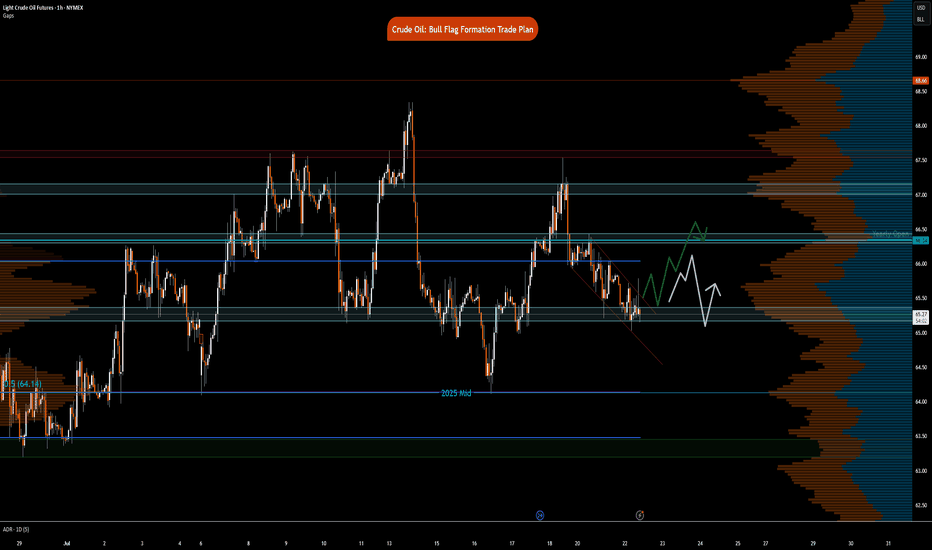

Crude Oil- Bull Flag formation Trade PlanNYMEX:CL1! NYMEX:MCL1!

Big Picture:

Let the price action and market auction be your guide

What has the market done?

The market has consolidated and pushed higher. There is an excess high at 67.87 from July 14th RTH. Market pushed lower, leaving behind excess with single prints above this showcasing strong area of resistance.

What is it trying to do?

The market is accepting prices in this range and building value. It has been in price discovery mode with a multi-distribution profile since June 24th.

How good of a job is it doing?

The market is currently forming a bull flag formation and attempting to push higher on the hourly time-frame.

What is more likely to happen from here?

Key Levels:

Neutral Zone 1: 67.16-67

Neutral Zone 2 : 66.45-66.30

Yearly Open: 66.34

Neutral zone 3 : 65.23-65.03

2025- Mid Range : 64.14

Scenario 1: False break, pull back and push higher

In this scenario, we expect prices to attempt to break bull flag formation, fail, however, neutral zone 3, acts as support for buyers to step back in to push prices towards yearly open and neutral zone 2.

Scenario 2: Break but fail to sustain push higher

In this scenario, we expect prices to break out of bull flag formation, however, fail around the 66 zone. Price reverts lower towards neutral zone 3 to further consolidate.

Nymex

How much higher for Platinum futures In this video I look at the current price of platinum on a higher tf and forecast where I believe the cool down to this rally might begin.

Using tools like the fib extension, volume profile and speed fan we are able to highlight a major reaction zone ahead at $1600 region .

Set alerts at these key levels for what might prove to be a solid short entry or a rejection , retest and claim for higher levels like the 1.618 ext .

Planning for the Next Trade in Crude OilNYMEX:CL1!

Key Levels – Higher Timeframe:

• 2025 High: 78.56

• Yearly Open (2025): 69.64

• 2025 mCVPOC: 71.83

• Yearly VWAP: 68.41

• AVWAP from Yearly Highs: 67.71

• 2025 mCVAL: 65.28

• March 2025 Low: 64.37

• 2024 Low: 59.91

April 2025 Key Levels:

• April mCVAL: 58.79

• April mCVPOC: 60.94

• April AVWAP from Lows: 61.29

• April AVWAP from Highs: 61.76

• April mCVAH: 63.73

Our previous trade idea played out as expected. With updated levels now in place, we aim to reassess the market context without falling into recency or confirmation bias. These biases often lead to an overly bearish outlook at market lows, especially amid ongoing headlines around trade war tensions and supply concerns. While such fundamentals are important, maintaining objectivity is key.

