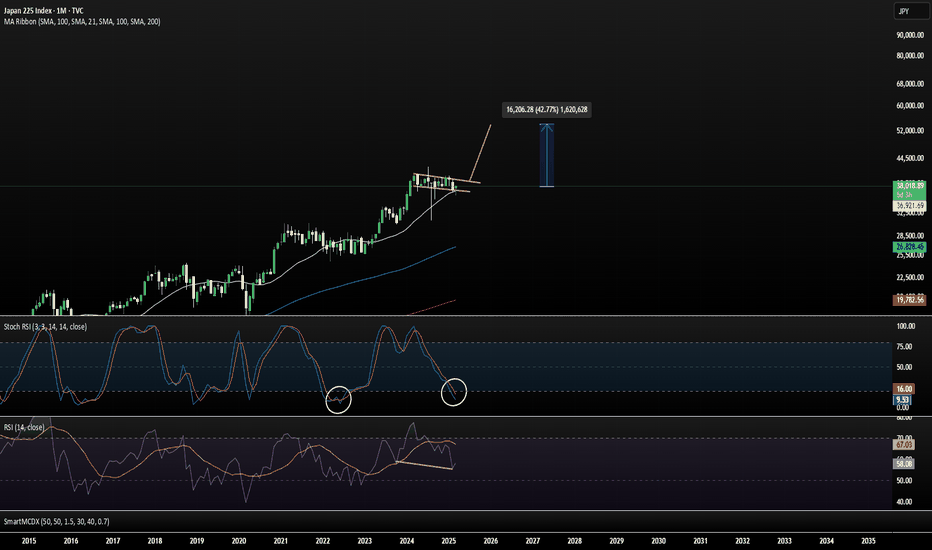

BOJ vs Fed: Fueling a Japan 225 Recovery?After an aggressive selloff that pushed Japan 225 (Nikkei) into oversold territory, the index printed a solid bullish reaction off the 30,500 key zone. This area aligns with prior demand and offers a clean invalidation level for long positioning. With heavy bearish sentiment already priced in, I’m positioning long with TP near the premium zone around 40,000.

The fundamental picture may be stormy, but technically, this is a textbook reversal play, I’m ready to ride it.

Technicals:

• Price reacted from major support around 30,500–30,800 zone, a level that held in the past.

• Daily imbalance filled, creating the perfect spot for a potential rebound.

• Descending channel break on lower timeframes indicates early bullish structure shift.

• Target zone: 39,000–40,000.

• SL: Below recent swing low, respecting tight risk management.

Fundamentals:

• Global Risk-Off Sentiment: Recession fears and tariffs pushed risk assets lower — Nikkei included.

• Tariff-Driven USD Weakness: US tariffs created uncertainty and drove global equity selloffs. However, hopes for a US-Japan trade deal are increasing, favoring the JPY and supporting Japanese equities.

• BOJ-Fed Divergence: BoJ is expected to raise rates due to broadening inflation, while the Fed is seen cutting rates soon. This differential supports capital inflows into Japan.

• Flight to Safety: Japan’s stable economy and improving policy outlook make it attractive as global volatility increases.

The selloff may have been excessive due to panic over macro headlines. However, price structure tells its own story, and it’s hinting at a bullish reversal. With multiple technical and fundamental confluences lining up, this is a well-balanced long opportunity with clear risk parameters.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

Nikkeitrade

"JP225/NIKKEI" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "JP225/NIKKEI" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (37600) Thief SL placed at the nearest / swing high level Using the 8H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34000

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"JP225/NIKKEI" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

A quick long on NikkeiWarning: This is a counter trend quick trade.

JPN is in a downtrend on Daily. H4 is flat.

After last night's sell off there will be some buyers in the market looking for a deal.

