WeekExpected Range: 25,000–25,750, with potential for a breakout toward 26,000 if resistance is cleared.

Bias: Sideways to moderately bullish, with risks of profit booking or volatility mid-week.

Probability:Bullish breakout (above 25,750): 40%

Consolidation (25,000–25,750): 50%

Bearish pullback (below 25,000): 10%

Long-Term Outlook (July 2025)Predictions suggest NIFTY could reach 26,055–26,484 by August, with a gradual climb to 28,400 by November 2025, driven by economic growth and sectoral strength. However, these are speculative and depend on sustained bullish momentum.

Disclaimer --

This analysis is based on recent technical data and market sentiment from web sources. It is for informational purposes only and not financial advice. Trading involves high risks, and past performance does not guarantee future results. Always conduct your own research or consult a SEBI-registered advisor before trading.

#Boost and comment will be highly appreciated

$NIFTY : Tested 22000 fib retracement. RSI Oversold. Long $NIFTYIn 2024 the light bearer of the developing markets was India and its index $NIFTY. It closely beat the S&P 500 in 2024. But 2025 has not been good for $NIFTY. The rotation trade sell India and buy Chinna by the large institutional investors has put immense pressure on the Indian indexes. The index almost fell into the bear market by collapsing close to 20%.

If you have been watching my blog space I made a case in point on 22 Feb 2025 that there is still some downside left in the chart. Since then, we have fallen another 2 % and sitting just at the bottom of the Upward sloping Fib Retracement channel drawn by joining the potential tops of the NSE:NIFTY weekly chart. The chart pattern on 22 Feb 2025 clearly indicated that we can touch the lows around 22000. We touched the lows of 22032 on 28 Feb 2025. Since the we have gained some lost ground.

Final verdict: Possible retest the 22000 levels and then go long from there on $NIFTY.

Nifty Analysis: Potential Final Low and Key Reversal ZonesNifty Analysis: Potential Final Low and Key Reversal Zones

Pattern & Wave Structure

=====================

1. The market appears to be in the late stages of a higher-degree Wave (4) correction in a classical A‑B‑C formation.

2. Based on current wave counts, the 17th February low could mark the completion of Wave C (and thus Wave (4)).

3. If the price undercuts that low again, the 25th Feb–6th March window stands out as another high‑probability reversal zone.

Price & Time Analysis

================

1. Fibonacci Retracements near the 23,400–22,550 region align with typical corrective targets (0.382 and 0.5 retracements).

2. Several cycle durations (High‑High, Low‑Low, etc.) also converge in the late Feb to early March window, suggesting that if the 17th Feb low fails, price is likely to pivot within this narrow time band.

Momentum Across Multiple Time Frames

==============================

1. Daily (8‑ & 13‑period Stoch RSI): Just triggered a bullish reversal signal, indicating a near‑term upside bias.

2. Weekly Stoch RSI: Currently in a bearish phase but could shift higher if price stabilizes or rallies from current levels.

3. Monthly Momentum: Deep in oversold territory, suggesting the market is nearing a major inflection point (downside risk appears more limited).

Overall Outlook

===========

With three time frames hinting that bearish momentum is losing steam—and a clear confluence of Fibonacci targets and time cycles—downside appears limited if not already exhausted.

A decisive push above recent swing highs would strengthen the case that the 17th Feb low was a significant bottom.

Conversely, a brief extension lower into late Feb–early March could still offer a strong rebound if support is confirmed in that zone.

Conclusion

=========

The interplay of price levels, time cycles, and momentum indicators points to a potential final leg of the correction nearing completion. If 17th Feb was not the turning point, then the upcoming 25th Feb–6th March window may serve as an important inflection date for Nifty. Keep an eye on key Fibonacci support zones and the evolving Stoch RSI signals for confirmation of a sustained upside move.

#nifty50 analysis for upcoming week 18-22nd Nov 2024Nifty Takes a Beating: A Deep Dive

Last week, the Nifty 50 index experienced a significant downturn, closing at 23,532, a 600-point drop from the previous week's high of 24,336. The index breached the crucial support level of 23,550, dipping as low as 23,484. Currently hovering near its 50-week exponential moving average (50WEMA) at 23,230, the Nifty is expected to consolidate within a range of 23,100 to 24,000 in the coming week. Wednesday our markets will be closed due to Maharashtra elections so volatility will be high.

