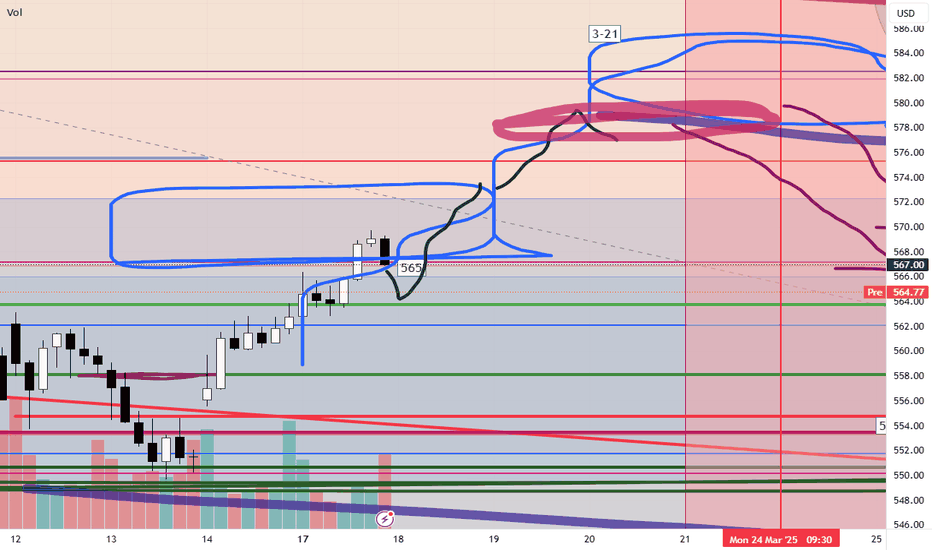

SPY/QQQ Plan Your Trade for 3-21-25 : BreakAway PatternToday's Breakaway pattern may show up in the form of an Island Top or break-away to the upside if my analysis is correct.

I see the markets stalling over the past few days, potentially setting up a "last breakaway" type of pattern today.

I've highlighted how these "last" patterns work where price sets up a peak or trough (in this case a peak) as a last/exhaustion move and how this move can sometimes be very aggressive.

I urge traders to stay cautious today as we are moving into a MAJOR REVERSAL weekend.

I believe the markets will suddenly change direction next week (early) and will move back into downward trending by March 25-26.

Gold and Silver may rally today if the markets move into that Exhaustion Peak pattern. Keep an eye out for Gold/Silver/Bitcoin to potentially rally today and into early next week.

Overall, traders should stay very cautious as we move into next week's peak/top/rollover.

Don't get too aggressive trying to prepare for the rollover or any potential upside move over the next 3-5+ days.

Let the markets show us what and when we need to be aggressive.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Nq!

DAX Trade Log DAX Buy Setup with Ichimoku Confluence

Geopolitical tensions—especially the ongoing conflict in Eastern Europe—continue to influence risk sentiment, while inflation and central bank policy remain in the spotlight. The European Central Bank’s more hawkish stance contrasts with fears of slowing growth in the Eurozone. Despite these headwinds, the DAX could see a near-term bounce, supported by technical signals:

1. Ichimoku Confluence : Price is testing the Kijun and the lower edge of the cloud, aligning with a daily pivot. A close back above the Kijun/cloud area suggests potential upside.

2. Volume Spike : Recent volume surge around this support zone may indicate bullish absorption—watch for follow-through.

3. Macro Backdrop : Although persistent inflation and geopolitical uncertainties loom large, short-term volatility can present trading opportunities. Keep an eye on ECB communications and any unexpected developments in global tensions.

4. Risk Management : A 120-point SL (around 2% account risk) below the key support could help protect against false breaks. Targets include the top of the cloud or previous swing highs.

5. 8-Day Cycle : Day 2 in your cycle analysis suggests a potential upswing—confirmation will come if price holds above this confluence zone.

