Nifty Analysis EOD – August 2, 2025 – Friday🟢 Nifty Analysis EOD – August 2, 2025 – Friday 🔴

Trapped at the Top, Slammed at the Close – Bulls Burnt Out!

🗓️ Nifty Summary

With the continuation of yesterday's hidden weakness, today's session gave early hope but ended with a bearish surprise. Nifty opened near the key support zone of 24,735 ~ 24,725, hovered indecisively, then suddenly rallied to 24,780, trapping bulls just under resistance.

But the trap was set.

A sharp reversal followed as Nifty broke not just the day’s low, but also the previous day’s support zone of 24,660 ~ 24,675, pulling the index lower into the 24,565.35 close — the second lowest close since May 12.

A fierce 2–3 hour tug-of-war between bulls and bears took place in a tight 40–50 point range until 2:50 PM, when bulls gave up—leading to a 100+ point fall in the last half-hour. shocked many traders, especially those fatigued from the earlier choppy action.

Much like yesterday, both sides of the trade were available today.

Did you catch them?

Zoom Out View :

Today’s close is just 23 points above the June 3 close, wiping out nearly 59 sessions (81 days) of gain.

Will the zone of 24460 ~ 24542 provide support again, or are we headed for a retest of the 24000 ~ 23800 and 23200 ~ 22800 (Pattern Target and Virgin) range?

Yes, you read correctly 23200 ~ 22800…!

Not so soon…but eventually…!

wish you tell me crazy and hope I am wrong…!

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 24,734.90

High: 24,784.15

Low: 24,535.05

Close: 24,565.35

Change: −203.00 (−0.82%)

Candle Structure

🔴 Large bearish body (169.55 pts)

☁️ Moderate upper wick (49.25 pts)

⬇️ Short lower wick (30.30 pts)

Interpretation

Opened lower, climbed early but failed at 24,780+.

Selling dominated the rest of the session, closing near lows.

Moderate upper wick shows early bullish attempt was rejected.

Candle Type

Bearish Marubozu-like – clear seller dominance.

Key Insight

Sellers defended 24,780–24,800 zone.

Closing near 24,560 keeps the short-term bias bearish.

Next support: 24,500, 24,470 ~ 24460

⚠️ Bulls must reclaim 24,735+ on closing basis to neutralize sentiment.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 212.37

IB Range: 87.55 → Medium

Market Structure: Balanced

Trades Triggered

🕙 10:05 AM – Long Entry → 🎯 Target Hit (R:R – 1:1)

🕚 11:09 AM – Short Entry → 🎯 Target Hit (R:R – 1:2)

🔍 Trade Summary

Both sides were offered—clean hit on long and solid breakdown on short. A Gladiator’s delight.

📊 Support & Resistance Levels

🔼 Resistance Zones

24620

24660 ~ 24675

24725 ~ 24735

24780 ~ 24795

24860 ~ 24880

🔽 Support Zones

24,542 ~ 24,535

24,500

24,470 ~ 24,460

24,380

💬 Final Thoughts

"Traps are laid where confidence is highest. Stay alert, stay flexible."

A textbook day where patience paid off — those who didn’t force trades were rewarded with clean moves in both directions.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Niftyintraday

Nifty Analysis EOD – July 30, 2025 – Wednesday🟢 Nifty Analysis EOD – July 30, 2025 – Wednesday 🔴

Trapped in Illusion – A Day of Decoy Moves

Nifty moved 130 points today, falling short of the 2-week average range of 196 points. It formed its IB by 11:40 AM, marking the day's high and low early. For the rest of the session, it hovered between the IB high and the previous day high, eventually closing near the mean.

Despite a close below the open, Nifty managed a green close vs. the previous day—making it a classic "moboroshi candle" day, where visuals deceive sentiment.

