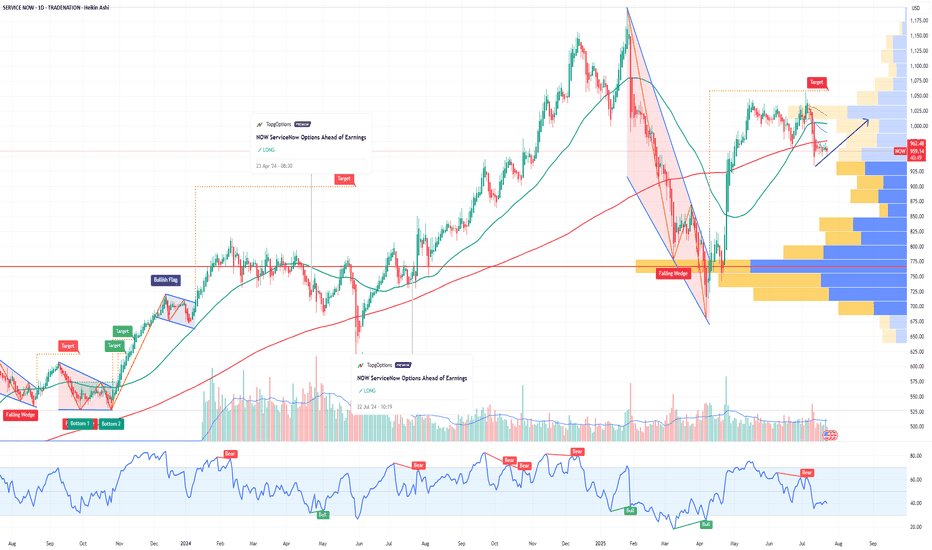

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the recent rally:

Analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 960usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $97.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Now!

GOLD (XAUUSD, 1H) Double Bottom & Continuation to Lower FibsOn the 1-hour chart, gold attempted to form a double bottom structure, which initially showed bullish potential. However, the price action quickly reversed near resistance, failing to sustain above key EMAs and trendline zones. This invalidates the reversal attempt and reaffirms the current bearish structure within the descending channel.

The price is now trading back below broken support and heading towards deeper Fibonacci retracement levels, with visible supply pressure and repeated failure to hold any bullish breakout. Volume has shifted lower on rallies, confirming weak buyer commitment.

Downside targets (Fibonacci structure):

– $3251 – 0.382 retracement

– $3221 – 0.618 retracement (primary structural support)

– $3165 – 0.786 extension zone (final support before breakdown scenario)

The descending wedge remains valid. Unless the market reclaims $3305–$3334 with strong confirmation, the corrective leg toward the lower support zones is likely to continue. A clean break below $3220 would open the door for a move toward the $3160s.

The failed double bottom setup confirms bearish continuation. Structure, volume, and trendlines all align with a move lower. Watch for reactions at $3221 and $3165 as critical levels.

ServiceNow (NOW) – Technical and Fundamental Analysis 1WServiceNow shares have broken below a key ascending trendline on the weekly chart, strengthening the bearish outlook. The price is approaching the 666, 538, and 338 support zones, which may act as potential reversal areas. The RSI continues to decline, indicating weakening bullish momentum, while the MACD confirms a bearish crossover. EMA 50/200 suggest a rising risk of further downside.

Fundamentally, ServiceNow remains a leader in cloud-based solutions and business process automation. However, it faces pressure from rising interest rates and a possible slowdown in corporate IT spending. Valuation remains elevated, making the stock vulnerable to broader market shifts and macroeconomic headwinds. Upcoming earnings reports will be critical in determining the next move.

The main scenario suggests a drop toward 666 and 538, with a potential extension to 338. An alternative scenario would be a recovery above 766, opening the way toward 868 and 1012. A confirmed close below 666 will reinforce the bearish trend.

NOW: Bearish Signs – Harmonic Pattern Hints DeclineServiceNow (NOW): Bearish Setup Ahead of Earnings

ServiceNow (NOW) is showing signs of potential bearish movement as it nears its earnings announcement on January 29.

