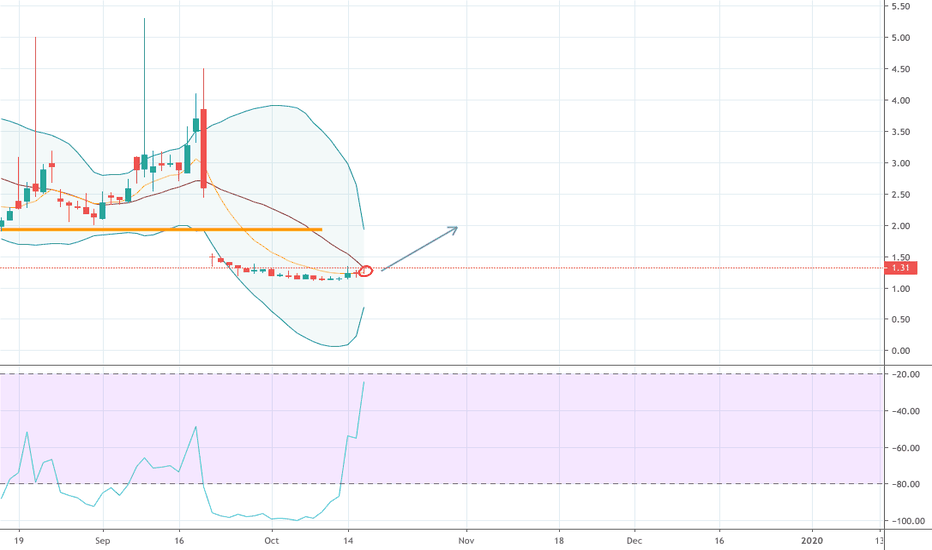

mid term +4,000% perfect RSI setup InspireMD, Inc., a medical device company, focuses on the development and commercialization of proprietary MicroNet stent platform technology for the treatment of vascular and coronary diseases in Europe, Latin America, the Middle East, and Asia. 1d

NSPR

A penny stock with huge potential InspireMD Engages Hart Clinical Consultants to Conduct Clinical Trial for CGuard Carotid Stent System in the United States

Tel Aviv, Israel – February 24, 2021 – InspireMD, Inc. (NYSE American: NSPR), developer of the CGuard™ Embolic Prevention System (EPS) for the prevention of stroke caused by carotid artery disease, announced today that it has engaged Hart Clinical Consultants (HCC), a leading Contract Research Organization (CRO) to conduct the clinical trial for its CGuard Carotid Stent System in the United States.

Potential gain:100/+250

Reward/Risk:5-12

Timeframe: up to 1 year

I always try to present the charts in a simple comprehensive format to prevent any confusion.

This is just my technical view, neither a fundamental comment,nor a recommendation to trade..!

Please review my track record and calculate the odds for yourself..!

You’re likes and comments encourage me to continue this.

Stay tuned great live stream and quality content videos coming soon..!

NSPR InspireMD - Israeli Company with high volume, nice momentumNSPR InspireMD - Israeli Company with high volume, nice momentum

?? On the way to higher levels @ 5 $, @ 7 $, @ 11 $, @ 15 $ and above ??

Good luck and happy investing!

NSPR still getting beat downNow like you and many others I'm shocked by NSPR price action, so what could have caused it? Well theres one and that was the FDA IDE approval, yet today was ann that they got the full FDA IDE approval green light.

News

-Got FDA IDE approval in the US today

-Last week they where at LD Micro 500 they gave us some company insights

1: Theres already sales in Brazil for next er. At this time er expectations didn't factor that in, so it is nearly 100% they will be making money instead of losing money.

2: They were very confident in getting the FDA IDA approval last week along with the expansion in France and Asia. Can be shown on the company website roadmap.

TA

Now the news is bullish, yet why hasn't price action reflect that? Well only thing it can be said is that people waited for the FDA IDE approval too long, so where can we go from here?

-Well be shot up 40% this morning so even though I have resistance lines from .4194-.4594, it looks like its a very week in the grandscale of this company, so are primary resistance will be .4397-.4594 with .4922 being the true goal to go full rocket. On webull we went passed it, yet on tradingview we didn't so I'll stand with .4922 being the biggest hurdle.

-Support is nothing since we kept waterfalling lower, yet if any support it ranges at .3913,.3713, and with the red zone .3506 and .3368

-Atm we are makingout withe the ema, which if we can hold it and have a good bounce off of it we can stop buying and it can confirm bullish price action. If it dips below it, it could mean I final acculation zone before we moon.

-MACD is very bullish atm, but if we rise and it gets closer it might be the end short term

-RSI is oversold, so we could suspect sideways movement with massive ranges, slow rise up, or a pure dump. A dump is unlikely in my opinion.

Overall

I've been dca every week, due to the fact of the being in the Brazil market and already having sales. I think this will produce massive gains in the near term, so i'll be holding and will update you guys if we hit lower lows or break the massive resistance.

NSPR still dippingOkay I'm gonna start off with the news

News

-NSPR beat earnings by 44%, yet still losing money. It has been making more money due to its past performance and not losing as much. We can project that they might be profitable next year.

