$NVDA one more leg lower $58-76 targetNASDAQ:NVDA bounced off the lows at $86 but is now finding resistance, I think it's likely that we turn lower next week and start falling towards the targets below.

I think it's very likely that we make it down to the lower supports at $63-58 before we see a sustainable bounce form.

Let's see how it plays out over the coming weeks.

NVDA

Nvidia Prepares For New All-Time High, Last Chance To Buy Low!The market always gives as second chance. This is a phrase that I love to share and it is true, it is confirmed here on this very chart.

The action for NVDA moved back down to produce a higher low —your second and last chance. This higher low is happening within a very strong buy-zone and this can mean the difference between massive profits or an opportunity that is lost. From here on, Nvidia will grow long-term set to produce a new All-Time High in the coming months.

The minimum target and price level for this rise stands around ~150 within 1-3 months. Then a correction and then higher, much higher... Up, up and up go we.

I can entertain you with tons of details I have the ability but I will not do so. I will go straight to the point.

» The next All-Time High and main target for this wave is 194, this can take a little more, or less, than 6 months.

What will happen next, we will have to wait to ask the chart.

It is my pleasure to write for you again.

Make sure to boost if you would like more updates.

If you boost and comment, we can move to daily updates as the market grow.

Go in, go now, buy-in and go LONG!

Nvidia is going up! Together with Bitcoin and the Altcoins.

Thanks a lot for your continued support.

Namaste.

Tesla Finds Support, 657 Next Easy High & All-Time HighTesla is looking pretty good right now, support has been found. The correction amounted to -55.5%. It started in mid December 2024 and the first low was hit in March 2025.

Since March TSLA has been in the process of forming a bottom.

The action moved below 0.786 Fib. retracement level in relation to the last bullish wave. The action is back above this level now and this is pretty good. As long as the action happens above the magic blue dashed line, Tesla is good and set to grow.

This signal, perfect symmetry, is supported by rising volume.

Buy volume is rising massively as TSLA moves into a long-term support zone.

(Smart people, smart money and smart traders buy when prices are low —this volume signal reveals the highest buying in years as TSLA hits support.)

The most revealing fact from a logical standpoint is the size of the correction, a 55% correction is a lot by any standard. When a market goes through such a strong correction, it tends to reverse and produce next a new move. It moves in waves. It goes up and down, up and down. We are seeing the end of the down-move and this will automatically lead to an up-wave.

When the bottom was hit, last month, the action goes flat. Tesla was clearly moving lower but as support was found the bottom stays flat. This is another revealing signal for the logical mind. No longer a downtrend but a consolidation phase, which is part of a transition period.

» So the market was bullish and from bullish turned bearish, from bearish it went sideways and from sideways it will grow.

This is an easy buy.

Thanks a lot for your comment and continued support.

Namaste.

NVDA Recovery in Motion — Bullish Setup BrewingNVDA 6H TECHNICAL ANALYSIS 📈

OVERALL TREND

📈 UPTREND — The chart confirms an early-stage recovery from a key pivot low (April 22), with moderate confidence (4.8%). The structure is forming higher lows, and price is currently above several critical short-term MAs. Trend Score sits at +0.10.

📉RESISTANCE ZONE

🔴 153.1300 — SELL STOPLOSS | PIVOT HIGH

🔴 149.8423 — SELL ORDER 2

🔴 143.18875 — SELL ORDER 1

🎯ENTRIES & TARGETS

🎯 139.8280 — EXIT BUY & TP 4

🎯 127.7263 — BUY ORDER & TP 3

🎯 119.8750 — BUY ORDER & TP 2 | MID PIVOT

🎯 108.5705 — BUY ORDER & TP 1

📈SUPPORT ZONE

🟢 97.0121 — BUY ORDER 1

🟢 89.9455 — BUY ORDER 2

🟢 86.6200 — BUY STOPLOSS | PIVOT LOW

✍️STRUCTURAL NOTES

Recent bounce from 86.62 pivot low signals strong bullish interest

Key reentry occurred above 97.01, aligning with short-term moving averages

All major short-term and mid-range MAs (10–100) are BUY-rated

Oscillators mixed: MACD and Ultimate Oscillator lean bullish, while Momentum and Williams %R flash caution

