Nifty is not going north anywhere till 2026This is completely based on neowave time rules.

Nifty may go down slow and steady towards16900 by Dec 2026

Nifty May go up and make a new high and will fall back to 20900 by Dec2026

Nifty may get restricted going down much or up. Will settle at 18850 by Feb 2026.

We are in double formation from top. 1st Phase is in progress. 2nd Phase of selling may start from Late Aug or Early Sep.

Labels are hidden on purpose.

Niftyoutlook

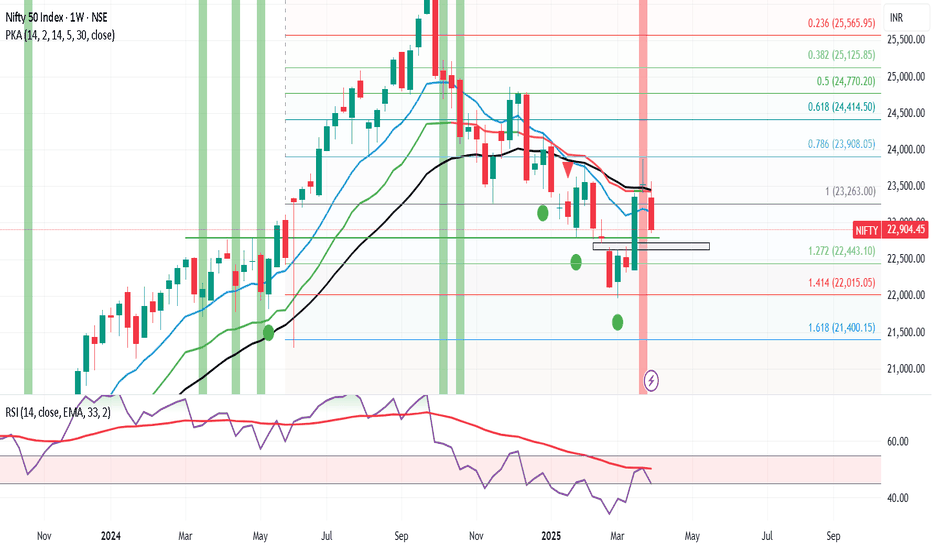

Nifty Wkly Outlook: Market Volatility, Supprt Lvls & Possible

Nifty ended the week at 22,904, marking a significant decline of 600 points from the previous week’s close. The index reached a high of 23,565 and a low of 22,857. As anticipated, the dragonfly doji formation from last week, coupled with concerns over Trump’s new tariff measures taking effect from April 2nd, contributed to global market jitters. These factors spooked investors and led to heightened volatility across the board.

My initial forecast for Nifty's trading range this week was 24,000-23,000, but the lower end of that range was breached by 150 points, indicating increased downside pressure. Looking ahead, there is potential for Nifty to find support around the 22,600/22,400 zone, where it may consolidate and form a base to attempt a rebound towards the 24,000 level. However, if the index were to break below the critical support level of 21,964 (which, frankly, seems unlikely), a deeper correction towards 19,700 could unfold. * That said, I believe most of the negative news has already been priced in, and we could see a market recovery within the next 10-15days, depending on how the bulls respond to this pullback .*

In the global markets, the S&P 500 has closed below its 100-week exponential moving average (WEMA) at 5,074, and if it falls below this week’s low of 5,069, we could see a further slide towards 4,750/4,800, representing a 6% drop from current levels. Should Nifty also correct by 6% from its current position, this aligns with a potential support zone around 21,900/22,000, making it an interesting technical level to watch.

It will be crucial to monitor if the wounded bulls can stage a comeback or if the market will continue its downward trajectory. Stay tuned!

