Nifty’s Make-or-Break Zone: Will Bulls Charge or Bears Bite?www.tradingview.com

---

### 🧠 **1. Context at-a-glance**

- Recent bounce from a **Demand Zone (D1 Key Level)** around **21,800**.

- Strong bullish rally into a **Supply Zone (~22,600–22,750)**.

- Price is currently showing **hesitation within this resistance**, with smaller-bodied candles forming → potential reversal signals.

- The oscillator has **crossed bullish** from oversold but is nearing a decision zone.

---

### 🔮 **Future Move Scenarios**

#### 🟥 SCENARIO A: **Rejection from Supply Zone** (Most Likely Short-Term)

- **Why?** Price has hit a resistance with fading momentum and no breakout confirmation.

- **What happens?**

- Price retraces toward **22,200**, potentially even **21,800–21,900**.

- Retest of BOS level possible before the next directional leg.

- **Watch for:** Bearish candle formations (engulfing / long wicks), oscillator stalling below 50.

---

#### 🟩 SCENARIO B: **Bullish Breakout Above 22,750**

- **What confirms it?**

- A strong bullish candle closing above 22,750 with follow-through.

- **Next Targets:**

- 🔼 **23,000** (round level and minor resistance)

- 🔼 **23,300–23,500** (old supply zone)

- Eventually back to **23,750+**

- **Oscillator support:** If the indicator crosses 50+, bullish momentum could sustain.

---

### 📉 Oscillator Hints:

- Still below 50 — **recovery in progress**, not full momentum yet.

- If price rejects and oscillator drops → **Bearish divergence** possibility.

---

### 🧭 **Your Playbook**

| Zone | Action Idea | Trigger to Watch |

|------------------|-------------------------------|----------------------------------|

| 22,600–22,750 | Short / Hedge | Rejection candle, loss of momentum |

| 22,200–22,300 | Potential buy zone (aggressive) | Bullish candle or bounce confirmation |

| Break > 22,750 | Buy on Retest or Momentum | Breakout candle + volume |

| < 21,800 | Bearish continuation | Break of demand zone + close below |

---

Niftytrendanalysis

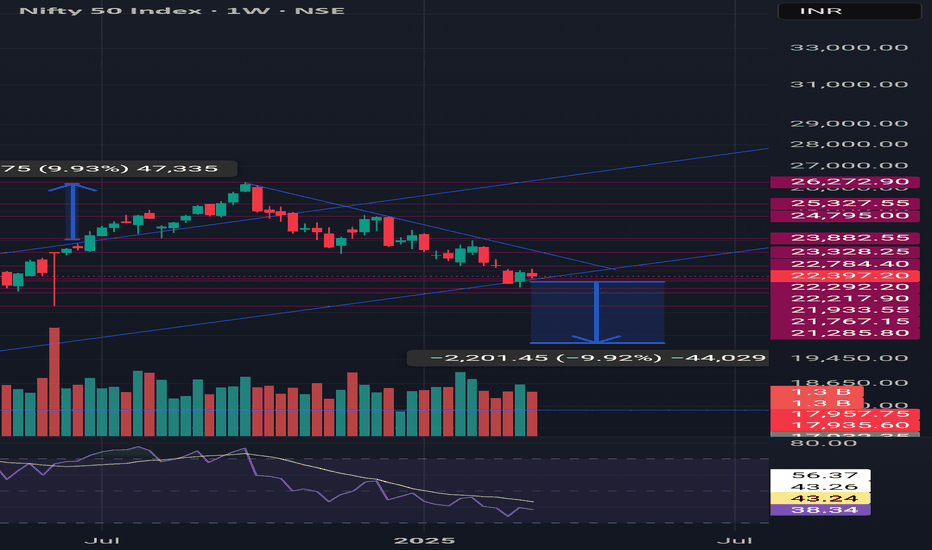

Nifty Futures Daily view for April 2025Our Precision Scalper accurately identified the sell entry for Nifty Futures two days in advance, providing traders with a strategic edge. With minimal risk per trade, this powerful tool effectively captures trends and sustains them until completion. To maximize risk management, ensure a stop-loss is set for every entry.

Nifty Futures Daily analysis for April 2025I expect Nifty to be bearish for the month of April 2025. According to my analysis, my Dynamic Buy/Sell indicator confirmed sell signal today with Stop-Loss. After sell confirmation, I adjusted the EOD targets to 720 degrees and I foresee the Nifty Futures to drop down to target 2 or 3 by April 21st or 25th. It may not be a continuous fall, there may be a pull back before the fall.

NIFTY : Trading Levels and Plan for 31-Mar-2025📌 NIFTY Trading Plan – 31-Mar-2025

📊 Market Overview:

Nifty closed at 23,495, showing mixed sentiment near the Opening Support Zone (23,401 – 23,465). The market is at a crucial juncture, with potential bullish momentum above resistance levels, while breakdowns below key supports may trigger selling pressure.

This plan will help you react strategically to different opening scenarios, ensuring a favorable risk-reward ratio.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,600)

A gap-up above 23,600 signals bullish momentum, but for sustained upside, Nifty must stay above 23,642 – 23,842. Watch for rejection at resistance zones, as profit booking can lead to reversals.

✅ Plan of Action:

If Nifty sustains above 23,772, expect a move towards the next resistance at 23,925 – 23,990. A breakout above 23,990 could open doors for 24,050+.

If price faces rejection at 23,842, a pullback towards 23,642 → 23,495 is possible. If it breaks below 23,495, expect further downside.

Avoid aggressive longs inside 23,642 – 23,842, as this is a potential reversal zone. Wait for a decisive breakout or rejection confirmation.

🎯 Pro Tip: If the gap-up is filled within the first 15-30 minutes, it suggests weak buying pressure and increases the probability of a reversal.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,500)

A flat opening near 23,495 indicates indecision. The market will take direction after the first few candles, so breakouts or breakdowns from key levels should be closely monitored.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,642, it may head towards 23,772 → 23,925. Monitor price action near these resistance levels before entering fresh longs.

Downside case: If Nifty breaks below 23,495, it could test 23,336 → 23,164. A breakdown below 23,164 will shift the trend bearish.

