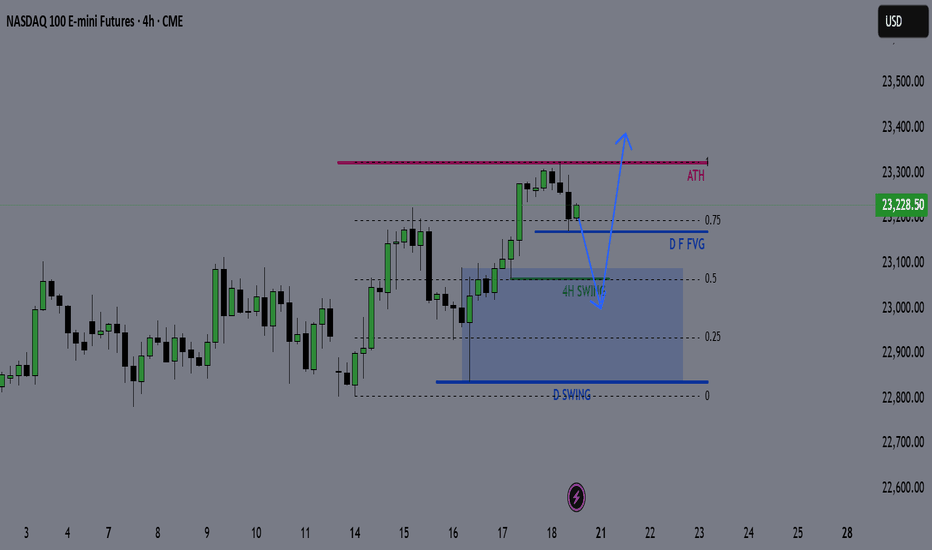

NQ Weekly Outlook & Game Plan 20/07/2025NQ Weekly Outlook & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

NQ continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

📊 Technical Analysis:

Price is currently in price discovery, and the weekly structure remains strongly bullish — so I prefer to follow the strength.

We might see a minor retracement before pushing further above the all-time high (ATH).

🎯 Game Plan:

I'm expecting a potential retracement to the 0.5 Fibonacci level, which is the discount zone in a bullish environment.

Interestingly, the 4H liquidity zone aligns perfectly with the 0.5 Fib level — this confluence suggests price may gather enough energy from there to make new highs.

✅ Follow for weekly recaps & actionable game plans.

Nqfutures

NASDAQ: Minor Pullback, Still on TrackOn Friday, the Nasdaq experienced a slight pullback, which was quickly absorbed at the start of the week. Currently, the index is still developing the turquoise wave B, which should top out just below resistance at 23,780 points, signaling the start of the bearish wave C. This move should lead to the low of the magenta wave (4) within our turquoise Target Zone between 17,074 and 15,867 points. Alternatively, there is a 42% probability that wave alt.(4) is already complete. In this scenario, the magenta wave alt.(5) could carry the index immediately above the mentioned resistance.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

NQ Weekly, Daily & 4 HR Chart Bullish Confirmation for Sun MonLooking for a bounce after 3 straight weeks of lower prices here starting with Sunday night's open barring any Trump/geopolitical news. Monday is a No Red Folder News Day, which also makes it look good for the longs. However, starting on Tuesday and for the rest of the week, we have red folder news every day...

Tue

Mar 11

10:00am

USD

JOLTS Job Openings

Wed

Mar 12

8:30am

USD

Core CPI m/m

Thu

Mar 13

8:30am

Core PPI m/m

PPI m/m

Unemployment Claims

226K 221K

Fri

Mar 14

10:00am

USD

Prelim UoM Consumer Sentiment

Prelim UoM Inflation Expectations

Intraday Levels for Nasdaq 100 Futures - 12/05/2024This analysis focuses on the Nasdaq 100 Futures, aiming to identify potential support and resistance levels where the price could experience intraday bounces or trend reversals, as well as zones where the price might potentially break higher or move lower.

Considerations

To confirm the validity of these levels, it is essential to evaluate real-time conditions as the price approaches these zones. Factors such as pressure, trading volume, and Order Flow will play a critical role in determining whether these supports hold or are likely to be broken.

NQ Futures Daily Bullflag to $22,000After a sudden drop from ATHs and a big rebound, a daily bullflag formed into month end setting September up for a very big run.