Ichimoku Base Line neutral — awaiting trend confirmation

Hull MA diverges from other MAs — short-term caution on overheated price

📉TRADE OUTLOOK

📈 Bullish bias toward TP3 @ 127.72 and TP4 @ 139.82

📉 Short-term pullback likely at 108.57 or 119.87 — use dips as potential reentry

🔍 Watch for rejection near 143.18–153.13 to reassess continuation vs correction

🧪STRATEGY RECOMMENDATION

CONSERVATIVE TREND FOLLOW:

— Entry: 97.01

— TP: 108.57 / 119.87 / 127.72 / 139.82

— SL: Below 86.62

AGGRESSIVE REVERSAL:

— Entry: 86.62 (Pivot Low Defense)

— TP: 97.01 / 108.57

— SL: Below 83.00

“Discipline | Consistency | PAY-tience™”

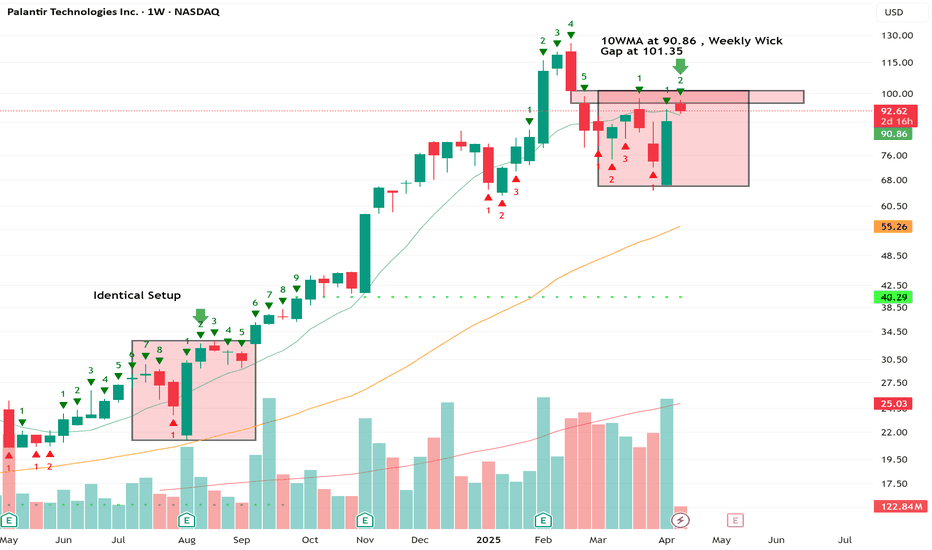

$PLTR Trade: Buy $90.86 , Target $101.35Beep Beep. Hope everyone is taking care of their trading accounts during this volatile phase in the markets. I noticed an identical setup on the weekly from back in August 24' and I'm looking to take advantage. We have a trend reversal on the Tom Demark sequential that helps identify trend exhaustion through a 9 Count. Currently on a 2 Count, we're testing the gap while simultaneously testing the 10WMA at 90.86.There is also a weekly gap at 101.35 ... Entry would be the 10WMA. Target the weekly Gap. Trade is as follows:

Trade Idea - Swing NASDAQ:PLTR $95 Calls 4/25

Entry - 10 WMA @ $90.86

Target - Gap on Weekly at $101.35

Nvidia - The Chart Just Told Us So!Nvidia ( NASDAQ:NVDA ) might just still head a little lower:

Click chart above to see the detailed analysis👆🏻

After Nvidia perfectly retested the previous rising channel resistance just a couple of months ago, it was quite expected that we'll see a retracement. The overall trend however still remains bullish and if Nvidia drops a little more, the overall bullrun continuation rally might just follow.

Levels to watch: $80

Keep your long term vision,

Philip (BasicTrading)

cup with handle pattern on the 1-hour time frameWelcome to today's analysis! Let’s break down the current price action on NASDAQ:NVDA and potential trade setups.

🌐 Overview: NASDAQ:NVDA Forming a Cup with Handle Pattern

📈 NASDAQ:NVDA is currently forming a cup with handle pattern on the 1-hour time frame. This pattern is typically bullish and could indicate a potential upward move.

🔄 Current Scenario:

NASDAQ:NVDA has formed a cup shape and is now developing the handle. The handle is a consolidation phase before a potential breakout.

The key level to watch is the resistance at the top of the handle. A breakout above this level could signal a bullish continuation.