📉 Intraday 5 Min Time Frame Chart

🪜 Intraday Walk

IB formed by 11:40 AM

False breakout on both sides trapped traders badly

Nifty stayed stuck between IB high and PDH

Closed slightly above the previous close, but below open

Eyes on breakout of 24,910 for targets of 24,995 and 25,090–25,110

🔄 Trend & Zone Update

📈 Resistance Zone Shifted To: 25,110 ~ 25,090

📉 Support Zone Shifted To: 24,520 ~ 24,480

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Candle Type: Small Red Hammer‑Like Candle (Decoy / Moboroshi)

Today’s OHLC:

🟢 Open: 24,890.40

🔺 High: 24,902.30

🔻 Low: 24,771.95

🔴 Close: 24,855.05

📈 Change: +33.95 (+0.14%)

📌 Candle Structure:

Real Body: 35.35 pts (Small bearish body)

Upper Wick: 11.90 pts (Very small)

Lower Wick: 83.10 pts (Long)

📌 Key Observations:

Buyers stepped in near 24,770 zone

Closed near open but slightly lower → mild net selling

Long lower wick indicates dip buying support

📌 Implication:

Buyers defended 24,770–24,780 zone

A reclaim of 24,900–24,920 may resume bullish move

A close below 24,770 weakens support

🛡 5 Min Intraday Chart

🛡️ Gladiator Strategy Update

ATR: 195.72

IB Range: 78.15 → Medium

Market Structure: Balanced

💥 Trades Triggered:

🕙 10:25 AM – Short Entry → SL Hit

📌 Trade Summary:

False IB breakouts on both sides led to a stop loss hit—typical trap in a tight consolidation phase.

📌 Support & Resistance Levels

📈 Resistance Zones:

24,880 ~ 24,890

24,910

24,995

25,090 ~ 25,110

📉 Support Zones:

24,830 ~ 24,820

24,780

24,725 ~ 24,715

24,660 ~ 24,650

🔮 What’s Next? / Bias Direction

Awaiting breakout above 24,910 for potential targets of 24,995 and 25,090–25,110. Consolidation may reward patient breakout players in upcoming sessions.

🧠 Final Thoughts

“Structure is key. When levels work, respect them. When they break, adapt.”

Today's range was narrow, but traps show signs of buildup. Be ready when the market unwinds.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 29, 2025 – Tuesday🟢 Nifty Analysis EOD – July 29, 2025 – Tuesday 🔴

Bulls Strike Back After Trendline Trap & Break

Nifty started below the previous day's low, and after marking day low at 24,598.60, it rose to 24,725 where it faced the trendline and CPR zone. A sharp rejection from there quickly pushed Nifty back to the day's open level. A base-building process began, characterized by a low-range but high-volatility phase.

Gradually, Nifty crossed the VWAP and the trendline again, breaking the day's high and CPR zone, ultimately reaching R1 and closing near the highest point at 24,830.40.

In the first half, both long and short traders got trapped in fast swings—refer to the chart for visual cues.

🕯 5 Min Time Frame Chart with Intraday Levels

🔄 Trend & Zone Update

📈 Resistance Zone Shifted To: 25,110 ~ 25,090

📉 Support Zone Shifted To: 24,520 ~ 24,480

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,609.65

High: 24,847.15

Low: 24,598.60

Close: 24,821.10

Change: +140.20 (+0.57%)

🕯Candle Structure Breakdown:

Real Body: Green candle (Close > Open):

24,821.10 − 24,609.65 = 211.45 pts (large bullish body)

Upper Wick: 26.05 pts (small)

Lower Wick: 11.05 pts (very small)

🕯Interpretation:

Market opened lower but found strong buying support, rallying to nearly 24,850.

Closed near the day’s high—bulls dominated.

Tiny lower wick shows hardly any selling pressure after the open.

🕯Candle Type:

Bullish Marubozu-type — strong signal of reversal or continuation, indicating control by buyers.

🕯Key Insight:

Strong bounce from sub-24,600 back above 24,800 has improved short-term sentiment.

If 24,830–24,850 breaks in the next session, potential upside till 24,920–24,995.

Support now shifts to 24,700–24,720.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 202.98

IB Range: 128.5 → Medium

Market Structure: Balanced

Trades Triggered:

🕒 11:10 AM – Long Entry → Target Hit 🎯 (1:3 Risk:Reward)

🧱 Support & Resistance Levels

Resistance Zones:

24,815 ~ 24,830

24,850

24,920

24,995

Support Zones:

24,725

24,693

24,660 ~ 24,650

🧠 Final Thoughts

“Volatility shakes the weak hands; structure empowers the patient.”

