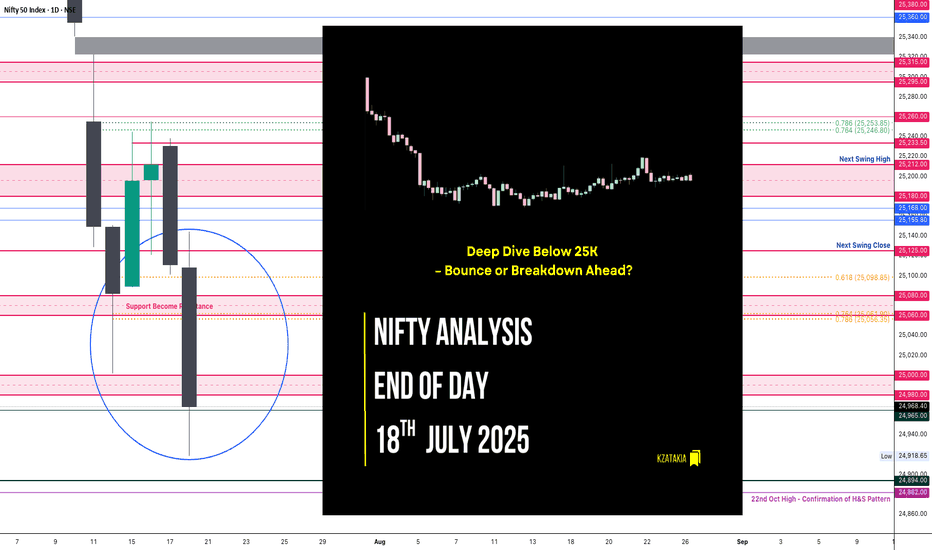

Nifty Analysis EOD – July 18, 2025 – Friday🟢 Nifty Analysis EOD – July 18, 2025 – Friday 🔴

“Deep Dive Below 25K – Bounce or Breakdown Ahead?”

As we discussed yesterday, a big move was on the cards — and Nifty delivered.

The index started flat to negative, and from the opening tick, sellers took firm control. It sharply broke through multiple key supports: PDC, PDL, S1, the important 25,080–25,060 support zone, swing low, 25,000–24,980, and even 24,965.

Buyers finally showed up near 24,920, a crucial level, and pulled off a modest 86-point recovery. The session ended at 24,968.40, still below the psychological 25,000 mark and the fractal swing low of July 14.

🕯 5 Min Time Frame Chart with Intraday Levels

🔍 Mixed Signals:

✅ Positive: Today’s low aligns with the 0.618 Fib retracement from the June 13 low to June 30 high — potential support zone.

✅ Positive: RSI(3 of 3) shows bullish divergence — early reversal sign?

❌ Negative: Closed below July 14 swing low — weak structural signal.

❌ Negative: Below 25,000 — psychological breakdown.

❓Now the big question: Will this bearish move continue, or is it a fakeout before reversal?

You're still bullish on the overall daily trend, but tactically bearish for intraday until a close above 25,125 confirms strength.

🕯 Daily Time Frame Chart For Additional View

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,108.55

High: 25,144.60

Low: 24,918.65

Close: 24,968.40

Change: −143.05 (−0.57%)

📊 Candle Structure Breakdown

Real Body: 140.15 pts → Large red bearish body

Upper Wick: 36.05 pts → rejection near early highs

Lower Wick: 49.75 pts → dip buying near 24,920

🔍 Interpretation

Mildly negative open with early strength attempt near 25,140

Sharp decline through major support zones

Buyers stepped in at 24,920, but recovery lacked follow-through

Close below 25K and key swing low confirms steady intraday selling pressure

🕯 Candle Type

Strong Bearish Candle with both wicks — sellers dominated, but not without some resistance from buyers at the lows.

📌 Key Insight

Short-term bearish momentum confirmed

24,920–24,890 is next critical support; breakdown may extend to 24,882–24,825

Bulls need to close above 25,125+ to reclaim control

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.56

IB Range: 126.45 → Medium IB

Market Structure: 🔴 Imbalanced

🟢 Trades Triggered:

09:42 AM – Short Trade → ✅ Trailed SL Hit Profit (R:R = 1 : 3.87)

📌 Support & Resistance Levels

Resistance Levels:

24,980 ~ 25,000

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

“Sometimes markets fall not to reverse, but to recharge.”

Today’s drop pierced major support zones, but the bounce from 0.618 Fib hints at possible resilience.

Structure needs clarity — Monday’s session will reveal whether this was a trap or fuel for bears.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Niftytrend