Bearish Divergence: Notable on both the daily and weekly charts, suggesting weakening momentum.

Double Tops Formation: A reversal pattern indicating potential selling pressure.

AB=CD Harmonic Pattern: The bearish harmonic pattern has completed, signaling a possible correction.

Key Levels to Watch:

A closing below $999 would indicate a break of structure, potentially targeting the rising trendline support.

If you’re holding positions, consider off-loading some shares at current levels and re-evaluating after the earnings announcement.

Stay vigilant and monitor price action closely. Happy trading!

Pre-Market Updates: NOW Long Position PotentialThis morning, ServiceNow saw a $1.2B in volume after Baird raised its Price Target for NOW to $1,250 (from $975), maintaining their Outperforming Rating. From a technical analysis perspective, for those who may not hold this currently, now could potentially be a great opportunity to either snatch some shares or prospect some option plays.

Based on our 3-6 Month Price Projection from our TA, NOW is trending to see at least $1120 by early March - $1220 by early June, so options with expirations in March or June to be more conservative (with a lower delta) around the 1180-1200 Price Target would be sufficient.

Holding shares would get provide a potential for 10-15% increase alone by expecting NOW to at best retest that $1157 Resistance before compressing back to the lower Yellow Support Level that we've respected and used for paste price projections which were on point based on the trend. So if we stick to trend and hear some great things from Earnings on Feb 26th, 2025 showing continued guidance upwards.

Connect with us for more by visiting the links in our signature to access more tools and resources at @MyMIWallet #MyMIWallet

GBPJPY sellAs we have seen GJ has given us a beautiful upward momentum and it seems like now the momentum has been broken as GJ was moving with bullish trendline and recently it has broken below the trendline and going to be bearish the bullish candle forming has no Bullish volume also its a retest of the trendline so we will be bearish for further action keeping an eye on the pair see what happens

NOW ServiceNow Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 760usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $32.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

7 Dimensions Idea for BUY Gold CORE Analysis Method: Smart Money Concept

😇 7 Dimension Analysis

Time Frame: H1

1️⃣ Swing Structure: Bullish

🟢 Structure Behavior: Break of Structure (BoS)

🟢 Swing Move: Impulsive

🟢 Pull Back: 2

🟢 Internal Structure: Bullish

🟢 External Order Block (OB): Mitigated

🟢 Support & Demand: Start Accumulation from discounted area

🟢 Time Frame Confluence: H4 and H1 POI

2️⃣ Pattern

🟢 CHART PATTERNS:

W pattern formed at major swing

Continuation: Falling Wedge with proper breakout and retest, aligning with the breakout level and Fair Value Gap (FVG) level, making this area a high-probability POI for buyers

🟢 CANDLE PATTERNS:

Record Session Count (RSC) detected, indicating a correction towards 2404

Long wick candle at the bottom of RSC indicates bullishness

Engulfing and Kicker Sash patterns indicate bullish control at 2403

3️⃣ Volume

🟢 Volume during Correction: Dried up but now showing good volume as price moves upward

4️⃣ Momentum

🟢 RSI: Indicates full bullishness according to Grandfather Father Strategy

5️⃣ Volatility Bollinger Bands

🟢 Middle Band: Supported, contraction during retracement indicating potential range formation

🟢 Band Puncher: Lower band puncher indicates bullish strength

6️⃣ Strength According to ROC: Bullish

7️⃣ Sentiment: Bullish

✔️ Entry Time Frame: 5 minutes

✅ Entry TF Structure: Bullish with 5-minute swing liquidity sweep

☑️ Current Move: Impulsive in entry time frame

☑️ FIB Trigger Event: Triggered

☑️ Trend Line Breakout: Done

💡 Decision: Buy

🚀 Entry: 1st entry at 2406, 2nd entry at 2397

✋ Stop Loss: 1st at 2399, 2nd at 2391

🎯 Take Profit: 2441

😊 Risk to Reward Ratio: 7.5

🕛 Expected Duration: 2 days

SUMMARY

This analysis identifies a bullish swing structure on the H1 time frame with a proper BoS and impulsive moves. The internal structure remains bullish, supported by a mitigated external OB and accumulation at the discounted area. The pattern analysis highlights a W pattern and a falling wedge breakout with a retest, positioning this area as a high-probability POI for buyers. Candlestick patterns further confirm bullish control, supported by favorable volume and momentum indicators.