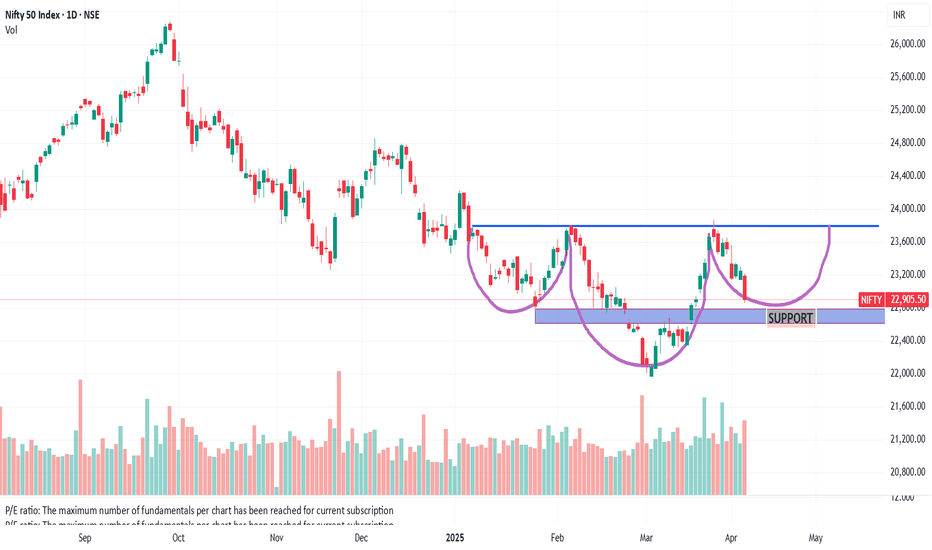

Head & Shoulder Pattern in Making in NIfty 50 IndexI can see a clear Neck & shoulder Pattern in Making.

all international Markets are down and now on their Support Area.

Mostly all international Market should bounce back from here.

Nifty 50 once touches 22800 and if takes a support from here it should then proceed toward 23800 to complete H&S pattern.

There is a resistance @ 23800. If market break that resistance then 23800 should act as a Support and Market should Advance for 24800 levels.

"Otherwise"

if Market Crashes below 22800 and doesn't take support here next major support will be 22000 but this is less likely.

Hope for the best!

Nifty Futures intraday trend analysis on April 7th & 8thAccording to my Trend Analysis, on 7th Nifty Futures is likely to bounce back and the raise will not sustain on April 8th. The levels provided in the chart are calculated without taking Gaps into account. In the first 15mts on 7th April, there is a bullish candle formation. Trade with Stop-Loss.

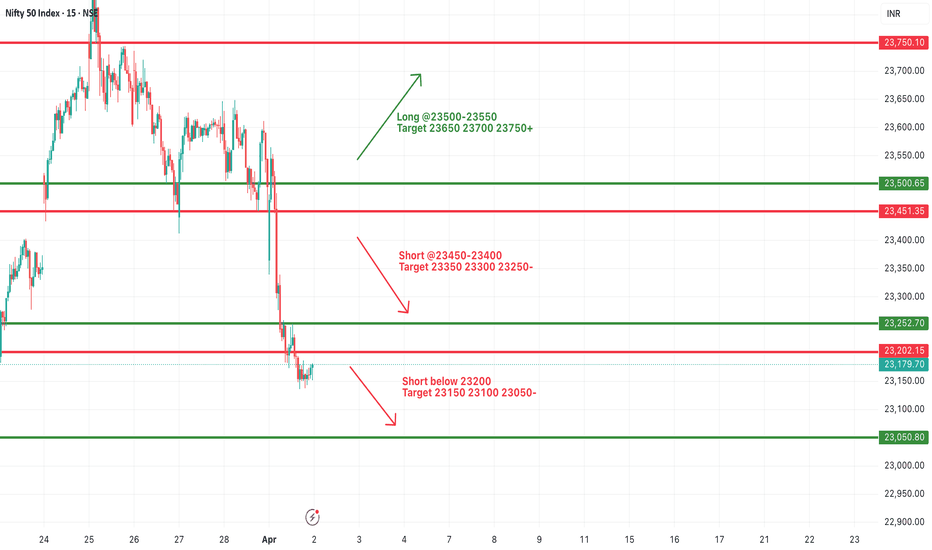

#NIFTY Intraday Support and Resistance Levels - 02/04/2025Today will be slightly gap up opening expected in nifty. After opening if nifty starts trading below 23200 level then expected sharp downside upto 23050 level in opening session. Upside 23450 level will act as a strong resistance for today's session. Any bullish side rally can reversal from this level.