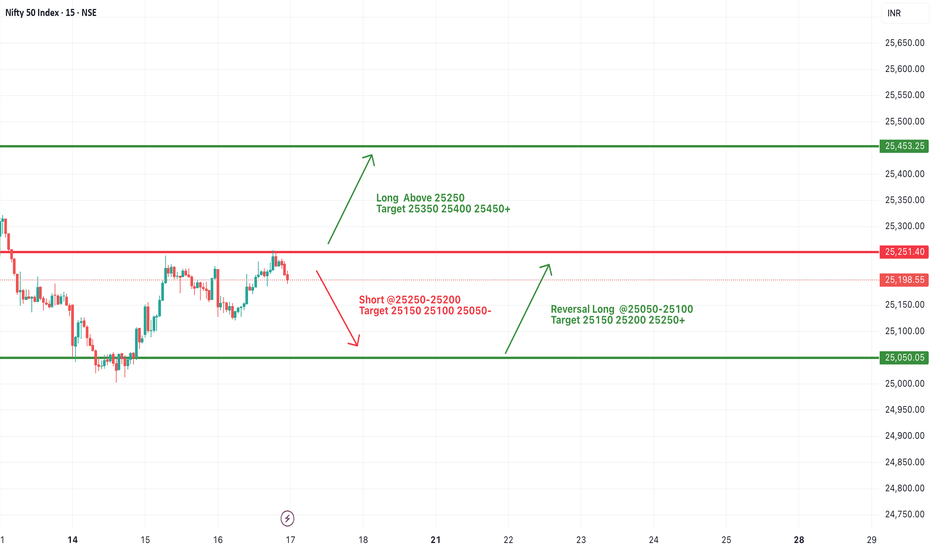

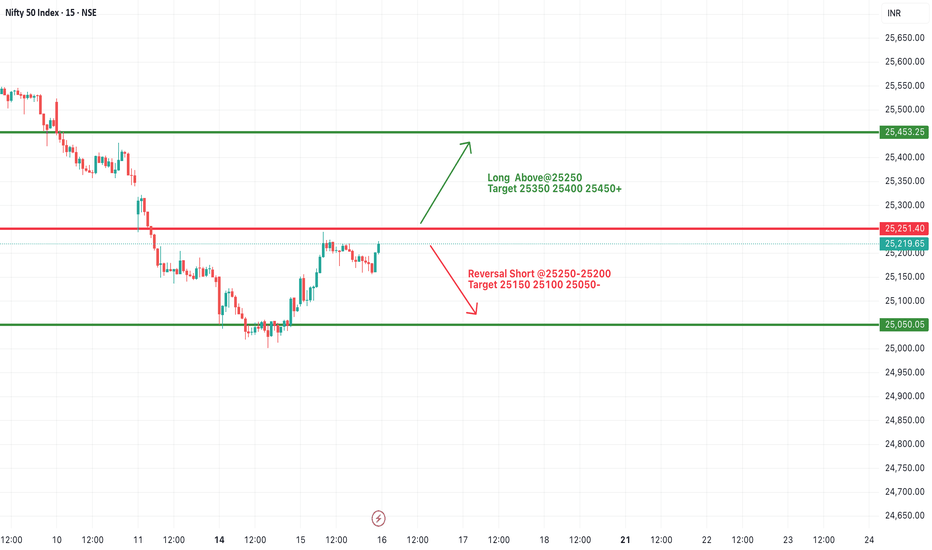

#NIFTY Intraday Support and Resistance Levels - 18/07/2025Nifty is likely to open slightly gap-up today near the 25100–25150 zone. There are no major changes from yesterday’s levels, so the same trading levels remain in focus for today’s session. If Nifty sustains above the 25250 level, we can expect an upside move toward 25350, 25400, and even 25450+ levels. This area remains a crucial resistance zone for potential bullish continuation.

On the downside, if Nifty fails to cross and sustain above 25250 and breaks below the 25200–25250 zone, we may witness a downward move with possible targets at 25150, 25100, and 25050.

A reversal long opportunity may arise in the 25050–25100 support zone if the market finds buying interest after a dip. From this level, we can expect targets around 25150, 25200, and 25250+.

The index is trading in a tight range with no fresh cues. Avoid aggressive entries and stick to level-based trades with strict stop-loss and partial profit booking.

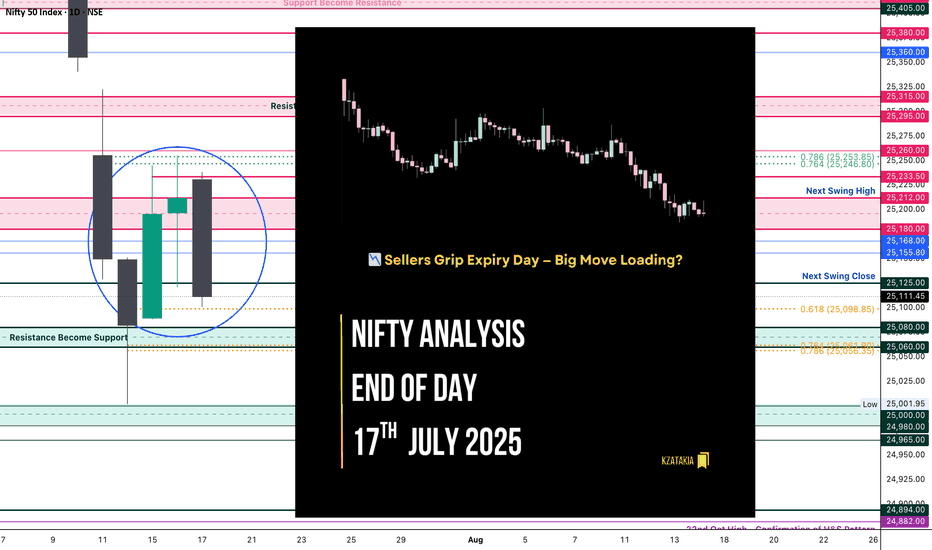

Nifty Analysis EOD – July 17, 2025 – Thursday🟢 Nifty Analysis EOD – July 17, 2025 – Thursday 🔴

📉 Sellers Grip Expiry Day — Big Move Loading?