Avoid trading inside the No Trade Zone (23,495 – 23,642), as price could consolidate before a breakout.

🎯 Pro Tip: In a flat opening, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,400)

A gap-down below 23,400 may indicate fresh selling pressure, making it crucial to observe whether buyers step in at support zones.

✅ Plan of Action:

If price sustains below 23,400, expect a decline towards 23,336 → 23,164. A breakdown below 23,164 could lead to a sharp fall towards 23,100.

If price finds support at 23,164 and rebounds, it may recover towards 23,336 → 23,495. A strong close above 23,495 will shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to a strong upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,925 → 23,990

🟧 No Trade Zone: 23,495 – 23,642

🟩 Support: 23,336 → 23,164 → 23,100

🔸 Bullish Bias: Above 23,642, targeting 23,772 – 23,925

🔸 Bearish Bias: Below 23,400, expecting a fall towards 23,336 – 23,164

🔸 Neutral/Choppy: Inside 23,495 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

NIFTY--@Manipulation??Nifty index is broken the trendline strongly...

Before going to break price a strong consolidation is given with a lot of liquidity lies below it...

@22400 levels

now price is exactly at the zone of resistance.

the resistance zone is lies at 24000-24300, after a strong movement to upside price is still not given any retracement...

Case1::

I am expecting either a strong retracement towards trendline.

the retracement should be in the form of correction with slower one.

Corrective pullback::

Case2::

After the liquidity above the 24000 and 24300, price has to give some retracement..

If we buy here it will completely becomes a manipulation....

Buying above the resistance zone is also a manipulation on topside...

If price breaks the resistance zone, then will wait for a correction towards the trendline areas.

Note::

So in order to buy the breakout of trendline the stoploss placement is very large...so with large stoploss will never go for buying...

the 2 possible buying areas are

1.breakout candle at the trendline

2.after the liquidity grab below the strong consolidation zone( before breakout of trendline.)

we have manipulation on both sides....if we go for long price will make an attempt of retracement as lot of liquidity lies below.

Better to look for short above the resistance zone(topside liquidity).If no retracement now.

NIFTY : Trading Levels and Plan for 28-Mar-2025📌 NIFTY Trading Plan – 28-Mar-2025

📊 Market Overview:

Nifty closed at 23,601, consolidating within a No Trade Zone after a strong uptrend. The market is at a critical juncture, and the price action at key levels will determine the next directional move.

This plan provides clear trade setups for different opening scenarios and helps you navigate market volatility with a structured approach.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,700)

A gap-up opening above 23,700 will push Nifty closer to the Last Intraday Resistance Zone (23,772). The key factor will be whether Nifty sustains above resistance or faces rejection.

✅ Plan of Action:

If Nifty sustains above 23,772, it can move towards the next resistance at 23,931. A breakout above 23,931 could trigger a rally towards 24,000+, but watch for profit booking at higher levels.

If price faces rejection at 23,772 and reverses, expect a pullback towards 23,650 → 23,600. A strong rejection here could lead to an intraday sell-off.

Avoid fresh longs inside 23,700 – 23,772, as this area may act as a profit-booking zone. Wait for confirmation before taking trades.

🎯 Pro Tip: If the gap-up is quickly filled within the first 15 minutes, it signals weak buying strength and increases the probability of an intraday correction.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,600)

A flat opening suggests indecision among traders, and the market will likely take direction after the first few candles. The best strategy is to trade breakouts or breakdowns from key levels.

✅ Plan of Action:

Upside case: If Nifty breaks and sustains above 23,650, it may head towards 23,700 → 23,772. Observe the price action near resistance before taking fresh longs.

Downside case: If Nifty breaks below 23,520, it could test 23,450 → 23,300. A breakdown below 23,300 will turn the trend bearish.

Sideways caution: If Nifty remains inside the No Trade Zone (23,451 – 23,642), avoid taking trades as volatility could trap both buyers and sellers.

🎯 Pro Tip: In a flat opening scenario, wait for a clear 15-minute candle close above or below key levels before entering trades.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,500)

A gap-down below 23,500 could indicate profit booking or fresh selling pressure. The critical factor will be whether buyers defend key support zones.

✅ Plan of Action:

If price sustains below 23,500, expect a decline towards 23,300. A breakdown below 23,300 may accelerate selling towards the Buyer’s Support Zone (23,136 – 23,300).

If price finds support at 23,300 and rebounds, it may attempt a recovery towards 23,450 → 23,520. A strong close above 23,520 could shift momentum back to the bulls.

Be cautious of bear traps – If the market gaps down but quickly recovers, it could trigger short covering, leading to an upside reversal.

🎯 Pro Tip: If the gap-down occurs near a strong buyer’s support zone, wait for a bullish price action confirmation before entering long trades.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Use proper position sizing to manage risk.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode rapidly.

🔹 Use Spreads for Protection – Instead of naked options, use spreads to limit risk and improve probability.

🔹 Trade at Key Levels – Avoid impulsive trades; focus on defined support and resistance zones.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,772 → 23,931 → 24,000

🟧 No Trade Zone: 23,451 – 23,642

🟩 Support: 23,520 → 23,300 → 23,136

🔸 Bullish Bias: Above 23,772, targeting 23,931 – 24,000

🔸 Bearish Bias: Below 23,500, expecting a fall towards 23,300 – 23,136

🔸 Neutral/Choppy: Inside 23,451 – 23,642, avoid unnecessary trades

🎯 Final Advice:

Stick to the structured trading plan and execute only at key levels.

Avoid emotional trading—wait for confirmation before entering trades.

The first 15-30 minutes after market open will provide better clarity—observe price action before committing to a trade.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your own research or consult a financial advisor before making any trades.

Nifty Futures Intraday Trend on March 27, 2025I anticipate a bearish trend for tomorrow. 23719 looks like a strong resistance and the support levels are at 23441 and 23198 (If breaks 23 441).

I foresee a good bearish trading opportunity and I avoid all Buy Signals and Focus on my PUTs.

Ready to trade? Trade with proper stop-loss.