Upside PTs are: 20150, 20300, 20450, and 22000 if a break above the previous ATH to finish out the bullflag

SL would be invalidation of the flag

NQ | QQQ | Day trading plan 7-26-2024CME_MINI:NQU2024

Bullish Scenario

Immediate Resistance Levels:

Bullish Line: : 19,115.75

Target Price 1: 19,168.75

Target Price 2: 19,278.50

Strategy:

Entry: Consider entering a long position above the immediate resistance at 19,115.75.

Stop Loss: Place a stop loss below the nearest support at 19,041.75 to minimize risk.

Targets: Set targets at the resistance levels mentioned above. Partial profit-taking can be considered at each target level.

Confirmation: Look for bullish candlestick patterns or confirmation from volume indicators before entering the trade.

Bearish Scenario

Immediate Support Levels:

Bearish Line: 19,065.00

Target Price 1: 19,041.75

Target Price 2: 18,998.75

Target Price 3: 18,932.00

Strategy:

Entry: Consider entering a short position if the price breaks below the Bearish Line at 19,065.00.

Stop Loss: Place a stop loss above the nearest resistance at 19,115.75 to minimize risk.

Targets: Set targets at the support levels mentioned above. Partial profit-taking can be considered at each target level.

Confirmation: Look for bearish candlestick patterns or confirmation from volume indicators before entering the trade.

Summary

Bullish Entry: Above 19,115.75 with targets at 19,168.75 and 19,278.50.

Bearish Entry: Below 19,065.00 with targets at 19,041.75, 18,998.75, and 18,932.00.

Stop Losses: Adjust according to the nearest support/resistance levels to manage risk.

This analysis should be used in conjunction with other indicators and market conditions for a comprehensive trading strategy.

7/10 To Soar or Not to Soar Is the Question .GREATTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTTT MORNING YALLLLLLLLLLLLLLLLLLLLLLLLLLLLLLL!!!!!

😏 😏 😏

07/10/2024

**News** ON THE BLOCK TODAY!!!!

**~~Wholesale Inventories (Preliminary)~~**

10:00 AM ET

***EIA Petroleum Status Report***

10:30 AM ET

***Midnight*** **CONSENTRATED CONSOLIDATION **

*#ES 5634.25*

*#NQ 20709.50*

💰 **BUYSIDE**💰

***#ES 5646.5***.--->Above this level we look for --->....

🟢 5653.25

🟢 5676.85

🟢 5694.75

🟢 5711.25

🟢 5727.50

🟢 5738.25

***#NQ 20772.00***...---> Above this level we look for-->

🟢 20788.50

🟢 20813.00

🟢 20843.75

🟢 20878.00

🟢 20902.25

🟢 20933.25

💰 **SELLSIDE**💰

***#ES 5630***--- Below this level and we look for

🔴 5616.75

🔴 5604

🔴 5580

🔴 5564.50

🔴 5550.25

***#NQ 20696.50***---> Below this level and we look for

🔴 20685

🔴 20656

🔴 20639

🔴 20619

🔴 20594

Trade Plan NQ Futures: week starting May 5th, 2024 Trade Plan NQ Futures: week starting May 5th, 2024

Based on the provided levels for the NQH2024 futures contract, here's a weekly trade plan focusing on trading from the pivot to the upside or downside targets:

Weekly Pivot: 17847 Current Price: 18000

Upside Targets:

First Target: 18090

Second Target: 18348

Third Target: 18605

Downside Targets:

First Target: 17731

Second Target: 17560

Third Target: 17378

Trade Plan:

Long Trades: Look for buying opportunities if the price remains above the weekly pivot (17847).

Entry: Consider entering long positions on pullbacks towards the pivot (17847) or if the price breaks above the current price (18000).

Targets: Target the upside levels of 18090, 18348, and potentially 18605.

Stop Loss: Place a stop loss below the pivot or below significant support levels identified during the week.

Short Trades: Consider shorting the market if the price breaks below the weekly pivot (18847) or the current price (18000).

Entry: Enter short positions on breakdowns below the pivot (17731) or the current price (18000).

Targets: Aim for downside targets of 17731, 17560, and potentially 17378.

