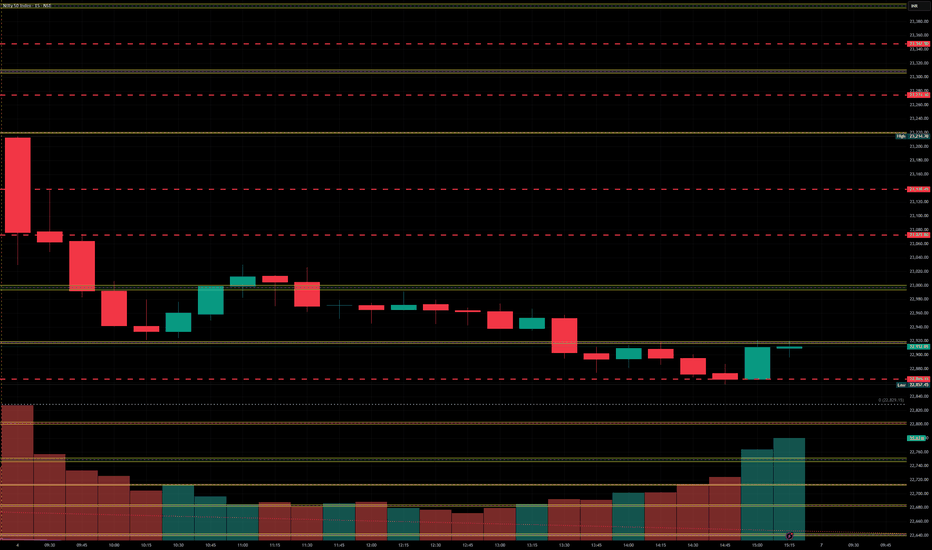

Nifty levels - Apr 11, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Niftylevels

#NIFTY Intraday Support and Resistance Levels - 09/04/2025Today will be slightly gap down opening expected in nifty. After opening if nifty starts trading below 22450 level then possible sharp downside rally in index upto 22250 level. 22250 will act as a strong support for today's session. Any major downside in index expected below this support level. Upside rally expected if nifty starts trading and sustain above the 22550 level in today's session

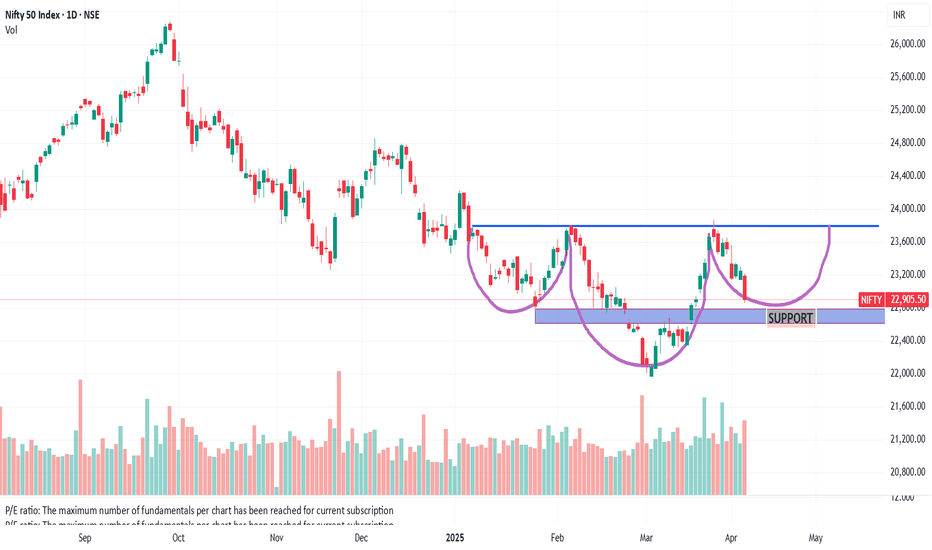

The Nifty spot weekly analysisBased on my analysis, the Trend Trading indicator continues to signal a bullish outlook, with a strong support level at 22,150. However, if Nifty Spot closes below this level on a weekly basis, the next potential support could be around 20,241. Considering the influence of the time factor on price movements, market bearishness may persist until the end of June 2025, with a possible positive shift beginning in July.

Nifty’s Make-or-Break Zone: Will Bulls Charge or Bears Bite?www.tradingview.com

---

### 🧠 **1. Context at-a-glance**

- Recent bounce from a **Demand Zone (D1 Key Level)** around **21,800**.

- Strong bullish rally into a **Supply Zone (~22,600–22,750)**.

- Price is currently showing **hesitation within this resistance**, with smaller-bodied candles forming → potential reversal signals.