This leads us to the central question: Is all this bearish sentiment already priced in? If so, why are sellers still dominant?

From a broader perspective, the overall context for crude remains bearish. However, this does not imply an immediate continuation to lower prices.

Currently, price is trading below both the midpoint of 2025 and that of 2024. Additionally, the recent price swing failed at the March 2025 low—an important technical rejection. The 2024 low at 59.91 now serves as key structural support. We anticipate further consolidation within the April 2025 value range, specifically between mCVAH (63.73) and mCVAL (58.79).

We define the area between April’s mCVPOC (60.94) and AVWAPs (61.29 / 61.76) as a "noise zone"—a region where price action is likely to be choppy and directionless. This zone is not favorable for directional trades.

Potential Trade Setup – Range-Bound Play

Example Trade 1: Long Crude Oil

• Entry: 59.91

• Stop: 59.20

• Target: 61.76

• Risk: 71 ticks

• Reward: 185 ticks

• Risk/Reward Ratio: 2.6R

Example Trade 2: Long Crude Oil

• Entry: 58.80

• Stop: 58.20

• Target: 61.76

• Risk: 60 ticks

• Reward: 296 ticks

• Risk/Reward Ratio: 4.93 R

Important Notes:

• These are example trade ideas and not financial advice or recommendations.

• Traders should conduct independent analysis and ensure proper risk management.

• Stop-loss orders are not guaranteed; slippage may occur, resulting in losses beyond predefined levels.

• AVWAP levels are accurate at the time of posting, they may vary as indicator further calculates prices with new volume and price information.

Glossary Index for all technical terms used:

ATH: All time high

VPOC: Volume Point of Control

VAL: Value Area Low

VAH: Value Area High

VP: Volume Profile

AVP: Anchored Volume Profile

C: Composite (prefix before VAL, VAH, VPOC, VP, AVP)

mC: micro-Composite (prefix before VAL, VAH, VPOC, VP, AVP)

AVWAP: Anchored Volume Weighted Average Price

Green Zones: Bull/ Buyers support zones

Red Zones: Bear/Seller resistance zones

WTI Crude Oil CL Futures Weekly Plan AnalysisNYMEX:CL1!

In this tradingview blog, we will refer to our February 18, 2025 weekly trade plan for NYMEX WTI CL futures . Last week, we outlined two potential scenarios, with our primary scenario playing out—though not exactly as expected. Prices reversed lower more sharply than anticipated, offering minimal pullbacks on the 4-hour timeframe. However, when analyzing the hourly chart, our plan aligned well, as prices ultimately reverted to key LIS/yearly open bull support, which also confluences with the 2025 VAL.

We highlighted the following key levels:

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 72.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1 stated “Range bound week ahead.” We noted the following:

“In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.”

Consistency is key in everything we do. We are creatures of habit. Energy flows where attention goes.

We provide these weekly plans to traders and the wider public to showcase that, instead of strategy hopping, a trader can achieve consistency by sticking to one approach. If that approach is not working, perhaps it is time to go back to the drawing board. Whether that be backtesting, walk-forward optimization or incorporating key market statistics that you have gathered and observed.

The goal of these weekly plans is to provide you with a structured roadmap that you can adapt to your own trading style. In our experience, while there are many ways to approach the market—whether through different indicators or methods for drawing levels and plans—staying consistent in your approach often leads to identifying similar key levels. Volume, price and time leave behind footprints. Although they do not provide a certain future, they can help you stay grounded, accepting the random nature of the markets, thinking in terms of probabilities and perhaps learning more so you can also gain similar insights.

As Bruce Lee said, “I do not fear a man who practiced different kicks a thousand times. I would fear a man who practiced the same kick a thousand times.”

Is CL looking bearish? Short below LIS/Yearly Open?NYMEX:CL1!

Macro update:

Will we see another bullish leg like Jan 2025? Or does crude oil have room to move further lower and resume its downtrend after putting in the high of the year?