Stop Loss: Place a stop loss above the pivot or above significant resistance levels identified during the week.

Risk Management:

Ensure proper risk management by sizing positions appropriately based on the distance to target and stop loss levels.

Consider using trailing stops to lock in profits as the price moves in your favor.

Monitor the market closely for any changes in price action or news events that could affect the trade.

Note: Always adapt your trading plan based on real-time market conditions and adjust your approach as necessary to manage risk effectively.

More possible downside for NQPrice has moved for ERL(ATH) to IRL(Weekly Bullish OB) which created a MSS on the weekly time frame.

Price has retraced nicely off of the Weekly OB and is now entering premium of the current dealing range on the daily

- This week we will not trade on Monday as there is no news and will be expecting accumulation.

- If market sentiment has truly shifted I am expecting to see Monday accumulation, Tuesday to create the high of the week into that daily FVG, and then expansion lower to reach for previous weeks low.

- If that Daily FVG is violated I’ll be expecting ATH again.

Nasdaq 4h Daily Commentary

"#Nasdaq : On the 4-hour chart, there's a clear indication that the price continues to move downwards. If we are bearish, I expect to see the price fill the liquidity gap and then break the previous low, directing the liquidity in Tue 16 Orderblock. However, if we break the last bearish defense in the chart, it will lead us to anticipate a rally upwards. I will provide daily updates on the 4-hour charts. If you have any questions or something you would like me to include in my analysis tomorrow, please leave it in the comment section below.

Good luck to everyone in their trading endeavors!"

Nasdaq Weekly Analysis Sure, here's the corrected text:

We see the price bouncing from Mon 10 OCT '22 after a year and a half of bearish market and going directly to retest the all-time high on Mon 22 Nov '21 again by MON 22 JAN '24. However, it starts to move towards a new all-time high, but with limited liquidity hindering further price increase. We've already witnessed a significant bullish move, and it's time for the market to correct itself. We've observed a weekly candle breaking the market structure forcefully towards the order block from Tue 02 Jan '24 and breaking the 50% retracement level from Mon 23 Oct '23 low to the all-time high. We anticipate the price to continue being bearish to shake out buyers and accumulate new liquidity if we aim to reach a new all-time high.

Our focal point in the NASDAQ for the 2Q is the breaker from Mon 24 Jul above the 50% Fibonacci level of the bullish leg and between 0.6/0.7 of the Fibonacci level to turn bullish. Breaking Mon 23 Oct '23 liquidity support would put us in a significantly bearish condition.

Weekly Plan NQ Futures 4/14/2024Weekly plan: NQH2024

SEED_ALEXDRAYM_SHORTINTEREST2:NQ FUTURES 4/07/2024

18406 >> 18566 >>> 18718

Weekly pivot: 18284, Now 18172, Weekly Open TBD

18063 >> 17934>>> 17734

-------------------------------------------------

Based on the provided levels for the NQH2024 futures contract, here's a weekly trade plan focusing on trading from the pivot to the upside or downside targets:

Weekly Pivot: 18284

Current Price: 18172

Upside Targets:

First Target: 18406

Second Target: 18566

Third Target: 18718

Downside Targets:

First Target: 18063

Second Target: 17934

Third Target: 17734

Trade Plan:

Long Trades: Look for buying opportunities if the price remains above the weekly pivot (18284).

Entry: Consider entering long positions on pullbacks towards the pivot (18284) or if the price breaks above the current price (18172).

Targets: Target the upside levels of 18406, 18566, and potentially 18718.

Stop Loss: Place a stop loss below the pivot or below significant support levels identified during the week.

Short Trades: Consider shorting the market if the price breaks below the weekly pivot (18284) or the current price (18172).

Entry: Enter short positions on breakdowns below the pivot (18284) or the current price (18172).

Targets: Aim for downside targets of 18063, 17934, and potentially 17734.

Stop Loss: Place a stop loss above the pivot or above significant resistance levels identified during the week.

Risk Management:

Ensure proper risk management by sizing positions appropriately based on the distance to target and stop loss levels.

Consider using trailing stops to lock in profits as the price moves in your favor.

Monitor the market closely for any changes in price action or news events that could affect the trade.

Note: Always adapt your trading plan based on real-time market conditions and adjust your approach as necessary to manage risk effectively.