Nifty started again with an OH (Open = High) formation and slipped down 94 points before 10:30 AM, marking the day’s low at 25,144. During this fall, it broke the support zone of 25,212 ~ 25,180. Although a retracement followed, it couldn’t sustain above the mean and eventually broke below the previous day’s low (PDL), closing at 25,111.45.

The weekly expiry was wild and volatile — especially from 12:30 to 2:30 PM. Interestingly, if we consider the total range of the last three sessions, it is just 166 points — well below average. This suggests a phase of consolidation. A significant move may emerge once Nifty decisively breaks the broader zone of 25,000 to 25,255.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,230.75

High: 25,238.35

Low: 25,101.00

Close: 25,111.45

Change: −100.60 (−0.40%)

Candle structure breakdown:

Real body:

Red candle (Close < Open): 25,230.75 − 25,111.45 = 119.30 points → Decent-sized bearish body

Upper wick:

25,238.35 − 25,230.75 = 7.60 points → Very small

Lower wick:

25,111.45 − 25,101.00 = 10.45 points → Small

Interpretation:

Nifty opened slightly lower, made a weak attempt upward, then saw consistent selling throughout the day, closing near the session’s low. The negligible wicks indicate that sellers were in full control, and buyers had little room to fight back.

Candle Type:

A strong bearish candle (almost Marubozu) with very small wicks → Clear dominance by sellers.

Key Insight:

The test of the 25,100 zone again shows weakening bullish strength.

If the next session breaks below 25,100, the fall may extend toward 25,000–25,050.

For bulls to regain short-term momentum, a close above 25,200–25,220 is necessary.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 176.62

IB Range: 60.85 → Medium IB

Market Structure: Balanced

Trades Triggered:

🕒 10:53 AM – Long Trade → Trailed SL Hit Profit (R:R = 1:0.42)

🧭 What’s Next? / Bias Direction

The market is coiling within a narrow range across multiple sessions, hinting at a potential breakout move.

📌 Watch Zone: 25,000 to 25,255

🔻 A break below 25,000 may open 24,950–24,900

🔺 A close above 25,260 could drive price toward 25,350+

Bias remains neutral-to-bearish unless bulls reclaim 25,220 decisively.

🧱 Support & Resistance Levels

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

🧠 Final Thoughts

"Structure is key. When levels work, respect them. When they break, adapt."

Three sessions of compression hint at expansion soon — stay alert and trade level-to-level with discipline.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

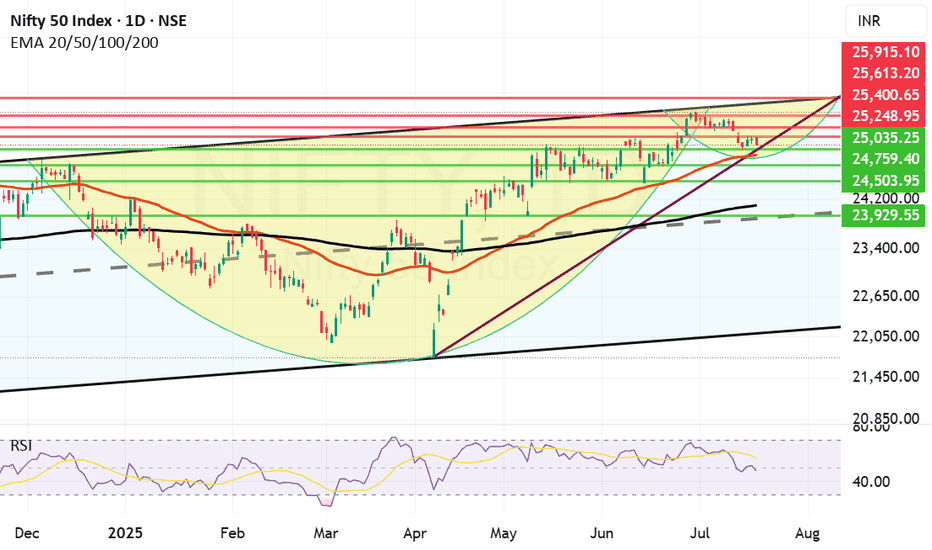

If Mother Line Support will hold, we might see a C&H formation. Although we saw a negative closing today, the chart suggests that if Mother line support will hold we might see a reversal and a Cup and Handle Formation in the near future. Cup and Handle formation is a great pattern which can help us reach the previous high and surpass it. If it happens or not only time can tell.

Supports For Nifty right now remain at: 25035, 24930 (Important Mother Line Support of Daily chart), 24759 and 24503. If 24503 is broken then there will be overall weakness in the market and we can see Nifty plummeting to 24097 (Father Line Support of Daily chart). Just below 24907 there will also be the mid channel support of 23929. (Just in case we reach there).

Resistances For Nifty Remain at: 25248, 25400, 25613 and 25915 seems to be the channel top as of now.

Nifty is delicately placed and the support of 24930 and Resistance of 25248 are the key levels to be watched. Above 25248 Bulls become strong. Below 24930 Bears become strong. Right now we are in no man's land with shadow of the candle slightly negative. If we see a bounce tomorrow or from the Mother line the shadow will has potential to turn positive later in the day tomorrow or next week.

