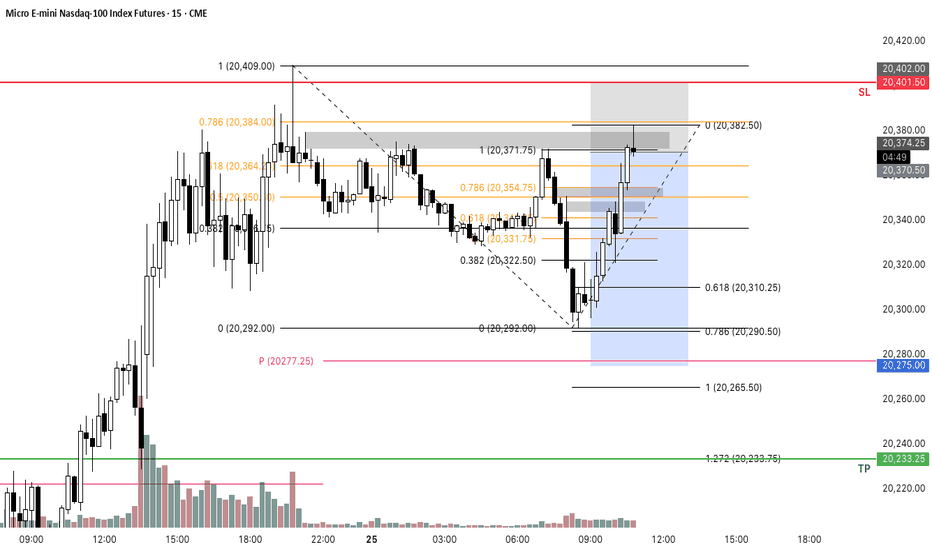

Tuesday's NQ Trade idea 3.25.25 first trade of the day. SL was hit at $160 profit. We disrespected the bearish FVG level.

Let's see what happens next.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Nq100

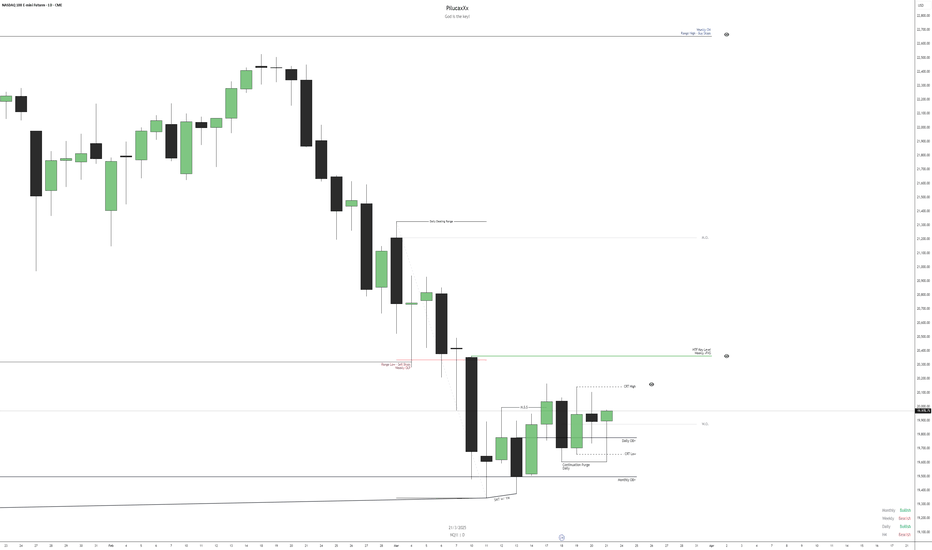

$NQ IdeaAnalyzing the NQ for the upcoming week, we observe that the price held at the monthly OB, where an SMT also formed, reinforcing the indication of a bullish continuation from that point.

On the daily chart, we identify a shift in market structure, evidenced by the presence of an SMT + MSS, followed by a continuation purge of the price. Given this, we understand that our weekly DOL will initially be the daily CRT High and the Weekly FVG, although the final target may be the monthly Range High.

Additionally, based on the economic calendar, we anticipate more significant movements on Monday, Thursday, and Friday due to news related to the dollar.

