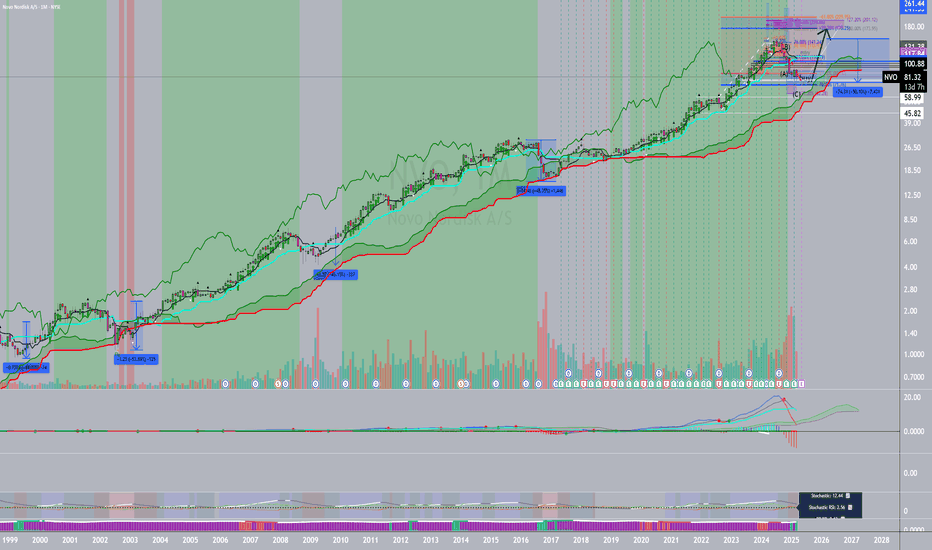

$NOV: Lot of loss in weight loss. Is it in buy zone? Currently the weight loss drugs are having a severe loss of weightage in the corresponding indices. The poster child of weight loss and diabetes drugs XETR:NOV and NYSE:LLY are seeing some of the worst drawdown in their history. Today we look at the worst of the 2 in this space which is $NOV. Novo Nordisk had a lot of missed steps in the current year, and the stock price has lost almost 70% from its peak of 148 $ in June of 2024. It has a long and painful drawdown of almost 70% from its ATH.

The downward sloping pattern is so prominent that it is hard to ignore the drawdown in this stock. But the question comes will there me more loss and pain this weight loss pioneer or there is a visible buy zone for this stock. I did some unorthodox chart today plotting the downward slopping Fib retracement by joining the tops of the recent lower highs and on the lower bound of the lower lows. We see the clear levels provided by the Fib levels. Currently the stock is at 0.786 level with price at 49 $. I think once the key psychological level of 50 $ is broken the stock can go below the 0.786 level and may touch the 1.0 Fib level which is @ around 40 $. And with 0.618 being the upper limit with price 52 $. This range was also in play during 2021 and 2022 when the stock did a year long consolidation before moving higher.

Verdict: XETR:NOV is within the accumulating zone with 52 $ as top and 40 $ as the bottom. 70 % drawdown from the top is a tempting discount on the price and a good entry point for long term.

Novonordisk

NovoNordisk, possible rotation,safe green buy Zone after confirmNovo Nordisk got slammed after Patrick appeared in the Technical analysis and slammed the Price all the way down to goblintown. After some profit cuts and FUD in the market a possibly rotation is possible. The GLP-1 market is misunderstood. if a rotation is confirmed and some more facts will be shared after lilly earnings today a possible rotation and green buy zone will be confirmed. after new facts and confirmation a High risk/reward oppertunity is possible.

Let's all hope patrick will appear back again (maybe after lilly earnings) in the charts and will take everyting upside down.

Good luck.

NovoNordisk, LT dirt cheap | GLP-1 a misunderstood growth marketNovo Nordisk stock has lost quite some weight since the release of Eli lilly's drug Zepbound and Mounjaro and since the rise of compounded, or generic copycat GLP-1 alternatives. The growth of the company has slown down a bit, but the overall GLP-1 market growth is still impressive and misunderstood. Both Lilly and NVO have become some of the cheapest PEG stocks in the markets and compettitors, of which most known, Hims en hers health also took a slice of growth of this market by telehealth GLP-1 descriptions.