Nifty is holding on above the Father line but by a thin margin.After reaching a weekly high of 23869 Nifty decided to fall back in search of its support zone. Currently it is holding above the Father line in the daily chart which is at 23406. Below the Father line there is Mother line waiting to support Nifty at 23114 in case the weakness seen on Friday persists. We will be in trouble again in case we get a daily or weekly closing below this level. In such a scenario the supports for Nifty will be at 22827, 22294 and 21939. In case the Nifty is able to gain momentum again the resistances it will face will be near 23536, 23671 and 23864. Closing above 23869 will enhance the short term momentum in Nifty which can lead it to 24K+ levels.

To know more about supports, Resistances, investing in stocks based on sector index, Trend lines Parallel Channels, Mother, Father and small Child Theory, Behavioural finance, Fundamental analysis, Technical analysis, Profit booking etc. Read my book The Happy Candles Way to Wealth creation. It is as on date one of the highest rated books on Amazon. The paperback version and Kindle can be bought through Amazon. You can also contact me to buy the same.

Things are slightly off balance with shadow of the candle just slightly in favour of bears as of now but Bulls will definitely try and retake the advantage back to their side given a slight opportunity. So the Bull and Bear tussle to continue into April and may escalate given Trump Tarif announcements and upcoming result season.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. No one can guarantee any success in highly volatile market or otherwise. There is also chance of bias in our opinion. The supports and resistances indicated are based on data which has a cycle time of being 3 months or older so it is not necessary that it will work. The author or Smart Investment will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Nifty Futures Daily view for April 2025Our Precision Scalper accurately identified the sell entry for Nifty Futures two days in advance, providing traders with a strategic edge. With minimal risk per trade, this powerful tool effectively captures trends and sustains them until completion. To maximize risk management, ensure a stop-loss is set for every entry.

Nifty Futures Daily analysis for April 2025I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull back before the fall.

NIFTY : Trading Levels and Plan for 31-Mar-2025📌 NIFTY Trading Plan – 31-Mar-2025

📊 Market Overview:

Nifty closed at 23,495, showing mixed sentiment near the Opening Support Zone (23,401 – 23,465). The market is at a crucial juncture, with potential bullish momentum above resistance levels, while breakdowns below key supports may trigger selling pressure.

This plan will help you react strategically to different opening scenarios, ensuring a favorable risk-reward ratio.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,600)

A gap-up above 23,600 signals bullish momentum, but for sustained upside, Nifty must stay above 23,642 – 23,842. Watch for rejection at resistance zones, as profit booking can lead to reversals.

✅ Plan of Action:

If Nifty sustains above 23,772, expect a move towards the next resistance at 23,925 – 23,990. A breakout above 23,990 could open doors for 24,050+.

If price faces rejection at 23,842, a pullback towards 23,642 → 23,495 is possible. If it breaks below 23,495, expect further downside.

Avoid aggressive longs inside 23,642 – 23,842, as this is a potential reversal zone. Wait for a decisive breakout or rejection confirmation.

🎯 Pro Tip: If the gap-up is filled within the first 15-30 minutes, it suggests weak buying pressure and increases the probability of a reversal.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,500)

A flat opening near 23,495 indicates indecision. The market will take direction after the first few candles, so breakouts or breakdowns from key levels should be closely monitored.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,642, it may head towards 23,772 → 23,925. Monitor price action near these resistance levels before entering fresh longs.

Downside case: If Nifty breaks below 23,495, it could test 23,336 → 23,164. A breakdown below 23,164 will shift the trend bearish.

Avoid trading inside the No Trade Zone (23,495 – 23,642), as price could consolidate before a breakout.

🎯 Pro Tip: In a flat opening, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,400)

A gap-down below 23,400 may indicate fresh selling pressure, making it crucial to observe whether buyers step in at support zones.

✅ Plan of Action:

If price sustains below 23,400, expect a decline towards 23,336 → 23,164. A breakdown below 23,164 could lead to a sharp fall towards 23,100.

