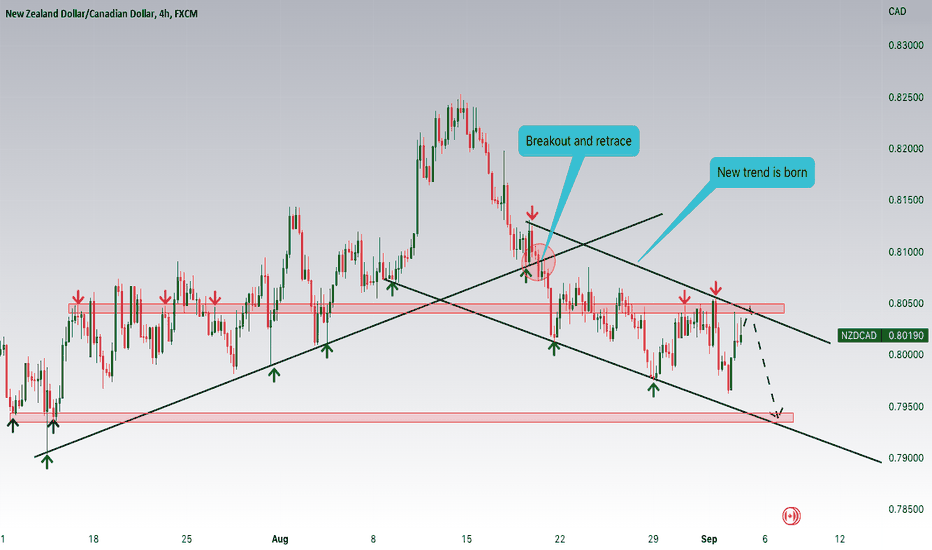

Joe Gun2Head Trade - Gap fill on NZDCADTrade Idea: Selling NZDCAD

Reasoning: Filled the overnight gap at likely to head lower

Entry Level: 0.8016

Take Profit Level: 0.7962

Stop Loss: 0.8031

Risk/Reward: 3.67:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Nzd-cad

NZDCAD 1D MA50 is the key. Sell below, buy above.The NZDCAD pair has offered us an excellent pattern for a sell high/ buy low plan on our previous analysis more than two months ago:

As you see, we were successful on the sell exactly on the 1D MA50 (blue trend-line) rejection and the buy on the Lower Lows trend-line of both the Megaphone and Channel Down patterns.

Right now there is a conflict as to where we could be in relation to the prior formations. This may be a quick accumulation below the 1D MA50 similar to July 30 2021 (green circle) or a failure below the 1D MA50 similar to April 15 2022.

The 1D MA50 can give the solution to this. As long as 1D candles close below it, the action is a sell targeting first the 0.79100 Support and the 1.5 Fibonacci extension (0.7745) as part of a new Lower Low formation. A closing above the 1D MA50 though, should be taken as a bullish signal, targeting the 0.8250 Resistance and potentially the 1D MA200 (orange trend-line).

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

LONG NZDCAD on Daily ChartThe tradeWELL FX algo printed a countertrend entry-with-trigger on long NZDCAD on 08/01 with entry between 0.80885 and 0.81135. Initial target at 0.82750 with stop at 0.79020 trailing.

The pair completed an orthodox head-and-shoulders pattern.

Market sentiment is neutral, slightly favoring the bulls.

NZDCAD Testing the 1D MA50 and following exactly our planThe NZDCAD pair couldn't have traded better lately as it has been following exactly the trading plan we posted on June 17:

As you see after a rebound to the 1D MA50 (blue trend-line) and rejection, the pair made a Lower Low exactly at the bottom of both the Bearish Megaphone and Channel Down patterns, which is where we advised for a buy. Since then has been slowly rising for the past 2 weeks and is now again testing the 1D MA50. A break above, justifies our expectation that all this price action since March has a mirror pattern of March - July 2021. The target is at least the 1D MA200 (orange trend-line).

On the other hand, if the price gets rejected on the 1D MA50, be ready to take an opposite position and sell targeting the 2.0 Fibonacci extension, which is what took place on the December 30 2021 rejection.

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

NZD/CAD over 520 pips moveI will be doing a multi time frame analysis of this pair. Starting from the monthly all the way down to the daily.

Monthly:

Price is currently in a downtrend making lower lows and lower highs. We could expect the formation of a lower low. Also there is a zone of demand that has not been clearly tested yet. We could expect the price to test the demand zone below the current previous low for a liquidity run.

Weekly

Price is clearly In a downtrend. We could expect the creation of a new impulse. The reason we could expect the creation of a new impulse is because below the low there is a demand zone that has no been tested yet. There is liquidity sitting below the low which we could expect the market to reach that zone.

Daily

Price is creating higher highs and higher lows. The price is in an uptrend. To look for a short opportunity we have to wait for the price start creating lower lows and lower highs.

approach:

Wait for the daily switch of environment. If you want to have a better entry with a better risk reward look for opportunities in lower time frames

NZDCAD, next bullish impulse 600+ !Hi Traders,

Price action is shaping up to give a nice bullish impulse run. Looking at the HTF, price is at the bottom boundary of a bullish continuation structure which has already made multiple swing highs/lows with an inverted head & shoulders pattern forming. Look for entries on the LTF this upcoming week.

Trade Safe!