In our opinion, most headlines since the new US administration have already been priced in by market participants.

Crude oil fundamentals—encompassing supply, production, and demand outlook—are likely to influence prices more significantly than headline news. Our analysis indicates that the market has rebalanced, trading above the Composite Volume Point of Control (CVPOC) at $68.45 per barrel, as derived from our 2022 anchored Composite Volume profile. Furthermore, the 2025 Volume profile is exhibiting a “b”-shaped formation, signaling a move toward balance in its lower range.

From a market auction perspective, two key price ranges are established:

Q4 2024 Lower Distribution: Approximately $65–$70, indicating a balanced market.

Q1 2025 Value Area: Approximately $70–$75, also reflecting balance.

In our analysis, it’s essential to adopt a broader view by examining higher timeframe levels to stay aligned with these key market levels. While intraday or intrawork trends may display bearish or bullish momentum, the overall market auction framework suggests further consolidation within these ranges—unless new developments significantly alter the crude oil fundamentals or breaking headlines emerge that have yet to be priced in.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

Jan 2024 CVPOC and mCVPOC Q4 2024 confluence: 68.45 - 68.25

Key Bull Support/LIS: 69.90 - 70.50

Feb 2025 VAL: 70.80

2025 mCVPOC: 72.82

Feb 2025 VAH: 72.70

mCVAH/Jan 2025 mid: 74.96 - 74.80

Scenario 1:

Price gets above key support to further consolidate within Feb 2025 Value Area

Scenario 2:

Intraday bullish price action with higher lows that fails to gain momentum above the 2025 VPOC.

Scenario 3:

Price holds below Yearly Open and LIS key support. A bearish head and shoulders pattern develops to push prices lower to test CVPOC 2022.

Micro CME contracts allow for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

Does our LIS hold? Weekly CL Trade IdeaNYMEX:CL1!

Macro Update:

There are a lot of market moving events taking shape on the macro landscape.

Peace negotiations between warring countries, reciprocal trade tariffs, and a US-Iran nuclear deal.

We need not mention that any of these events may potentially turn market sentiment risk on or risk off. It all depends on how these all unfold.

On the economic front, we have rate decisions from various central banks. Most central banks reiterate cautious cuts and turn hawkish amidst concerns about the rising inflation outlook. Central banks are also pointing towards rising uncertainty on the outlook itself as we mentioned above. It all depends on how events unfold.

WTI Crude Oil Big Picture:

Viewing a weekly full session WTI crude oil chart, we can see 3 weeks of one time framing up on the weekly chart starting Dec 30th, 2024. We then saw a rejection of uptrend and prices reverting to 2024 Value area. We can see four bearish weekly candlesticks from the week starting Jan 20th, 2025. Last week, the price action on the weekly timeframe formed an inverted hammer showing bearish pressure increasing on WTI crude oil. Our key LIS and key bull support show the confluence of multiple market generated levels has held up for the past 3 weeks.

Traders take note that WTI crude oil futures contract has rolled over to April 2025 contract. Symbol: CLJ2025

In addition, DOE WTI inventory numbers will be released on Thursday 11am CT due to US President’s Day on Monday February 17th, 2025.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

2025 mcVPOC: 72.82

Feb 2025 mcVAH: 7 2.48

2025 mcVAL: 70.56

Yearly Open/ LIS: 70.52

Key Bull Support/ Confluence Zone: 70.52 - 70.12

Scenario 1: Range bound week ahead

In this scenario we expect range bound price action contained within Feb 2025 micro composite Value Area.

Scenario 2: Risk-off sentiment shift prices below key LIS

In this scenario, we may see a breakdown of our key bull support and Line in Sand. Price moves and stays below yearly open price, providing a possible shift lower towards composite volume point of control (CVPOC).

Micro CME contracts allow for more precise risk management during volatile market conditions. Additionally, you can participate in the CME and TradingView paper trading competition, giving you the opportunity to test your skills in The Leap without risking real money.

Crude Oil Trade Idea: Bounce from Support or Rally to $80?Macro Update

Index futures sold off during overnight trading as market sentiment turned risk-off.