If price finds support at 23,164 and rebounds, it may recover towards 23,336 → 23,495. A strong close above 23,495 will shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to a strong upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,925 → 23,990

🟧 No Trade Zone: 23,495 – 23,642

🟩 Support: 23,336 → 23,164 → 23,100

🔸 Bullish Bias: Above 23,642, targeting 23,772 – 23,925

🔸 Bearish Bias: Below 23,400, expecting a fall towards 23,336 – 23,164

🔸 Neutral/Choppy: Inside 23,495 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

#Nifty50 Market Update: A Week of Volatility and Uncertainty

The #Nifty50 closed at 23,519, marking a 170-point rise from last week's close, after hitting a high of 23,869 and a low of 23,412. As anticipated last week, once Nifty managed to sustain above the crucial 23,300 level, it surged to a high of 23,869, before retracing to close at 23,519. However, this week’s market candle formed a Dragonfly Doji, indicating that bears continue to hold control, as concerns over the financial year-end and the looming uncertainty of Trump's new tariff policy, set to take effect on April 2, dampened market sentiment.

With the market facing such pressure, it's crucial to consider the potential volatility for next week, as the market will be truncated due to the Eid holiday on Monday. As a result, Nifty could trade within a broad range of 24,000 to 23,000. For the next phase of an uptrend, Nifty must hold above 24,000, after which it could test higher levels of 24,200, 24,414 (a key Fibonacci level), and possibly 24,600.

Looking at the broader market trends, the monthly time frame remains bearish, while the weekly is slightly bullish and the daily trend is bullish. If favorable conditions align, we may begin to see upward movement in Nifty and other indices by mid-April, though in the interim, we’ll likely need to weather the storm and remain patient with the bearish sentiment.

S&P 500 Market Update: Testing Critical Support Levels

The S&P 500 closed at 5,580, down about 90 points from the previous week's close, hitting a low of 5,572. With the index closing near its weekly low, it suggests downward pressure may persist into the next week, with potential support levels at 5,550 and 5,458 (another key Fibonacci level). A test of these levels could put additional strain on Indian markets as well, amplifying volatility.

Overall, the market remains in a precarious position, and investors should brace for potential swings until more clarity emerges, especially with the geopolitical and policy risks at play.

NIFTY--@Manipulation??Nifty index is broken the trendline strongly...

Before going to break price a strong consolidation is given with a lot of liquidity lies below it...

@22400 levels

now price is exactly at the zone of resistance.

the resistance zone is lies at 24000-24300, after a strong movement to upside price is still not given any retracement...

Case1::

I am expecting either a strong retracement towards trendline.

the retracement should be in the form of correction with slower one.

Corrective pullback::

Case2::

After the liquidity above the 24000 and 24300, price has to give some retracement..

If we buy here it will completely becomes a manipulation....

Buying above the resistance zone is also a manipulation on topside...

If price breaks the resistance zone, then will wait for a correction towards the trendline areas.

Note::

So in order to buy the breakout of trendline the stoploss placement is very large...so with large stoploss will never go for buying...

the 2 possible buying areas are

1.breakout candle at the trendline

2.after the liquidity grab below the strong consolidation zone( before breakout of trendline.)

we have manipulation on both sides....if we go for long price will make an attempt of retracement as lot of liquidity lies below.

Better to look for short above the resistance zone(topside liquidity).If no retracement now.

NIFTY : Trading Levels and Plan for 28-Mar-2025📌 NIFTY Trading Plan – 28-Mar-2025

📊 Market Overview:

Nifty closed at 23,601, consolidating within a No Trade Zone after a strong uptrend. The market is at a critical juncture, and the price action at key levels will determine the next directional move.

This plan provides clear trade setups for different opening scenarios and helps you navigate market volatility with a structured approach.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,700)

A gap-up opening above 23,700 will push Nifty closer to the Last Intraday Resistance Zone (23,772). The key factor will be whether Nifty sustains above resistance or faces rejection.

✅ Plan of Action:

If Nifty sustains above 23,772, it can move towards the next resistance at 23,931. A breakout above 23,931 could trigger a rally towards 24,000+, but watch for profit booking at higher levels.