NIFTY : Levels and Plan for 27-Mar-2025📊 Market Context:

NIFTY closed at 23,464.30, experiencing a minor pullback after a previous uptrend. The index is currently at a crucial support zone, where price action will determine the next movement.

Let’s analyze the plan for different opening scenarios and structure our trades accordingly.

🔼 Scenario 1: Gap-Up Opening (100+ points above 23,590)

A gap-up above 23,590 will place NIFTY near its Opening Resistance. This level is important because it has previously acted as a supply zone, and bulls need strong momentum to sustain above it.

✅ Plan of Action:

If price sustains above 23,590, we can expect a bullish move towards the Last Intraday Resistance at 23,660. A breakout above this level may extend gains to 23,780+.

If price gets rejected from 23,590 and starts reversing, look for a shorting opportunity, targeting 23,501 → 23,464.

Avoid aggressive long trades inside the 23,590 – 23,660 zone unless there is a clear breakout with volume.

🎯 Pro Tip: If the gap-up is weak and fills within 15 minutes, it indicates profit booking, leading to a possible retracement.

⚖ Scenario 2: Flat Opening (Within ±100 points, around 23,464)

A flat opening suggests market indecision, requiring confirmation before entering a trade.

✅ Plan of Action:

Upside case: If NIFTY breaks above 23,501, it can move towards 23,590. Observe price action at this level before deciding on further longs.

Downside case: If NIFTY breaks below 23,464, expect a decline towards the Opening Support Zone (23,501 – 23,477). A breakdown below 23,477 could trigger a deeper fall to 23,297.

Neutral Zone: If the index trades between 23,464 – 23,501, it indicates a choppy market. Avoid unnecessary trades here.

🎯 Pro Tip: A flat opening often leads to fake breakouts in the first 15 minutes. Wait for a strong candle close before entering a position.

🔽 Scenario 3: Gap-Down Opening (100+ points below 23,350)

A gap-down below 23,350 will put NIFTY near its Last Intraday Support Zone (23,297 – 23,343). If this level fails, further downside is possible.

✅ Plan of Action:

If price sustains below 23,350, expect a test of 23,297. A breakdown here could lead to heavy selling towards 23,182 – 23,100 levels.

If price rebounds from 23,297, it could trigger a pullback towards 23,464. Watch price action at 23,464 – 23,501 for signs of rejection or continuation.

Be cautious of bear traps—if price quickly reverses after a sharp gap-down, it might indicate a short-covering rally.

🎯 Pro Tip: In a gap-down scenario, avoid panic selling. Watch for reversals from key support levels before initiating fresh shorts.

⚠️ Risk Management Tips for Options Traders

🔹 Avoid over-leveraging – Keep your position sizing disciplined to minimize potential losses.

🔹 Theta Decay Awareness – If the market consolidates, option premiums will erode quickly.

🔹 Hedge Your Trades – Use spreads instead of naked options to reduce risk.

🔹 Wait for Confirmation – Enter trades only after a breakout/breakdown is retested with volume.

📌 Summary & Conclusion

📍 Key Levels to Watch:

🟥 Resistance: 23,590 → 23,660 → 23,780

🟧 No Trade Zone: 23,501 – 23,464

🟩 Support: 23,501 → 23,297 → 23,182

🔸 Bullish Bias: Above 23,590, targeting 23,660 – 23,780

🔸 Bearish Bias: Below 23,350, expecting a fall towards 23,297 – 23,182

🔸 Neutral/Sideways: If price remains between 23,501 – 23,464, avoid unnecessary trades.

🎯 Final Advice:

Stick to the plan and trade only at key levels.

Avoid trading inside No Trade Zones.

Let the market settle for 15-30 minutes before making big moves.

📢 Disclaimer

I am not a SEBI-registered analyst. This trading plan is for educational purposes only. Please conduct your research or consult a financial advisor before trading.

Nifty Review & Analysis - DailyNifty opened Gap up +90 points and soon saw profit booking, again found buying and made high of 23870 and saw sell off to 23650 levsl to close flat at 22368.

Price Action : - Bullish

Nifty closed Flat with some profit booking at highs.

Candle Pattern: - Bullish

Formed a Bearish candle, shpuld see tomorro’s candle for further direction.

Daily EMA Positioning: Bullish

10dEMA 23105

20dEMA 22926

50dEMA 23036

200dEMA 23402

EMA Trend:

Closed above 10dEma ,20dEma, 50DEMA and 200DEMA,

Daily MA suggests Buy

Hourly suggests Strong Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index is above 60 now at 71.65 - Just Over Bought

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 23300-200

Immediate Support 22500

Immediate Resistance 22700

Major Resistance 23800, 24000

Trend:

Short Term Trend is Sideways Consolidation

Daily Options Activity:

Highest CE OI was at 24000 also saw OI addition at 24000. 23800, 23700 - Resistance

Highest PE OI was at 23500, with no major PE addition

PCR is 1 indicating indecisiveness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 33%/67% indicating addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw little addition in longs +2K with shorts unchanged -Bullish

Nifty Futures price was flat with 3% OI Addition indicating Long Additions

Observation:

Nifty looks strong above 23500, saw profit booking at 23870. Might consolidate above 23500-600 for further move

Overall Trend:

Sentiment is Positive Sideways

Outlook for Next Session:

Nifty looks strong around 23600, might consolidate above 23550 before another upmove to 24000

Approach & Strategy:

Long around 23500-600 in April contract, with 23300 as SL

My Trades & Positions:

Long in 23600CE April contract

NIFTY READY FOR CORRECTION: BOOK PROFITSCRIPT: NIFTY CURRENT CONTINIOUS FUTURS

Timeframe: Daily

Important Support and Resistance Zones:

Resistance Zone: 23,170 - 23,240 = 70 points (supply zone)

Support Zone: 22,910 - 22,825 = 85 points (Demand Zone)

Today's High: 23,232.60

RSI: 59.08

As per past data, we can observe, price has corrected from mentioned supply zone and importantly when RSI has reached 60 mark on daily timeframe.

Here, there are several factors joining hands to correct Nifty in coming days.