🔑 Key Levels to Watch

🔴 Resistance: Top of the Handle (Needs breakout for continuation)

🟢 Target: Measured move equal to the depth of the cup, projected from the breakout point.

🛠️ Trade Scenarios

📌 Bullish Scenario (Breakout Above Resistance)

If NASDAQ:NVDA breaks and holds above the handle resistance, it could move toward the target level.

This breakout would confirm the cup with handle pattern and suggest a potential upward trend.

📌 Bearish Scenario (Failure to Breakout)

If NASDAQ:NVDA fails to break out and instead moves lower, it could retest the support levels within the cup or handle.

A failure to hold above key support levels could indicate a potential reversal or further consolidation.

📌 Conclusion

NASDAQ:NVDA is forming a cup with handle pattern on the 1-hour time frame. A breakout above the handle resistance could signal a bullish move toward the target level. If the price fails to break out, further consolidation or a retest of support levels may be necessary.

NVDA’s Wild Crash Alert: I’m Braced for a Heart-Stopping Drop!NVDA’s like a rocket losing altitude, and I’m on edge! It’s at $95.99, but I’m seeing it tumble to $90, maybe $88.95, then $83.59 if the bears go wild. If that breaks, whoa—$77.48 could hit hard! I’m glued to $90 for the first clue—big selling there, and it’s game on for a slide.

Kris/Mindbloome Exchange

Trade Smarter Live Better

We're seeing a nice box breakout NVDA | Bullish?We're seeing a nice box breakout here, which could indicate a good opportunity for a deeper correction. Therefore, we're setting the target at $91.5 and would continue moving lower until we see another box breakout in the opposite direction. Additionally, there is a major resistance level around the $91.5 zone, which will give us insight into how far NVDA's downtrend might go—or whether this could mark the turning point.

NVDA: Buy the Dip or Miss the Run?NVDA 💥🔥

Let’s be real, the market’s been shaky. Between the spike in volatility and the new tariff chatter coming out of the Trump camp, tech stocks are getting tossed around. But here’s the thing—volatility is where the setups live. And NVDA, sitting at the center of the AI revolution, isn’t going to stay down forever.

This might be the window. We’re talking a solid entry zone between 90 and 70, right where volatility meets opportunity.

Our profit targets?

✅ 110 for a clean bounce

✅ 125 as momentum builds

✅ 145+ if the bulls take the wheel again

It’s not about chasing—this is about timing the wave before it rips. So if you’re into smart risk, layered entries, and riding volatility like a pro… NVDA just rang the bell.

Disclaimer: This is not financial advice. All trading involves risk, especially in volatile conditions. Always do your own research or speak to a licensed financial advisor before making any trading decisions.

IM BEARISH ON NVIDIA WITH A TARGET OF $55.00. HERE IS WHY:NVIDIA (NVDA) Known for their GPUs, recently has experienced a decline in asset price. Trump tariff's may have been a bearish news catalyst, but do the technicals show a bigger bearish picture?

1 Day chart: While the RSI recently signaled oversold conditions, the RSI line looks to be crossing down the RSI based moving average. Furthermore the 200 Day EMA and 65 Day EMAs appear to be forming a death cross. DMI is still indicating bearish, and the ADX is still above 20.

With recent political news, the tech company has been working on bolstering their U.S based production. But with inflation cooling (6 month low) , I believe many high performing blue chip stocks may see a dip as traders and institutions price in deflation, new news and political events.

My opinion on a target is $55.00 , and there is significant open interest on long puts for this price that are expiring in the coming months.

Will NVIDIA pull out of this downtrend? Or will it become a great value buy for investors?

Disclaimer: Not financial advice.

Nvidia: Bullish Monday?A new week is about to get started and we would like to know if the NVIDIA Corporation (NVDA) chart supports a bullish Monday.

What is the chart saying on the daily timeframe?

The chart has many positive signals and support a strong week but...

Good Sunday my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

I hope you are doing great.

Let's read the chart; together, let's trade!

The chart looks really good and the short-term can always surprise, anything goes.

The chart is saying, "up, straight up," and even though the markets are unpredictable, I can easily tell you what the market is doing and is most likely to happen after the weekly close.

NVDA is super bullish and likely to continue growing based on multiple signals:

1) The falling wedge pattern is already confirmed. The action broke above it.

2) The trading volume supports a continuation of the pattern breakout.