Today’s session was a textbook example of how the market tests conviction. After trapping early traders with sharp intraday swings, Nifty rewarded those who respected structure and waited for confirmation. The reclaim of the trendline, VWAP, and CPR zone reinforced the strength of bullish intent. If the momentum continues above 24,850, we may be entering a fresh leg of the uptrend—stay nimble, but don't lose sight of the bigger picture.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 28, 2025 – Monday 🟢 Nifty Analysis EOD – July 28, 2025 – Monday 🔴

⚡️ Bears Bite Back After a Hopeful Morning Surge

📊 Nifty Summary

Nifty opened with a minor gap-down of 32 points and slipped an additional 67 points in the first 3 minutes, testing the critical support zone of 24,755 ~ 24,729. After marking a day low at 24,732.70, it witnessed a sharp recovery breaching key levels — CDO, Gap, PDC — and touched the CPR BC level. Rejection from there caused a retracement to the mean, followed by another successful attempt breaching CPR BC and IB High. However, it couldn’t sustain above, as profit booking and pressure from a higher time frame bearish trendline dragged the index below the CPR zone and even past the PDL.

Support at 24,780 offered brief relief, but a bearish triangle formed between the HTF trendline and that support and The breakdown at 12:40 led to a clean move, with the pattern target achieved.

🕯 5 Min Time Frame Chart with Intraday Levels

🔁 Trend & Zone Update

📍 Resistance Zone Shifted To: 25,100 ~ 25,120

📍 Support Zone Shifted To: 24,520 ~ 24,480

🧭 What If Plans – 29th July Outlook

🅰️ Plan A (Contra Long Setup)

If market opens inside the previous day range and finds support at 24,700 ~ 24,729,

→ Potential targets: 24,780, 24,815, 24,840

🅱️ Plan B (Trend is Friend – Short Continuation)

If market opens inside range and faces resistance around 24,830 ~ 24,815,

→ Aim for: 24,780, 24,720, 24,640, 24,580

🔄 On-the-Go Plan

If market Gaps Up/Down outside previous day’s range,

→ Wait for IB formation and act based on structure & S/R levels.

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,782.45

High: 24,889.20

Low: 24,646.60

Close: 24,680.90

Change: −156.10 (−0.63%)

🕯 Candle Structure Breakdown:

Real Body: 101.55 pts (Red candle, bearish)

Upper Wick: 106.75 pts (Long — rejection from highs)

Lower Wick: 34.30 pts (Defended slightly)

🕯 Interpretation:

Tried to rally above 24,880 but faced aggressive selling. Closed well below open, forming a bearish rejection candle resembling a shooting star. Bears clearly took control after the intraday bounce attempt.

🕯 Key Insight:

Selling pressure visible from 24,880–24,900 zone.

Close below 24,700 keeps bearish tone intact.

Next Support: 24,650–24,620.

Bulls' challenge: Reclaim and close above 24,850.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 197.91

IB Range: 122 → Medium

Market Structure: Imbalanced

Trades Triggered:

09:27 – Long Entry → 🎯 Target Hit (1:1.5 R:R)

12:40 – Short Entry → 🎯 Target Hit (1:2.5 R:R)

🧱 Support & Resistance Levels

Resistance Zones:

📍 24,729

📍 24,780

📍 24,815 ~ 24,830

📍 24,850

📍 24,920

Support Zones:

📍 24,640

📍 24,580

📍 24,520 ~ 24,480

💭 Final Thoughts

🧠 “Every breakout starts with hesitation — but not every hesitation leads to a breakout.”

Today’s structure showed strong indecision, but sellers used it to dominate.

Monday’s triangle breakdown proved that structure plus patience = power. Keep your bias flexible and trust your levels.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