1) Nifty reaching its supply zone

2) RSI near to mark 60

3) Past 4 days Nifty is rising continuous

Takeaway:

Yesterday's Close: 22972.95

Today's Close: 23,191.00

Difference: 259.65

Half the Difference: (259.65/2 = 109.025)

Subtracting from Today's Close: 23191.00 - 109.025 = 23081.975

Now, If price crosses this level in coming days, we can expect further fall in Nifty.

Target Condition: Price must cross 23,081 level in coming couple of days. If so,

Target Price: We will see further correction in Nifty till our Support Zone which is at

22,910.00 - 22,825.00

Expected Time: Approximately 7 to 12 Days from today.

Nifty Review & Analysis - Daily

Nifty opened Gap up +150 points again following Global Cues and saw surge throughout the day making a high of 23708 and closing at 23658 (+1.5%).

Price Action : - Bullish

Nifty closed 1.5% in positive. Consequtive 6 days green candle and closing above 10,20,50 nad 200 dEMA

Candle Pattern: - Bullish

Formed a Big Green candle with a small wick on upside.

Daily EMA Positioning: Bullish

10dEMA 22979

20dEMA 22848

50dEMA 23036

200dEMA 23399

EMA Trend:

Closed above 10dEma ,20dEma, 50DEMA and 200DEMA,

Daily MA suggests Strong Buy

Hourly suggests Strong Buy

15mins Suggests Strong Buy

The momentum indicator, RSI - Relative Strength Index is above 60 now at 71.5 - Just Over Bought

Momentum gaining towards Upside

Support/Resistance Levels:

Major Support 23300-500

Immediate Support 22600

Immediate Resistance 22750

Major Resistance 24000

Trend:

Short Term Trend is Bullish

Daily Options Activity:

Highest CE OI was at 24000 also saw some unwinding with huge Unwinding at 23600-500 highest - Support

Highest PE OI was at 23300, highest Put addition seen at 23500 followed by 23600 - support

PCR is 1.2 indicating Bullishness

Daily Futures Activity FII + Pro F&O Data:

FII Long/Short ratio at 32.5%/67.5% indicating addition of Longs by FIIs - Bullish

Change in Futures OI:

FII Future positions saw littl3 addition in longs +2K with shorts unchanged -Bullish

Nifty Futures price was higher by 01.5% and 12.5 %OI Increase indicating Long Additions

Observation:

Nifty looks strong above 23550 forming daily positive green candles, closing above 10,20,50, 200dEMA and RSI just in overbought zone

Overall Trend:

Sentiment is very Positive

Outlook for Next Session:

Nifty looks strong around 23600, might consolidate above 23550 before another upmove to 24000

Approach & Strategy:

Long with 22850 as SL in April contract, continue with SL 23500

My Trades & Positions:

Long in 23200CE April, closed and moved to 23600CE April

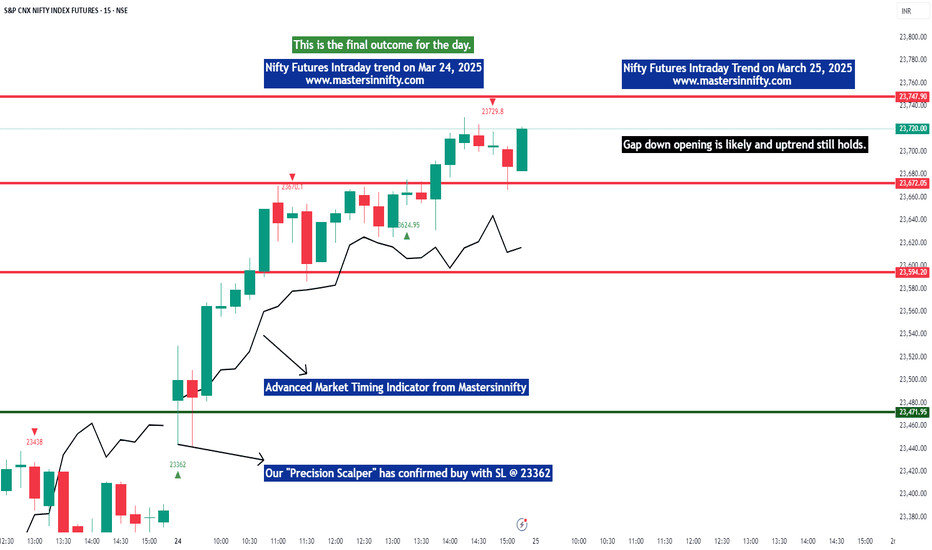

Nifty Futures intraday trend for March 25, 2025Nifty Futures broke the key resistance at 23623 and closed higher and the further uptrend is anticipated to take resistance at 23825.

Nifty futures may begin with a gap down opening tomorrow ie March 25th and a down trend in the morning may give us an opportunity to enter long.

NIFTY : Intraday Trading levels and Plan for 25-Mar-2025📊 Nifty Trading Plan – 24-Mar-2025 (Educational & Strategy-Oriented)

Chart Timeframe: 15-Min | Key reference zones marked on chart

📍

🚀 GAP-UP Opening (Above 23,407)

If Nifty opens with a gap-up above 23,407, it will enter the Wave 3 Resistance Zone (23,508 – 23,582), which is a high-probability reversal zone.

✅ Plan of Action:

• Don’t rush into buying after the gap-up. Wait and observe the price behavior around 23,508 – 23,582.

• This area is likely to witness profit booking or short build-up.

• Look for signs of reversal like bearish engulfing, shooting star, or bearish divergence on RSI.

• If such patterns form, consider buying Put Options (OTM PE) with a stop-loss on a 15-min candle closing above 23,585.

• If Nifty sustains above 23,582 with strong volume, then we might be heading into an extended up-move, but this is lower probability.

• Safer trades are shorting on signs of exhaustion at higher levels.

📌 Key Zone to Watch: 23,508 – 23,582 (Wave 3 Resistance)

📈 FLAT Opening (Between 23,245 – 23,407)

This is the Opening Resistance / Support Band (23,345 – 23,407), acting as a decision-making zone.

✅ Plan of Action:

• Let the market settle in the first 15–30 mins.

• If price holds and builds strength above 23,345, Nifty may climb towards 23,407, and if broken, test 23,508+.

