Nvda_analysis

Nvidia Partners With General Motors to Build Self-driving CarsNVIDIA Corporation, a computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally Partners With General Motors to Build Self-driving Cars.

Also in another news, IBM Taps NVIDIA AI Data Platform Technologies to Accelerate AI at Scale.

Apparently, shares of Nvidia (NASDAQ: NASDAQ:NVDA ) is undeterred by all this news presently down 3.43% trading with a weak RSI of 44.

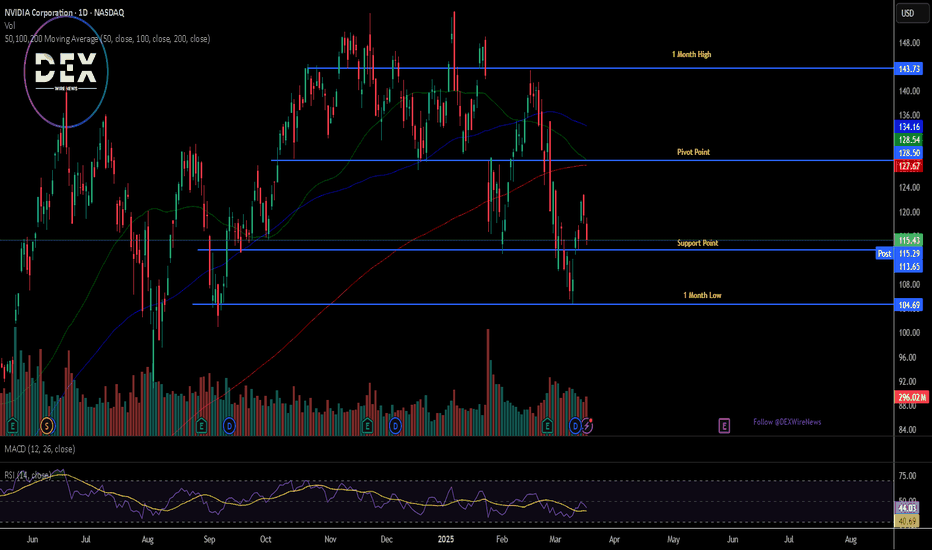

The 78.6% Fibonacci retracement point is acting as support point for shares of NVidia a break below that pivot could lead to a dip to the 1-month axis. Similarly, a breakout above the 38.2% Fibonacci retracement point could catalyse a bullish renaissance for $NVDA.

$140 - $150 are imminent for NVDANVIDIA Stock Analysis & Forecast

Price Outlook: $140 - $150 in Sight

NVIDIA (NVDA) has consistently been one of the most rewarding stocks for investors, delivering substantial returns over the past few years. However, following its all-time high (ATH) of approximately $153 on January 7, 2025, the stock experienced a notable pullback, declining to around $105.

Since that dip, NVDA has shown signs of recovery, with the current price stabilizing at $121.67. This upward momentum suggests a potential rally toward the $140 - $150 range in the near term.

Investment Strategy

Long-Term Perspective: Given NVIDIA’s strong fundamentals and market dominance, accumulating shares for long-term investment remains a solid strategy.

Short-Term Trading: For traders, technical indicators suggest potential entry and exit points. Refer to my chart for the accompanying chart for detailed technical analysis (TA) insights.

While the stock has shown resilience, monitoring key support and resistance levels will be crucial in determining the next phase of its movement.

Nvidia (NVDA) Share Price Rises Over 6%Nvidia (NVDA) Share Price Rises Over 6%

The NVDA stock chart shows that following yesterday’s trading session, the share price climbed over 6%, outperforming the Nasdaq 100 index (US Tech 100 mini on FXOpen), which gained just over 1%.

Despite this recovery from a six-month low, NVDA shares remain down 15% year-to-date.

Why Did Nvidia (NVDA) Shares Rise Yesterday?

Positive sentiment swept through the stock market after U.S. inflation data came in lower than expected. The Consumer Price Index (CPI) for the month stood at 0.2%, below analyst forecasts of 0.3% and the previous reading of 0.4%.

Investors may now be looking for opportunities following the March sell-off, triggered by Trump’s tariff policies and recession fears—and NVDA shares appear attractive in this context.

Barron’s suggests that NVDA stock may currently be undervalued, while MarketWatch cites BofA analyst Vivek Arya, who advises investors to focus on Nvidia’s gross profit margins as a key driver of significant share price growth.