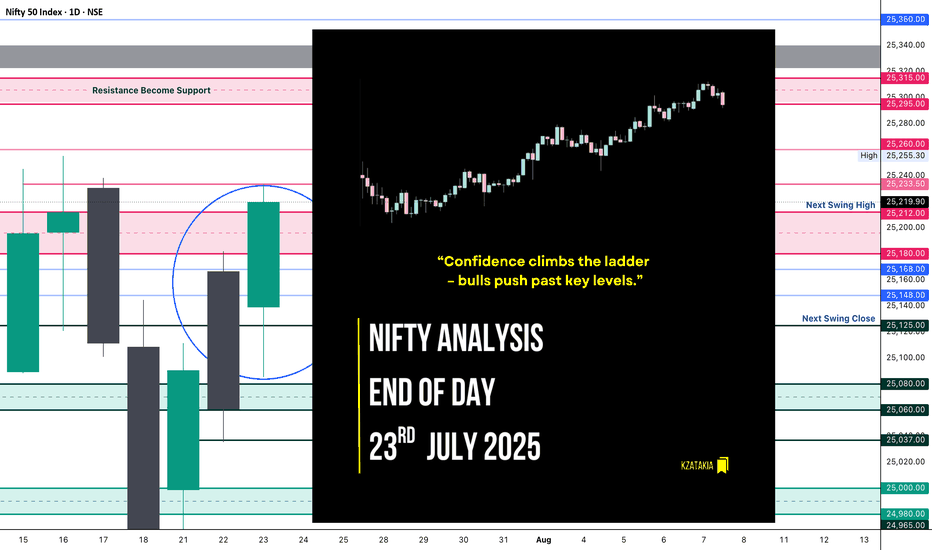

Nifty Analysis EOD – July 23, 2025 – Wednesday 🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

25,180 ~ 25,212

25,233

25,260

25,295 ~ 25,315

25,340 ~ 25,322 (Gap Zone)

Support Zones:

25,168

25,125

25,080 ~ 25,060

25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

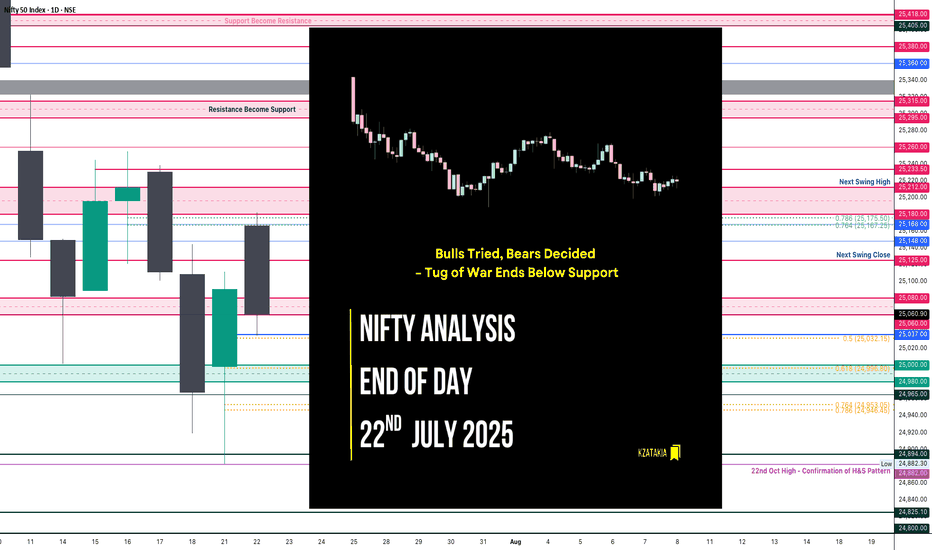

Nifty Analysis EOD – July 22, 2025 – Tuesday🟢 Nifty Analysis EOD – July 22, 2025 – Tuesday 🔴

"Bulls Tried, Bears Decided – Tug of War Ends Below Support"

Nifty opened with an 88-point gap-up, continuing the bullish sentiment, right at the resistance zone of 25,180 ~ 25,212. However, the market opened at the high (OH) and quickly slipped around 100 points to form the Initial Balance (IB). After a brief bounce back to the mean, it faced resistance, leading to a breakdown of IB and further losses of 77 points.

A supportive bounce emerged near 25,060 ~ 25,080, but the price was pushed down again by PDH + VWAP + R1. The day closed below PDC and under the support zone at 25,065, showing bearish dominance despite a volatile tug-of-war between bulls and bears.

Today’s low tested the 0.5 Fibonacci retracement level (from yesterday’s low to today’s high). If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,166.65

High: 25,182.00

Low: 25,035.55

Close: 25,060.90

Change: −29.80 (−0.12%)

Candle Structure:

Real Body: Red (−105.75 pts) → Decent bearish body

Upper Wick: 15.35 pts → Small

Lower Wick: 25.35 pts → Moderate

Interpretation:

Price opened strong but faced selling near 25,180, leading to a steady drop throughout the session. The lower wick shows some buying attempt near 25,035, but the close below open signals bears dominated.