• Weak price action (rejection wicks or low volumes) from 23,345–23,407 signals weakness. In that case, look for short opportunities with SL above 23,407.

• Avoid CE entries unless price sustains above 23,407 with momentum and volume breakout.

• If price starts to slip below 23,245, sellers will get more active and price could drop quickly to next support.

📌 Key Decision Zone: 23,345 – 23,407

📌 Support Trigger: 23,245 (Opening Support)

📉 GAP-DOWN Opening (Below 23,245 or near 23,185 – 22,985)

If Nifty opens below the Opening Support at 23,245, or even near deeper support zones of 23,185 or 22,985, it will bring in volatility and create both breakdown and reversal opportunities.

✅ Plan of Action:

• A gap-down near 23,185 should be watched carefully. This is a minor intraday support. If held with a bullish candle (like a hammer), consider buying CE with SL below 23,160.

• If the gap-down extends to 22,985 (Last Support for Intraday), it's a strong bounce zone. A bullish reversal candle here provides high RR long trades.

• If price fails to hold 22,985, sellers may dominate and drag Nifty further down. Consider PE trades only after a 15-min close below 22,985.

• Avoid panic trading – let the zone react and only act based on confirmation candles.

📌 Bounce Zones: 23,185 and 22,985

📌 Breakdown Trigger: Below 22,985

🛡️ Risk Management Tips for Options Traders:

• Avoid trading first 5–15 mins after opening, especially on gap days – let price give structure.

• Use hedged strategies like Bull Call or Bear Put Spreads to reduce premium loss due to theta decay.

• Trade light near reversal zones – don’t go all-in on emotional conviction.

• Always place stop-loss on closing basis (15-min candle), not fixed points, especially during volatile moves.

• If VIX is high, premiums are inflated – focus on quick entry & exit, no holding hoping for magic.

📌 Summary & Conclusion:

• Nifty has entered a critical decision zone.

• Watch 23,407 carefully – above it, bulls may attempt a final push to 23,582, but signs of exhaustion there are likely.

• On the downside, supports at 23,185 & 22,985 will act as bounce zones.

• Directional trades should be initiated only after price confirms intent post opening.

• Use structure + volume for confidence in setups.

⚠️ Disclaimer: I am not a SEBI-registered analyst. The above content is for educational purposes only. Please do your own analysis or consult a certified financial advisor before making any trading decisions.

NIFTY : Intraday Trading Levels and Plan for 20-Mar-2025📅 NIFTY TRADING PLAN – 20-Mar-2025

🕒 Timeframe: 15 Min | 📌 Reference Close: 22,911.80

📏 Gap Opening Threshold: 100+ points

📈 1. GAP-UP Opening Scenario (Opening Above 23,010)

If NIFTY opens 100+ points higher — around or above 23,010 — it enters the Profit Booking Zone: 22,995 – 23,067 .

✅ Action Plan:

- If Nifty opens in the 22,995–23,067 zone, avoid aggressive long trades at open. This zone has historically triggered selling pressure.

- Observe the behavior near 23,067 . If candles start rejecting higher prices or form reversal patterns (e.g., bearish engulfing), plan short trades with SL just above 23,067 .

- If Nifty crosses 23,067 with momentum and volume, upside extension is possible toward 23,185 — the Last Intraday Resistance .

- Avoid shorting blindly above 23,067 . Let price consolidate or form lower highs before initiating any counter-trend short.

📌 Educational Note: Profit booking zones often create whipsaws. Let the market decide the intent before jumping in.

🚫 Don't chase gaps — instead, wait for re-entry opportunities once price confirms direction.

📊 2. FLAT Opening Scenario (Between 22,850 – 22,950)

If NIFTY opens within a tight 40–50 point range around its closing level (±50 points), it's considered a flat opening.

✅ Action Plan:

- Allow the market to settle for the first 15–30 minutes . Avoid early entries.

- If Nifty sustains above 22,995 , we may see a quick move toward 23,067 . One can consider intraday longs above 22,995 with a stop loss near 22,950 .

- If price faces rejection at 22,995 and drops below 22,912–22,880 (previous close zone), short opportunities may arise toward 22,800 (Opening Support) .

- Keep an eye on 22,800 as it is a key intraday support. Breakdown below it can lead to a deeper fall toward 22,728 and 22,632 .

📌 Educational Note: Flat openings often provide the best setups if you let price action settle. Stay nimble and neutral till breakout/breakdown confirms.

📉 3. GAP-DOWN Opening Scenario (Opening Below 22,812)

If NIFTY opens with a gap-down of 100+ points (around or below 22,812 ) — look for action near support zones like 22,800, 22,728, and 22,632 .

✅ Action Plan:

- If Nifty opens near 22,800 and holds, wait for a reversal pattern. Intraday long trades are possible toward 22,912+ .

- A clean breakdown below 22,728 (Last Intraday Support) may trigger a slide toward 22,632 (Buyer’s Support) .

- Avoid catching falling knives. Only buy near 22,632 if there’s clear bullish reversal with volume confirmation.

- If price opens below 22,728 and tries to retest and fails to reclaim that level, short trades can be considered with a stop above 22,728 .

📌 Educational Note: Big gap-downs often attract panic exits in the first 15 mins. Wait for a base to form before looking for reversal trades.

🧠 OPTIONS TRADING – RISK MANAGEMENT TIPS

💼 Use defined stop losses based on 15-min or 30-min candle close. Avoid emotional exits.

⚖️ Avoid buying deep OTM options during rangebound conditions — prefer ATM or ITM for better delta control.

🛡️ Use hedged strategies like bull call spreads or bear put spreads during high IV scenarios.

📉 On breakdown or breakout days, trade with the trend using limited-risk directional strategies.

💰 Never risk more than 1.5–2% of capital per trade — capital preservation is key for consistency.

📌 SUMMARY & CONCLUSION:

Gap-Up above 22,995: Profit booking zone. Wait for reversal signs or breakout to 23,185.

Flat Opening: Best setups possible — breakout above 22,995 or breakdown below 22,880.

Gap-Down below 22,812: Watch 22,800–22,632 support zones for potential reversal or breakdown.

🎯 Let price lead the way — react, don’t predict. Enter only on confirmation. Stay disciplined and respect the market structure.