Short term Outlook: Neutral to negative.

Medium Term Outlook: Neutral to Positive.

Long Term Outlook: Positive.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

#NIFTY Intraday Support and Resistance Levels - 17/07/2025Opening Expectation: Slight Gap-Up Around 25200

Nifty is likely to open slightly gap-up near the 25200 level, showing early signs of strength. If the index manages to sustain above the 25250 level, we may see a continuation of the upward momentum with targets around 25350, 25400, and 25450+. This zone marks the upper resistance, and a breakout with strong volume could push prices into a bullish trend for the session.

On the other hand, if Nifty faces rejection around 25250–25200 and begins to slide, a short opportunity opens up with downside targets at 25150, 25100, and 25050. Sustained weakness below these levels could intensify selling pressure. However, in case the index reverses and bounces from the 25050–25100 zone, a quick intraday long trade can be considered toward 25150, 25200, and 25250+.

Today’s bias remains slightly positive, but the session may remain volatile between key levels. Traders should focus on price action around the 25250 resistance and use trailing stop losses with strict risk control.

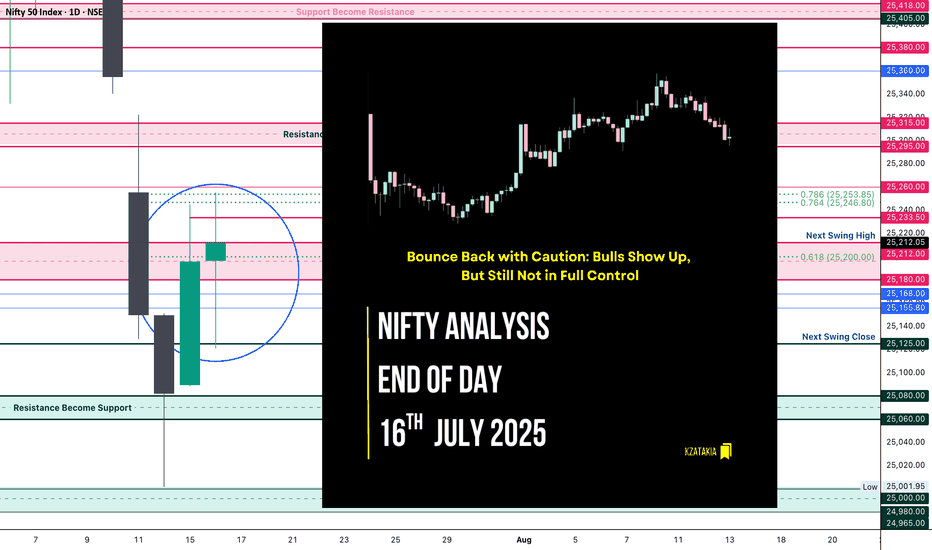

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

#NIFTY Intraday Support and Resistance Levels - 16/07/2025Nifty is likely to open flat near the 25200 mark, with the index currently hovering just below a key resistance zone of 25250. A decisive breakout above 25250 may provide momentum for a further upside rally toward 25350, 25400, and possibly 25450+. This level has acted as resistance in the past, so sustaining above it will be crucial for any bullish continuation.

On the flip side, 25250–25200 is also a potential reversal zone. If Nifty fails to break and sustain above it, then sellers may take control, and the index could see a pullback toward the immediate support levels of 25150, 25100, and 25050.

Since the index is near a crucial breakout/rejection point, early session price action will determine the direction.

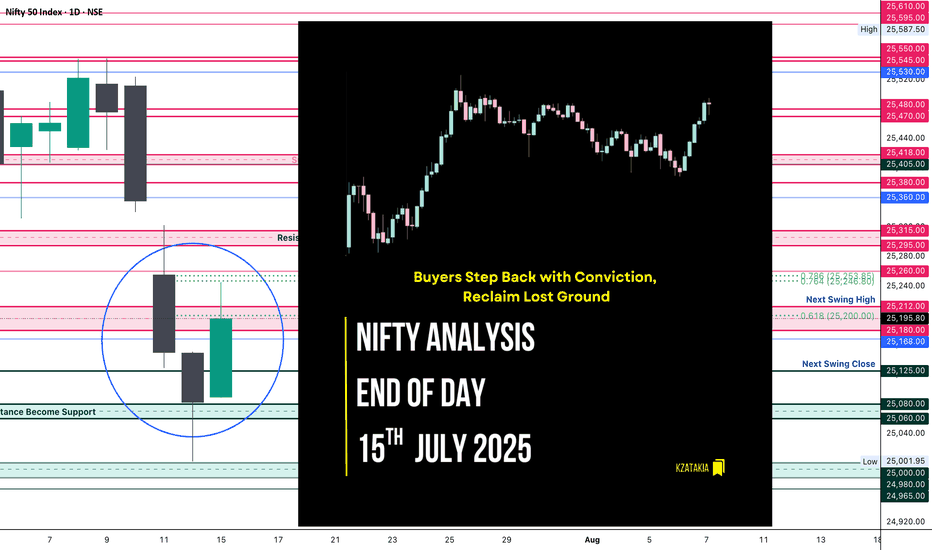

Nifty Analysis EOD – July 15, 2025 – Tuesday🟢 Nifty Analysis EOD – July 15, 2025 – Tuesday 🔴

"Buyers Step Back with Conviction, Reclaim Lost Ground"

Nifty began the session with a flat-to-positive tone, and the first 5-minute candle confidently added 60 points, pushing the index toward 25,150 – aligning with the Previous Day High (PDH). However, the level couldn't hold on the first attempt and Nifty slipped back to the day's open. After a brief consolidation, bulls made a strong comeback.