Technical Analysis of NVDA Stock

Earlier this month, we identified a descending channel (marked in red) and suggested that its lower boundary could act as support—which was confirmed (highlighted by the circle).

Bullish perspective:

- The stock opened with a bullish gap and gained throughout the session, failing to hold below the psychological $110 level.

Bearish perspective:

- The price remains within the descending channel, with the median line potentially acting as resistance.

- The $117.50 level, previously a support, has turned into resistance (as indicated by the arrows) and may pose a challenge to further recovery.

NVDA Share Price Forecast

According to TipRanks:

- 39 out of 42 analysts recommend buying NVDA stock.

- The average 12-month price target for NVDA shares is $177.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA Stock: Under $120 pressured? $111 Break Signals $100 RiskIs NVIDIA (NVDA) stock in trouble? As long as NVDA stays under the 120 area, it’s under serious pressure, and the red flag is a drop below 111, opening the door to a fall to the 100 area. In this video, we dive into the latest NVDA stock analysis, breaking down how U.S. export controls have slashed sales to China—now just 15% of total revenue—spooking investors. Could this be the catalyst for a bigger crash? We explore technical levels (120, 111, 100), the impact of CEO Jensen Huang’s sales warning, and what it means for NVDA stock price in near term. Don’t miss this critical update— Drop your thoughts in the comments: Is NVDA a buy or a sell at these levels?

Nvidia’s Sharp Decline: Market Turbulence or Buy Opportunity?Nvidia ( NASDAQ:NVDA ) shares took a steep dive on Monday, falling nearly 9% after former President Donald Trump confirmed that tariffs on imports from Canada and Mexico will take effect on Tuesday. This sharp drop contributed to broader market weakness, with the Dow tumbling 800 points (-1.8%) and the Nasdaq Composite sliding over 3%.

Despite Nvidia’s recent earnings beat, its stock has fallen over 13% since last Wednesday, erasing its $3 trillion market cap and bringing its valuation down to $2.79 trillion. However, Tuesday’s trading session saw a notable rebound, with NASDAQ:NVDA gaining 3% as buying pressure returned. Given the technical setup and macroeconomic factors at play, is Nvidia poised for a comeback?

Tariff Fears and Supply Chain Scrutiny

Nvidia’s revenue surged 78% year-over-year to $39.33 billion in its latest earnings report, surpassing analysts’ expectations. However, investor sentiment remains cautious due to the uncertainty surrounding new trade tariffs.

Trump’s 25% tariff on imports from Mexico and Canada could impact Nvidia’s supply chain. While most of Nvidia’s chips are manufactured in Taiwan, other high-end components and full computing systems are assembled in Mexico and the U.S., making them subject to the new duties.

Technical Analysis

Despite Monday’s sharp sell-off, Tuesday’s market session saw a 4% bounce, signaling potential recovery. Key technical indicators suggest a possible shift in momentum. Nvidia’s relative strength index (RSI) has dipped close to oversold territory, suggesting the stock may be due for a reversal. NASDAQ:NVDA is trading at levels last seen in September, a historically strong support area that could trigger buying interest.

With traders digesting tariff implications and market conditions stabilizing, Nvidia could see a short-term bounce if momentum continues.

Nvidia (NVDA) Stock Hits New Yearly LowNvidia (NVDA) Stock Hits New Yearly Low

The NVDA stock chart shows that during yesterday’s trading session, the price dropped to $112.16, marking:

→ A new low for 2025, surpassing the previous bottom set on 3 February.

→ The lowest price in nearly five months.

Why Is Nvidia (NVDA) Stock Falling?

Bearish sentiment may be driven by:

→ A Wall Street Journal report stating that Chinese companies can still access Nvidia’s latest Blackwell chip despite Biden-era restrictions. Investors may fear tighter regulations, as the U.S. aims to limit technological advancements for geopolitical rivals.

→ The impact of Trump’s trade tariffs, which continue to disrupt global markets.

Technical Analysis of NVDA Stock

As noted in our report five days ago, NVDA’s price is forming a more defined downward channel (red) while moving further away from the Rising Wedge pattern (blue).

How Low Could Nvidia (NVDA) Stock Drop?

Despite NVDA’s weak performance relative to the broader market, investors may seek long positions in this former 2024 market leader.

Potential support levels:

→ The lower boundary of the red channel.

→ The psychological $100 mark.