As previously highlighted, the monthly chart has weakened, and its impact is already evident. A further correction seems likely before a sustainable bottom is formed. A breach of the 23,250 support level could trigger a deeper correction of 7-7.5%, potentially taking the index down to 21,555. To resume its upward trajectory, the Nifty needs to convincingly close above 24,500 on consecutive days.

The S&P 500 also faced rejection from a critical Fibonacci level of 6,013, resulting in a 2.7% correction to 5,870. A breach of this week's low of 5,853 could lead to an additional 1.2% decline to 5,783. Such a move could intensify selling pressure in global markets, including India.

#Nifty50 outlook for upcoming week 21-25th Oct 2024The Nifty 50 index concluded the week at 24,854, a 110-point decline from the previous week's close. Despite hitting a high of 25,212 and a low of 24,567, the index remained within its expected trading range of 25,550 to 24,350. Looking ahead, I anticipate the Nifty to continue trading between 25,400 and 24,300.

A breakdown below 24,486 , the WEMA21 support level, would signal a bearish trend, potentially leading to a decline towards 23,400 or 23,300 . Conversely, a sustained move above 25,144 could pave the way for a rally to 25,500-25,600.

Meanwhile, the S&P 500 index achieved a new all-time high weekly close of 5,864, up approximately 40 points from the previous week. This suggests a potential upward move of 2-2.5% from its current level, targeting the significant Fibonacci level of 6,013. It remains to be seen if this positive momentum in the U.S. market will translate into a recovery for the Indian stock market."

#nifty50 outlook for upcoming week 14th-18th Oct 2024The Nifty 50 closed the week at 24,964, a 50-point decline from the previous week. While it touched a high of 25,234, it also dipped to a low of 24,694. As predicted last week, the index remained within the range of 25,600 to 24,400.

Looking Ahead: A Cautious Outlook

For the upcoming week, I anticipate a trading range of 25,550 to 24,350. However, the low of 24,694 is a crucial support level. If the Nifty breaches this, the next strong support lies at 24,400-24,350. A breakdown below this level could signal a potential decline towards 23,300.

A Bullish Monthly Perspective

Despite the recent volatility, my monthly outlook for the Nifty remains bullish. Therefore, I will follow a "buy on dips" strategy.

S&P 500: A Positive Sign

As mentioned previously, the S&P 500 has successfully reached its first Fibonacci target of 5820. To initiate the next leg of its upward movement, it needs to sustain above this level. If it can do so, we could see it touch 5899 or even 6012 (a significant level). This positive momentum in the U.S. market could also provide support to Indian equities.

#nifty50 analysis for upcoming week 23-27th Sept 2024The #Nifty50 soared to a new all-time weekly high of 25,791, gaining a remarkable 430 points from the previous week's close. It reached a peak of 25,849 and a low of 25,285. As predicted, the Nifty has been trading within the 25,810-24,750 range. For the upcoming week, I anticipate a trading range of 26,400-25,200 . A breach of these levels could ignite significant market volatility.

As highlighted last week, the strong Fibonacci level of 25,810 is crucial. If the Nifty closes above this level next week, be prepared for a potential rally towards the next magical level of 26,990 or 27,000. Although reaching these levels may take some time, it's essential to be positioned for such a move.

Meanwhile, the S&P 500 finally broke through the strong resistance of 5,637, thanks to the Federal Reserve's rate cut. If it can maintain above this week's high of 5,733, we could see further gains towards resistance levels of 5,800, 6,000, or even 6,140. Since the S&P 500 has surpassed a significant Fibonacci level, it's poised to potentially reach another strong Fibonacci level of 6,959, which is 20% higher than current levels. Such a move would likely propel the Nifty towards 27,000.

A breakdown below this week's low of 5,604 would indicate a failed breakout and could lead to a test of support levels at 5,445 or 5,432. Exciting times are ahead!"