Stay vigilant, monitor news flow, and maintain discipline in your trading plan. This is not financial advice—always do your own due diligence.

SPY/QQQ Plan Your Trade For 3-20-25 : Flat-Down PatternToday's SPY Cycle pattern suggests the SPY/QQQ will stay somewhat muted in trading range today.

I still believe the SPY/QQQ are in a moderate melt-up type of trend - attempting to reach a peak near the end of this week or early next week (see the patterns for March 24, 25, 26).

Even though I believe we are struggling to try to move higher, I do believe any failure of the SPY to move above the 0.382 Fibonacci retracement level would be a technical failure related to the breadth of this pullback.

Thus, I believe the markets have at least one more attempt to try to move higher over the next 5+ days before topping and rolling over into a broader downtrend.

Gold and Silver moved solidly lower this morning - almost like a Panic type of selling. I believe this is related to the Flat-Down pattern and I believe Gold/Silver will recover fairly quickly. I do believe this is a huge opportunity for Gold/Silver over the next 30+ days. I believe Gold will attempt to move above $3500-3600 before the end of April.

BTCUSD rolled higher yesterday by more than $4000 - just like I predicted.

Incredible.

And, that is another reason why I believe the SPY/QQQ have more room to the upside than we are seeing right now.

Remember this is a trader's market.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Trading Is Not Gambling : Become A Better Trade Part IOver the last few weeks/months, I've tried to help hundreds of traders learn the difference between trading and gambling.

Trading is where you take measured (risk-restricted) attempts to profit from market moves.

Gambling is where you let your emotions and GREED overtake your risk management decisions - going to BIG WINS on every trade.

I think of gambling in the stock market as a person who continually looks for the big 50% to 150%++ gains on options every day. Someone who will pass up the 20%, 30%, and 40% profits and "let it ride to HERO or ZERO" on most trades.

That's not trading. That's flat-out GAMBLING.

I'm going to start a new series of training videos to try to help you understand how trading operates and how you need to learn to protect capital while taking strategic opportunities for profits and growth.

This is not going to be some dumbed-down example of how to trade. I'm going to try to explain the DOs and DO N'Ts of trading vs. gambling.

If you want to be a gambler - then get used to being broke most of the time.

I'll work on this video's subsequent parts later today and this week.

I hope this helps. At least it is a starting point for what I want to teach all of you.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

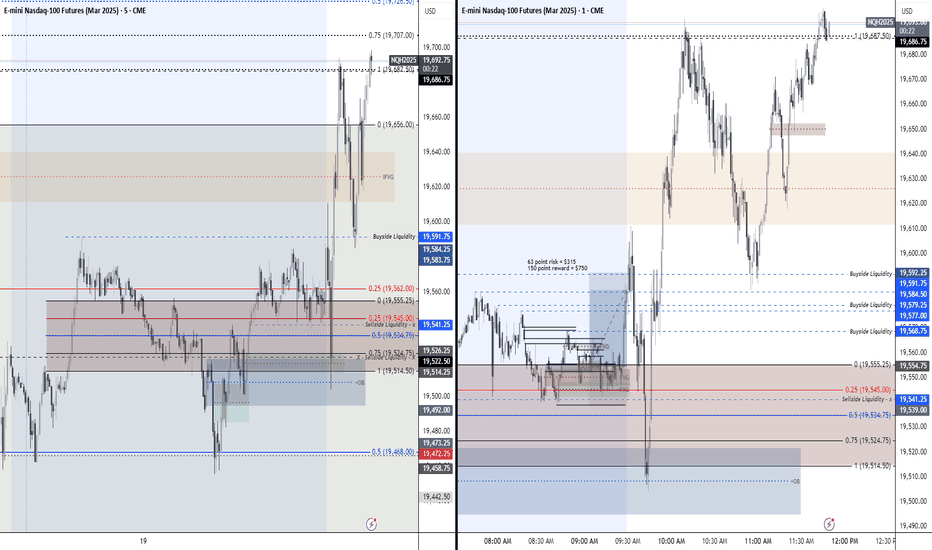

Review of my NQ Morning trade before FOMCThis is me going over the trade we took today that was a loss. Had we kept SL under the low of 19,541.25 we would've hit TP and caught our trade. We are done trading for today, just wanted to hop on here to share with you guys the result of the trade and outcome.