📢 Disclaimer: I am not a SEBI-registered analyst . This trading plan is purely for educational purposes. Please consult with your financial advisor before taking any position.

NIFTY : Intraday Trading Levels and Plan for 19-March-2025🔥 NIFTY – Intraday Trading Plan for 19-Mar-2025

Current Market Price (CMP): 22,848.75

Chart Time Frame: 15-min

📘 Opening Scenario 1: GAP-UP Opening (100+ points)

If NIFTY opens with a strong gap-up above 22,950, it would directly open into the Profit Booking Zone: 22,995 – 23,067 .

Avoid aggressive long entries near the opening if prices directly hit the profit booking zone, as early buying could trap latecomers. Wait and observe price action in the 22,995 – 23,067 range. If the index forms bullish consolidation with strength, breakout above 23,067 can push it towards the final resistance at 23,185. If rejection occurs near this zone, look for reversal signals like a 15-min bearish candle with follow-up selling to consider short scalps targeting back to 22,850 – 22,775.

🧠 Tip: Avoid call option entries if IVs are inflated and premiums are already factored in after a big gap-up. Time decay can eat your premiums fast.

📗 Opening Scenario 2: FLAT Opening (within 50-80 pts)

In case of a flat or minor gap opening near 22,800 – 22,850, the price will open just above the key consolidation zone: 22,727 – 22,801 .

Look for first 15-30 minutes consolidation. If NIFTY sustains above 22,801, fresh buying can push it to test 22,995. A failure to sustain above 22,801 and breakdown below 22,775 will drag prices back into the range. The downside targets then would be 22,656 and 22,532. No trade zone for flat opening: avoid trades inside 22,727 – 22,775, unless a directional breakout occurs.

🧠 Tip: For flat openings, best setups come after the first 15-30 minutes. Let the market decide the direction first—then align your trade.

📙 Opening Scenario 3: GAP-DOWN Opening (100+ points)

A gap-down below 22,700 will place the index back into or below the consolidation zone. Major supports are at 22,656**, 22,532, and Buyers’ Support: 22,270 – 22,320.

Aggressive buying should be avoided unless NIFTY shows strong reversal signals from support zones like 22,532 or 22,270. If prices bounce from the Buyers’ Support Zone, a quick upside retracement towards 22,656 or even 22,727 is possible. However, if NIFTY breaks below 22,270, it could enter a deeper correction territory—so keep strict stop losses.

🧠 Tip: When buying the dip in a gap-down scenario, use options spreads (e.g., bull call spreads) to reduce premium decay risk while maintaining upside exposure.

💡 Risk Management Tips for Options Traders:

✅ Use defined-risk strategies like spreads (Bull Call / Bear Put)

✅ Avoid chasing momentum in the first 15 minutes of market opening

✅ Stick to 1–2 high probability trades per day

✅ Always place stop loss based on structure or candle close

✅ Never average into losing options trades—respect time decay

✅ Focus on ATM or slightly OTM contracts with 1–2 day expiry for best gamma moves

📊 Summary & Conclusion:

Key Zones to Watch:

🔸 Resistance Zone: 22,995 – 23,067

🔸 Support Zone: 22,656 – 22,532

🔸 Buyers’ Zone: 22,270 – 22,320

🔸 No Trade Zone: 22,727 – 22,775

Be reactive, not predictive. Let price action guide your trades based on these levels. Respect volatility and avoid emotional trades.

⚠️ Disclaimer: I am not a SEBI registered analyst. The above levels and insights are for educational purposes only. Please consult your financial advisor before taking any positions. Trade responsibly! 💼📉

NIFTY : Intraday Trading Levels and Plan for 18-Mar-2025📅 NIFTY INTRADAY TRADING PLAN – 18th March 2025 (Tuesday)

🕒 Timeframe: 15 Min | 📍Reference Closing: 22,515

📉 CHART STRUCTURE EXPLAINED:

Nifty closed near the middle of the Opening Resistance / Support Zone (22,508–22,547). There are clearly defined areas of support and resistance on both sides that help frame our intraday plan. Price action around these zones will provide direction for high-probability trades.

🟩 GAP-UP OPENING (100+ points): Above 22,617

If Nifty opens above the Last Intraday Resistance (22,617), it enters a potential breakout zone.

Avoid entering trades immediately after a GAP-UP above 22,617. Let the index retest this level for confirmation. If the price sustains above 22,617 for 15 minutes with higher volume, expect a continuation rally towards the Profit Booking Zone (22,727–22,801). Wait for a dip near 22,617 or even the upper band of 22,547. If the retest holds, go long with SL below 22,547. Profit booking is advised near 22,727–22,801 as this zone is likely to attract selling. Avoid fresh longs near 22,800 unless there’s a consolidation breakout.

🧠 Educational Note: Chasing GAP-UPs leads to poor entries. The best trades happen when price retests a broken resistance and confirms support.

🟨 FLAT OPENING (Within 22,508–22,547 Zone)

This is the Opening Resistance / Support Zone — a tricky area that demands patience.

Avoid trading in the first 15–30 minutes if price opens inside the 22,508–22,547 zone. It’s a chop zone, prone to false breakouts. A breakout above 22,547 with volume gives a long opportunity towards 22,617, and eventually 22,727. A breakdown below 22,508 brings the price into the Opening Support Zone (22,403–22,420). Watch for reversal signs here for possible bounce trades. Only consider directional trades once Nifty decisively exits this range.

🧠 Tip: In tight ranges, option premiums decay faster. Avoid entering trades without confirmation.

🟥 GAP-DOWN OPENING (100+ points): Below 22,403

If Nifty opens below the Opening Support Zone, volatility increases and levels become more critical.

Support is visible at the Buyers' Zone (22,210–22,247). If the index opens around this zone, wait for a reversal pattern like bullish engulfing or double bottom on 15-min chart. If 22,210 holds with a strong bounce, a long can be initiated targeting 22,403–22,508 with SL below 22,210. However, if 22,210 breaks with conviction, bears may drag the index to 21,950–22,000 levels. Avoid shorts immediately at open—wait for either breakdown retest or confirmation below 22,210.