The copycat descriptions could be dangerous due to unvalidated low quality GLP-1 or agonist GLP-1 substances. Therefore a lot of law suits have been initiated by NVO.

Where Oral Wegovy still has to be FDA approved withinin ~4, 7 months in USA, the company also has new medication approvals awaiting in the pipeline, medications like Cagrisema. (Phase 3 clinical trials, approval in late 2025 or early 2026)

Amycretin - a unimolecular long-acting GLP-1 and amylin receptor agonist.

Where investors have already praised Lilly for the better drug, GLP-1 demand is surging harder than production for both companies.

Where Wegovy and Ozempic are approved by The FDA to sell, many costs for the patients themselfs aren't covered by the health insurance yet. Wegovy or Zepbound isn't covered for mainstream when prescribed by your physician yet. it's only covered for severe obisty for example. Therefore penetration rates of the drug aren't very high yet and will get higher where it will be coverd for more people. Also due to the high cost many copycat GLP-1 agonist market have arisen.

There is some improvement in cost coverage for these types of medicine Which will boost the revenue due to prescribtion sales.

Next these facts, there are still new markets for GLP-1 to be approved like in india and Japan where worldwide demand is much greather than production capacity. Both Lilly and NVO are expanding fast. Many new production volume is created and Needed!, NVO is expanding production sites in brazil and china.

I'm exited for the earnings today. NVO has had many dumps before but has proven to be a up only company. The profits of the company have doubled from $7B to >$14B since Wegovy FDA approval. from the top shares have dumped 70% where there is still >10% growth. Since the FDA approval (june 2021), other markets excluded the share is just +40% up. The stock is much cheaper now with double the profits and revenue, and still >10% growth.

Let's see what happens with earnings. Good luck.

Novo Nordisk (Revised) | NVO | Long at $47.78**This is a revised analysis from February 5, 2025: I am still in that position, but added significantly more below $50**

Novo Nordisk NYSE:NVO is now trading at valuations before its release of Wegovy and Ozempic... From a technical analysis perspective, it's within my "major crash" simple moving average zone (gray lines). When a company's stock price enters this region (especially large and healthy companies) I always grab shares - either for a temporary future bounce or a long-term hold. While currently trading near $47 a share, I think worst case scenario here in 2025 is near $38-$39. Tariffs may cause a recession in the second half of 2025, so no company would be immune.

As mentioned above, I am still a holder at $86.74. However, I went in much heavier within my "major crash" simple moving average band and have a final entry planned near $38-$38 (if it drops there). My current cost average is near $55.00.

Why do I still have faith in NYSE:NVO ? Because no one else does right now, yet it generated $42 billion in revenue, $14 billion in profits, and has significant cash flow YoY. The company has a massive pipeline, despite Wegovy and Ozempic competition, and I think the market is undervaluing its position in the pharmaceutical industry.

Revised Targets in 2028:

$60.00 (+25.6%)

$70.00 (+46.5%)

$80.00 (+67.4%)

Is Novo Nordisk a buy? Novo Nordisk $NYSE: NVO plummets 22% on July 29, wiping out $57.5B in market value!

Here's what's happening and how I see it.

Here’s the breakdown on why the stock hit its lowest since Nov 2022:

Slashed 2025 Guidance: Sales growth cut to 8–14% from 13–21%, operating profit to 10–16% from 16–24%. Weak U.S. demand for Wegovy & Ozempic, plus competition from cheaper compounded GLP-1 drugs (i.e. grey market), cited as key issues.

CEO Shake-Up: Lars Fruergaard Jørgensen out, Maziar Doustdar in as CEO effective Aug 7. Investors worry Doustdar’s limited U.S. experience could hurt Novo’s edge in its biggest market (57% of sales).