The second push broke through the PDH, Day High, and the resistance zone of 25,180–25,212, and extended the move up to mark the day’s high at 25,245.20. Post that, the index hovered above the breakout zone and closed solidly at 25,195.80, showing strength and follow-through.

📈 The day’s structure was clean and directional — a healthy bounce and hold above critical levels, reinforcing the idea that buyers are regaining control after last week’s consolidation and weakness.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,089.50

High: 25,245.20

Low: 25,088.45

Close: 25,195.80

Change: +113.50 (+0.45%)

📊 Candle Structure Breakdown

Real Body: 106.30 points – strong green bullish body

Upper Wick: 49.40 points – profit-taking or resistance at highs

Lower Wick: 1.05 points – negligible dip from open

🔍 Interpretation

Opened flat and quickly built momentum.

Temporary pullback in first 15 minutes was bought into strongly.

Closed with a clean green body, showing clear intraday bullish intent.

Holding above the 25,180–25,212 zone is a big win for bulls.

🕯 Candle Type

Bullish Marubozu-like (strong green body with minimal lower wick) — shows conviction and potential start of a new upswing post recent chop.

📌 Key Insight

25,080–25,100 is now a key base and must be protected.

If Nifty can break and hold above 25,240–25,250, a move toward 25,295–25,315 looks likely.

Failure to hold above 25,180 would be first sign of hesitation.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.18

IB Range: 67.35 → Medium IB

Market Structure: 🟢 Balanced

Trades Triggered

10:30 AM – Long Trade → ✅ Target Achieved, Trailed SL (R:R 1:2.48)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

"Trend is nothing without follow-through — today buyers showed up, but tomorrow they must push past 25,250 to prove it wasn't just a bounce."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

#NIFTY Intraday Support and Resistance Levels - 15/07/2025Nifty is expected to open with a gap-up today near the 25050–25100 zone. If the index sustains above this level after the opening, bullish momentum could follow with potential upside targets of 25150, 25200, and 25250+. This zone will act as the key intraday support-turned-demand area.

However, if Nifty struggles to hold above 25200–25250 and shows signs of reversal from this zone, we might witness selling pressure. A rejection from this region could lead to a pullback toward 25150, 25100, and 25050 levels.

On the downside, a breakdown below 24950 will signal further weakness. If that level is breached decisively, it can lead to sharp downside movements toward 24850, 24800, and even 24750. This would indicate a reversal of early bullish sentiment.

Today’s session could remain volatile around key levels. It’s advisable to watch price action around the 25050–25250 range for intraday confirmation before taking directional trades.

Nifty Analysis EOD – July 14, 2025 – Monday🟢 Nifty Analysis EOD – July 14, 2025 – Monday 🔴

"Broken Support, Fought Resistance – Tug of War in Play"

Nifty began the day with a classic Open = High (OH) setup, instantly rejecting any bullish intent. The crucial support zone of 25,080–25,060 was taken out early, and the market went on to mark the day's low at 25,001.95, a level that quickly turned into a decisive battleground.

After a bounce from the low, 25,125 emerged as a stiff resistance that pushed the index back below the broken support zone. For most of the session, the same support zone turned into resistance — a textbook polarity flip. However, in the final hour, Nifty showed resilience and finally closed back above 25,080, ending the session at 25,082.30.

🔄 The structure was full of failed intraday breakouts, signaling confusion and conflict — likely fueled by a wider CPR, imbalanced market structure, and medium IB of 109 pts. It was a low-volatility session, but packed with psychological tests.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,149.50

High: 25,151.10

Low: 25,001.95

Close: 25,082.30

Change: −67.55 (−0.27%)

📊 Candle Structure Breakdown

Real Body: 67.20 points – small to moderate bearish body

Upper Wick: 1.60 points – negligible upside attempt

Lower Wick: 80.35 points – strong defense from day’s low

🔍 Interpretation

Opened higher but got instantly rejected (OH formation).

Sellers took charge early but failed to hold momentum all the way.

The long lower wick reflects buyer presence at key 25,000 zone.

The close below open but above reclaimed support suggests tug of war — with bulls slightly redeeming themselves by EOD.

🕯 Candle Type

Hammer-like red candle — while bearish on close, the long lower shadow indicates potential exhaustion of selling and hints at reversal if follow-through buying emerges next session.

📌 Key Insight

25,000–25,020 has emerged as crucial near-term support.

A strong open or close above 25,150–25,180 may confirm a bullish reversal setup.

Breakdown below 25,000 opens the door for a fall toward 24,950 or lower.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 188.77

IB Range: 109.20 → Medium IB

Market Structure: 🔴 Imbalanced

Trades Triggered

09:50 AM – Long Trade → ❌ SL Hit

01:05 PM – Short Trade → ❌ SL Hit

📉 Tough day for directional trades — false breakouts dominated.

