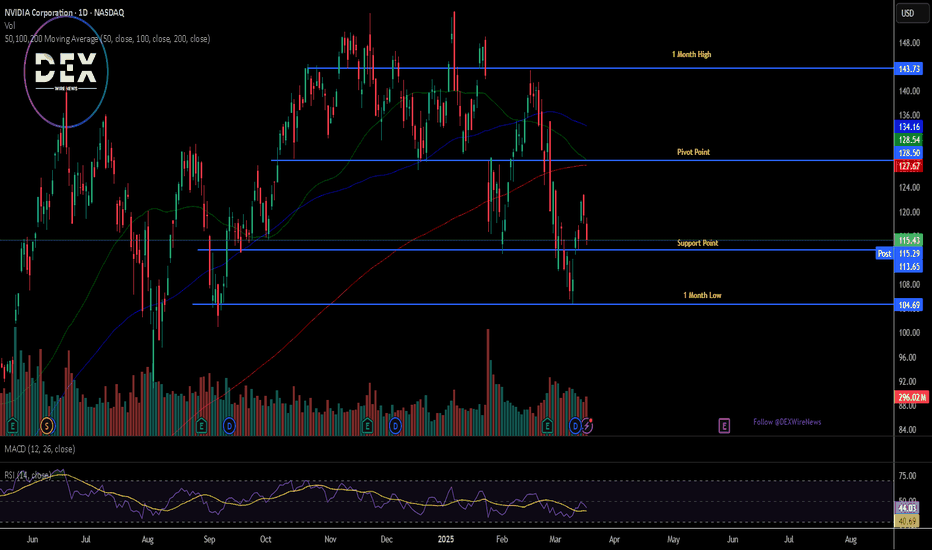

Nvdia has a new Aggressor.The boxes you are observing are the Larger scale supply and demand zones. These areas map out the current large liquidity. This includes the newest Player (collective players). This new player has been aggressively on the 17th and 18th.

Why does identifying a new aggressor matter?

New aggressors shape the way we view previous areas of supply and demand. Some look at the price getting to their target, without giving any thought to HOW it gets there.

In this instance:

Previous supply and demand have been established (we do not know how big they are or who is stronger). Some clues we do have is how it approaches these areas, and new aggressors can give us the clues we need... Will it bounce off demand? or fulfill it and continue lower?

New aggressors can put more pressure on these Demand or supply zones simply because they are becoming more aggressive closer to these areas.

Prediction

Scenario 1

Rolling over, and touching the 106 demand zone. Get's bought up, and new aggressors presents themself (bringing more demand). Price Target = 123.

If there is continued demand through this area, a case can be made for a 138 target before a correction/ reversal.

Scenario 2

New demand chews up this new aggressor. We should then have a bullish run to 131. 131 would present itself as a great short-term options (short).

Scenario 3

Rolling over with NEW (short) aggressors. This will put tons of pressure on the 106 players, and hopefully the 96's hang on (not charted).

Please feel free to share you input, thank you for taking the time.

Happy Trading!

Nvidia_analysis

Nvidia Partners With General Motors to Build Self-driving CarsNVIDIA Corporation, a computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally Partners With General Motors to Build Self-driving Cars.

Also in another news, IBM Taps NVIDIA AI Data Platform Technologies to Accelerate AI at Scale.

Apparently, shares of Nvidia (NASDAQ: NASDAQ:NVDA ) is undeterred by all this news presently down 3.43% trading with a weak RSI of 44.

The 78.6% Fibonacci retracement point is acting as support point for shares of NVidia a break below that pivot could lead to a dip to the 1-month axis. Similarly, a breakout above the 38.2% Fibonacci retracement point could catalyse a bullish renaissance for $NVDA.

Nvidia (NVDA) Share Price Rises Over 6%Nvidia (NVDA) Share Price Rises Over 6%

The NVDA stock chart shows that following yesterday’s trading session, the share price climbed over 6%, outperforming the Nasdaq 100 index (US Tech 100 mini on FXOpen), which gained just over 1%.

Despite this recovery from a six-month low, NVDA shares remain down 15% year-to-date.

Why Did Nvidia (NVDA) Shares Rise Yesterday?