If price faces rejection at 23,772 and reverses, expect a pullback towards 23,650 → 23,600. A strong rejection here could lead to an intraday sell-off.

Avoid fresh longs inside 23,700 – 23,772, as this area may act as a profit-booking zone. Wait for confirmation before taking trades.

🎯 Pro Tip: If the gap-up is quickly filled within the first 15 minutes, it signals weak buying strength and increases the probability of an intraday correction.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,600)

A flat opening suggests indecision among traders, and the market will likely take direction after the first few candles. The best strategy is to trade breakouts or breakdowns from key levels.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,650, it may head towards 23,700 → 23,772. Observe the price action near resistance before taking fresh longs.

Downside case: If Nifty breaks below 23,520, it could test 23,450 → 23,300. A breakdown below 23,300 will turn the trend bearish.

Sideways caution: If Nifty remains inside the No Trade Zone (23,451 – 23,642), avoid taking trades as volatility could trap both buyers and sellers.

🎯 Pro Tip: In a flat opening scenario, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,500)

A gap-down below 23,500 could indicate profit booking or fresh selling pressure. The critical factor will be whether buyers defend key support zones.

✅ Plan of Action:

If price sustains below 23,500, expect a decline towards 23,300. A breakdown below 23,300 may accelerate selling towards the Buyer’s Support Zone (23,136 – 23,300).

If price finds support at 23,300 and rebounds, it may attempt a recovery towards 23,450 → 23,520. A strong close above 23,520 could shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to an upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,931 → 24,000

🟧 No Trade Zone: 23,451 – 23,642

🟩 Support: 23,520 → 23,300 → 23,136

🔸 Bullish Bias: Above 23,772, targeting 23,931 – 24,000

🔸 Bearish Bias: Below 23,500, expecting a fall towards 23,300 – 23,136

🔸 Neutral/Choppy: Inside 23,451 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

Nifty Futures Intraday Trend on March 27, 2025I anticipate a bearish trend for tomorrow. 23719 looks like a strong resistance and the support levels are at 23441 and 23198 (If breaks 23 441).

I foresee a good bearish trading opportunity and I avoid all Buy Signals and Focus on my PUTs.

Ready to trade? Trade with proper stop-loss.

Nifty finds a support just above Mother line and Mid-channel.Nifty has today found a good support just above Mother line of the hourly chart and Mid-channel support zone as it bounced from lows of the day near 23412 to close at 23591. Tomorrow being the weekly closing, monthly closing and financial yearly closing it become very important or one of the most important days for investment enthusiasts. A positive closing tomorrow will empower bulls in a lot of ways.

The first support for Nifty will be at 23550. A very strong support zone for Nifty right now remains between 23412 and 23380. This zone includes today's low, mid channel support and mother line support. A closing below 23380 will bring bears back into action who can potentially drag Nifty again to 23145, 23003 or levels below 22801.

Resistance zone for Nifty remains at 23646 today's high, 23670, 23778 and 23900. A closing above 23900 will empower bulls to take Nifty to higher levels of 24046, 24169 or 24378.

As described earlier very important day tomorrow with shadow of the candle being neutral to positive.

Disclaimer:

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

NIFTY : Levels and Plan for 27-Mar-2025📊 Market Context:

NIFTY closed at 23,464.30, experiencing a minor pullback after a previous uptrend. The index is currently at a crucial support zone, where price action will determine the next movement.

Let’s analyze the plan for different opening scenarios and structure our trades accordingly.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,590)

A gap-up above 23,590 will place NIFTY near its Opening Resistance. This level is important because it has previously acted as a supply zone, and bulls need strong momentum to sustain above it.

✅ Plan of Action:

If price sustains above 23,590, we can expect a bullish move towards the Last Intraday Resistance at 23,660. A breakout above this level may extend gains to 23,780+.

If price gets rejected from 23,590 and starts reversing, look for a shorting opportunity, targeting 23,501 → 23,464.

Avoid aggressive long trades inside the 23,590 – 23,660 zone unless there is a clear breakout with volume.