🧠 Insight: Panic gap-downs often trigger short-covering rallies. Watch how price behaves in the first hour.

📘 RISK MANAGEMENT TIPS FOR OPTION TRADERS:

🛡️ Risk management is your ultimate edge in the market. Follow these key principles:

Never trade options without a stop loss. Monitor levels, not just premium prices. Avoid selling far OTM options when market structure is trending. It’s a trap during sharp moves. If market is inside range, go with spreads instead of naked options to reduce Theta burn. Size your positions wisely—don’t risk more than 1–2% of total capital on a single trade. Always book partial profits at target zones and trail the rest with a stop.

🧠 Options are like ice—they melt fast in choppy markets. Patience and timing are key!

📌 SUMMARY & CONCLUSION:

✅ Resistance Levels: 22,617 / 22,727 / 22,801

✅ Support Levels: 22,403 / 22,210

✅ Critical Zones:

⚠️ 22,508–22,547 (Opening Decision Zone)

✅ 22,403–22,420 (Support)

🛑 22,727–22,801 (Profit Booking Zone)

👉 Wait for confirmation before entering. Let market structure guide your direction, not emotions.

❗ Disclaimer: I am not a SEBI registered analyst. This plan is shared purely for educational purposes. Please consult with your financial advisor before making any trading decisions.

NIFTY : Intraday Trading levels and Plan for 17-Mar-2025📊 NIFTY Trading Plan – 17-Mar-2025

Nifty is currently hovering near the Opening Support Zone: 22,351 – 22,378, with a key resistance at 22,442 and profit booking zone near 22,617. Depending on how the market opens, we will plan our trades accordingly.

💡 Let’s analyze different scenarios:

🔥 Scenario 1: Gap-Up Opening (100+ Points)

If Nifty opens above 22,442, the index will test the last intraday resistance at 22,551. A decisive breakout above 22,617 may trigger strong bullish momentum.

✅ Plan of Action:

If Nifty sustains above 22,551, look for bullish price action and enter longs with targets of 22,617 and 22,680+.

If a sharp rejection occurs near 22,617, consider booking partial profits and trail SL.

Avoid chasing longs if Nifty starts showing weakness near resistance. Wait for a pullback.

📌 Key Levels to Watch: 22,442 (Support) | 22,551 (Breakout Zone) | 22,617+ (Profit Booking Zone).

📢 Tip: In case of a fake breakout above 22,617, selling pressure may drag Nifty back to 22,442. Watch for reversal patterns before taking aggressive trades.

📉 Scenario 2: Flat Opening (Within 50 Points)

If Nifty opens near 22,383 – 22,434, we will monitor price action near the Opening Support/Resistance Zone. The first 30 minutes will be crucial for direction confirmation.

✅ Plan of Action:

If Nifty bounces from 22,351 – 22,378, look for long opportunities targeting 22,442 and 22,551.

If Nifty struggles to hold 22,442, expect sideways action. Trade only near major levels.

A breakdown below 22,351 will indicate weakness, leading to a test of 22,296 and 22,208.

📌 Key Levels to Watch: 22,351 – 22,378 (Support Zone) | 22,442 (Resistance) | 22,551 (Breakout Confirmation).

📢 Tip: Use a wait-and-watch approach in the first 30 minutes. Let the market establish direction before making big trades.

🛑 Scenario 3: Gap-Down Opening (100+ Points)

A gap-down below 22,351 could push Nifty towards the last intraday support of 22,296. If the selling extends, watch the golden retracement zone at 22,114, which is a high-probability demand zone.

✅ Plan of Action:

If Nifty stabilizes at 22,296, expect a recovery towards 22,351 – 22,378. Scalping opportunities exist.

If selling pressure continues below 22,296, expect a further slide to 22,114, which will be a must-watch area for buyers.

Only consider fresh longs at 22,114 if strong reversal signs appear. Else, avoid catching falling knives.

📌 Key Levels to Watch: 22,296 (Support) | 22,208 (Breakdown Confirmation) | 22,114 (Golden Buy Zone).

📢 Tip: Avoid aggressive longs in a gap-down scenario unless a clear reversal is seen at major supports. Watch for confirmation before entering any trade.

⚡ Risk Management Tips for Options Traders

🔹 Premium Decay Alert: If Nifty consolidates, avoid buying OTM options. Time decay will erode premiums.

🔹 Hedge Positions: If selling options, hedge using spreads to reduce risk.

🔹 Exit at SL: Do not hold options hoping for reversals. Stick to the predefined SL.

🔹 Avoid Trading the First 5-Minutes: Market volatility is high; let a pattern form.

🔹 Size Appropriately: If uncertain, reduce lot size and wait for confirmation.

📌 Summary & Conclusion

✅ If Nifty Opens Gap-Up: Watch for 22,551 – 22,617 resistance zones. A breakout can trigger further upside.

✅ If Nifty Opens Flat: First 30 minutes are crucial. Support at 22,351 – 22,378 should hold for longs.

✅ If Nifty Opens Gap-Down: Watch 22,296 for a reaction. If broken, 22,114 is a key buy zone.

📢 Final Note: The best trades come when price action confirms levels. Avoid emotional trading and respect stop losses.

📜 Disclaimer

I am not a SEBI-registered analyst . All views are for educational purposes only. Traders should conduct their own analysis or consult a financial advisor before making any investment decisions.

NIFTY : Intraday Trading levels and Plan for 13-Mar-2025📘 NIFTY Trading Plan for 13-Mar-2025

Chart Reference: Nifty is currently trading near 22,468, with price showing rejection from near-term resistance. Multiple levels such as 22,435, 22,496, and 22,600 are key zones to watch.

Let’s break down the trading approach into opening scenarios 👇

✅ 1. GAP-UP OPENING (100+ points above previous close)

If NIFTY opens near or above the Opening Resistance Zone – 22,600 to 22,626 :

📍 This zone has acted as a supply area earlier, and a gap-up into this area could trap late buyers if not sustained.

🟧 Scenario 1 – Rejection at Resistance:

🔻 If NIFTY opens within this resistance zone and shows early weakness (such as a bearish engulfing, evening star, or rejection wick), short trades can be considered.