Positive sentiment swept through the stock market after U.S. inflation data came in lower than expected. The Consumer Price Index (CPI) for the month stood at 0.2%, below analyst forecasts of 0.3% and the previous reading of 0.4%.

Investors may now be looking for opportunities following the March sell-off, triggered by Trump’s tariff policies and recession fears—and NVDA shares appear attractive in this context.

Barron’s suggests that NVDA stock may currently be undervalued, while MarketWatch cites BofA analyst Vivek Arya, who advises investors to focus on Nvidia’s gross profit margins as a key driver of significant share price growth.

Technical Analysis of NVDA Stock

Earlier this month, we identified a descending channel (marked in red) and suggested that its lower boundary could act as support—which was confirmed (highlighted by the circle).

Bullish perspective:

- The stock opened with a bullish gap and gained throughout the session, failing to hold below the psychological $110 level.

Bearish perspective:

- The price remains within the descending channel, with the median line potentially acting as resistance.

- The $117.50 level, previously a support, has turned into resistance (as indicated by the arrows) and may pose a challenge to further recovery.

NVDA Share Price Forecast

According to TipRanks:

- 39 out of 42 analysts recommend buying NVDA stock.

- The average 12-month price target for NVDA shares is $177.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Should wait for the Breakout..Bearish Divergence on Weekly & Monthly TF.

However, Hidden Bullish Divergence is appearing

on Weekly TF which is actually a Positive sign.

Immediate Support seems to be around 126 - 130.

But if 140 is Sustained on Weekly basis, we may witness

further Upside around 150ish.

Best Approach would be to wait for the Rectangular Channel

Breakout.

NVDA Lost it's key support level. Are we headed to 50$ ?The critical support level has been breached, and the price action suggests we could be headed toward the $50 zone 📉. Adding fuel to the bearish case, we see a major bearish divergence on the MFI indicator, signaling weakening momentum.

Is this the beginning of a deeper correction? Stay sharp! ⚠️

Nvidia’s Sell-Off Deepens: How to Capitalize on the Decline?📉 Nvidia’s Technical Breakdown:

● Nvidia’s stock has been caught in a storm of selling pressure over the past month.

● The recent breach of critical trendline support levels suggests the downward trend could gain momentum in the days ahead, opening the door for savvy traders to capitalize on the bearish momentum.

🔄 NVDS: The Perfect Inverse Play for Nvidia’s Slide

● For those looking to navigate this decline, an inverse ETF like NVDS NASDAQ:NVDS offers a compelling opportunity.

● Designed to move in the opposite direction of Nvidia’s stock, NVDS has shown a chart pattern that almost perfectly inverse Nvidia’s price action.

● This makes it a strategic tool to potentially profit from the stock’s anticipated slide.

Nvidia’s Sharp Decline: Market Turbulence or Buy Opportunity?Nvidia ( NASDAQ:NVDA ) shares took a steep dive on Monday, falling nearly 9% after former President Donald Trump confirmed that tariffs on imports from Canada and Mexico will take effect on Tuesday. This sharp drop contributed to broader market weakness, with the Dow tumbling 800 points (-1.8%) and the Nasdaq Composite sliding over 3%.

Despite Nvidia’s recent earnings beat, its stock has fallen over 13% since last Wednesday, erasing its $3 trillion market cap and bringing its valuation down to $2.79 trillion. However, Tuesday’s trading session saw a notable rebound, with NASDAQ:NVDA gaining 3% as buying pressure returned. Given the technical setup and macroeconomic factors at play, is Nvidia poised for a comeback?

Tariff Fears and Supply Chain Scrutiny

Nvidia’s revenue surged 78% year-over-year to $39.33 billion in its latest earnings report, surpassing analysts’ expectations. However, investor sentiment remains cautious due to the uncertainty surrounding new trade tariffs.

Trump’s 25% tariff on imports from Mexico and Canada could impact Nvidia’s supply chain. While most of Nvidia’s chips are manufactured in Taiwan, other high-end components and full computing systems are assembled in Mexico and the U.S., making them subject to the new duties.