🎯 Pro Tip: If the gap-up is weak and fills within 15 minutes, it indicates profit booking, leading to a possible retracement.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,464)

A flat opening suggests market indecision, requiring confirmation before entering a trade.

✅ Plan of Action:

Upside case: If NIFTY breaks above 23,501, it can move towards 23,590. Observe price action at this level before deciding on further longs.

Downside case: If NIFTY breaks below 23,464, expect a decline towards the Opening Support Zone (23,501 – 23,477). A breakdown below 23,477 could trigger a deeper fall to 23,297.

Neutral Zone: If the index trades between 23,464 – 23,501, it indicates a choppy market. Avoid unnecessary trades here.

🎯 Pro Tip: A flat opening often leads to fake breakouts in the first 15 minutes. Wait for a strong candle close before entering a position.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,350)

A gap-down below 23,350 will put NIFTY near its Last Intraday Support Zone (23,297 – 23,343). If this level fails, further downside is possible.

✅ Plan of Action:

If price sustains below 23,350, expect a test of 23,297. A breakdown here could lead to heavy selling towards 23,182 – 23,100 levels.

If price rebounds from 23,297, it could trigger a pullback towards 23,464. Watch price action at 23,464 – 23,501 for signs of rejection or continuation.

Be cautious of bear traps—if price quickly reverses after a sharp gap-down, it might indicate a short-covering rally.

🎯 Pro Tip: In a gap-down scenario, avoid panic selling. Watch for reversals from key support levels before initiating fresh shorts.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Keep your position sizing disciplined to minimize potential losses.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode quickly.

🔹 Hedge Your Trades – Use spreads instead of naked options to reduce risk.

🔹 Wait for Confirmation – Enter trades only after a breakout/breakdown is retested with volume.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,590 → 23,660 → 23,780

🟧 No Trade Zone: 23,501 – 23,464

🟩 Support: 23,501 → 23,297 → 23,182

🔸 Bullish Bias: Above 23,590, targeting 23,660 – 23,780

🔸 Bearish Bias: Below 23,350, expecting a fall towards 23,297 – 23,182

🔸 Neutral/Sideways: If price remains between 23,501 – 23,464, avoid unnecessary trades.

🎯 Final Advice:

Stick to the plan and trade only at key levels.

Avoid trading inside No Trade Zones.

Let the market settle for 15-30 minutes before making big moves.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your research or consult a financial advisor before trading.

Nifty Review & Analysis - DailyNifty opned at 23700 and couldn’t go higher trading in a range for most part of the morning session, then saw selling pressure and tested 23450 and closed in neagtive at 23486 down -0.7%

Price Action : - Bullish

Nifty closed Neagtive with some profit booking at highs.

Candle Pattern: - Bullish

Formed a Neagtive Bearish candle, Bearish untill recent highs taken out

Daily EMA Positioning: Bullish

10dEMA 23176

20dEMA 22980

50dEMA 23136

200dEMA 24080

EMA Trend:

Closed above 10dEma ,20dEma, 50DEMA and 200DEMA,

Daily MA suggests Buy

Hourly suggests Sell

15mins Suggests Strong Sell

The momentum indicator, RSI - Relative Strength Index is now below 70 at 65 - not Overbought

Momentum gaining towards Neutral to Positive

Support/Resistance Levels:

Major Support 23000

Immediate Support 22300-200

Immediate Resistance 22550

Major Resistance 23700, 24000

Trend:

Short Term Trend is Sideways Consolidation with Negative bias

Daily Options Activity:

Highest CE OI was at 24000 also saw OI addition at 24000. 23600, 22500 - Resistance

Highest PE OI was at 23500, saw Pe unwinding at 23000 with no major PE addition

PCR is 0.8 indicating mild Bearishness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 33.5%/66.5% indicating addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions in longs & shorts remained unchanged -not Bearish

Nifty Futures price was -.7% with 2.5% Decrease in OI indicating Shorts Additions

Observation:

Niftylooked below 23700 as it couldn’t find buyers and saw selling at highs to close weak below 23500

Overall Trend:

Sentiment is Sideways cautious

Outlook for Next Session:

Nifty saw profit booking afrter 6-7 days of large upmove. Now in No trade Zone basically. Wait and watch for clear signal till 22300 or 22800 taken out

Approach & Strategy:

Wait and Watch with Long bias

My Trades & Positions:

No Positions

Nifty Coming back to test its supports.After a proper breakout and a rally which stretched above 1900 points from the March 4 lows, Nifty was clearly overbought on the hourly chart. It might be coming down for one or more of the following reasons:

1) Retesting support from where it can launch fresh move.