We are going long based on:

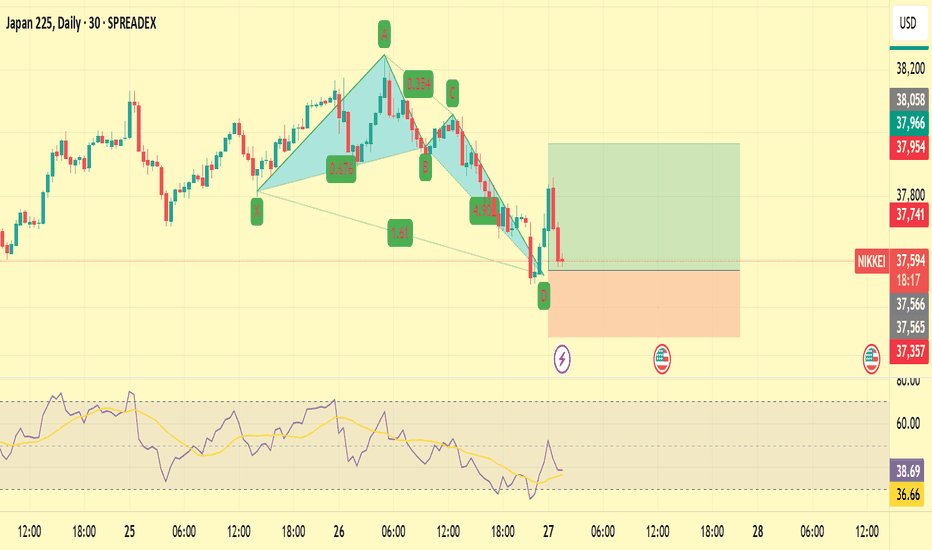

1) There is a crab pattern

2) RSI divergence on M15

3) Strong support at 37500 area

Stop loss is 200+ pips and target is 400.

Selling NIKKEI at 37500Happy new week everyone,

We are looking to sell NIKKEI at 37500 based on the action we see this morning.

1) It created a high last week at 37,622

2) There is lot of divergence on H1, M30, M15

3) There is a shark pattern which is not quite valid, but shows a good sign to sell.

This could be a big move downwards.

JP225/NIKKEI "JAPAN 225" Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the JP225/NIKKEI "JAPAN 225" Indices CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (38300) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

The JP225 (Nikkei 225 Index) is trending downwards due to a combination of economic, market, and geopolitical factors that are creating a bearish environment for Japanese equities. Below is a detailed explanation of the key reasons behind this downward movement.

⭐⚡🌟Weak Corporate Earnings

Many companies within the Nikkei 225, such as major players in the technology and automotive sectors (e.g., Toyota and Sony), have reported disappointing earnings. Growth has slowed to just 2% year-over-year, far below the expected 5%. This weakness in corporate performance is reducing investor confidence and dragging the index lower.

⭐⚡🌟Rising Inflation and Slowing GDP Growth

Japan’s inflation rate has climbed to 2.5%, surpassing the Bank of Japan’s (BoJ) 2% target. This higher inflation is eroding consumer purchasing power, which hurts domestic spending and, in turn, corporate profits. At the same time, Japan’s GDP growth has decelerated to just 0.8% in the latest quarter, signaling a sluggish economy. A slowing economy is a strong bearish signal for the stock market.

⭐⚡🌟Stronger Yen Hurting Exporters

The yen has strengthened to 142.00 against the U.S. dollar. Since the Nikkei 225 is heavily weighted toward export-driven companies, a stronger yen makes Japanese goods more expensive abroad, reducing competitiveness and cutting into profits. This currency movement is a significant factor pushing the index down.

⭐⚡🌟Global Economic Pressures

U.S. Monetary Policy: The U.S. Federal Reserve’s hawkish stance, with interest rates steady at 3.5%, has strengthened the U.S. dollar. This makes Japanese exports less attractive and reduces the yen-denominated earnings of multinational firms in the Nikkei 225.

China’s Slowdown: China, a key trading partner for Japan, is experiencing economic contraction, with its PMI at 49.2. Weak demand from China is hurting Japanese exporters, adding further downward pressure on the index.

⭐⚡🌟Technical Weakness

The Nikkei 225 is trading below its 50-day simple moving average (36,800) and nearing its 200-day simple moving average (35,500). It’s also struggling to hold support at 36,500. These technical indicators suggest a bearish trend, with the potential for further declines if key support levels break.