Competition: Eli Lilly’s Zepbound (20.2% weight loss vs. Wegovy’s 13.7%) & Mounjaro are stealing market share. Compounded GLP-1s from Hims & Hers add pricing pressure.

Here's what I see:

There's a strong bearish sentiment, but the stock is very underpriced.

Considering the current stock price, EPS is at an all-time high. This means investors get more earnings for their stock.

P/B, P/E, and P/S ratios are at the lowest level since 2017! This is despite revenue growth of 25%+ for 3 consecutive years.

Operating margins are still quite healthy.

The company still has a very significant share (over 50%) of the GLP1 drugs worldwide.

The valuation of this company is now at the best level of the last 7-8 years.

There might be more volatility ahead, but I see the recent price drop as an opportunity to buy a pharma giant at a big discount, giving investors a margin of safety.

Quick note: I'm just sharing my journey - not financial advice! 😊

Why Did Novo Stock Fall So Sharply YesterdayNovo Nordisk shares plunged nearly 20–23% on July 29, 2025, marking its worst trading day since Black Monday in 1987.

Significant Downgrade of 2025 Financial Outlook

The company revised its sales growth forecast for 2025 down to 8–14%, from its prior guidance of 13–21%, and reduced expected operating profit growth from 16–24% to 10–16%. This adjustment was attributed to weaker-than-expected demand for Wegovy and Ozempic, and rising competitive pressures

#TheWallStreetJournal

I will start my accumulation using DCA, but will be happier to start buying this stock heavily from $47 zone.

trade with care.

I look forward to connecting with you

Novo Nordisk (NVO) – Oversold Reversal + Earnings CatalystNovo Nordisk (NVO) has declined 61.13% from its all-time high of $148 (June 2024), finding support at $57.55. Over the past two weeks, the stock has rebounded over 15%, currently trading around $66.30, with strong reversal signals just ahead of earnings.

This setup presents a compelling opportunity, both technically and fundamentally, for a tactical trade or a longer-term position.

Simply Wall St

🔍 Technical Highlights:

✅ Rebound from long-term ascending trendline (~$57–58 zone)

✅ RSI rising from oversold levels (28 → 32 and climbing)

✅ MACD approaching a bullish crossover, indicating momentum shift

✅ Two consecutive green weekly Heikin Ashi candles post-bottom

✅ Defined risk with invalidation below $57 support

📈 Trade Setup:

🟢 Entry Zone: $66–68 (current price range)

🔴 Stop Loss: Below $57.00 (break of structure and breakout base)

MarketWatch

+6

StockAnalysis

+6

Simply Wall St

+6

✅ TP1: $78 – previous support zone

✅ TP2: $90 – February 2025 high before the selloff

✅ TP3: $110 – around December 2024’s local top

🗓️ Earnings – May 7, 2025

🔹 Analysts project ~19.7% YoY revenue growth

🔹 Continued strong demand for Ozempic and Wegovy

🔹 Forward P/E ratio at 16.33, below industry average

🔹 Robust margins and high institutional ownership

🔹 Significant free cash flow and a promising innovation pipeline

StockAnalysis

📌 This appears to be a high-quality oversold bounce with a well-defined risk/reward structure ahead of a significant earnings catalyst. Whether you're considering a swing trade or building a core position, this setup aligns both technical and fundamental factors.

Let’s monitor how this unfolds. 📊🔬

Disclaimer: This is not financial advice – just sharing my perspective. Please conduct your own research before making investment decisions.

Novo Nordisk: 50% Drops Lead to Amazing GrowthFundamentals :

Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more.

Technicals :

uHd + extreme indicator +u3 volume last month +horizontal support + a-b-c + key fib pb

Projection: 200 to 250 within two years, tentatively.

Finally a stock I like...this one is a real dealFinally, an investment idea! (after how much doom and gloom?) — Novo Nordisk.

You will all be familiar with Ozempic, the Danish company’s flagship product and the reason so many celebrities, influencers, b listers and regular schmegular Americans are suddenly skinny. I ignored the stock for most of ‘23/24, because it was so expensive. I am still a value investor (for my sins) and I just didn’t see a lot of value there — it was priced in.