It is important to emphasize that this analysis is based solely on price action, and macroeconomic factors may impact the market throughout the week. Therefore, we must be prepared for potential changes in the scenario.

Sharp reversal in US marketsAmid market volatility and uncertainty, US stock indices experienced a sharp decline last week. The Dow Jones Index (#DJI30) fell by 3.5%, the S&P 500 (#SP500) dropped by 4.1%, and the Nasdaq-100 (#NQ100) lost 5.5%.

Investors reacted nervously to new economic data, including rising inflation and expectations of interest rate hikes, leading to a sell-off in stocks and a decline in key indices. The drop was particularly significant in the technology and consumer sectors, where companies like Apple and Tesla lost around 6-7% of their value.

However, starting March 13, 2025, the indices began to recover: #DJI30 gained 2.3%, #SP500 rose by 2.5%, and #NQ100 increased by 3.1%.

The recent rebound in US stock indices has been driven by several factors that restored investor confidence. Let’s take a closer look at the main reasons:

• Improvement in unemployment data: Labor market statistics played a crucial role in the market recovery. The US unemployment rate fell to 3.4% in February 2025, marking a record low in recent decades. This indicates strong employment levels and economic resilience, boosting investor optimism and supporting stock market growth.

• Stabilization of inflation and interest rate expectations: Although inflation in the US remains high, recent data showed a slowdown in its growth. Reduced inflationary pressure gave investors hope that the Federal Reserve (Fed) might slow down the pace of interest rate hikes. This was perceived as a sign of potential economic stabilization, positively impacting stock indices.

• Growth in consumer spending: One of the key drivers of the recent market recovery has been the increase in consumer spending. In Q1 2025, consumer demand in the US showed strong performance, serving as an essential indicator of economic activity. Increased spending on goods and services supports business stability and enhances corporate revenues, which, in turn, stimulates stock growth.

• Absence of new geopolitical risks: In recent weeks, there have been no major geopolitical crises or new threats on the international stage. This helped financial markets stabilize, as investors could focus on economic data and corporate earnings reports, contributing to stock index growth.

• Positive corporate earnings reports:

• #Microsoft (MSFT): Microsoft shares rose by 4.2% after reporting strong quarterly results, driven by growth in cloud services and software revenue.

• #Google (GOOGL): Alphabet’s stock increased by 3.7% due to higher advertising revenue and improved forecasts for upcoming quarters.

• #Apple (AAPL): Apple shares climbed 2.9%, supported by strong sales of new products and rising revenue from services.

• #Tesla (TSLA): Tesla stock surged 5.6%, fueled by strong electric vehicle sales growth and optimistic profit projections for the next quarter.

These companies demonstrated significant growth on the back of improved financial performance, strengthening investor confidence and aiding the stock market’s recovery amid volatility.

So despite last week’s market downturn, the current situation in the US stock market signals a potential recovery and a more positive trend in the coming weeks.

$NQ IdeaOn the monthly chart, NQ maintains its bullish structure, confirming an uptrend. However, in recent weeks, the price has undergone a correction, pulling back to an equilibrium zone before potentially resuming its predominant upward movement. We can see that the price is holding at the Mean Threshold of a monthly rejection block, while also forming an SMT on swing lows with ES and YM on the weekly chart.

Since we trade on an intraday basis, it is essential to analyze multiple timeframes to confirm our bias. On the weekly chart, last week's candle swept the previous week's low and closed below the range. However, given the presence of an SMT at the lows, it is unlikely that the price will target the PWL (Previous Week Low). Instead, a correction toward a discounted area on H4 could occur before the bullish movement begins.

This scenario makes sense because the H4 chart has engineered liquidity in a premium zone, and the price is still trading within that area. Furthermore, last week's shift in market structure confirmed a bullish bias on H4, but before resuming the uptrend, we might see a sell-off to clear liquidity, as the price remains in a premium zone on H4.

Based on the economic calendar, there is a possibility that the weekly low will be formed on Monday, creating an opportunity for a counter-trend trade early in the week. However, this setup carries high risk, requiring caution and confirmation before entry.

