NOVNI think Novan Inc (NASDAQ:NOVN) will post a sharp rally from current levels. This was a $20 stock in June and at $8.14, in my opinion, there is a compelling risk/reward scenario. The risk is the stock continues to fall, the reward is a swift 30-50% type move for this oversold stock. Analysts price targets are very high compared to current prices.

NOVN

$NOVN swing-trade*This is not financial advice, so trade at your own risks*

*My team digs deep and finds stocks that are expected to perform well based off multiple confluences*

*Experienced traders understand the uphill battle in timing the market, so instead my team focuses mainly on risk management*

My team has been paying close attention to the price action of biotech company $NOVN these past few days after it experienced an 80 percent increase last Friday. Despite its amazing performance $NOVN failed to break strong resistance at $20 per share and experienced a drastic drop down to $10.76. $NOVN now rests at support at $11 per share.

My team expects $NOVN to perform well short-term due to this overly excessive sell-off.

We have entered today at $11 per share and have set our first take profit at $15 indicating a 36 percent increase from current levels.

Entry: $11

First take profit: $15

2nd take profit: $18

Stop loss: $10

If you want to see more, please like and follow us @SimplyShowMeTheMoney

Market going crazyLast time I talked about NNDM is determining the value of NNDM after their acquisition, which is bullish for the company and believing it should valued at a $10 stock. We look at NNDM and show there's no fundamental change in the long term price action, yet we can assume we might not get the gains we want in the market until the fall. According to market watch cash on hand is 671million and liabilities are 689million and adding these together gives 1.360billion dollar, yet the stock market values the company at a billion dollars. They are losing money due to the pandemic, yet they have enough cash to be sustainable. I did take profit on some NOVN shares still at a profit, yet decide to take a bite of NNDM and bought over 300 shares. I think atm the market is under valuing certain assets, yet retail traders don't care, which can be seen in erc20 scam coins, leaving btc and going into AMC atm, and along with NANO cryptocurrency which is still sub 50 in ranking marketcap. I'm not saying I'm not a fan of AMC or NANO, but think theirs value in stocks like NNDM that are so low it makes hedge funds that are buying cry tears of joy.

Technicals have no rhyme or reason in the current market besides being oversold and undervalued.

NOVAN a biotech stock that might fly very soonDisclaimer: I do own a position and you may want to do your own DD, since this post maybe bias even if its not. Please do your own research.

Novan is a pennystock biotech that picked up steam last fall like many pennystocks, but through out 2021 stocks have been getting hit with biotech and pennystocks/low caps being the worst hit sectors. Cathie Woods states in her investment strategy is buy sectors that are hurt the most and that have the protentional to move higher. Novan is its own patient product of nitric oxide throughout United States and Europe and wants to expand on it.

News

-March 29th The CEO bought 70,000 shares, which is bullish when the CEO is buying

-Voting has started and results come in on May 4th. There are many things in here such as increasing the share count by 15million, which shares off 200million doesn't seem much. This doesn't mean shares will get dumped it just means they have the option to do offerings in the future.

-Q2 (current quater that last till the end of May possibly June) they will get the results of sb206 B, which looks positive. sb206 will the first every treatment for a skin condition called Mollescum. In doing a quick google search, business wire estimates in 2017 there was over 12million cases and half was in the United States. Googling Mollescum cases in the United States go up 200k a year. Now how does Novan fit into this? Well they would be the only FDA treatment on the market, which would send market shares shoring to a billion dollar valution in a short period time (pt would be around $7).

-They also partnered up with Catalent to develop a COVID treatment, which has shown with Novan's product that can reduce the spread of Covid of around 90%. Which catalyst would send Novan to a 10billion dollar valuation, but its up to Catalent. This product is suppose to hit in Q3/Q4, but leans more of a Q3.

Pipeline

-Like ZOM, Novan is also entering the pet care field, but not a device to do testing. On the last webinar investor prestation, they are working to test their product to help skin dieses in dogs and atm are targeting K9s. This would pickup after sb206 and would get more news sometime around q4 or early next year (most likely when they get the marketing of sb206 going).

TA: Now that was alot of "shilling," but its great to know the protentional of a mid/long term play of Novan. It begs the question is if the pennystock is under the radar. Zack Investments and a big advocate in Novan and gave Novan a pt of $4, but 2021 hit and crashed the market. So heres some TA that might help you keep your risk at check if you enter.