Imagine my surprise as I was thinking about “megatrends” (vom) for the year ahead — AI, data, 'zempy. Novo stock has fallen 37.80% in the last six months. And you know what that means…that’s a real deal!

Why is it a real deal? (Don’t you like booze stocks Eden?)

Ozempic is not going away. At this point it is synonymous with weight loss as “Uber” is to ridesharing or Google is to search.

Note this data per Barclays, from recently issued rx data in the US — Ozempic script issuance has grown +8.4%, while WeGovy slightly trails it at 7.4% — both owned by Novo. While Eli Lilly also makes a GLP, Novo is still the leader.

Strong guidance from management on sales — +16% - 24% — roughly implies revenue of $48bn for ‘25 and $57bn for ‘26…that’s a compounder.

America and much of the western world has an obesity problem. There is a clear incentive for governments to underwrite the drug because obesity has a clear social + fiscal cost on society — per UoA, the fiscal cost of obesity in NZ is at least $2bn¹.

People have an incentive to use Ozempic, because they are vain.

This is a nice hedge against the booze stocks I like so much. Benefit from both sides of the trade — buy booze at low teens multiples; buy Novo and benefit from lower drinking rates as there’s several studies that imply ‘Zempy reduces drinking.

I don’t want Ozempic, because I like to live the good life.

This does not mean the vast majority of people won’t use Ozempic. At the moment, one in eight Americans have used a GLP. That’s +334mn people. 40% of Americans are obsese.

There’s a Lollapalooza effect happening here — a bunch of incentives — vain people, governments wanting less obese people, the various side health benefits of GLPs, etc. I like when a lot of incentives are aligned because you’re relying on psychology rather than projecting numbers on an excel spreadsheet.

Novo has sold off recently due to a trial of its CagriSema drug missing expectations. Eyes on the prize, though — current GLPs, which still have plenty of market to saturate.

Eli Lilly has traded up in recent times, while Novo has traded down. The two tend to trade in lockstep so the disconnect is an opportunity to buy the world’s leading GLP maker at a good price.

Eli Lilly is the closest comp, but it trades at a 38x fwd multiple, while Novo trades at 20x — i.e. an almost 50% multiple discount (see chart). I like that too…

Note analyst recs on chart also…

This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

Novo Nordisk | NVO | Long at $86.74The Good:

NYSE:NVO expects its GLP-1 drugs Wegovy and Ozempic to soon come off the Food and Drug Administration's official shortage list.

Just reported better-than-expected net profit in Q4 2024, amid soaring demand for its obesity drugs.

Revenues for the Q4 2024 came in at $11.6 billion, up 30% compared to the same quarter in 2023.

From a technical analysis perspective, hovering near my historical simple moving average which may lead to a near-term price increase due to positive earnings

The Bad:

Slower growth in 2025 (16%-24% for 2025 vs 18%-26% in 2024).

Chart has been on a major run since 2020 and may be due for further correction.

Personally, the positives outweigh the negatives given the obesity drug demand. Thus, at $86.74, NYSE:NVO is in a personal buy zone.

Targets:

$96.00

$105.00

Loss in weight loss Drugs GLP1 Drug producers started 2024 with very strong momentum with Lilly touching nearly a market cap of 1T USD. But since then, the GLP1 manufactures have lost a lot of momentum. Novo Nordisk is at 52 weeks low as shown by the red line. Eli Lilly stock chart also showing bearish engulfing candle. The 20-Day, 50-Day and 100-Day are almost below the 200 Day SMA showing bearish divergence. IN the short to medium term the Price trend looks bearish unless there is a positive catalyst for the stock.

NVO LongNovo Nordisk, a global leader in diabetes and obesity treatments, has traditionally maintained a solid financial standing with strong revenue growth, impressive profitability, and a robust pipeline of new treatments. However, the company has recently faced a significant dip in its stock price, largely due to market concerns related to its obesity treatment segment. While these concerns may reflect short-term volatility or market uncertainty, it’s important to recognize that the company's underlying fundamentals remain strong.