If the Rising Wedge plays out, bears may target $85, based on the A-B range projected from point C.

A high-risk bullish argument could suggest that yesterday’s drop was a false bearish breakout below the 3 February low.

NVDA Stock Price Forecast

Analysts remain optimistic, possibly due to last week’s strong earnings report.

According to TipRanks:

→ 38 out of 41 analysts recommend buying NVDA.

→ The 12-month average price target is $178.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA: Fibonacci cluster support and 200MA at 126.5. NASDAQ:NVDA : Fibonacci Cluster Support at 126.5 Sets Up Potential 10% Rally to 140

Looking at NVIDIA's technical setup, I've identified a critical support zone that could launch NASDAQ:NVDA toward a significant target if it holds.

Technical Analysis

The current price action shows NVIDIA testing a key support zone consisting of:

- Fibonacci cluster at 126.5

- 200 Moving Average support

If this support zone holds, I'm targeting the next Fibonacci cluster at 140, representing approximately a 10.7% upside potential.

Entry Strategy

I'm monitoring two potential entry scenarios:

Aggressive Entry (15-minute chart):

- Wait for 8 EMA to cross above 34 EMA

- Price must break above the most recent swing high

- Entry on confirmation of this break

Conservative Entry (30-minute chart):

- Same criteria as above but on the 30-minute timeframe

- Provides more reliable signals with fewer false breakouts

Risk Management

Stop Loss: Place stops below the 126.5 Fibonacci/200 MA support zone (approximately 124-125)

Profit Target: First target at the 140 Fibonacci cluster

Conflicting Indicators

My analysis shows mixed signals that require caution:

1. My WillVall indicator on the weekly chart shows a potential buy opportunity at current prices, BUT it needs to change direction and move above the 15 level before confirming a long-term entry

2. Multiple timeframe squeeze indicators (Weekly, 4D, 3D, 2D) are currently in squeeze with negative momentum, suggesting downside pressure

3. According to IBD Market School methodology, the market is showing signs of correction and the buy switch is currently OFF, indicating we should avoid new long positions

Trade Plan

Given the current market conditions and mixed signals:

- Wait for confirmation of support at the 126.5 zone

- Look for entry signal confirmation on preferred timeframe

- Use smaller position size due to conflicting indicators

- Set clear stop loss below support (124-125)

- Target the 140 Fibonacci cluster for profit taking

I'll remain patient and wait for clearer market conditions before committing significant capital to this trade. The technical setup is promising, but broader market conditions suggest caution.

NVDA to 151? Morning Trading Fam

Currently this is what I am seeing with NVDA, looks like we have decent support around 118 if that level holds I can see us driving up to 144 then 151 from here. However if we break through the 118 support: we could possibly see a massive breakdown down to 87-88 dollar range.

Kris/ Mindbloome Exchange

Trade Smarter Live Better

NVDA : Good shopping pointshello friends

We have analyzed these stocks for you in a very simple way. In the long term...

We have identified good shopping points where you can shop.

Note that the price is at the ceiling of the channel and it is not logical to buy at the ceiling of the channel, so either we buy in case of correction or if the channel is broken and its failure is valid, we can buy.

*Trade safely with us*

Breaking: Nvidia ($NVDA) Surges 4% on Earnings BeatNvidia (NASDAQ: NASDAQ:NVDA ), the U.S.-based semiconductor giant, has once again outperformed market expectations, reporting $39.3 billion in Q4 revenue, a 2.7% increase beyond analyst projections. While its dominance in AI chips remains unchallenged, a surprising growth driver has emerged: its automotive and robotics segment. With demand for driver-assist technology soaring, this segment is poised to become Nvidia’s next multi-billion-dollar business.

The Rise of Nvidia’s Automotive Business

Nvidia’s automotive and robotics revenue surged by 103% year-on-year, reaching a record $570 million in Q4 FY2025. This brings its total segment revenue for the fiscal year to $1.69 billion, marking the second consecutive year above the $1 billion threshold.

Although automotive contributes just 1.45% to Nvidia’s total revenue, analysts predict exponential expansion as real-world applications of autonomous driving and robotics continue to develop.

Technical Analysis

As of the latest session, NASDAQ:NVDA closed up 3.67% and continued its positive momentum, rising 2% in premarket trading. From a technical standpoint, Nvidia is approaching a bullish breakout, supported by the following indicators:

- RSI at 48: This suggests the stock is neither overbought nor oversold, leaving ample room for an upward push.