Newswires reported that, after Colombia denied entry to two U.S. deportation aircraft, President Trump announced emergency tariffs of 25% on all Colombian imports, with plans to increase them to 50% next week. Additionally, The Wall Street Journal noted growing support among President Trump's advisors to impose 25% tariffs on Canada and Mexico as early as Saturday to initiate negotiations.

Meanwhile, Chinese startup DeepSeek is challenging U.S. dominance in the AI sector by introducing a low-cost model rivaling OpenAI's o1. This development may intensify geopolitical and economic tensions.

Adding to the unease, Chinese Manufacturing and Non-Manufacturing PMIs missed expectations. Manufacturing PMI came in at 49.1, below the forecast of 50.1. Markets in China and most of Asia will remain closed starting Tuesday for the Lunar New Year holiday, which could lead to lower regional liquidity.

Looking ahead, the week features several high-impact events:

Wednesday, January 29:

Federal Reserve interest rate decision and the first FOMC press conference of 2025.

Bank of Canada interest rate decision.

Thursday, January 30th:

ECB interest rate decision

Preliminary Q4 GDP data (QoQ).

Friday, January 31st:

Core PCE Price Index (Dec).

Crude Oil Futures Update

Our prior trade idea from January 13 played out well, with Scenario 1 materializing. While prices briefly approached $80, crude oil futures have since retreated to trade near the $74 handle.

As we close out January, here’s an updated map of key levels to watch:

Key Observations:

On the chart, we can see a downtrend channel after the recent push higher in crude oil. Our blue zone is our LIS (73.65 - 74 zone).

We see the market pulling back towards the confluence of 2024 VAH, 2024 mid range and 2025 yearly open. This is our key support for bulls to take long trade.

Scenario 1: Down and Back Up

Watch for a pullback toward the key confluence zone from our LIS. A bounce from this confluence zone could offer a strong opportunity for bulls to take long trades, targeting higher levels.

Scenario 2: Rally Toward $80

If prices reclaim the January 2025 mid-range and confirm bullish setups, long trades targeting a move back toward monthly highs in the $80 range may develop.

For risk management during volatile conditions, traders can consider Micro Crude Oil Futures . Managing risk is paramount, as losses are an inherent part of trading.

This week’s data releases, geopolitical developments, and tariff announcements are likely to shape market sentiment. Stay cautious and adapt to new information as it unfolds. Risk management remains the cornerstone of success in volatile markets.

Not confident to incorporate these into your trading plan? Why not incorporate our trade ideas to your trade plan in TradingView and CME’s paper trading competition; “The Leap”.

Are CL Futures starting a new bull trend in 2025?Crude Oil WTI Nymex Futures

NYMEX:CL1!

Big Picture:

Crude Oil WTI NYMEX Futures Update – January 2025

Crude Oil WTI NYMEX futures are trading higher, with bullish price action evident at the start of 2025. Price has broken above the 2024 Composite Value Area High (CVAH) and is now approaching the Composite Value Area High from the 2022 high, as shown in the chart above.

Macroeconomic Outlook

From a global perspective, persistent inflation may be supported by elevated commodity prices. Higher crude oil prices, coupled with potential trade wars and tariffs, could drive up costs in major sectors, such as rare earth minerals.

In this scenario, we anticipate central banks, including the Federal Reserve, maintaining higher interest rates. We believe the previously expected two rate cuts of 25 basis points each for this year may be reduced to zero. However, this creates a challenging environment for central banks. A combination of sticky inflation, resilient job markets, and low unemployment could lead to a "goldilocks" scenario. Recessionary risks will be increased unless some means of fiscal policy measures provide further support to the US economy.

Key Levels to Watch

Key levels represent areas of interest and zones of active market participation. The more significant a key level, the closer we monitor it for potential reactions and trade setups in alignment with our trading plan.

