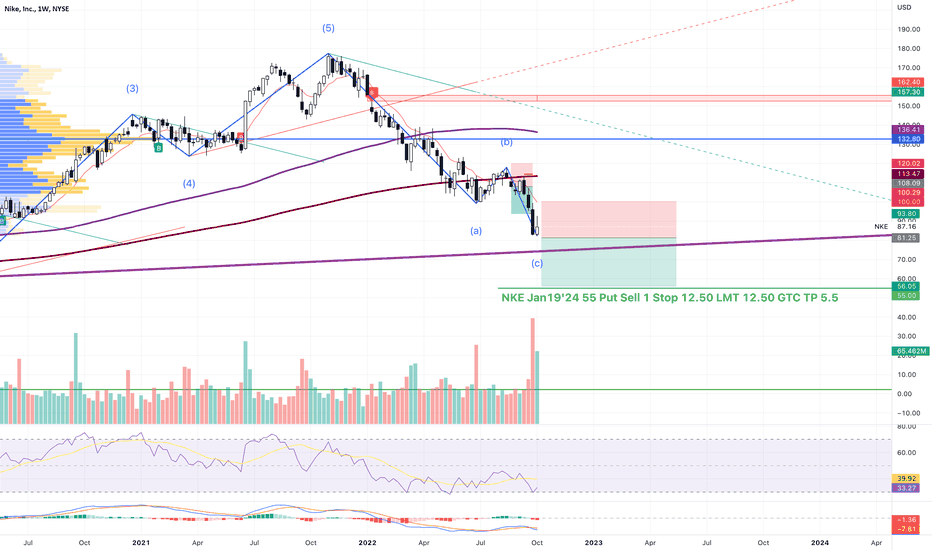

$NKE Short, clear divergence of RSI, and 9/21 crossover.Ticker: $NKE

Investment Strategy: Short

#RSI divergence from oversold

#Crossover of 9ema and 21 ema.

#MACD crossover and divergence.

Fundamental analysis:

Nike, Inc. (NKE) financials that may be helpful in conducting a fundamental analysis of the company:

Revenue: Nike, Inc.'s revenue has been steadily increasing over the years. In 2020, the company generated revenue of $37.4 billion and in 2021, it generated $39.1 billion.

Earnings: Nike, Inc. has been consistently profitable over the years. In 2020, the company had net income of $3.8 billion and in 2021, it had net income of $4.2 billion.

Dividends: Nike, Inc. has been paying dividends to shareholders. In 2021, the company paid dividends of $2.2 billion.

Debt: Nike, Inc. has a significant amount of debt. As of December 2021, the company had long-term debt of $8.2 billion.

Market Capitalization: Nike, Inc. has a market capitalization of $152.3 billion as of January 26th, 2023.

P/E ratio: Nike, Inc. has a P/E ratio of 34.7 as of January 26th, 2023, which is higher than the industry average.

Business Model: Nike, Inc. is a multinational corporation that is engaged in the design, development, and worldwide marketing and selling of footwear, apparel, equipment, accessories, and services.

Note: Please note that this information is for educational purposes only and should not be considered as financial advice. It is important to conduct your own research and consult with a financial professional before making any investment decisions.

NKE

Nike extends gains Nike's stock (NKE) kept rising in the intraday levels, buoyed by positive pressure from the 50-day SMA, and amid the dominance of the upward correctional wave in the short term, with negative signals from the RSI after reaching overbought levels, hurting the stock's movements.

Therefore we expect the stock to rise and target the resistance of 138.65, provided it settles above 118.47.

NIKE Inverse Head & Shoulders start the recoveryNike Inc. (NKE) broke above the 118.70 Resistance of the Shoulder level of the Inverse Head and Shoulders (IH&S) pattern that started in August. Having rebounded last week on the 1D MA50 (blue trend-line) and already now above the 1D MA200 (orange trend-line), this IH&S bears resemblances with the one in early 2020 which kick started the post COVID crash recovery.