🎯 Targets:

➤ 22,496 (Initial Support)

➤ 22,435 (Next Support)

🟩 Scenario 2 – Breakout Above 22,626:

✅ A strong 15-min bullish candle above 22,626 with volume confirmation can trigger a long entry.

🎯 Targets:

➤ 22,680

➤ 22,800 (Last Intraday Resistance)

🧠 Tip: In gap-up opens, avoid immediate entries. Wait 15–30 mins for the market to establish direction. If upside sustains with strength, trail using VWAP or 5-min EMA.

⚖️ 2. FLAT OPENING (within ±100 points)

If NIFTY opens between 22,435 – 22,496:

This region is the Opening Support/Resistance Zone , meaning both bulls and bears will be active here. The key is to observe who dominates.

🟩 Long Setup:

If NIFTY holds above 22,496 and gives a breakout above 22,600, it will confirm bullish strength.

🎯 Upside Targets:

➤ 22,680

➤ 22,800

🟥 Short Setup:

If price fails to hold above 22,435 and breaks below it with momentum:

🎯 Downside Targets:

➤ 22,319 (Opening Support)

➤ 22,208 (Last Intraday Support)

🧠 Tip: Use option strategies like straddles or strangles near this flat zone if expecting a breakout or expansion in volatility. Avoid naked directional trades unless there is strong confirmation.

🔻 3. GAP-DOWN OPENING (100+ points below previous close)

If NIFTY opens near or below 22,319 (Opening Support):

📍 The area between 22,319 – 22,208 is critical for support. Watch closely for price action.

🟩 Reversal Setup:

If NIFTY opens near 22,208–22,319 and holds this support with signs of strength (bullish pin bar, morning star, or strong bullish volume), a reversal trade can be taken.

🎯 Targets:

➤ 22,435

➤ 22,496

🟥 Breakdown Setup:

If support at 22,208 breaks with a large red candle and follow-through, short trades can be initiated.

🎯 Targets:

➤ 22,140–22,100 Zone (Intraday Expansion Move)

🧠 Tip: Gap-downs can lead to high implied volatility. Be cautious of IV crush if reversal happens. Consider bear put spreads to manage premium risk.

💡 Risk Management Tips for Options Traders

Avoid buying deep OTM options post 12 PM unless there is strong trend confirmation. Always trade with a defined stop-loss. Use 15-min closing basis for better validation. Consider spreads (bull call, bear put) to reduce the impact of theta decay. On volatile days, reduce position size and hedge your trades. Don’t trade immediately after a gap — let the first 15–30 mins settle to avoid traps.

📌 Summary & Conclusion

✅ Key Resistance Zones:

➤ 22,600–22,626 (Opening Resistance)

➤ 22,800 (Last Intraday Resistance)

✅ Key Support Zones:

➤ 22,435 (Pivot Zone)

➤ 22,319 (Opening Support)

➤ 22,208 (Last Support Zone)

🎯 Let price action guide your trade around these key levels. Remember — reacting to the market is better than predicting it.

⚠️ Disclaimer

I am not a SEBI registered analyst. This trading plan is shared purely for educational purposes. Please do your own research or consult your financial advisor before making any investment or trading decisions.

NIFTY : Intraday Trading Levels and Plan for 12-Mar-2025📅 NIFTY Trading Plan – 12-Mar-2025

(Timeframe: 15-min | Chart structure based on demand/supply and price action)

Opening Scenarios 📈📉

Gap-Up Opening (📍+100 Points or more)

If Nifty opens above the 22,598 resistance zone, price may initially test this level as support.

🔹 A successful hold here can trigger a bullish rally toward the last intraday resistance at 22,800, with intraday targets around 22,700+.

🔸 However, if Nifty fails to sustain above 22,598 and slips back inside the orange resistance zone, a corrective dip back to 22,496–22,482 may occur.

📌 Plan of Action:

✅ Buy on retest & strength above 22,598

❌ Avoid fresh longs if candles close back below 22,598

Flat Opening (±100 Points)

If Nifty opens near 22,520–22,482, this range becomes a decision-making zone.

🔹 Holding above 22,520 can provide a quick upside move toward 22,598+.

🔸 On the other hand, weakness below 22,482, especially on hourly close, can open downside toward the Opening Support Zone: 22,358–22,415.

📌 Plan of Action:

✅ Wait for the first 15–30 min range breakout

💡 Above 22,520 = bullish bias

⚠️ Below 22,482 = cautious; only scalp short with confirmation

Gap-Down Opening (📉 -100 Points or more)

A gap-down near or below 22,358–22,415 places price directly into the Opening Support Zone.

🔹 Watch for price rejection wicks or bullish reversal candles near this zone.

🔸 If broken decisively, Nifty may test 22,259 (last intraday support) and then the Best Buy Zone: 22,115–22,155, which aligns with the golden retracement zone.

📌 Plan of Action:

✅ Wait and observe price action at 22,358–22,259

📉 Short only if there's breakdown with volume

📈 Strong bounce near 22,115–22,155 = high RR long trade setup

📘 Risk Management Tips for Options Traders 💡

📏 Avoid buying OTM calls or puts after big gap openings . Wait 15–30 mins for premium decay to stabilize.

🛑 Always place SL based on chart levels or candle close—not fixed points .

🧠 Avoid averaging losing options positions —theta decay can kill.

💸 Position sizing is key: Never risk more than 1–2% of capital per trade.

🎯 Trade with a plan, not emotions. Let levels guide your decisions.

📊 Summary & Key Levels

🔹 Upside Resistance: 22,598 – 22,800

🔸 Key Pivot Levels: 22,520 / 22,482

🟢 Support Zones: 22,358 – 22,259 – 22,115

⚠️ Best Risk-Reward Zone: 22,115 – 22,155 (Watch for reversal signs)

📌 Conclusion

Nifty is trading in a reactive zone. Smart trading lies in reacting to key levels, not predicting. Avoid emotional trades near resistance or support—let price confirmation guide you. Patience will reward the prepared trader.

📛 Disclaimer: I am not a SEBI registered analyst. All views shared are for educational purposes only. Please consult your financial advisor before taking any trades.