Candle Type:

Bearish candle with moderate lower wick – resembles a Bearish Engulfing setup after a green candle, suggesting profit-booking or fresh selling.

Key Insight:

Sellers defending 25,180–25,200 firmly

Holding above 25,030–25,050 is critical; breaking this could retest 24,950–25,000

Bulls must reclaim 25,120–25,150 for momentum revival

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 182.32

IB Range: 92.6 → Medium

Market Structure: Balanced

Trades Triggered:

10:45 AM – Short Trade → Trailing SL Hit (1:0.8)

12:45 PM – Long Trade → SL Hit

📌 Support & Resistance Levels

Resistance:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

🧠 Final Thoughts:

"Markets often dance between zones of power — where bulls flex and bears press. It's not chaos, it's the choreography of sentiment."

The 25,000–25,212 zone continues to be the battlefield. Let’s see who seizes the upper hand tomorrow.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

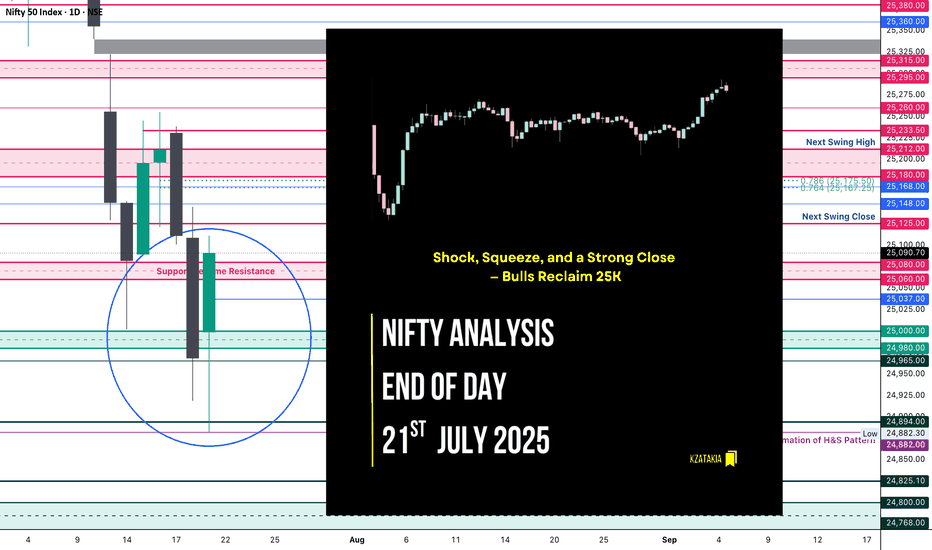

Nifty Analysis EOD – July 21, 2025 – Monday 🟢 Nifty Analysis EOD – July 21, 2025 – Monday 🔴

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

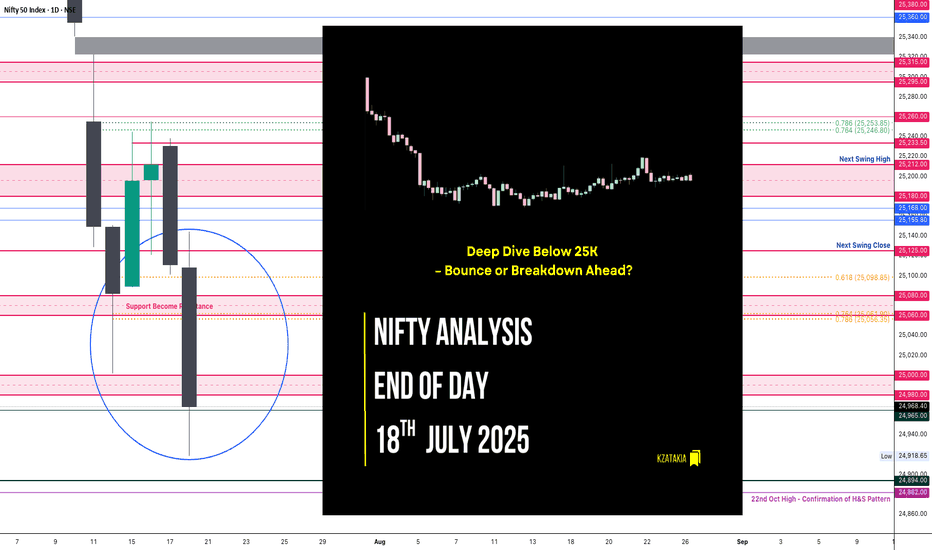

Nifty Analysis EOD – July 18, 2025 – Friday🟢 Nifty Analysis EOD – July 18, 2025 – Friday 🔴

