NZD_CHF RISKY LONG|

✅NZD_CHF is going down to retest a horizontal support of 0.5050

Which makes me locally bullish biased

And I think that we will see a rebound

And a move up from the level

Towards the target above at 0.5073

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZD (New Zealand Dollar)

Bullish bounce off overlap support?NZD/USD is falling towards the support level which is an overlap support that lines up with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.5695

Why we like it:

There is an overlap support level that lines up with the the 50% Fibonacci retracement.

Stop loss: 0.5638

Why we like it:

There is a pullback support level that lines up with the 78.6% Fibonacci retracement.

Take profit: 0.5764

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD/JPY Bearish Opportunity – Resistance Rejection & Weak NZ Eco🔹 Current Price: 86.46

✅ TP1: 85.84 – First Support Level

✅ TP2: 85.22 – Intermediate Support

✅ TP3: 84.12 – Major Support Zone

🔻 Stop Loss: 87.57 (Above Resistance)

🔥 Why Are We Bearish?

1️⃣ Strong Resistance Rejection & Bearish Indicators

Price is rejecting a strong resistance zone (87.00-87.57), where sellers have stepped in before.

MACD Bearish Crossover confirms downside momentum.

RSI Reversal from Overbought suggests a cooling-off period for buyers.

2️⃣ Weakening New Zealand Economy

Consumer confidence dropped to 89.2 (previously 97.5) in Q1 2025, signaling economic slowdown.

New Zealand GDP expected to contract by 0.8% in 2025, adding bearish pressure.

The RBNZ remains cautious about interest rate hikes, reducing NZD's strength.

3️⃣ Technical Setup Aligns with the Short Trade

Key Resistance Holding: 87.00-87.57 area has historically rejected price.

Bearish MACD & RSI Divergence indicate momentum is fading.

Potential Breakdown to 84.12 if support levels fail.

📌 Conclusion

NZD/JPY is rejecting a strong resistance level, with bearish technical indicators and weak fundamentals in New Zealand’s economy supporting further downside. This setup offers a high-probability short trade for both swing traders and short-term setups.

NZDJPY Potential DownsidesHey Traders, in today's trading session we are monitoring NZDJPY for a selling opportunity around 85.800 zone, NZDJPY is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 85.800 support and resistance area.

Trade safe, Joe.

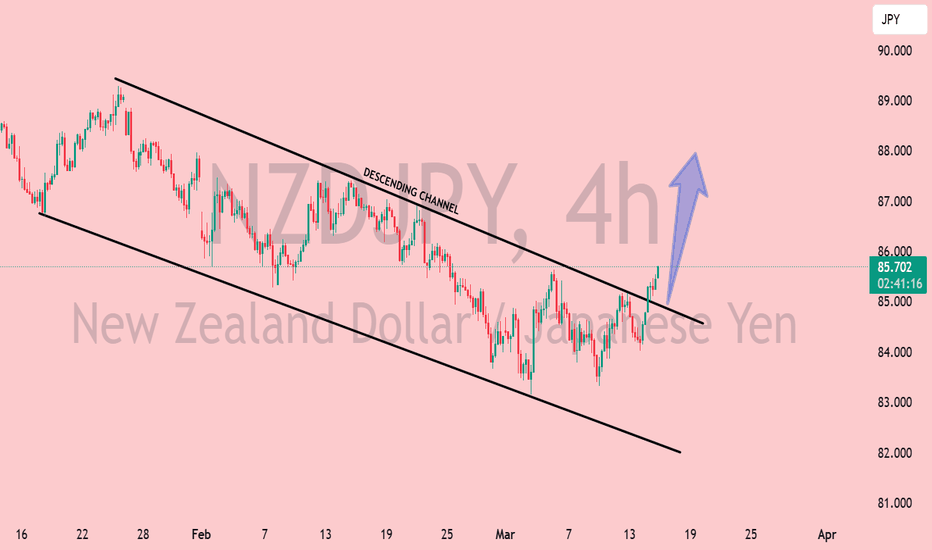

NZDJPY - Shifting Trends Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉NZDJPY has been overall bearish , trading within the falling channel marked in red.

However, it is currently retesting the lower bound of the channel which lines up perfectly with the support zone marked in blue.