⭐⚡🌟Negative Market Sentiment

Speculative Traders: Data shows speculative traders have cut their net long positions to 10,000 contracts from 20,000, signaling reduced bullishness. Meanwhile, commercial hedgers have increased net short positions to 30,000 contracts, indicating expectations of lower prices.

Retail Investors and Analysts: Retail investor bullishness has dropped to 40% from 60%, and major analysts (e.g., Nomura) have lowered their year-end targets for the Nikkei 225 to 36,000 from 38,000. This shift reflects growing pessimism.

⭐⚡🌟Geopolitical and Policy Risks

Regional Tensions: Recent missile tests by North Korea (March 5, 2025) have raised security concerns in the region, dampening investor sentiment in Japan.

Bank of Japan Policy: The BoJ has hinted at potential rate hikes in late 2025. Tighter monetary policy could increase borrowing costs and weigh on stock valuations, contributing to the bearish outlook.

⭐⚡🌟Global Risk-Off Sentiment

The S&P 500 has fallen to 5,800, reflecting a broader global shift away from risky assets. At the same time, gold prices have risen to $3,000, signaling increased demand for safe-haven assets. This risk-off mood is spilling over into the Japanese market, pushing the Nikkei 225 lower.

⭐⚡🌟Commitments of Traders (COT) Data

COT data provides insights into futures market positioning for the Nikkei 225.

Speculative Traders:

Net long positions stand at approximately 20,000 contracts, up from 15,000 the previous month. This increase in bullish bets reflects growing confidence among speculators—a strong bullish indicator.

Commercial Hedgers:

Net short positions are at around 25,000 contracts, consistent with typical hedging activity. This stability suggests hedgers see current levels as sustainable—neutral.

Open Interest:

Total contracts reach approximately 50,000, an 8% increase month-over-month. Rising participation indicates growing market momentum—bullish.

Summary: COT data strongly supports a bullish outlook. Speculative long positions and rising open interest signal upward momentum, while hedgers’ steady shorts indicate no imminent sell-off pressure.

⭐⚡🌟Future Trend Prediction

Price projections for the Nikkei 225 across different timeframes.

Short-Term:

Range: 36,800 - 37,500

A breakout above 37,000 toward 37,500 is plausible if trade talk momentum persists. A pullback to 36,800 could occur on profit-taking.

Medium-Term:

Range: 36,500 - 38,000

Breaking resistance at 37,500 could propel the index to 38,000, driven by BOJ policy and trade developments. A drop below 36,500 might test 36,000 if global risks escalate.

Long-Term:

Bullish Target: 39,000 - 40,000

Achievable if the BOJ maintains easing, the yen weakens further, and global growth accelerates—60% probability.

Bearish Target: 34,000 - 35,000

Possible if the BOJ tightens policy, the yen strengthens, or a global recession emerges—40% probability.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Buying Nikkei at 38070 for a 1:8 R:R TradeHere is why we want to trade this trade:

1) The low of last weekend is at 38050

2) There is a harmonic pattern with its stop loss at this level (patterns turn here also)

3) There is a lot of divergence now

4) Strong support at the 38000 level

This pair moves really fast so a 200 pip stop loss is imperative.

Long on Nikkei 225For now, I am long on Nikkei 225. We have a bottom, currently looking for a retest of broken support and a higher low. Once confirmed this is an easy long to the golden zone between 0.5 and 0.618 Fibonacci retracement levels.

Target 1 - 39,400

Target 2 - 40,300

For mid term I will be looking for a significant pullback from the nikkei 225. However, there is still potential for bullish price action in the short term.

JP225/Nikkei 225 Index CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the JP225/Nikkei 225 Index CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 39200.0

Sell Entry below 38200.0

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 40300.0 (or) Escape Before the Target

Bearish Robbers TP 37400.0 (or) Escape Before the Target

Fundamental Outlook 📰🗞️

Current Fundamentals:

Japanese Economy: The Japanese economy is expected to grow at a moderate pace, with a forecasted GDP growth rate of 1.2% for 2023.