As you see even the 1D RSI sequences between the two are similar. It would appear that right now we are in the process of turning the 1D MA200 in a Support as in mid-June 2020. Two weeks after the price convincingly broke above the Right Shoulder and the rally stopped just below the 2.0 Fibonacci extension.

If the current pattern repeats the 2020 one, then the 2.0 Fib extension will get the price to 155.00. That is just below the 0.786 Fib retracement from the All Time High. Right now the price is on the 0.382 Fib.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

NIKE LONGS!Nike longs!

Nike (NKE) has surged over 12% in the premarket after the athletic footwear and apparel maker reported better-than-expected quarterly results and raised its revenue forecast.

Price action has formed an inverse head and shoulders pattern, looking for the price to run back towards $150, as we look to break out of the bearish market structure via the weekly.

NKE - Just do itNike Inc - Intraday - We look to Buy at 99.72 (stop at 91.56)

Broken out of the channel formation to the upside. We have a Gap open at 99.72 from 10/11/2022 to 11/11/2022. Further upside is expected although we prefer to buy into dips close to the 99.72 level. Expect trading to remain mixed and volatile.

Our profit targets will be 118.44 and 139.00

Resistance: 109.31 / 113.36 / 118.47

Support: 99.72 / 92.10 / 82.22

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

$NKE: Bottom signal in the weekly chart$NKE has a very interesting basing pattern and reversal signal, according to weekly Time@Mode analysis here, while being down 40% from the top. A rare juncture, for a very valuable brand. Definitely an interesting setup here for mid to long term trade.

Best of luck!

Ivan Labrie.

NKE - SHORT TERM BULLISH SCENARIONike, Inc. is the world's largest supplier of athletic shoes and apparel and a major manufacturer of sports equipment. The company has a great history and is one of the most recognizable brands in the world.

Since the price reached an all-time high in November 2021 the stock tumbled more than 50 %

Possible short-term buy in the price channel.

Re-test of the support level of $80 is expected and, that will provide a better risk-reward ratio for the bulls with a target of the $ 100 resistance

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Nike is the New K-Swiss? Sheesh! A reach, or plausibly true?Well honestly, seeing that Nike's chart only exciting moment was during the bull run of Covid-19, I can only make the assumption that maybe that was the peak of Nike's capitulation.

Nike seemingly isn't the global sports fashion it used to be as sports are becoming the 2nd preference for entertainment nowadays. Let's be honest, you're excited about the game because of the social reward it brings.

The pandemic for sure snuffed that.

Kids love tablets. Kids love Fortnite. As a matter of fact everybody loves video games and social media, as the human game moves from social to individual based lifestyles. We're moving into a main character world society.

So I see Nike either becoming a pure fashion house which is crazy, or just becoming a ranging chart eventually priced to hit zero as Nike fades away.

I think for any of these legacy brands that can't keep up with a static high quality product that stands the erosion of time. Look at Hermes, the pricing on that stock is ridiculous, with neutral technical readings.

What do you think?

Green, potential growth - Nike acquires supply chain integration that

overlaps reseller industry while maintaining

green business model. A new shoe tech maybe . But what tech can nike implement into its approach that can really groundbreaking without setting a new pricing model for its products?

Yellow - Nike is still cool but can't seem to

shake new innovations by competitor

entering the space. might get stuck in a

outdated fashion model as 2 - 3 new generations

of humans entering grade school might think

nike is for lames. thats if kids even care about streetwear at

that point. Let's not forget with any trend, they end or restructure itself.

Trends are subjective to value by herd mentaility.

Red- Nike becomes the new K Swiss. I think this will also

correlate into the new interest of the incoming generations

whom all seem to be or will be metahumans.

generation meta. the generation that will only see value as intrinsic, but that's a maybe and very

speculative. Nike is only seemingly popular in social environments where it reigns supreme. The kids only like dunks.

Jordan branded nonndurables are just ehh.

Honestly when it comes to apparel brands, personally I don't see myself engaging any non durable seriously.

PS: Had to republish due to House Rule Violations.