📌 Support & Resistance Zones

Resistance Levels

25,125

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Reclaimed ground doesn’t mean victory – yet. Watch the next move. Rejection below 25,000 ends the bulls' narrative; a strong move above 25,180 rewrites it.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty has taken support at 25K but can the support hold?Nifty today took a meaningful support at 25001 and bounced close to 25082. However ending the was in the negative by 67.55 points. RSI today went as low as 13.52 indication of oversold market. IT was a major drag after result that market did not like.

Now the resistances in front of Nifty are at 25106, Father Line Resistance at 25106, 25234, Mother Line Resistance at 25297, 25403 and finally 25543. Supports for Nifty remain at 25K, 24866 Chanel Bottom support and finally 24752. Below 24752 Bears can totally take control of the market if we reach there.

Things are in balance right now with Mid-cap, Small-cap starting to see some buying. If IT can hold the levels we will see growth from here. If IT index further caves in and other indices do not support we can see a down side. Shadow of the candle right now is neutral to negative.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

NIFTY 24740: Smart Money Signals Bearish Move IncomingThe directional bias is clear – bearish – and I'm currently waiting for a precise setup to present itself. Based on the Smart Money Concept, we could be looking at a potential short opportunity around the 24740 zone.

📍 Once the setup is confirmed, I’ll be sharing the exact entry and stop-loss levels with you.

Stay tuned – patience here is key. Let the market come to us.

#NIFTY Intraday Support and Resistance Levels - 14/07/2025Nifty is expected to open slightly gap-down after consistent bearish momentum in the previous sessions. The index is hovering near 25140, and immediate support lies around the 25200 level. A breakdown below this level could lead to further downside pressure, with key support targets at 25150, 25100, and 25050.

If the index breaks and sustains below 24950, it may trigger a deeper correction toward the next support levels at 24850, 24800, and 24750. These zones should be watched closely for potential reversals or continuation of bearish momentum.

On the upside, any recovery and sustained move above the 25250 level may lead to a pullback rally. In that scenario, immediate resistance levels to watch would be 25350, 25400, and 25450+.

Intraday structure remains weak unless Nifty reclaims the 25250+ zone with strength. Price action near the 25200–25050 support range will be crucial in deciding the direction of the day.

L&T Finance – Cup & Handle Breakout After 8 Years!L&T Finance has finally broken out of a classic Cup and Handle pattern, reclaiming its 2017 all-time high after nearly 8 years of consolidation. Strong volume confirmation adds weight to this long-term bullish breakout. A must-watch for positional traders and investors looking for momentum in the NBFC space!

Nifty Analysis EOD – July 11, 2025 – Friday🟢 Nifty Analysis EOD – July 11, 2025 – Friday 🔴

"Smooth Slide, Silent Pressure – Bulls on the Edge"

Nifty opened with a 60-point gap-down, and despite an initial attempt to fill the gap with a 40-point bounce, the index couldn’t sustain. What followed was classic, smooth selling pressure — a slow bleed marked by 16 consecutive 5-minute candles that never broke the previous candle’s high.

There was no panic, just a persistent drift downward. The day’s structure was a silent yet firm rejection from higher levels, with 25,150 acting as an anchor for most of the session, eventually closing near 25,140.

📉 This session marks a revisit to the breakout zone of June 26–27.

Is this a false breakout or a healthy retest?

Only time — and a bounce or breakdown from 25,080–25,060 — will tell.

⚠️ If we close below 25,000, the entire bullish move from late June might be invalidated.

But a sharp bounce from the 25080–25060 zone could spark a hopeful reversal setup.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,255.50

High: 25,322.45

Low: 25,129.00

Close: 25,149.85

Change: −205.40 (−0.81%)

📊 Candle Structure Breakdown

Real Body: 105.65 points – clean bearish body

Upper Wick: 66.95 points – buyers rejected

Lower Wick: 20.85 points – weak defense at bottom

🔍 Interpretation

Price opened weak and stayed weak.

An intraday push to 25,320 was sharply sold into.

Closing near the day’s low shows full bear control.

Minimal bounce from day low indicates lack of bullish confidence.

🕯 Candle Type

A Bearish Rejection Candle – resembles an inverted hammer in a downtrend; suggests sellers still strong and bulls hesitant

📌 Key Insight

The zone of 25,320–25,350 has turned into firm intraday resistance.

25,100–25,130 is the immediate make-or-break support — below that lies 25,000–25,050.

For bulls to breathe again, we need a bounce and hold above 25,250–25,300.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 193.17

IB Range: 78.45 → Medium IB

Market Structure: 🔴 Imbalanced

Trades Triggered

10:21 AM – Short Trade → 🎯 Trailing SL Hit (R:R 1:2.41)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

"It wasn’t a crash, it was a quiet rejection — and that makes it more dangerous. If bulls don’t show up now, bears might get bolder from here."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty at Make-or-Break Zone: What to Expect Next Week Markets eMarkets ended the week under pressure, with the Nifty 50 closing at 25,149, down 312 points from the previous week. The index traded within a tight band, hitting a high of 25,548 and a low of 25,129 — perfectly respecting the 25,900–25,000 range mentioned in last week’s analysis.

Now, Nifty finds itself at a crucial support level near 25,000. A rebound from this zone could trigger a short-term rally towards 25,500–25,600, which will act as immediate resistance. However, traders should proceed with caution, as the monthly chart remains neutral to bearish, indicating that this could just be a temporary bounce rather than a sustained uptrend.