Technical Analysis

Despite Monday’s sharp sell-off, Tuesday’s market session saw a 4% bounce, signaling potential recovery. Key technical indicators suggest a possible shift in momentum. Nvidia’s relative strength index (RSI) has dipped close to oversold territory, suggesting the stock may be due for a reversal. NASDAQ:NVDA is trading at levels last seen in September, a historically strong support area that could trigger buying interest.

With traders digesting tariff implications and market conditions stabilizing, Nvidia could see a short-term bounce if momentum continues.

Nvidia (NVDA) Stock Hits New Yearly LowNvidia (NVDA) Stock Hits New Yearly Low

The NVDA stock chart shows that during yesterday’s trading session, the price dropped to $112.16, marking:

→ A new low for 2025, surpassing the previous bottom set on 3 February.

→ The lowest price in nearly five months.

Why Is Nvidia (NVDA) Stock Falling?

Bearish sentiment may be driven by:

→ A Wall Street Journal report stating that Chinese companies can still access Nvidia’s latest Blackwell chip despite Biden-era restrictions. Investors may fear tighter regulations, as the U.S. aims to limit technological advancements for geopolitical rivals.

→ The impact of Trump’s trade tariffs, which continue to disrupt global markets.

Technical Analysis of NVDA Stock

As noted in our report five days ago, NVDA’s price is forming a more defined downward channel (red) while moving further away from the Rising Wedge pattern (blue).

How Low Could Nvidia (NVDA) Stock Drop?

Despite NVDA’s weak performance relative to the broader market, investors may seek long positions in this former 2024 market leader.

Potential support levels:

→ The lower boundary of the red channel.

→ The psychological $100 mark.

If the Rising Wedge plays out, bears may target $85, based on the A-B range projected from point C.

A high-risk bullish argument could suggest that yesterday’s drop was a false bearish breakout below the 3 February low.

NVDA Stock Price Forecast

Analysts remain optimistic, possibly due to last week’s strong earnings report.

According to TipRanks:

→ 38 out of 41 analysts recommend buying NVDA.

→ The 12-month average price target is $178.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVDA to 151? Morning Trading Fam

Currently this is what I am seeing with NVDA, looks like we have decent support around 118 if that level holds I can see us driving up to 144 then 151 from here. However if we break through the 118 support: we could possibly see a massive breakdown down to 87-88 dollar range.

Kris/ Mindbloome Exchange

Trade Smarter Live Better

Nvidia stumbles to test 200 MA post earningsWill the dip buyers emerge here?

US markets continue to remain on the back foot, with the tech sector in sharp focus after Nvidia’s earnings. The chip giant initially climbed over 1% in pre-market trading but swiftly reversed, dropping 4% as investors reacted to results that, while decent, failed to dazzle. With chipmakers driving market volatility and concerns mounting over US-China tech tensions, Nvidia’s performance today could set the tone for the sector.

Adding to uncertainty, Donald Trump reignited trade war fears, announcing that tariffs on Mexico, Canada, and China will take effect on 4 March.

Let's see if Nvidia dip-buyers will emerge to defend the 200-day MA around $126 area, or whether we will see further weakness heading into the close. Next key levels to watch include $120.00 and $115.00. Wednesday's low of $128.50 is now the key resistance level to watch. It would be a bullish scenario if we go back above this level now.

On a macro front, attention turns to Friday’s Core PCE data following weak economic reports, including a 4.6% slump in pending home sales and rising jobless claims. Next week we have ISM PMIs and NFP jobs report, as well as a rate decision from the ECB, all to look forward to.

By Fawad Razaqzada, market analyst with FOREX.com

Breaking: Nvidia ($NVDA) Surges 4% on Earnings BeatNvidia (NASDAQ: NASDAQ:NVDA ), the U.S.-based semiconductor giant, has once again outperformed market expectations, reporting $39.3 billion in Q4 revenue, a 2.7% increase beyond analyst projections. While its dominance in AI chips remains unchallenged, a surprising growth driver has emerged: its automotive and robotics segment. With demand for driver-assist technology soaring, this segment is poised to become Nvidia’s next multi-billion-dollar business.