Give it a like ♥ and a 🚀 if you found this insightful.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Pt. 2 of Navigating NQ during FOMCPart 2. Continuation showing my thoughts and trade stop out.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Navigating PRE FOMC on NQTrade Idea for NQ, we could've captured a good amount of points, I was targeting higher buyside liquidity so it led to this trade being stopped out. Total loss was around -$19 after shifting sl near BE.

Pt. 2 for this trade where I show you my stop out will be posted next.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

SPY/QQQ Plan Your Trade For 3-19-25 : Top PatternToday's Top pattern suggests the SPY/QQQ will attempt to rally up to resistance, then form a peak/top in price, and then roll over a bit.

After yesterday's fairly consolidated price range, I believe the SPY/QQQ may rally through most of the day and move into the topping pattern near the end of today's trading day.

Overall, I believe the markets are still rolling into the Excess Phase Peak consolidation phase and that means traders need to prepare for extreme price volatility.

What is interesting is how BTCUSD is trying to rally a bit, but not finding upward momentum.

As I stated in today's video, I believe a fairly big move upward, possibly $3000 or more, in BTCUSD could happen between now and the end of this week.

This would be a perfect upward price advance into resistance that could correlate with a move h higher in the SPY/QQQ - targeting the upper level of the Consolidation Phase.

Gold and Silver have reached a "pause" level. I believe Gold and Silver will only pause for 48 to 96 hours before attempting to break higher. So, metals will still attempt to break higher into late March 2025.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Nasdaq Intraday TradeWith the overnight GAP, price jumped above the white Centerline, just to come back in the Asia session.

We see that price broke the white CL and halted afterwards. Do yo see where it halted? Yes, at the Centerline of the yellow Momentum Fork!

And currently it's pushing up through the white CL again...hmmm...

So, we have momentum, clear support at the yellow CL, a potential new push through the white CL and a loooooot of Air...and stop/losses above to be sucked in §8-)

I'm long with a stop below the yellow CL low, and with multiple targets to the upside.

Let's have fun!

SPY/QQQ Plan Your Trade For 3-18-25 : Gap Reversal Counter-TrendFirst off, thank you for all the great comments and feedback. I really love hearing from TradingView subscribers and how my research is helping everyone find success.

Just recently, I received some DMs from viewers saying my research has been "dead on" - which is great.

One thing is for sure, the big move in Gold/Silver is just getting started.

Today's SPY Cycle Pattern is a Gap-Reversal in a Counter Trend mode. The long-term & short-term bias is currently BEARISH - so I believe the GAP Reversal will be to the upside.

Meaning, I suggest we start the day with a mild lower GAP - followed by a moderate price reversal in early trading, leading to a continued melt-up type of trend for the SPY/QQQ

Gold and Silver are likely to attempt to melt a bit higher into the TOP pattern for today. I believe this is just a temporary resistance level for metals.

Bitcoin is struggling to find upward momentum - but I believe BTCUSD still has a $3k-$5k rally left to reach the current Consolidation highs. We'll see if it breaks higher over the next 3-5 days before rolling over into a new downtrend.

Again, I really appreciate all of my followers and viewers. I want all of you to learn to see, read, and understand price action more clearly than ever before.

That's why I don't use any technical indicators on my chart. I want you to understand PRICE is the ultimate indicator.

Get some..

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Video for 3-17: GAP PotentialAs we start moving into the Excess Phase Peak pattern consolidation phase, I believe the SPY/QQQ will attempt a moderate rally for about 3-5+ days, then roll into a deep selling mode after March 21-24.