Looking ahead, expect Nifty to trade within a range of 24,700 to 25,600. A breakdown below 24,700 could open the gates for deeper cuts, while a breakout above 25,600 needs to be backed by strong volume and participation to confirm a trend reversal.

Sector Watch: Reliance Shines Amidst Caution

Among the large caps, Reliance Industries stands out as the only stock showing strength on the monthly chart, while other heavyweights and key sectors continue to lack momentum. This narrow leadership is a red flag for broader market sustainability.

Global Markets: S&P 500 at a Crossroads

Globally, the S&P 500 closed at 6,259, down slightly from last week. What’s more important is the formation of a Doji candle — a classic sign of indecision. A move above 6,300 could lead to upside targets of 6,376 / 6,454 / 6,500, which would likely boost sentiment in global and Indian equities.

However, if the index slips below 6,150, it would mark a failed breakout, potentially triggering a global correction — a risk that Indian markets can't ignore.

Final Word

We’re at a critical juncture. While technicals suggest a potential bounce in Nifty from 25,000, the lack of confirmation on higher timeframes and uncertain global cues call for prudence over aggression.

👉 I’ll be staying out of the market this week. The setup doesn’t offer a favorable risk-reward, and in trading, patience is often the best position.

Let the charts speak. We’ll act accordingly.

Sector Rotation Strategy🌐 Sector Rotation Strategy: A Smart Way to Stay Ahead in the Stock Market

What Is Sector Rotation?

Imagine you're playing cricket. Some players shine in certain conditions — like a fast bowler on a bouncy pitch or a spinner on a turning track. The same idea applies to stock market sectors.

Sector Rotation is the process of shifting your money from one sector to another based on the market cycle, economic trends, or changing investor sentiment.

In simple words:

"You’re moving your money where the action is."

First, What Are Sectors?

The stock market is divided into different sectors, like:

Banking/Financials – HDFC Bank, Kotak Bank, SBI

IT– Infosys, TCS, Wipro

FMCG – HUL, Nestle, Dabur

Auto – Maruti, Tata Motors

Pharma – Sun Pharma, Cipla

Capital Goods/Infra – L&T, Siemens

PSU – BEL, BHEL, HAL

Real Estate, Metals, Energy, Telecom, etc.

Each sector behaves differently at various stages of the economy.

Why Is Sector Rotation Important?

Because all sectors don’t perform well all the time.

For example:

In a bull market, sectors like Auto, Capital Goods, and Infra usually lead.

During slowdowns, investors run to safe havens like FMCG and Pharma.

When inflation or crude oil rises, energy stocks tend to do better.

When interest rates drop, banking and real estate might shine.

So, instead of holding poor-performing sectors, smart investors rotate into the hot ones.

How Does Sector Rotation Work?

Let’s say you are an investor or trader.

Step-by-step guide:

Track the economy and markets

Is GDP growing fast? = Economy expanding

Are interest rates high? = Tight liquidity

Is inflation cooling down? = Growth opportunity

Observe sectoral indices

Check Nifty IT, Nifty Bank, Nifty FMCG, Nifty Pharma, etc.

See which are outperforming or lagging.

Watch for news flow

Budget announcements, RBI policy, global cues, crude oil prices, etc.

E.g., Defence orders boost PSU stocks like BEL or HAL.

Move your capital accordingly

If Infra and Capital Goods are breaking out, reduce exposure in IT or FMCG and rotate into Infra-heavy stocks.

Real Example (India, 2024–2025)

Example: Rotation from IT to PSU & Infra

In late 2023, IT stocks underperformed due to global slowdown and US recession fears.

Meanwhile, PSU and Infra stocks rallied big time because:

Government increased capital expenditure.

Defence contracts awarded.

Railway budget saw record allocations.

So, many smart investors rotated out of IT and into:

PSU Stocks: RVNL, BEL, HAL, BHEL

Capital Goods/Infra: L&T, Siemens, ABB

Railway Stocks: IRFC, IRCTC, Titagarh Wagons

This sector rotation gave 30%–100% returns in a few months for many stocks.

Tools You Can Use

Sectoral Charts on TradingView / Chartink / NSE

Use indicators like RSI, MACD, EMA crossover.

Compare sectors using “Relative Strength” vs Nifty.

Economic Calendar

Track RBI policy, inflation data, IIP, GDP, etc.

News Portals

Moneycontrol, Bloomberg, ET Markets, CNBC.

FIIs/DII Activity

Where the big money is going – this matters!

Sector Rotation Heatmaps

Some platforms show weekly/monthly performance of sectors.

📈 Sector Rotation Strategy for Traders

For short-term traders (swing/intraday):

Rotate into sectors showing strength in volumes, price action, breakouts.

Use tools like Open Interest (OI) for sector-based option strategies.

Example:

On expiry weeks, if Bank Nifty is showing strength with rising OI and volume, rotate capital into banking-related trades (Axis, ICICI, SBI).

Sector Rotation for Long-Term Investors

For investors, sector rotation can be used:

To reduce drawdowns.

To book profits and re-enter at better levels.

To ride economic trends.

Example:

If you had exited IT in late 2022 after a rally, and entered PSU stocks in early 2023, your portfolio would’ve seen better growth.