Monetary Policy: The Bank of Japan (BOJ) has maintained its ultra-loose monetary policy, with a negative interest rate of -0.1% and a commitment to purchase Japanese government bonds (JGBs) to keep the 10-year yield around 0%.

Inflation: Japan's inflation rate has been rising, but it remains below the BOJ's target of 2%. The current inflation rate is around 0.5%.

Trade Tensions: The ongoing trade tensions between the US and China have had a negative impact on the Japanese economy, particularly on the country's export-oriented industries.

Upcoming News:

BOJ Interest Rate Decision: The BOJ is scheduled to announce its interest rate decision on March 18, 2023. The market expects the BOJ to maintain its current monetary policy stance.

Japanese GDP Growth: The Japanese government will release its GDP growth data for Q4 2022 on March 10, 2023. The market expects the economy to have grown at a moderate pace.

US-China Trade Talks: The US and China are scheduled to resume trade talks in March 2023. A positive outcome could boost the Japanese economy and the JP225.

Bullish Factors:

BOJ's Ultra-Loose Monetary Policy: The BOJ's commitment to maintaining its ultra-loose monetary policy could continue to support the Japanese stock market.

Weakening Yen: A weakening yen could boost Japan's export-oriented industries and support the JP225.

Improving Corporate Earnings: Japanese companies have been reporting improving earnings, which could support the JP225.

Bearish Factors:

Global Economic Slowdown: A global economic slowdown could negatively impact the Japanese economy and the JP225.

Trade Tensions: Escalating trade tensions between the US and China could negatively impact the Japanese economy and the JP225.

Rising Inflation: Rising inflation could lead to higher interest rates, which could negatively impact the Japanese stock market.

Trading Alert⚠️ : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"JP225 / NIKKEI225" Japanese Index Market Bullish Heist PlanHola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist "JP225 / NIKKEI225" Japanese Index Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 2H timeframe

Target 🎯 : 41.000

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NIKKEI Long Trade Targets Await!NIKKEI Trade Details:

The Nikkei index on the hourly timeframe confirms a bullish setup, with a clear long entry signal as per the Risological swing trading indicator . The trend is gaining strength, and the chart suggests a potential move towards profit targets.

NIKKEI Key Levels:

Entry: 38304

Stop Loss (SL): 38004

Take Profit Targets:

TP1: 38674

TP2: 39273

TP3: 39873

TP4: 40243

NIKKEI Analysis:

The chart indicates a recovery with higher lows and sustained buying pressure. The Risological trendline confirm the bullish trend, and momentum indicators align with the upward trajectory. With calculated risk, this trade offers a solid reward ratio.

NIKKEI Outlook:

Monitor for momentum consistency to hit targets. Stay alert for profit-locking opportunities at each target level to maximize gains. Watch out for resistance near higher levels to secure returns effectively.

Japan 225: Amid Bearish Momentum and Global UncertaintyThe Japan 225 index is currently trading below the FibCloud, signaling a potential downward trend. My target for this short trade is around the 35,500- 36,200price area, where I anticipate significant support based on historical price movements and Fib levels. For now, I’ll let the trade run, while closely monitoring price action near the 40,000 zone. It’s crucial that the price remains below this level for the short trade to remain valid. A recovery back above 40,000 could signal a reversal, and in such a case, I may reassess my strategy.

Technical Overview:

• Partials: 38,000- 37,000area.

• Stop Loss: Monitoring the 40,000 zone as a key level of resistance.

• Key Indicators: The FibCloud provides strong bearish signals, and the declining price action suggests continued selling pressure.

• Risk Management: I’ll adjust the stop-loss level accordingly if the market shows signs of recovery or increased volatility. Taking partials at key support levels to secure profit remains an essential part of this strategy.