-Their offering that was held in June came out that it was so they can remain compliant with the exchange. That Friday they have became fully compliant so they won't get delisted.

-On their earnings report they got mostly compliant FDA IDE approval, yet on that they will get fully compliant FDA IDE approval in 45days. This should be on the 27th, so next week, which I labeled on the graph.

-Upcoming catalist: they hope to get into the France and China markets soon. Plus with approval in Brazil we could see that profit from the company in q4/ another earnings beat. Maybe over 100%, yet with COVID not sure, but certain in q1 next year.

TA

-Not sure what to say since an earnings beat should have pushed the price higher, yet we saw a sell off with no FDA IDE approval to common investors liking. At the same time the volume showed it being very low compared to the past showing its just small sellers and yesterday someone bought 200k shares touching our old trading zone.

-the low at .4194 was in the middle of the gap of the intial drop from .80 to .39 then gaping up to .42-.47

Final thoughts

I'm DCAing this stock and think its gonna pay off pretty soon. Recent SEC filing shows that their CFO has sign a contract starting in 2022 that he will get an annual renewal of his job. This shows there is some long term potential if a CFO is entering this contract and wants to see growth in this company or he will get fired. There was alot more in the earnings report like and they don't want to do any more offerings and they also have alot of cash on hand to play with, so upside potential is pretty high.

NSPR just getting started?Now buying my 3000 shares than seeing it pump to .61 (highest RH showed), was just luck with getting the news about Brazil approval NSPR product, yet looking at the chart begs to wonder is it over?

News

-CGuard got approval to be used in Brazil. I will post a DD at the end of this for NSPR, yet the consumer market of CGuard in Brazil can be up too 213 million citizens. The DD also suggest NSPR is looking for partners to China to distribute CGuard next.

-NSPR is looking for FDA IDE approval that it had to resubmit testing in May. If it gets approved it will get clinical trial testing to be able to be sold in the USA, which it already has approval for in Europe. It already has positive feedback from its test it submitted.

-Voting coming up to add more shares (double current shares). This is negative, yet with the price of a share atm I really don't think it will past, since they raised money already in early June.

-Insiders have be buying shares up to 4 million, which gives answers to the weird volume after the dump.

-Low float: tbh no clue what this means or what I'm looking at since I don't trade on what is low float. But alot of people say this stock volume should be above dollar with all the positive news.

TA

-Again volume is beyond head scratching, which reading the DD it makes since with 4million shares being bought up from CEO, Co, and other institutions.

-RSI is dead center

-MACD shows more momentum to the upside. Only thing that could affect it if tech stocks sell off again or a negative catalyst such as shares increase.

-now for the support and resitance lines short term and long term: support can be at the .50, .4922, and .4594. After that maybe new lows or a bear trap.

-Resistance is at .61/.5764, than next a bounce to $.7493-$.6491, $.9750, $1.1275, than all i got this a pump to $3.0811 (500%). One alysise has a $2 target, yet I don't see any activity since from $1.1275-$3.0811 was just a straight dump.

Final thoughts

I'll hold my 3k shares, since positive catalyist out number the negative one coming up. This company will have zero effect on its US and China relation, since its HQ is in Israel. With years of downside there is speculation what the overall outcome of this company, since it has been 15 years and its still around. I say its a hold and a buy between these ranges with .45 being buy, yet hold if it dips under that price.

DD

www.reddit.com

NSPR WedgeIf you seen any of my other basic charts, you know I like wedges. Here I see another forming for NSPR. I don't always play these for mega pumps. I see this one eventually going to fill that GAP up north.

I've been having some success with wedges, from my published ideas, 1 played out and 1 was a dud, 1 still to be seen? Either way I like wedges.

Not finical advice, just a hobby trader.

$NSPR Emergency Buy SignalDown Nearly 100 Percent From Alltime Highs

I used log scale to view insane dump. Market Cap 1 point 8 million. If you buy now, you’ll be a millionaire!

Great project. Buy asap!

NSPR STOCK READY FOR LONG!I believe this stock can give from 3-20% in the next week. Long.

Mother of longs and shorts, queen of the profits,

Take care and get rich!

NSPR Could Be Deep Value Comeback StoryI wrote an extensive piece on NSPR in which I go into depth on the company and the potential turnaround story, you can find it here: rockvuecapital.wordpress.com

Trading at a 77% discount to book value, an 81% discount to sales, an 81% discount to NCAV, and a 43% discount to net cash, NSPR is roadkill in the market. However, no matter how great the value may seem, it does nothing for us if the price action doesn't coincide with our thesis. For this reason we must take into consideration the chart. As you can see from the chart, there is tremendous amounts of consolidation at the 0.76 to .60 price channel. In an effort to focus more on the price action, I am looking for a breakout from that 0.76 price level. If that breakout happens, it could signal the bullish thesis I laid out. A more convincing price action would be a breakout above the 50 MA. I am content to wait on this one and wait for the price action to confirm my entry.

NSPR TRADING IN A RISING WEDGENSPR is trading in the middle of a rising wedge, so it has possibilities to trade long if the lower channel holds or to go short if you see a rejection on the upper channel. A strong rejection on the upper channel can determine a breakout to the downside.