2) Correcting the RSI which had gone into the overbought zone.

3) Pressure due to upcoming Monthly and Financial year closing approaching on 28th March 2025.

3) The rally might have fizzled out.

4) Tax harvesting being done by retail investors.

5) Pressure due to upcoming Monthly and Financial

The first 4 options seem to be more likely of the 5 points mentioned above. FII was again on the buying side today so DII and Retail were the major selling parties.

Nifty Supports currently remain at:

1) Strong support zone of 23398 and 23309 (Hourly Mother Line support). This zone also includes the formidable mid channel support.

2) Next support is at 23145.

3) The next critical support for the rally remains at (Father line of the hourly chart) which is at 22959.

4) Final support for the rally will be at Channel bottom which is at 22801.

Nifty Resistance currently are at:

1) 23602 which is now a resistance.

2) 23749 a formidable resistance.

3) Recent rally top at 23869.

4) The zone between 24071 and 24267. (The areas that can be new channel top).

If you want to learn more about Mother, Father and the Small child theory designed by me about the stock market, Parallel Channels, charts, Candlestick analytics, Fundamental analysis, Mother and Father line importance, How to book profits, how to find a balance between Technical and fundamental analysis through Happy Candles Numbers, understand Behavioral Finance and other interesting topics by learning which you can make your money work harder you should read my book THE HAPPY CANDLES WAY TO WEALTH CREATION which is available on Amazon in paperback and kindle version. E-version of the same is available on Google Play Books too.

More volatility can be expected int the next 2 days due to ongoing Ukraine-US-Russia announcements, Financial year expiry and Trump Tarif updates. Trade with caution.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Nifty Review & Analysis - DailyNifty opened Gap up +90 points and soon saw profit booking, again found buying and made high of 23870 and saw sell off to 23650 levsl to close flat at 22368.

Price Action : - Bullish

Nifty closed Flat with some profit booking at highs.

Candle Pattern: - Bullish

Formed a Bearish candle, shpuld see tomorro’s candle for further direction.

Daily EMA Positioning: Bullish

10dEMA 23105

20dEMA 22926

50dEMA 23036

200dEMA 23402

EMA Trend:

Closed above 10dEma ,20dEma, 50DEMA and 200DEMA,

Daily MA suggests Buy

Hourly suggests Strong Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index is above 60 now at 71.65 - Just Over Bought

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 23300-200

Immediate Support 22500

Immediate Resistance 22700

Major Resistance 23800, 24000

Trend:

Short Term Trend is Sideways Consolidation

Daily Options Activity:

Highest CE OI was at 24000 also saw OI addition at 24000. 23800, 23700 - Resistance

Highest PE OI was at 23500, with no major PE addition

PCR is 1 indicating indecisiveness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 33%/67% indicating addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw little addition in longs +2K with shorts unchanged -Bullish

Nifty Futures price was flat with 3% OI Addition indicating Long Additions

Observation:

Nifty looks strong above 23500, saw profit booking at 23870. Might consolidate above 23500-600 for further move

Overall Trend:

Sentiment is Positive Sideways

Outlook for Next Session:

Nifty looks strong around 23600, might consolidate above 23550 before another upmove to 24000

Approach & Strategy:

Long around 23500-600 in April contract, with 23300 as SL

My Trades & Positions:

Long in 23600CE April contract

Good Trendline Breakout Candle by Nifty. Nifty has given a good break out above Father line (200 Days EMA) at 23399 and Long term trend line. This shows that Bulls have made a comeback and are out of Coma. However Bears can try to disrupt things later in the week. Important resistance zone of Nifty now is between 23708 and 23830. Crossing and closing above 23830 has potential for the rally to inch upwards towards next resistance levels at 24030 and 24215.