“Deep Dive Below 25K – Bounce or Breakdown Ahead?”

As we discussed yesterday, a big move was on the cards — and Nifty delivered.

The index started flat to negative, and from the opening tick, sellers took firm control. It sharply broke through multiple key supports: PDC, PDL, S1, the important 25,080–25,060 support zone, swing low, 25,000–24,980, and even 24,965.

Buyers finally showed up near 24,920, a crucial level, and pulled off a modest 86-point recovery. The session ended at 24,968.40, still below the psychological 25,000 mark and the fractal swing low of July 14.

🕯 5 Min Time Frame Chart with Intraday Levels

🔍 Mixed Signals:

✅ Positive: Today’s low aligns with the 0.618 Fib retracement from the June 13 low to June 30 high — potential support zone.

✅ Positive: RSI(3 of 3) shows bullish divergence — early reversal sign?

❌ Negative: Closed below July 14 swing low — weak structural signal.

❌ Negative: Below 25,000 — psychological breakdown.

❓Now the big question: Will this bearish move continue, or is it a fakeout before reversal?

You're still bullish on the overall daily trend, but tactically bearish for intraday until a close above 25,125 confirms strength.

🕯 Daily Time Frame Chart For Additional View

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,108.55

High: 25,144.60

Low: 24,918.65

Close: 24,968.40

Change: −143.05 (−0.57%)

📊 Candle Structure Breakdown

Real Body: 140.15 pts → Large red bearish body

Upper Wick: 36.05 pts → rejection near early highs

Lower Wick: 49.75 pts → dip buying near 24,920

🔍 Interpretation

Mildly negative open with early strength attempt near 25,140

Sharp decline through major support zones

Buyers stepped in at 24,920, but recovery lacked follow-through

Close below 25K and key swing low confirms steady intraday selling pressure

🕯 Candle Type

Strong Bearish Candle with both wicks — sellers dominated, but not without some resistance from buyers at the lows.

📌 Key Insight

Short-term bearish momentum confirmed

24,920–24,890 is next critical support; breakdown may extend to 24,882–24,825

Bulls need to close above 25,125+ to reclaim control

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.56

IB Range: 126.45 → Medium IB

Market Structure: 🔴 Imbalanced

🟢 Trades Triggered:

09:42 AM – Short Trade → ✅ Trailed SL Hit Profit (R:R = 1 : 3.87)

📌 Support & Resistance Levels

Resistance Levels:

24,980 ~ 25,000

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

“Sometimes markets fall not to reverse, but to recharge.”

Today’s drop pierced major support zones, but the bounce from 0.618 Fib hints at possible resilience.

Structure needs clarity — Monday’s session will reveal whether this was a trap or fuel for bears.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty EOD Analysis – May 3, 2025 Monday🟢 Nifty EOD Analysis – May 3, 2025 Monday🔴

A positive open... but no follow-through. Still stuck in consolidation.

📊 Nifty Summary

Nifty opened with a gap up of 72 points at 24,420, marking the first open above 24,365 in the last 7 sessions — a positive sign. However, the enthusiasm lacked momentum. Price struggled to cross the resistance at 24,526, and the index drifted back toward the mean, trading the entire day between the initial balance (IB) range and hovering around VWAP.

🔹 Intraday Movement: Just 125 points, the smallest in the last 12 sessions — a clear sign of contraction.

🔹 Closing: 24461 closing is the first closing above 24365 in the last 7 sessions.

🔹 Structure: Daily candle formed an Inside Bar, signaling potential energy buildup.

📌 Strategy Forward: Stay alert for an expansion move from this coil — contraction often precedes sharp action.