The Rise of Nvidia’s Automotive Business

Nvidia’s automotive and robotics revenue surged by 103% year-on-year, reaching a record $570 million in Q4 FY2025. This brings its total segment revenue for the fiscal year to $1.69 billion, marking the second consecutive year above the $1 billion threshold.

Although automotive contributes just 1.45% to Nvidia’s total revenue, analysts predict exponential expansion as real-world applications of autonomous driving and robotics continue to develop.

Technical Analysis

As of the latest session, NASDAQ:NVDA closed up 3.67% and continued its positive momentum, rising 2% in premarket trading. From a technical standpoint, Nvidia is approaching a bullish breakout, supported by the following indicators:

- RSI at 48: This suggests the stock is neither overbought nor oversold, leaving ample room for an upward push.

- Key Fibonacci Levels: In case of a pullback, the 65% Fibonacci retracement level serves as a strong support zone, providing a potential rebound point.

- Breakout Potential: A move above the 1-month high could signal further bullish momentum, paving the way for new highs.

With AI-driven demand surging, and Nvidia's automotive and robotics division gaining traction, the company is well-positioned for long-term profitability. Investors should keep a close watch on technical breakouts and fundamental milestones, as Nvidia continues to redefine the future of AI and autonomous technology.

Nvidia (NVDA) Share Price Dips Slightly After Earnings ReportNvidia (NVDA) Share Price Dips Slightly After Earnings Report

Following the close of the main trading session yesterday, Nvidia released its quarterly earnings report, exceeding analysts' expectations:

→ Earnings per share: Actual = $0.89, Expected = $0.84

→ Revenue: Actual = $39.3 billion, Expected = $38.1 billion (a 78% increase year-on-year)

It was also revealed that Nvidia’s latest AI chip family, Blackwell, generated $11 billion in sales for the quarter. This eased concerns that transitioning to the Blackwell chip series could lead to a decline in revenue.

How Nvidia (NVDA) Shares Reacted to the Earnings Report

Despite the strong earnings, Nvidia’s share price did not benefit significantly. Post-market trading saw heightened volatility, with NVDA shares fluctuating between $126 and $136 in the first few minutes after the report’s release.

As volatility subsided, NVDA stabilised around $129, slightly below Wednesday’s closing price of $131.37, reflecting a decline of approximately 1.7%.

Technical Analysis of NVDA Stock Chart

In February, NVDA’s share price continued to hold below the lower boundary of its previous upward trend channel after failing to break the psychological barrier at $150. Specifically:

→ The lower channel boundary has now acted as resistance (indicated by the arrow).

→ A downward trend channel (marked in red) is becoming increasingly apparent.

As a result, NVDA shares have not shown the ability to recover from the panic sell-off on 27 January, when Nvidia and other leading AI companies saw their stocks plummet following the success of Chinese startup DeepSeek.

NVDA Share Price Forecast

Analysts remain optimistic, possibly due to the expected increase in AI-related capital expenditure by major tech firms in 2025. Additionally, the upcoming GTC conference could serve as a bullish catalyst, likely featuring new product announcements within the Blackwell family.

According to TipRanks:

→ 33 out of 36 analysts recommend buying NVDA shares.

→ The 12-month average price target for NVDA is $177.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NVIDIA Bullish Setup!NVIDIA Bullish Setup! 💚

NVIDIA remains in a strong uptrend, respecting its trendline support and showing bullish momentum leading into its earnings report on Feb 26. With buyers stepping in at key levels, a push towards the $150 target looks likely in the short term!

🔹 Current Price: $137

💡 Why bullish?

🔹 Strong long-term uptrend 📈

🔹 Buyers defending higher lows 💪

🔹 Anticipation of earnings momentum 🔥

🎯 My personal target: $150

Nvidia's Price Approaches the $110 MarkThe stock has dropped more than 11% over the past five trading sessions due to newly imposed tariffs on Taiwanese semiconductors (which could increase Nvidia's costs) and growing concerns over DeepSeek's advanced AI model, which has intensified competition in the sector. Additionally, rising global trade tensions have led investors to lose confidence in Nvidia's future market outlook. As one of the most influential technology companies worldwide, a potential slowdown in global economic growth could negatively impact Nvidia's sales and revenue projections.

