Nzdcadsell

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Expecting pullbacks and bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

NZDCAD - Short Term Sell Trade Update!!!Hi Traders, on May 7th I shared this idea "NZDCAD - Looking To Sell Pullbacks In The Short Term"

I expected to see retraces and further continuation lower. You can read the full post using the link above.

Retrace and push lower happened as per the plan!!!

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDCAD - Looking To Sell Pullbacks In The Short TermM15 - Bearish divergence followed by the most recent uptrend line breakout.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

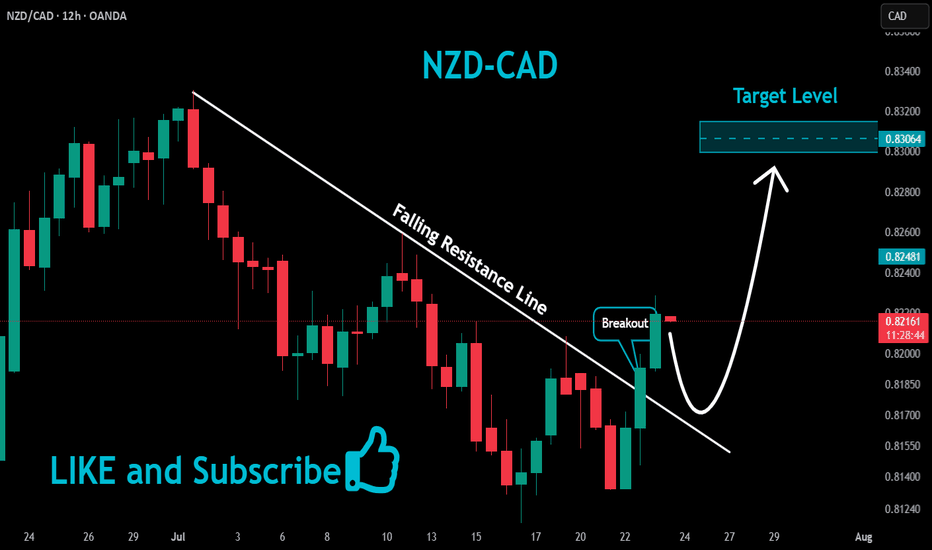

NZDCAD at Key Resistance Level: Will it Drop To 0.81608?OANDA:NZDCAD is approaching a key resistance level that has previously acted as a strong barrier, triggering bearish momentum in the past. This zone also aligns with prior supply areas where sellers have stepped in, making it a potential point of interest for those looking for short opportunities. Given its historical significance, how price reacts here could set the tone for the next move.

If bearish signals emerge, such as rejection wicks, bearish candlestick patterns, or signs of weakening bullish pressure, I anticipate a move toward the 0.81608 level. However, a clear breakout above this resistance could challenge the bearish outlook and open the door for further upside. It's a pivotal area where price action will likely provide clearer clues on the next direction.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with a proper risk management.

Best of luck!

#NZDCAD: Two Areas To Sell From! Swing SellThe NZDCAD has hit a critical level, and it might start going down from where we set our selling points. We also have two targets for when we should enter the market.

Good luck and trade safely!

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️

NZDCAD Discretionary Analysis: Bounce at 0.83Hello traders and happy Easter Monday!

I'm expecting a bounce on NZDCAD. I'm interested in this 0.83 zone. It might turn into a strong bounce point. If the signs are there, I'm jumping in with a short.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

#NZDCAD: Great Time To Swing Sell! Comment Your View! NZDCAD is at a critical selling level, and we expect a significant drop. The chart shows potential price reversals, either continuing in our direction or rising to the red circle before reversing. A risk-managed trade could benefit from this.

Good luck and trade safely!

Much Love ❤️

Team Setupsfx_

NZDCAD — Sell Setup at Key Resistance ZoneOANDA:NZDCAD has reached a key resistance zone, marked by prior price rejections, suggesting strong selling interest. This area has previously acted as a key supply zone, increasing the likelihood of a bearish reversal if sellers step in.

If the price confirms resistance within this zone through bearish price action—such as wick rejections or lower timeframe weakness—we could see a move toward 0.81780, which aligns with a logical target based on recent market structure.

However, if the price breaks and holds above this resistance area, the bearish outlook may be invalidated, potentially opening the door for further upside.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

NZDCAD - Short after BOS !!Hello traders!

‼️ This is my perspective on NZDCAD.

Technical analysis: Here we are in a bearish market structure from daily timeframe perspective, so I look for a short. We can see that price rejected from bearish OB + level 0.82000. As well we have hidden divergence for sell.

On H1 we have regular divergence, so I wait for a short position after BOS.

Fundamental news: Upcoming week on Wednesday (GMT+2) we will see results of Interest Rate on CAD. News with high impact on currencies.

