Bowser Takes the Castle $NTDOYThe CEO of Nintendo is retiring, leaving Doug Bowser to take the reigns of Nintendo. Keep it on your watchlist as the Megalodon has given us a buy sign!

The Megalodon indicator uses an artificial intelligence, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes!

Nintendo

Hands off my bread! Let's go, Nintendo! The Age of Mar 10 is about to come and Q2 is about to begin! Why do I have a feeling that you will release the new hardware and games the day after Nvidia Reports its earnings!!?

Fundamentally sound.

IP alone is worth a billion dollars.

Handheld market will be back in the full swing w/ the new Mini console!

All indicators point to an oversold company.

The product line is solid; games have a very successful attachment rate; accessories are great additions; movie production swinging in gear, the amusement park in the works, summer Olympics of 2020 and toys toys toys!!

Lets go!

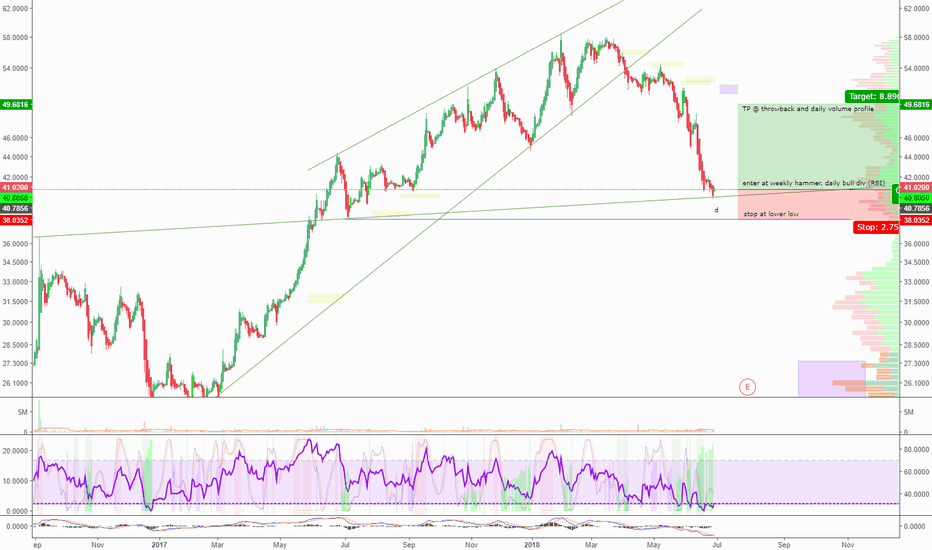

Nintendo Correction OverNintendo finished its ABC correction and has begun a new impulse wave. Breakout above bull flag confirms uptrend. MACD formed a bullish cross over and the Stoch is trending up. RSI is approaching oversold on the daily, so there may be a slight pullback in the near future, but its still < 50 on the weekly. First target is the 78.6% fib, which was a previous support level. This is about $49 - $50. Next is the 100%, ie the previous high, at about $57.

My opinion not financial advice

Pokémon Go mania is not yet over yet - long Nintendo (target 45)Nintendo shares could add a further 60% from current levels if the speculative mania continues.

Augmented Reality game that allows players to interact with real-world surroundings via their smartphone with a theme built around the Pokémon brand

Released 6th June 2016 in Asia, the game has seen more users downloads than dating app Tinder, and it's popularity is reflected in Google search traffic eclipsing that of keyword searches for "p*rn"

Germany became the first European country to have access last week, with the subsequent UK launch having been delayed due to server outages following download numbers

Players across Europe and the US have been unable to access the game following overwhelming demand

As the parent company, Nintendo reportedly has a 30% stake in the development company, which was spun off from Google in 2015

Disappointing Wii sales and a switch to mobile gaming amongst casual gamers have hurt Nintendo, but with PG they now have an opportunity to reclaim this business by establishing a share of the mobile market by leveraging their globally-recognised Pokémon brand

One-third of the game’s total revenues are derived from app store downloads (rest in-game)

Making $1.6m a day from iPhone users in the US alone

Extrapolating this figure, total revenues from US iPhone users (including the in-game majority) could be worth around $5m per day. Given continued growth in popularity and new launches in other countries, a conservative estimate could approximate total revenues globally, across all mobile platforms, in excess of $10m per day ($3.7bn per year).

Having added $15bn in market cap since the 86% rally in the share price, it looks as though speculators are getting ahead of fundamentals. However, King games' 'Candy Crush Saga' raised $7bn in their IPO and demonstrated the potential for monetising spin-offs and sequels

Overseas revenues (esp. USD) are a boon for Japanese Nintendo who report earnings in Yen

Whilst I am fascinated by manias but very rarely participate (on the upside at least), I believe that active and aggressive traders could stand to profit from buying in to the parabolic move in Nintendo. With a stop towards the prior day's low, or Fibonacci retracement level in the event of a short-lived pullback on a daily interval, upside momentum remains targeting levels of 37 initially and eventually 45 if this move is to be sustained. I would not rule out a 61.8% retracement of the 2007 high (52.85) or even a return to 78.50, however the shares would be grossly overvalued and truly represent mania, presenting a tremendous short opportunity.

Nintendo can go higher upon Pokemon go crazeI suspect that the mobile game will be very successful especially in Asia. It is very successful now in US, Australia and New Zealand. It seems that the game craze will last according to my presumption up to 1 month. There could be some extra positive movements.

Nintendo: Interesting long setupI think we have a nice opportunity in Nintendo, specially if we opt for going long the yen denominated stock, since we'd gain exposure to the Yen, which I see as a good idea in any portfolio. The OTC market stock is poised to rally as well, to the order of 95% or so, with 20% downside risk in it based on the monthly setup on chart. If trading the TSE stock, you have a nice monthly long setup with 18% downside risk. There is a considerable spread when comparing Nintendo to the likes of Sony, so that might also be a good setup to check out (pair trade).

Setup #1: Go long 7974 or NTDOY, risking 20% downside, aiming for a 100% return within a year.

Setup #2: Short an 85% size position in SNE and long 100% size on NTDOY (risking 1% at 11.90% and 13.91% from entry respectively)

Check out my updated track record here: pastebin.com

If interested in my real time whatsapp alerts and swing trading newsletter, or in personal tuition, contact me privately. I'm offering a considerable discount on a packaged course which includes access to my private trading signals list for a year.

Cheers!

Ivan Labrie

Link to Tim West's chatroom: www.tradingview.com

We discuss setups like this often there. Feel free to stop by and subscribe to his indicator pack. If you have any questions ask.

Risk disclaimer: My analysis is provided as general market commentary and does not constitute investment advice. I will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.