- The oscillator has **crossed bullish** from oversold but is nearing a decision zone.

---

### 🔮 **Future Move Scenarios**

#### 🟥 SCENARIO A: **Rejection from Supply Zone** (Most Likely Short-Term)

- **Why?** Price has hit a resistance with fading momentum and no breakout confirmation.

- **What happens?**

- Price retraces toward **22,200**, potentially even **21,800–21,900**.

- Retest of BOS level possible before the next directional leg.

- **Watch for:** Bearish candle formations (engulfing / long wicks), oscillator stalling below 50.

---

#### 🟩 SCENARIO B: **Bullish Breakout Above 22,750**

- **What confirms it?**

- A strong bullish candle closing above 22,750 with follow-through.

- **Next Targets:**

- 🔼 **23,000** (round level and minor resistance)

- 🔼 **23,300–23,500** (old supply zone)

- Eventually back to **23,750+**

- **Oscillator support:** If the indicator crosses 50+, bullish momentum could sustain.

---

### 📉 Oscillator Hints:

- Still below 50 — **recovery in progress**, not full momentum yet.

- If price rejects and oscillator drops → **Bearish divergence** possibility.

---

### 🧭 **Your Playbook**

| Zone | Action Idea | Trigger to Watch |

|------------------|-------------------------------|----------------------------------|

| 22,600–22,750 | Short / Hedge | Rejection candle, loss of momentum |

| 22,200–22,300 | Potential buy zone (aggressive) | Bullish candle or bounce confirmation |

| Break > 22,750 | Buy on Retest or Momentum | Breakout candle + volume |

| < 21,800 | Bearish continuation | Break of demand zone + close below |

---

Nifty levels - Apr 09, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 08/04/2025Gap up opening in nifty. After opening if nifty sustain above 22500 level then possible upside move upto 22750+ level in opening session. 22750 level will act a strong resistance expected reversal from this level. If nifty starts trading below 22400 then possible sharp downside rally upto 22050 in today's session.

Nifty levels - Apr 08, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 07/04/2025Strong gap down opening expected in nifty near 22050 level. After opening if nifty sustain above 22050 level and gives reversal then expected some correction rally upto 22450 level. This level will act as a strong resistance for today's session. Any bullish side rally can reverse from this level. Downside in case nifty gives breakdown of 22000 level and starts trading below 21950 then expected sharp downside upto 21550 level in today's session.

Nifty is not going north anywhere till 2026This is completely based on neowave time rules.

Nifty may go down slow and steady towards16900 by Dec 2026

Nifty May go up and make a new high and will fall back to 20900 by Dec2026

Nifty may get restricted going down much or up. Will settle at 18850 by Feb 2026.

We are in double formation from top. 1st Phase is in progress. 2nd Phase of selling may start from Late Aug or Early Sep.

Labels are hidden on purpose.

Head & Shoulder Pattern in Making in NIfty 50 IndexI can see a clear Neck & shoulder Pattern in Making.

all international Markets are down and now on their Support Area.

Mostly all international Market should bounce back from here.

Nifty 50 once touches 22800 and if takes a support from here it should then proceed toward 23800 to complete H&S pattern.

There is a resistance @ 23800. If market break that resistance then 23800 should act as a Support and Market should Advance for 24800 levels.

"Otherwise"

if Market Crashes below 22800 and doesn't take support here next major support will be 22000 but this is less likely.

Hope for the best!

Nifty Futures intraday trend analysis on April 7th & 8thAccording to my Trend Analysis, on 7th Nifty Futures is likely to bounce back and the raise will not sustain on April 8th. The levels provided in the chart are calculated without taking Gaps into account. In the first 15mts on 7th April, there is a bullish candle formation. Trade with Stop-Loss.

Nifty levels - Apr 07, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Nifty levels - Apr 04, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