For this week, we are looking for bullish opportunities toward equilibrium or until the price encounters resistance to continue rising. However, this outlook will be adjusted as price action unfolds throughout the week.

It is also worth noting that this will be a challenging week, due to a lack of major economic news and an upcoming Federal Reserve speech on interest rates, which could significantly impact the market and increase volatility.

Quick 70 point scalp on NQShowing you guys a trade idea with my current thoughts on the market and price.

I will be busy today so that is all for me, taking my $370 dollars for the day and I am calling it.

Good luck and Good trading to anyone trading today!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

NQ Weekly, Daily & 4 HR Chart Bullish Confirmation for Sun MonLooking for a bounce after 3 straight weeks of lower prices here starting with Sunday night's open barring any Trump/geopolitical news. Monday is a No Red Folder News Day, which also makes it look good for the longs. However, starting on Tuesday and for the rest of the week, we have red folder news every day...

Tue

Mar 11

10:00am

USD

JOLTS Job Openings

Wed

Mar 12

8:30am

USD

Core CPI m/m

Thu

Mar 13

8:30am

Core PPI m/m

PPI m/m

Unemployment Claims

226K 221K

Fri

Mar 14

10:00am

USD

Prelim UoM Consumer Sentiment

Prelim UoM Inflation Expectations

Possible NQ Bounce Starting Monday 3/10/25Monday and the rest of the coming week could be the start of the NQ making a bounce. If not, it's look out below with a break of 20,000 going to 19,000 rather quickly. Price will dictate how we go but a good bounce is not out of the question. Watch the video for more details.

Feel free to leave your comments.

Thanks for watching.

$NAS100 IdeaIf the monthly close occurs as projected, we will confirm a double liquidity purge, signaling a bearish scenario. Additionally, buyer liquidity will have been absorbed, with the price closing within the range, further reinforcing the downside perspective for NAS100. However, we still have one more week to validate this bias. On the daily chart, we will wait for a market structure shift before considering short positions.

My NAS Long Scalp IdeaUS stocks and indices are very neutral recently. I however remain slightly bullish and found a small setup. This is pure price action bias but including the fundamental view we are in a neutral state as we are waiting for upcoming economic news. This week has been neutral due to the lack of news. We got a bunch of Trump speech but nothing more.

This idea is meant for short term It could completely reverse on me so do your own research and trade safely.

Intraday Levels for Nasdaq 100 Futures - 12/16/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/13/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

Intraday Levels for Nasdaq 100 Futures - 12/12/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

US 100 Trade LogUS100 Long Setup (1H)

Trade Logic:

- Entry: Long within the 1-hour Fair Value Gap (FVG) located in the discount zone relative to this timeframe.

Confluence Factors:

- Bullish Momentum: The market is strongly bullish, with price action consistently breaking resistance and forming higher highs.

- Relative Aggression: While the FVG is in a discount zone on the 1H timeframe, higher timeframes do not confirm the same, making this a relatively aggressive trade.

- Supportive Context: Recent pullback aligns with the FVG, offering a potential continuation opportunity as buyers step in.

- Risk-Reward: Minimum 1:2 RRR with a tight stop-loss of 50 points, ensuring disciplined risk management.

- Target: TP1 at the next intraday resistance; TP2 near psychological levels like 15,500.

Macro Context:

- Market Sentiment: Strong risk-on sentiment in equities as major indices rally, supported by favorable economic data and dovish central bank tone.

- Tech Strength: Nasdaq constituents leading the charge with inflows into growth and tech sectors, further reinforcing bullish momentum.

- Volatility: VIX remains low, indicating stable conditions conducive to continuation of bullish trends.

Additional Consideration:

While this setup is aggressive, the bullish momentum makes it a calculated risk worth attempting. Keep stops tight and monitor if price fails to hold the FVG. Reassess if higher timeframe resistance levels come into play, suggesting a larger pullback.

Intraday Levels for Nasdaq 100 Futures - 12/09/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

The range used in this analysis serves only as a reference for broader-level insights.

For intraday operations, it is advisable to utilize a lower timeframe to refine entry and exit points more accurately.

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.