I don't believe we have reached a bottom - yet.

I do see a lot of people talking about "the bottom is in" and I urge all of you to THINK.

What do you believe will be the basis of US and GLOBAL economic growth starting RIGHT NOW?

Can you name one thing that will be the driver of economic expansion and activity?

I can't either.

Thus, I suggest traders prepare for more sideways consolidation range trading over the next 60+ days as hedge assets and currencies attempt to balance risks.

BTCUSD, Gold, Silver should all be fairly quiet this week. I'm not expecting any huge price moves this week.

I expect the SPY/QQQ & BTCUSD to move a bit higher while Gold and Silver melt upward a bit further.

Then, after March 21, I expect bigger volatility and a broad rotation in the SPY/QQQ/Bitcoin where Gold/Silver will start a bigger move higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

$NQ IdeaOn the monthly chart, NQ maintains its bullish structure, confirming an uptrend. However, in recent weeks, the price has undergone a correction, pulling back to an equilibrium zone before potentially resuming its predominant upward movement. We can see that the price is holding at the Mean Threshold of a monthly rejection block, while also forming an SMT on swing lows with ES and YM on the weekly chart.

Since we trade on an intraday basis, it is essential to analyze multiple timeframes to confirm our bias. On the weekly chart, last week's candle swept the previous week's low and closed below the range. However, given the presence of an SMT at the lows, it is unlikely that the price will target the PWL (Previous Week Low). Instead, a correction toward a discounted area on H4 could occur before the bullish movement begins.

This scenario makes sense because the H4 chart has engineered liquidity in a premium zone, and the price is still trading within that area. Furthermore, last week's shift in market structure confirmed a bullish bias on H4, but before resuming the uptrend, we might see a sell-off to clear liquidity, as the price remains in a premium zone on H4.

Based on the economic calendar, there is a possibility that the weekly low will be formed on Monday, creating an opportunity for a counter-trend trade early in the week. However, this setup carries high risk, requiring caution and confirmation before entry.

For this week, we are looking for bullish opportunities toward equilibrium or until the price encounters resistance to continue rising. However, this outlook will be adjusted as price action unfolds throughout the week.

It is also worth noting that this will be a challenging week, due to a lack of major economic news and an upcoming Federal Reserve speech on interest rates, which could significantly impact the market and increase volatility.

$800 Profit in under 10 Minutes on NQ! Turned $800 Profit in Under 10 Minutes Trading NQ! 📈💰 Watch How It Happened! 👀🔥

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

SPY/QQQ Plan Your Trade For 3-14-25: Temp BottomToday's Cycle Pattern is a Temporary Bottom pattern. I suspect the markets may attempt to move a bit lower in early trading before attempting to find a new base/support level.

Yesterday's low may prove to be very important depending on what the markets do today. Initially, I thought yesterday's low was the Temporary Bottom pattern (one day early). But, I do believe the markets will continue to be volatile in early trading today and may move downward to retest lows before trying to move higher - setting up the Temporary Bottom pattern.

Gold and Silver will likely continue to melt upward unless there is some big news that disrupts the US Dollar's downward slide. I see Gold trying to rally above $3200 very quickly over the next 15+ days.

Bitcoin is still consolidating and is currently in a short upward price phase (much like the SPY/QQQ). In fact, the SPY/QQQ and Bitcoin are all in an EPP consolidation phase.

So, that means even though we may see a volatile type of price move over the next 15-30+ days, price is ultimately trapped in a consolidated price range and will/should attempt to break downward into the Ultimate Low.

Therefore, if we get a moderate pullback/rally phase over the next 5+ trading days, be aware that the rally upward will end near March 21-24 and turn downward very sharply before the end of March (based on my research).