Nifty 50 Index (NSE: NIFTY) AnalysisBased on the daily chart for the Nifty 50 Index (NSE: NIFTY), here is the summary and analysis:

Key Levels:

- Current Price: 22,488.65

- 50% Retracement Level: 22,458.10

- 61.8% Retracement Level: 22,324.60

- Target Price: 23,600

Chart Analysis:

1. Upward Trend: The chart shows an overall upward trend, with the index making higher highs and higher lows.

2. Retracement: The index is currently in a retracement phase, falling from its recent high of 22,705.75. The price has retraced to the 50% Fibonacci retracement level and is approaching the 61.8% level.

3. Support Zone: The blue shaded area represents a significant support zone between the 50% and 61.8% retracement levels. This zone could provide strong support and potential for a rebound.

Potential Scenarios:

1. Bullish Scenario:

- If the index finds support at the 50% or 61.8% retracement levels and rebounds, it could continue its upward trend towards the target price of 23,600.

- Confirmation of a bullish trend would come with a strong bounce from the support zone and a move back above the previous high of 22,705.75.

2. Bearish Scenario:

- If the index breaks below the 61.8% retracement level, it could indicate a deeper correction.

- A break below this level could lead to further downside, possibly testing lower support levels not shown in the current chart.

Trading Strategy:

1. Watch for Support: Monitor the price action closely around the 50% and 61.8% retracement levels. Look for signs of a reversal or strong buying interest in this zone.

2. Buy Position: Consider entering a long position if the index shows a strong bounce from the support zone with increasing volume and bullish candlestick patterns.

3. Stop-Loss: Place a stop-loss slightly below the 61.8% retracement level to manage risk in case of a further decline.

4. Target: Aim for the target price of 23,600 for the long position.

Conclusion:

- The Nifty 50 Index is currently in a retracement phase within an overall uptrend. The 50% and 61.8% retracement levels are critical support zones to watch. A strong rebound from this zone could lead to a continuation of the upward trend towards the target of 23,600. Conversely, a break below the 61.8% level could signal further downside. Monitoring the price action and volume around these key levels will be crucial for making informed trading decisions.

NIFTY Prediction Levels, Whats Next?Here is an interesting chart of NIFTY in 15 min time frame.

I am currently in a nice profitable SHORT position. However, markets are very unpredictable around the election results, so I may lose all profits thats currently unrealized. I am willing to take that risk after coming from a 1300+ points BankNifty points gain and 600+ nifty points gain.

Let's see the firework thats gonna start soon in the market.

Disclaimer: Because election results are very near, please be careful with your position sizing.

All the best.

NIFTY 50 Analysis For Feb 23rd!Hello Traders,

Here is a Brief Overview About The Analysis of NIFTY 50 For Feb 23rd,

There Are Total of 3 Support Zones Which You Need To Look For And Same 2 Resistance Zones And To Be Mentioned One Grey Area And We Have 3 Imbalance Zones!

The Horizontal Lines From Volume To Volume And OI To OI Indicates The Market Range in Between For That Particular Day!

The Blue Arrow Path Showing The Direction of The NIFTY 50 For That Day.

Note : Those Levels Are For That Particular Day Only.

Please Note That The Only Purpose of The Information On This Page is Purely Educational.

We Are Not Registered with SEBI; Therefore, Before Making Any Financial Decisions OR Investing, Please Consult with A SEBI-Qualified Financial Advisor. We Don't Have Any Responsibility For Your Profits OR Losses.

I Would Welcome Your Participation And Support in the Form of Likes, Comments, And Follow us to Offer Some Encouragement.

Thank You.

Swastika InvestmartSWASTIKA INVESTMART

Growing stock brokerage firm Swastika Investmart, listed in Bombay Stock exchange, trading very cheap in comparison to its peers.

Swastika has an Earning Per Share of Rs22 , FV of 10 and is going to become a National Brand.

MUST BUY & Hold for 5 to 10 years time frame.

The stock price is expected to rally 10 times from current levels.

Nifty Levels for 20th June2023This is not a prediction! And never believe in any prediction either! Just My-Lines to watch if it's respected and PA have an edge will buy or Short. Trade your system, trade what you see!

Check my previous post to see how well the levels were respected and reacted. Always wait for a retest to validate the levels, if its crosses above or below