When evaluating the company through the lens of intrinsic value indicators—such as discounted cash flow analysis, price-to-earnings ratios, and projected growth rates—Novo Nordisk appears to be trading at a favorable price relative to its long-term growth potential. This suggests that, despite the recent drop in stock price, the company’s shares may be undervalued, offering a potentially attractive entry point for investors who are willing to take a long-term view.

In the long run, the obesity treatment market is expected to grow, and Novo Nordisk’s leadership in this space, along with its diversified portfolio and innovation-driven strategy, could well position it to benefit from future market developments. Therefore, the current stock price may present a buying opportunity for those who believe in the company’s continued strength and market leadership.

#DYOR

Novo Nordisk (NVO): Beautiful Reversal Pattern is emerging Novo Nordisk price has charted a famous and beautiful reversal pattern - Head & Shoulders.

We have 3 peaks with the middle one the tallest also called Head.

The Right Shoulder inclines down so the magnitude of the bearish move is strong.

The dotted line between valleys of the Head is called a Neckline.

The bearish target for this reversal is located at the distance of Head's height subtracted from the breakdown point on the Neckline.

So, the target is at $89.

This area aligns very well with the bottom of last October and the peak of last May.

Can Market Turbulence Create Future Innovation?In a dramatic turn of events that sent shockwaves through the pharmaceutical industry, Novo Nordisk's recent setback with its experimental obesity drug CagriSema presents a fascinating case study in market resilience and scientific progress. The company's stock plummeted 24% after trial results showed a 22.7% weight reduction efficacy, falling short of the anticipated 25% target. Yet, beneath this apparent disappointment lies a deeper story of pharmaceutical innovation and market adaptation.

The obesity treatment landscape stands at a pivotal crossroads, with the market experiencing exponential growth from its modest beginnings to a staggering $24 billion industry in 2023. Novo Nordisk's journey, alongside competitor Eli Lilly, exemplifies how setbacks often catalyze breakthrough innovations. The CagriSema trial, involving 3,400 participants, represents a clinical study and a testament to the industry's commitment to addressing global health challenges.

Looking ahead, this moment of market recalibration might well be remembered as a turning point in the evolution of obesity treatment. With projections suggesting a potential $200 billion market by the early 2030s, the current turbulence could drive even greater innovation and competition. The fact that only 57% of trial participants reached the highest CagriSema dose points to untapped potential and future opportunities for optimization, suggesting that today's apparent setback might pave the way for tomorrow's breakthroughs.

Novo Nordisk Correction: Key Levels & Opportunities for InvestorNovo Nordisk, Europe’s largest publicly traded company, has experienced exceptional growth, especially in the diabetes and obesity treatment markets. Known globally for its expertise in insulin production, Novo Nordisk has also recently expanded into the obesity treatment market with products like Wegovy, which have seen rapid adoption and driven substantial revenue gains. Strong financials and a robust R&D pipeline make it a leading global player, well-positioned for future growth in metabolic health.

From a technical analysis perspective, Novo Nordisk faced resistance at the significant psychological level of €1000, struggling to break above this for several months. Eventually, the stock began a correction phase. Yes, it happens with large market-cap stocks as well. Such pullbacks provide strategic buying opportunities, particularly at former resistance levels where the stock previously consolidated, which are now potentially acting as support.

Examples like Apple, Microsoft, and Google in 2022 show similar patterns, where prior minor resistance points offer ideal entries during corrections. Currently, Novo Nordisk is approaching an initial support level around €725, which may present a first entry point for those looking to add it to their portfolios gradually. This level allows for a cautious position, leaving room for additional buys if prices dip further. Should the stock decline, the next support zone lies between €500-€600, marked by a significant psychological level (€500) and a 50% drop from the peak. Kind of an ideal scenario for adding to the position.

This approach sets a flexible plan for entering Novo Nordisk with room for adjustments based on market movements.

Regards,

Vaido

Novo Nordisk's Wegovy Secures China Approval, Poised for Major MDanish pharmaceutical giant Novo Nordisk gains significant access with the approval of its weight-loss drug Wegovy in China. This move grants Novo Nordisk entry into the world's second-largest economy, targeting a growing population facing obesity challenges.

