Nqlong

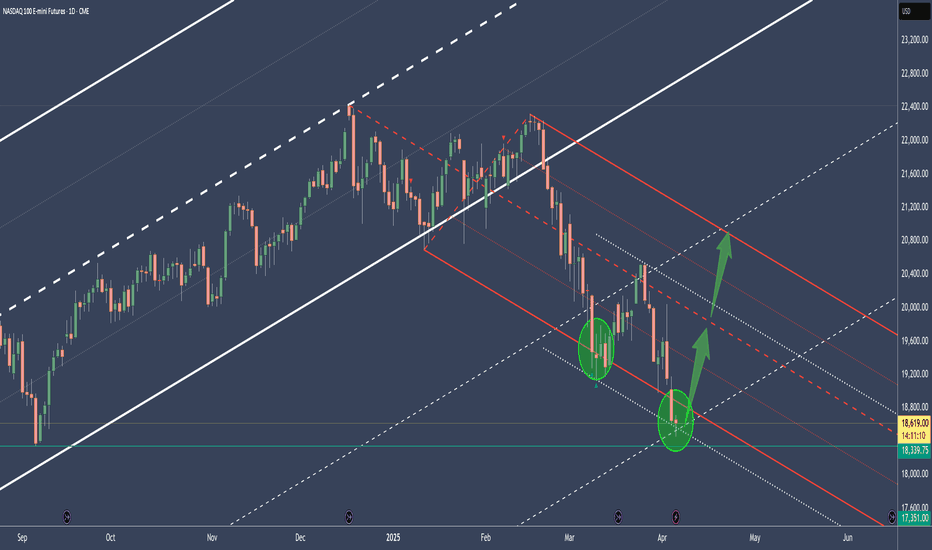

NQ - Nasdaq's potential to reboundThe Median or Centerline:

The Median (Centerline) Line is the central element of the Pitchfork and acts as the equilibrium point. Price tends to oscillate around this line, and it often serves as a strong reference for potential reversals or price targets. A price move back toward the Median Line is common after significant moves away from it.

Pitchfork (Red):

The red Pitchfork, drawn through significant price points, provides the overall trend direction and shows the potential path to the downside. The red line indicates a bearish bias in the current setup, as it has been guiding the price lower.

Green Circles and Arrows:

These represent key areas of support.

The lower green circle and green arrows indicate price has found solid support in this region. The price has been bouncing from this support level, showing that it is reacting to the [ower boundary of the Pitchfork. This behavior aligns with the rule that the price tends to respect these boundaries, creating a foundation for a potential move back toward the Median Line.

Price Action Analysis:

The price recently tested the lower green circle and green arrows, bouncing off this support level, which is a typical reaction in a Pitchfork setup.

According to the Median Line theory , when the price moves too far away from the Median Line, it often returns toward it. Therefore, the bounce off the lower boundary suggests that price may now be setting up for a bullish reversal toward the RED Median Line .

Bottom Line:

The price action is following the general Pitchfork playbook . The bounce from the lower green circle suggests that the price is setting up for a potential bullish reversal toward the RED Median Line .

The next major test will be the upper resistance in the red Pitchfork , after the break of the Centerline. If the price can break through this resistance, a strong move higher is likely.

Keep an eye on this critical point!

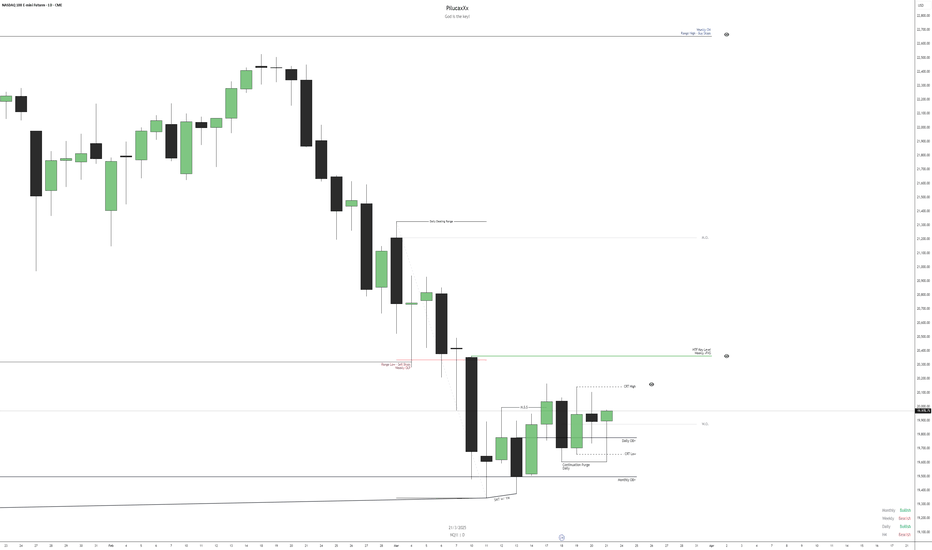

$NQ IdeaAnalyzing the NQ for the upcoming week, we observe that the price held at the monthly OB, where an SMT also formed, reinforcing the indication of a bullish continuation from that point.