Accelerated Downtrend

Nvidia has already undergone a significant decline from the $150 price zone and is now approaching the key support level at $114 per share. So far, the sharp bearish moves have largely been accompanied by price gaps, and no clear trend-defining structure has emerged to establish a decisive bearish bias. This suggests that, in the long run, investors should watch for potential bullish corrections, given the speed of the recent sell-off.

RSI Indicator

The RSI line has consistently declined and is now approaching the oversold zone near the 30 level. This signals a strong imbalance between buying and selling pressure, which could increase the likelihood of short-term upward corrections in the stock price.

Key Levels

$130: The most significant resistance level, representing a neutral price zone over the past few months. A return to this level could reinforce a sideways market outlook in the coming weeks.

$114: A critical support level, aligning with the 61.8% Fibonacci retracement barrier. Sustained movements below this level could reinforce the bearish perspective and trigger a more extended selling wave.

By Julian Pineda, CFA - Market Analyst

NVIDIA in Correction phaseWhat to Expect After Nvidia's Major Market Cap Tumble

Rocky White

Wed, January 29, 2025 at 6:00 PM GMT+5 2 min read

Expectations were high for artificial intelligence (AI) companies, but they took a hit on Monday after Chinese startup DeepSeek claimed it can spend way less money and deliver AI performance comparable to major tech firms.

This triggered massive selloffs in megacap stocks. Nvidia (NVDA) fell 17%, losing over $500 billion in market capitalization -- a record-breaking decline, larger than the entire market cap of companies like Mastercard (MA), Netflix (NFLX), Costco (COST), and Bank of America (BAC).

Broadcom (AVGO) also plunged 17%, losing about $200 billion in market value, while Oracle (ORCL) fell roughly 14%, or $70 billion in market cap. It made me curious how stocks have tended to perform after such massive losses.

NVIDIA Local UptrendNVIDIA in Local Uptrend on the 1-Hour Chart

NVIDIA made a higher high on the 1-hour chart, so we are in a local uptrend. It’s possible that we’ll see a higher low next, and then move up to a new higher high, or we could continue going higher right now.

If tomorrow the 4-hour candle close stays above $126.63 (yellow line) and holds that level, then we’ll have gained that support. In that case, we are back in the big range with the potential to reach $148.

NVIDIA Forms Inside Bar Pattern After Significant Drop...NVIDIA is currently exhibiting an inside bar pattern following a significant 17% decline, which was triggered by the DeepSeek Panic incident. This pattern indicates a period of consolidation where the price is stabilizing within the range established by the preceding candle. To make informed decisions moving forward, it is prudent to monitor price action closely and wait for a definitive breakout from this inside bar formation. A breakout above the upper boundary could signal a potential reversal or upward momentum, while a breakdown below the lower boundary may suggest further bearish pressure. Hence, exercising patience and assessing volume and market context will be crucial before committing to any trades.

Nvidia Stock Goes 'DeepSeek', Ahead of Earnings CallNvidia's stock has experienced significant volatility recently, largely influenced by the emergence of a new AI model from Chinese startup DeepSeek. This model, known as R1, reportedly rivals the capabilities of advanced models from major U.S. tech companies like OpenAI and Google, but does so using less powerful and cheaper chips. This development has raised concerns among investors about the sustainability of Nvidia's market dominance and the high valuations of U.S. tech stocks.

Impact of DeepSeek on Nvidia Stock

Stock Performance.

On January 27, 2025, Nvidia's shares plummeted by over 16%, marking its largest intraday drop since August 2023. This decline wiped more than half-a-trillion US dollars from Nvidia's market capitalization. The stock fell approximately 12.5% in early trading, reflecting widespread investor anxiety about the implications of DeepSeek's advancements.

Investor Sentiment.

The introduction of DeepSeek's AI model has prompted a reevaluation of the heavy investments made by U.S. tech firms in AI technologies. Analysts noted that if DeepSeek can achieve competitive results with lower costs, it may lead to reduced demand for Nvidia's high-end chips. This has caused a ripple effect across the tech sector, with other semiconductor stocks also experiencing declines.

Market Reactions.