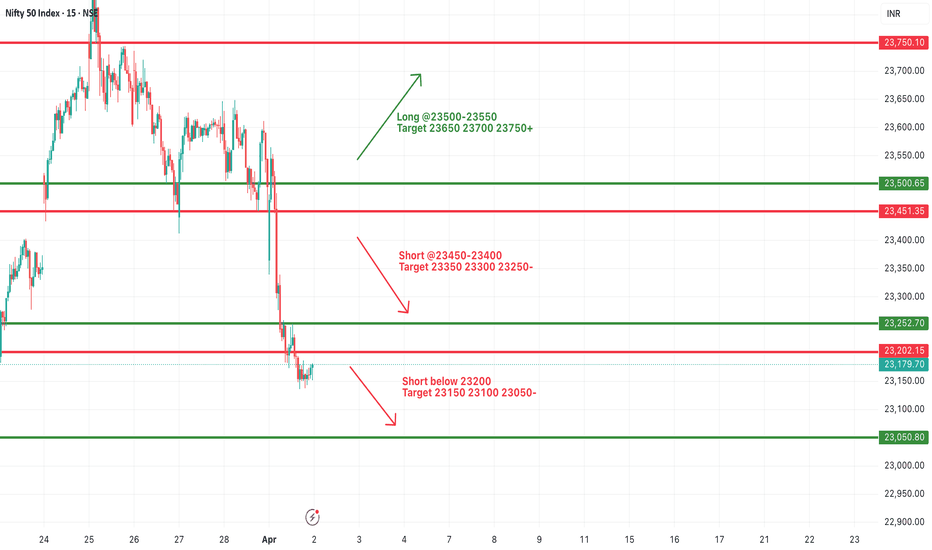

#NIFTY Intraday Support and Resistance Levels - 03/04/2025Gap down opening expected in nifty. After opening if nifty starts trading below 23200 level then possible sharp downside rally upto 23000 level. Any bullish side rally can face resistance at 23450 level. Expected reversal from this level. Major upside movement only expected if nifty starts trading and sustain above 23500 level.

Nifty levels - Apr 03, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

#NIFTY Intraday Support and Resistance Levels - 02/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty starts trading below 23200 level then expected sharp downside upto 23050 level in opening session. Upside 23450 level will act as a strong resistance for today's session. Any bullish side rally can reversal from this level.

Nifty Futures Daily view for April 2025Our Precision Scalper accurately identified the sell entry for Nifty Futures two days in advance, providing traders with a strategic edge. With minimal risk per trade, this powerful tool effectively captures trends and sustains them until completion. To maximize risk management, ensure a stop-loss is set for every entry.

Nifty Futures Daily analysis for April 2025I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull back before the fall.

NIFTY : Trading Levels and Plan for 31-Mar-2025📌 NIFTY Trading Plan – 31-Mar-2025

📊 Market Overview:

Nifty closed at 23,495, showing mixed sentiment near the Opening Support Zone (23,401 – 23,465). The market is at a crucial juncture, with potential bullish momentum above resistance levels, while breakdowns below key supports may trigger selling pressure.

This plan will help you react strategically to different opening scenarios, ensuring a favorable risk-reward ratio.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,600)

A gap-up above 23,600 signals bullish momentum, but for sustained upside, Nifty must stay above 23,642 – 23,842. Watch for rejection at resistance zones, as profit booking can lead to reversals.

✅ Plan of Action:

If Nifty sustains above 23,772, expect a move towards the next resistance at 23,925 – 23,990. A breakout above 23,990 could open doors for 24,050+.

If price faces rejection at 23,842, a pullback towards 23,642 → 23,495 is possible. If it breaks below 23,495, expect further downside.

Avoid aggressive longs inside 23,642 – 23,842, as this is a potential reversal zone. Wait for a decisive breakout or rejection confirmation.

🎯 Pro Tip: If the gap-up is filled within the first 15-30 minutes, it suggests weak buying pressure and increases the probability of a reversal.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,500)

A flat opening near 23,495 indicates indecision. The market will take direction after the first few candles, so breakouts or breakdowns from key levels should be closely monitored.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,642, it may head towards 23,772 → 23,925. Monitor price action near these resistance levels before entering fresh longs.

Downside case: If Nifty breaks below 23,495, it could test 23,336 → 23,164. A breakdown below 23,164 will shift the trend bearish.

Avoid trading inside the No Trade Zone (23,495 – 23,642), as price could consolidate before a breakout.

🎯 Pro Tip: In a flat opening, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,400)

A gap-down below 23,400 may indicate fresh selling pressure, making it crucial to observe whether buyers step in at support zones.

✅ Plan of Action:

If price sustains below 23,400, expect a decline towards 23,336 → 23,164. A breakdown below 23,164 could lead to a sharp fall towards 23,100.

If price finds support at 23,164 and rebounds, it may recover towards 23,336 → 23,495. A strong close above 23,495 will shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to a strong upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,925 → 23,990

🟧 No Trade Zone: 23,495 – 23,642

🟩 Support: 23,336 → 23,164 → 23,100

🔸 Bullish Bias: Above 23,642, targeting 23,772 – 23,925

🔸 Bearish Bias: Below 23,400, expecting a fall towards 23,336 – 23,164

🔸 Neutral/Choppy: Inside 23,495 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.