📌 5 Min Time FrameChart

📌 Daily Time FrameChart

🕯️ Daily Time Frame Chart & Candle Breakdown

🔍 Today’s Candle Type: Spinning Top with a long upper wick

Candle Definition:

A Spinning Top reflects market indecision — both bulls and bears attempted moves, but neither gained dominance. A long upper wick with a narrow body often signals failed bullish momentum or fading enthusiasm.

📌 Today’s OHLC:

Open: 24,419.50

High: 24,526.40

Low: 24,400.65

Close: 24,461.15

Change: +114.45 (+0.47%)

🧱 Candle Structure:

🔹 Real Body:

🟢 Green candle with a modest body →

24,461.15 – 24,419.50 = 41.65 pts

🔹 Upper Wick:

24,526.40 – 24,461.15 = 65.25 pts

🔹 Lower Wick:

24,419.50 – 24,400.65 = 18.85 pts

📖 Candle’s Interpretation:

Despite a strong open and attempt to push higher, the resistance at 24,526 capped the move. The long upper wick shows that buyers lacked follow-through strength, and the close back near the middle of the range indicates a market still stuck in balance.

📉 The Inside Bar + Narrow Range combo is a potential signal for volatility ahead — traders should watch closely for a breakout from this range.

⚔️ Gladiator Strategy Update

📊 Strategy Parameters:

ATR: 303.46

IB Range: 110.65 pts

IB Category: Medium IB

Market Structure: Balanced

📌 Trade Highlights:

Trade Count: 0

❌ No Trigger generated by the system — a no-trade day.

🧠 Note: In contraction phases, it’s common to get fewer setups. Patience is key.

🔮 What’s Next?

Markets are coiling tightly, and an expansion move is likely around the corner. As long as price holds above the 24,330–24,360 band, bulls have hope — but conviction is needed above 24,540.

🧱 Support & Resistance Levels

🔺 Resistance Zones:

24,480 ~ 24,540 (Includes psychological level: 24,500)

24,590 (PDH – Immediate hurdle)

24,800

🔻 Support Zones:

24,400 (CDL)

24,330 ~ 24,360

24,190 ~ 24,225 (Immediate Support)

24,120

24,050

24,000 ~ 23,950

23,820

23,710 ~ 23,660

23,500

23,410 ~ 23,370

23,215

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Intraday Trade Setup | 30th January 2025Nifty opened flat around 23030 and after forming a low at 22976 it went up and made high above 23180.

Tomorrow, buy Nifty if sustains above 23180 for the targets of 23240 and above marked level. On the other side, sell if Nifty sustains above 23080 for the targets of 23030 and above marked level on the chart.

Expectations: Volatile Day

Intraday Levels:

Buy Above - 23180

Sell Below - 23080

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 10th January 2025Nifty opened with flat but we saw weakness since morning, broke our sell level 23630 around 10:25 and Nifty hit both of our targets.

Tomorrow, Sell Nifty if sustains below 23490 for the targets of 23440 and below marked level. On the other side, sell Nifty if sustains above 23580 for the targets of 23640 and above marked level on the chart.

Expectations: Volatile Day

Intraday Levels:

Buy Above - 23580

Sell Below - 23490

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 9th January 2025Nifty opened with a gap-up, faced resistance exactly at our buy level 23750 and came down. Nifty broke sell level 23640 around 10:15 and hit all our targets on downside.

We have seen recovery from 23500 levels in second half. Tomorrow, Buy Nifty if sustains above 23750 for the targets of 23800 and above marked level. On the other side, Sell Nifty if sustains below 23630 for the targets of 23580 and below marked level on the chart.

Expectations: Range-bound day

Intraday Levels:

Buy Above - 23750

Sell Below - 23630

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 8th January 2025Nifty opened with a gap-up, came down and taken support near our buy level 23660 but Nifty traded in a range whole day today so it was a typical options sellers day.

Tomorrow, Buy Nifty if sustains above 23800 for the targets of 23850 and above marked level. On the other side, Sell Nifty if sustains below 23640 for the targets of 23590 and below marked level on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 23800

Sell Below - 23640

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 6th January 2025Nifty opened flat, morning opening price was the day high and Nifty started falling soon after open. Nifty made low around 23975 and closed new day low.