CVAH: 79.50

Resistance R1: 79.50 – 79.85

Resistance R2: 81.30 – 81.60

Neutral Level: 78.77

CVAH 2024 / Support: 75.00

Support (Yearly Open): 71.85

Scenario 1: Exhausted Buyers, Mean Reversion

In this scenario, we anticipate range-bound price action, offering a potential short opportunity if buyers appear exhausted. Price action and volume analysis would need to confirm this. Look for absorption around the neutral zone or below R1/CVAH, with prices failing to push higher. A lower high and seller dominance would confirm a mean reversion short setup.

Scenario 2: Breakout Above CVAH

A confirmed breakout above CVAH could indicate further bullish price discovery and the potential for a new uptrend. Consolidation above CVAH followed by strong price action would provide a trigger for long positions. However, significant resistance at this level necessitates confirmation via price action and volume analysis before taking action.

Scenario 3: Swing Failure at CVAH

In this scenario, prices rise above the neutral zone and R1/CVAH, but sellers regain control, pushing prices lower. A swing failure candle with a long wick near the resistance zone would indicate the failure. A subsequent higher low could present a short opportunity for a mean reversion trade.

We encourage you to monitor these levels closely and incorporate them into your trade planning. Share your thoughts or insights on these key levels in the comments below.

WTI Crude Oil 2024: Range-Bound Trends and Key LevelsBig Picture:

WTI Crude Oil Futures prices have been largely range-bound for most of 2024 with yearly low of 62.54 and high at 81.75 defining the trading range. Analyzing the Composite Volume Profile since January 2022 reveals that 2024’s price action has been contained within the Composite Value Area High (CVAH) at $79.91 and Composite Value Area Low (CVAL) at $63.57

We further note that while there are many bearish and bullish analyses for crude oil floating from different market analysts, market auction theory and charts point towards further range bound price action for December 2024 and foreseeable 2025 ahead until proven otherwise.

OPEC+ meeting is scheduled to take place on December 5th, 2024. It was previously planned to take place on Dec 1st, 2024. The change accommodates the Kuwait Summit, with Saudi Arabia and its allies expected to discuss production quotas—a decision that could influence market dynamics.

Additionally, U.S. crude oil production in 2024 has reached record-high levels.

Geopolitical issues have not had a major impact on Crude prices as prices remain range bound. Intraday volatility remains amidst geopolitical uncertainty.

WTI Crude Oil Key Levels:

CVAH : 79.91

CVAL : 63.57

2024 Yearly Mid : 72.15

2024 Yearly Lo : 62.54

2024 CVAH : 75.60

2024 CVAL : 66.97

Market Scenarios:

Short Term Resistance (2024 Mid and CVAH) : Price movements toward the upper range (CVAH at $79.91 or $75.60) could signal buyer exhaustion, with limited upside momentum expected.

Short Term Support (CVAL and Yearly Low) : Movements toward lower levels (CVAL at $63.57 or $66.97) may indicate seller exhaustion, preventing a significant breakdown.

As crude oil remains range-bound, traders should monitor these key levels and the OPEC+ meeting outcomes for potential catalysts. Until then, the market appears set to maintain its current trading range.

Disclaimer : The views expressed are personal opinions and should not be interpreted as financial advice. Derivatives involve a substantial risk of loss and are not suitable for all investors.

Platinum: Not yet done 📉We currently locate the platinum price in the green wave (b). As soon as this low has been placed little further down the chart, we expect another major detour with green waves X and Y before we can consider the important low of the blue wave (b) to be completed. Please note our alternative: If the price falls directly below the support at $843.10 (40% likely), we assume that the alternative wave alt. (b) will be completed directly.

NatGas: Dived in 🤿 🌊The price of NatGas has now reached the turquoise target zone between $2.98 and $2.77. Here we expect a turning point with the low of the turquoise wave (ii), ideally at the 78.60% retracement of the zone. From there, the price should move higher in large steps until it completes the orange wave (iii) at $4.60.

WTI: Unstoppable 🚀WTI is riding a robust bullish wave, propelling it to its highest levels in 10 months. In our analysis, we anticipate that, to complete the blue wave , it must surpass the resistance at $93.74. Subsequently, a noteworthy descent is in the cards. It’s essential to note that a dip below $73.89, though with a 38% probability in our estimation, signifies a further decline within the green wave alt. .