The sentiment is bullish with key indicators such as RSI and Bollinger Bands supporting an upward move. Entry points are identified at 2406 and 2397 with respective stop losses and a target take profit at 2441, providing a risk to reward ratio of 7.5. The expected duration for this trade setup is 2 days, contingent on continued bullish momentum and price behavior as outlined.

NOW ServiceNow Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 810usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $29.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NOW is a buy after a down tech stock day LONGNOW is on 15 minute chart with a volume profile overlaid and relative volume and volatility

indicators below the chart. NOW had a good earnings beat late January. It is halfway to the

next earnings. I think right now software stocks are hotter than hardware/ networking stocks.

NOW got dragged down by technology headwinds into its support and the fall got rejected

by buyers near to the close of the regular market hours. The lower VWAP bands are confluent

with the support zone and confirm deep oversold and undervalued stock price.

I believe this is excellent for a long trade perhaps lasting until the run-up before earnings is

6-7 weeks through the buy of a small lot of shares or a call option expiring at the May or June

monthly in the range of $750 ( OTM). This will complement existing positions in CRM

CRWD and PLTR.

A Novice's Handbook to Trading Triumph

-----

🙏

In an era where financial landscapes evolve rapidly, venturing into the dynamic domain of foreign exchange (Forex) trading need not be an intricate odyssey. This novella of wisdom unveils the rudiments, steering you through the intricate labyrinth of setting up your financial fortress, handpicking the tools of the trade, deciphering the enigmatic timelines, and sculpting entry strategies with the finesse of an artisan.

Navigating the Terrain of Account Setup:

Your journey commences by selecting the sturdy vessels of financial exploration, the likes of Coinbase, revered for transmuting mundane currency into the futuristic realms of cryptocurrency. Navigate the seas of connectivity, tethering your accounts to the steadfast anchors of Visa, Mastercard, or the versatile iDeal. Venture further into the undiscovered territories with a seasoned guide – Tradersway, an oracle in the realm of brokers, beckoning with bespoke options for an authentic trading saga.

Sculpting the Trading Landscape: Platforms and Tools as Your Artistic Palette

Forge your path with MetaTrader 4 (MT4), the canvas for your live trading masterpiece. Unveil the ethereal allure of a Virtual Private Server (VPS), akin to a mythical power-up, enriching your automated trading endeavors. Wander into the meadows of TradingView, where user-friendly charts bloom, and ideas spring forth from a convivial community of traders. Consider wielding the nNouSign indicator, a magical wand for crafting diverse trading strategies.

Chronicles of Time: Timeframes for Poetic Analysis

For decisions swift as the flutter of a butterfly's wing, gaze upon the 5-minute (5M) and 15-minute (15M) charts, where markets pirouette in perpetual rhythm. Should your ambitions soar higher, ascend to the 1-hour (1H) chart, where profit potential unfurls like a tapestry woven with the threads of time.

Crafting Entry Strategies: The Artistry of Navigating Waves

In the realm of 5M and 15M, embrace the mystique of the nNouSign indicator on TradingView, intertwining with the 21 Linear Weighted Moving Averages (MA) on the sacred grounds of MT4. Enlist the Williams Percent Range (WPR) at 40, a beacon illuminating shifts and retests. Draw lines, as an artist sketches contours, on both your chart and the WPR canvas for heightened insights. Decipher the harmonies between MA and WPR, directing the symphony of buying and selling. Set the crescendo with Take Profit (TP) at favored peaks or where echoes of prices linger in the corridors of time.