- Key Fibonacci Levels: In case of a pullback, the 65% Fibonacci retracement level serves as a strong support zone, providing a potential rebound point.

- Breakout Potential: A move above the 1-month high could signal further bullish momentum, paving the way for new highs.

With AI-driven demand surging, and Nvidia's automotive and robotics division gaining traction, the company is well-positioned for long-term profitability. Investors should keep a close watch on technical breakouts and fundamental milestones, as Nvidia continues to redefine the future of AI and autonomous technology.

Nvidia (NVDA) Share Price Dips Slightly After Earnings ReportNvidia (NVDA) Share Price Dips Slightly After Earnings Report

Following the close of the main trading session yesterday, Nvidia released its quarterly earnings report, exceeding analysts' expectations:

→ Earnings per share: Actual = $0.89, Expected = $0.84

→ Revenue: Actual = $39.3 billion, Expected = $38.1 billion (a 78% increase year-on-year)

It was also revealed that Nvidia’s latest AI chip family, Blackwell, generated $11 billion in sales for the quarter. This eased concerns that transitioning to the Blackwell chip series could lead to a decline in revenue.

How Nvidia (NVDA) Shares Reacted to the Earnings Report

Despite the strong earnings, Nvidia’s share price did not benefit significantly. Post-market trading saw heightened volatility, with NVDA shares fluctuating between $126 and $136 in the first few minutes after the report’s release.

As volatility subsided, NVDA stabilised around $129, slightly below Wednesday’s closing price of $131.37, reflecting a decline of approximately 1.7%.

Technical Analysis of NVDA Stock Chart

In February, NVDA’s share price continued to hold below the lower boundary of its previous upward trend channel after failing to break the psychological barrier at $150. Specifically:

→ The lower channel boundary has now acted as resistance (indicated by the arrow).

→ A downward trend channel (marked in red) is becoming increasingly apparent.

As a result, NVDA shares have not shown the ability to recover from the panic sell-off on 27 January, when Nvidia and other leading AI companies saw their stocks plummet following the success of Chinese startup DeepSeek.

NVDA Share Price Forecast

Analysts remain optimistic, possibly due to the expected increase in AI-related capital expenditure by major tech firms in 2025. Additionally, the upcoming GTC conference could serve as a bullish catalyst, likely featuring new product announcements within the Blackwell family.

According to TipRanks:

→ 33 out of 36 analysts recommend buying NVDA shares.

→ The 12-month average price target for NVDA is $177.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA expected to remain volatile near term before bullish move!!Expecting to see sellers resume control at 135-136 levels near term, to take price back to 118-120$ gap fill target for liquidity purposes.

After that, looking for price advancement to 158-165 buy-side target levels for final high on weekly buy cycle.

Nvidia Earnings Right Ahead! Nvidia (ticker: NVDA) is set to announce its Q4 FY2025 earnings results after the market closes today. The report will be for the full fiscal year and covers the period between 1 November (2024) and 31 January (2025).

As the last of the Magnificent Seven stocks to report, Nvidia’s earnings results are a widely anticipated market event. Heading into the earnings release, the Bloomberg Magnificent 7 index – represents an equal-weighted measure of Nvidia, Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Meta Platforms (META), and Tesla (TSLA) – dipped below the 10% threshold to indicate a correction. Furthermore, major US equity markets are on the back foot, with the tech-heavy Nasdaq 100 down nearly 2% this month and crossing south of its 50-day simple moving average.

Analysts’ Estimates for NVDA Earnings

Nvidia has a consistent history of exceeding estimates and raising expectations. Wall Street forecasts Nvidia’s revenue will reach US$38.1 billion for Q4 FY2025, reflecting an eye-watering 73% year-on-year (YY) rise. Should actual revenue align with expectations, it would surpass the company’s Q3 FY2025 estimate (US$37.5 billion). Nvidia’s bottom line (net income) is also projected to climb to US$21.08 billion, up from US$12.84 billion in the same quarter a year prior. Adjusted Earnings Per Share (EPS) is also expected to increase to US$0.84, which would mark a 62% YY rise.

Regarding current analysts’ ratings (Refinitiv), approximately 54% recommend a ‘Buy’, 37% a ‘Strong Buy’, and 9% suggest a ‘Hold’.

