Nq_analyse

Intra day Trade for the day Test Post 6/24GOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOOD MORNING

06/24/2024

***Midnight*** Concentrated consolidation

*#NQ 19961.25*

💰 **BUYSIDE**💰

***#NQ 20031.50***...---> Above this level we look for-->

🟢 20089.50

🟢 20113.25

🟢 20151.50

🟢 20201.50

🟢 20246.00

🟢 20292.25

🟢 20332.50

💰 **SELLSIDE**💰

***#NQ 19908.25***---> Below this level and we look for

🔴 19880.25

🔴 19812.50

🔴 19775.25

🔴 19749.50

🔴 19693.25

🔴 19647.75

***Expected Moves For Today***

*SPX-ES Difference*--> **70**

*Spy Expected Move* **2.14**

Upside Range **546.64**

Downside Range **542.36**

*SPX Expected Move* ***20.70***

Upside Range **5490.70**

Downside Range **5449.30**

⚠️ ***Sweet Spot contracts for SPX would be*** ⚠️

🔴 5445p and the 5430p(MOMENTUM TRADE)

🟢 5485c and the 5500c(MOMENTUM TRADE)

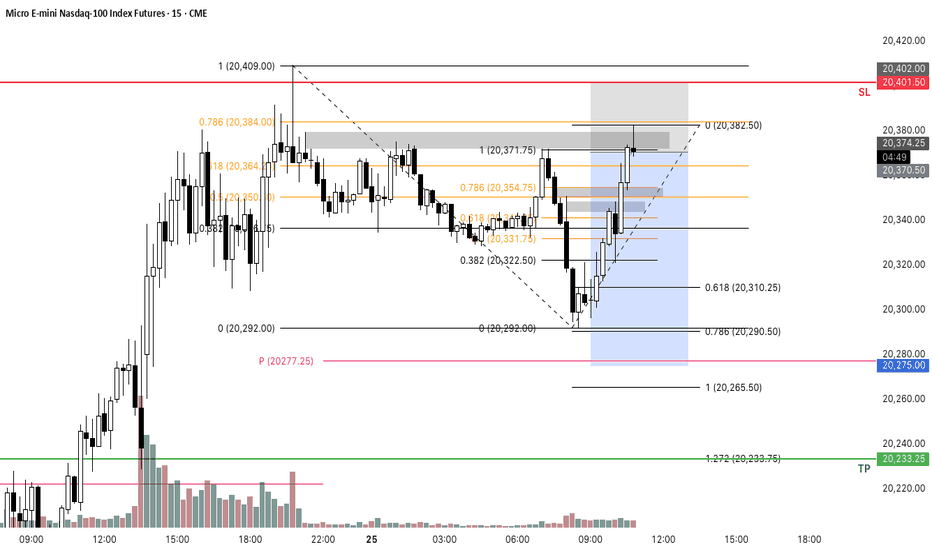

NASDAQ 100 E-mini Futures NASDAQ 100 E-mini FuturesCME_MINI:NQ1!

NASDAQ 100 E-mini Futures

When the Nasdaq market is described as being in a downward direction, it means that the overall trend of the market is experiencing a decline. This downward movement is typically reflected in the broad-based Nasdaq Composite Index, which tracks the performance of thousands of stocks listed on the exchange

NQ made a double bottom when ES did make a new lowsIn my eyes NQ and RTY are stronger then ES at this moment, which is kinda strange to me as it was the leading for the whole move down since ATH.

Support held today (tomorrow's support box).

Ichimoku cloud (not shown here) is in a thin area, so it has a weak support and can break below the lows to finally catch up with the ES.

There is similar bull trendline as in the ES chart I just posted, Im expecting it to hold to go long.

Ideally we get t test it tomorrow or Wednesday am. If we do gap down tomorrow to test that trendline I will be buying longs and hold into Wed high.

Gaping down tomorrow will kill short the open idea and I will be looking for a low to buy instead.