The sonnet of 1H unfolds with kindred strategies, casting TP anchors where your heart desires or where the echoes of prosperity resonate. Anticipate the ballet of trends, choreographed by the highs/lows of yesteryears or the harmonious convergence of MA and WPR.

Risk Management: Navigating the Seas of Uncertainty

As the helmsman of your financial vessel, chart the waters of risk with sagacity. Know the depths you are willing to plunge for the elusive treasures of profit. Let stop-loss orders be the vigilant guardians against tempests, strategically placed to avert colossal losses. For instance, on a £300 expedition trading XAUUSD with a 1:500 leverage, let the StopLoss, a guardian set at 200 pips, stand steadfast at 1987.00 for a buy trade anchored at 1989.00. As you navigate, survey the constellations of currency pairs—those that pirouette in unison and those that waltz in opposing directions.

Educational Alchemy: The Chronicles of Wisdom

Embark on an odyssey through the scrolls of easily decipherable Forex education platforms. Join the symposiums of Forex communities, where sages share their sagas and novices glean the pearls of insight. Chronicle your journey, the trials, and the triumphs in the scrolls of a journal, an atlas mapping the uncharted territories of your evolving knowledge.

Epilogue: 🌹

In the grand tapestry of Forex trading, the loom is not as daunting as it may seem. Armed with the artisan's tools, weave your narrative, learning with every stroke of the quill. Navigate the seas of risk with the astuteness of a seasoned mariner, adjusting your course with each gust of the trading winds. In the realm of Forex, the adventure unfolds not as a tumultuous tempest but as a voyage guided by the stars of knowledge. Bon voyage, intrepid trader! May your odyssey be as prosperous as the markets are ever-changing.

-----

❣️

EUR USD IdeaGreetings, fellow traders! It's an intriguing landscape in the world of forex, where the dollar seems to have locked itself in a strong consolidation phase. This appears to be driven by algorithmic movements, and over the past two months, we've witnessed price action oscillating within a tight volume range. Highs and lows have been established with minimal fluctuations in trading volume, making it a relatively smooth sail for range-bound traders.

The 50% range line, acting as a pivotal point, has been a constant source of fascination as it continues to flip back and forth, emblematic of the algorithmic consolidation at play. While it's possible that we may see this consolidation persist throughout the end of the year, it's important to note that it's also been a fertile ground for those who have mastered the art of trading within this range.

In essence, it's as if the markets have adopted a rhythm of their own, and for traders who are skilled at navigating this unique dance, there have been opportunities aplenty.

NOW ServiceNow Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 470usd strike price Puts with

an expiration date of 2024-5-17,

for a premium of approximately $27.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

WDAY - Rising Trend Channel [MID-TERM]🔹Rising trend channel in the medium long term.

🔹The short-term trading range has experienced a POSITIVE trend as it has broken a short-term resistance level.

🔹In case of a NEGATIVE reaction, the stock has support at approximately 207.

🔹Technically POSITIVE for the medium long term.

Chart Pattern:

🔹DT - Double Top | BEARISH | 🔴

🔹DB - Double Bottom | BULLISH | 🟢

🔹HNS - Head & Shoulder | BEARISH | 🔴

🔹REC - Rectangle | 🔵

🔹iHNS - inverse head & Shoulder | BULLISH | 🟢

Verify it first and believe later.

WavePoint ❤️

INTU - Rising Trend Channel [MID-TERM]🔹Rising trend channel in the medium long term.

🔹In case of a NEGATIVE reaction, the stock has support at approximately 490.

🔹Short-term trading range has been positively signaled by breaking a resistance level.

🔹The RSI is showing a Bearish Divergence against the price, indicating a potential downward reaction.

🔹Technically positive for the medium long term.

Chart Pattern:

🔹DT - Double Top | BEARISH | 🔴

🔹DB - Double Bottom | BULLISH | 🟢

🔹HNS - Head & Shoulder | BEARISH | 🔴

🔹REC - Rectangle | 🔵

🔹iHNS - inverse head & Shoulder | BULLISH | 🟢

Verify it first and believe later.

WavePoint ❤️