3) The correction was really strong but the reaction to support was even stronger. Such a strong reaction indicates that traders were anxious and ready to buy. The only reason to sell was based on political bad news. With the bad news removed, up we go. NVDA is solid and with Bitcoin and mining growing, the market expanding, AI, NVDA is set to follow and also grow.

4) Both the 0.786 and 0.618 Fib. retracement levels are major support and gauge the strength of a stock. If the action is happening below, bearish; when the action happens above bullish. The fact that the action moved below just to recover makes this a strong bullish signal. A failed signal for the bears because they failed to move prices lower. A strong bullish signals for the bulls because the action is back above long-term critical support.

5) The session 10-April closed as a hammer and this also points up.

6) Finally, NVDA managed to close daily above EMA8, EMA13 and EMA21. Short-term bullish bias is now valid, active and confirmed.

All these are bullish signals saying that the market will move higher next.

What needs to happen for all this to become invalid?

NVDA would need to close daily below the last low.

No need to worry about short-term moves and noise. We are going up long-term.

The correction here reached more than 43%. Believe it or not, a 43% drop is a very strong drop. For the market to go lower, it would need to be the end of the company or worse. What need is there for a stock like this one, with a great product in huge demand, to drop by 80%, for what reason?

We are going up.

Namaste.

April 17, 2025 - Powell, Japan & TrumpHello everyone, it’s April 17, 2025. Yesterday’s U.S. trading was pure market carnage. Semiconductors ( NASDAQ:NVDA , NASDAQ:AMD , NASDAQ:ASML ) were steamrolled as AI chip bans to China kicked in and Trump dropped another tariff bomb, hiking duties to 245%. That wiped $200 billion off Nvidia alone.

In Chicago, Powell stoked the flames, warning tariffs will fuel inflation and choke growth, and insisted he’s in no rush to cut rates. The CME_MINI:NQ1! tumbled 3%, the CME_MINI:SOX1! lost 4.1%, and bond futures plunged.

This morning, U.S. futures are up about 0.75% on headlines that Trump’s talks with Japanese negotiators are “going very well,” sparking rallies across Asia: Nikkei +1%, Hong Kong +2.7%, Shanghai +1%. It seems even a whiff of détente with Japan sends everyone scrambling back into risk assets.

On commodities, BLACKBULL:WTI jumps to $63.35 amid fresh U.S. sanctions on Iran and OPEC output cuts; OANDA:XAUUSD rockets to $3,352 /oz; INDEX:BTCUSD hovers near $83,500.

Today watch the ECB’s rate cut, Powell’s next speech, Philly Fed and jobless claims before the Good Friday shutdown. With Trump’s erratic tariff theatrics and Powell’s warning of higher inflation and slower growth, volatility is set to reign supreme. Buckle up.

Nvidia : Should I be worried?Looking closely at Nvidia NASDAQ:NVDA , we can see that since March, the price has gravitated back to the Point of Control (POC) on the volume profile. From there, we’ve seen a solid reaction — up around 33%, after Nvidia had previously taken a sharp hit from its recent top.

In my view, it’s very possible that Wave 4 is now complete. It’s been a very complex, sideways consolidation, but that’s typical behavior for a fourth wave. Zoom out, and the bigger picture looks a lot cleaner — this whole range doesn’t seem nearly as messy on the higher timeframes.

That said, I’m not fully bullish yet. For me, $122 is the key level. Only once we break and hold above $122, I’ll shift into a more confidently bullish stance. Until then, it’s still possible we revisit the $80–$85 range, maybe even sweep the previous low. It doesn’t have to happen, but structurally, it’s still on the table.

Given the broader uncertainty — macroeconomic pressure, U.S.–China tensions, regulatory noise — I’m staying cautious. For now, I’m mainly focused on this from an 8-hour chart perspective. Until we get that confirmation above $122, I’m not rushing into any aggressive positions.

NVDA Weekly Options Trade Plan 2025-04-16NASDAQ:NVDA NVDA Weekly Analysis Summary (2025-04-16)

Below is our integrated analysis based on all available model reports.

──────────────────────────────

SUMMARY OF KEY POINTS FROM EACH MODEL

• Grok/xAI Report

– Technical indicators on lower timeframes (5‐minute) have shown short‑term weakness (price below the 10‑period EMA and bearish MACD) while the daily chart remains more neutral to slightly bullish.

– The max pain level ($110.00) lies below the current price ($112.20), suggesting there could be some pull‐back pressure.