Tomorrow, Buy Nifty if sustains above 24055 for the targets of 24105 and above marked level. On the other side, Sell Nifty if sustains below 23920 for the targets of 23850 and below marked level on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 24055

Sell Below - 23920

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 26th DecemberNifty opened flat around 23740 and after consolidating between 23740 and 23700 we saw an up move towards 23850 which acted as resistance again.

Tomorrow, Buy Nifty if sustains above 23770 for the targets of 23820 and above marked level. On the other side, Sell Nifty if sustains below 23680 for the targets of 23630 and below marked level on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 23770

Sell Below - 23680

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 23rd DecemberNifty opened with a minor gap-down and we saw a bounce in morning 23880 to 24000. Buy trade triggered as per trade setup posted for Friday but Nifty missed our 1st target of 24080 by 14 points and reversed.

For tomorrow, if Nifty sustains above 23650 we expect to see an up-move towards 23720 and above marked levels. On the other side, if Nifty breaks a crucial support 23500 on downside we may see 23430 and below marked levels on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 23650

Sell Below - 23500

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 20th DecemberNifty opened with a big gap-down near crucial support of 23850 today due to US markets and Nifty traded in a range created in first 15 mins.

For tomorrow, if Nifty sustains above 24000 we expect to see an upmove towards 24080 and above marked levels. On the other side, if Nifty breaks 23920 on downside we may see 23920 and below marked levels on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 24000

Sell Below - 23920

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 19th DecemberNifty opened with a minor gap-down and it morning we saw some volatile moves, once Nifty sustained below 24300 which was a crucial support level, we saw good fall and Nifty made a low near 24150 and closed below 24200.

There is US Fed meeting tonight and tomorrow we may see the impact on Indian markets.

For tomorrow, if Nifty sustains below 24150 we may see further downside towards 24100 and below marked levels. On the other side, if Nifty breaks 24250 on upside we may see 24300 and above marked levels on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 24250

Sell Below - 24150

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 17th DecemberNifty opened with a minor gap-down and after consolidating Nifty broke our Sell level 24670 on downside and made a low around 24600. Traders followed the idea must have booked profit in Sell side.

For tomorrow, if Nifty sustains below 24600 we may see further downside towards 24550 and below marked levels. On the other side, if Nifty breaks 24710 on upside we may see 24760 and above marked levels on the chart.

Expectations: Range bound day

Intraday Levels:

Buy Above - 24710

Sell Below - 24600

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

Nifty Intraday Trade Setup | 16th DecemberNifty opened with a minor gap-down and gave a breakdown in morning which dragged Nifty below 24200. However Nifty took support near 24180 and gave strong reversal, went initially till day high 24520 and after breakout we saw rally in Nifty towards 24792.

For tomorrow, if Nifty sustains above 24810 we may see further rally towards 24860 and upper marked levels. On the other side, if Nifty broke 24670 on downside we may see 24620 and below marked levels on the chart.

Expectations: Volatile day

Intraday Levels:

Buy Above - 24810

Sell Below - 24670

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

NIFTY Trade Setup for Wednesday (04-Dec-2024)NSE:NIFTY

Key Notes:

NIFTY FUTURES OI Data is Bullish Bias.

Previous day, Price closed at Demand (M15) zone.

Price is looking for Buy Stops at the premium zone.

There are cluster of Institutional bearish reference levels to hold the price.

If there is a gap up opening today, price must break the bearish reference level.

If price fails to break even with gap up, Price will like to take U turn from bearish levels.

Nifty Intraday 23 Oct 2024 Levels for SellingToday Nifty made new low and following price action on every timeframe.

For good risk reward if price starts moving upwards and taking reversal near 24600, then we can go for sell trade.

For Followup trade, any 5 min candle close below 24445 then also we can go for sell trade.

Note : Its just an analysis, wait for the price to confirm.

Disclaimer : Always follow risk to reward, this is the only key to success in market, no matter how much good a trade is looking we never know the future.

NIFTY 50 INTRADAY TRADING SETUP FOR 05.07.2024

Disclaimer - All information on this page is for educational purposes only,

we are not SEBI Registered, Please consult a SEBI registered financial advisor for your financial matters before investing And taking any decision. We are not responsible for any profit/loss you made.