Special Report: Celebrating 40 Years of Crude Oil FuturesNYMEX: WTI Crude Oil ( NYMEX:CL1! )

On March 30, 1983, New York Mercantile Exchange (NYMEX) launched futures contract on WTI crude oil. This marked the beginning of an era of energy futures.

WTI is now the most liquid commodity futures contract in the world. It’s 1.7 million daily volume is equivalent to 1.7 billion barrels of crude oil and $125 billion in notional value. For comparison, global oil production was 89.9 million barrels per day in 2021.

Looking back at 1983, exactly 40 years ago:

• NYMEX was primarily a marketplace for agricultural commodities, with Maine Potato Futures being its biggest contract;

• NYMEX was a small Exchange with 816 members, mainly local traders and brokers;

• Known as Black Gold, crude oil was a strategic commodity regulated by governments and monopolized by the Big Oil, the so-called “Seven Sisters”;

• Pricing of crude oil was not a function of free market but controlled by the Organization of Petroleum Export Countries (OPEC), an oil cartel.

The birth of crude oil futures contract was a remarkable story of financial innovation and great vision. Facing a “Mission Impossible”, NYMEX successfully pulled it off. At the helm of the century-old Exchange was Michel Marks, its 33-year-old Chairman, and John E. Treat, the 37-year-old NYMEX President.

The “Accidental Chairman”

Michel Marks came from a long-time NYMEX member family. His father, Francis Q. Marks, was a trading pit icon and influential member. Since high school, the younger Marks worked as a runner on the trading pit for his family business. After receiving an Economics degree from Princeton University, Michel Marks returned to NYMEX as a full-time member, trading platinum and potatoes.

In 1977, the entire NYMEX board of directors resigned, taking responsibility for the Potato Futures default from the prior year. Michel Marks was elected Vice Chairman of the new Board. He was 27 years old.

One year later, the Chairman at the time suffered a stroke. Michel Marks replaced him as the new NYMEX Chairman. At 28, he’s the youngest leader of any Exchange in the 175-year history of modern futures industry.

White House Energy Advisor

John E. Treat served in the US Navy in the Middle East and later worked as an international affairs consultant in the region. He received an Economics degree in Princeton and a master’s degree in international relations from John Hopkins.

During the Carter Administration (1977-1981), Treat worked at the US Department of Energy. He served as Deputy Assistant Secretary for International Affairs and sat on the National Security Council and the Federal Energy Administration. In his capacity, Treat was at the center of the formation of US energy policy.

After President Carter lost his reelection bid, Treat left Washington in 1981. At the time, NYMEX was exploring new contracts outside of agricultural commodities. One possible direction was the energy sector, where NYMEX previously listed a Heating Oil contract with little traction in the market. With his strong background, Treat was recruited by NYMEX as a senior vice president.

A year later, after then President Richard Leone resigned, Treat was nominated by Chairman Marks to become NYMEX President. He was 36 years old.

The Birth of WTI Crude Oil Futures

In 1979, the Islamic Revolution in Iran overthrew the Pahlavi dynasty and established the Islamic Republic of Iran, led by Shiite spiritual leader Ayatollah Khomeini.

Shortly after, the Iran-Iraq War broke out. Daily production of crude oil fell sharply, and the price of crude oil rose from $14 to $35 per barrel. This event was known as the second oil crisis. It triggered a global economic recession, with U.S. GDP falling by 3 percent.

After President Reagan took office in 1981, he introduced a series of new policies, known as Reaganomics, to boost the U.S. economy. The four pillars that represent Reaganomics were reducing the growth of government spending, reducing federal income taxes and capital gains taxes, reducing government regulation, and tightening the money supply to reduce inflation.

In terms of energy policy, the Reagan administration relaxed government regulations on domestic oil and gas exploration and relaxed the price of natural gas.

NYMEX President John Treat sensed that the time was ripe for energy futures. He formed an Advisory Committee to conduct a feasibility study on the listing of crude oil futures. His strategic initiative received the backing of Chairman Michel Marks, who in turn gathered the support of the full NYMEX membership.