📈As per my trading style , as long as the support zone holds, I will be looking for buy setups on lower timeframes.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish drop?EUR/NZD has rejected of the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 1.88951

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bearish drop?NZD/CAD is rising towards the pivot and could drop to the 1st support.

Pivot: 0.82703

1st Support: 0.81897

1st Resistance: 0.83299

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce?NZD/JPY has bounced off the pivot and could rise to the 1st resistance level.

Pivot: 85.10

1st Support: 84.01

1st Resistance: 86.85

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

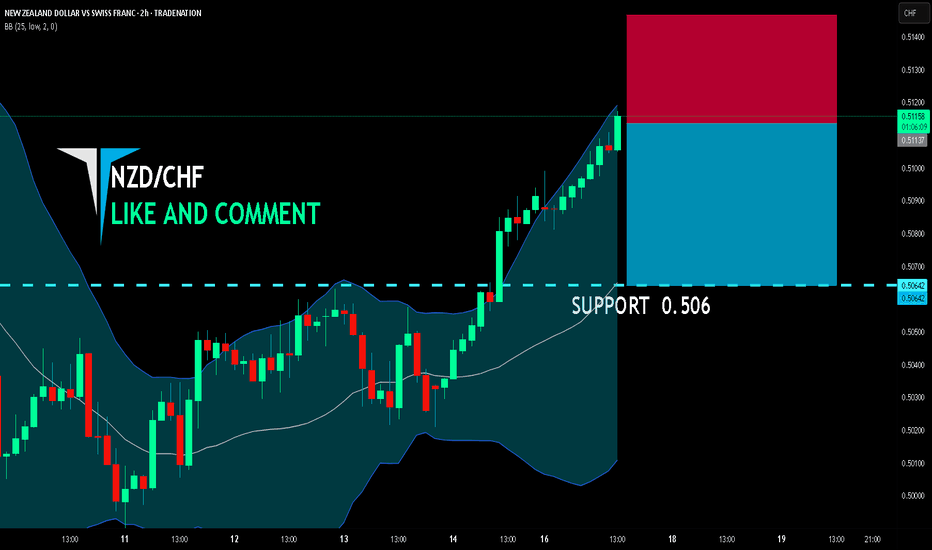

NZD/CHF BEST PLACE TO SELL FROM|SHORT

NZD/CHF SIGNAL

Trade Direction: short

Entry Level: 0.511

Target Level: 0.506

Stop Loss: 0.514

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 2h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Could the Kiwi drop from here?The price is rising towards the resistance level which is a pullback resistance that lines up with the 50% Fibonacci retracement and could drop from this level to our take profit.

Entry: 0.5801

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Stop loss: 0.5830

Why we like it:

There is a pullback resistance level.

Take profit: 0.5760

Why we like it:

There is a pullback support level that is slightly above the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop?NZD/JPY has reacted off the resistance level which is a pullback resistance and could drop from this level to our take profit.

Entry: 86.85

Why we like it:

There is a pullback resistance level.

Stop loss: 87.63

Why we like it:

There is a pullback resistance level.

