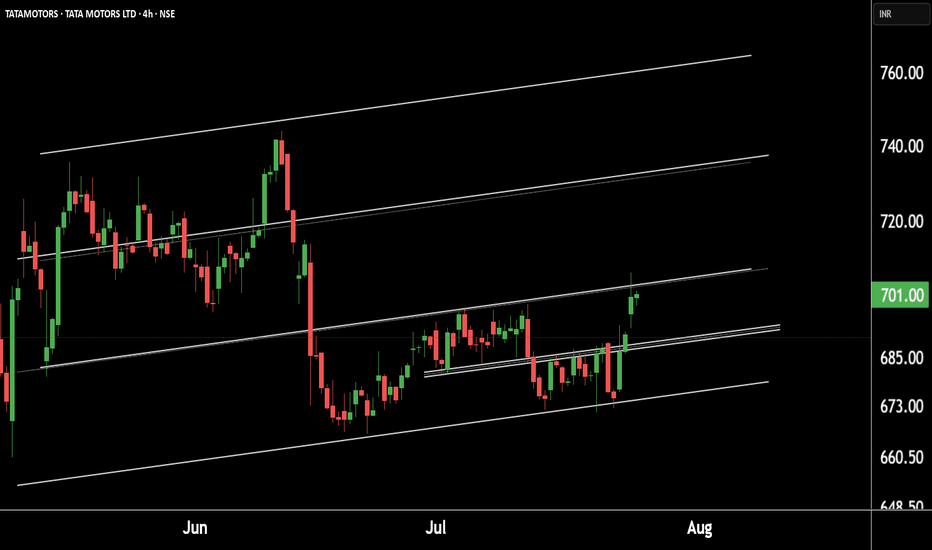

Tata Motors Gearing Up for a Fresh Rally! Technical Breakout !!This is the 4 hour chart of tata motor.

Tatamotor is moving in well defined parallel channel and bounced from it's supportt level near at 680, now ready for the breakout level at 705 .

If this level is sustain after the breakout then , we will see higher price in Tata motor.

Thank you !!

Niftyautosector

NiftyAuto Avoid new LongsNifty Auto appears to be at bad Risk/Reward ratio.

Relative Momentum Indicator is pointing to temporary peak.

Better to avoid fresh Longs.

Since there are sectors which are doing well, I would concentrate on them rather than trying to find short trades in Auto. Especially when the Nifty is looking bullish.

Subros @365 Bullish studiesSubros looks good on charts as it hasnt fell like other stock has been through.

has made fantastic bullish patterns which technical analyst like to learn and move through them

Positives

1. it has given breakout from price channel which is a bullish pattern.

2. Break out from Range - subros after giving BO from falling wedge remained in range and now it is able to sustain above the 340 odd levels.

3. 200 DMA - well placed above 200 day moving average. which is healthy and +ve sign as per technical analysis.

4. Double Bottom : it made double bottom near 275 indicates the bullishness in stock & even we can say rounding bottom type pattern from their.

5. leading indicator RSI above 50 another good sign.

6. another indicator MACD which shows direction is positive as well.

7. after drawing Fibo levels we can see 375 being a resistance above it 398 - 420 levels can be tested and 500 - 600 can be seen if it move above it.

These pattern suggesting initiate a buy call and even in dips as it moves like, can give fantastic returns. SL can be placed near 285- 300.

Disclaimer: not sebi registered the view is only for education purpose please ask advisor before investing.

NIFTY AUTO Trend AnalysisWorst scenario for those who are bullish thinking of potential Cup with Handle pattern formation on a broader outlook or reverse Head & Shoulder pattern on a narrower outlook.

If you look carefully, you can see the descending broadening wedge clearly as highlighted in my chart.

You can zoom out to see the broader view of my chart with all the drawings.

Technically this chart looks almost similar to the Ashok Leyland chart I have posted earlier this month.

TDI is at upper band with NIFTY AUTO nearing the resistance zone in confluence with the edge of pitchfork and upper edge of the descending broadening wedge highlighted.

Moreover a strong hidden bearish divergence in MACD histogram is observed on weekly timeframe. (Not applied here because chart is on daily timeframe).

Expecting a fall of approximately 30-33% towards 7700-8000 level, which is next possible support zone lying near golden Fib level.

The fundamental attributes of major auto companies are not looking good specially with the declining OPM% (At lowest levels).

It's better to avoid FOMO in auto sector stocks because of all good news and invest after this big correction or else keep averaging.

Do your own due diligence before taking any action.

Peace!!

Nifty Auto AnalysisFMCG, Pharma, IT, Metals major indices have already performed. Banks, Automobiles are the ones to start performing. Autos had formed a zone and direction will be clear once it breaks either up or down. Considering that nifty auto is already 15% down, and seeing the fact that it's staying strong in lower levels, an upward breakout could be possible.

Stocks to focus

#Bajaj_Auto

#Eicher

#Maruti