The options implied volatility for the stock suggests the company’s share price could swing 8% in either direction. However, I want to add that although heightened volatility is evident heading into the event, it is important to consider that implied volatility reflects how far options investors anticipate the stock price to move. Consequently, it is not always reliable and has, in the past, fluctuated as high as 16% and as low as 0.5% before NVDA earnings reports.

Blackwell Chip Supply Concerns

Concerns remain high over the Blackwell chip supply. If manufacturing issues regarding this are mentioned in today’s report and the share price drops, some investors may see this as a dip-buying opportunity, given that supply problems are likely temporary. This, coupled with limited evidence of a slowdown in demand, potentially positions the stock well for the future. Of course, while Chinese AI start-up DeepSeek recently carved out a dent in Nvidia’s share price, Nvidia CEO Jensen Huang recently made the headlines, commenting that although DeepSeek’s R1 reasoning model is ‘impressive’, the Artificial Intelligence (AI) space will still need to rely on Nvidia’s chips. I expect Huang to reiterate similar comments today.

Supporting Huang’s latest comments, it is worth acknowledging that all of the key US Hyperscalers – large data centres and cloud service providers that offer computing and data solutions – confirmed capital expenditures on AI data centres. Although Microsoft was recently thrown into the spotlight after reports from TD Cowen noted that it has started to cancel leases from some of its data centre capacity in the US, the company has since stated that they ‘will continue to grow strongly in all regions’. Microsoft also repeated that it would still spend US$80 billion on capital expenditures for the fiscal year.

What Do the Charts Say?

First and foremost, you will note that the stock has not done much this year and is currently trading at similar levels seen in June 2024.

The weekly chart, however, offers some interesting observations. The stock pencilled in an all-time high of US$153.13 at the beginning of the year and established the start of a double-top pattern that was recently completed (the neckline was breached, a horizontal line taken from the low of US$126.86). In addition, the pattern’s profit objective is still calling for attention to the downside at US$105.30.

Therefore, given the break of weekly trendline support and the double-top pattern’s downside target not yet being reached, I feel there is (technical) scope for a push lower to around the US$105ish region. If earnings do surprise to the downside, it will take a 16.7% drop to reach the said level!

Seems like buying pressure will fall for a while in NVDAFollowing the negative news recently, including fears of a trade war between USA and China, and the concern about the cheaper AI moder DeepSeek, made the shares of Nvidia fall. Shares of other hight-tech companies also fell including Alphabet, Apple and Microsoft.

On the technical the price broke the strong support trendline from beginning of 2024 while also making a big gap down at the start of the week. The 100EMA is also broken down, indicating the beginning of a short/mid-term pullback.

The selling idea here is interesting, but risky. I will be looking for sell setups with small lots in the coming days.

NVIDIA (NVDA) - Failed Bear Flag, Bullish Reversal in Play📉 Failed Bear Flag Pattern

NVDA initially formed a bear flag, with a strong downward flagpole followed by consolidation in an upward-sloping channel. However, instead of breaking down as expected, the price reversed at the lower boundary, signaling bulls absorbing selling pressure.

📈 Breakout Potential

The recent impulse move out of the flag formation aligns with a Wave 1 breakout, confirming a potential bullish trend. If the Wave 2 retracement holds above previous lows, NVDA could see a strong Wave 3 rally towards $130-$140.

🔍 Key Resistance & Confirmation Levels

Immediate resistance around $122-$124 (previous highs & bear flag upper boundary). A break above $124 with volume could trigger further bullish momentum. Downside risk remains if NVDA re-enters the bear flag below $115.

🚀 Bullish Bias Unless Invalidated

Given the failed bear flag breakdown and Elliott Wave structure, the bias shifts bullish towards higher highs. Watch for strong follow-through on Wave 3 to confirm this setup.

📊 Trade Plan:

Entry: On pullbacks above $118-$120

Target: $130-$145

Stop: Below $115

💡 Let me know your thoughts! Do you agree with this bullish outlook?

Don't forget,

Patience is Paramount.

$NVDA: Broadening Formation & Earnings Play – $180 Calls for MayHey what's up everyone. Here's an analysis on NASDAQ:NVDA 👇🏽

💹 Trade Analysis & Setup

NVIDIA ( NASDAQ:NVDA ) is currently trading at $116.66, showing high volatility inside a Broadening Formation (BF) on both the daily and monthly timeframes.

This setup is a textbook liquidity expansion pattern, where price is making higher highs and lower lows within a widening megaphone structure.