– With mixed signals and elevated volatility, the analysis does not provide a strong directional conviction – hence no trade was recommended.

• Llama/Meta Report

– The shorter‑term (5‑minute) technicals indicate a bearish setup (MACD below signal, RSI near 45) despite the daily chart’s support from above‑average prices, supporting a slight downside bias.

– The report favors a put option (near ATM), suggesting that an option between the current price and the max pain level may capture a potential move downwards.

– Their setup initially mentioned the possibility of a trade “if premium is acceptable.”

• Gemini/Google Report

– Detailed multi‑timeframe analysis points to:

○ Immediate (M5) weakness (price trading below very short‑term EMAs and with bearish MACD signal),

○ Negative catalyst from export restrictions and the high–yet falling–VIX, and

○ A gravitational pull toward $110 (the max pain).

– This model’s analysis is moderately bearish and recommends buying a weekly naked put.

– Their trade plan suggests buying a put with a strike near $111 (which sits between the current price and max pain) with an entry at market open, a target premium gain of roughly 80–100% and a stop loss at about 50% of the premium.

• DeepSeek Report

– Also reviews technicals and sentiment inputs but concludes that conflicting signals and incomplete options data render a clear trade decision uncertain f

or today.

• The report leans toward “no trade” until further clarity is available.

──────────────────────────────

AREAS OF AGREEMENT AND DISAGREEMENT

• Agreement points:

– Most analyses agree that NVDA is trading a strong 5‑day rally and that, with the max pain level set at $110.00, there’s potential for a pullback.

– All reports also note the mixed technical picture when viewing short‑term versus daily charts.

– The immediate (intraday) indicators (M5 MACD, EMAs) lean toward weakness, even if the longer‑term trend remains less clear.

• Disagreements:

– Grok/xAI and DeepSeek lean toward “no trade” given the ambiguity and risk, whereas Llama/Meta and Gemini/Google see a moderate bearish opportunity.

– The recommended strike levels differ slightly: one report referenced the ATM region near $112 while the more detailed Gemini/Google plan suggests a slightly lower strike ($111) to better capture a potential move toward max pain.

──────────────────────────────

CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus:

• Although there is no unanimity, the preponderance of evidence—especially the short‑term technical weakness, the negative export restrictions news, elevated (but falling) volatility, and the max pain setup—leans toward a moderately bearish bias for today’s session.

Recommended Trade:

• We recommend a weekly naked put option trade (using only weekly options) if NVDA trades within or near our expected range at the open.

• Best execution is near market open provided the premium falls into or near our target range ($0.30–$0.60, allowing for slight flexibility).

• Specifically, purchase a $111 put expiring on April 17, 2025, which places you between the current trading level and the $110 max pain level.

• Entry Timing: At market open.

• Confidence Level: Approximately 65%

• Key risk factors include:

– The inherent conflict between short‐term and longer‐term signals,

– Possibility of the stock continuing its r

ecent rally (or failing to reach down near $110), and

– Extreme theta decay and premium volatility with only one day to expiration.

• Trade Parameters (example):

– Entry premium target about $0.50 per contract (if within acceptable range),

– Profit target set around $0.90 (roughly an 80% gain on premium), and

– Stop loss around $0.25 (50% of entry premium).

──────────────────────────────

TRADE_DETAILS (JSON Format)

{

"instrument": "NVDA",

"direction": "put",

"strike": 111.0,

"expiry": "2025-04-17",

"confidence": 0.65,

"profit_target": 0.90,

"stop_loss": 0.25,

"size": 1,

"entry_price": 0.50,

"entry_timing": "open"

}

Chips Down: What Shadows Loom Over Nvidia's Path?While Nvidia remains a dominant force in the AI revolution, its stellar trajectory faces mounting geopolitical and supply chain pressures. Recent US export restrictions targeting its advanced H20 AI chip sales to China have resulted in a significant $5.5 billion charge and curtailed access to a crucial market. This action, stemming from national security concerns within the escalating US-China tech rivalry, highlights the direct financial and strategic risks confronting the semiconductor giant.

In response to this volatile environment, Nvidia is initiating a strategic diversification of its manufacturing footprint. The company is spearheading a massive investment initiative, potentially reaching $500 billion, to build AI infrastructure and chip production capabilities within the United States. This involves critical collaborations with partners like TSMC in Arizona, Foxconn in Texas, and other key players, aiming to enhance supply chain resilience and navigate the complexities of trade tensions and potential tariffs.

