NZD (New Zealand Dollar)

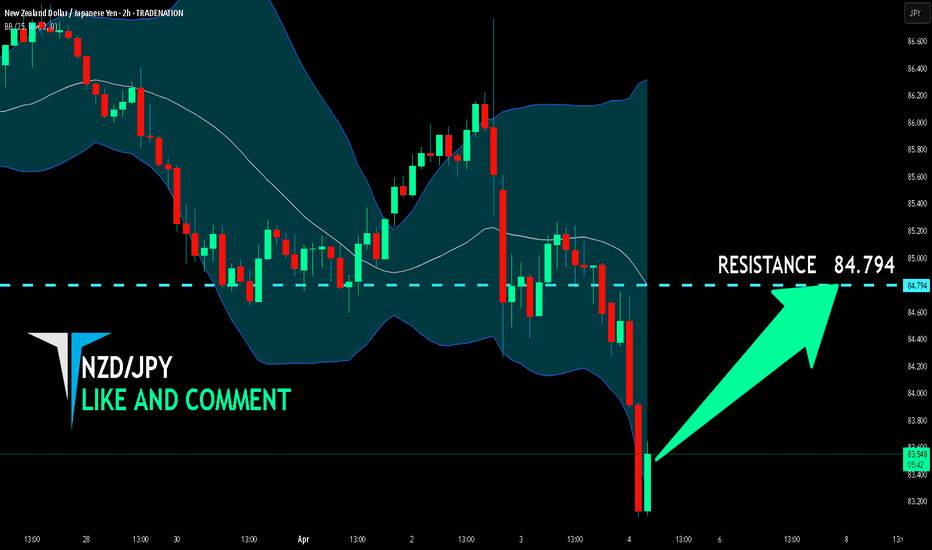

NZD/JPY BEST PLACE TO BUY FROM|LONG

Hello, Friends!

NZD/JPY pair is in the uptrend because previous week’s candle is green, while the price is evidently falling on the 2H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 84.794 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP_NZD LONG FROM RISING SUPPORT|

✅GBP_NZD is trading along

The rising support

And as the pair will soon retest it

I am expecting the price to go up

To retest the supply levels

Above at 2.2659

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish bounce for the Kiwi?The price is falling towards the support level which is a pullback support that is slightly above the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.5761

Why we like it:

There is a pullback support level that is slightly above the 50% Fibonacci retracement.

Stop loss: 0.5713

Why we like it:

There is a pullback support level that lines up with the 71% Fibonacci retracement.

Take profit: 0.5831

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDUSD: Rejection possible on the 1D MA200.NZDUSD is bullish on its 1D technical outlook (RSI = 60.829, MACD = 0.001, ADX = 25.517) as it is on the bullish wave of the 8 month Channel Down. The trend should be turning bearish soon however as not only is the pair approaching the top of the Channel Down but also the 1D MA200 and has completed a +6.18% increase like the June 12th 2024 high did. The 1D RSI is already ranged and is losing momentum so this may be the perfect level to sell. The trade is short, aiming at the S1 level (TP = 0.55250).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

GBPNZD: Bullish Forecast & Outlook

Looking at the chart of GBPNZD right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBP/NZD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

GBP/NZD is making a bearish pullback on the 1H TF and is nearing the support line below while we are generally bullish biased on the pair due to our previous 1W candle analysis, thus making a trend-following long a good option for us with the target being the 2.264 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Could the price bounce from here?NZD/JPY is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 84.49

1st Support: 83.49

1st Resistance: 85.54

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?NZD/CAD has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.81458

1st Support: 0.81095

1st Resistance: 0.82317

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY The Target Is UP! BUY!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 85.141

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 86.026

My Stop Loss - 85.089

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Could the Kiwi reverse from here?The price is risng towards the resistance level which is aa pullback resistance that lines up with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.5760

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 0.5810

Why we like it:

There is a pullback resistance level.

Take profit: 0.5689

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZDCHF: Will Start Falling! Here is Why:

The recent price action on the NZDCHF pair was keeping me on the fence, however, my bias is slowly but surely changing into the bearish one and I think we will see the price go down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDUSD - Like a Bow and Arrow!!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDUSD has been overall bullish trading within the rising wedge pattern marked in blue.

Today, NZDUSD is retesting the lower bound of the wedge.