Arnold Safir, an economist on the advisory board, led the contract design of WTI crude oil futures. The underlying commodity is West Texas Intermediate produced in Cushing, Oklahoma. The delivery location was chosen for the convenience of domestic oil refineries. WTI oil contains fewer impurities, which results in lower processing costs. US refineries prefer to use WTI over the heavier Gulf oil.

WTI trading code is CL, the abbreviation of Crude Light. Contract size is 1,000 barrels of crude oil. At $73/barrel, each contract is worth $73,000. Due to the profound impact of crude oil on world economy, NYMEX lists contracts covering a nine-year period.

On March 29, 1983, the CFTC approved NYMEX's application. The next day, WTI crude oil futures traded on the NYMEX floor for the first time.

Competing for the Pricing Power

Now that crude oil futures were listed. Initially, only NYMEX members and speculators were trading the contracts. All the oil industry giants sat on the sidelines.

John Treat knew that without their participation, the futures market could not have meaningful impact on the oil market, not to mention a pricing power over crude oil.

In early 1980s, the global oil market was monopolized by seven Western oil companies, known as the "Seven Sisters". Together, they control nearly one-third of global oil and gas production and more than one-third of oil and gas reserves.

1) Standard Oil of New Jersey, later became Exxon;

2) Standard Oil of New York, later became Mobil Oil Company; It merged with Exxon in 1998 to form ExxonMobil;

3) Standard Oil of California, later became Chevron; It took over Texaco in 2001, and the combined company is still named Chevron;

4) Texaco, collapsed in 2001 and was taken over by Chevron;

5) Gulf Oil, which was acquired by Chevron in 1984;

6) British Persian Oil Company, operating in Iran, withdrew after the Iranian Revolution and then fully operated the North Sea oil fields, later British Petroleum ("BP");

7) Shell, an Anglo-Dutch joint venture.

Treat's background as President Carter's energy adviser played a key role. After nearly a year of hard work, the first Big Oil entered the NYMEX crude oil trading floor. However, it was not until five years later that all Seven Sisters became NYMEX members.

OPEC producers tried to boycott the crude oil futures market. However, as trading volume grew, they eventually gave in, first by Venezuela and then the oil producers in the Middle East.

Interestingly, the Middle Eastern oil producers started out by trading COMEX gold futures, probably as a hedge against oil prices. Gold has been a significant part in the Middle Eastern culture for long. As the main buyers of gold, the Arabs buy more gold when their pockets are filled with rising oil prices, and conversely, they sell gold when oil revenues fall and their ability to buy gold decreases.

With the participation of Big Oil and OPEC, coupled with an active crude oil options market, crude oil pricing power has shifted from the Middle East to NYMEX's trading floor by the end of the 1980s. WTI has also become a globally recognized benchmark for crude oil prices.

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

USOILOil prints this great weekly candle, which suggests that price is going to revert back into Value, and deems the excessively high oil prices as a tad overpriced, which is great. We have this big weekly pin inside the range of the previous candle, and typically these produce some great trades as the bearish pressure starts to build, we can look to aim for three trade points from here. Enjoy.

Shorting Palladium FuturesPalladium is in a strong downtrend right now. In fact, in the Trend Following Market Trends Barometer , it is the strongest trend with a value of over 70%.

We are opening short positions at market price with a very strong risk management metric - as always - aiming to surf the downtrend and lose only 0.5% of our portfolio value if there is a pullback. Our target is around 1505, but the exit will be through volatility and trailing stops.

As we can see, the trend has an RSI of 39.70 on the weekly chart. It is below the 210, 70 and 14 SMA's, and has broken a trend line support. There are opportunities to follow the trend.

We can open more positions further if the trend remains bearish and close them on a percentage basis if sharp pullbacks occur. Again, it depends on volatility and trailing stops. The system is automated.

Product. Palladium futures (NYMEX). No CFDs or other OTC derivatives for now.

Position: Sell, market price.

Stop loss: around 1 800 (trailing stop, we can re-enter if there is a pullback).

Target: Around 1 500 (we won't manually close, the TL stop will).

Resizing: We can open more positions if the trend is strong.

Risk: High.