Elliott Wave View: Nike (NKE) Incomplete Bearish SequenceNike (ticker: NKE) shows incomplete bearish sequence from the all-time high 11.5.2021 high as well as from 3.30.2022 high. The ideal and minimum target for this bearish sequence is around 77. The right side therefore remains to the downside and rally should fail in 3, 7, or 11 swing.

Near term, the Elliott Wave view on Nike (NKE) suggests that cycle from 9.13.2022 high is in progress as a 5 waves impulse. Down from 9.13.2022 high, wave (1) ended at 94 and rally in wave (2) ended at 99.89. Nike then resumed lower in wave (3) with internal subdivision as another impulse in lesser degree. Down from wave (2), wave 1 ended at 94.48 and wave 2 ended at 98.32. Wave 3 ended at 82.33, wave 4 ended at 86.20 and final leg lower wave 5 ended at 82.15 which completed wave (3). Wave (4) rally is in progress as a zigzag Elliott Wave structure. Up from wave (3), wave A ended at 86.47 and pullback in wave B ended at 85.25.

Final leg higher wave C is expected to complete at 89.5 – 92.12 area and this should end wave ((4)) as well. This is a 100% – 161.8% Fibonacci extension of wave A. From this area, the stock can resume lower in wave (5). Near term, as far as pivot at 99.9 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.

NKE - Strong Uptrend ContinuationGreen line shows the dominant bullish trend, this extends back for awhile

White line shows apparent downtrend, with a nice falling wedge to allow for the breakout to the upside and hence continuation

I expect price short term to rise back to dotted orange line, this is shown with bars pattern

NIKE - BULLISH SCENARIOThe downtrend for Nike Inc seems to be over. The American sportswear company got huge support at the $ 100 price level.

The 1st,2nd, and 3rd resistance levels are located respectively at $ 118, $ 130, and $ 140

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.

Nike (pullback to make double bottom?)Looks like we may be entering into a corrective state of market structure. We have recently finished our second 5 wave impulse being that we are on a downtrend currently. We have been dealing with a bearish rally filled with good news from the media while there are still battles ongoing with rumors of war, inflation , supply chain issues etc. I could keep going but you get the point. Smart money is still being strategic about the manipulation so I wouldn't get too bullish . If this corrective wave is true, we would like to see a pullback into the B wave which should start a range for the new "ABC" correction before judging the next breakout. We have our stop loss set at the high of wave a to be safe and our target are at the 61%, 78%, and 100%, to account for either a "regular flat", "irregular flat", or a "running flat". Not advice of course! Let's see how this plays out going forward.

Thanks for the support! Remember, the better you is tomorrow but the current days needs enough attention to get you there!

Ready for tomorrow? NKE prediction for the next few days This is not financial and I barely, if at all, know what I am doing. But, please follow if you like my predictions.

I thought I would chart NKE because Cramer talked about it the other day and it's fun to watch his inverses. He said Nike was a good buy at the end of last week.

I figured with an economy that is in a recession (not technically), inflation out of control, supply issues, and Covid over in China that this would be a good opportunity to predict a severe downtrend.

There really isn't much in the chart that needs to be stated. The trend is really bad. It is on a steep downtrend and I am expecting a much more serious dip before the middle of July.

The only support I see in the long run is at about $95. If it breaks $95 then I could see an even stronger dip to $65. The last time it was at this level was in 2020. It is already making new lows.

$NKE Analysis, Key levels & Targets$NKE Analysis, Key levels & Targets

Just an observation that since 1989, the 100EMA has been a consistent support for NKE. That would take it to 90.14 today, but that number might be different when it actually crosses…

I have my alerts set…

—-

I am not your financial advisor. Watch my setups first before you jump in… My trade set ups work very well and they are for my personal reference and if you decide to trade them you do so at your own risk. I will gladly answer questions to the best of my knowledge but ultimately the risk is on you. I will update targets as needed.

GL and happy trading.

IF you need anything analyzed Technically just comment with the Ticker and I’ll do it as soon as possible…