The key catalyst in play is NVDA earnings on Feb 21, 2025, which could drive significant price action and IV expansion.

🔼 Bullish Case (Targets: $129 - $141.88 - $150+)

Earnings Catalyst (Feb 21): AI demand remains strong, with NVDA leading the semiconductor market.

Breakout Zone at $123-$125: NVDA must reclaim this zone to shift into an uptrend.

$129 (Prior Weekly High): A breakout here could bring momentum buyers & institutions into play.

Gap Fill to $141.88: Major upside potential exists if NVDA can sustain bullish momentum post-earnings.

🔻 Bearish Risks (Key Support & Breakdown Levels)

Daily Lower BF Break (~$113-$115): If this level fails, downside could accelerate toward $110-$105.

Monthly Broadening Formation Lower Level (~$100-$95): Extreme downside risk in the worst-case scenario.

Earnings Disappointment: If NVDA’s report fails to meet expectations, a strong move down is possible.

Theta Decay Impact: My contract loses value daily (~$3.53 per day), so a slow move up is not favorable.

IV Crush Post-Earnings: If NVDA doesn’t move much after earnings, option value could rapidly drop.

🚀 My Trade Plan

Bullish Breakout Plan: Hold if NVDA reclaims $123-$129, targeting $141-$150+ before March-April.

Earnings Play Strategy: Hold through earnings ONLY IF NVDA builds strength into Feb 21.

Exit if $113 breaks below with strong volume to prevent further downside losses.

NVDA’s Daily & Monthly Broadening Formations confirm high volatility & liquidity expansion. The next major move is likely earnings-driven.

If NVDA clears $129, I will hold my calls. If support at $113 fails, I may exit early.

💡 Trade Details:

Position: NVDA $180c 16 MAY 25

Entry Price: $2.60

Current Price: $1.72

P/L Open: (-$85.66) / (-33.8%)

Delta: 11.36 (~0.11)

Theta: (-3.53)

Key Catalyst: Earnings on Feb 21, 2025

Bullish NVDA 30m EMA Crossover - 2/21 $127cNice "Buy" signal EMA crossing on the 30m chart there at the end of the day along with a breakthrough of the downward trend line - may see a pump before the open tomorrow and, if she holds, could see an inverse of what I predicted a little while ago where we actually have MM's catch bears in a trap with their puts and sky this thing. Would make sense since a lot of people are saying NVDA will go down further.

Current play is the 2/21 $127c @ $6/contract. Targeting a 100% return to $12. If we get momentum, could see this go to $18 or even back to the high before Monday's gap down to $22. Could put a SL in around $5.

NVIDIA in Correction phaseWhat to Expect After Nvidia's Major Market Cap Tumble

Rocky White

Wed, January 29, 2025 at 6:00 PM GMT+5 2 min read

Expectations were high for artificial intelligence (AI) companies, but they took a hit on Monday after Chinese startup DeepSeek claimed it can spend way less money and deliver AI performance comparable to major tech firms.

This triggered massive selloffs in megacap stocks. Nvidia (NVDA) fell 17%, losing over $500 billion in market capitalization -- a record-breaking decline, larger than the entire market cap of companies like Mastercard (MA), Netflix (NFLX), Costco (COST), and Bank of America (BAC).

Broadcom (AVGO) also plunged 17%, losing about $200 billion in market value, while Oracle (ORCL) fell roughly 14%, or $70 billion in market cap. It made me curious how stocks have tended to perform after such massive losses.

$NVDA - Resilience in ActionNASDAQ:NVDA

In my previous post (linked above) I noted the amount of macro upwards pressure NASDAQ:NVDA

Even with the market becoming leary of (or noticing other A.I. developer options), NASDAQ:NVDA still just makes the HARDWARE that these A.I. models are able to use and abuse in order to perform better. NASDAQ:NVDA will continue to create great hardware, and continually iterate on the items that will continue to make A.I. great.

My recommendation? Continue to hold, and buy at these lower levels. NASDAQ:NVDA will continue to rise.

NVDA's Next Big Moves: Targeting 190, 175, 170! NVDA's on a wild ride, and here's where we might be heading. We're eying some exciting highs with targets at 190, 175, and 170 if we can break through 147. But, keep your seatbelts on because if the market doesn't hold up, we could be looking at a drop all the way down to 110, or even 98. Let's keep our fingers crossed for the highs but prepare for any dips.

Trade Smarter/ Live Better

Kris/ Mindbloome Exchange