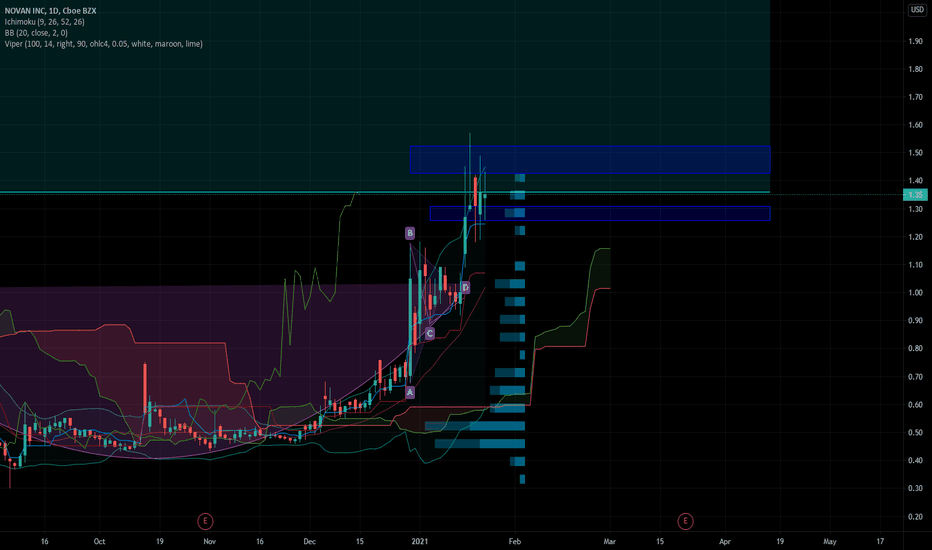

-Resistance in the short term is at $1.08, but closing was $1.10 on April 16, so $1.13 would act more of a challenge. After that is $1.32, $1.45, and then $1.63. With tight consolidation in the past between $1.63-$1.76, breaking that could shoot up to $1.96 or $2+

-Support: support is tricky cause we are free falling like most pennystocks such as ZOM. I would say a micro 5min scale, Every $0.02 is support, but on the hourly we could fall as low $0.96, but its unlikely. Last year we gain compliance of the $1, so there's a lot of buyers from here too $0.96 that will keep it above $1. Now if we get a negative catalyst we could drop too $0.86-$0.81

-MACD leans bearish as we look for a reversal

-RSI is oversold and leans bullish for a bounce back with resistance at 46.89. If people wondering where I get these RSI lines, I look at where its uptrending and make a guess where it breaks and the price starts dropping and the RSI goes from overbought to oversold levels.

-VPVR means shit like ZOM's TA, but in the past a lot of support at these levels in the past.

-Current EMA 50 is at $1.27, 128 is at $1.40, and the 200 is at $1.45.

Final Thoughts

Biotechs are risky, but with the CEO buying at $1.40 and seeing the price way below that is a sign to toss in some money or go all in. Its up too you, but I would take the bet and wait this storm out. The confidence between ZOM and Novan is I would pick a stock that has a bigger upside in a near term timeline. Again its best too do your own your research.

Stock Play: NOVNVolume accumulation, above the 14ma, will test the red cloud on the right with levels above. Good luck if you play!!

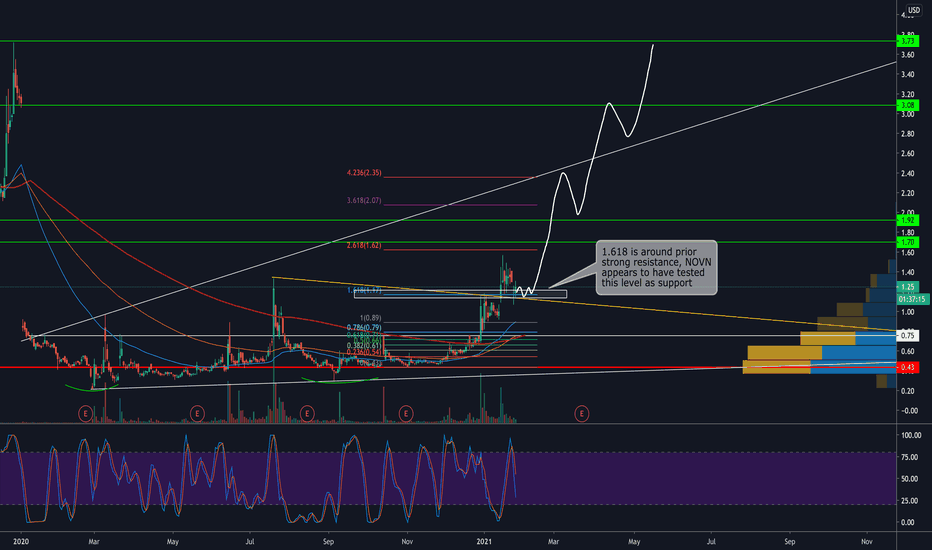

$NOVN - Long - Gapfill to 3 USD - 1/23/2021- Seems to be breaking out, watch for consolidation first at this support level

- It's a pennystock so manage risk

- Gap to fill, Cup & Handle, Bull flag

- fundamentals seem good

- Trigger is strong volume up on this bull flag

PT: 3.1

GL

NOVN long ideaWell looks like NOVN is breaking out to new highs. Simple setup. Price above the supporting moving averages and moving above recent resistance.

Swing trade developingEnter at support with tight stop loss. 1,2,3

Watch the volume closely to find the entry point and Watch the 5 min rsi to confirm it

Enjoy

NOVN$NOVN RSI way overbought, could reject here retest .36c B4 breaking up or could just power through straight to .80c So I am holding & watching