Fundamental Overview:

• Asia-Pacific Market Sentiment: As noted in the news, Asia-Pacific markets are mixed with attention on China’s loan prime rate announcement and Japan’s general election at the end of the week. While China’s central bank cut the one- and five-year LPRs by 25 basis points, this has not done enough to boost confidence, especially with property stocks tumbling.

• Japan’s Economic Data: Japan’s exports fell by 1.7% in September compared to the same period last year, signaling a potential slowdown in trade. Additionally, the Nikkei closed marginally lower recently, indicating bearish market conditions.

• Global Outlook: Japan’s market might be impacted further by inflation figures and GDP data expected this week, adding volatility and making the short trade setup timely.

Note: Please remember to adjust this trade idea according to your individual trading conditions, including position size, broker-specific price variations, and any relevant external factors. Every trader’s situation is unique, so it’s crucial to tailor your approach to your own risk tolerance and market environment.

JP225 / NIKKEI 225 Index Bank Money Heist Plan on Bullish Side.Ola! Ola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist JP225 / NIKKEI 225 Index Bank based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

NIKKEI 225 INDEX: Breaks Out! TP1 Done – Higher Targets AwaitNIKKEI 225 INDEX Analysis:

The Nikkei Index shows promising bullish momentum on the 15-minute timeframe, with the first target (TP1) successfully reached using the Risological Swing Trading Indicator. This long trade setup suggests a potential continuation towards higher targets as buying pressure remains strong.

Key Trade Details:

Entry Level: 38,384.25

Target Levels:

TP1: 38,544.16 (Achieved ✅)

TP2: 38,802.91

TP3: 39,061.66

TP4: 39,221.57

Stop Loss: 38,254.88

Market Insight:

The Nikkei’s breakout reflects positive sentiment in the Japanese equity market, likely influenced by global economic factors and investor optimism. This upward movement aligns with a strengthening technical trend, supporting the possibility of reaching the remaining targets if the bullish momentum sustains.

Summary:

With TP1 already hit, traders eye the remaining targets. A tight stop loss below the recent breakout level offers protection while allowing for gains as the trade progresses towards TP2 and beyond.

NIKKEI 225 Falls Hard! Short Trade Hits All TargetsThe Nikkei 225 has displayed strong bearish momentum after the short entry at 39921.50, with the price moving through multiple profit targets.

Key Levels

Entry: 39921.50 – The short position was initiated as the price broke below this level, confirming bearish pressure.

Stop-Loss (SL): 40104.00 – Positioned above recent resistance to safeguard against potential reversals.

Take Profit 1 (TP1): 39695.93 – The first target was reached, confirming the initial strength of the downtrend.

Take Profit 2 (TP2): 39330.93 – Further selling pressure led to this level being hit.

Take Profit 3 (TP3): 38965.93 – The downward trend continued, achieving this target.

Take Profit 4 (TP4): 38740.36 – The ultimate target, indicating a significant bearish move.

Trend Analysis

The price is firmly below the Risological Dotted trendline, affirming the strength of the bearish trend. The continuous downward movement highlights strong selling momentum, suggesting that bears remain in control.

The short trade on the Nikkei 225 has progressed well, with all targets reached. The final target at 38740.36 underscores a strong decline, supported by the Risological Dotted trendline and consistent selling pressure.

JP225 / NIKKEI 225 Cash Index Market Money Heist PlanHola! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist JP225 / NIKKEI 225 Cash Index Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

JP225 / NIKKEI INDEX 225 Money Heist Plan On Long SideMy Dear Robbers / Traders,

This is our master plan to Heist JAPAN 225 Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent Swing Low

Stop Loss : Recent Swing Low using 1h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style

Nikkei to form a higher low?JP225YJPY - 24h expiry

Price action looks to be forming a bottom.

Short term bias is mildly bullish.

Preferred trade is to buy on dips.

The hourly chart technicals suggests further upside before the downtrend returns.

Further upside is expected although we prefer to buy into dips close to the 37830 level.

We look to Buy at 37830 (stop at 37530)

Our profit targets will be 38580 and 38680

Resistance: 38570 / 41135 / 42120

Support: 36990 / 35705 / 34425

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.