Key Considerations:

Wegovy targets patients with a Body Mass Index (BMI) of 30 or higher alongside weight-related comorbidities like hypertension and type 2 diabetes.

The approval coincides with the impending expiration of the semaglutide patent in 2026, potentially intensifying competition with generic alternatives.

Novo Nordisk adopts a strategic initial focus on self-pay patients in China, mirroring its approach in other regions for early adoption before broader insurance coverage.

Competition emerges from Eli Lilly's weight-loss product Zepbound and domestic Chinese drug manufacturers.

Wegovy's potential for success in China aligns with the remarkable growth of Novo Nordisk's diabetes drug Ozempic (sharing the same active ingredient), which saw sales double in the region last year.

Novo Nordisk demonstrates a proactive commitment to meeting the global demand for weight-loss solutions through substantial investments in production capacity. Maintaining leadership in this market requires a continued focus on innovation, strategic expansion, and effective market penetration strategies as the semaglutide patent nears expiration.

The approval of Wegovy represents a significant milestone for both Novo Nordisk and China's public health efforts in addressing obesity. While this marks a new chapter in global weight-loss treatment, the competitive landscape promises to intensify. Novo Nordisk's future success hinges on its ability to navigate this evolving market.

NOVO NORDISK on the 1D MA50 starts looking a buy again.Novo Nordisk (NVO) hit the 1D MA50 (blue trend-line) again for the first time since December 18 2023 and after a long time it gives buy signals again. The correction came after the March 07 rejected at the top of the (dotted) Channel Up, following overbought 1D RSI levels before that for 2 weeks.

That is a pattern consistent with all previous Higher High formation of the Channel UP and then all rebounded after the 1D RSI hit its 1 year Support Zone. The final level to buy, if the price drops that low, would be the 1D MA100 (green trend-line).

Our Targets are first $139.00 (Resistance 1) and finally $158.00 (top of the (dotted) Channel Up).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Novo Nordisk's Leap into the AI Future: With NVIDIA PartnershipIn the ever-evolving landscape of technological innovation, a new wave of AI computers is poised to revolutionize computation as we know it. With processors designed specifically for AI programs, these machines unlock a realm of possibilities for individuals, governments, and scientific organizations alike. At the forefront of this transformative wave is Danish healthcare giant Novo Nordisk ( NYSE:NVO ), spearheading a groundbreaking initiative in collaboration with tech titan NVIDIA.

The convergence of AI and healthcare represents a monumental leap forward in the quest for optimized diagnostics, treatment, and research. Recognizing the pivotal role of AI in reshaping the future of healthcare, Novo Nordisk has embarked on a visionary journey by establishing an AI Innovation Center in Denmark. In partnership with the Export and Investment Fund of Denmark (EIFO) and NVIDIA, Novo Nordisk is set to harness the power of AI to propel research and development in healthcare, life science, and quantum computing to unprecedented heights.

Central to this ambitious endeavor is the Gefion supercomputer, poised to serve as the beating heart of Denmark's AI Innovation Center. Powered by NVIDIA's state-of-the-art H100 Tensor Core GPU, purpose-built for large-scale computing tasks, Gefion is poised to unlock new frontiers in computational prowess. With an initial investment of €80 million from the Novo Nordisk Foundation and an additional €8 million from EIFO, Gefion is slated to be one of the most powerful computers in the world, equipped to tackle complex challenges such as protein structure prediction with unparalleled precision.

The significance of this collaboration extends beyond mere computational power; it represents a paradigm shift in the integration of AI into the fabric of research and development. By leveraging purpose-built AI chips, organizations can transcend the limitations of traditional computing, unlocking new realms of possibility in data analysis, pattern recognition, and workload management. As NVIDIA unveils the groundbreaking Blackwell chip, heralded as the world's most powerful AI chip, the stage is set for a new era of innovation and discovery.