Moreover, it is approaching a strong structure marked in green.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of structure and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #NZDUSD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

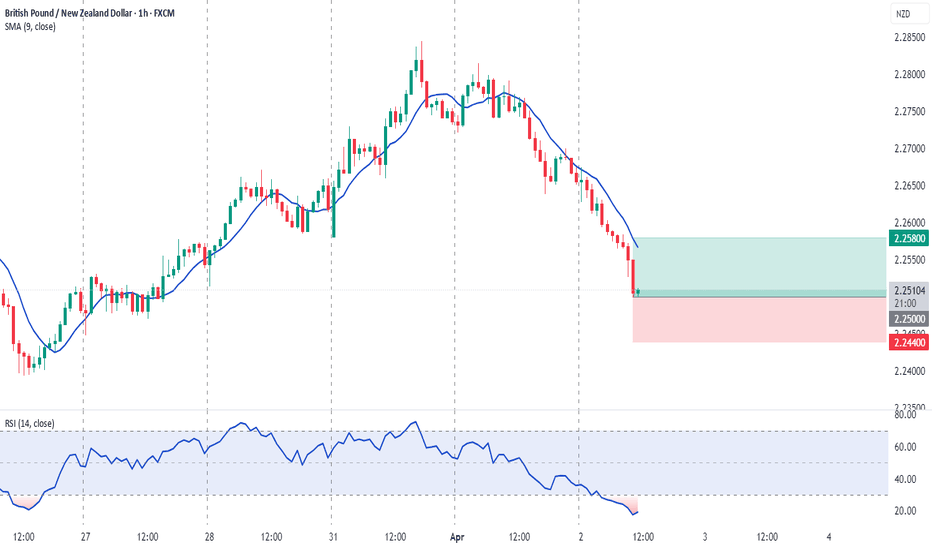

GBPNZD Will Grow! Long!

Here is our detailed technical review for GBPNZD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 2.253.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 2.277 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Bullish bounce?NZD/CAD has bounced off the pivot which acts as a pullback support and could rise to the 1st resistance which is a pullback resistance.

Pivot: 0.81458

1st Support: 0.81069

1st Resistance: 0.82317

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish reversal off pullback resistance?NZD/USD is rising towards the resistance level which is a pullback resistance that line sup with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.5712

Why we like it:

There is a pullback resistance level that lines up with the 61.8% Fibonacci retracement.

Stop loss: 0.5747

Why we like it:

There is a pullback resistance that is slightly above the 50% Fibonacci retracement.

Take profit: 0.5648

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD_JPY BEARISH BREAKOUT|SHORT|

✅NZD_JPY is going down

After the bearish breakout

Which reinforces our bearish

Bias and we will be expecting

A further bearish move down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD Will Fall! Sell!

Please, check our technical outlook for NZDCAD.

Time Frame: 2h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.816.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.813 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

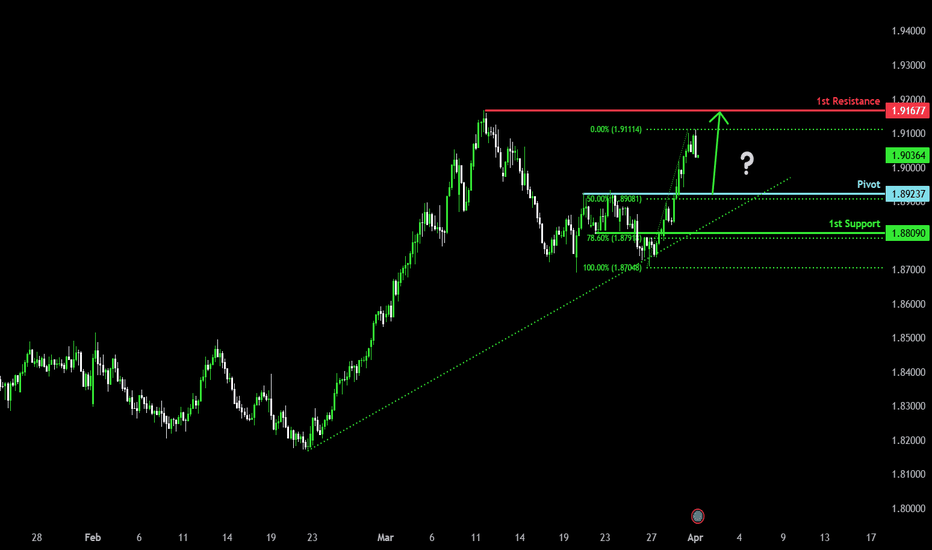

Falling towards 50% Fibonacci support?EUR/NZD is falling towards the pivot which has been identified as a pullback support and could bounce to the pullback resistance.

Pivot: 1.89237

1st Support: 1.88090

1st Resistance: 1.91677

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.