Despite these proactive steps, Nvidia's core operations remain heavily dependent on Taiwan Semiconductor Manufacturing Co. (TSMC) for producing its most advanced chips, primarily in Taiwan. This concentration exposes Nvidia to significant risk, particularly given the island's geopolitical sensitivity. A potential conflict disrupting TSMC's Taiwanese fabs could trigger a catastrophic global semiconductor shortage, halting Nvidia's production and causing severe economic repercussions worldwide, estimated in the trillions of dollars. Successfully navigating these intertwined market, supply chain, and geopolitical risks is the critical challenge defining Nvidia's path forward.

NVDA Weekly Options Trade Plan 2025-04-15NVDA Weekly Analysis Summary (2025-04-15)

NASDAQ:NVDA

Below is a synthesized, step‐by‐step quant analysis of NVDA’s weekly options environment based on all model reports and the provided options data:

─────────────────────────────

SUMMARY OF MODEL KEY POINTS

▪ Grok/xAI Report – Price is trading tightly in a range near $112.20 with short‐term oscillation between support (~$111.95) and resistance (~$112.35). – Very mixed short‐term indicators (5‑minute MACD bearish but daily MACD bullish) and overall neutral technicals. – High option volume and open interest around $110 (max pain) and $115, but the report concludes with “no trade recommendation” given the mixed signals.

▪ Llama/Meta Report – Confirms NVDA is at $112.20 and finds 5‑minute charts “neutral/consolidating” while noting the daily chart shows some bullish recovery. – Despite daily technical hints of a potential bullish reversal, overall bias is assessed as moderately bearish. – Recommends a put option trade—specifically a $109 strike put with an ask premium of $0.84—citing a moderately bearish view and a 70% confidence level.

▪ Gemini/Google Report – Acknowledges that while the daily chart is bullish (strong momentum above keys like the 10‑day EMA) short‑term M5 charts show consolidation and the negative news (export restrictions and a possible $5.5B charge) adds significant uncertainty. – Notes that the max pain level is at $110 (below the current price) and that although pre‑market action appears firm, the conflicting signals create high risk. – Concludes strongly to “NO TRADE” at the open given the mixed and conflicting signals (confidence around 30%).

▪ DeepSeek Report – Points out that although NVDA is trading above some key EMAs, the negative news and heavy put open interest (especially near the $110 level) weigh on sentiment. – Using max pain logic and a moderately bearish bias (targeting a move toward $110), recommends buying a $110 strike put at a $1.10 premium with a 68% confidence level. – Provides detailed entry, profit target, and stop‐loss conditions (though the premium is notably above an “ideal” range of $0.30–$0.60).

───────────────────────────── 2. AREAS OF AGREEMENT AND DISAGREEMENT

Agreement: – All models acknowledge that the negative news (export restrictions, potential $5.5B charge) introduces strong bearish pressure. – There is a common observation that options open interest clusters around the $110 level (max pain) with heavy activity on both calls and puts, signaling sensitivities near that price. – Technical indicators in the very short term (5‑minute charts) show consolidation, even though the daily charts lean more bullish in some cases.

Disagreement: – Grok/xAI and Gemini conclude that the mixed signals (technical consolidation with bearish news drag) warrant no immediate trade at open. – Llama/Meta and DeepSeek tilt toward a moderately bearish view and recommend a put trade—though they differ on the exact strike (Llama selects ~$109, DeepSeek prefers $110) and premium levels. – Confidence levels differ substantially (from 0% and 30% up to 68–70%), reflecting uncertainty about whether the news or bullish technicals will dominate intraday.

───────────────────────────── 3. CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus: The environment remains ambiguous. Although the daily charts show some bullish resilience, the weight of recent negative news, the gravitational pull of $110 max pain, and heavy put volumes lean toward a modestly bearish bias. Still, the signals are mixed and the immediate post‑open direction is highly uncertain.

Recommended Trade (if you choose to be opportunistic): Based on Llama/Meta and DeepSeek—if you’re willing to take a moderately bearish bet at open—a put trade might be considered. However, note that Gemini and Grok/xAI advocate waiting for a clearer signal given the uncertainty.