However, the pursuit of AI-driven solutions is not without its challenges. The exponential growth of AI techniques necessitates substantial resources and computational power, placing a premium on investment in AI computing infrastructure and application development. As organizations vie for supremacy in the burgeoning AI landscape, the race to deliver transformative solutions is intensifying, with Novo Nordisk and NVIDIA poised to lead the charge.

As the Gefion supercomputer nears completion and the promise of AI-driven healthcare innovation looms on the horizon, the world watches with bated breath. With each milestone achieved, the boundaries of what is possible in healthcare are pushed ever further, ushering in a new era of possibility, progress, and promise. In the realm of AI-driven healthcare, the future is not just bright—it's transformative.

Novo Nordisk Surges to Record HighsNovo Nordisk ( NYSE:NVO ) made waves in the pharmaceutical industry as its stock skyrocketed to unprecedented heights following the announcement of groundbreaking results from its experimental oral weight-loss drug, amycretin. The drugmaker's innovative approach, which combines GLP-1 and amylin hormones, surpassed expectations by demonstrating remarkable efficacy in comparison to established market competitors like Wegovy.

Key Highlights of Novo Nordisk's Breakthrough:

- Performance Comparison: Amycretin achieved exceptional results, with patients experiencing over 13% weight loss within 12 weeks, overshadowing the 6% weight loss recorded by Wegovy, Novo's existing weekly shot.

- Analyst Reactions: Industry experts hailed amycretin's performance as "solid," emphasizing its potential to revolutionize weight-loss treatments.

- Future Prospects: Novo plans to initiate Phase 2 studies for amycretin in late 2024, aiming to further validate its efficacy and pave the way for regulatory approval.

Market Impact:

Novo Nordisk's stellar performance sent its stock soaring by over 9.39%, reaching an all-time high. Meanwhile, competitors such as Eli Lilly ( NYSE:LLY ) and Viking Therapeutics ( NASDAQ:VKTX ) experienced fluctuations in response to Novo's breakthrough.

Competitive Landscape:

Novo Nordisk's ( NYSE:NVO ) success has intensified competition within the weight-loss drug market, with companies like Eli Lilly and Viking Therapeutics racing to develop similar treatments targeting multiple hormones for enhanced efficacy.

Manufacturing Challenges and Future Outlook:

Despite the excitement surrounding amycretin, Novo ( NYSE:NVO ) faces manufacturing hurdles due to the substantial demand for its existing products like semaglutide injections. However, the company is exploring innovative packaging solutions to address these challenges and capitalize on amycretin's commercial potential.

Conclusion:

Novo Nordisk's ( NYSE:NVO ) groundbreaking achievement underscores its commitment to innovation and addressing unmet medical needs in the weight-loss sector. As the company continues to advance amycretin through clinical trials and navigate manufacturing constraints, investor confidence remains high, propelling its stock to record levels and solidifying its position as a frontrunner in the pharmaceutical industry.

The Big 4 Earnings Releases today (POSITIVE)The Big 4 Earnings Releases today (POSITIVE)

✅ Novo Nordisk ⬆️

✅ Mastercard ⬆️

⌛️ Qualcomm (released later today)

✅ Boston Scientific ⬆️

The chart shows expected & reported earnings & price action. IMO Mastercard looks particularly promising.

NYSE:NVO NYSE:MA NASDAQ:QCOM NYSE:BSX

VCP Breakout Buy in NVONovo Nordisk is emerging from a textbook volatility compression pattern (VCP) - the setup made famous by Mark Minervini. Notice the series of progressively shallower pullbacks from left to right as supply has been absorbed by buyers.

NVO is a market-leading stock by all accounts. Shares are up 75% over the last twelve months with no signs of slowing down. This is largely thanks to its new weight loss drug showing tremendous results in clinical trials.

The company has also experience accelerating earnings growth for the last several quarters - another favorite quality of Minervini's for identifying top performers.

NVO looks buyable here as a swing trade with a stop loss 9-10% below the current price.

NVO Novo Nordisk Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NVO Novo Nordisk prior to the earnings report this week,

I would consider purchasing the $162.5 strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $6.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.