Take profit: 85.71

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

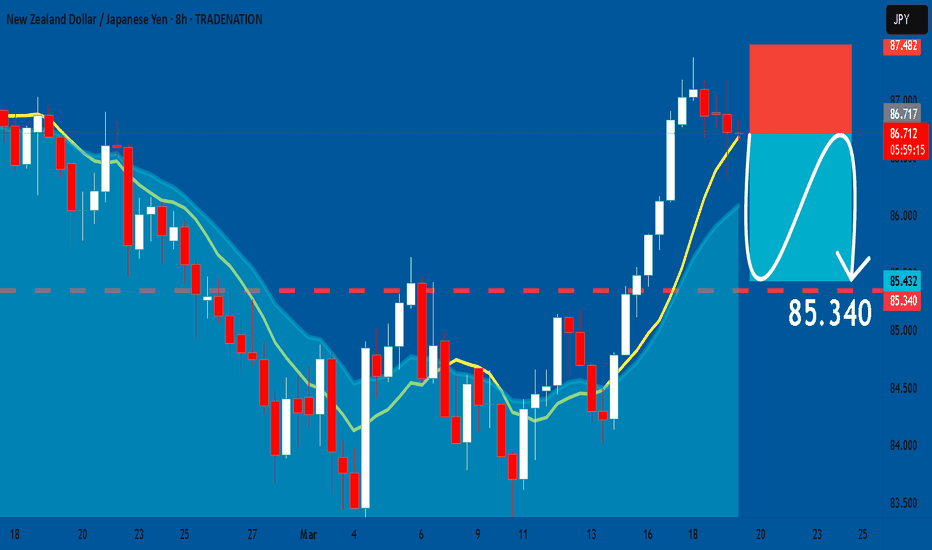

NZDJPY: Short Trading Opportunity

NZDJPY

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell NZDJPY

Entry - 86.726

Stop - 87.482

Take - 85.340

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZDJPY at Key Support Level - Rebound Towards 87.300?OANDA:NZDJPY has reached a significant support zone, highlighted by previous price reactions and strong buying interest. This area has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in.

The current market structure suggests that if the price confirms support within this zone, we could see a bullish reversal. A successful rebound could push the pair toward the 87.300 level, a logical target based on previous price behavior and current market dynamics. Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

NZD/JPY SELL 4H

Hi, my name is Andrea Russo and I am a Forex Trader. Today I want to talk to you about an interesting trade on the NZD/JPY cross.

I have currently decided to position myself in sale (short) on NZD/JPY at an entry price of 86,860, with a stop loss set at 87,840 and a target price of 84,190. I will explain my reasoning behind this choice and the technical and fundamental analyses that supported my decision.

Technical Analysis

Looking at the daily chart of NZD/JPY, I noticed a significant resistance in the area around 87,000, which in the past has repeatedly rejected attempts to increase the price. At the time of entry, the price was showing signs of weakness near the resistance, indicating to me an excellent opportunity for a short position. Furthermore, the RSI and MACD indicators were suggesting an overbought condition, reinforcing the possibility of an impending bearish move.

From an Elliott wave perspective, the cross appears to be in a possible corrective wave, with room for further downside towards the target level of 84,190.

Fundamental Analysis

On the fundamental side, the New Zealand Dollar (NZD) looks vulnerable due to the recent economic slowdown in New Zealand, while the Japanese Yen (JPY) has shown signs of strengthening as a safe haven, especially amid global uncertainty. Monetary policies from respective central banks point to a possible tailwind in favor of the Yen, further increasing the bearish outlook for the NZD/JPY pair.

Strategy

My strategy involves:

Short Price: 86,860

Stop Loss: 87,840 (to limit losses in case of contrary movements)

Target Price: 84,190 (key support area, representing a reasonable level of profit).

This trade is based on a balance between technical and fundamental analysis, with a favorable risk/reward ratio.

Conclusion

I remain alert for any news or market events that could affect the trade and adjust the strategy if necessary. Remember that Forex trading carries significant risks and is not suitable for all investors.

I hope this analysis can be useful to you. Happy trading and may the pips be in your favor!

NZD/JPY: Potential Reversal After Resistance TestThe NZD/JPY pair has been in a bullish trend for the past two weeks but has now encountered resistance, leading to sideways movement around this level. On the daily timeframe, a rejection candle has formed, though the price has yet to retest the February high, where liquidity remains.

There is a possibility that the price may attempt to capture this liquidity before turning lower, potentially forming a bearish divergence. If a rejection occurs at the 87.500 resistance level, the market could initiate a corrective move downward. The next key target is the support zone around 85.800

NZD/JPY Trendline Breakout (19.3.2025)The NZD/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Trendline Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 85.83

2nd Support – 85.10

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Bearish drop?EUR/NZD is rising towards the pivot and could drop to the 50% Fibonacci support.

Pivot: 1.88686

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

NZDJPY forming a top?NZDJPY - 24h expiry

The primary trend remains bearish.

Bearish divergence is expected to cap gains.

Preferred trade is to sell into rallies.

Rallies should be capped by yesterday's high.

Bespoke resistance is located at 87.00.

We look to Sell at 87.00 (stop at 87.40)

Our profit targets will be 85.40 and 85.10

Resistance: 87.30 / 87.70 / 88.00

Support: 86.30 / 85.50 / 85.00

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD/JPY BEST PLACE TO BUY FROM|LONG

Hello, Friends!

NZD/JPY pair is in the uptrend because previous week’s candle is green, while the price is evidently falling on the 1D timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 86.006 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

✅LIKE AND COMMENT MY IDEAS✅