For traders who prefer to have a trade based on a bias toward a downside reaction, one possible trade would be: • BUY a single‑leg, naked weekly PUT option. • Strike: $109.00 (ask premium of $0.84 is close enough given liquidity and moderate bearish distance). • Expiration: April 17, 2025 • Entry: at market open • Rationale: With a moderately bearish tilt from the negative news and max pain considerations, a $109 put offers a risk/reward profile in a premium region slightly above the ideal range (but acceptable given the high-impact catalysts). • Confidence Level: ~70% • Key risks: A continued short‑term consolidation or a “bounce” in price (especially if NVDA moves toward the max pain level and finds support) would hurt a put position. Also, any unexpected bullish catalyst could quickly overturn the bearish bias.

That said, because of the significant conflicting factors and the risk that the negative news may already be priced in, one could also justify sitting on the sidelines (as recommended by two of the models).

───────────────────────────── 4. FINAL RECOMMENDATION

In our view, the market is too conflicted for a high‑confidence directional bet. However, if you are inclined to act on the moderately bearish view—and you accept the risk of an early move against your position—the put side is the only candidate for a single‑leg trade. With that said, given the discord among the models (with two models advising “no trade”), a conservative trader might well decide to wait for clearer price action at the open.

───────────────────────────── TRADE DETAILS (JSON Format)

{ "instrument": null, "direction": null, "strike": null, "expiry": null, "confidence": null, "profit_target": null, "stop_loss": null, "size": null, "entry_price": null, "entry_timing": null }

───────────────────────────── FINAL NOTE: While there is some support for a moderately bearish put trade (for example, buying a $109 put at $0.84), the divergent signals from the models (including strong advice from two reports to avoid trading today) mean that risk management is paramount. Many quant practitioners would prefer to wait until post‑open confirmation before jumping in.

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Nightly $SPY / $SPX Scenarios for April 16, 2025🔮 🔮

🌍 Market-Moving News 🌍:

🗣️ Federal Reserve Speeches: Federal Reserve Chair Jerome Powell is scheduled to speak at 1:30 PM ET, providing insights into the economic outlook and potential monetary policy adjustments. Additionally, Cleveland Fed President Loretta Mester will speak at 12:00 PM ET, and Kansas City Fed President Jeffrey Schmid and Dallas Fed President Lorie Logan will speak at 7:00 PM ET.

📊 Key Data Releases 📊

📅 Wednesday, April 16:

🛍️ Retail Sales (8:30 AM ET):

Forecast: +1.2%

Previous: +0.2%

Measures the total receipts of retail stores, reflecting consumer spending trends.

🏭 Industrial Production (9:15 AM ET):

Forecast: -0.1%

Previous: +0.7%

Indicates the output of the nation's factories, mines, and utilities.

🏠 Homebuilder Confidence Index (10:00 AM ET):

Forecast: 37

Previous: 39

Assesses the confidence of homebuilders in the market for newly built single-family homes.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

April 15th Trade Journal & Stock Market AnalysisEOD accountability report: +940

Sleep: 8 hour, Overall health: Good

**Daily Trade Recap based on VX Algo System **

9:30 AM Market Structure flipped bullish on VX Algo X3! - easy money

10:10 AM VXAlgo ES X1 Sell Signal - easy money

1:02 PM Market Structure flipped bearish on VX Algo X3! - easy money

1:40 PM VXAlgo ES X1 Buy signal (triple signal) -a bit tuff but still work out

3:30 PM VXAlgo ES X1 Sell Signal (double signal) - a bit tuff but still work out

**Wed plan: ** Watch for 48M support or 195M support to tag around 5200-5300s.

US President Says All Necessary Permits Will Be Given to NVDAIn shocking turn of events today, US President Donald Trump said "All necessary permits will be expedited delivered to Nvidia."

The asset however, fail to play according to the rhythm of the fundamental, up by 1.51% as of the time of writing with the RSI at 56.27. Nvidia has also been plaque by Trump's tariff rate increment that saw the shares lose about 29% in market value for the past 3 weeks.

For Nvidia Shares ( NASDAQ:NVDA ), a break above the $150 resistant could pave way for a bullish course. Similarly, failure to break pass the resistant point could resort to a bearish reversal bringing it back to the support point.

Analyst Forecast

According to 43 analysts, the average rating for NVDA stock is "Strong Buy." The 12-month stock price forecast is $172.76, which is an increase of 53.68% from the latest price.