The supports for Nifty now remain at 23399, 23109 and 23036. The sectors that are driving the rally are Banking (Both Private and Public sector), Finance, Public Sector Industries. Midcap, Smallcap, Infra, Pharma, Consumer Goods and some other sectors are also trying to catch up. Overall it has been a V shaped recovery. This week's closing will decide if the rally can turn out into full blown Bull run or not. Signs are ominous.

Predicting exact top and exact bottom remains illusive. When People were calling for Doomsday scenario and 20K, 19K levels we have seen Nifty rising 1694 points from 4th March Low of 21964.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. No one can guarantee any success in highly volatile market or otherwise. There is also chance of bias in our opinion. The supports and resistances indicated are based on data which has a cycle time of being 3 months or older so it is not necessary that it will work. The author or Smart Investment will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

NIFTY READY FOR CORRECTION: BOOK PROFITSCRIPT: NIFTY CURRENT CONTINIOUS FUTURS

Timeframe: Daily

Important Support and Resistance Zones:

Resistance Zone: 23,170 - 23,240 = 70 points (supply zone)

Support Zone: 22,910 - 22,825 = 85 points (Demand Zone)

Today's High: 23,232.60

RSI: 59.08

As per past data, we can observe, price has corrected from mentioned supply zone and importantly when RSI has reached 60 mark on daily timeframe.

Here, there are several factors joining hands to correct Nifty in coming days.

1) Nifty reaching its supply zone

2) RSI near to mark 60

3) Past 4 days Nifty is rising continuous

Takeaway:

Yesterday's Close: 22972.95

Today's Close: 23,191.00

Difference: 259.65

Half the Difference: (259.65/2 = 109.025)

Subtracting from Today's Close: 23191.00 - 109.025 = 23081.975

Now, If price crosses this level in coming days, we can expect further fall in Nifty.

Target Condition: Price must cross 23,081 level in coming couple of days. If so,

Target Price: We will see further correction in Nifty till our Support Zone which is at

22,910.00 - 22,825.00

Expected Time: Approximately 7 to 12 Days from today.

Nifty Review & Analysis - Daily

Nifty opened Gap up +150 points again following Global Cues and saw surge throughout the day making a high of 23708 and closing at 23658 (+1.5%).

Price Action : - Bullish

Nifty closed 1.5% in positive. Consequtive 6 days green candle and closing above 10,20,50 nad 200 dEMA

Candle Pattern: - Bullish

Formed a Big Green candle with a small wick on upside.

Daily EMA Positioning: Bullish

10dEMA 22979

20dEMA 22848

50dEMA 23036

200dEMA 23399

EMA Trend:

Closed above 10dEma ,20dEma, 50DEMA and 200DEMA,

Daily MA suggests Strong Buy

Hourly suggests Strong Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index is above 60 now at 71.5 - Just Over Bought

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 23300-500

Immediate Support 22600

Immediate Resistance 22750

Major Resistance 24000

Trend:

Short Term Trend is Bullish

Daily Options Activity:

Highest CE OI was at 24000 also saw some unwinding with huge Unwinding at 23600-500 highest - Support

Highest PE OI was at 23300, highest Put addition seen at 23500 followed by 23600 - support

PCR is 1.2 indicating Bullishness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 32.5%/67.5% indicating addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw littl3 addition in longs +2K with shorts unchanged -Bullish

Nifty Futures price was higher by 01.5% and 12.5 %OI Increase indicating Long Additions

Observation:

Nifty looks strong above 23550 forming daily positive green candles, closing above 10,20,50, 200dEMA and RSI just in overbought zone

Overall Trend:

Sentiment is very Positive

Outlook for Next Session:

Nifty looks strong around 23600, might consolidate above 23550 before another upmove to 24000

Approach & Strategy:

Long with 22850 as SL in April contract, continue with SL 23500

My Trades & Positions:

Long in 23200CE April, closed and moved to 23600CE April