Like, comment and subscribe to be in touch with my content!

NZDCAD - Look for a short position !!Hello traders!

‼️ This is my perspective on NZDCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. My point of interest is imbalance filled and rejection from bearish OB + institutional big figure 0.83000.

Like, comment and subscribe to be in touch with my content!

NZDCAD - Long from bullish order block !! Hello traders!

‼️ This is my perspective on NZDCAD.

Technical analysis: Here we are in a bullish market structure from 4H timeframe perspective, so I look for a long. My point of interest is price to fill the imbalance lower and then to reject from bullish OB.

Like, comment and subscribe to be in touch with my content!

NZDCAD SELL TF H4 TP = 0.8217On the H4 chart the trend started on Sept. 2 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 0.8217

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

7 Dimension 4RR Sell Setup for NZDCAD Core Analysis Method: Smart Money Concepts

Based on the Smart Money Concepts methodology, the following analysis has been conducted:

😇 7 Dimension Analysis

Time Frame: H4

Swing Structure:

Bearish swing structure with a Break of Structure (BOS) after taking inducement.

Corrective swing move has nearly mitigated everything with 3 pullbacks, forming a corrective internal bullish structure.

At the Point of Interest (POI), we see three key elements: Extreme Order Block (OB), Fair Value Gap (FVG), and Liquidity (LIQ) resting above the double top at the Premier zone of the swing.

All of these factors align to create a strong area for sellers.

Entry Model: Regular SMC

Resistance: Demand zone is prominent.

Pattern:

🟢 Chart Patterns:

Reversal: A double top pattern has been identified.

🟢 Candle Patterns:

Long wicks have appeared multiple times at the top, indicating rejection.

Momentum candles have also formed in the same area of interest, showing significant market activity.

A classic tower top candlestick pattern with valid parameters has been observed.

Volume:

🟢 Substantial volume has been observed in this area after a long time.

Despite the volume, it has been unable to cross the point of interest, indicating profit booking and a show of strength from sellers.

Momentum RSI:

🟢 After a strong bullish momentum, the RSI reversed from the overbought level and shifted into a range inside the sideways to bearish zone.

A divergence between the last two highs is supported by loud moves, signaling that sellers are still in control.

Volatility Bollinger Bands:

🟢 Transition from contraction to expansion has occurred with a proper squeeze breakout.

Walking on the band suggests that the bullish volatile move is nearing its end.

Price is forming an "M" pattern in Bollinger Band terms, which is a strong bearish signal.

Strength ADX: Sideways yet, indicating neutral strength in the market.

Rating: ⭐⭐⭐⭐⭐

All dimensions are in favor of a bearish move.

✔️ Entry Time Frame: H4

✅ Entry TF Structure: Bearish

☑️ POI: Marked

💡 Decision: Sell limit

🚀 Entry: 0.8287

✋ Stop loss: 0.8333

🎯 Take profit: 0.8110

😊 Risk to reward Ratio: 4

🕛 Expected Duration: 15 Days

SUMMARY:

The analysis suggests a strong bearish setup with all dimensions aligning in favor of sellers. A sell limit order is recommended at 0.8287 with a stop loss at 0.8333 and a take profit at 0.8110. The trade offers a favorable risk to reward ratio of 4, and the expected duration is 15 days.

NZDCAD bearish continuation likely … the week of 05 Aug, 2024First of all, if you expect that every trade will be a winner, please move on. Don’t even bother to read this analysis.

This pair has been mostly bearish since mid-June with a pullback during the last few days. In my opinion this pullback will soon end and if I see evidence of that I’ll be taking a short trade.

Note that the 38.2% retracement level and the 200 dma are already trying to contain the current up move. The bulls can still push through to the 50% or even the 61.80% levels, so I am going to be watching the PA closely. A momentum move above the 61.80% area will negate my analysis. Let’s see how this plays out.

This is not a trade recommendation. You should be aware that trading carries a high level of risk, so only trade with money you can afford to lose. Please use sound money and risk management, trading without a stop or moving the stop away from price is a recipe for disaster.

If you like my idea, please give a “boost” and follow me to get even more.

Please comment and share your thoughts too!!

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

NZDCAD - Short active !! Hello traders!

‼️ This is my perspective on NZDCAD.

Technical analysis: Here we are in a bearish market structure from 4H timeframe perspective, so I look for a short. I expect bearish price action from here as price rejected from trendline + liquidity zone. As well, on H1 we have regular divergence and for conservative entry you can wait break of structure.

Fundamental news: Upcoming week on Wednesday (GMT+3) we have results of Unemployment Rate on NZD, news with high impact on currency.

Like, comment and subscribe to be in touch with my content!