Pros of Sector Rotation

Better returns compared to static investing

Helps avoid underperforming sectors

Takes advantage of macro trends

Works in both bull and bear markets

Cons or Risks

Requires monitoring and active management

Timing the rotation is difficult

Wrong rotation = underperformance

May incur tax if frequent buying/selling (for investors)

Pro Tips

Don't rotate too fast; let the trend confirm.

Use SIPs or staggered entry in new sectors.

Avoid “hot tips”; follow actual price and volume.

Blend sector rotation with strong stock selection (don’t just chase sector).

Conclusion

The Sector Rotation Strategy is one of the smartest, most practical tools used by both traders and investors. You don’t need to be a pro to use it — just stay alert to the market mood, economic cycles, and where the money is moving.

Think of it as dancing with the market:

“When the music changes, you change your steps.”

Keep rotating. Keep growing.

NIFTY 1. Rectangle Box (Sideways Zone)

Nifty had earlier made a strong range-bound consolidation around 24,400 -25,000.

This has now become a strong support zone (red shaded area).

2. Breakout & Retest Pattern:

Nifty then broke out of this zone and went to around 25,600.

Now it is retesting the same old resistance (now support).

3. Price Action Zones:

Support Zone: 24,950 25,100

Resistance Zone: 25,600 - 25,800

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

#NIFTY Intraday Support and Resistance Levels - 11/07/2025Nifty is likely to open on a flat note today, continuing the weakness seen in the recent sessions. The index has shown a consistent downward move after facing resistance near the 25550 zone. If Nifty sustains below the 25450–25400 range, it may trigger further bearish momentum with immediate targets at 25350, 25300, and 25250. Breaching 25200 could lead to further downside toward 25150, 25100, and 25050 levels.

On the other hand, any sharp reversal and breakout above 25550 may revive bullish sentiment. Sustaining above this level can push the index toward 25600, 25650, and 25750+. However, upside movement will require strong buying interest and volume support.

Overall, the broader trend remains weak unless a clear breakout occurs. Traders are advised to trade with caution, wait for directional confirmation, and use strict stop-loss to manage risks in this volatile environment.

Nifty approaching Mid-channel support zone now. Nifty after a 120 point negative closing is entering an important support zone. This support zone has 3 layers. The First of the support lies at 25322 which is just above the mid-channel. The second for Nifty is near 25222 which is just below the mid channel support.

There is a possibility of bounce either from the current level or either of these 2 levels. If we get a closing below 25322 then there is a possibility that bears might try to pull Nifty down towards 25167 which is the Father line or 200 Hours EMA.

The resistances for Nifty remain at 25404, 25437 which is the Mother line or 50 hours EMA. Post that there are resistances at 25477, 25551 and 25641. Closing above 25641 is required for Nifty to fly towards 26K levels.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Nifty Analysis EOD – July 10, 2025 – Thursday🟢 Nifty Analysis EOD – July 10, 2025 – Thursday 🔴

"False Hopes, True Drop – Bears Tighten Their Grip"

Nifty opened with a mild 50-point gap-up, but within the very first minute, that optimism was crushed. It dropped nearly 100 points, breaching the previous day’s low, and entered the key support zone of 25405–25418, which held briefly for about half an hour.

But this wasn’t a day for bulls.

After a weak attempt to recover from the 25360 support (which held twice intraday), sellers regained momentum, dragged the index further down, and finally closed at the lowest point of the day – 25348.

🔸 Expiry volatility played its part — trapping option buyers and luring them into false reversals.

🔸 However, quick scalpers and intraday short-sellers likely capitalized well.

🔸 The structure was decisively bearish, with no meaningful intraday bounce.

Tomorrow becomes crucial.

Bulls have one last stronghold at the 25300 level.

Bears, already in charge, may extend the damage further if this breaks.

⚠️ Bias Levels:

🟢 Bullish above: 25420

🔴 Bearish below: 25290

⚪ Between = Neutral / Watch Mode

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,511.65

High: 25,524.05

Low: 25,340.45

Close: 25,355.25

Change: −120.85 (−0.47%)

📊 Candle Structure Breakdown

Real Body: 156.40 points – large red candle

Upper Wick: 12.40 points – minimal bullish push

Lower Wick: 14.80 points – bears kept pressure till close

🔍 Interpretation

Bears took over early and never let go

The close at day low shows strong conviction from sellers

Lack of significant wicks → no real fight from bulls

🕯 Candle Type

Bearish Marubozu-style candle – clear sign of dominance by sellers, and potential for continuation if no quick reversal

📌 Key Insight

Market is in a critical zone — hovering above the edge of deeper correction

25300–25290 is the line in the sand

A breakdown below can target 25,200–25,250

Bulls can only regain momentum above 25,420

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 189.49

IB Range: 113.75 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

10:52 AM – Short Trade → 🎯 Trail SL Hit (R:R 1:0.38)

📌 Support & Resistance Zones

Resistance Levels

25,380

25,405 ~ 25,418

25,470 ~ 25,480

25,530

25,545 ~ 25,550

Support Levels

25,315 ~ 25,295

25,260

25,212 ~ 25,180

25,125

💭 Final Thoughts

"Expiry days often blur the picture, but today’s price action was sharp. Unless bulls step up quickly, the breakdown may just be getting started."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.