You have lots of opportunity if this base sets up for a moderate rally in the SPY/QQQ, but play it cautiously as I don't believe we'll see new ATHs anytime soon.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade EOD Update for 3-13-25What a crazy day. The markets certainly decided to burn the longs almost all day.

I got a few messages from traders who continued trying to pick bottoms in this downtrend. FYI, that can be very dangerous.

If you are a short-term trader and are trying to pick a base/bottom all day today - you have to have a limit in terms of how much you are willing to risk within a single day.

I've seen dozens of traders blow up their accounts in a big, trending market.

Please learn from your actions. Develop a STOP POINT related to your trading decisions.

There is no reason to continue to try to execute "bounce" trades when the markets are trending as strongly as they are today.

This video should help you understand what I see as the potential over the next 5+ days.

We are still trying to hold above critical support near the 50% retracement level on the SPY.

Everything depends on what happens in DC and how the markets perceive risks.

Gold/Silver rallied very strong today. This is FEAR related to risks.

If the US government enters a shutdown, Gold and Silver could skyrocket much higher.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

SPY/QQQ Plan Your Trade Update For 3-13-25 - Fear Settling InWith the US government only about 39 hours away from a complete SHUT DOWN, I want to warn everyone that metals are doing exactly what they are supposed to do - hedge risks. While the SPY/QQQ are continuing to melt downard.

I created this video to show you the Fibonacci Trigger levels on the 60 min SPY chart, which I believe are very important. Pause the video when I show you the proprietary Fibonacci price modeling system and pay attention to the fact that any upward price trend must rally above 563.85 in order to qualify as a new Bullish price trend.

That means we need to see a very solid price reversal from recent lows or an intermediate pullback (to the upside) which will set a new lower Bullish Fibonacci trigger level.

Overall, the SPY/QQQ are in a MELT DOWN mode and I expect this to last into early next week unless the US government reaches some agreement to extend funding.

This is not the time to try to load up on Longs/Calls.

The US and global markets are very likely to MELT DOWNWARD over the next 2 to 5+ days if the US government does SHUT DOWN.

FYI.

Gold and Silver may EXPLODE HIGHER.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

Quick 70 point scalp on NQShowing you guys a trade idea with my current thoughts on the market and price.

I will be busy today so that is all for me, taking my $370 dollars for the day and I am calling it.

Good luck and Good trading to anyone trading today!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

SPY/QQQ Plan Your Trade For 3-13-25: Carryover PatternToday's pattern suggests the markets may attempt to continue to find support and move into a sideways pullback (upward) price channel.

I believe the markets have reached an exhaustion point that will move the SPY/QQQ slightly upward over the next 5 to 10+ days - reaching a peak near the 3-21 to 3-24 Bottoming pattern.

This bottoming pattern near March 21-24 suggests the markets will move aggressively downward near that time to identify deeper support.

I believe metals will continue to move higher as risks and fear drive assets into safe havens.

Bitcoin should continue to slide a bit higher while moving through the consolidation phase.

Watch today's video to learn more about what I do and how I help traders find the best opportunities.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

QQQ - Nasdaq has reached it's firstPrice reached the Warning Line 1.

This is a natural support, because it's a standard deviation stretch. From here, price has a high tendency of mean-reversion.

How far?

Most of the time it shoots back to the Lower-Medianline-Parallel.

Beware of the potential resistnace zone.

This level is a good one to take partial profits.

As for a stop, I would put it below the last swing-long. I may play it with Options (for example a Risk-Reversal), giving me more leeway to the downside if it's not playing out immediately.

US Market Reversal Emerged? This Week's Closing is CrucialThe final trading day of February. I always take the opportunity to analyze the monthly chart closely.

We saw an inverted hammer. From the cash chart, clearly, we can see the inverted hammer. Beyond that, it also appears to be a potential double top for the Nasdaq.

E-mini Nasdaq Futures & Options

Ticker: NQ

Minimum fluctuation:

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

Trading the Micro: cmegroup.com/markets/microsuite.html