The broader tech market was affected as well, with the Nasdaq index falling nearly 4% in pre-market trading. Other companies linked to AI and technology also saw significant drops; for instance, ASML and Broadcom fell by 7% and over 12%, respectively.

Perspectives by Fundamental and Technical Analyst

Skepticism About DeepSeek.

While some analysts expressed skepticism about DeepSeek's ability to compete effectively without advanced chips, they acknowledged that its success could force U.S. companies to reconsider their strategies regarding AI investments and efficiency. For example, Citi analysts maintained a "buy" rating on Nvidia, suggesting that major U.S. companies are unlikely to shift away from using Nvidia's GPUs in the near term.

Concerns Over Valuations.

Analysts at Wedbush highlighted that U.S. tech stocks are currently valued at premium levels, which makes them vulnerable to any disruptions in perceived technological superiority. They noted that even small developments like those from DeepSeek could significantly impact stock prices due to inflated expectations surrounding AI advancements.

Future Outlook.

Despite the immediate negative impact on Nvidia's stock, some analysts believe that concerns may be exaggerated and that U.S. firms are still well-positioned for long-term growth in AI technologies. They argue that while DeepSeek's model is impressive, it does not yet match the comprehensive infrastructure and ecosystem that American tech giants have developed.

Technical Outlook.

The main technical graph for Nvidia stock (1-week resolution) indicates on epic breakthrough of upside channel, which has been alive for more than last two years, until ̶D̶o̶n̶a̶l̶d̶ ̶T̶r̶u̶m̶p̶ someone entered ̶a̶ ̶c̶h̶a̶t̶ White House.

Ahead of Nvidia Earnings call (scheduled on February, 26) our 'fancy-nancy' Analyst Team is strongly against any Nvidia stock purchase below ready to be lost, $130 per share level.

Potentially 52-week SMA can support a stock for a while near $115 a share, otherwise we believe Nvidia stock will dive below $100 level again.

Conclusion

In summary, the rise of DeepSeek represents a pivotal moment for Nvidia and the broader tech sector, challenging existing assumptions about AI development costs and market dynamics. The ongoing situation will likely lead to further scrutiny of investment strategies within the industry as stakeholders assess the long-term implications of this emerging competition.

Nvidia (NVDA) Stock Price Drops by Approximately 17%Nvidia (NVDA) Stock Price Drops by Approximately 17%

The start of 2025 appeared favourable for Nvidia (NVDA) shares from a fundamental perspective:

→ On 6 January, Nvidia CEO Jensen Huang delivered a keynote at the Consumer Electronics Show (CES).

→ On 22 January, the company's stock prices rose following President Trump's Stargate project announcement.

However, news from China triggered a sharp decline, with Nvidia's stock price plunging approximately 17% yesterday, as shown on the Nvidia (NVDA) chart.

According to Reuters, last week the Chinese startup DeepSeek launched a free AI assistant requiring minimal resources. By Monday, the assistant had surpassed its American rival, ChatGPT, in downloads from Apple’s App Store.

CNN reports that the R1 model is both powerful and significantly cheaper than AI technologies from OpenAI, Google, or Meta. DeepSeek claimed to have spent just $5.6 million on its base model, compared to the hundreds of millions or billions invested by American companies in their AI technologies.

This may have led market participants to conclude that the AI industry requires fewer Nvidia chips than previously thought, prompting a sell-off of Nvidia shares. This decline also impacted other companies in the sector, with sharp drops in Oracle (ORCL), Broadcom (AVGO), and others.

As a result, Nvidia lost its title as "the world's most valuable company" to Apple, and its CEO saw his fortune decrease by 20%.

Technical analysis of Nvidia (NVDA) stock chart indicates that:

→ The upward channel (marked in blue), formed by price fluctuations throughout 2024, has been broken, as the price fell well below its lower boundary.

→ The psychological resistance level of $150, previously highlighted in our analyses (most recently on 6 January), held firm despite numerous challenges.

→ The sharp drop, accompanied by a bearish gap between $142 and $128, can be interpreted as a market structure shift (MSS).

This development may lead to reduced investor interest in the AI sector, with NVDA stock likely to continue its decline within a downward channel.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.