On the daily chart, we identify a shift in market structure, evidenced by the presence of an SMT + MSS, followed by a continuation purge of the price. Given this, we understand that our weekly DOL will initially be the daily CRT High and the Weekly FVG, although the final target may be the monthly Range High.

Additionally, based on the economic calendar, we anticipate more significant movements on Monday, Thursday, and Friday due to news related to the dollar.

It is important to emphasize that this analysis is based solely on price action, and macroeconomic factors may impact the market throughout the week. Therefore, we must be prepared for potential changes in the scenario.

Nasdaq Intraday TradeWith the overnight GAP, price jumped above the white Centerline, just to come back in the Asia session.

We see that price broke the white CL and halted afterwards. Do yo see where it halted? Yes, at the Centerline of the yellow Momentum Fork!

And currently it's pushing up through the white CL again...hmmm...

So, we have momentum, clear support at the yellow CL, a potential new push through the white CL and a loooooot of Air...and stop/losses above to be sucked in §8-)

I'm long with a stop below the yellow CL low, and with multiple targets to the upside.

Let's have fun!

QQQ - Nasdaq has reached it's firstPrice reached the Warning Line 1.

This is a natural support, because it's a standard deviation stretch. From here, price has a high tendency of mean-reversion.

How far?

Most of the time it shoots back to the Lower-Medianline-Parallel.

Beware of the potential resistnace zone.

This level is a good one to take partial profits.

As for a stop, I would put it below the last swing-long. I may play it with Options (for example a Risk-Reversal), giving me more leeway to the downside if it's not playing out immediately.

Nasdaq Potential Huge BounceI post this again, because from my last post, some only see a confusing picture instead of the chart.

Price nearly reached the L-MLH of the Red Fork.

This is a huge price stretch and chances are super high that we will see a big bounce to the upside.

As for PTG's I focus on the Red, and the Orange Centerline.

NQ Sep 16 Targets, gaps and SMC setups premarketThe new week is about to open.. Primary target for the week is that CLEAN upper zone at 925.

on the new Dec contract.

We have Short term interest above but we also never reclaimed any of the Last week bull move.. so we have a MONDAY HANGOVER possible situation with the 25% mark retrace of the bull week marked as a line in the sand below.

Monday and no news.. unlikely to move that much, but worth marking it out.

Best looking target to me right now is the OVERNIGHT HIGHS REH, should a good set up arise.

WKLY FVG is just below and attractive to move there during the premarket.

Happy Trading

- Doc

NQ Chart Idea - Swing Long Trade SetupNQ made triple bottom in Oct, Nov and then in Dec 2022. Since Dec 2022, NQ made a diagonal support line which was briefly broken on Aug 5th dump but then closed the week above this support line. In that dump, it made a double bottom at 17350 which is super bullish. 17530 was also a 0.382 fib level which was tested and respected as it didn’t close any candle below that level. I am personally with this PA as well as market fundamentals. Below are just two target prices that I am showing but I will want to ride this trade until 20350 after updating my SL in green.

Swing Long Setup

Entry: 19000

TP1: 19600 (0.618 fib retracement level)

TP2: 19700 (Major resistance)

SL: 4Hr candle closing below 19650

RR: 2:1

NOT A FINANCIAL ADVICE! DYOR

NQ expectations based on macro-economic analysis and structuralThere are 2 scenarios that I expect to occur, both with the final outcome, the circumstantial achievement of historical highs, because: we had a response to the restrictive monetary policies of the FED before 3/11/2023 with a lower than expected NFP and a rate of rising unemployment; then with decreasing inflation. I expect scenario 1 (white) to occur if in these days the markets close with a bearish acceptance below the last Value Area; scenario 2 (green) only if we have a bullish acceptance of the last established maximum. Seasonality should also not be overlooked as we are in Q4 and the very close Christmas rally, a Risk-ON period.

Nasdaq Bounce from L-MLHWhat a drag yesterday.

The red Fork gives us very good context.

We see how price reacted two times at the Center-Line.

Then came the "Flush" throu the CL with no pull-back.

No Mercy!

This move brought us down to the Lower-Medianline-Parallel. From here price starts to bounce.

It's also a level where NQ had support (see left side).

So far, divergence with the RSI is confirming a good potential for a bounce.

But I don't believe in this support, until we break the downsloping "Change In Behaviour" line. Price must prove that is has enough strenght.

If this CIB line gets broken, I expect a pullback to it.

This would be the level where I would stalk a long entry, with a target at the Center-Line.

Happy Hump-Day Tr8dingN3rds

$NQ1 showing out with a TRIPLE BOTTOM, can it continue to ATH?!CME_MINI:NQ1!

Obviously, we are a little late to the party, but we observe the triple bottom here. Price has hastily moved through weekly supply from April 2022. Buyers have held price up so far. Next stop is all time high with a 7:1 RR from here!

NQ (NAS100): simple positional theme tradinghi, hello fellow traders,

two areas were highlighted on the chart, to spot the attention to the possibility that local bottom just took place.

all in all, after that local bottom is created and calculation of the magnitude of the downside that brought us to that local low, target for the long set @ 15055.50

strategy: scale in (== refill) scale out (== book partial gains) as long the target did not reach. trade the LONG side of the market.

when target is reached, we will look further.

good luck